Exit Strategies: Where Real Estate Profits Are Actually Made

Learn about Exit Strategies for real estate investing.

Most real estate investors obsess over buying well.

Very few spend the same energy planning how they will exit.

That imbalance quietly destroys returns.

When I help clients analyze deals, one of the first questions I ask is not “How much cash flow does it produce?”

It’s “How do you get out of this if conditions change?”

I learned this the hard way rebuilding after bankruptcy.

Good properties without good exits become traps, not assets.

An exit strategy is not a future thought.

It is a design constraint you apply before you ever write an offer.

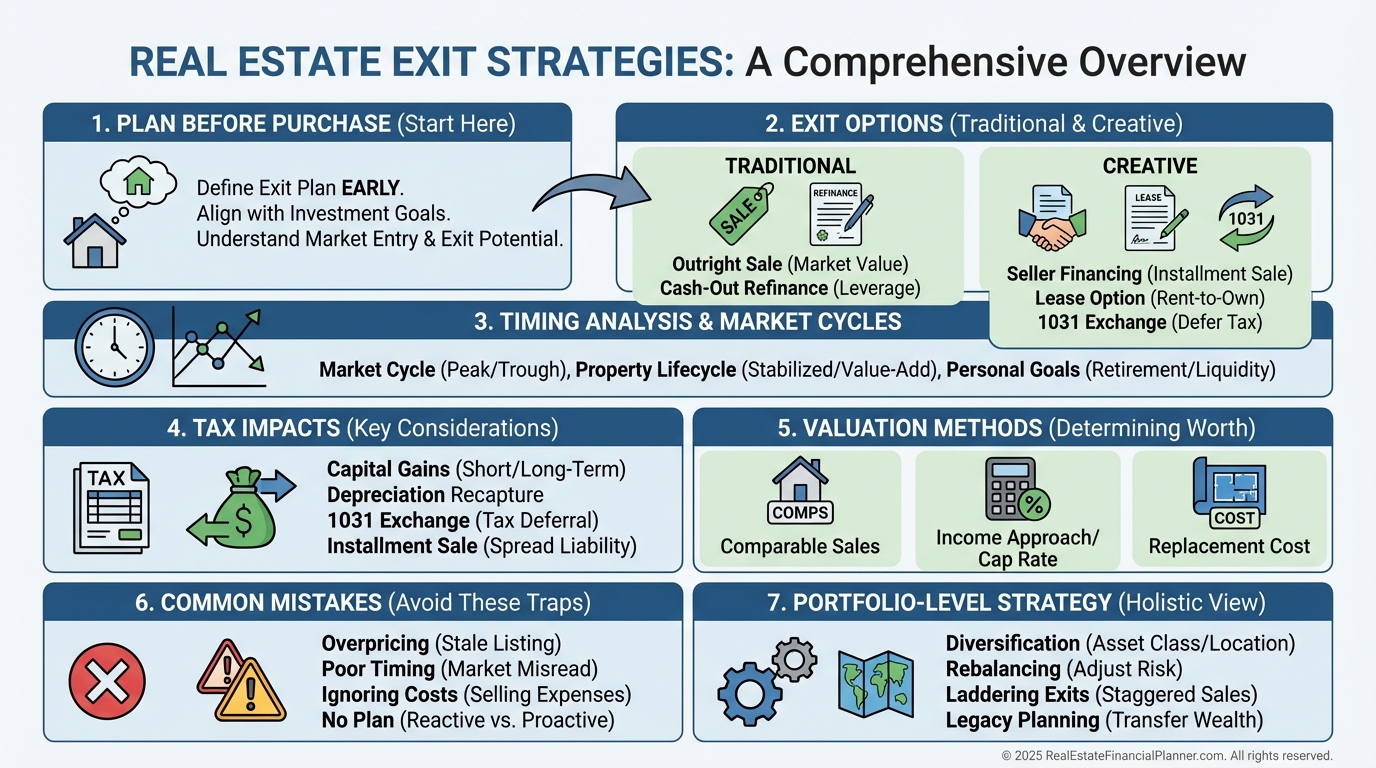

What Exit Strategies Really Mean

An exit strategy is the plan for how you will convert equity, cash flow, and appreciation into usable wealth.

