Contract to Close: The Deadlines That Can Cost You Thousands

Learn about Contract to Close for real estate investing.

You got your offer accepted. You’re under contract.

This is the part most investors underestimate, even though it’s the part most likely to blow up your deal.

When I help clients buy rentals, “Contract to Close” is where I see the same pattern: people treat deadlines like suggestions, and then they pay for it in stress, lost earnest money, or rushed decisions.

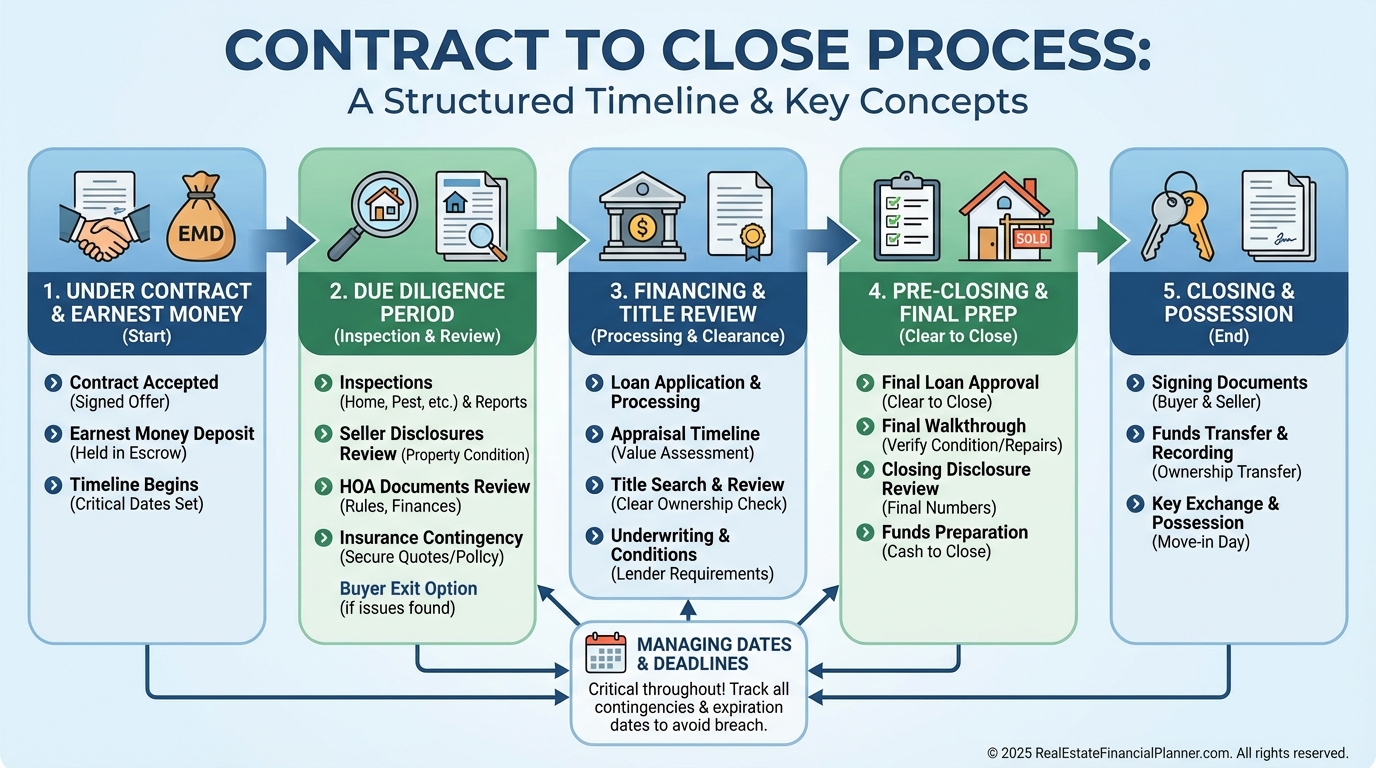

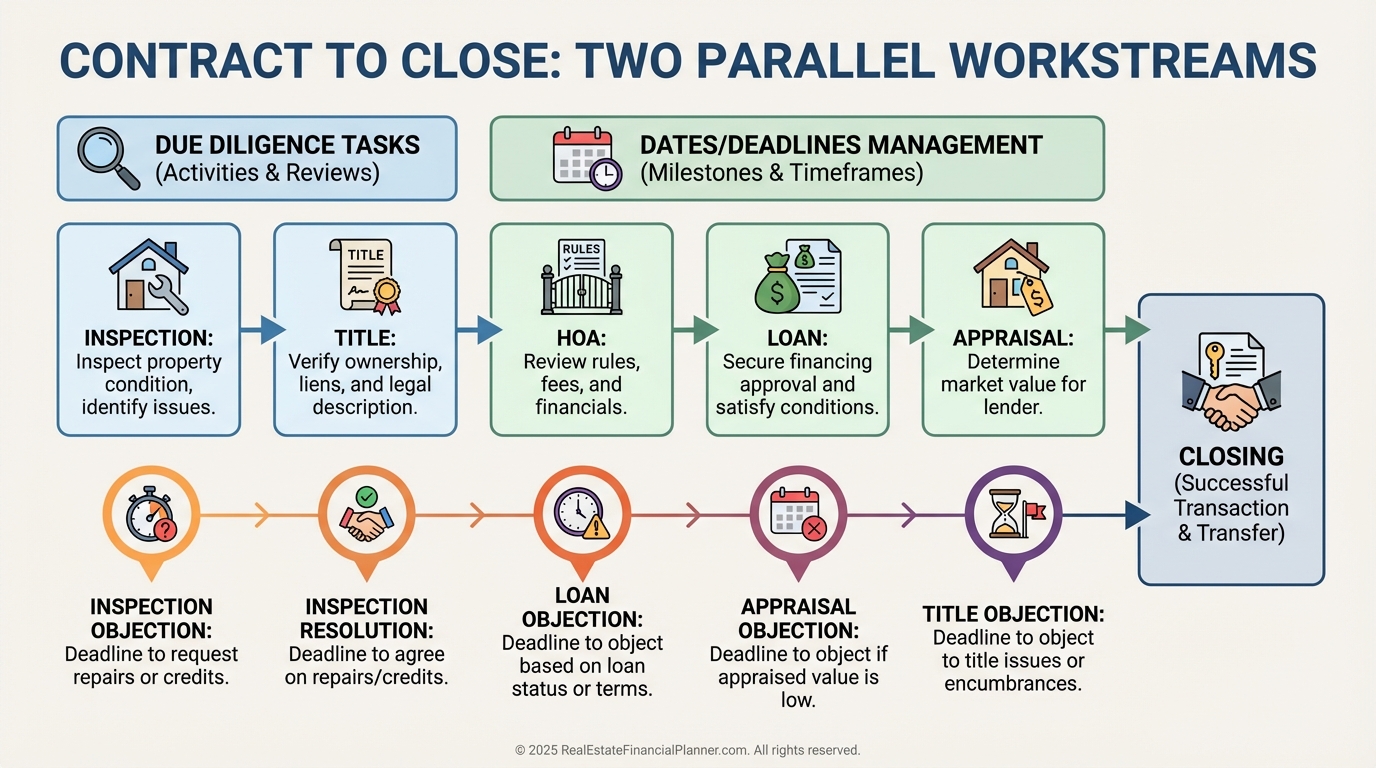

Contract to close is not one task. It’s two jobs running at the same time.

You do due diligence.

You manage dates and deadlines.

If either one slips, you don’t just “get delayed.” You can lose leverage, lose money, or lose the deal.

Contracts Vary by Market

Your contract language, your local customs, and even the type of property can change the sequence.

New construction contracts can be wildly different than standard resale contracts.

Use this as a practical framework, then confirm the exact definitions and deadlines in your contract.

If you’re ever unsure what a term means, check the definitions section of the contract first.

Then ask your agent or attorney the right question with the contract language in front of you.

The Two Major Components

1) Due Diligence

Due diligence is you verifying reality.

Everything you assumed when you made the offer gets tested here.

If you bought based on “it seems fine,” due diligence is where you find out whether “fine” is true.

2) Managing Dates and Deadlines

Deadlines are not vibes.

They are the guardrails that keep your earnest money protected and your options open.

When I rebuilt after bankruptcy, one thing became painfully clear: the fastest way to lose money is to be casual about commitments you don’t fully understand.

