Adjustable Rate Mortgages: Powerful Tool or Hidden Risk for Investors?

Learn about Adjustable Rate Mortgages for real estate investing.

Most investors treat adjustable rate mortgages as either dangerous or clever shortcuts.

Both views miss the point.

An adjustable rate mortgage (ARM) is not good or bad by itself. It is a leverage tool. Like all leverage tools, it rewards planning and punishes hope.

When I help clients analyze deals, ARMs usually show up when cash flow is tight, prices are high, or someone wants to move faster than fixed-rate financing allows.

That is exactly when mistakes get expensive.

What an Adjustable Rate Mortgage Really Is

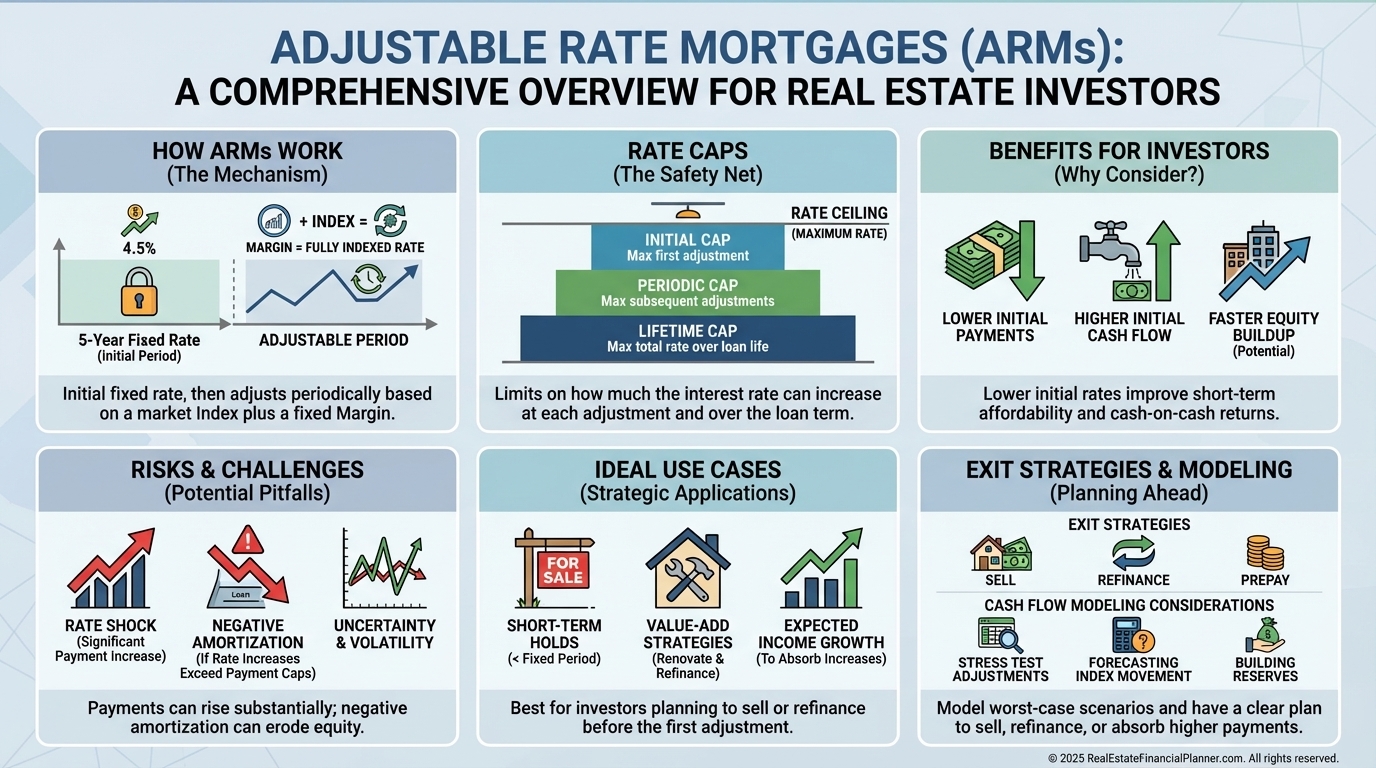

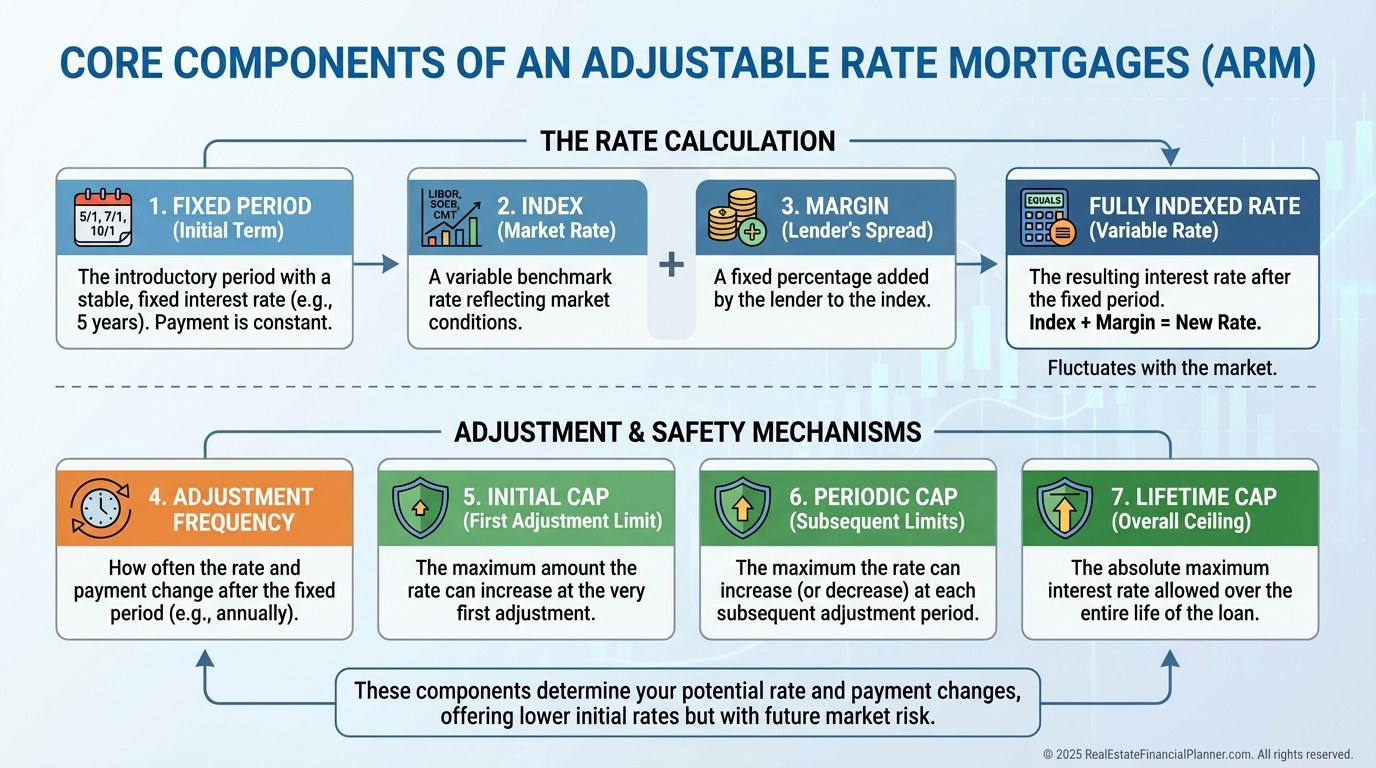

An adjustable rate mortgage starts with a fixed interest rate, then transitions into a variable rate tied to an index plus a margin.

The structure matters more than the headline rate.

Most residential ARMs follow the same basic pattern.

You get a fixed rate for three, five, seven, or ten years.

After that, the rate adjusts periodically based on a published index plus a lender margin.