It defines when, how, and under what conditions you stop owning the property.

Most investors confuse exits with vague intentions.

“I’ll sell someday” is not a strategy.

It is procrastination dressed up as optimism.

A real exit strategy considers:

Who the likely buyer will be

What valuation method that buyer will use

How taxes will affect your proceeds

What market conditions must exist

What alternatives you have if your first choice fails

Your exit assumptions drive your Internal Rate of Return more than almost any other input.

Change the exit, and the deal often collapses.

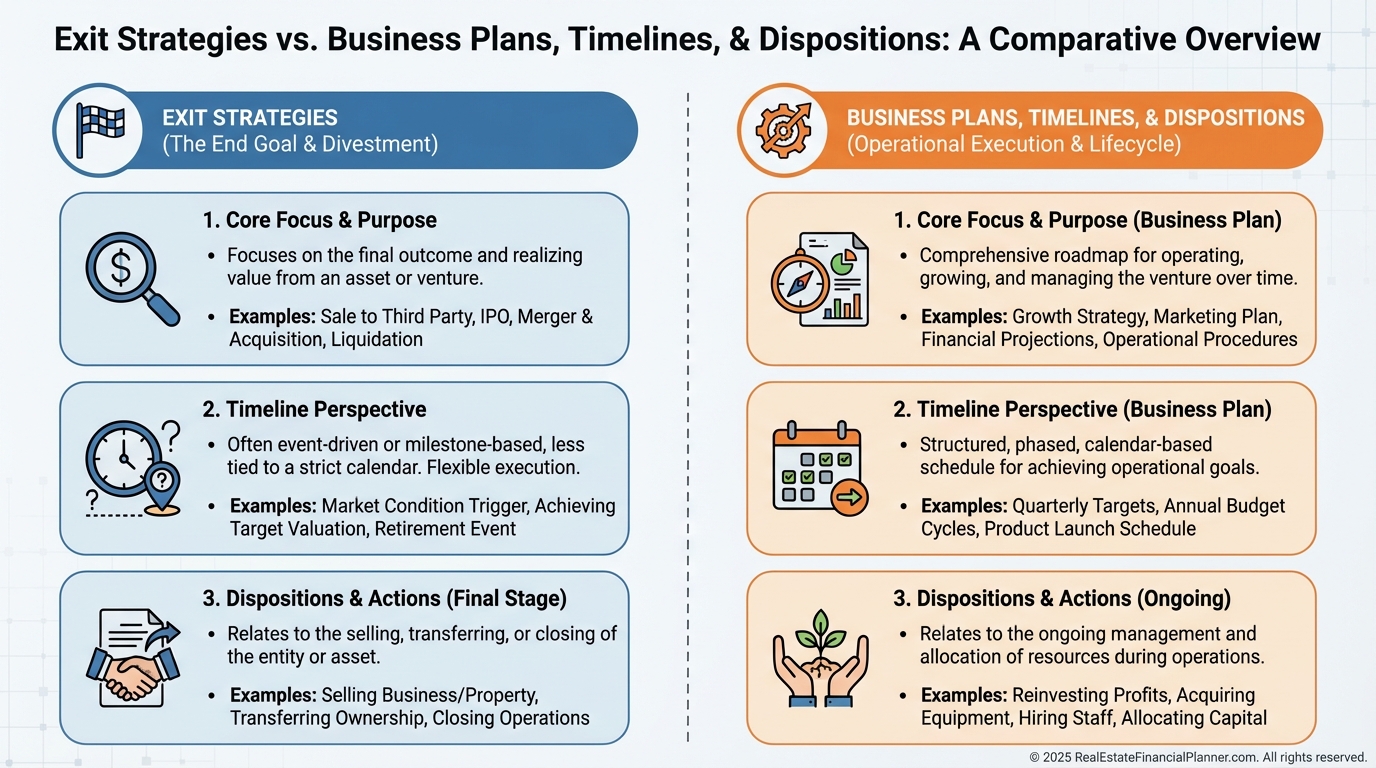

Exit Strategy vs. Related Concepts

An exit strategy is not your business plan.

The business plan explains how you operate while you own.

The exit explains how you get paid when you don’t.

An exit strategy is not a timeline.

“Five years” is a date, not a method.

An exit strategy is not the closing itself.

