Escrows: The Silent Cash Flow Killer Most Investors Ignore

Learn about Escrows for real estate investing.

Most real estate investors treat escrows like background noise.

Something the lender “just handles.”

That mistake quietly destroys cash flow.

When I help clients analyze deals, escrow errors are one of the most common reasons a “cash-flowing” property stops cash flowing a year later.

Escrows are not paperwork.

They are a cash flow system.

And if you ignore them, they will punish you.

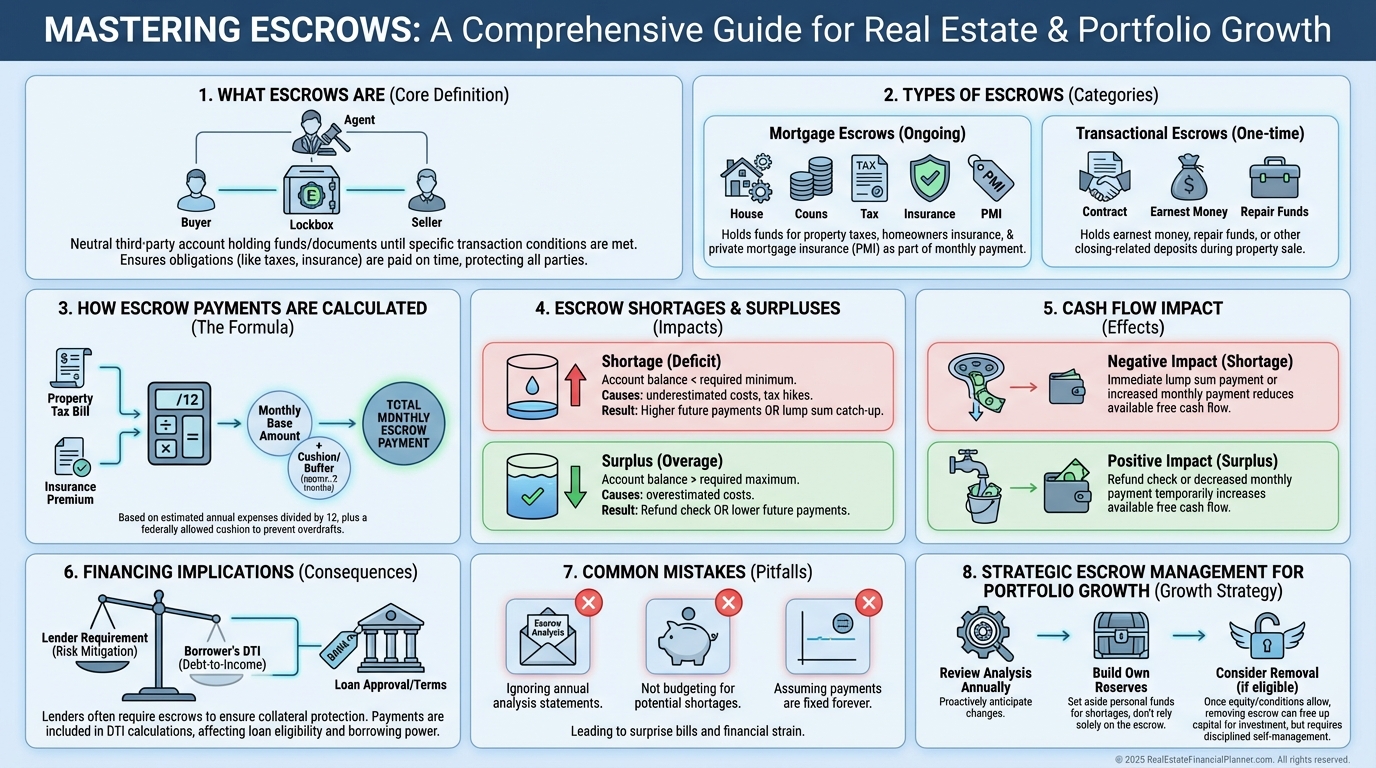

What Escrows Really Are

At their core, escrows are third-party holding accounts.

Your lender collects money monthly and holds it in trust to pay specific expenses when they come due.

