Multi-Member LLCs: The Partner-Ready Blueprint Investors Use to Structure, Protect, and Get Paid

Learn about Multi-Member LLCs for real estate investing.

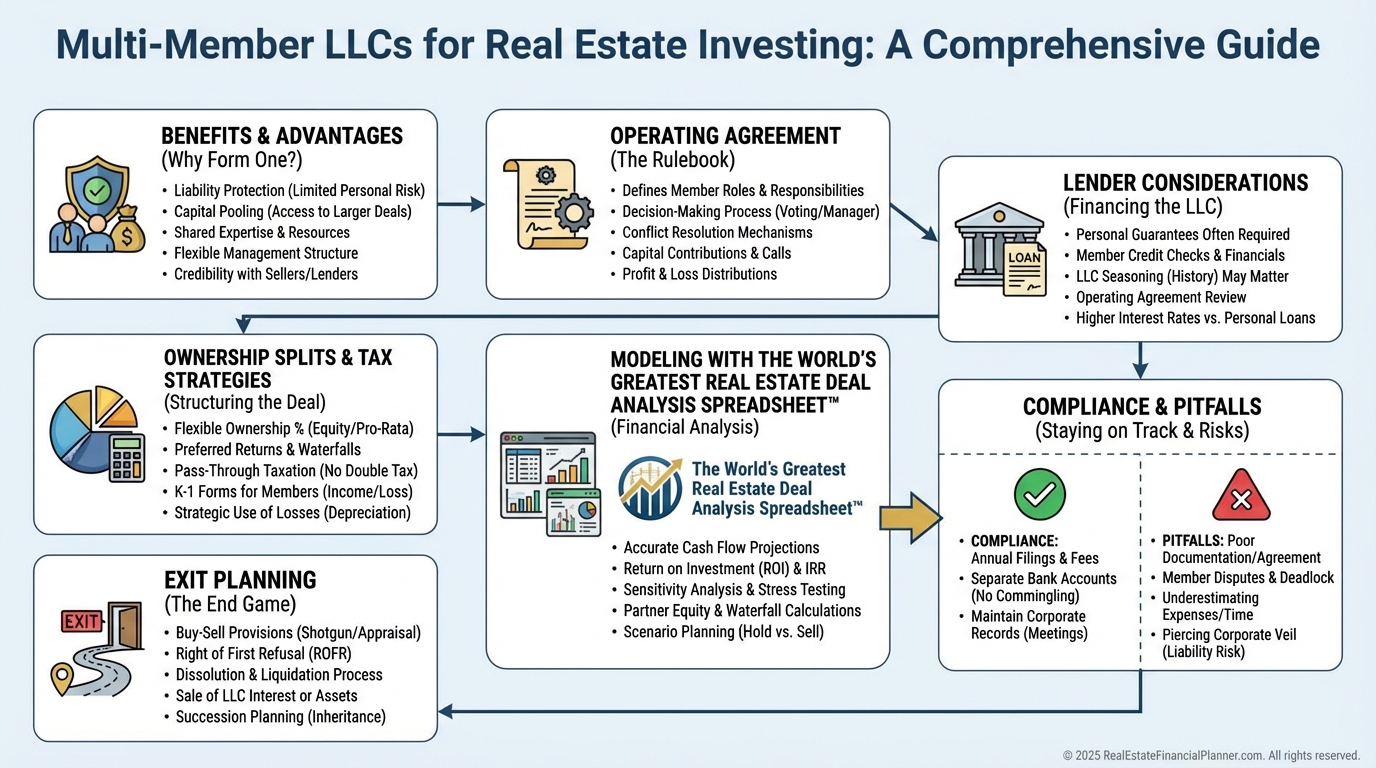

Why Partnerships Gravitate to Multi-Member LLCs

Real estate is a team sport, but teams without a playbook lose winnable games.

When I help clients form partnerships, I default to a multi-member LLC because it gives us flexibility without sacrificing protection.

You get pass-through taxation, adaptable management, and a credible wrapper for lenders and vendors.

