Loan Seasoning: The Invisible Timeline Controlling Your Refi, Cash‑Out, and Exit Strategy

Learn about Loan Seasoning for real estate investing.

Why Loan Seasoning Quietly Controls Your Access to Capital

When I help clients map their year, we plot the seasoning milestones first, and only then schedule rehabs, appraisals, and refis.

Seasoning is the invisible timeline that determines when you can unlock equity, change debt, or exit profitably.

Get it wrong and you bleed interest, pay extensions, and miss deals.

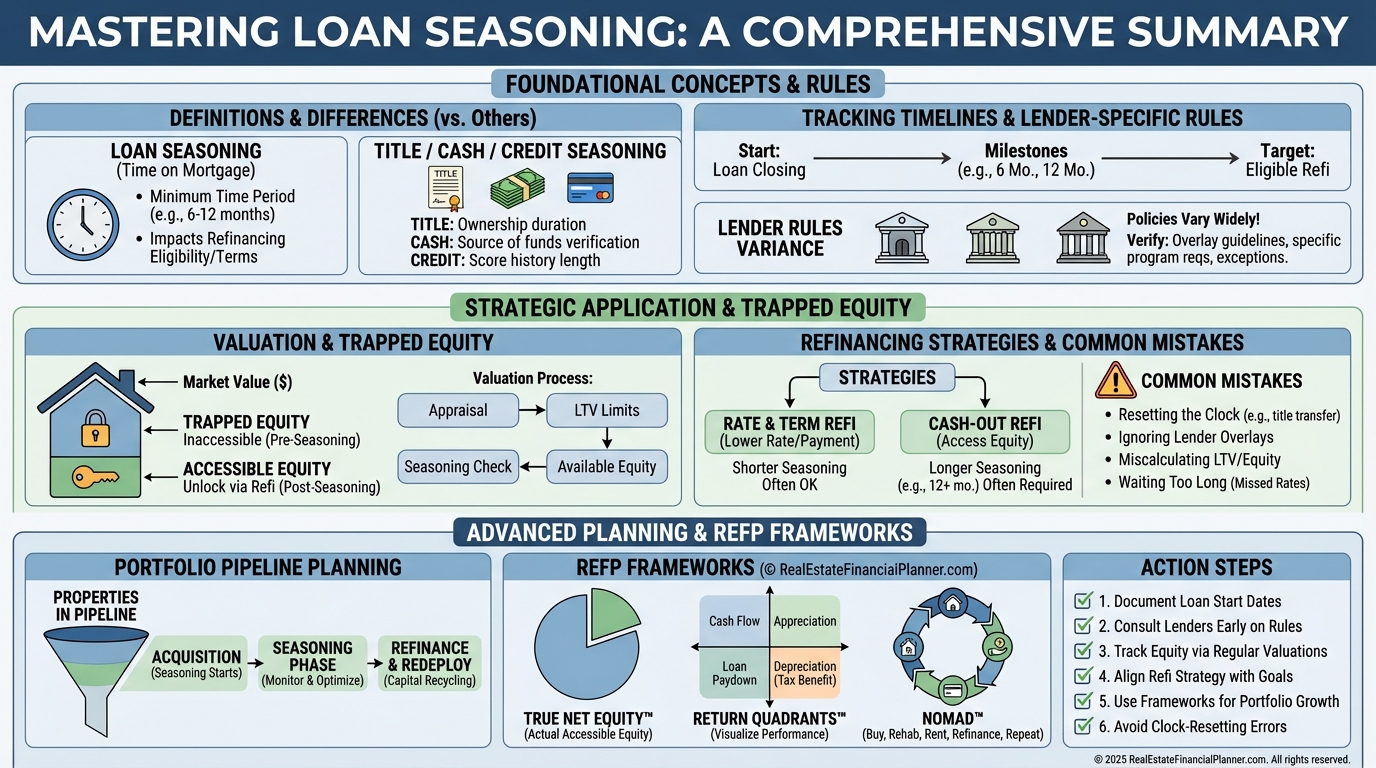

What Loan Seasoning Is (And What It Isn’t)

Loan seasoning is the age of the current loan plus its documented on-time payment history.

