The BRRRR Strategy Explained: How Investors Recycle Capital Without Bleeding Cash

Learn about BRRRR Strategy for real estate investing.

What BRRRR Really Is (And What It Is Not)

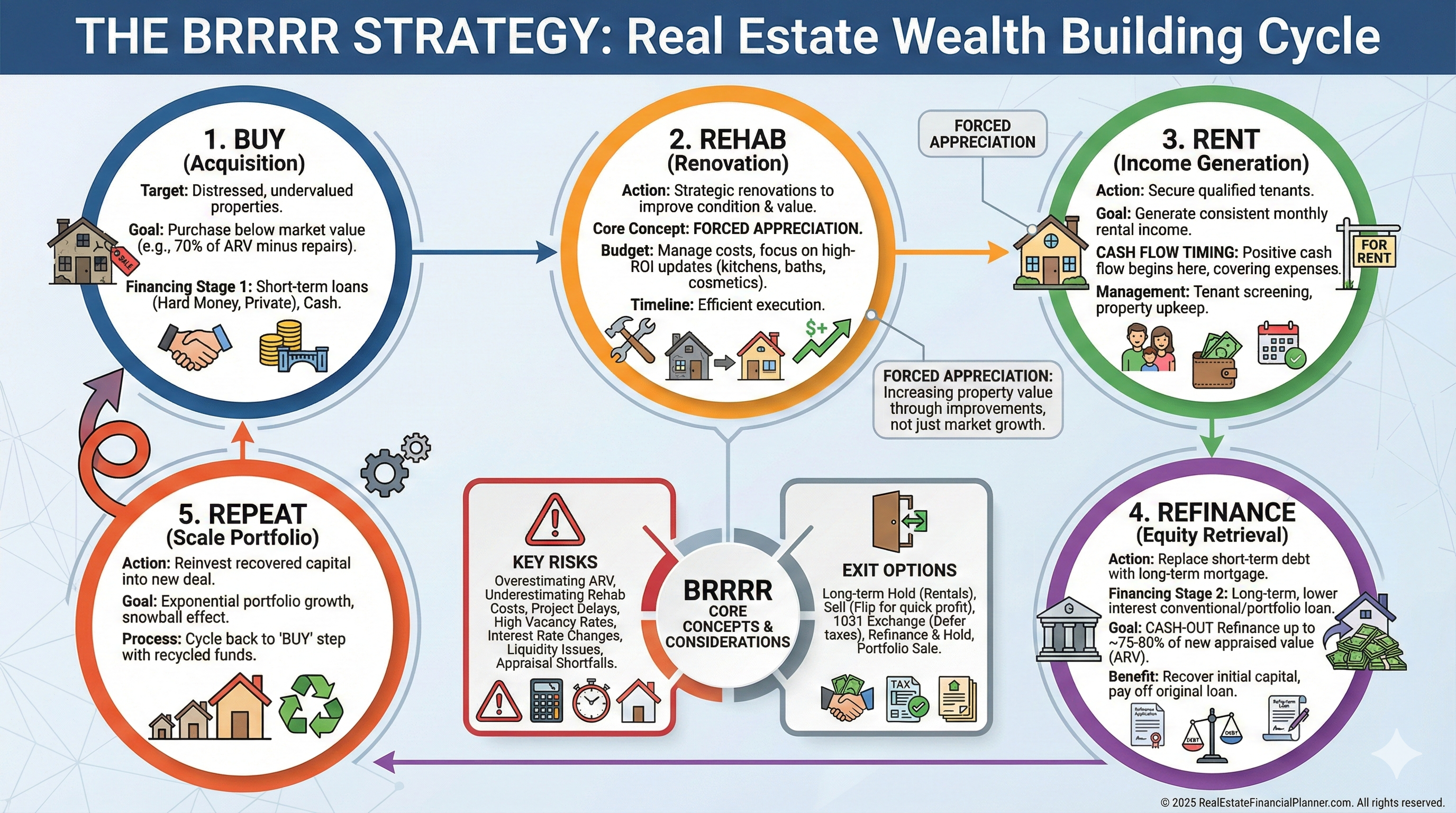

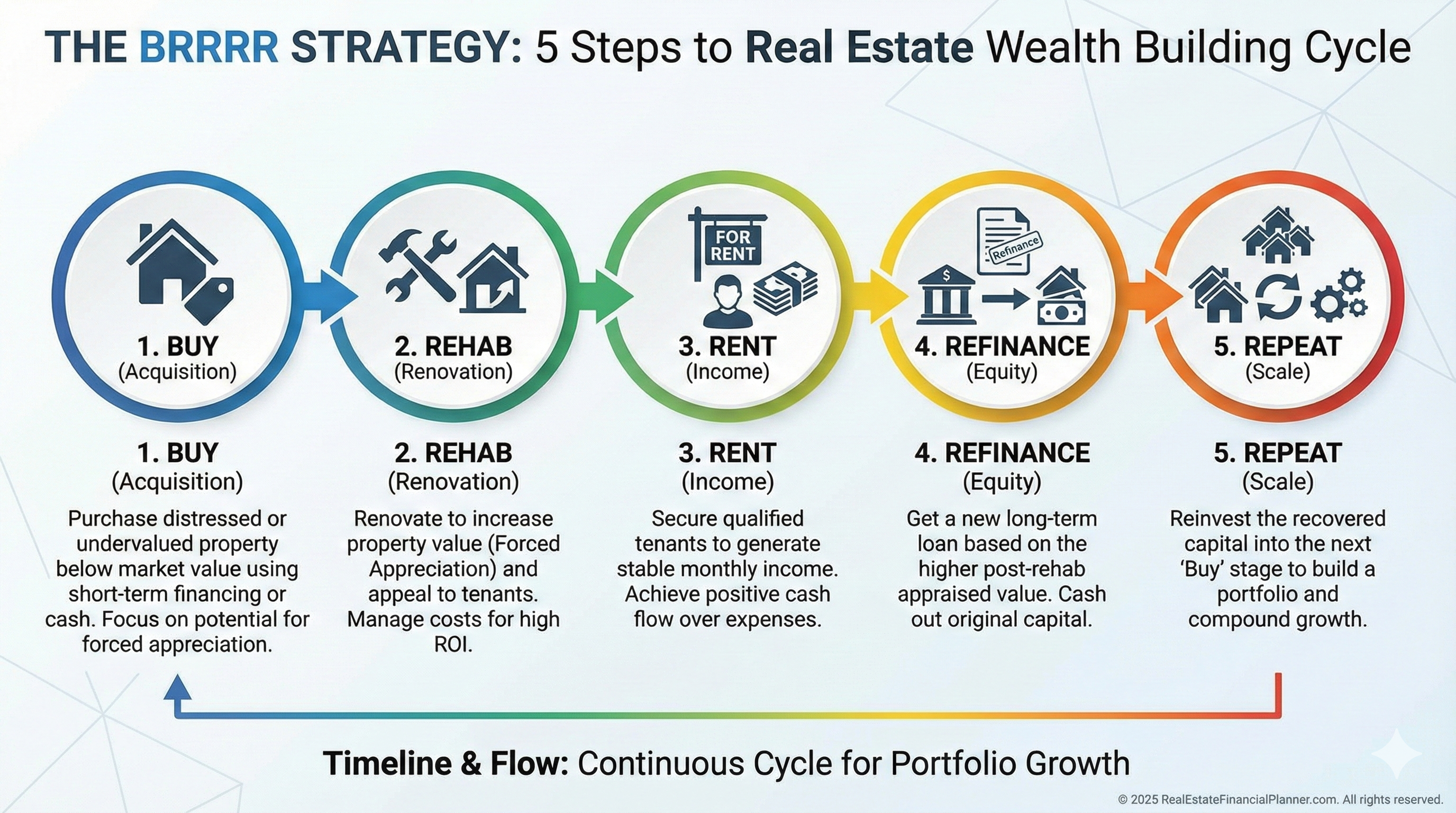

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat.