You also get structure for who writes checks, who swings hammers, and who gets paid—without burying the business in corporate formalities.

What a Multi-Member LLC Is (and Why It’s Different)

A multi-member LLC is a limited liability company with two or more owners.

It keeps personal assets separate from business liabilities and defaults to partnership taxation.

That default matters because it unlocks targeted allocations, guaranteed payments, and pass-through deductions for depreciation and interest.

Unlike single-member LLCs, multi-member entities often get stronger charging order protection in many states and can appear more substantial to lenders.

The Real-World Advantages Investors Actually Use

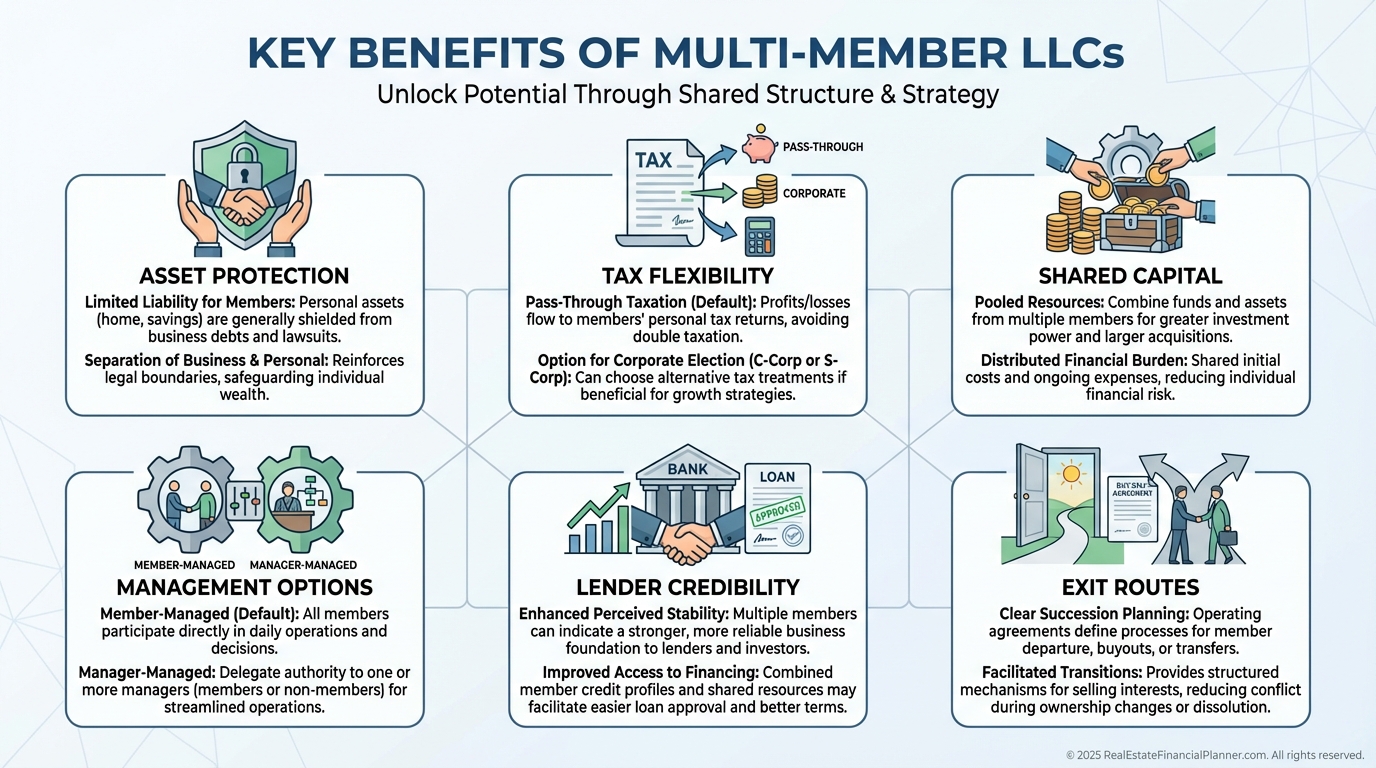

Asset protection is the headline, but it’s the layered protection that matters.