Deadlines are commitments with consequences.

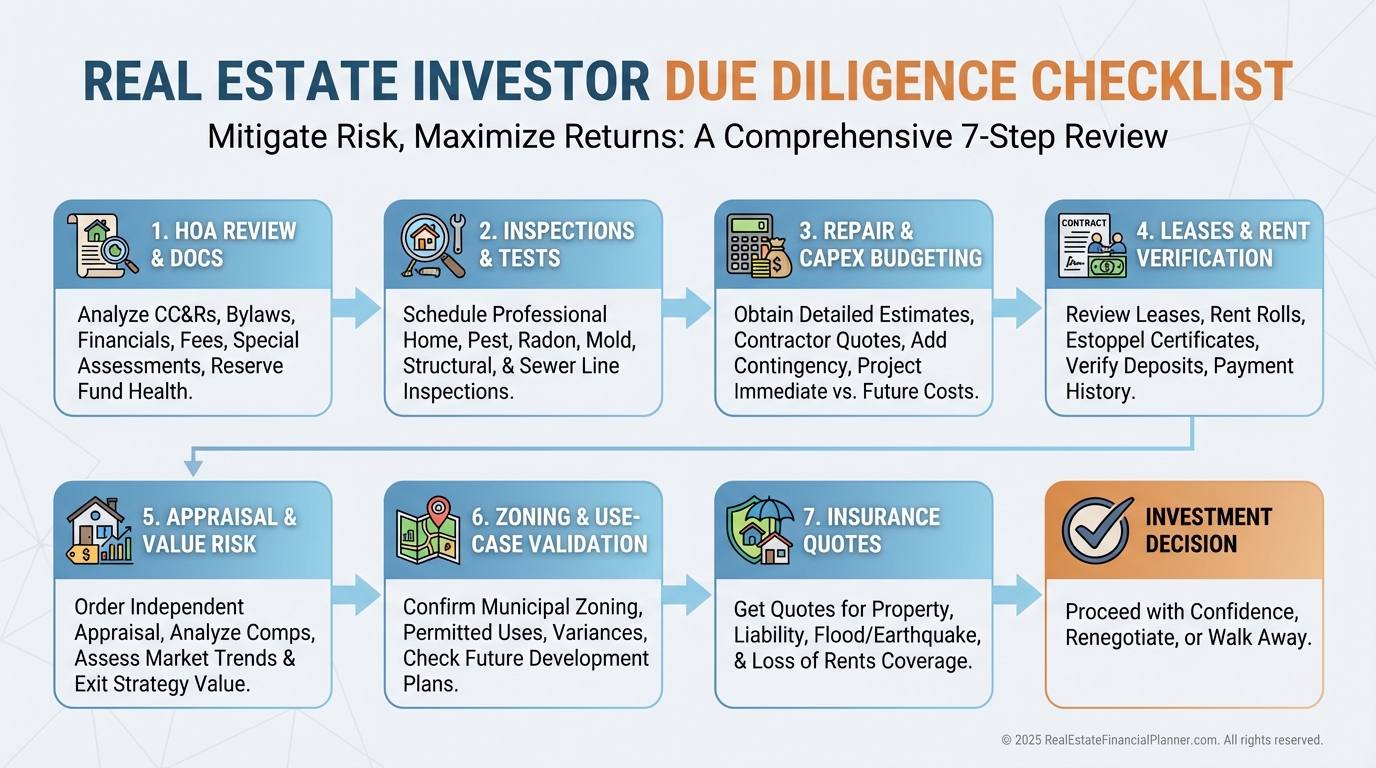

Due Diligence: What You Verify After You’re Under Contract

Think of due diligence like this.

You’re not trying to discover the obvious things you already knew on showing day.

You’re trying to confirm the things you couldn’t reasonably confirm before you had a contract.

Here are the categories I see matter most for investors.

HOA Documents and Rules

If the property has an HOA, you’re buying into a second layer of control.

You’re not just buying a unit. You’re buying rules.

You’re looking for rental restrictions, approval requirements, pet rules, parking rules, and special assessment risk.

If your strategy includes Nomad™, house hacking, or renting by the room, HOA rules can kill your plan.

Inspection and Repair Reality

Your inspection is not just about “is it broken.”

