Owner Financing: How Sophisticated Investors Close Faster, Negotiate Better Terms, and Scale Without Banks

Learn about Owner Financing for real estate investing.

Why Owner Financing Belongs in Your Playbook

When I help clients compete in tight markets, owner financing is often the edge that gets the deal without overpaying in cash.

It swaps bank friction for negotiated terms, so you can close faster, preserve cash, and design a payment that fits your plan.

I’ve used it to help investors buy properties that needed work, unique homes banks wouldn’t touch, and small portfolios from retiring landlords.

The common thread is alignment: your monthly payment solves the seller’s problem and grows your portfolio on your terms.

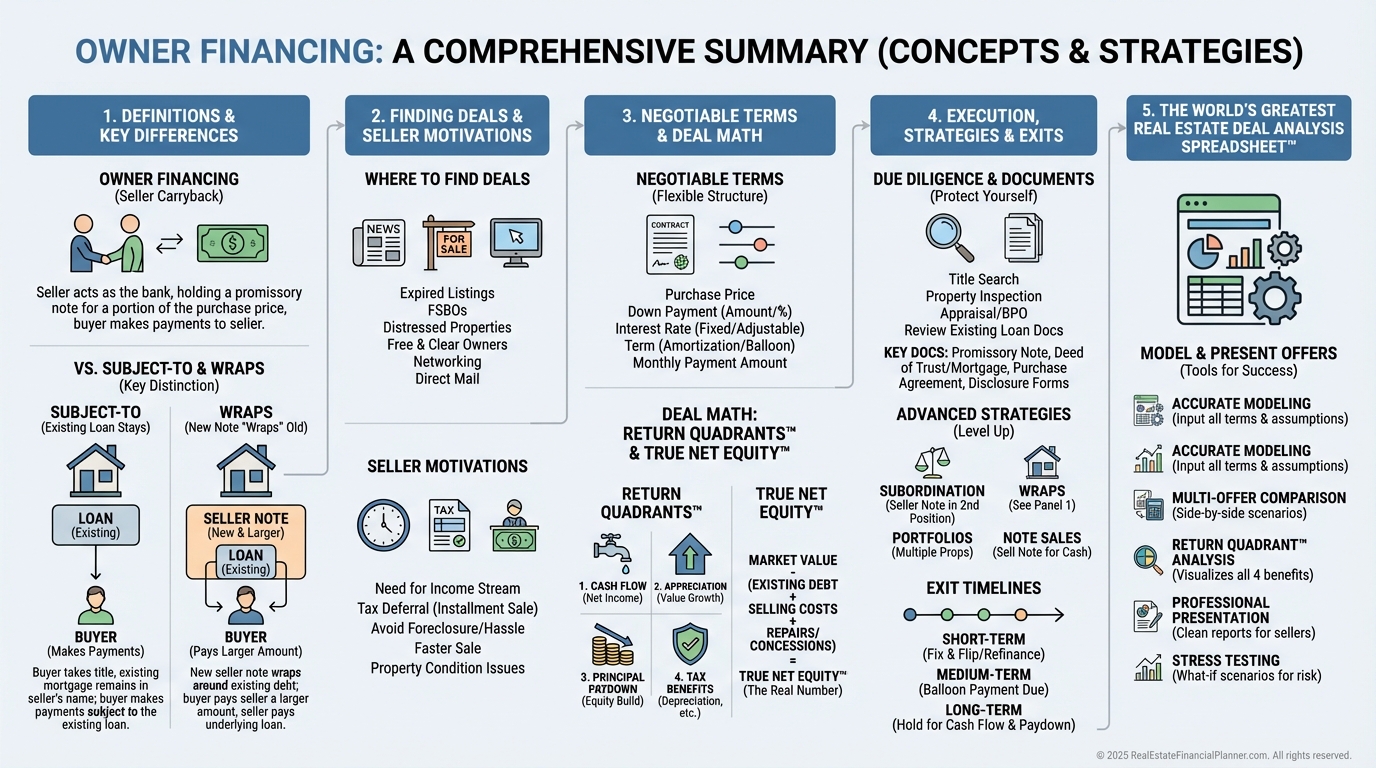

What Owner Financing Is—and Is Not

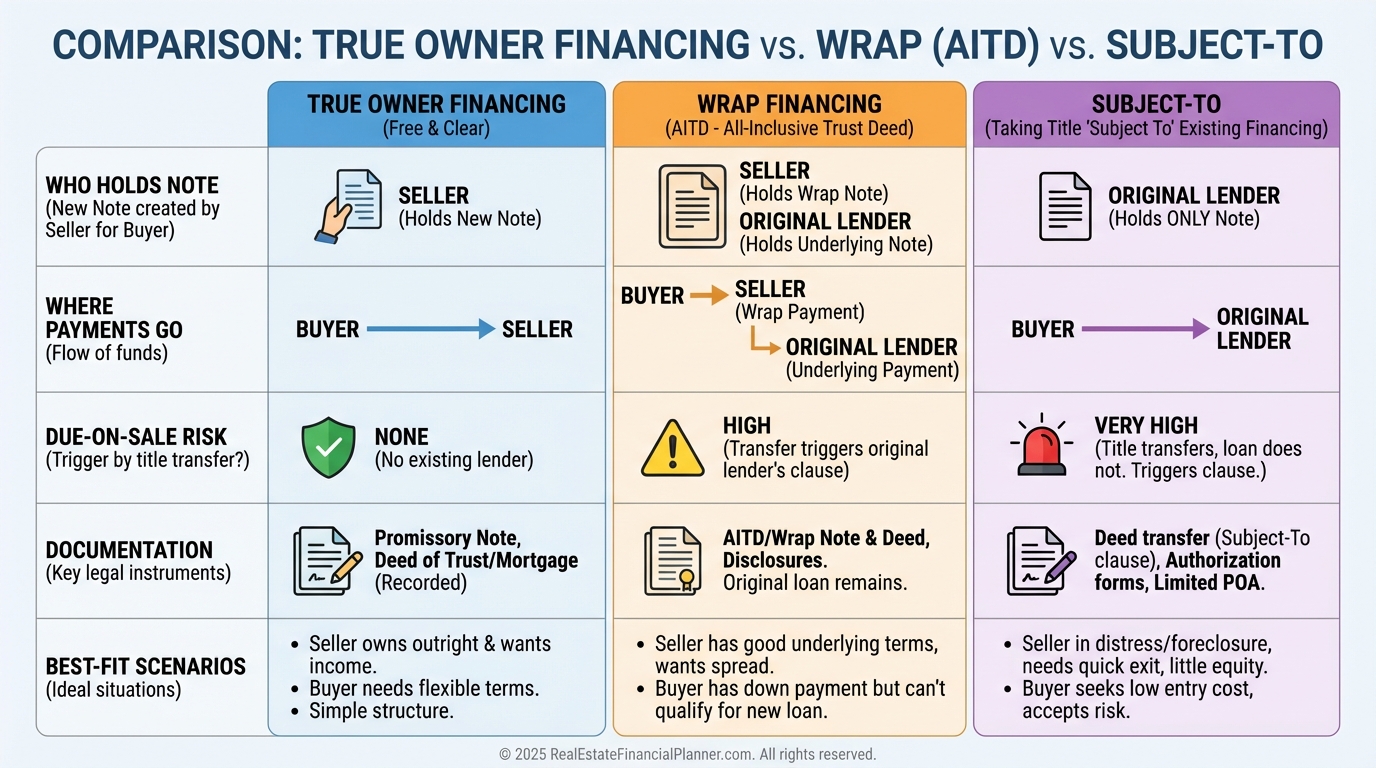

True owner financing is when the seller owns the property free and clear and becomes your lender.

If the seller still has a loan, that’s not true owner financing. Two alternatives appear instead.

Wrap financing (AITD) “wraps” the seller’s existing loan, and you pay the seller while they keep paying their bank.

Subject-to means you take title and continue paying the seller’s existing loan that stays in place under their name.

Each has different risks, disclosures, and due-on-sale considerations. I model all three but only pursue what matches the seller’s situation and my exit timeline.