The closing is the final step of years of preparation.

Why Exit Strategies Control Returns

When I model deals using REFP frameworks, exits dominate outcomes.

Disposition costs alone often remove eight to ten percent of the sale price.

Taxes remove another large slice if not planned.

A projected eighteen percent IRR can easily become eight percent after a sloppy exit.

The property did not fail.

The planning did.

Exit strategies determine:

After-tax proceeds

Capital redeployment speed

Opportunity cost

Portfolio flexibility

Owning real estate without exit planning is collecting properties, not building wealth.

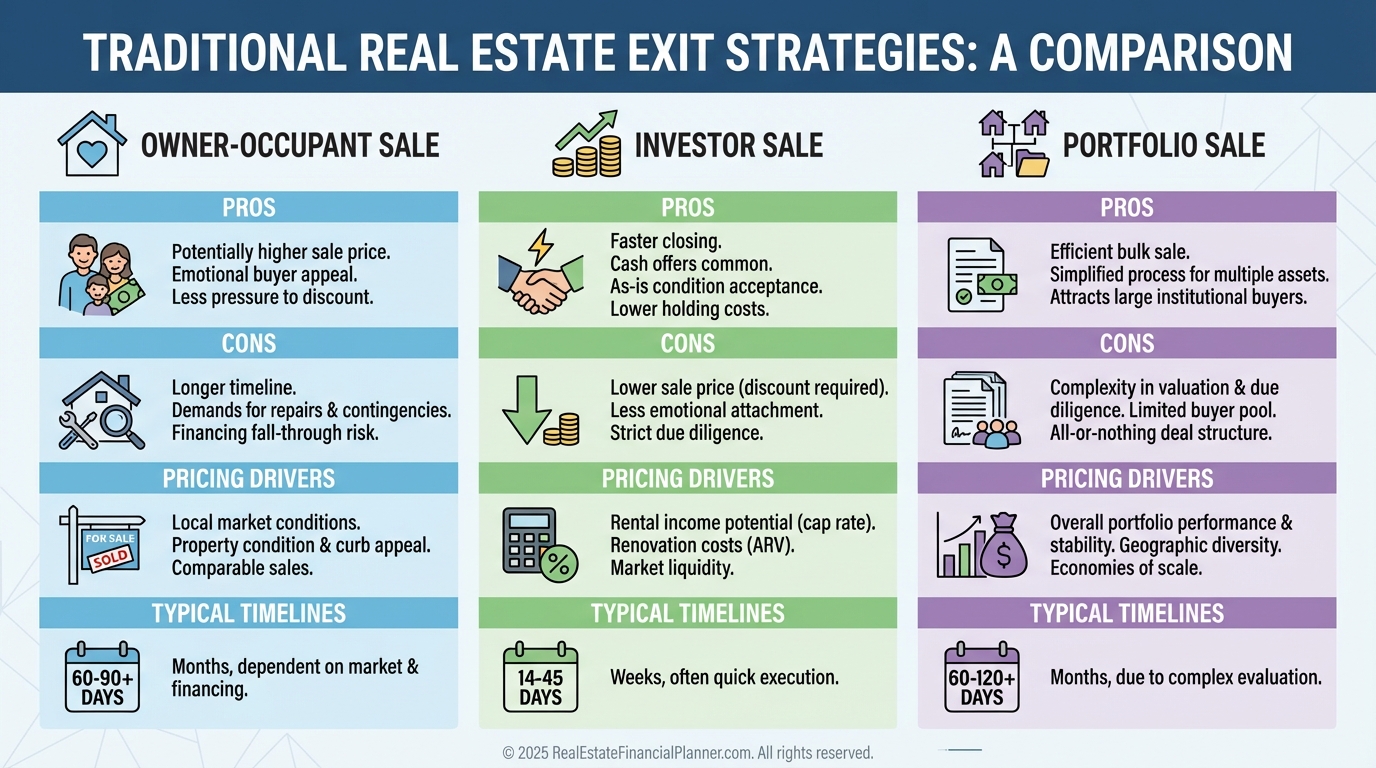

Traditional Exit Strategies

Traditional exits rely on straightforward sales.

They are familiar but still require planning.

Market Sale to Owner-Occupant

This usually produces the highest price.