It’s about “what will I own on day one, and what will it cost me to stabilize it?”

When I review deals with clients, I don’t treat inspection as a punch list.

I treat it as a decision point: accept, renegotiate, or terminate.

Bring in specialists when the house demands it.

Sewer scope. Structural. Roof. HVAC. Electrical.

Leases, Rents, and Tenant Paperwork

If it’s occupied, you verify the income.

That means leases, deposits, payment history, and whether the terms match what you were told.

You also verify whether the rent is market rent or fantasy rent.

If you’re building toward financial independence, your “Cash Now” has to be real.

Property Value and Appraisal Risk

You verify you’re not overpaying relative to the market.

Low appraisal problems don’t just happen to amateurs.

They happen when the market shifts, comps are thin, or the contract price got ahead of reality.

Zoning, Use Case, and “Can I Actually Do This?”

Short-term rental plans, ADU plans, remodel plans, or adding bedrooms are all “great ideas” until you meet zoning, permits, and code.

Verify the use case early, especially if the strategy depends on it.

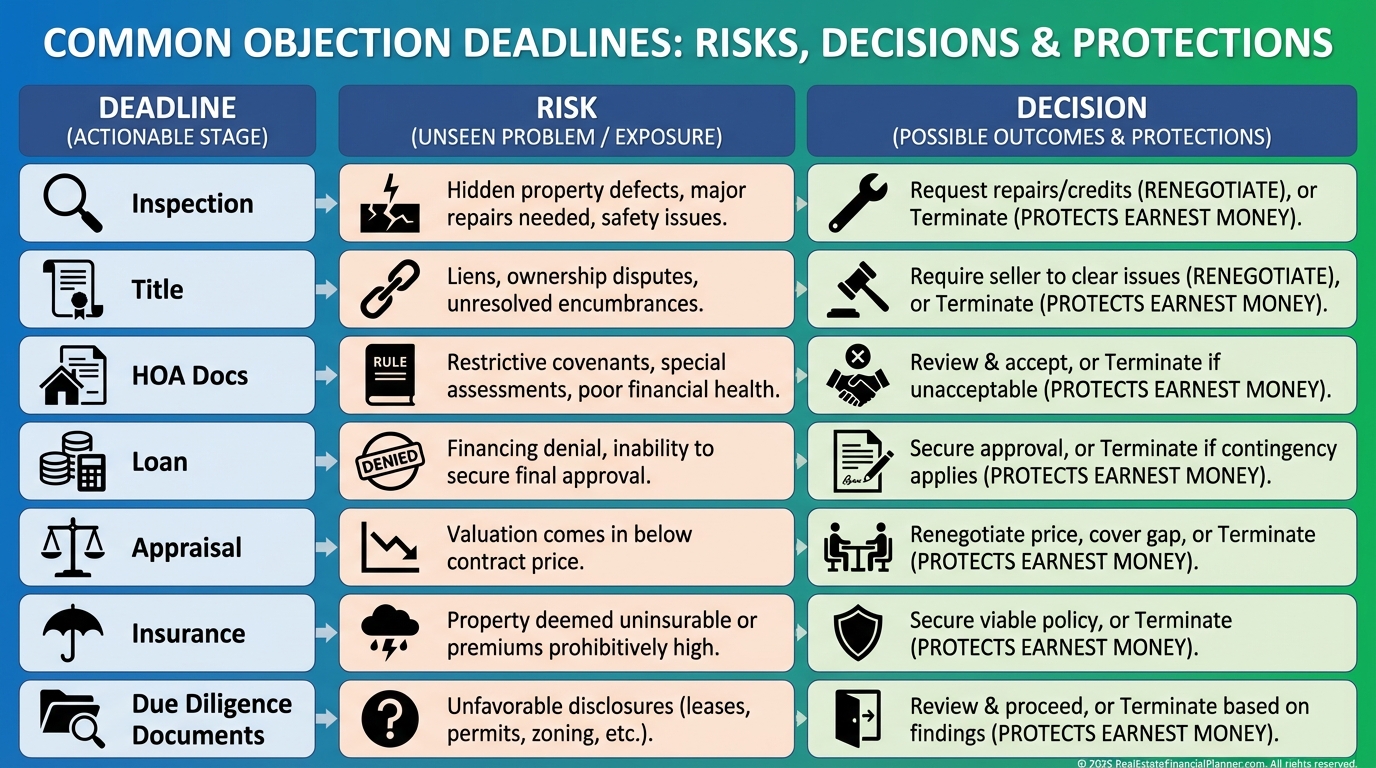

Dates and Deadlines: The Buyer’s Survival System

Most contracts have a pattern.