On paper, it looks like a magic trick. In practice, it is one of the most operationally demanding strategies in real estate.

When I help clients evaluate BRRRR deals, the first thing I clarify is this: BRRRR is not a passive investing strategy. It is a real estate entrepreneurial strategy that converts time, effort, and risk into captured equity.

If you want low effort and predictable returns, BRRRR is usually the wrong place to start.

Buy: Where Most BRRRR Deals Are Won or Lost

The buy phase is everything.

You are not just buying a fixer. You are buying a future rental that must still work after two rounds of financing.

When I analyze BRRRR opportunities, I model three prices simultaneously:

What you pay today

What it costs to fix

What it refinances for tomorrow

If any one of those numbers is optimistic instead of conservative, the entire strategy collapses.

Rehab: Forced Appreciation Comes With Real Risk

Rehab is where forced appreciation is created.

It is also where timelines slip, budgets explode, and returns quietly die.

When I rebuilt after bankruptcy, I learned the hard way that underestimating rehab costs does more damage than overpaying slightly for a property.

Every BRRRR rehab budget should include:

A contingency

Carrying costs

A realistic timeline

If you only model best-case outcomes, BRRRR will eventually punish you.

Rent: Stabilization Is Not Optional

Renting the property is not just about cash flow.

It is about proving to a lender that the property is financeable.

Vacancy delays, below-market rents, or operational chaos during this phase often derail refinances entirely. I’ve seen otherwise solid BRRRR deals fail simply because stabilization took longer than planned.