Usually:

Those costs don’t go to your lender.

They sit in escrow until the bill is paid.

That distinction matters.

Your principal and interest may be fixed, but escrow payments almost never are.

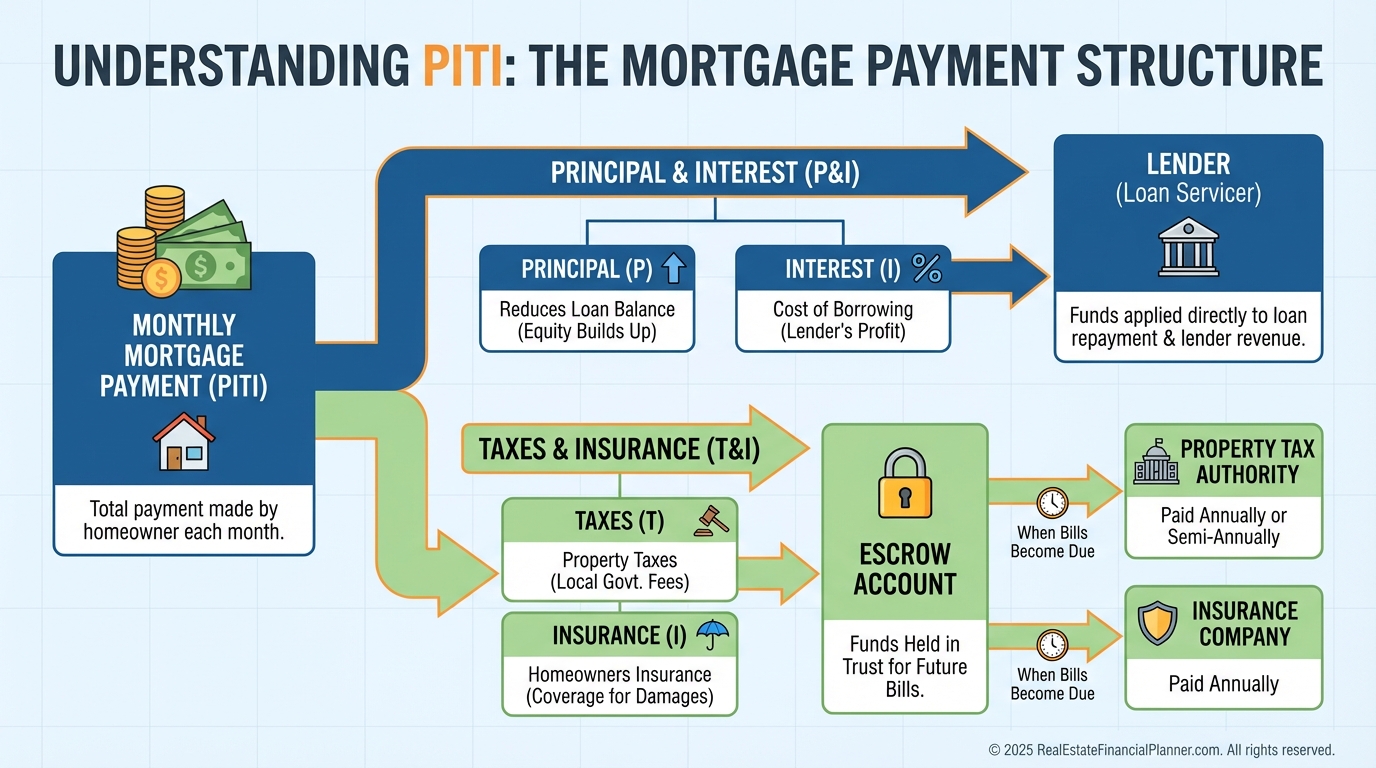

PITI Is Where Investors Get Tripped Up

Your total payment is not just principal and interest.

It’s PITI:

Principal

Interest

Insurance

Only the first two are predictable.

Taxes get reassessed.

Insurance premiums rise.

Escrows adjust annually.

That means your “fixed payment” is often anything but fixed.

When I rebuilt after bankruptcy, I became obsessive about modeling worst-case payment scenarios.