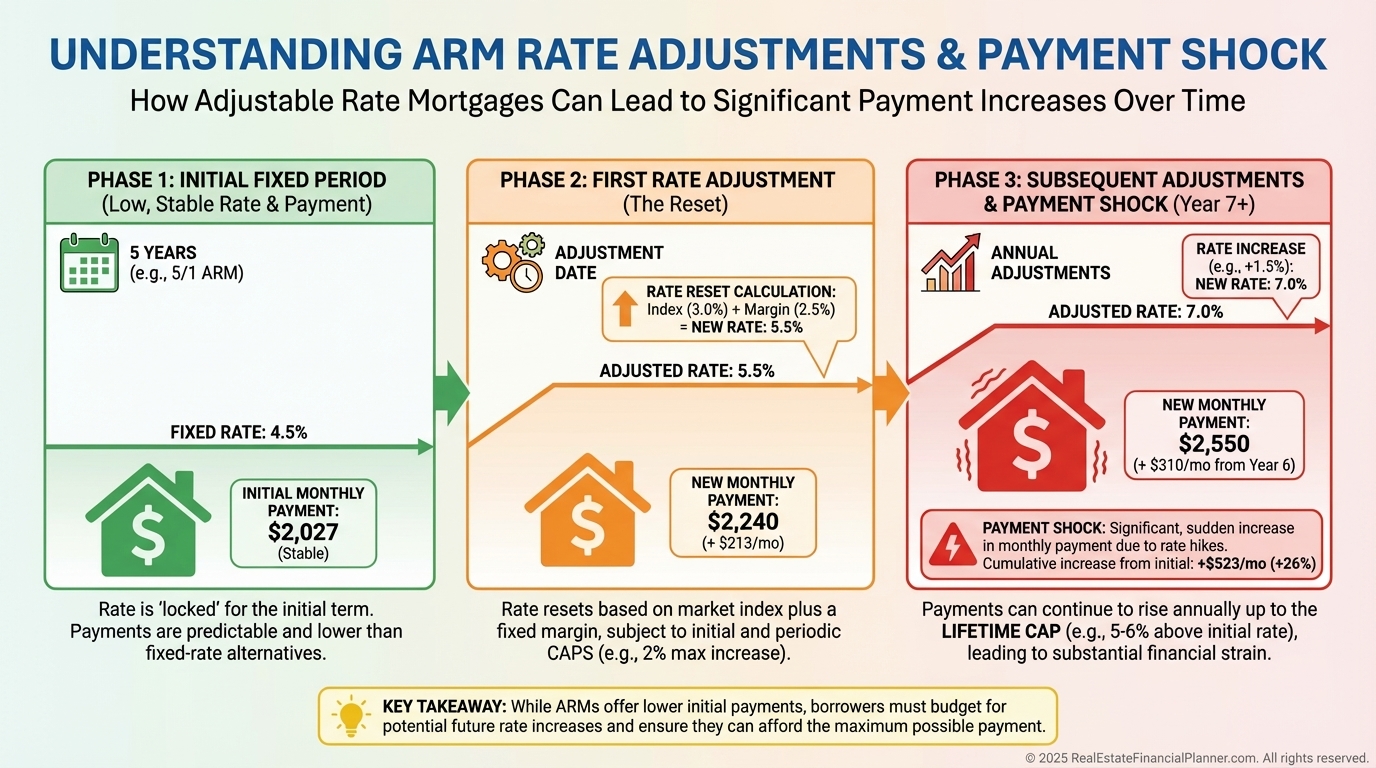

The caps are the safety rails.

Initial caps limit the first adjustment.

Periodic caps limit future adjustments.

Lifetime caps define the worst-case scenario.

When I run ARM scenarios, I always model the lifetime cap. Always.

If the deal fails there, it fails in real life.