LLC-level debts stay at the company, while charging order protection in many states limits a creditor’s reach to distributions.

Tax flexibility is next.

Pooling capital lets you buy bigger, better, and safer.

When I model deals for clients, the partnership often levels up from a small duplex to a stabilized 12- to 24-unit with professional management.

Management stays flexible.

You can be member-managed or manager-managed, with operators separated from purely passive partners.

Lenders notice.

Multiple members hint at deeper pockets and diversified skills, which can help with DSCR or bank portfolio loans.

Exits are cleaner.

Selling membership interests often avoids transfer taxes and keeps loans undisturbed, which matters for both estate planning and partner liquidity.

Set It Up Right the First Time

When partnerships fail, it’s almost always because the early decisions were rushed.

Slow down on the front end so you can move fast later.

Choose partners for more than money.

I look for aligned time horizons, consistent work ethic, and a track record of keeping commitments when deals get messy.

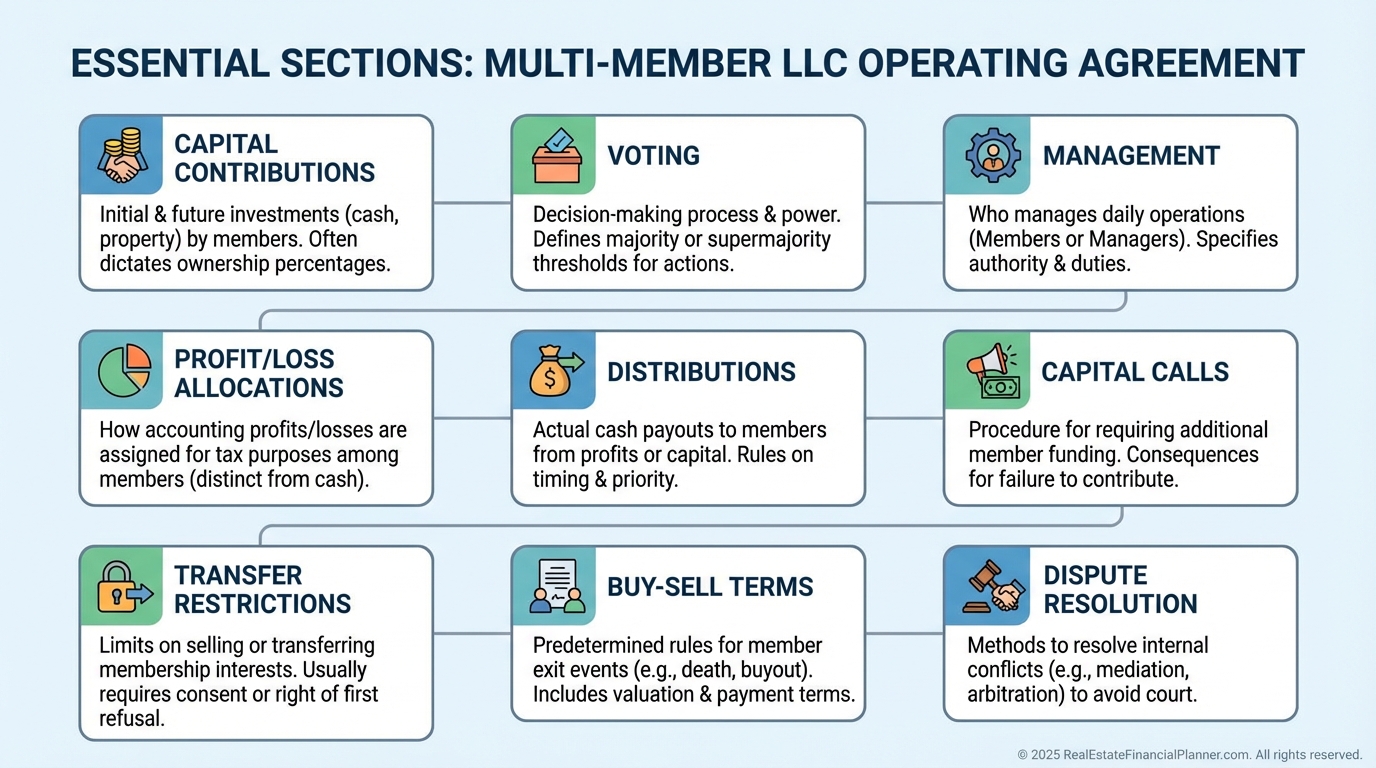

Draft a real operating agreement.