Strategic Advantages You Can Actually Use

Speed matters. Many owner-financed deals close in 7–14 days because there’s no bank underwriting.

Terms are flexible. I negotiate lower down payments, interest-only periods, or balloons that match my refinance window.

Credit friction fades. Sellers care about capacity and collateral, not an algorithm.

Costs drop. No lender fees or junk charges. I redirect savings into repairs and reserves.

Scalability increases. Banks cap loans; private notes don’t. I’ve watched clients double holdings by stacking well-structured seller notes.

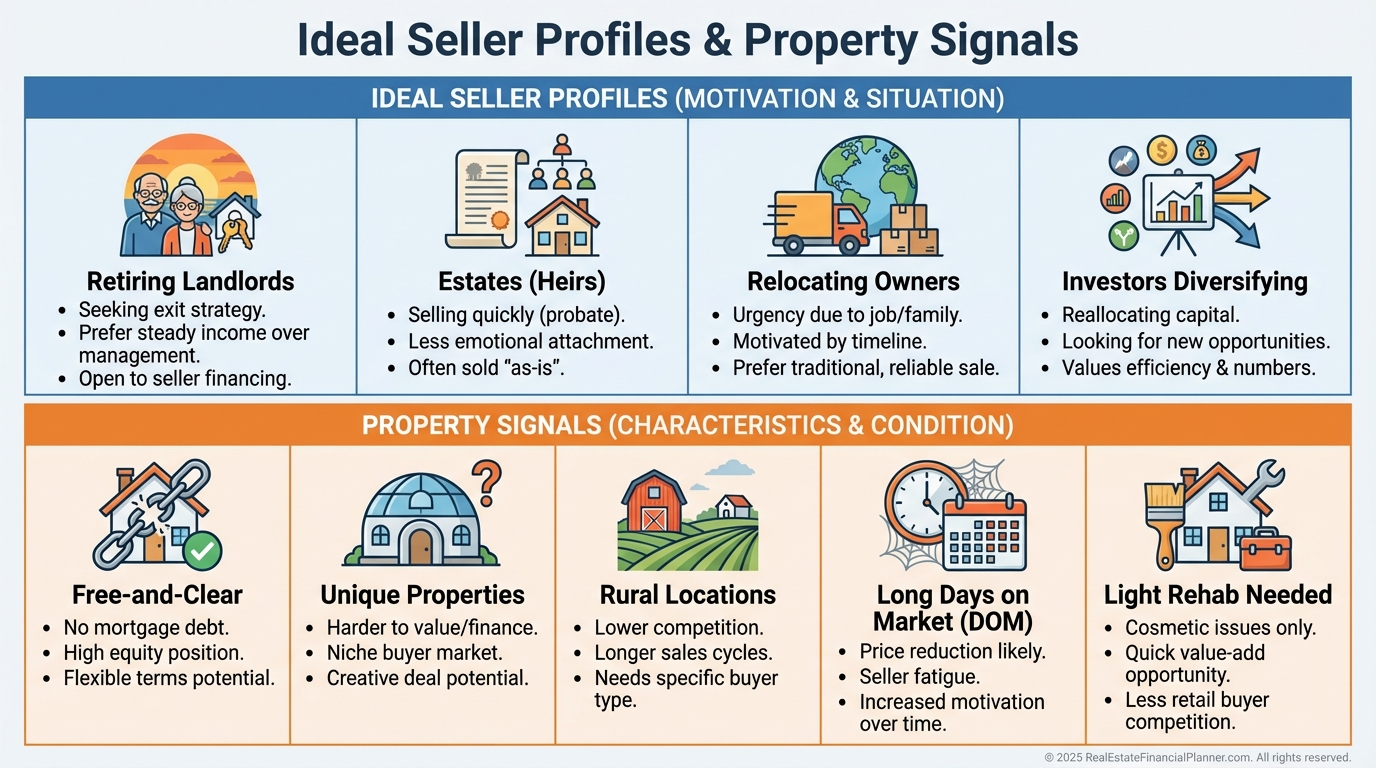

Where I Actually Find Owner Financing

I target free-and-clear owners, longer days-on-market properties, unique homes, rural assets, and estate sales.