Why Investors Are Drawn to ARMs

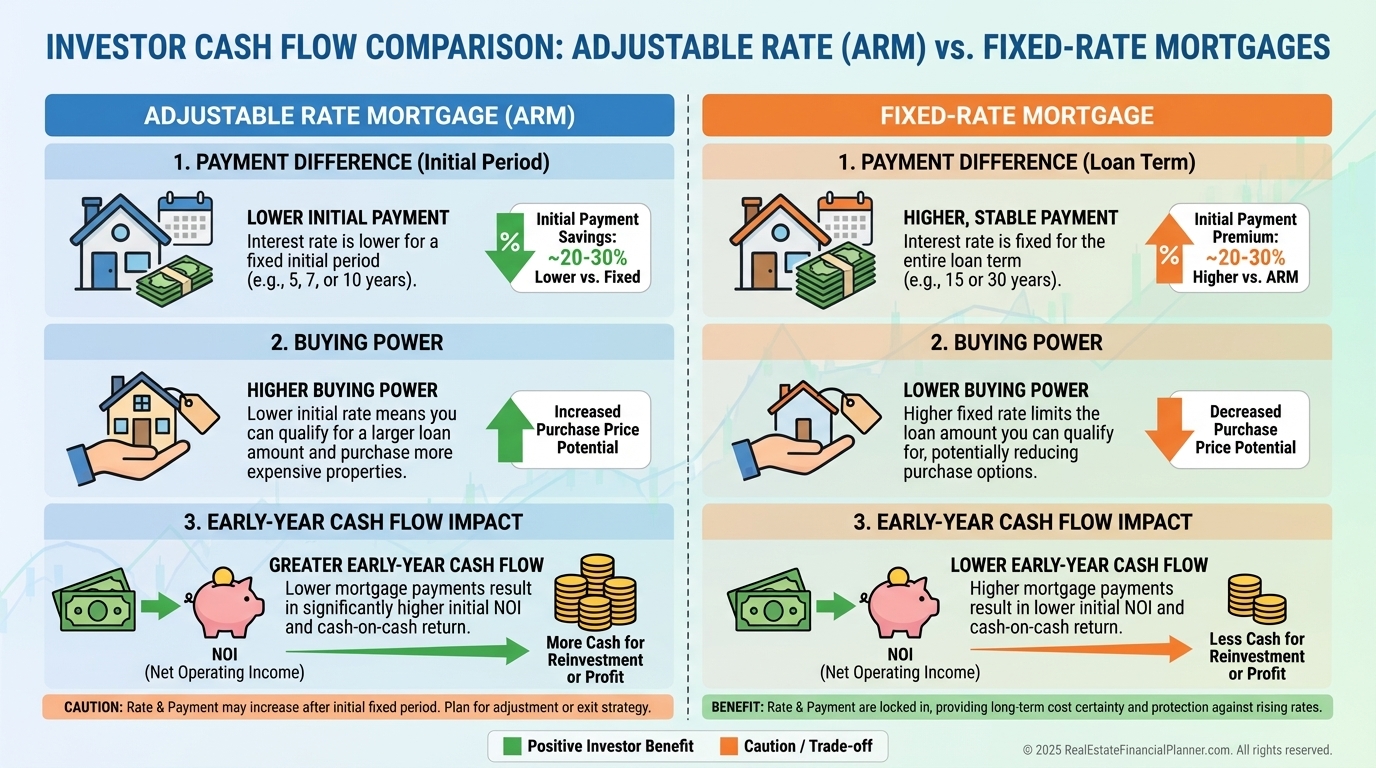

The attraction is simple.

Lower initial payments.

That single feature changes everything downstream.

Lower payments improve debt-to-income ratios.

They improve early cash flow.

They often allow you to buy a better property or one additional property.

In high-price, low-cash-flow markets, ARMs are sometimes the difference between investing and sitting on the sidelines.

But lower payments are not free money.

They are borrowed time.

The Hidden Risk Most Investors Do Not Model

The biggest ARM risk is not rising rates.

It is pretending you will “figure it out later.”

I have seen investors assume they will refinance before the adjustment.

Sometimes that works.

Sometimes credit tightens, values dip, or income changes.

I rebuilt after bankruptcy. I am painfully aware that refinancing is never guaranteed.

If your deal only works assuming perfect refinancing conditions, it is not conservative enough.

How I Analyze ARMs Inside REFP

I do not ask, “Will rates go up or down?”

I ask, “What happens if I am wrong?”