Templates miss the hard parts: deadlock breakers, capital call rules, major decision voting thresholds, and buy-sell triggers.

Define ownership by total value, not just cash.

If one partner brings $100,000 and another brings $50,000 plus full-time construction management, that sweat equity deserves real economics and vesting.

Select member- or manager-managed before your first offer.

If you want passive members insulated from daily operations, go manager-managed and name who can bind the company.

Choose the right state for where you’ll own and operate.

Register locally where the property sits and foreign-register out-of-state entities as needed, weighing privacy, fees, and charging order strength.

Model the Money Before You Sign

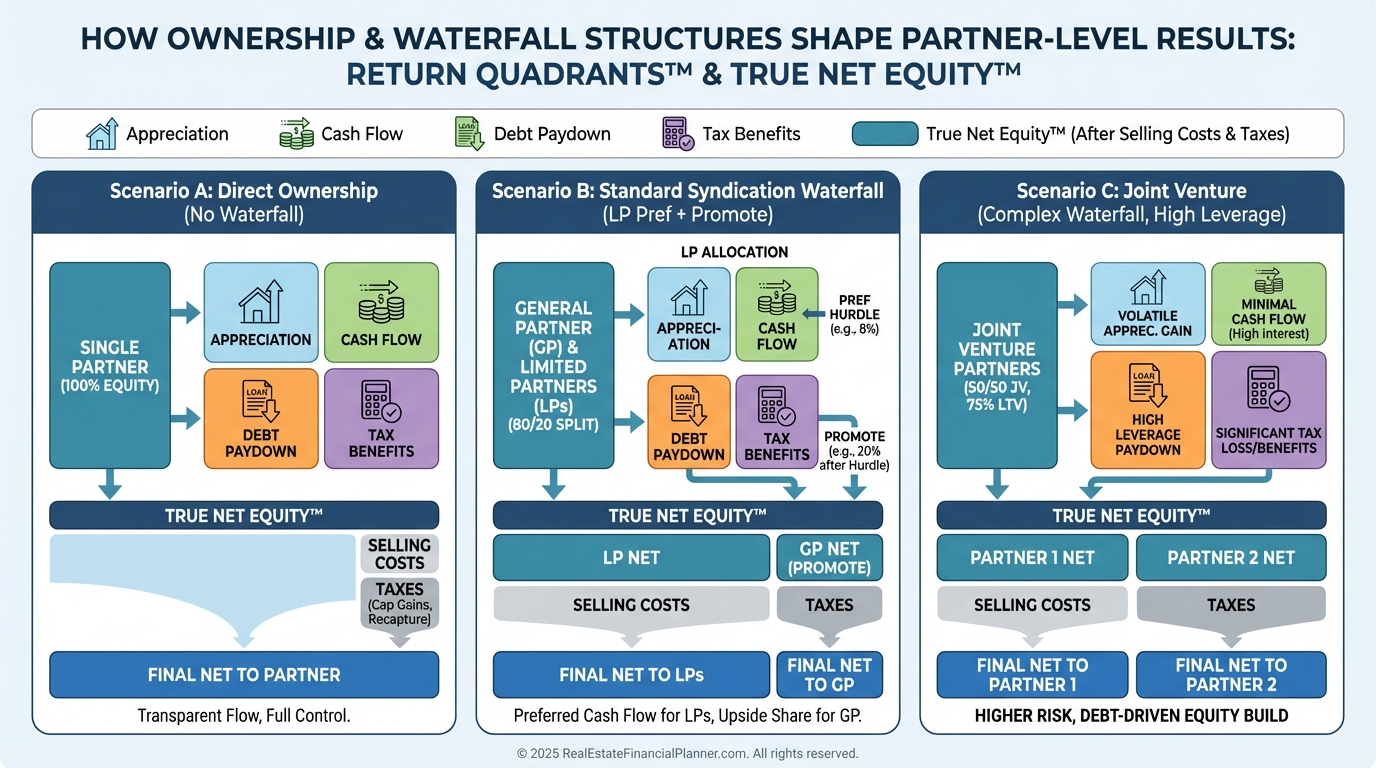

I never let partners ink an operating agreement until we’ve modeled how cash really moves.

We open The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and build member-by-member views.

We run Return Quadrants™—appreciation, cash flow, debt paydown, and tax benefits—for each partner, not just for the property.

Then we layer in True Net Equity™ to show what each partner could actually realize after selling costs, capital gains taxes, depreciation recapture, and transaction friction.

If sweat equity is involved, we test vesting and guaranteed payments.