It works best for single-family homes and some duplexes.

Sale to Another Investor

This is faster and more predictable.

Pricing is based on income, not emotion.

Portfolio Sale

Bundling properties attracts institutional buyers.

Scale can increase pricing but reduces flexibility.

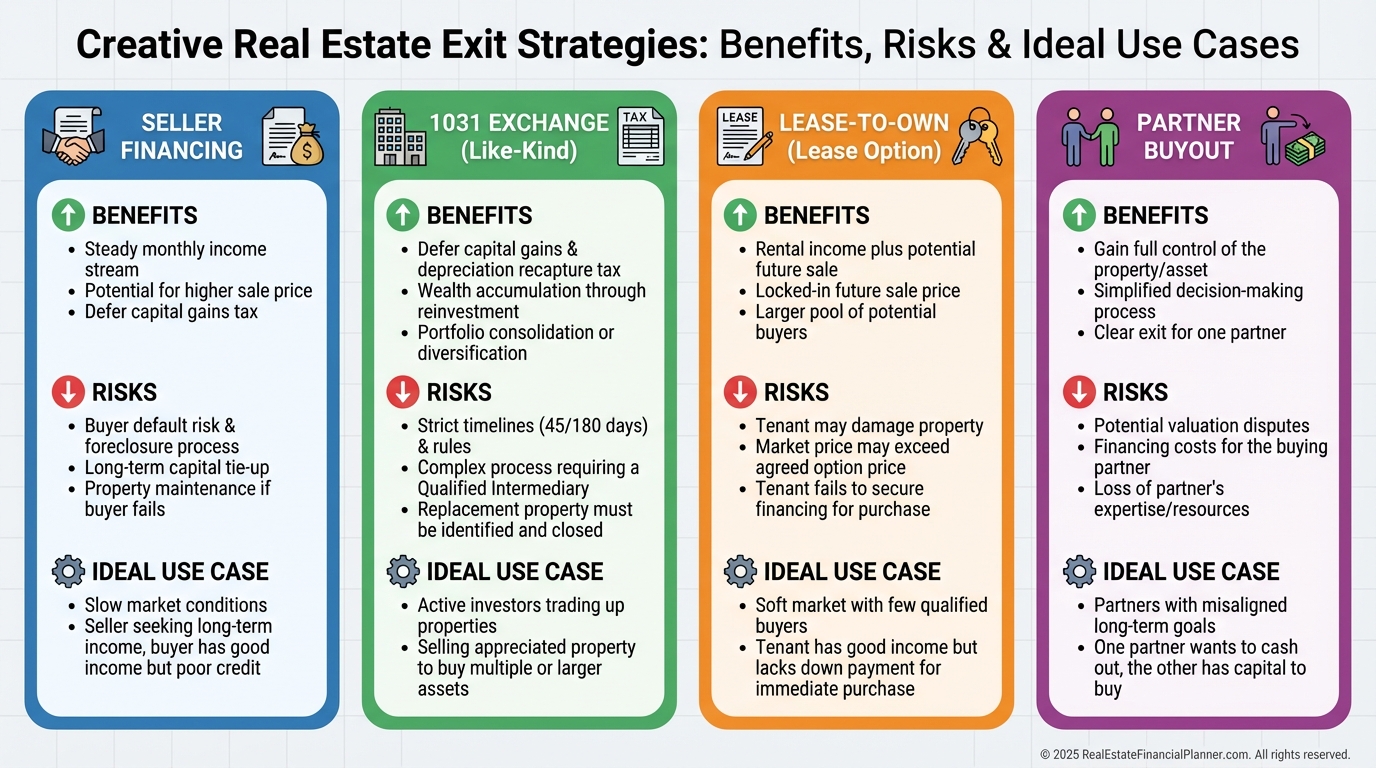

Creative Exit Strategies

Creative exits expand your buyer pool and often increase value.

Seller Financing

You may sell for more and earn interest.

You trade speed for long-term income.

1031 Exchange

This defers taxes, not profits.

It requires strict timing and discipline.

Lease-to-Own

This converts tenants into buyers.

It works well in affordability-constrained markets.

Partner Buyouts

These exits should be defined before purchase.

Agreements without buyout terms invite conflict.