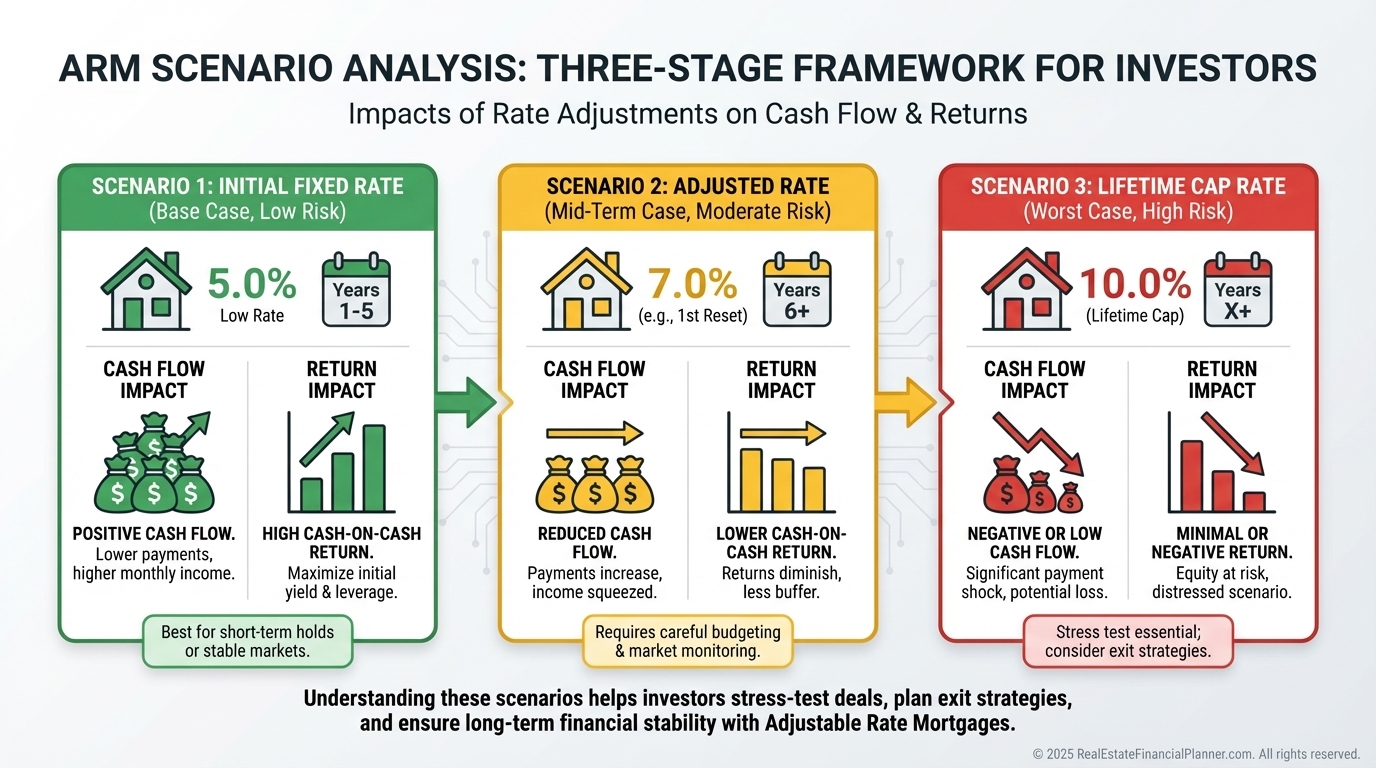

Using The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I run three scenarios:

Current ARM rate

Expected adjusted rate

Maximum lifetime cap rate

Then I look at cash flow, Return on Equity, and Return on True Net Equity™ in each case.

If the deal survives the worst case, the ARM becomes a strategic choice instead of a gamble.