Escrows were always the wildcard.

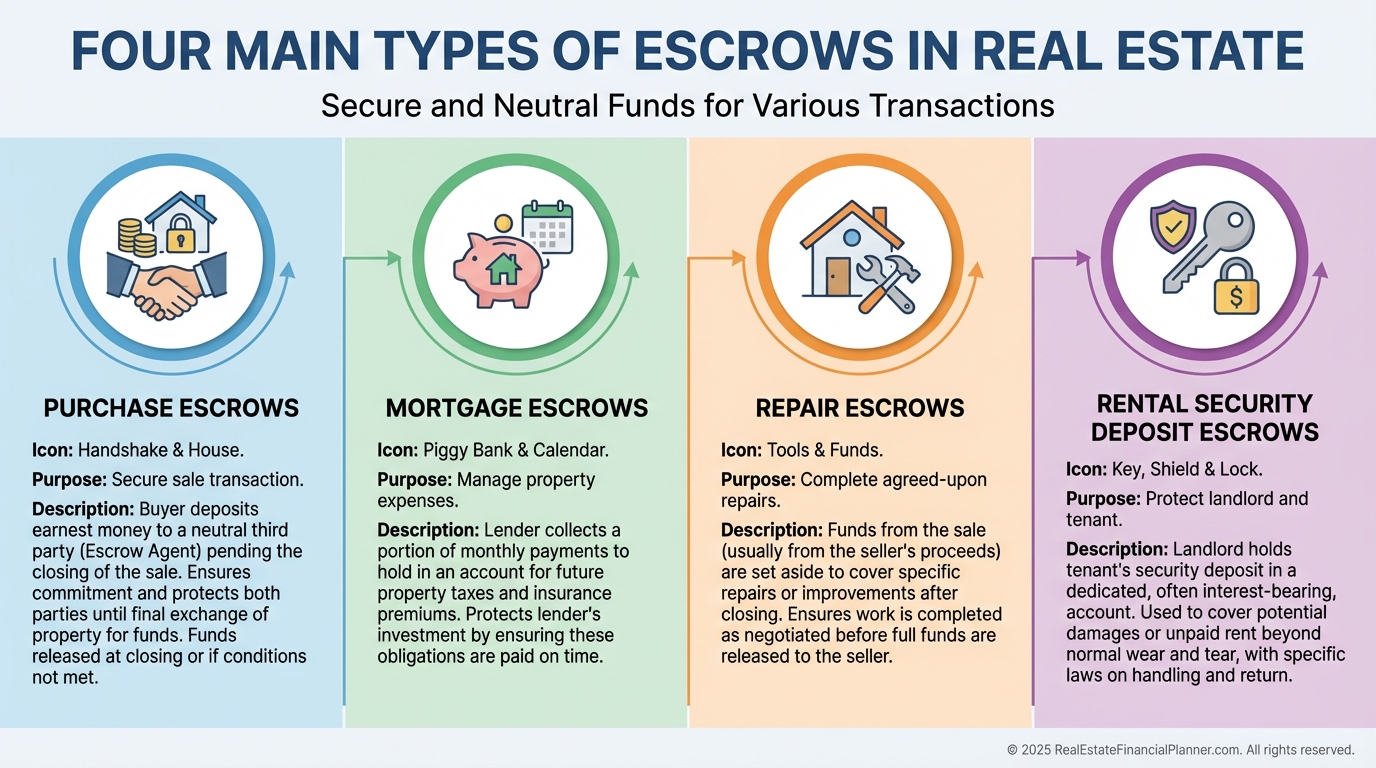

The Four Types of Escrows Investors Encounter

Not all escrows serve the same purpose.

Understanding the differences prevents expensive assumptions.

Purchase Escrows

Short-term accounts used during a transaction to hold earnest money and closing funds.

Mortgage Escrows

Ongoing accounts tied to your loan that collect taxes and insurance monthly.

Repair Escrows

Funds held after closing to ensure required repairs get completed.

Security Deposit Escrows

Tenant deposits held separately under state-specific landlord rules.

Each behaves differently.

Confusing them leads to cash surprises.

