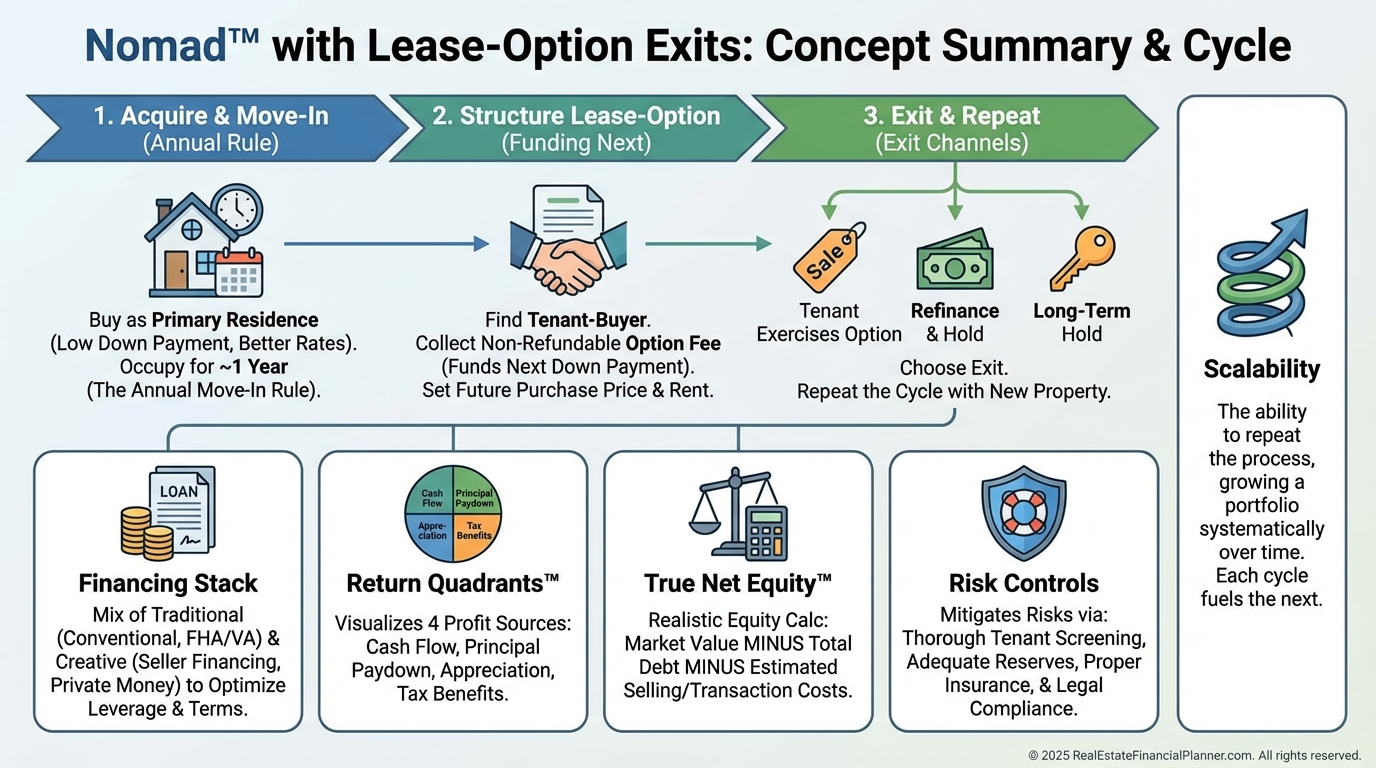

Nomad™ with Lease-Option Exits: The Step-by-Step Playbook to Fund Every Next Home with the Last One

Learn about Nomad™ with Lease-Option Exits for real estate investing.

Why This Strategy Works

When I help clients accelerate safely, I look for strategies that self-fund without cutting corners.

Nomad™ with Lease-Option Exits does exactly that.

