Cash Flow from Depreciation™: The Monthly Cash Flow Most Investors Miss

Learn about Cash Flow from Depreciation™ for real estate investing.

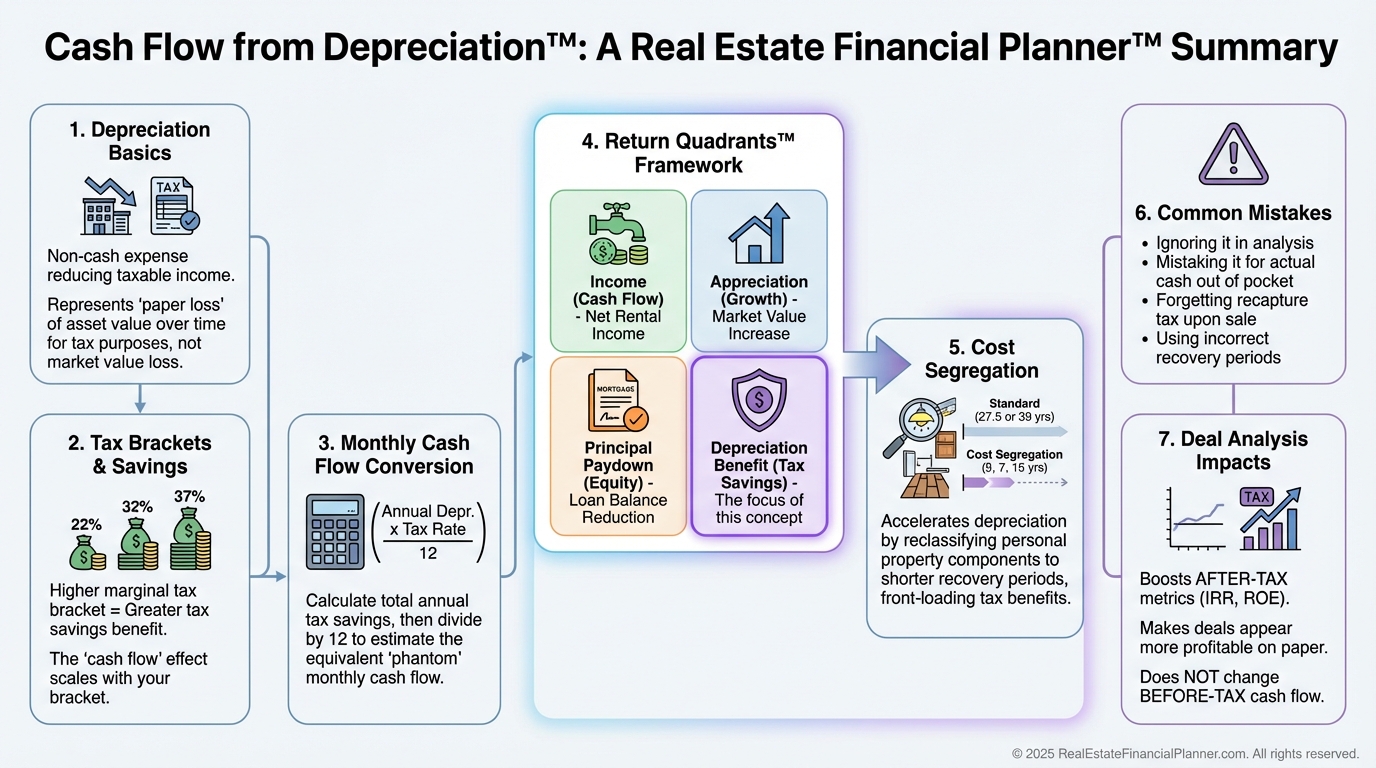

Cash Flow from Depreciation™ Overview

Most real estate investors think depreciation is just a tax formality.

Something that lives on Schedule E and shows up once a year.

When I help clients analyze deals, this is usually the return they misunderstand the most.

And it is often the return that quietly makes the deal work.

Cash Flow from Depreciation™ is not theoretical.

It is not appreciation.

It is not equity locked in your property.

It is real, spendable cash flow created by paying less in taxes each month.

When I was rebuilding after bankruptcy, I learned quickly that predictable cash flow matters more than flashy returns.

Depreciation became one of the most reliable sources of that cash flow.