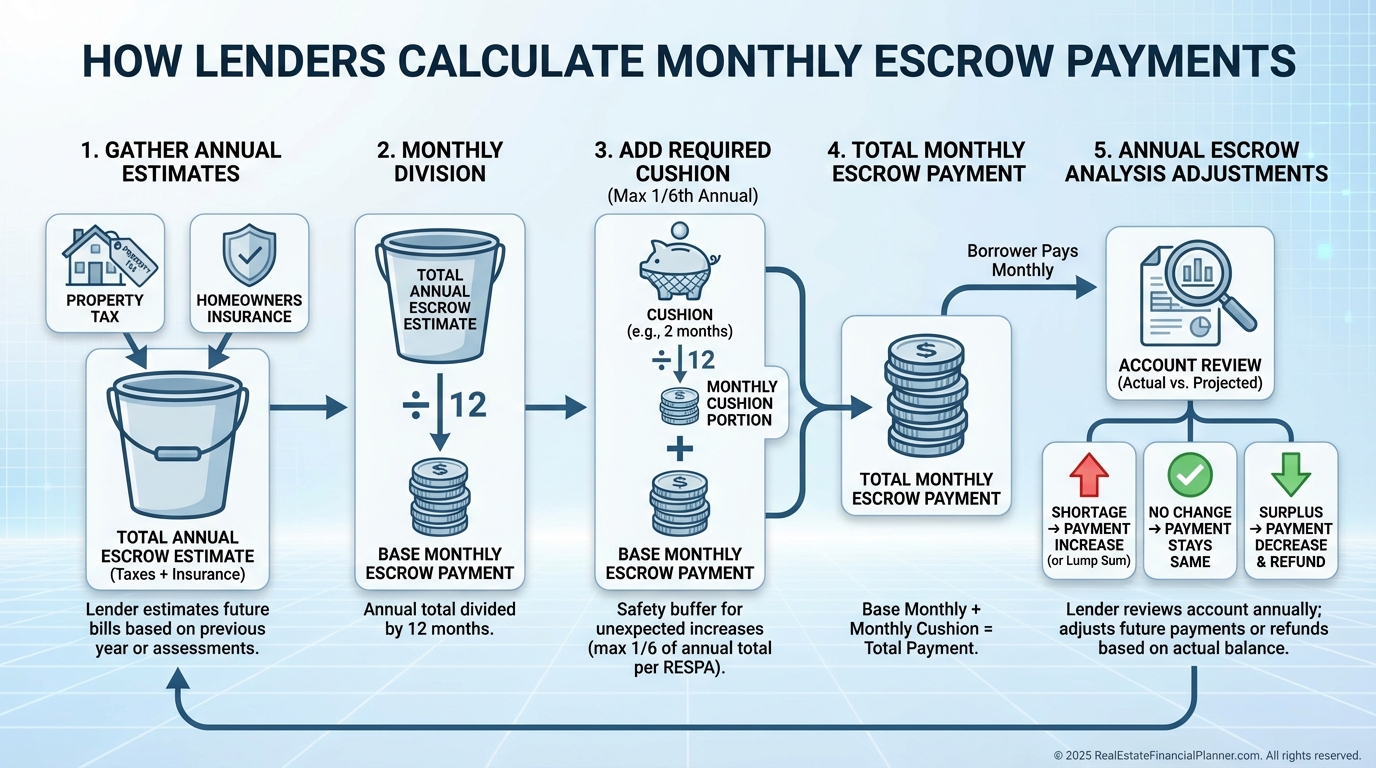

How Escrow Payments Are Actually Calculated

Most investors think escrow math is simple.

It isn’t.

Here’s what lenders really do:

Estimate annual taxes and insurance

Divide by twelve

Add a cushion, usually two months

Adjust annually based on actual bills

That cushion alone catches investors off guard.

When I review escrow analyses for clients, errors are common.

Outdated tax assumptions.

Wrong insurance premiums.

Missed reassessments.

Those errors compound silently until the adjustment letter arrives.