A delivery deadline (you receive documents).

An objection deadline (you raise issues).

A resolution deadline (you negotiate and resolve).

A termination option (if resolution fails, depending on the contract).

Miss the deadline, and you often lose the right to object.

That’s why “Contract to Close” feels busy.

You’re not only doing work. You’re doing work inside timeboxes.

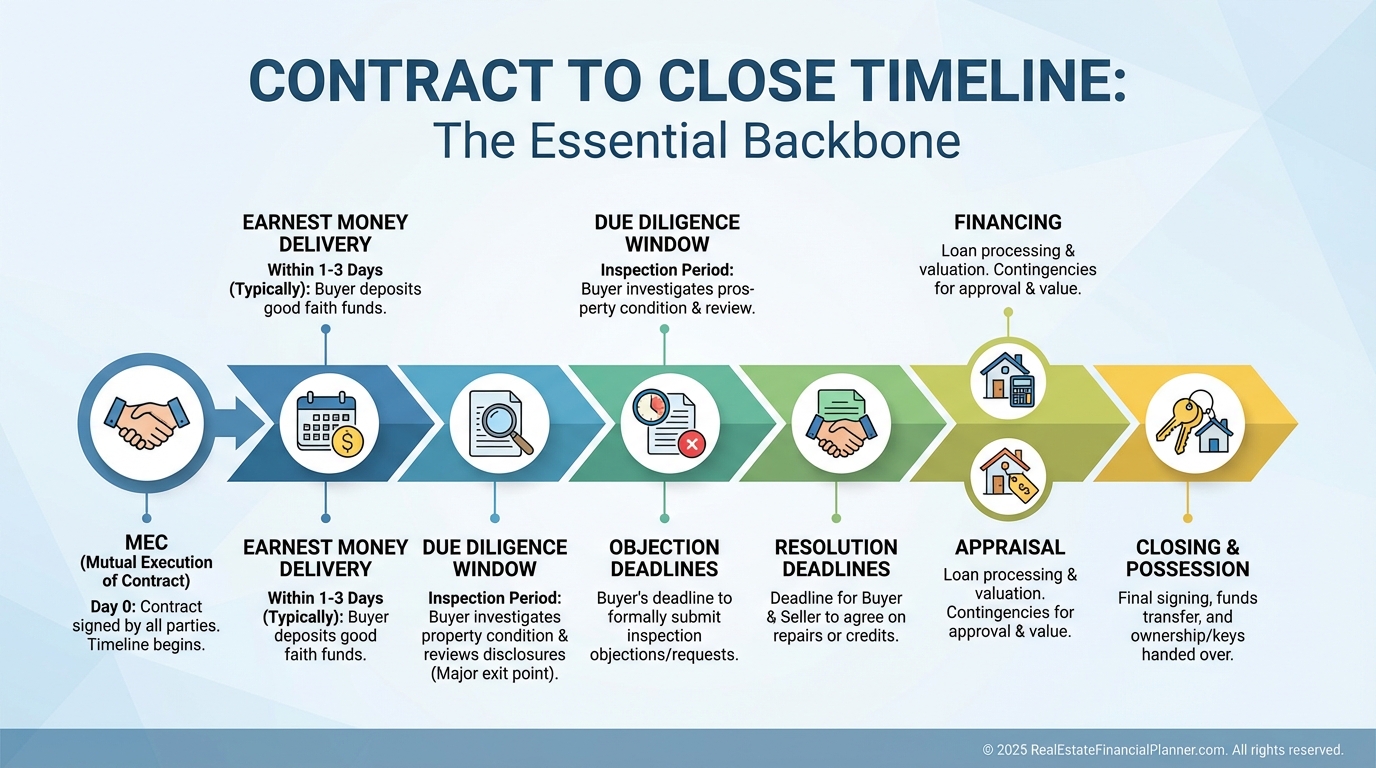

The First Clock That Matters: MEC and Earnest Money

Mutual Execution of Contract (MEC)

MEC is when the deal becomes real.