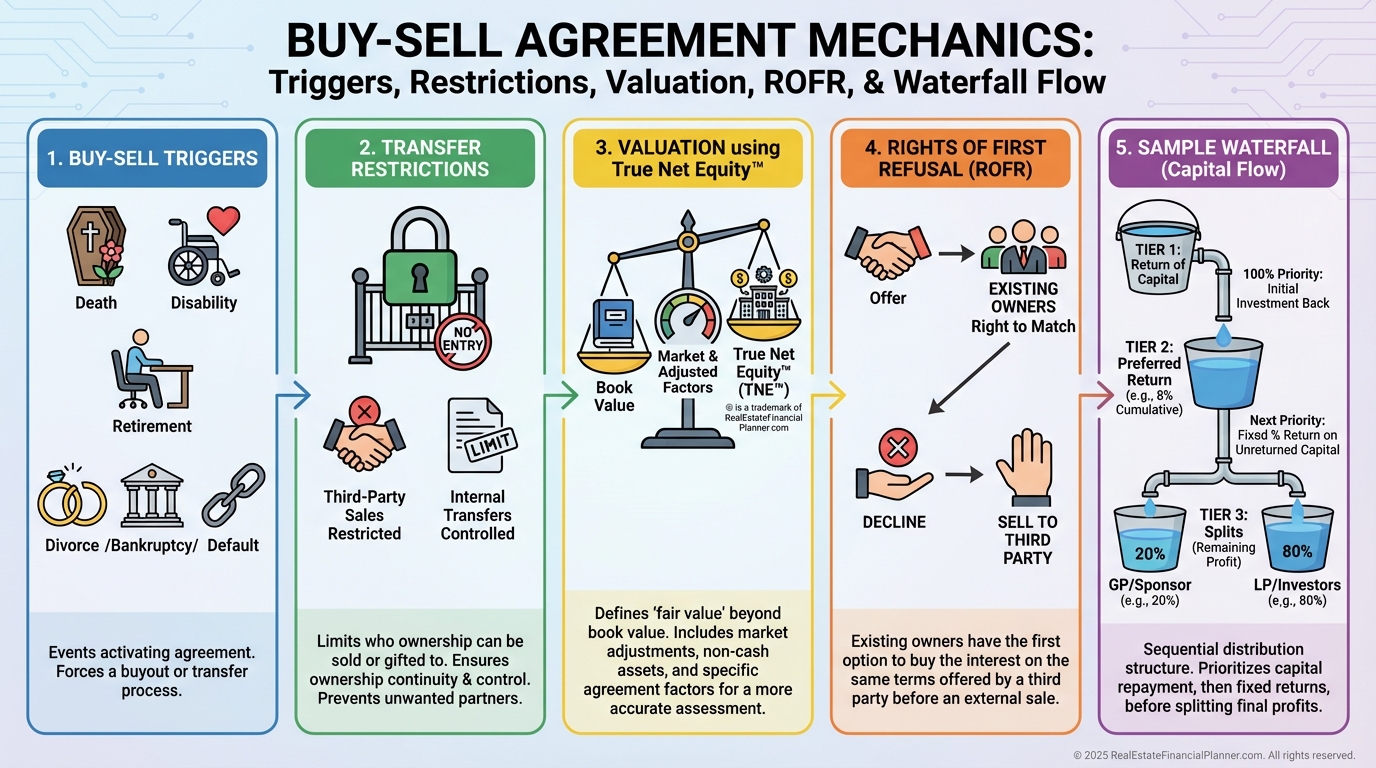

We model waterfalls that prioritize return of capital, a preferred return, and then splits.

We stress test the deal at lower rents, higher vacancies, and delayed