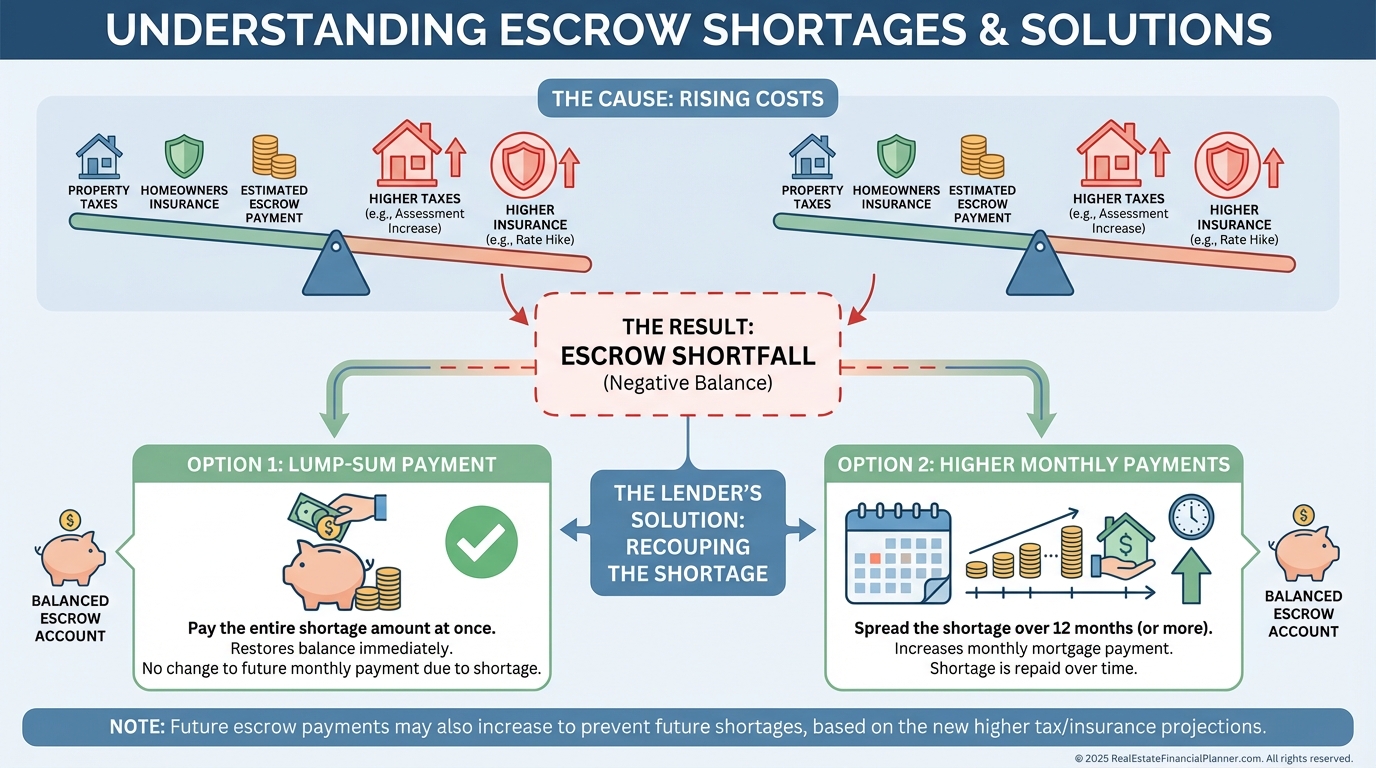

Why Escrow Shortages Wreck Cash Flow

Escrow shortages are not optional.

They must be paid.

Either:

As a lump sum, or

Spread over twelve months

Both hurt.

This is where investors tell me, “The property used to cash flow.”

Nothing changed operationally.

The payment changed.

Escrows killed the margin.