It’s the moment both parties have signed, and the deadlines start running.

If your contract is written as “MEC + X days,” then everything depends on knowing the true MEC date.

Earnest Money Deadline

Earnest money is not symbolic.

It’s money that can become a weapon if you breach contract.

I’ve seen buyers lose earnest money for one simple reason: they assumed someone else was handling it.

If you want peace of mind, treat earnest money delivery like wiring a down payment.

Confirm who holds it, how it’s delivered, and when it’s receipted.

Title: Recorded, Off-Record, and Resolution

Title is where you find out what you’re really buying.

Not the house.

The legal rights attached to the house.

Recorded Title Review

Liens, easements, covenants, judgments, access issues.

If you don’t understand something, your real estate agent is usually not the right expert.

Use the title company and an attorney when needed.

Off-Record Title Issues

Some problems don’t show up neatly in public records.

Unrecorded leases, handshake agreements, and weird occupancy situations can still become your problem.

Title Resolution Deadline

This is where objections either get cured, insured over, negotiated, or accepted.

Your decision is simple and brutal.

Proceed, or don’t.

HOA Documents: The Hidden Deal-Killer

HOA docs are boring until they cost you money.

Look at the rules and the financials.

Special assessments are not a surprise. They’re a math problem that was ignored.

If you’re buying for cash flow, an HOA fee increase can hit your returns immediately.

Seller Disclosures: Useful, Not Sufficient

Disclosures can point you toward issues.

They do not replace inspection.

They do not replace verification.

Use them to guide your questions, not to reassure yourself.

Financing: Loan Application, Loan Objection, and “Don’t Touch Your Credit”

Loan Application Deadline

Apply fast.

Your lender can’t solve problems they don’t know about yet.

Loan Objection Deadline

This is where buyers get trapped.

They assume, “If the loan fails, we’ll just cancel.”

That’s not always how it works.

If you miss the objection deadline, you can lose your escape hatch.

Credit Behavior During Contract to Close

Don’t open accounts.

Don’t buy a car.

Don’t move money around without telling your lender what it is and why it moved.

Underwriting hates surprises.

Appraisal: The Reality Check You Don’t Control

The appraisal is a third-party opinion that can change your entire deal.

If it comes in low, you typically have three choices.

Bring cash.

Renegotiate.

Terminate (if your contract and deadlines allow it).

If you’re modeling deals in REFP terms, this is one of the moments where your “Return on Investment Quadrant™” can get crushed by one extra cash requirement you didn’t plan for.

Survey or ILC: Boundaries, Encroachments, and Future Plans

If you want to add a fence, build an ADU, expand a driveway, or just avoid neighbor drama, the survey matters.

Encroachments and easements can turn “extra land” into “land you can’t use.”

Inspection: The Deadline Investors Must Treat Like a Hard Stop

The inspection objection deadline is where you either protect yourself or pretend problems don’t exist.

When I help clients, I want the inspection done early.

Not because I love inspectors.

Because I love time.

Time lets you get repair bids, negotiate calmly, and avoid last-minute decisions.

Insurance: The Quiet “No” That Can Kill a Deal

In some markets and property types, insurability is the problem.

Old roofs, prior claims, wildfire zones, knob-and-tube wiring, pools, and certain dog breeds can all change the terms.

Get quotes early.

If the contract gives you an insurance objection deadline, treat it like a real contingency.

Due Diligence Documents: The Investor-Specific Paper Chase

If the property is a rental, you may need more than a lease.

Estoppels, deposit accounting, payment ledgers, permits, warranties, and equipment leases.

Every missing document is a risk.

Every weird document is a conversation with your attorney, your property manager, or both.