rehabs to see who bears the downside.

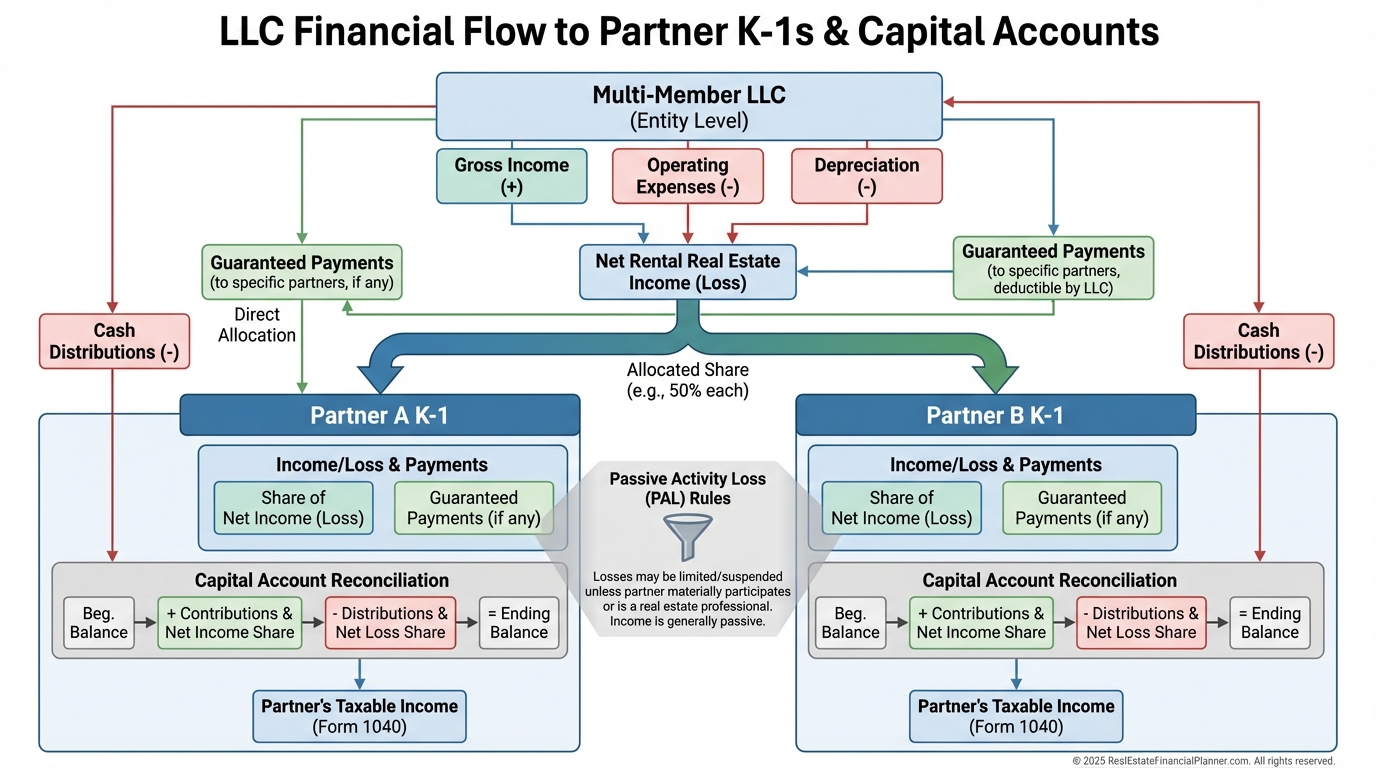

Taxes: How Profits, Losses, and Deductions Flow

Partnership taxation keeps the entity itself from paying income tax.