It is not the same as how long you’ve owned the property, how long cash sat in your account, or how long you’ve built credit.

Lenders use it to reduce churn risk and to verify you can service the debt over time.

The clock starts at closing and lenders verify with statements, credit reports, and title records.

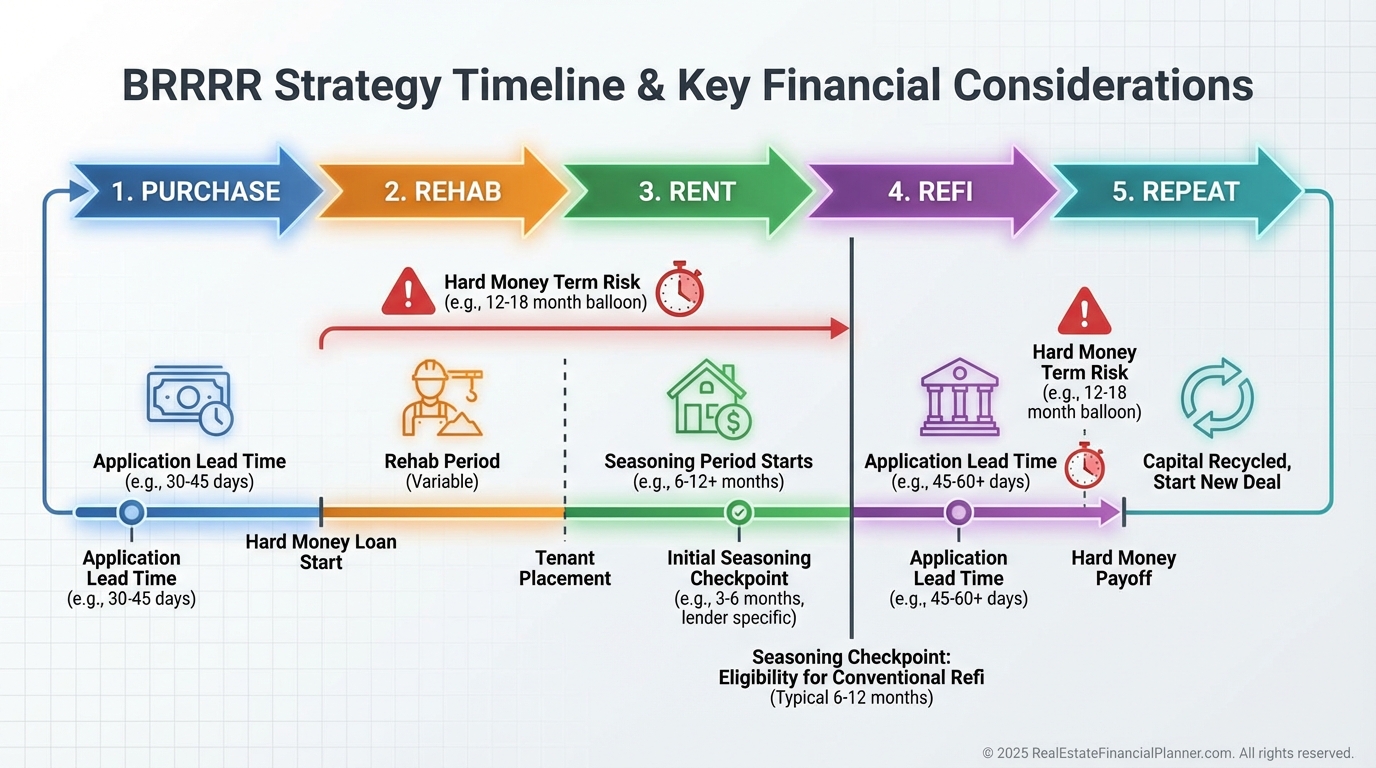

Field Story: The Duplex That Had to Wait

Sarah bought a duplex with hard money at 12% expecting to refi once stabilized.