What Cash Flow from Depreciation™ Actually Means

Depreciation allows you to deduct the cost of a rental property over time.

Residential properties are depreciated over 27.5 years.

But the deduction itself is not the return.

The return is the taxes you no longer have to pay.

That tax savings is Cash Flow from Depreciation™.

If depreciation reduces your tax bill by $3,600 per year, that is $300 per month you keep.

That money can pay bills, fund reserves, or help you qualify for the next loan.

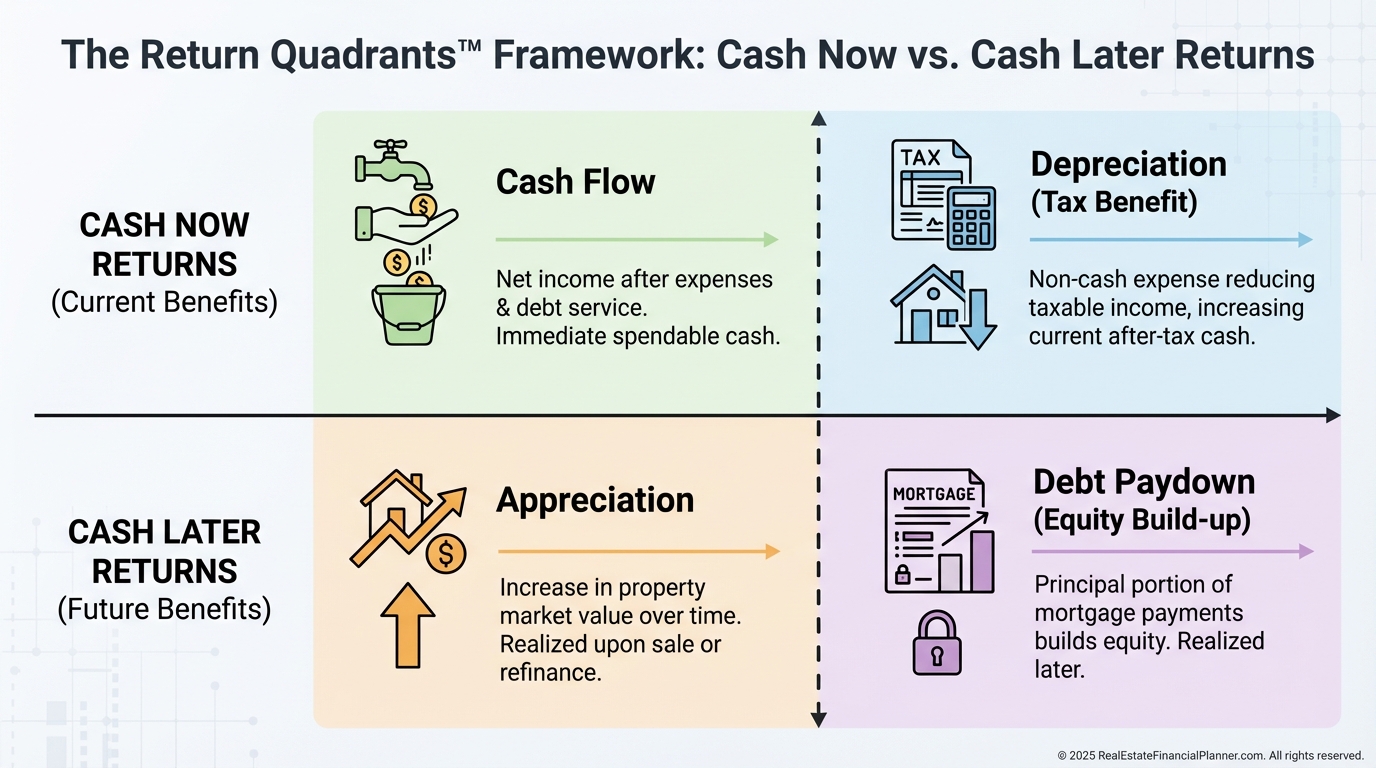

This is why depreciation belongs in the “Cash Now” category of the Return Quadrants™.

Return Quadrants™ and Cash Now vs Cash Later

Why Depreciation Is Less Speculative Than Other Returns

Appreciation depends on the market.

Cash flow depends on tenants and expenses.

