Debt Service Explained: The Silent Risk That Breaks Real Estate Deals

Learn about Debt Service for real estate investing.

Most investors think they understand debt service right up until it hurts them.

When I help clients analyze deals, debt service is almost always where the hidden risk lives. Not appreciation. Not rent growth. Debt service.

I’ve seen smart investors buy good properties and still fail because they misunderstood what they actually owed each month.

After rebuilding my own portfolio post-bankruptcy, I became borderline obsessive about debt service. It is the one number that decides whether you survive a downturn or lose everything.

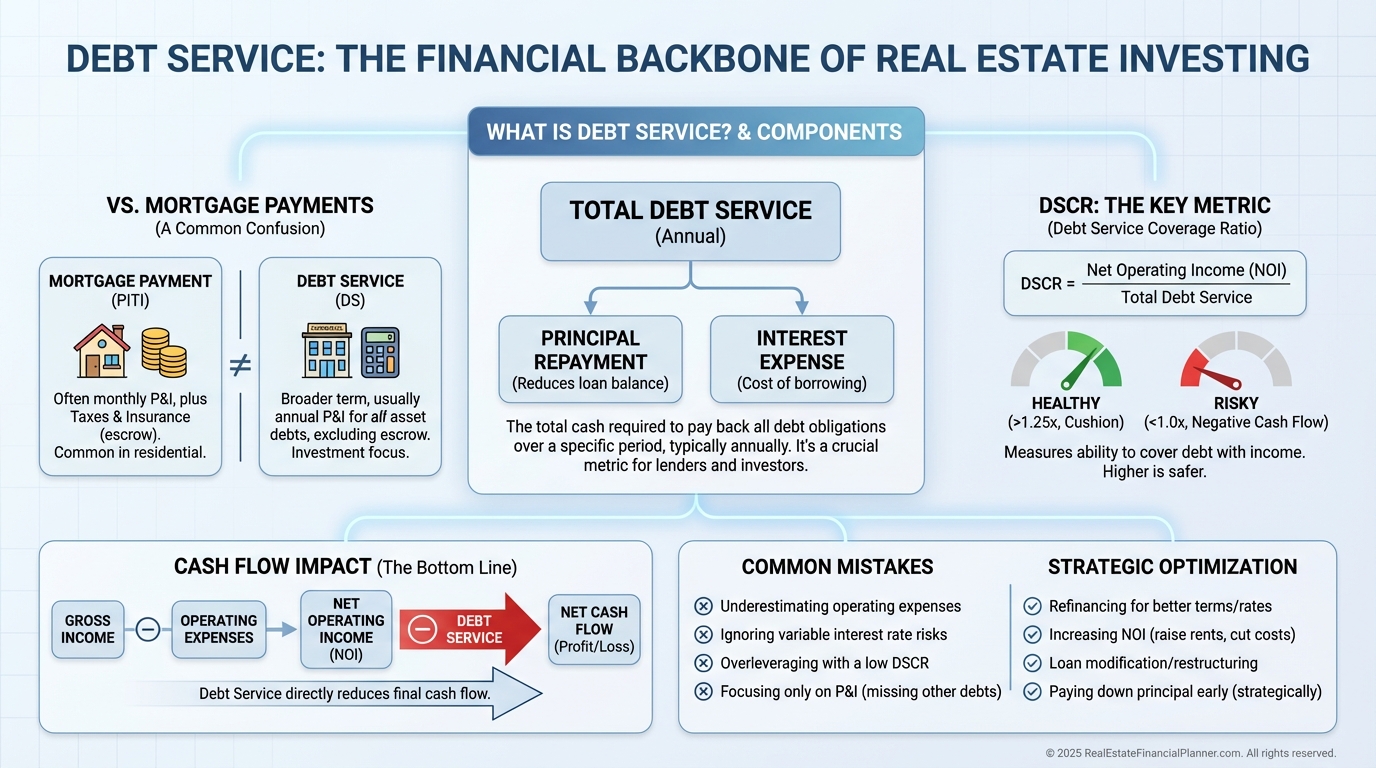

What Debt Service Really Means

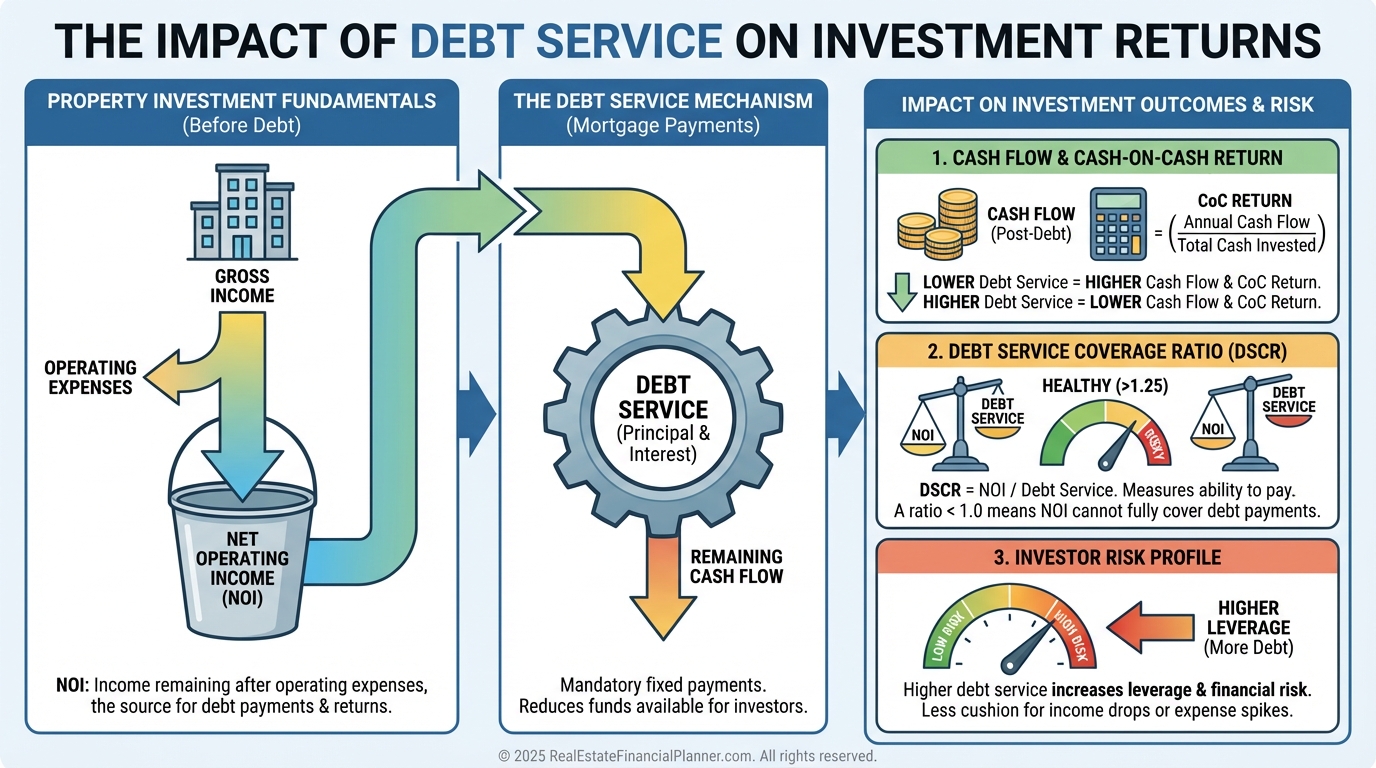

Debt service is the total required loan payments tied to a property.

That includes principal and interest, but it does not stop there.

If money must leave your account each month because of a loan secured by the property, it is debt service.

This is where investors get into trouble.

They assume debt service equals their mortgage payment. That shortcut ruins portfolios.