Her lender required six months of loan seasoning for the rate‑and‑term refi she wanted.

Three extra months at 12% cost her $4,500 and delayed the next down payment by a quarter.

When I reviewed her plan afterward, the fix was simple: align rehab and tenant placement to finish just before month five, then file the refi so it closes after month six.

How I Track Seasoning for Clients

I start with the closing date and build a milestone timeline in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Then I layer in lender rules, buffer time, and the processing window between application and closing.

Every property gets a one-page “Seasoning Sheet” with start date, payment history, next eligibility dates, target refi type, and backup lender.

I also store every monthly statement and payment confirmation because missing documentation is a common approval delay.

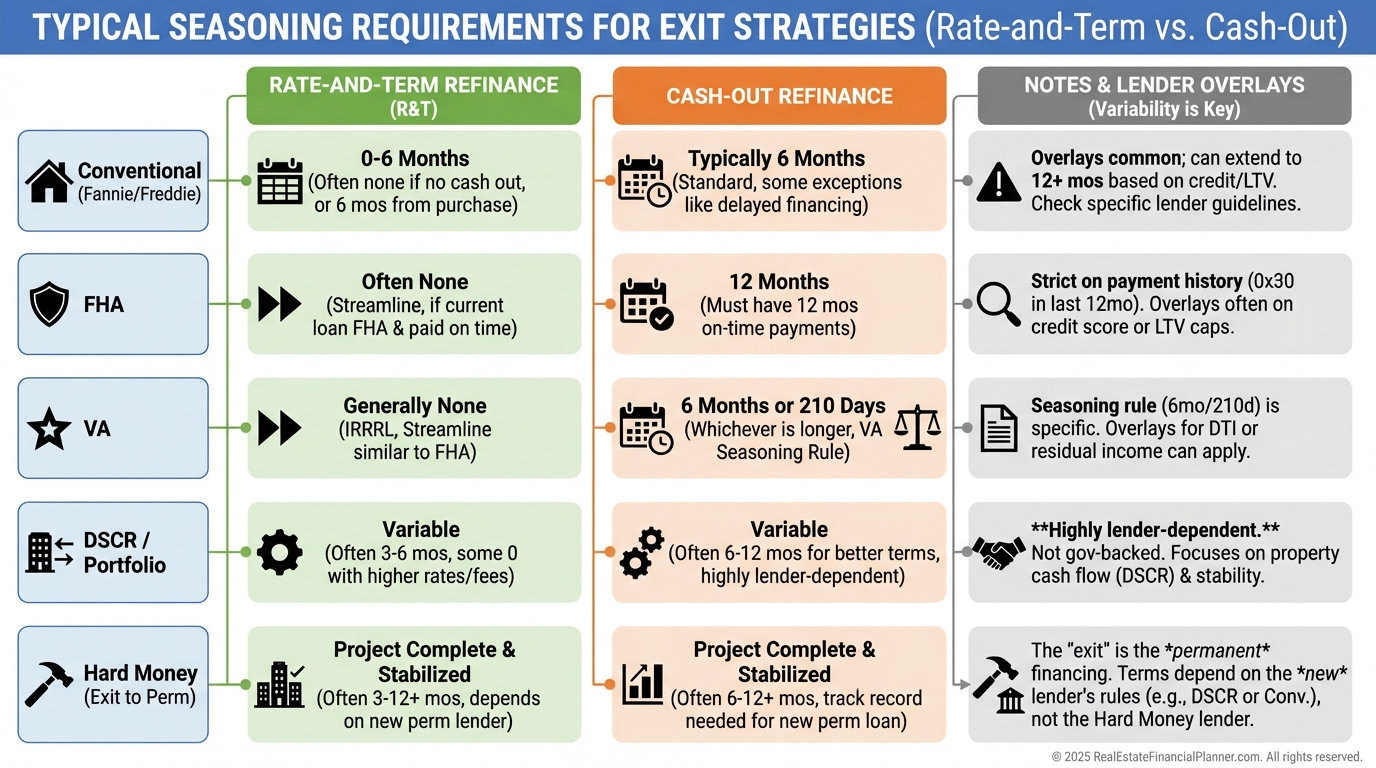

Typical Seasoning Rules by Loan Type

Rules vary by lender and program, but here’s what I model when underwriting.