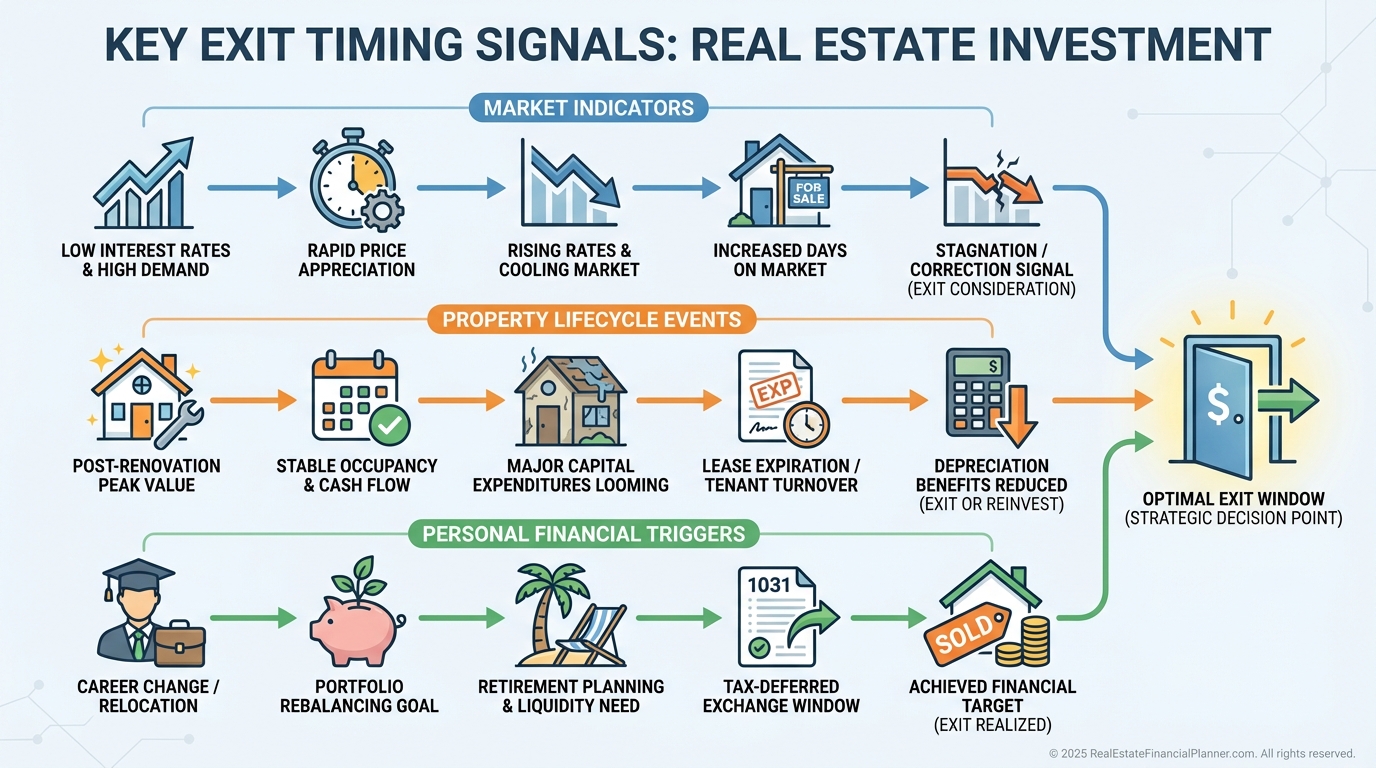

Timing Is Part of the Strategy

Exit strategies fail when timing is ignored.

Markets move in cycles.

Expenses arrive on schedules.

Life events do not ask permission.

When I review properties with clients, we map upcoming capital expenses.

Selling before large replacements often preserves six figures of value.

We also track local indicators.

Rising inventory, longer days on market, and slowing permits matter.

Personal timing matters too.

Taxes, retirement, income changes, and liquidity needs should all influence exit decisions.