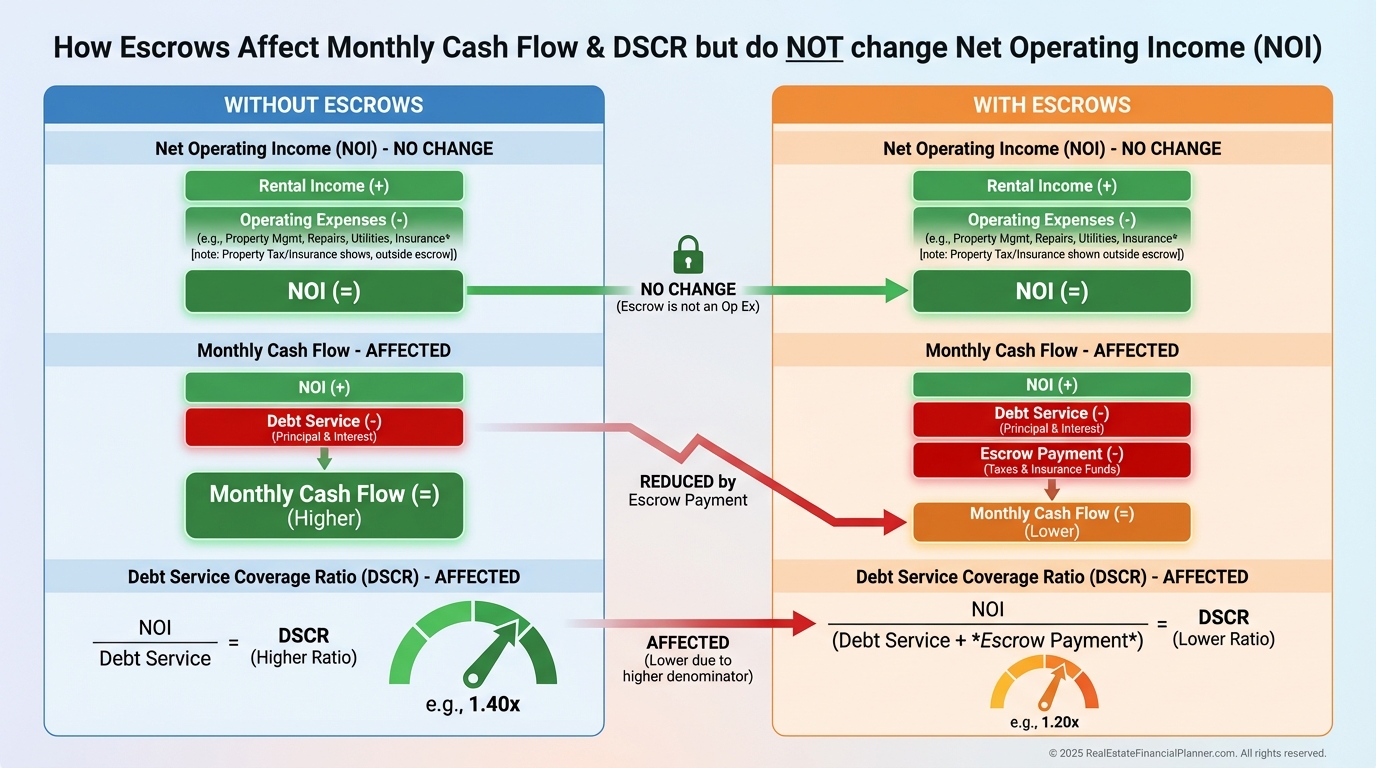

Escrows and Deal Analysis Mistakes

Escrows distort analysis when modeled incorrectly.

They affect:

Monthly cash flow

Borrowing capacity

But they do not change NOI.

That’s a critical distinction.

When I build models in Real Estate Financial Planner™, escrows live in the financing layer, not the operations layer.

Mixing those up leads to bad decisions.