I also watch for landlords tired of management, owners relocating quickly, and sellers in slow markets willing to trade terms for price.

When I rebuilt after a personal financial setback, these were the sellers who listened because my offer solved their income, timeline, or tax problem.

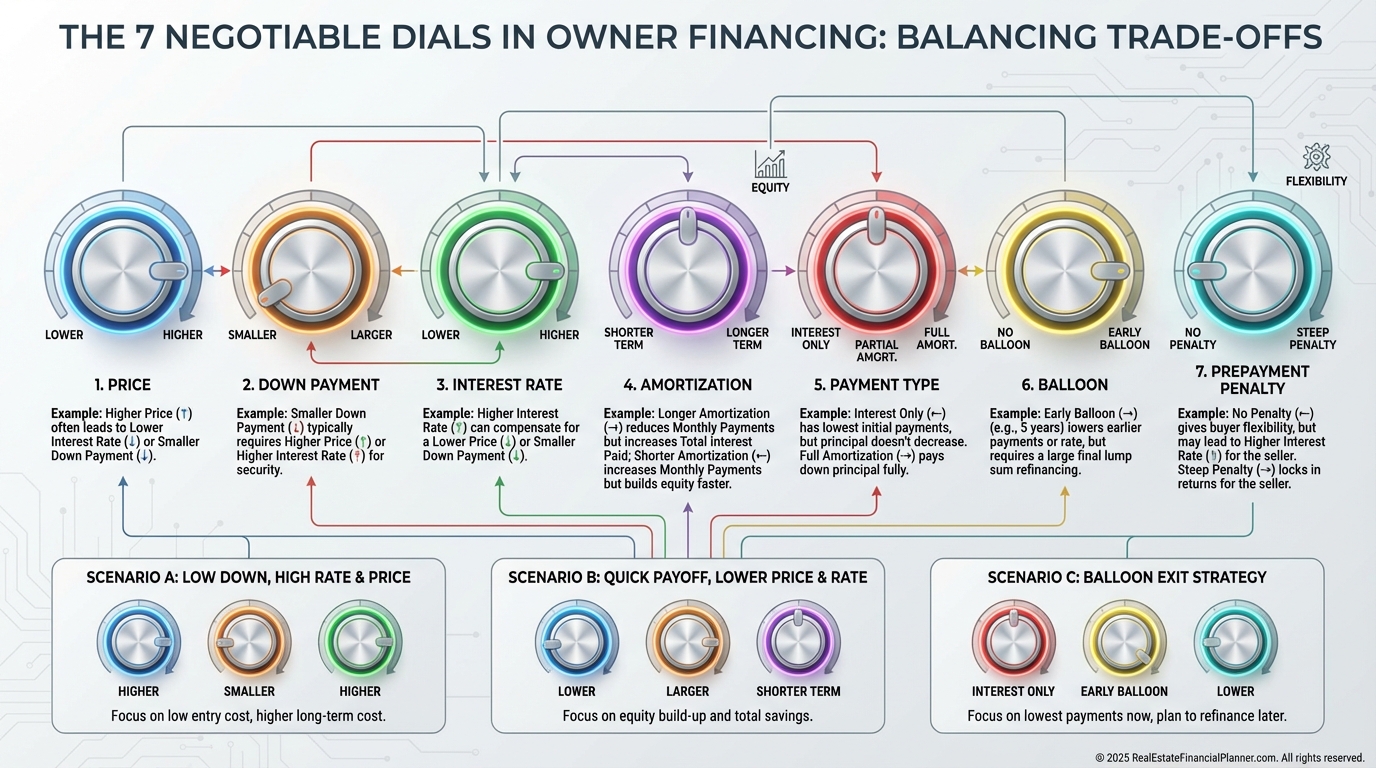

The Deal Structure Dials I Turn

I treat terms like dials I can adjust until the deal pencils.

The dials are price, down payment, interest rate, amortization, payment type, balloon timing, and prepayment penalty.