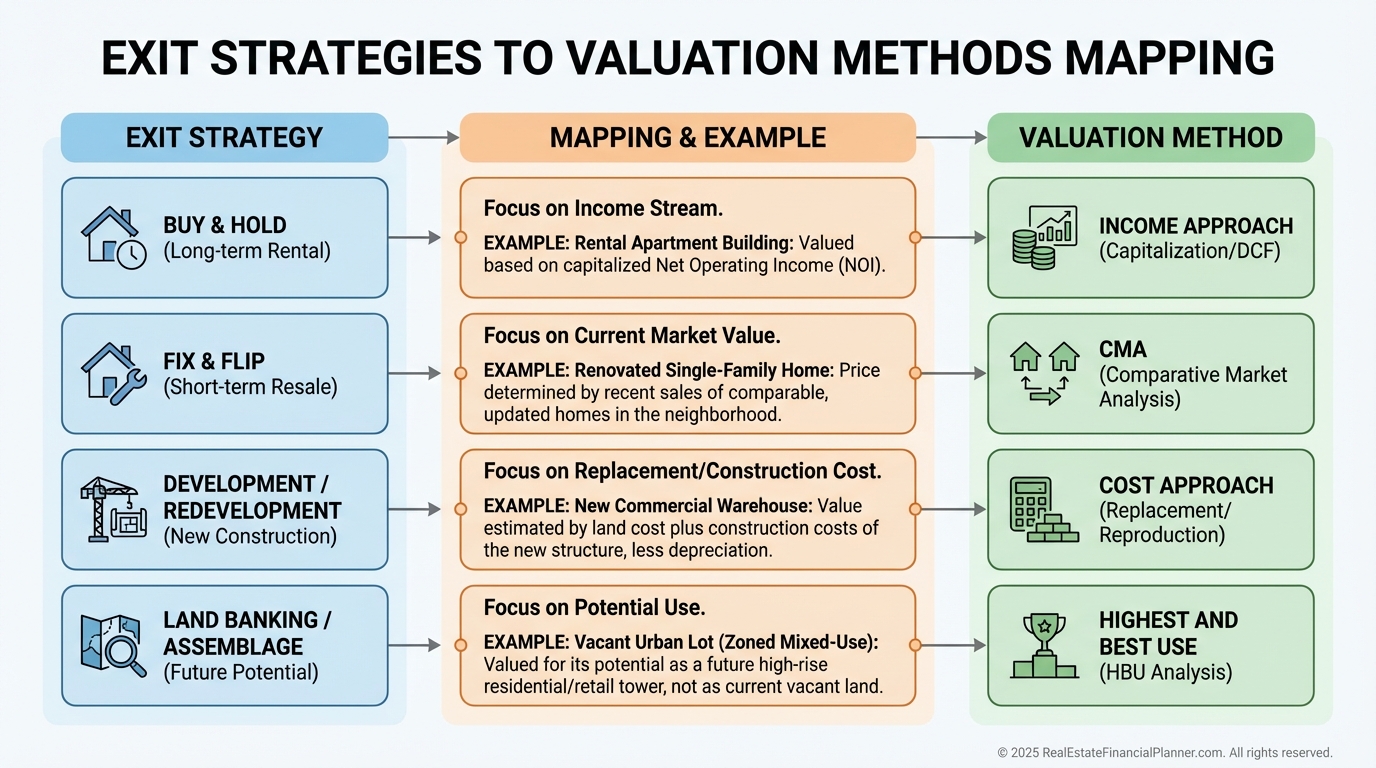

Valuation Depends on Your Exit

Different buyers value properties differently.

Owner-occupants rely on comparable sales.

Investors rely on forward-looking Net Operating Income.

Value-add buyers focus on replacement cost and upside.

If you plan to sell to investors, your rent roll matters more than your granite countertops.

If you plan to sell to homeowners, condition and presentation dominate.

Highest and best use analysis can unlock hidden value.

Some properties are worth more as something else.

Financing Choices Affect Exits

The loan you choose today limits your options tomorrow.

Balloon payments force timing.

Prepayment penalties reduce proceeds.

Rigid terms remove flexibility.

Refinancing can act as a partial exit.

It creates liquidity without triggering taxes.

Lenders increasingly ask about exits.

Clear strategies improve approval odds and pricing.

Common Exit Strategy Mistakes

I see the same errors repeatedly.

Ignoring market cycles.

Forgetting taxes.

Becoming emotionally attached.

Poor records reduce value and increase tax risk.

Deferred maintenance punishes sellers, not buyers.