Depreciation depends on the tax code and ownership.

Once you buy the property, your depreciation schedule is largely locked in.

Vacancy does not remove it.

Market crashes do not reduce it.

That predictability makes Cash Flow from Depreciation™ one of the most stable returns in real estate.

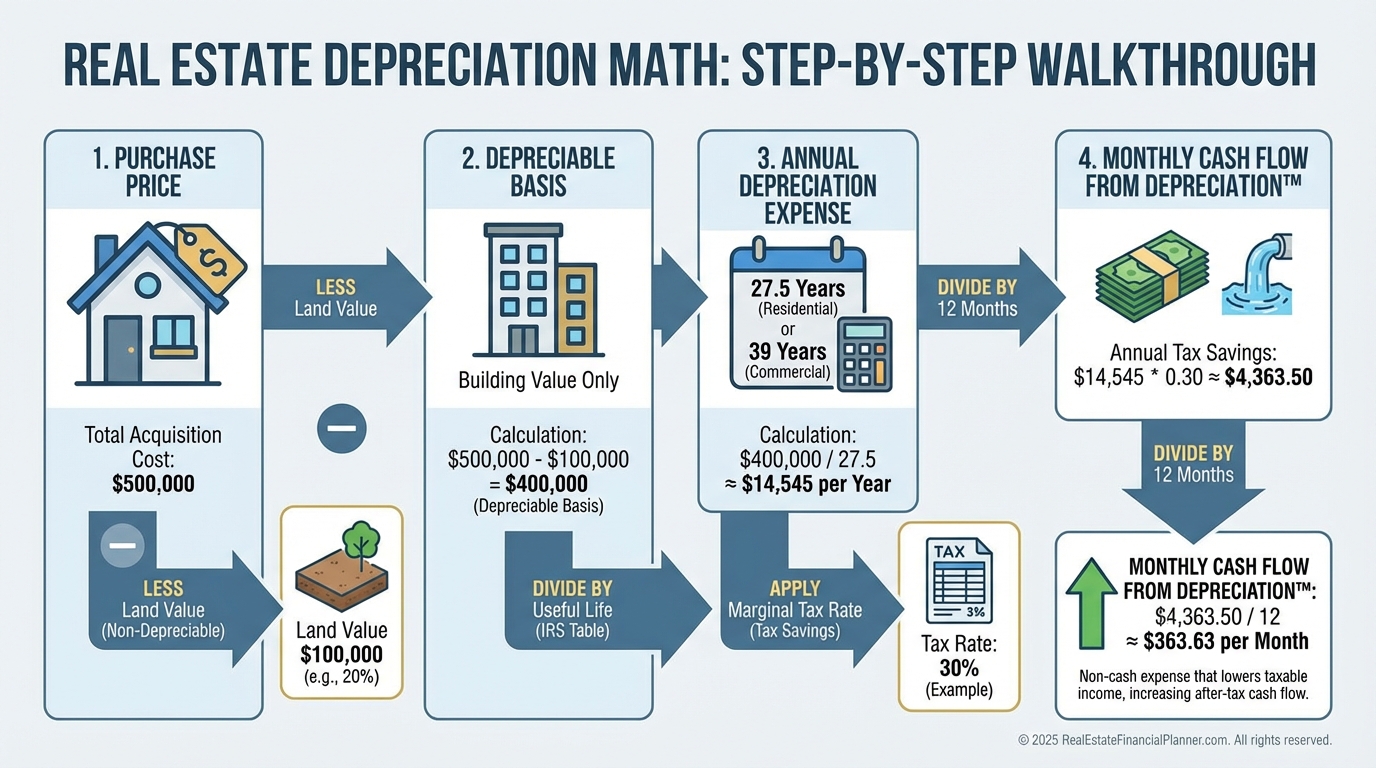

The Simple Math Behind Cash Flow from Depreciation™

I always separate this into two numbers when teaching clients.

Gross Depreciation is the deduction.

Cash Flow from Depreciation™ is the tax savings.

Start with the depreciable basis.

Purchase price minus land value, plus qualifying costs.

Example:

Purchase price: $400,000

Land value: $80,000

Depreciable basis: $320,000

$320,000 ÷ 27.5 years = $11,636 per year in depreciation.

Now apply your marginal tax rate.