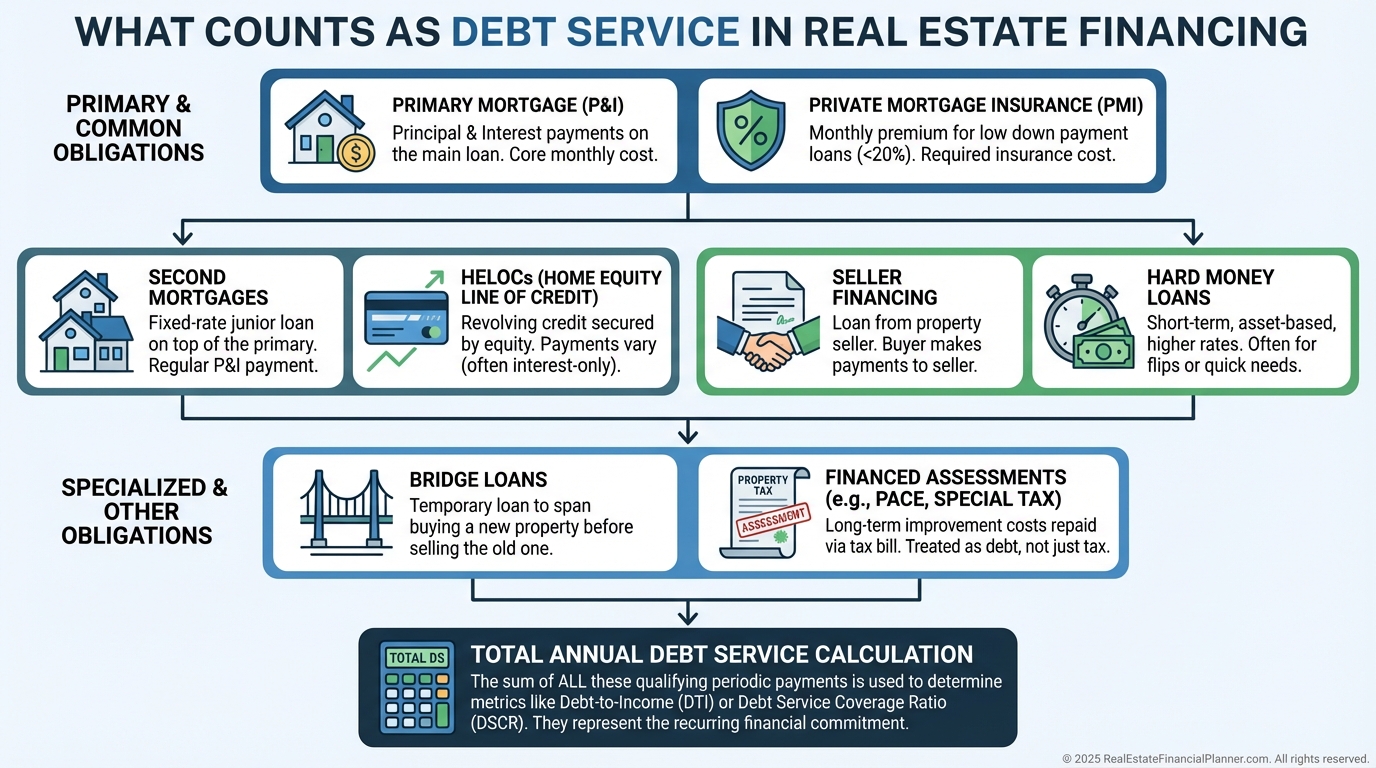

True debt service includes every required payment tied to financing.

Primary mortgages.

PMI.

Seller seconds.

HELOC minimums.

Hard money.

Bridge loans.

Financed assessments.

Miss one, and your analysis is fantasy.

Debt Service vs. Similar Terms

Debt service is not operating expenses.

Maintenance, management, utilities, insurance, and routine taxes are operating expenses. They keep the property running.

Debt service pays lenders.

Cash flow comes after both.

When I model deals inside REFP™, I treat debt service as non-negotiable. You pay it or you default. Everything else is secondary.

Why Lenders Obsess Over Debt Service

Lenders do not care about your optimism.

They care about coverage.