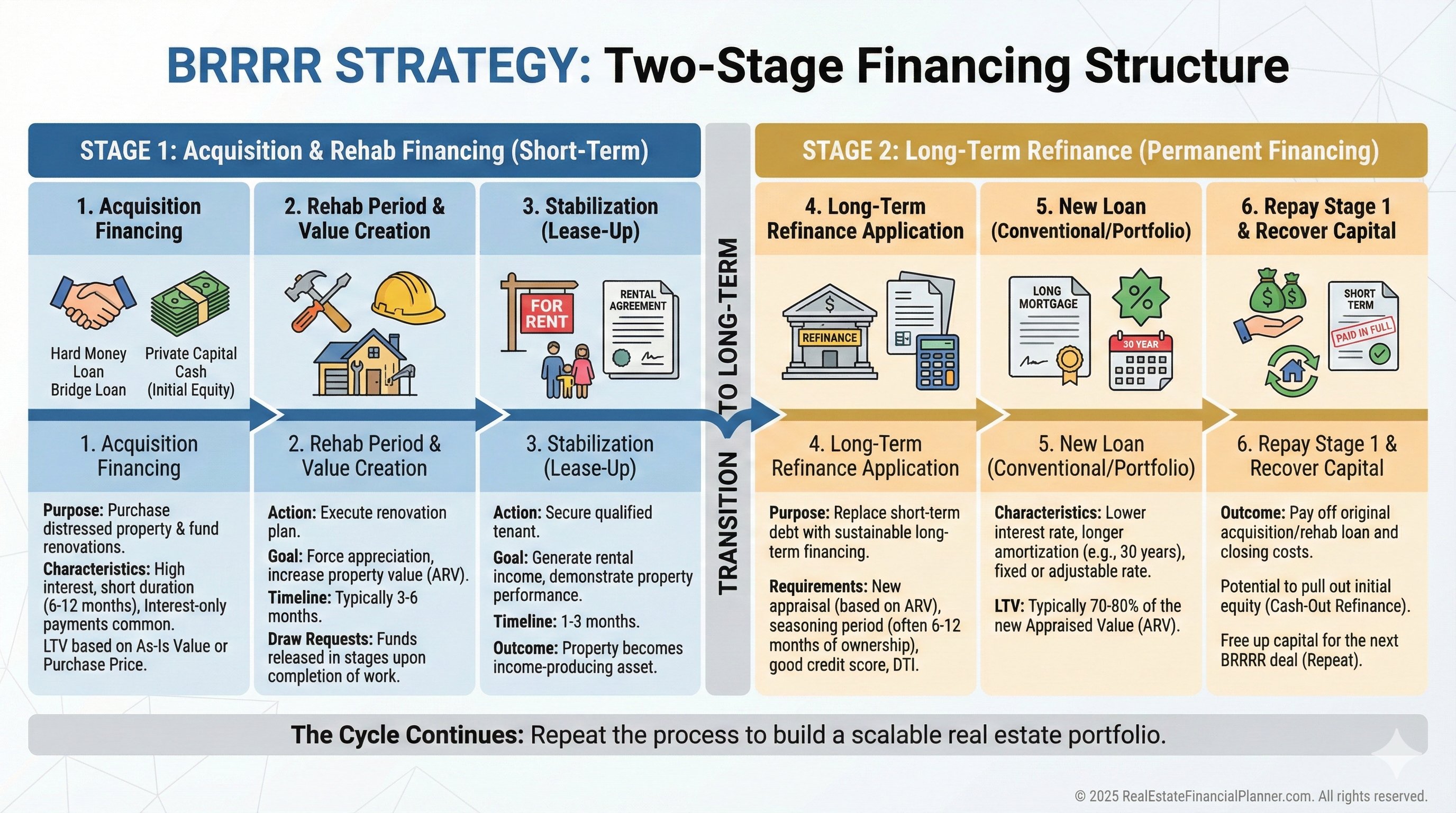

Refinance: Where Math Meets Reality

The refinance is where BRRRR either works or exposes wishful thinking.

Refinance rates are usually higher than purchase rates. Loan-to-value limits are real. Appraisals are conservative when markets soften.

When I model refinances in Real Estate Financial Planner™, I focus on Return on True Net Equity™ instead of just cash pulled out. Leaving five to ten percent in the deal is common, even in good markets.

Repeat: Scaling Is Slower Than People Expect

Repeating BRRRR requires deal flow, time, and emotional stamina.

You are managing construction, financing, tenants, and risk simultaneously. That naturally caps how fast you can scale unless you build systems or teams.

This is why BRRRR portfolios often grow in bursts rather than straight lines.