At a 32% tax rate:

$11,636 × 32% = $3,723 per year

That is about $310 per month in real cash flow.

Depreciation Math to Monthly Cash Flow

This is why I say some “break-even” deals are not break-even at all.

They are quietly profitable once depreciation is included.

How Depreciation Becomes Monthly Cash Flow

You do not have to wait for a refund.

When depreciation is predictable, you can adjust your tax withholdings.

That increases your take-home pay every month.

This is where most investors miss the connection.

They see depreciation as annual.

In reality, it can be monthly.

When I review portfolios, I often find investors leaving thousands per year on the table simply because they never adjusted withholding.

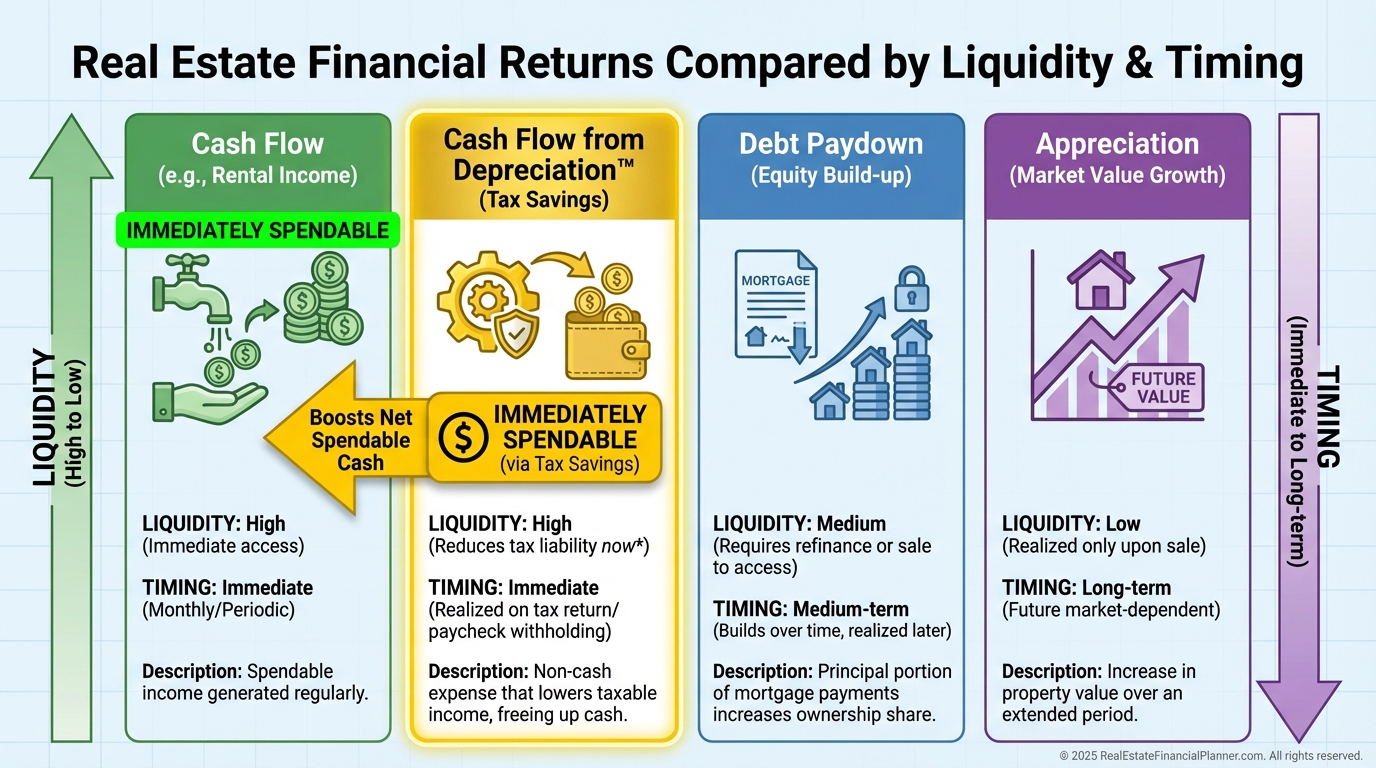

Comparing Depreciation to Other Returns

Depreciation shows up differently than other returns.

Appreciation feels exciting, but it is locked up.