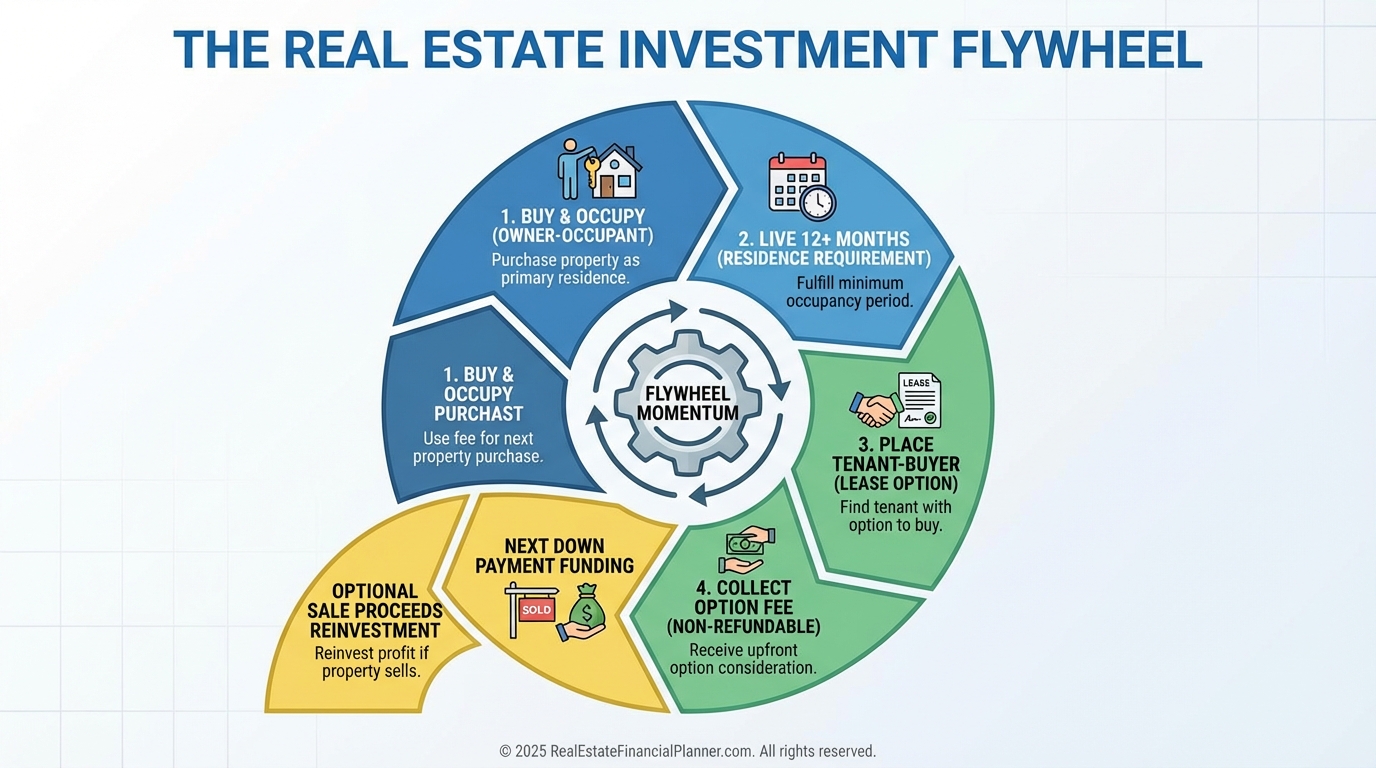

You buy as an owner-occupant, live there at least a year, then place a qualified tenant-buyer on a lease-option.

Their upfront, non-refundable option fee can become the down payment on your next home.

You keep owner-occupant interest rates, reduce capital expenses by selling earlier, and optimize Return on Equity by recycling profits.

What Is Nomad™ with Lease-Option Exits?

Traditional Nomad™ converts last year’s home into a long-term rental after you move.

Nomad™ with Lease-Option Exits converts last year’s home into a rent-to-own with a lease-option or lease-purchase.