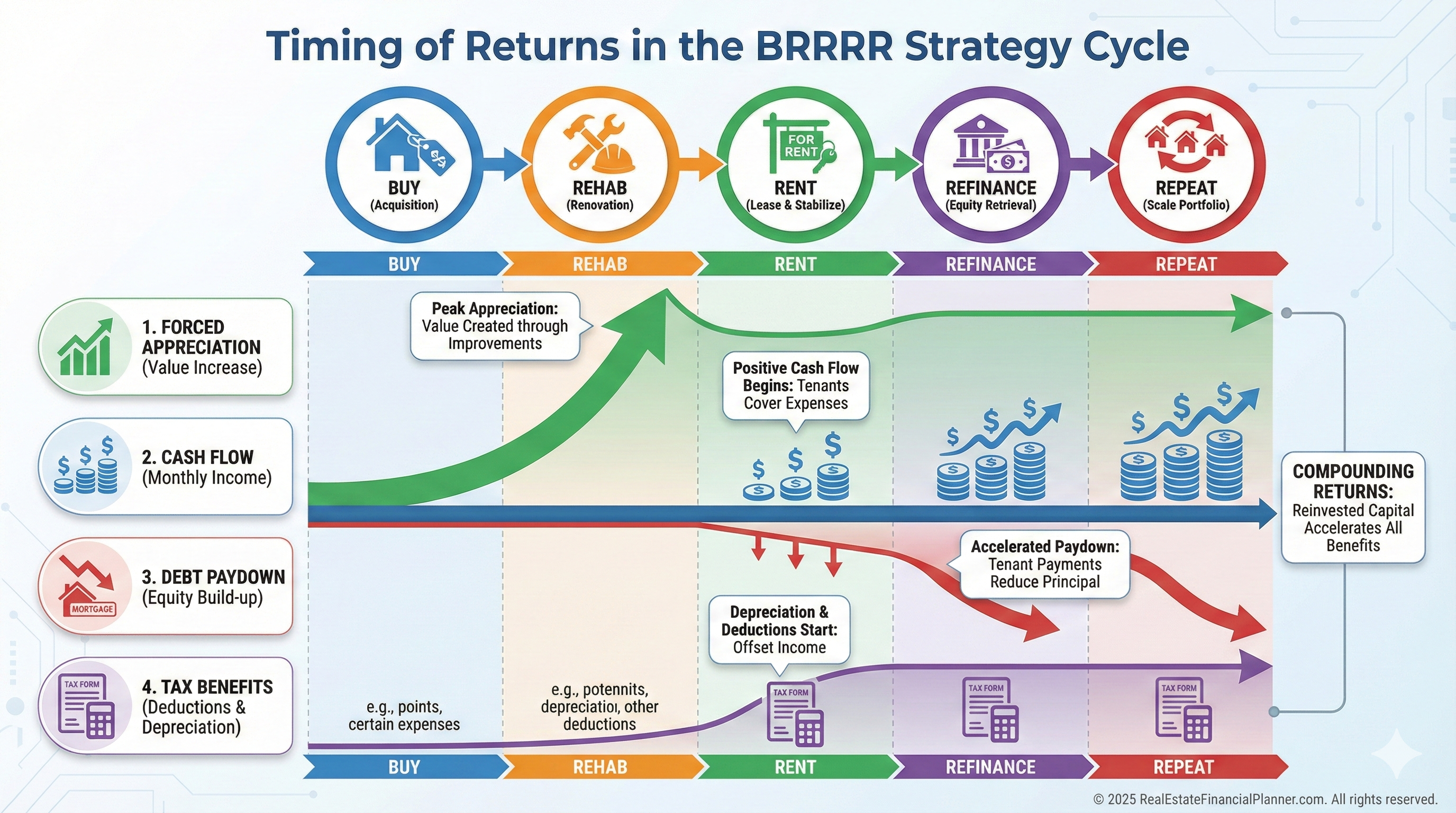

How BRRRR Makes and Loses Money

BRRRR earns returns from the same four components as all rental properties:

Cash flow

Tax benefits

The difference is timing.

Forced appreciation shows up early. Cash flow often shows up later. Debt paydown and natural appreciation take years.

Cash Flow Reality Most Investors Ignore

Negative cash flow during early BRRRR stages is common.

I treat this as deferred down payment, not failure. The problem arises when investors ignore cumulative negative cash flow and run out of reserves before refinancing.

This is why I insist clients model reserves explicitly instead of hoping everything stabilizes on schedule.