Profits and losses flow to members via Schedule K-1 according to the operating agreement.

Depreciation and interest deductions offset rental income and may create passive losses subject to passive activity rules.

Section 199A can offer up to a 20% deduction on qualified business income when criteria are met.

S-Corp election can reduce self-employment tax for active flips or development, but it’s rarely helpful for pure rentals because net rental income isn’t subject to SE tax.

C-Corp election is uncommon and reserved for specific, reinvestment-heavy strategies.

Distributions need to be coordinated with capital accounts.

Special allocations must have substantial economic effect, or the IRS can unwind them.

Guaranteed payments compensate operators regardless of profit and are taxable to the recipient, so we model their impact before adoption.

Compliance: The Habits That Preserve Protection

Courts look for separateness.

So do lenders and the IRS.

Open dedicated bank accounts, track capital accounts, and document major decisions with written consents.

Keep clean books and issue K-1s on time.

Never commingle personal and LLC funds, even for “small” items.

Calendar annual reports, franchise taxes, and registered agent renewals for each state you operate in.

When I audit partner files, I look for missing minutes, undocumented loans from members, and sloppy reimbursements.

Those are fixable today and expensive later.

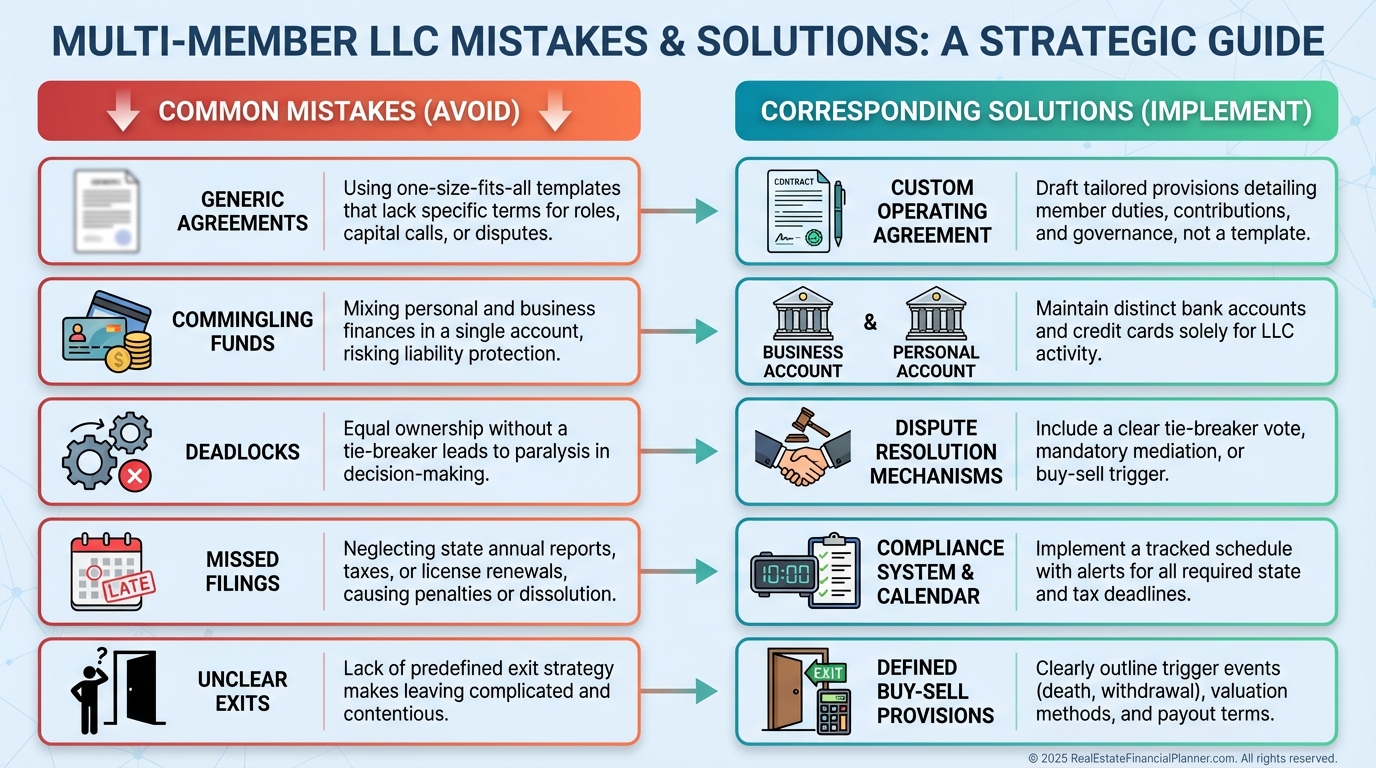

Pitfalls I See Most Often (and How We Avoid Them)

Operating with a generic agreement.

We replace it with a tailored version that fits your exact strategy, asset class, and timeline.

Commingling funds.

We implement a two-signature policy on distributions, and we reimburse only through documented expense reports.

Deadlocks at 50/50.

We avoid even splits or we add a deadlock breaker with a pre-agreed process.

Ignoring state compliance.

We assign a compliance owner, not “everyone,” and automate reminders.

No exit plan.

We define transfer restrictions, rights of first refusal, pricing formulas, and a clear buy-sell sequence.

Lender Reality: What Underwriting Actually Cares About

Underwriters care about the borrower of record, guarantors, and cash flow.

With multi-member LLCs, expect personal guarantees on smaller balance loans and DSCR focus for asset-based loans.

We confirm who can sign, who will guarantee, and whether any member’s credit profile could spook the deal.