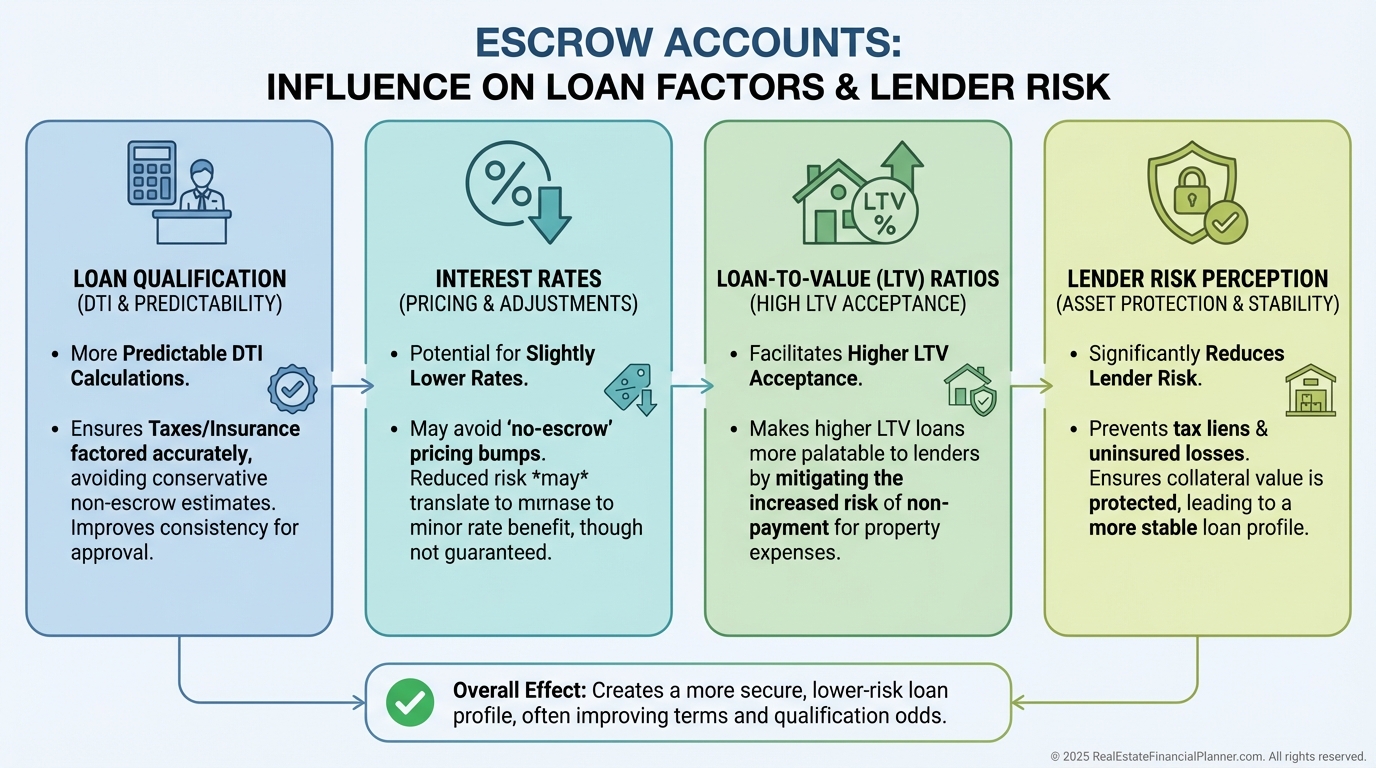

Financing Advantages Most Investors Miss

Lenders like escrows.

They reduce risk.

That can translate into:

Lower interest rates

Higher loan-to-value ratios

Better portfolio terms

I’ve seen investors qualify for larger loans simply because escrow management signaled professionalism.

Escrows are not just costs.

They are leverage tools when understood.

The Biggest Escrow Mistakes I See

These show up constantly when reviewing portfolios:

Underfunding at Closing

Investors forget escrows require upfront deposits.

Ignoring Reassessments

Taxes reset after purchase in many areas.

Assuming “All Insurance” Is Covered

Flood, umbrella, and special policies often are not.

Waiving Escrows Without Systems

Self-escrowing without discipline leads to penalties.

Poor Documentation

Missed deductions and audit risk follow sloppy records.

None of these are theoretical.

I’ve watched each one cost real money.