Relying on a single exit is dangerous.

Markets change faster than plans.

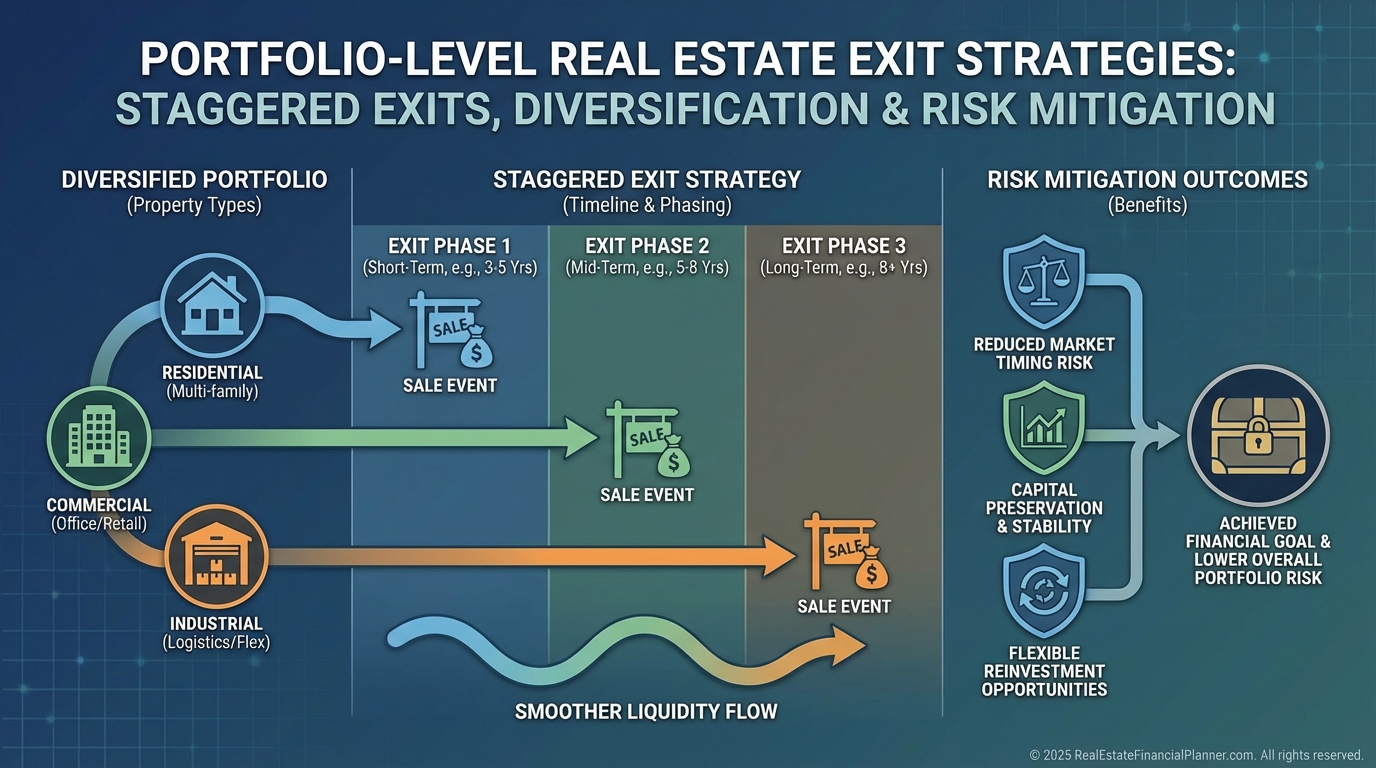

Using Exit Strategies at the Portfolio Level

Exit strategies should stagger across time.

Dumping multiple properties in one year creates tax chaos.

A balanced portfolio supports multiple buyer pools.

Flexibility increases resilience.

Selling into strength feels uncomfortable.

It is often correct.

Exit planning is risk management.

Multiple options reduce forced decisions.

Final Thoughts

The money you make in real estate is not locked in when you buy.

It is locked in when you exit.

Great investors design exits first.

Then they buy properties that support them.

Review your portfolio.

Identify missing exit plans.

Model different scenarios.

Your exit strategy is not the end of the deal.

It is the reason the deal exists.