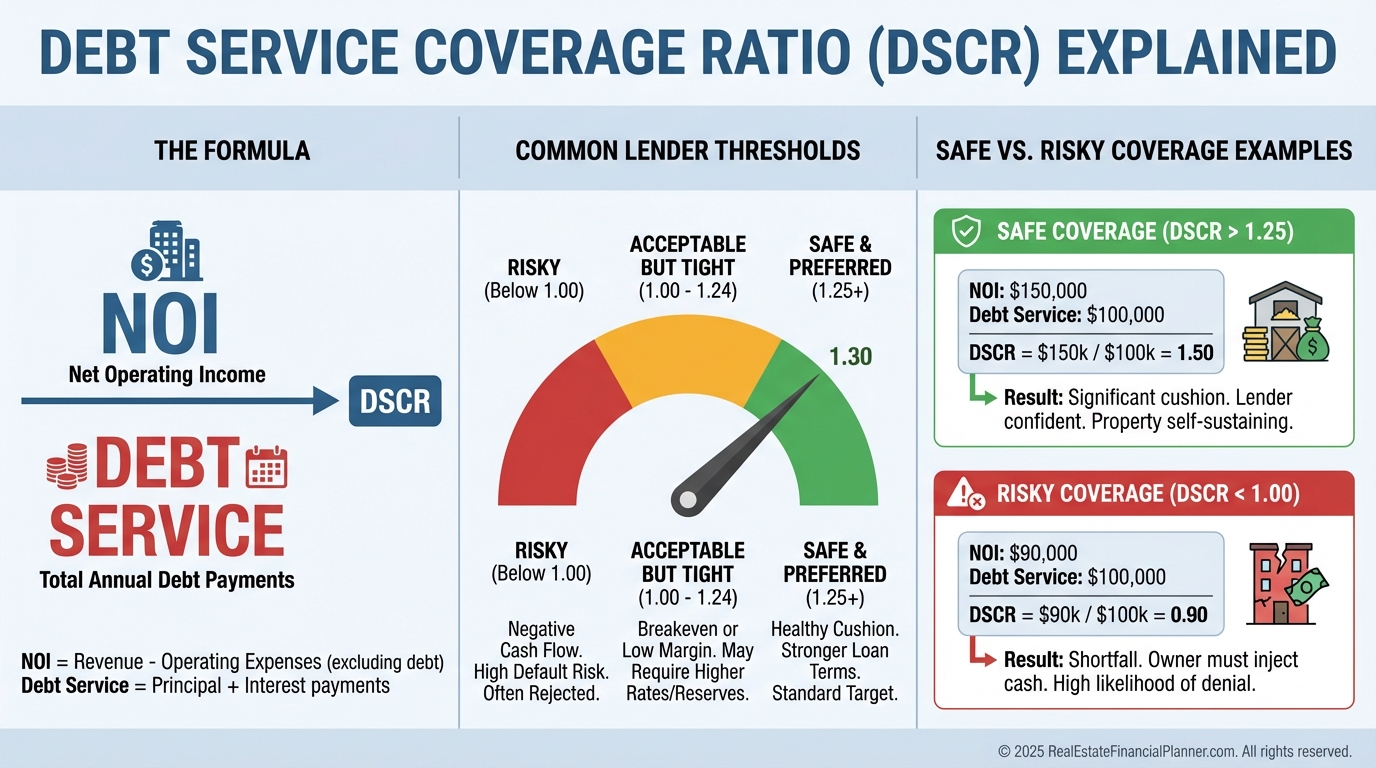

Debt Service Coverage Ratio (DSCR) measures how safely income exceeds debt obligations.

DSCR equals Net Operating Income divided by total debt service.

Most lenders want at least 1.20 to 1.25.

That margin is not a suggestion. It is survival space.

I warn clients that DSCR below 1.15 is fragile. Below 1.10 is dangerous. Below 1.00 is foreclosure math.