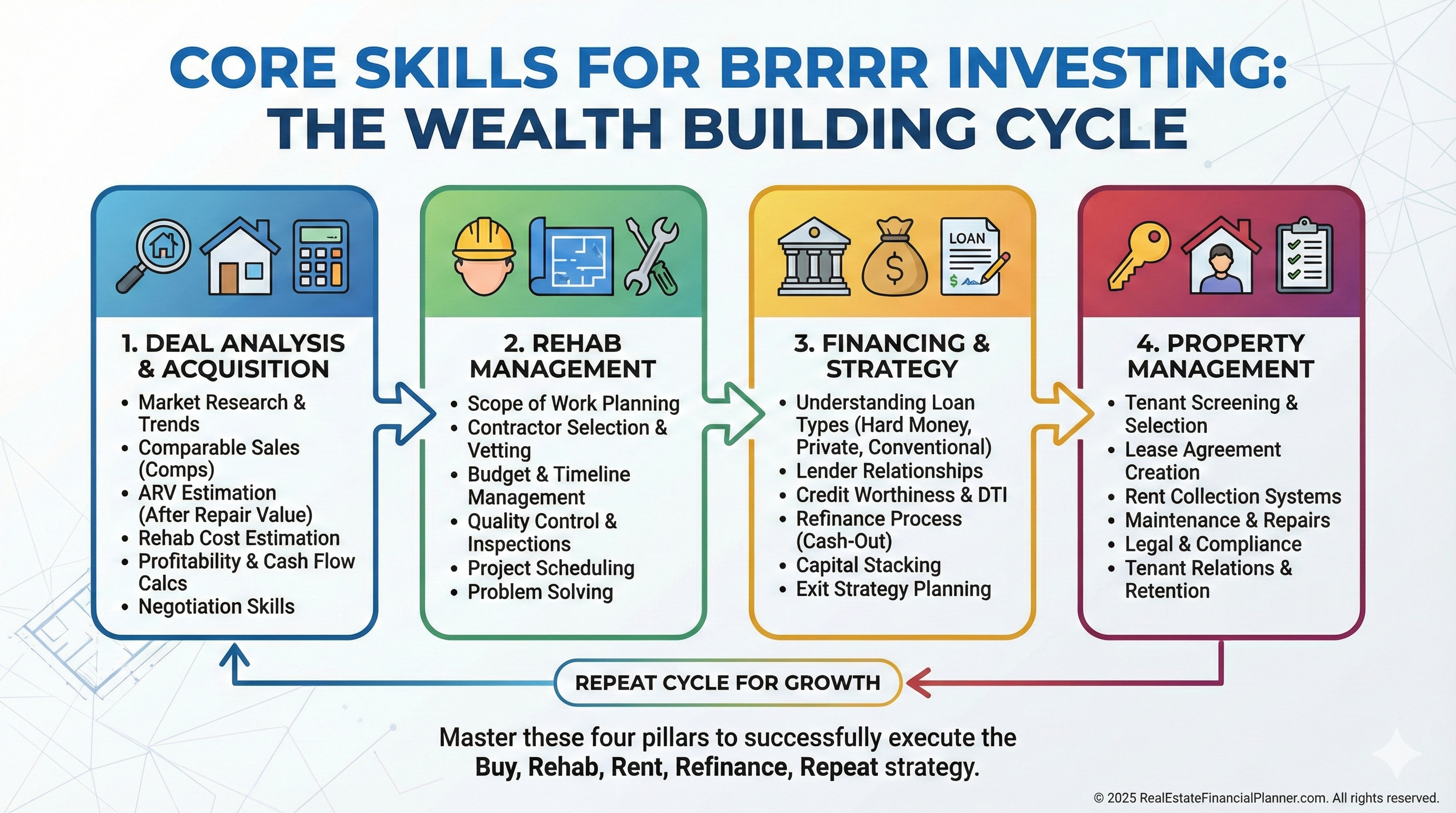

Skills BRRRR Quietly Requires

BRRRR demands more skills than most strategies:

Deal analysis

Rehab estimating

Contractor management

Financing navigation

If any one of these is weak, BRRRR magnifies the weakness.