Debt paydown builds equity, but it does not pay bills.

Cash Flow from Depreciation™ shows up quietly and consistently.

Comparing Returns by Liquidity

I have seen properties go from “barely works” to “comfortably profitable” once depreciation is properly modeled.

Scaling the Effect Across a Portfolio

One property adding $300 per month is helpful.

Five properties adding $1,500 per month is life-changing.

For high-income earners, the effect compounds faster.

Higher tax brackets create larger cash flow from the same depreciation.

This is one reason high earners often move into real estate sooner than later.

They feel the benefit immediately.

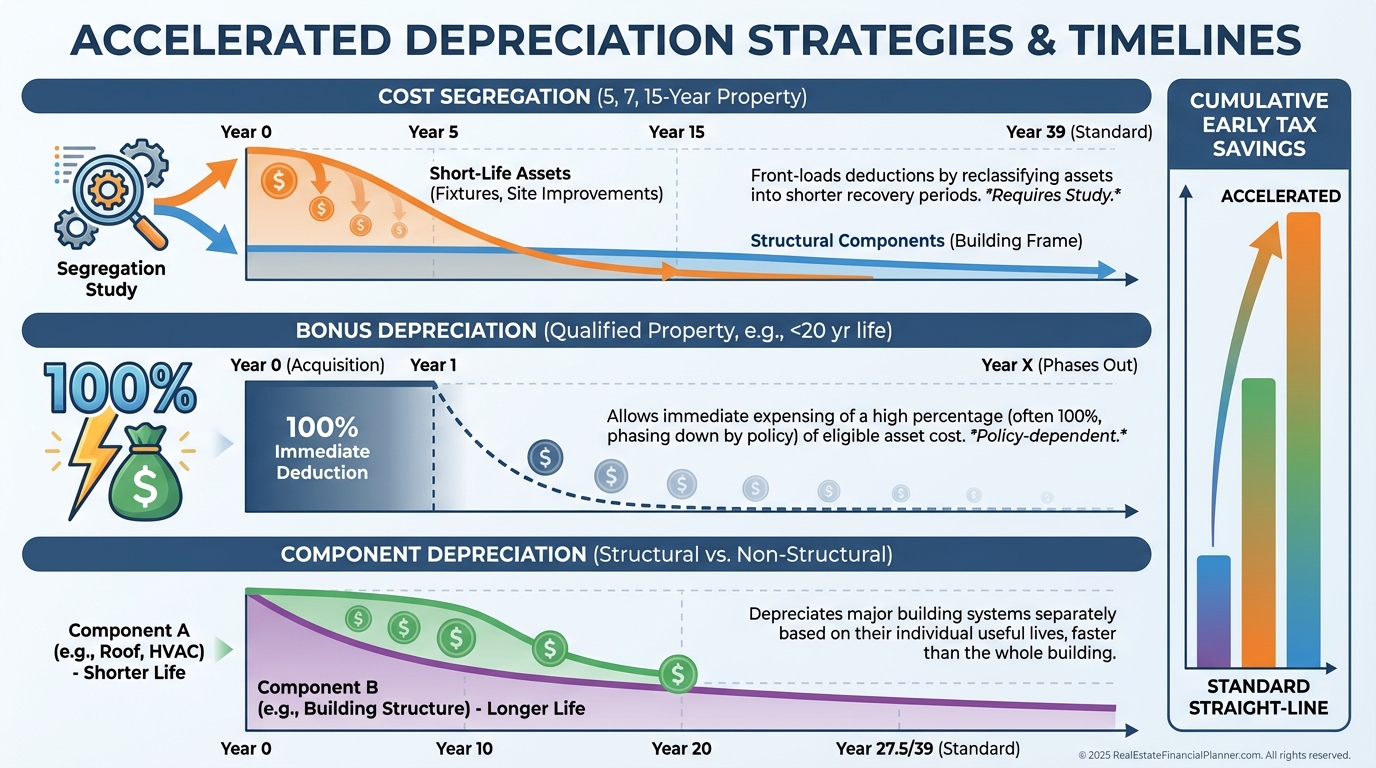

Advanced Ways Investors Accelerate Depreciation

Straight-line depreciation is just the starting point.

Cost segregation allows parts of the property to depreciate faster.