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to quickly test combinations and show sellers how a slightly higher price or interest yields them more income with less headache.

Here’s a simple baseline I model often: 10% down, 30-year amortization, 5–7 year balloon, and a 30–60 day interest-only stabilization period if the property needs work.

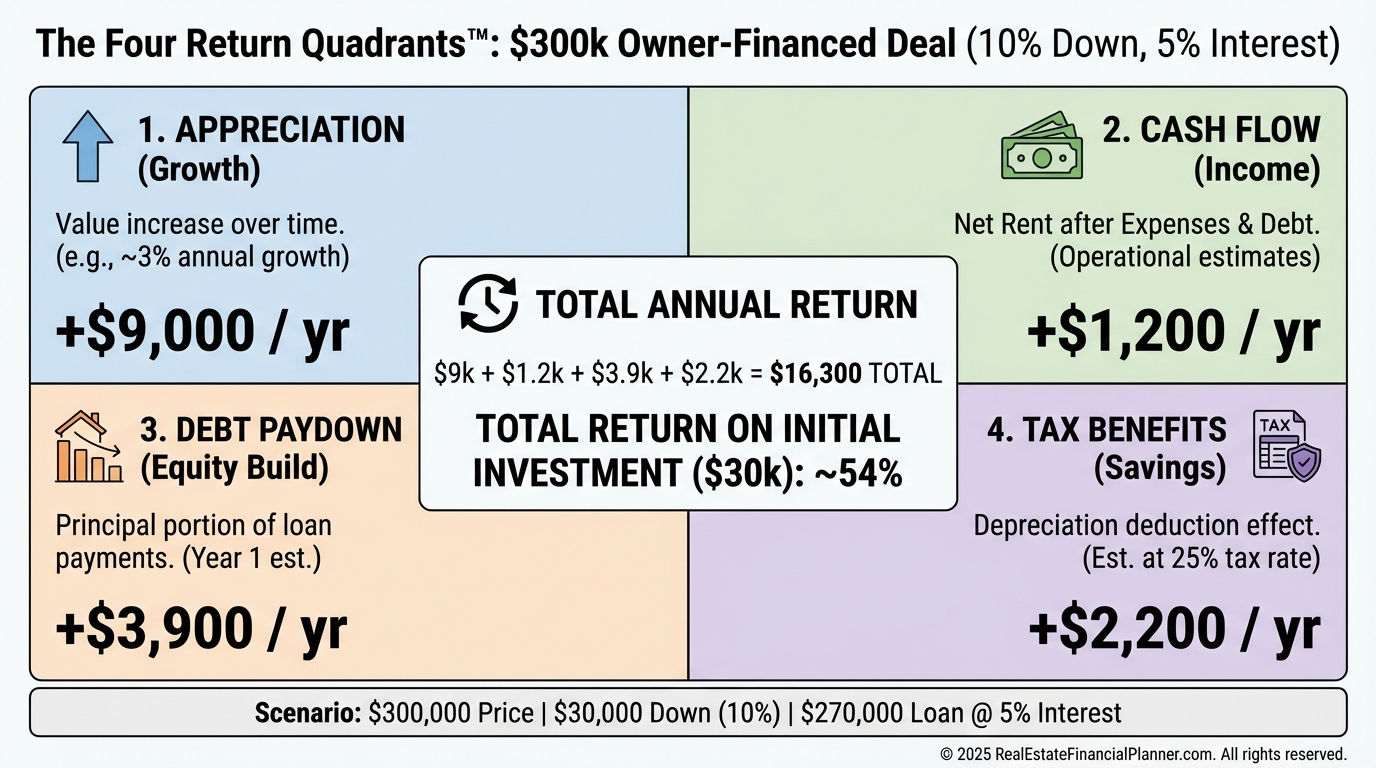

A Realistic Example With Return Quadrants™

Let’s model a modest single-family rental with owner financing.

Purchase price: $300,000. Down payment: 10% ($30,000). Seller note: $270,000 at 5% interest, 30-year amortization, 8-year balloon.

Estimated rent: $2,600 per month. Payment (P&I): about $1,449 per month.