When Adjustable Rate Mortgages Make Sense

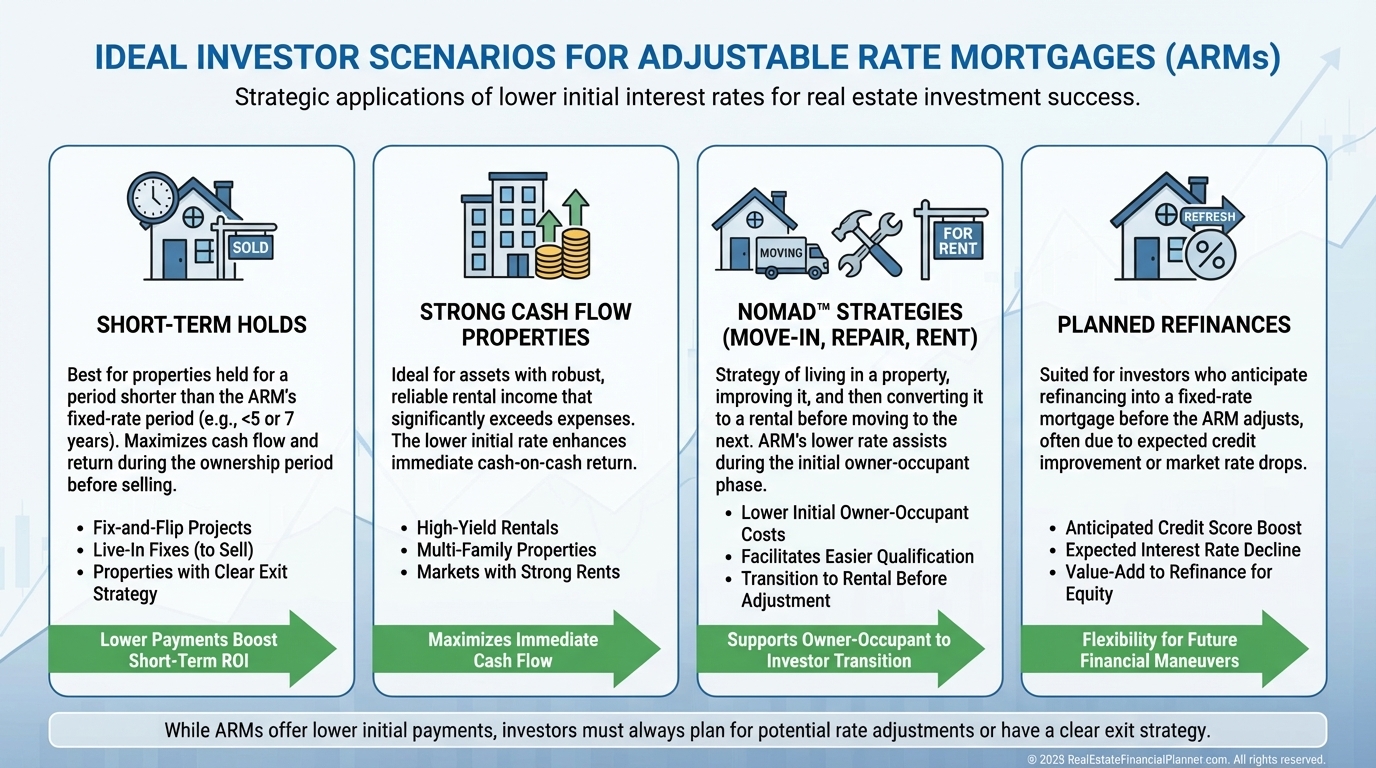

ARMs are most useful when time is on your side.

They work well when your hold period is shorter than the fixed-rate period.

They also work when cash flow is strong enough to absorb future increases.

I often see ARMs used effectively with Nomad™ strategies, planned property upgrades, or intentional refinance timelines.

They are least appropriate for thin-margin, long-term holds with no exit flexibility.

The Exit Strategy Must Come First

ARM discussions usually start with interest rates.

They should start with exits.

Sell.

Refinance.

Pay down aggressively.

Pick at least one before you sign.

If you cannot articulate the exit in one sentence, you are not ready for an ARM.

The Bottom Line on Adjustable Rate Mortgages

Adjustable rate mortgages are not beginner loans.

They are thinking tools.

Used correctly, they accelerate portfolio growth and improve early returns.

Used casually, they magnify stress, risk, and regret.

When clients ask me whether they should use an ARM, I rarely answer yes or no.

I show them the numbers.

The spreadsheet makes the decision obvious.