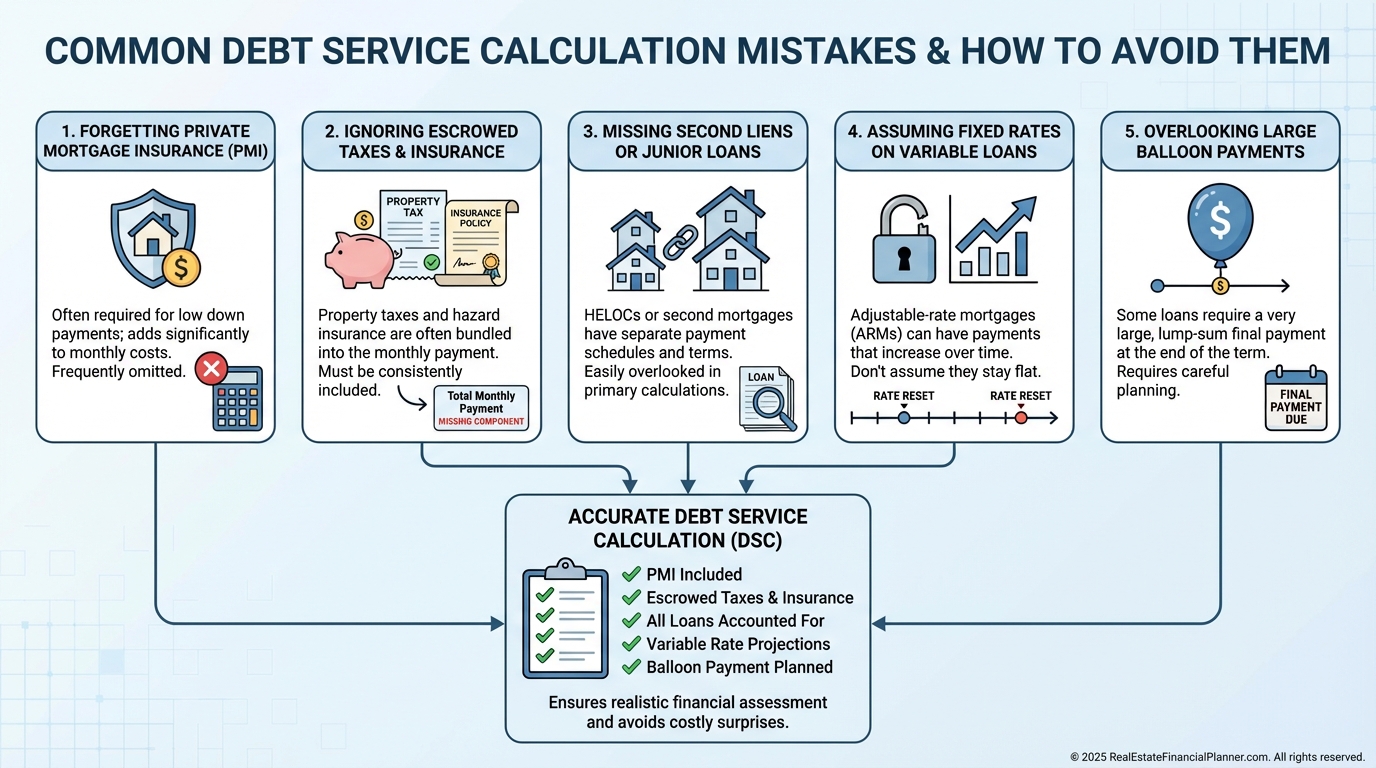

How Investors Miscalculate Debt Service

This is where deals go sideways.

I regularly see investors calculate only principal and interest, then celebrate positive cash flow.

Then reality arrives.

They forgot PMI.

They ignored escrow changes.

They excluded seller financing.

They assumed adjustable rates stay low.

They ignored balloon payments.

Those are not small errors. They compound every month.

A Real Calculation Example

When I walk clients through deals, I force them to list every loan.

Marcus buys a duplex.

First mortgage payment looks manageable.

Then we add the seller second.

Then the financed assessment.

Suddenly his “comfortable” deal is 40% more expensive than expected.

That difference is the line between holding long-term and panic selling.

Debt Service as a Return Killer

High debt service quietly destroys returns.

It lowers cash flow.

It reduces flexibility.

It magnifies vacancies.

In the Return Quadrants™, debt service directly attacks cash flow while increasing risk.

Lower debt service improves returns without raising rents or hoping for appreciation.

That is why experienced investors obsess over financing terms.

Strategic Use of Debt Service

Debt service is not just defensive.

It is strategic.

When I analyze acquisitions, I look for ways to control early-year debt service.

Interest-only periods.

Seller seconds with delayed payments.

Assumable low-rate loans.

These strategies buy time.

In Nomad™ strategies, owner-occupant financing often creates artificially low debt service compared to investor loans. That advantage compounds over decades.