Operating expenses (vacancy 5%, maintenance, capex, taxes/insurance, management): about $960 per month.

Projected cash flow: roughly $191/month or $2,292/year.

Year 1 Return Quadrants™:

•

Appreciation at 3%: ≈ $9,000.

•

Cash flow: ≈ $2,292.

•

Debt paydown (Yr 1 at 5%): ≈ $4,000.

•

Tax benefits (depreciation, assume 80% improvements = $240,000 / 27.5 ≈ $8,727; at 25% bracket ≈ $2,182 tax savings).

That’s ≈ $17,474 in total benefits on ~$30,000 down (plus closing and reserves). I sanity-check this in the Spreadsheet and review sensitivity if rents dip 5–10%.

True Net Equity™: What You Really Own

On paper, equity can look bigger than it truly is.

I calculate True Net Equity™ as market value minus realistic selling costs and the current loan balance.

Continuing the example after 3 years:

Value at 3% annual appreciation: ≈ $328,000.

Selling costs at 8%: ≈ $26,000.

Loan balance: ≈ $262,000.

True Net Equity™ ≈ $328,000 − $26,000 − $262,000 = ≈ $40,000.

I show this to clients so we decide whether to hold, refinance, or sell based on net, not rosy estimates.

How I Present Offers Sellers Accept

I never lead with “I can’t qualify at a bank.” I lead with “Here’s how I can give you a higher total price and predictable monthly income.”

I show two to three options with different down payments and rates, and I plot the seller’s total interest earned and payoff dates.

I include a one-page amortization snapshot and a simple comparison to their alternatives (CDs, bonds, cash sale net of tax).

It reframes the conversation from price-only to total outcome.