You collect a meaningful option fee before move-in, premium rent during the term, and a potential lump sum when they buy.

If they don’t buy, you can re-option, convert to a traditional rental, or sell conventionally.

Compliance First: Owner-Occupant Rules

You must actually move in and intend to live there for at least 12 months.

When I underwrite plans, I treat occupancy fraud as a non-starter.

Lenders verify occupancy; misrepresentation can mean fines or worse.

Stay 12 months or longer, then proceed.

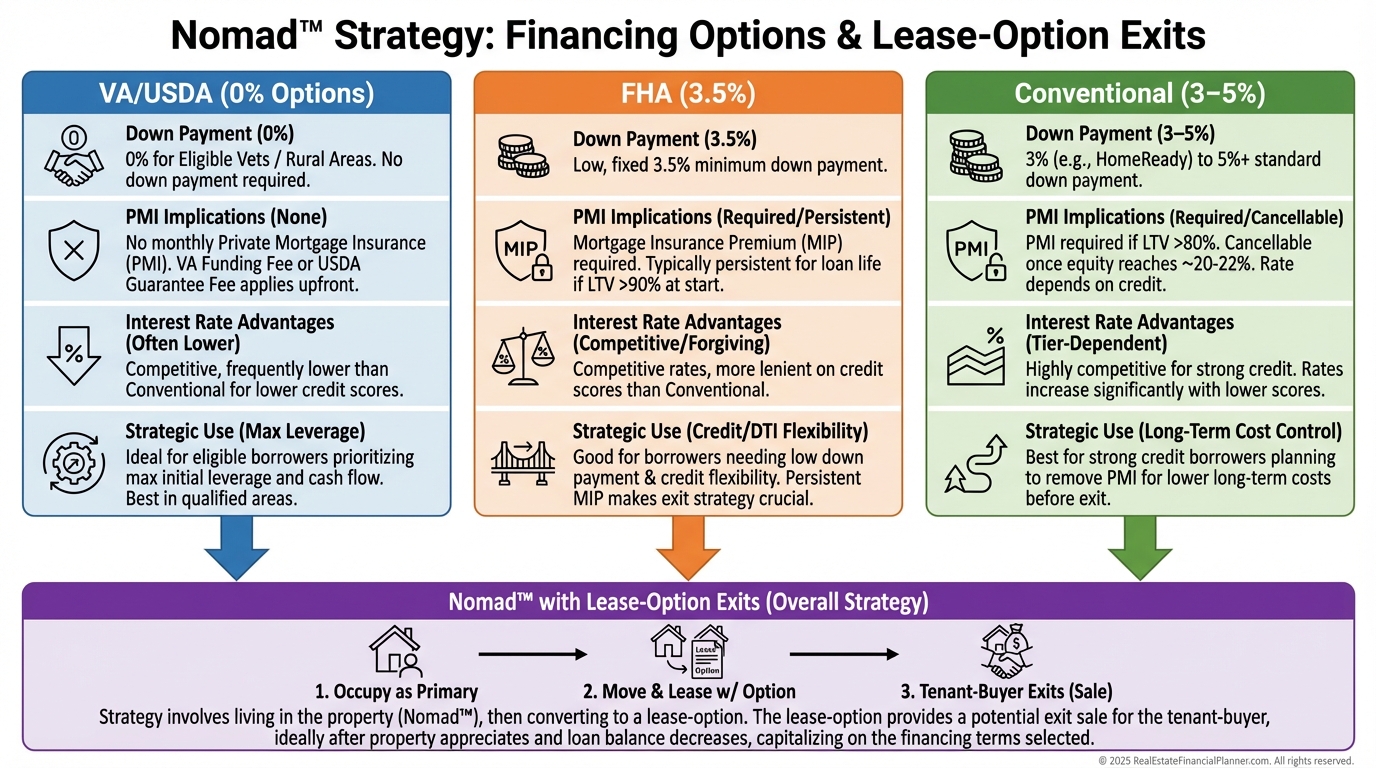

Financing the Purchase You Live In

Owner-occupant loans are the engine.