•

Conventional: Often ~6 months for rate‑and‑term; ~12 months for cash‑out.

•

FHA: Commonly 210 days (7 months) of ownership for cash‑out; streamline usually needs six on‑time payments and 210 days since prior closing.

•

DSCR/Portfolio: Wide range. Some local banks and credit unions allow shorter or no seasoning; others mirror agency rules.

•

VA: Often requires 210 days and a set number of payments for IRRRL; confirm cash‑out rules.

•

Hard Money Exit: Your term must exceed seasoning plus processing time, or you’ll pay extensions.

Always verify with the actual lender you plan to use; “lender overlays” can be stricter than the base guideline.

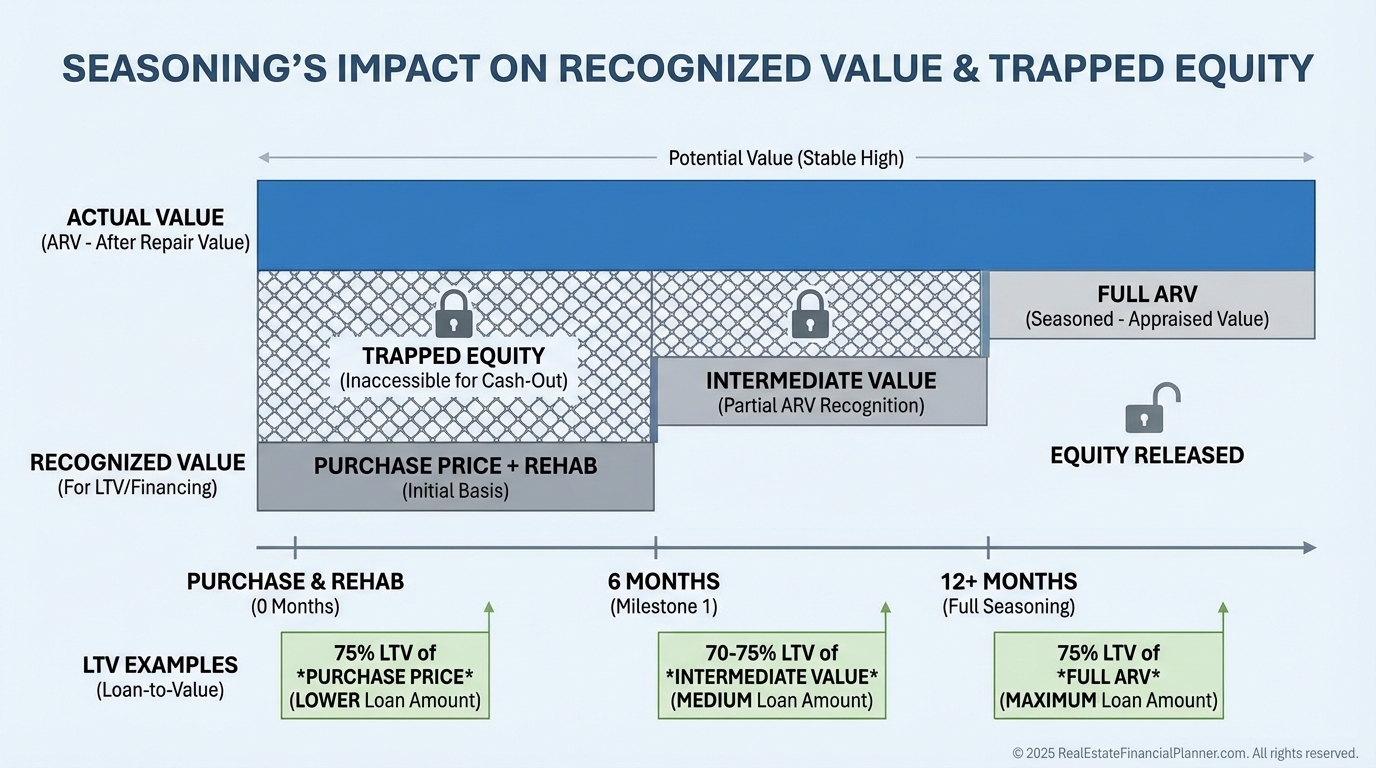

Seasoning, Appraisals, and Trapped Equity

Seasoning influences what value underwriters will accept—especially after quick rehabs.

I’ve seen lenders cap value near purchase price plus documented improvements until a certain age and payment history are met.

That creates “trapped equity”—you own it, but can’t pull it yet.

For BRRRR investors, this delay can stall your entire pipeline if your next deal depends on cash‑out proceeds.

The Math: Returns, DSCR, and Opportunity Cost

Your DSCR doesn’t change because time passes, but lender risk perception does.

Seasoned loans often get smoother approvals and sometimes better pricing or LTV.