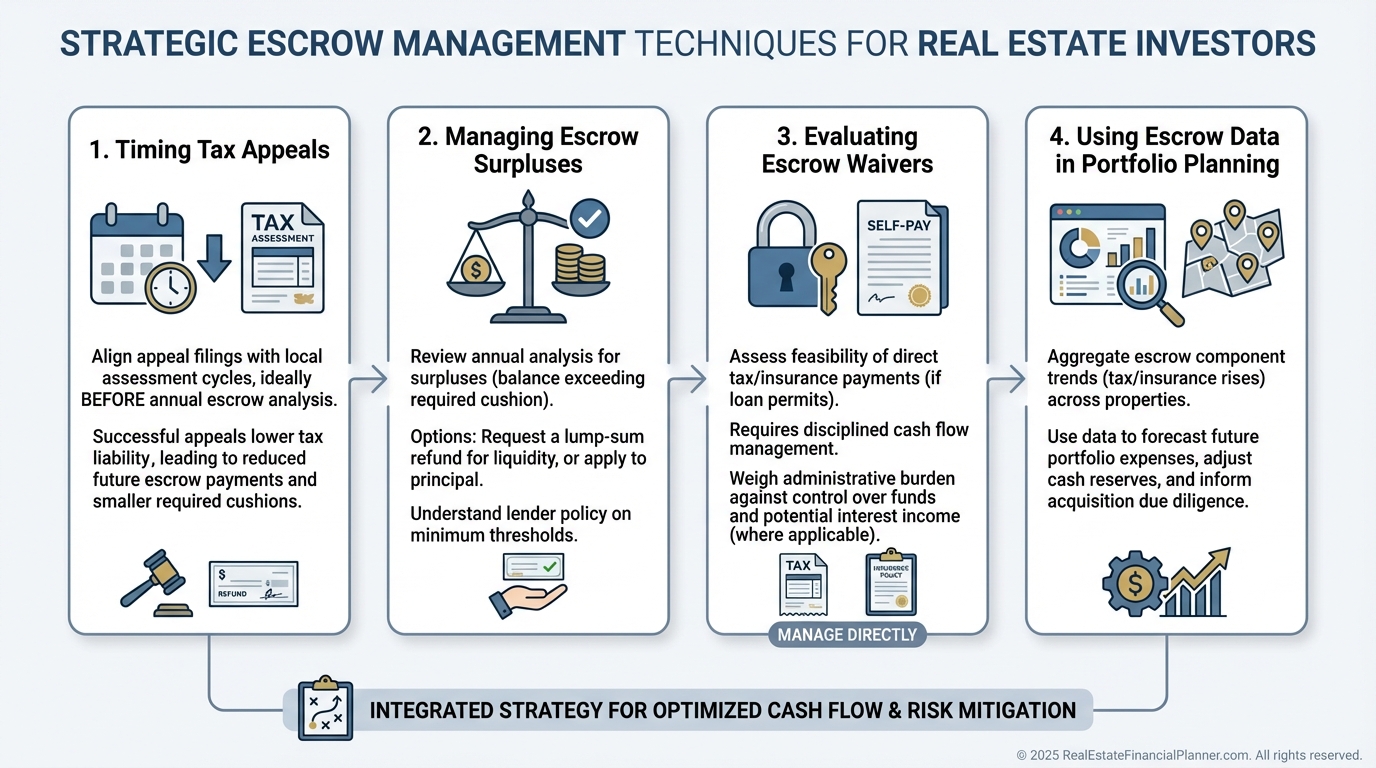

Turning Escrows Into a Strategic Advantage

Sophisticated investors treat escrows intentionally.

Not passively.

That includes:

Timing tax appeals before escrow analyses

Reviewing insurance annually, not passively renewing

Evaluating escrow waivers on seasoned properties

Modeling escrow changes inside Return on Equity calculations

Integrating escrow behavior into exit planning

Escrows affect True Net Equity™ more than most investors realize.

They shape what you keep, not just what you earn.

Taking Control of Escrows

Escrows are not exciting.

But they are powerful.

They quietly decide whether a property stays profitable or stalls.

Here’s what I recommend:

Pull every escrow analysis you have

Verify tax assumptions against county data

Confirm insurance coverage and renewal dates

Model escrow changes before buying, not after

Treat escrows as part of your investment strategy

Investors who master escrows don’t get surprised.

They get better terms, smoother cash flow, and stronger portfolios.

That’s not luck.

That’s systems.