Bonus depreciation can front-load deductions into earlier years.

Accelerated Depreciation Strategies

I am careful here.

Accelerating depreciation increases early cash flow but reduces future deductions.

This is why I model these decisions inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™ instead of guessing.

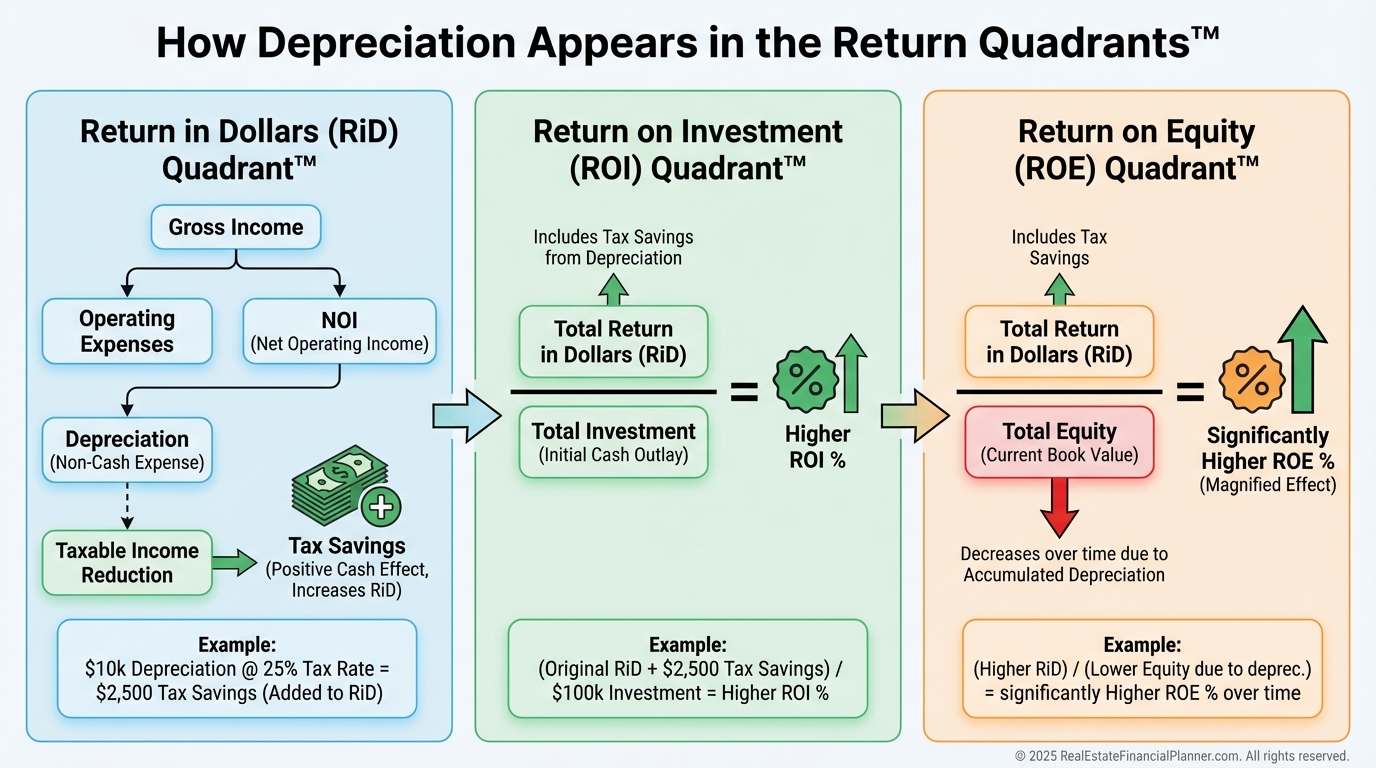

Depreciation Inside Deal Analysis

Ignoring depreciation skews deal comparisons.

In the Return in Dollars Quadrant™, depreciation often rivals cash flow.

In the Return on Investment Quadrant™, it boosts early returns dramatically.

In the Return on Equity Quadrant™, it influences hold-versus-sell decisions.

Depreciation Inside the Return Quadrants™

I also include reserves.

Responsible investing creates a drag on returns.

Cash Flow from Depreciation™ helps offset that drag and rewards disciplined investors.