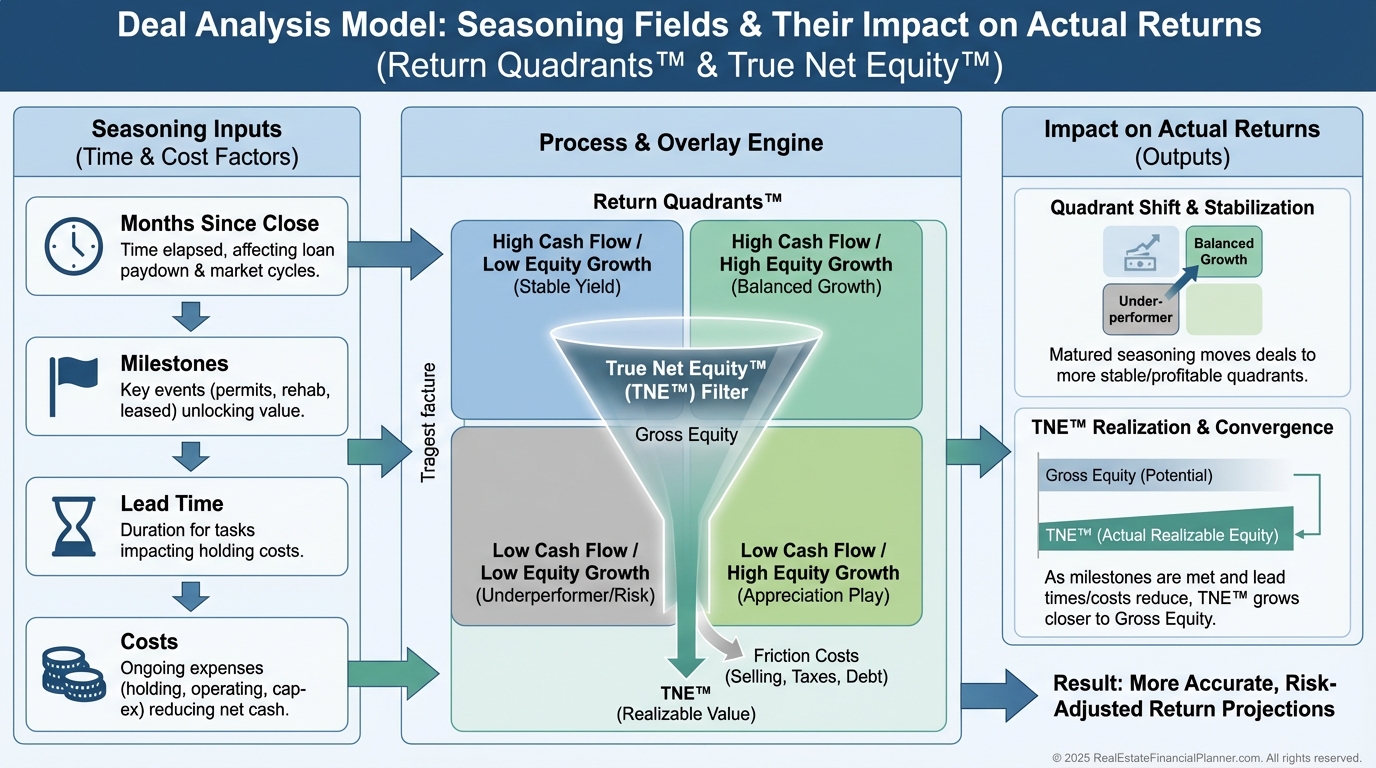

I model the opportunity cost using Return Quadrants™.

If $50,000 sits trapped for six months and you typically earn 15% cash‑on‑cash, that wait costs about $3,750.

With True Net Equity™, I subtract acquisition costs, selling/refi costs, and any prepayment or extension fees to get the real equity I can actually convert.

When I rebuilt after my own painful capital crunch years ago, this discipline kept me out of “paper rich, cash poor” traps.

Common Mistakes I See (And How We Prevent Them)

•

Assuming all lenders are the same.

•

Lining up a 6‑month hard money term when you need 6 months of seasoning plus 45‑60 days to close.

•

One late payment resetting eligibility with certain programs.

•

Mixing up title seasoning (ownership duration) with loan seasoning (age of current loan).

•

Weak documentation practices that slow underwriting.

I set clients up with auto‑pay, quarterly lender check‑ins, and a backup refi plan before we close.

Case Studies To Learn From

Sarah’s duplex showed the cost of ignoring the seasoning timeline.

Marcus tracked from day one and filed his rate‑and‑term refi in month five to close in month seven—clean, predictable, and cheap.

Jennifer bought at $200K, put in $50K, and appraised at $300K after three months.

Her lender capped recognized value due to limited seasoning, so her cash‑out was based on ~$250K.

Waiting until month six unlocked the full ARV for a larger, cheaper take‑out.

Robert’s BRRRR had a hard money balloon at month six.

His target lender needed six months of seasoning before he could even apply for a cash‑out above their threshold.

Processing took 45 days, and he paid extension fees and a higher rate for the final month.