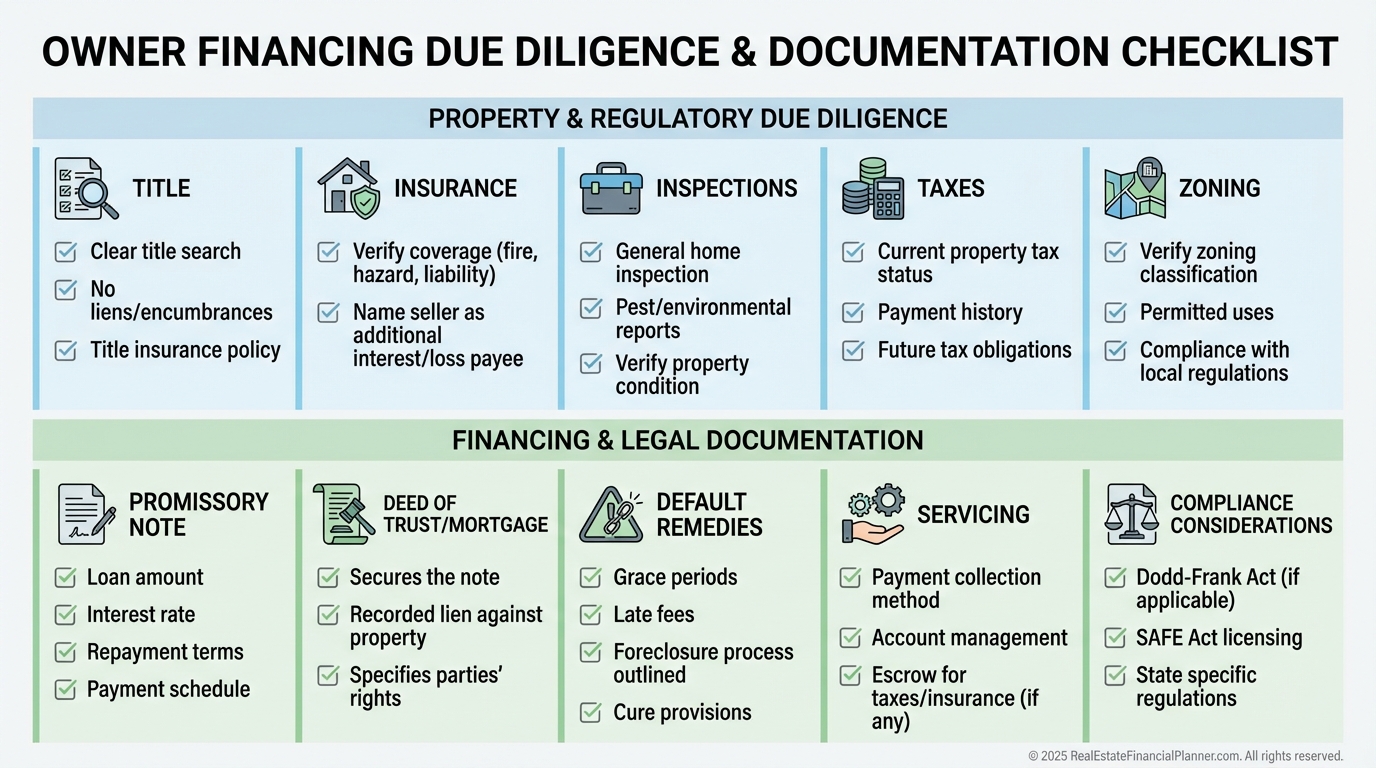

Due Diligence, Documents, and Risk Controls

Owner financing needs the same rigor as any acquisition—plus precise paperwork on the note and security instrument.

I verify title is free and clear, order title insurance, confirm taxes, check zoning, inspect thoroughly, and budget for repairs.

I document the promissory note, deed of trust or mortgage, insurance with the seller named as additional insured/loss payee, and verify remedies on default are clear.

If the seller mentions an existing loan, I pivot to a legal wrap or subject-to discussion and address due-on-sale risk transparently.

Also consider compliance. If the buyer is an owner-occupant, discuss Dodd-Frank, SAFE Act, and state usury rules with counsel. For investor-to-investor deals, requirements differ, but I still use licensed loan originators when appropriate.

Common Traps I Avoid

Unrealistic balloons without a refinance path.

Thin cash flow that evaporates with one repair.

Vague paperwork that doesn’t define late fees, default, or insurance requirements.

Seller confusion about their tax treatment. I always invite their CPA into the conversation.

And terms that rely on wishful exit timing instead of a realistic capital plan.

Advanced Strategies After Your First Win

Master Lease Options let you control and improve before you close, then convert to owner financing with predefined terms.

Portfolio packaging with retiring landlords can produce economies of scale and better overall pricing.

Subordination gets the seller to take a second position so you can place a new first for improvements.

Wraps help you monetize an interest rate spread when the seller’s underlying loan is low.

Season the note with on-time payments, then sell a partial to a note buyer to recoup capital while keeping control.

I map each of these in the Spreadsheet to see where risk shifts and whether the spread justifies the complexity.