Reserves and Survival

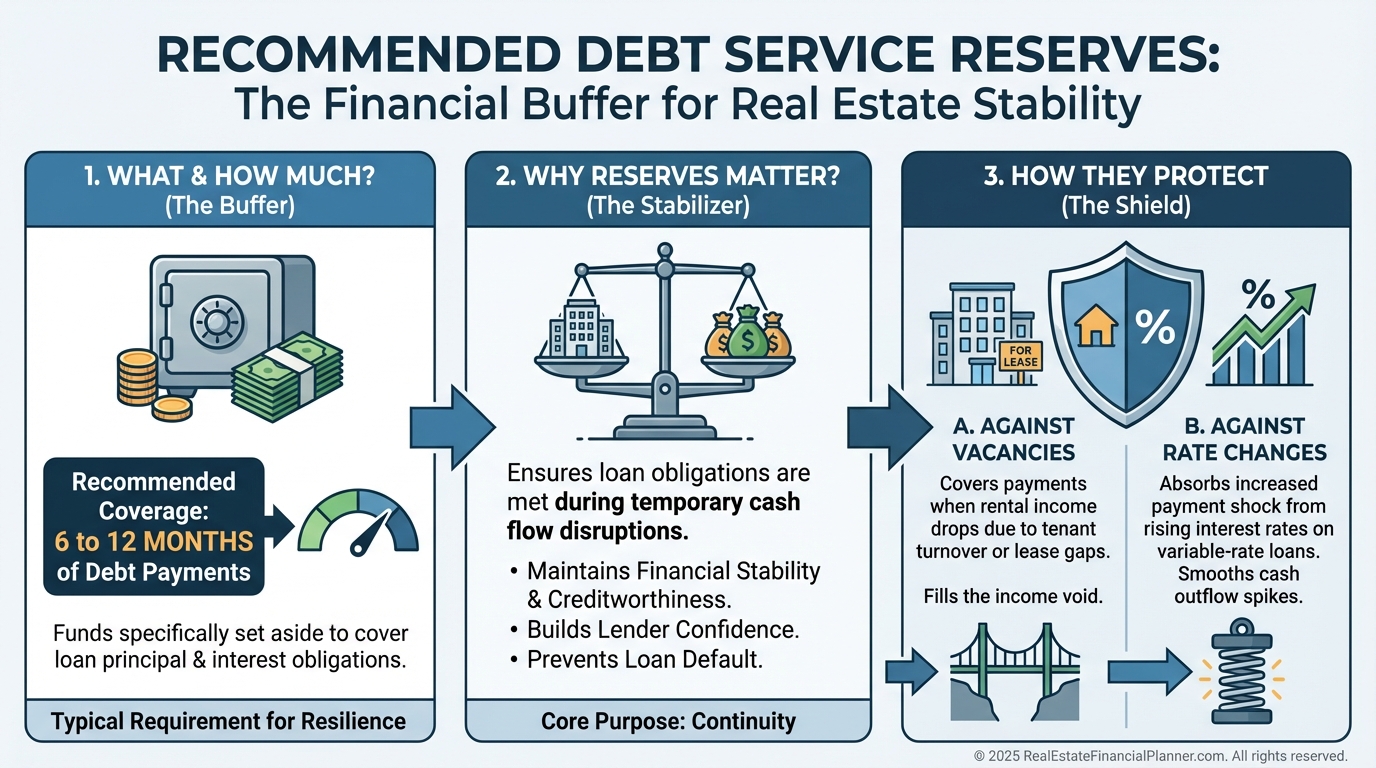

I insist clients hold six to twelve months of total debt service in reserves.

Not expenses.

Not partial payments.

Total debt service.

Vacancies happen.

Repairs happen.

Refinancing delays happen.

Debt service does not pause.

Exit Planning Starts with Debt Service

Exit strategy begins the day you buy.

Low debt service widens your buyer pool.

High debt service scares buyers away.

When I model exits using True Net Equity™, high debt service erodes value long before commissions or taxes show up.

Properties sell faster and for more money when debt service is reasonable.

Final Warning

Most failed investors did not buy bad properties.

They financed them badly.

Debt service is boring.

Debt service is mechanical.

Debt service decides everything.

If you want to build wealth instead of stress, master this one number.

Calculate it fully.

Monitor it monthly.

Engineer it intentionally.

That discipline is what separates professionals from gamblers.