Strategy: Build a Seasoning‑Conscious Portfolio

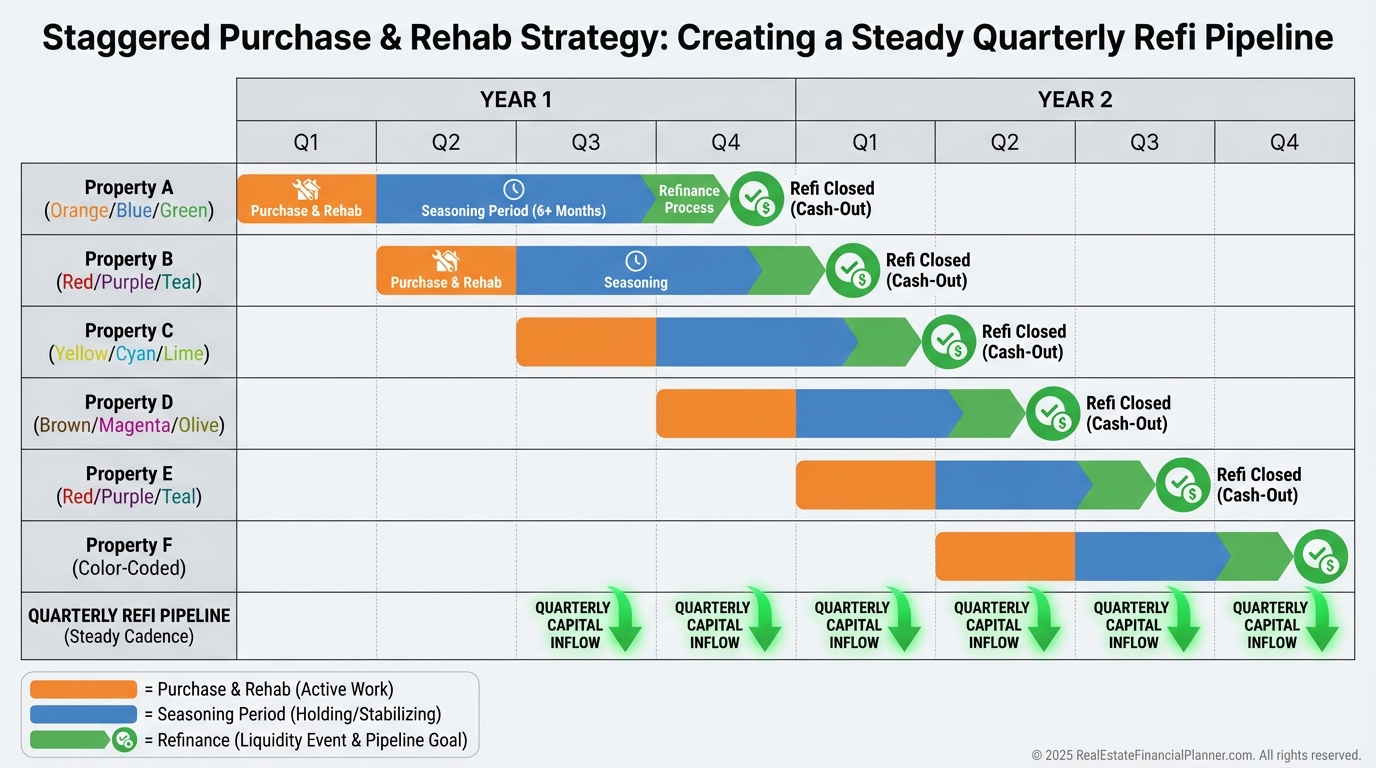

When I help clients scale, we stagger acquisitions so a refi matures every few months.

We keep multiple lender relationships warm—especially local banks with flexible portfolio loans.

If seasoning blocks an immediate move, we sometimes bridge selectively, but only when the spread justifies the carrying cost and risk.

Advanced Moves (Use Carefully)

Subject‑to deals can leverage the seller’s already seasoned loan, but require careful legal and due‑on‑sale risk management.

Partnership structures sometimes allow you to refi based on a partner’s longer ownership history, depending on lender policy.

Wholesale assignments bypass seasoning because you never close—but they also bypass long‑term wealth.

Use creativity to solve real constraints, not to skip underwriting fundamentals.

Plug It Into Your Deal Analysis

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add fields for:

•

Months since closing (current loan seasoning)

•

Target refi date by program

•

Required on‑time payments

•

Application lead time and expected close date

•

Holding costs during the seasoning period

•

Opportunity cost of trapped equity (Return Quadrants™ view)

•

True Net Equity™ after refi costs, fees, and reserves

Then I run multiple lender scenarios with different overlays to see how timing shifts the returns.

A deal that looks like 25% cash‑on‑cash with an immediate refi may be 17‑19% when you apply realistic seasoning rules—and that can change your buy box.

Your Next Three Moves

•

Open your spreadsheet and add seasoning tracking columns for every property.

•

Email three lenders today and document their seasoning and overlay rules.

•

Align your rehab and tenanting schedules so your strongest NOI lines up with your next seasoning milestone.

Seasoning isn’t a hurdle; it’s your calendar for releasing trapped capital on purpose.

Use it to time exits, reduce costs, and fund the next acquisition with confidence.