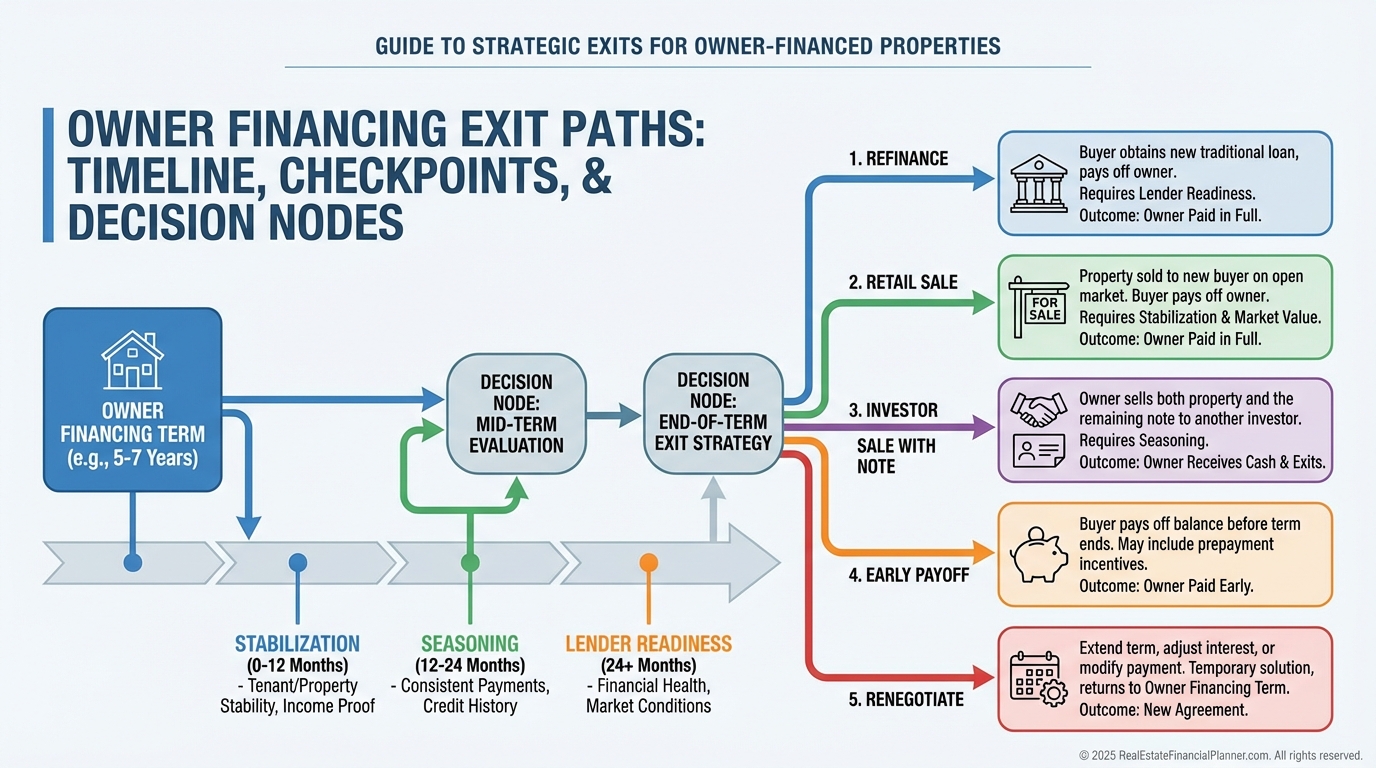

Exit Strategies and Timelines

I want at least two viable exits before I sign.

Refinance the balloon into agency or DSCR debt once rents stabilize.

Sell retail with assumable financing if the note allows, or sell to another investor and keep the note.

Pay off early if you negotiated no prepayment penalty, or renegotiate with the seller well before the balloon.

I keep a 12–24 month refinance readiness checklist so I’m never surprised by a deadline.

Finding Deals: Practical Lead Generation

I pull public records for free-and-clear owners and mail a simple letter offering steady monthly income and as-is sale.

I search listings for “owner will carry,” “seller financing,” and “flexible terms,” and I prioritize long DOM and unique homes.

I network with estate attorneys, CPAs, and property managers. Their clients often value income and simplicity over a cash bidding war.

Finally, I work with agents who understand creative finance and let me present terms cleanly and professionally.

Using The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I model at least three offers: lower price with higher down, higher price with lower down, and a middle road with a slightly higher rate.

I stress-test vacancy, rent drops, interest rate changes at refinance, and repair surprises.

Then I export a clean seller-facing summary: payment schedule, total interest earned, and comparable outcomes to a cash sale or bond ladder.

It turns a “creative” idea into a professional, numbers-first presentation.

Nomad™ With Owner Financing

There’s no bank occupancy requirement to manage, but insurance and local regulations still matter.

It’s a powerful way to acquire with low cash and grow a portfolio deliberately over time.

Your 30-Day Action Plan

Week 1: Build your lead list of free-and-clear owners and unique properties; draft a simple letter and email script.

Week 2: Practice two to three offer structures in the Spreadsheet and refine seller benefits with real numbers.

Week 3: Meet two investor-friendly attorneys and one note servicer; lock in your documents and servicing plan.

Week 4: Make five offers with terms that solve the seller’s problem and protect your downside with realistic exits.

If you do the reps, your first owner-financed deal won’t feel “creative.” It will feel inevitable.