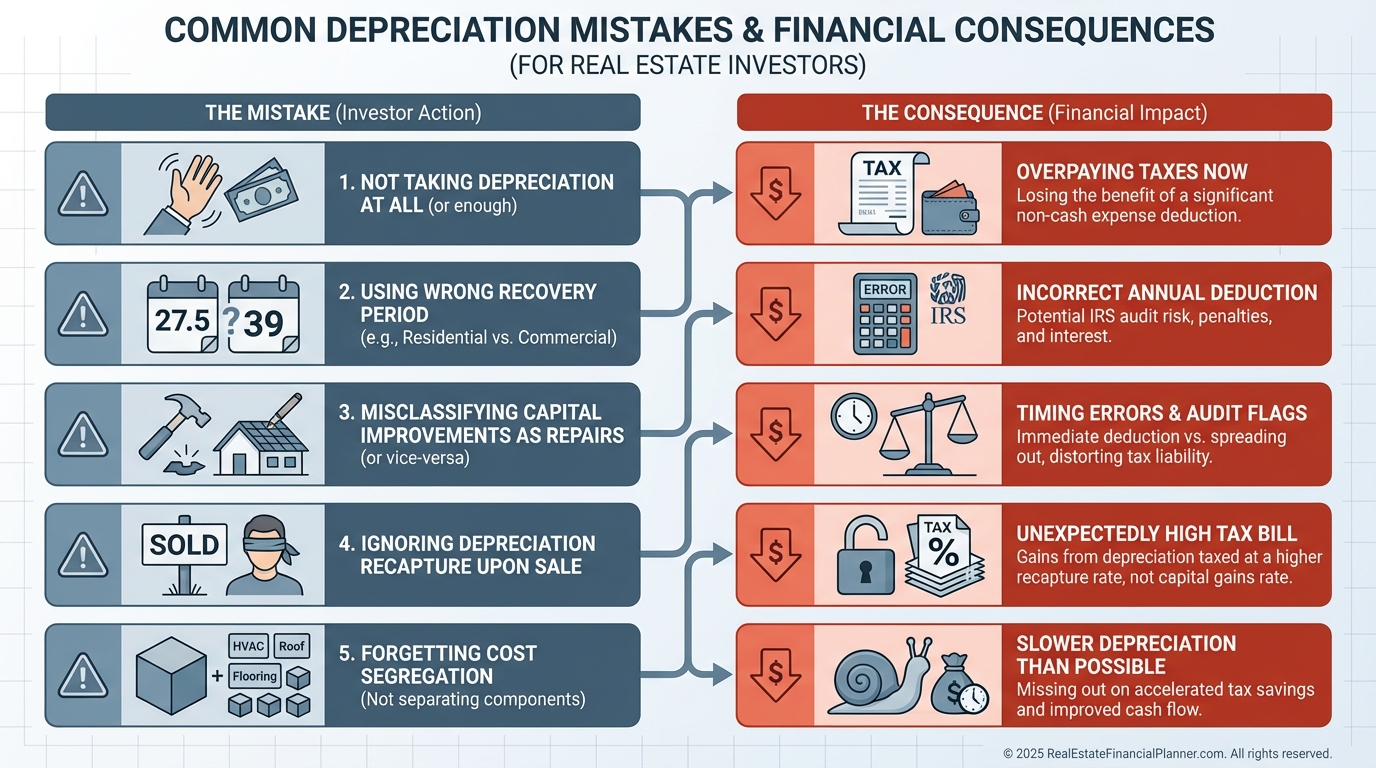

Common Mistakes I See Repeated

Some investors skip depreciation to avoid recapture.

That is a mistake.

The IRS assumes you took depreciation whether you did or not.

You lose the benefit but keep the tax bill.

Others miscalculate basis or forget improvements.

Every missed dollar of basis reduces future cash flow.

Common Depreciation Mistakes

How to Start Using Cash Flow from Depreciation™

This is not advanced wizardry.

It is disciplined analysis.

Model depreciation on every deal.

Convert it into monthly cash flow.

Include it in every Return Quadrants™ review.

When investors finally see this clearly, their deal standards change.

So does their confidence.

Cash Flow from Depreciation™ is not flashy.

It is boring, predictable, and powerful.

Those are exactly the returns that build financial independence.