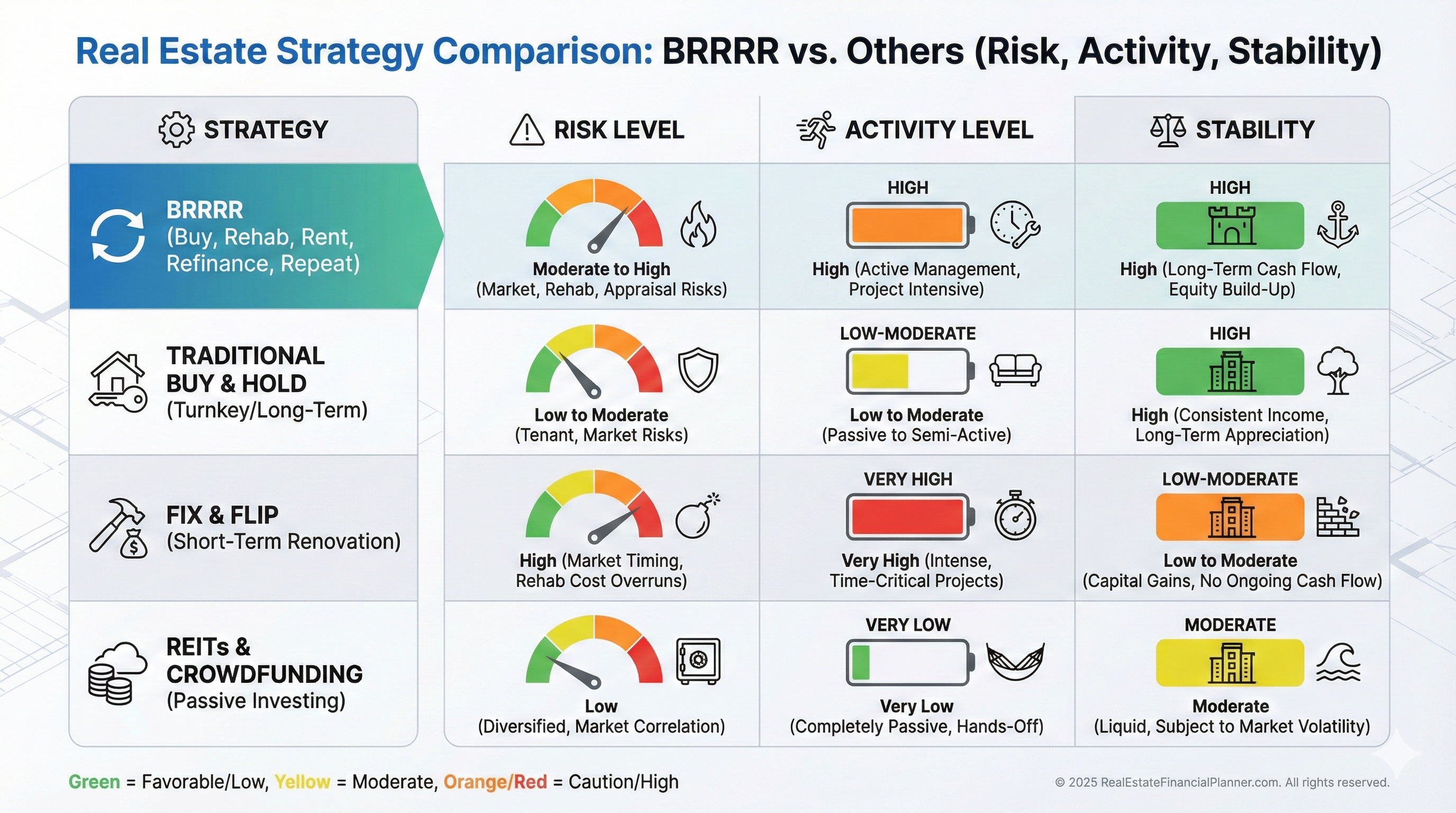

Risk, Stability, and Why BRRRR Is Actively Stable

BRRRR is very actively stable.

You must stay involved to keep it working, especially early. Compared to buy and hold or Nomad™, BRRRR demands more attention but can produce higher early equity if executed well.

When BRRRR Makes Sense

BRRRR works best when:

You can buy at a real discount

The finished property is a solid rental

You have reserves and patience

You want to convert effort into equity

It struggles in overpriced, low-cash-flow markets or when investors underestimate complexity.

Final Perspective

BRRRR is not easy money. It is earned equity.

When used intentionally, it can accelerate portfolio growth. When misunderstood, it quietly destroys cash flow and morale.

The strategy itself is neutral. Execution is everything.