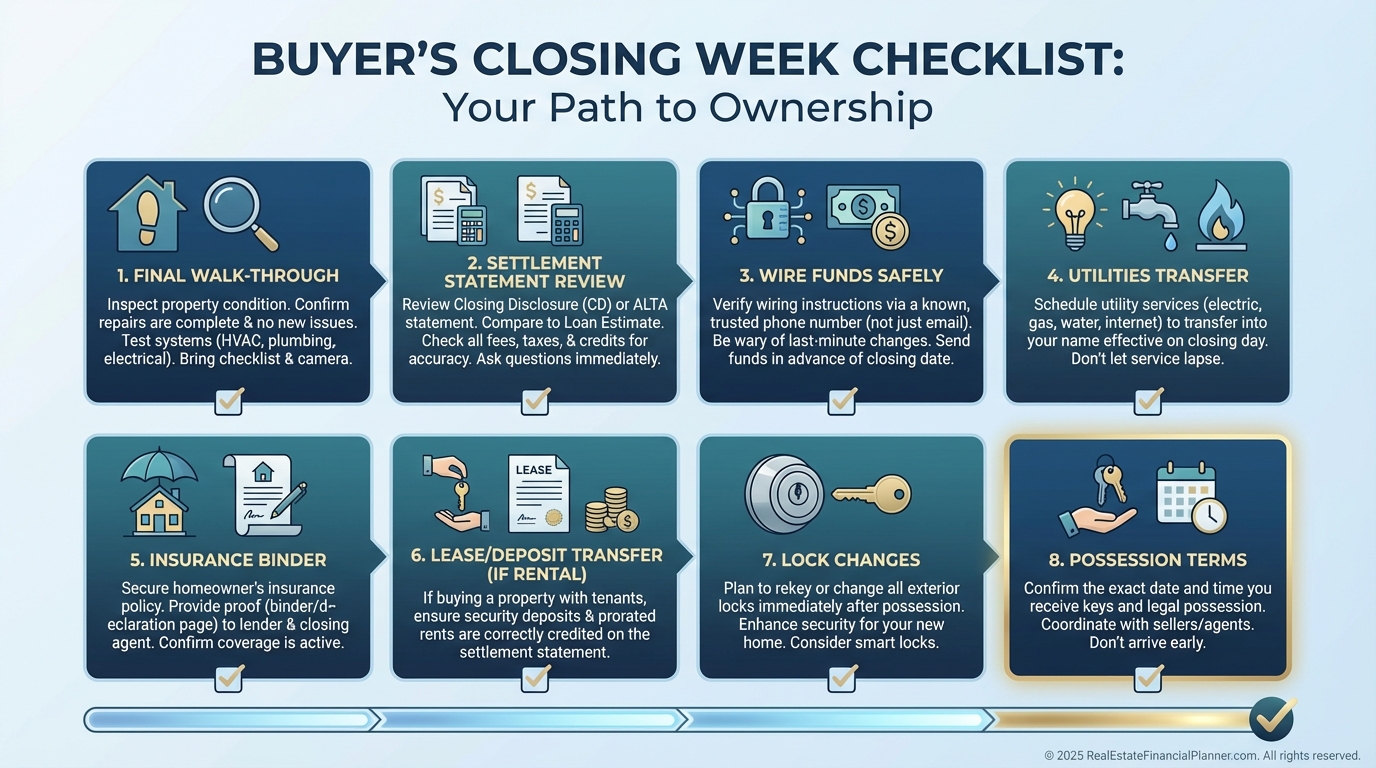

Closing and Possession: Where “Almost Done” Still Goes Wrong

Closing is not just signing.

Closing is funding, recording, and correct paperwork.

Plan for the logistics.

Utilities, wire instructions, final numbers, and scheduling.

Also plan for the reality that mistakes happen.

When I review settlement statements with clients, I’m looking for mismatched prorations, unexpected fees, and anything that contradicts the contract.

If it’s a rental, make sure lease assignments and deposits are handled correctly.

Possession matters too.

If the seller stays after closing, you’re taking on a landlord-style risk immediately.

Know the terms, the penalties, and what happens if they don’t leave.

No “Changing Your Mind”: The Deadline You Needed Was Yesterday

Here’s the hard truth.

Most contracts do not give you a clean “I changed my mind” exit.

If you want out, you need a contract-allowed reason, tied to the correct deadline, with the correct paperwork.

That’s why your contract to close plan should be built around decision points.

Not around hope.

If you’re the kind of investor who wants to play the long game, this is how you protect your ability to keep buying properties for years.

You don’t win by being the smartest person in the room.

You win by being the person who doesn’t make avoidable mistakes.