If a partner wants to use Nomad™ to owner-occupy, we do it personally, not in the LLC.

Transferring to the LLC later may trigger due-on-sale, so we evaluate that risk before moving title.

Exit, Liquidity, and Buying Out a Partner

You can sell units without selling the real estate.

That’s the quiet power of the structure.

In your agreement, define permitted transfers, rights of first refusal, pricing formulas, and the buyout timeline.

We often use a formula tied to True Net Equity™ to avoid endless appraisals and to keep everyone whole after selling costs and taxes.

For long-hold deals, we set a quarterly window where partners can request liquidity, subject to cash tests and lender covenants.

Case Studies from the Field

Fix-and-flip with aligned incentives.

A three-member team contributed $100k, $50k plus full-time renovations, and $25k plus acquisitions and sales.

We set ownership at 40/40/20, with guaranteed payments to the active operators.

After four flips and $150k in profit, everyone was paid according to the waterfall and no one argued about “who did more.”

Buy-and-hold with clean governance.

Five passive investors bought a 20-unit.

Each put in $100k for 20% and appointed one managing member to oversee third-party management.

Major decisions needed 80% approval, while routine calls sat with the manager.

When one member needed liquidity, the buy-sell formula gave the group a clear, dispute-free path.

Development with compliance discipline.

Two partners formed a manager-managed LLC, secured a bank construction loan with personal guarantees, and used weekly written consents for cost overruns.

They maintained spotless capital account records, sailed through the lender’s draw inspections, and refinanced into a DSCR loan on completion.

Your Next Steps

List your would-be partners and write down what each really brings: capital, credit, contracting, or time.

Schedule a working session to draft your operating agreement outline, not a template—your business deserves specifics.

Open The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and model partner-level Return Quadrants™ and True Net Equity™.

Decide member- or manager-managed, sign banking resolutions, and open the account before your first earnest money check.

Calendar compliance tasks for the year and appoint one person to police them.

When you’re ready, formalize the waterfall, lock the buy-sell terms, and go buy the right-sized deal together.