Private Mortgage Insurance is common under 20% down, but lease-option premiums often offset PMI’s drag.

When I model this, I check payment-to-income ratios, projected rent premiums, and reserves for at least 6 months of expenses.

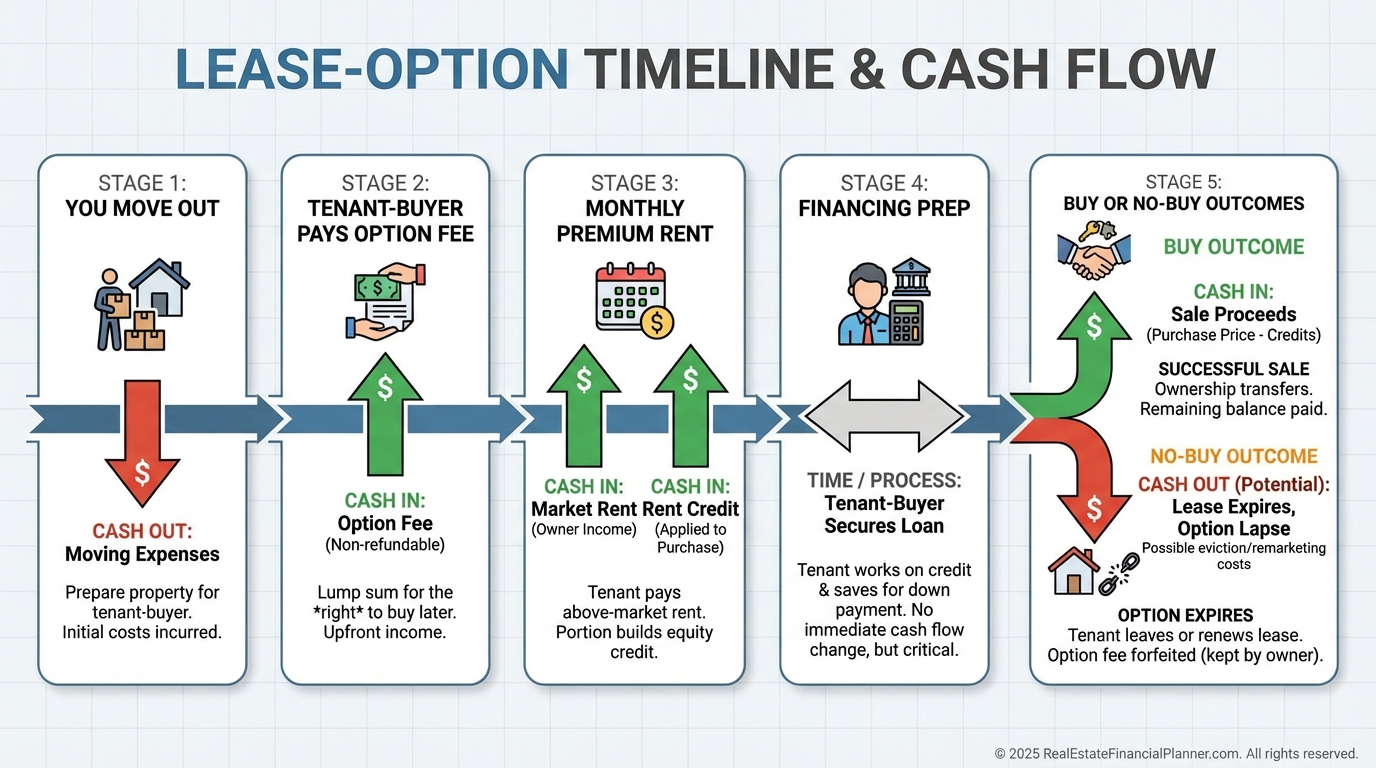

Structuring the Lease-Option

Here’s how I structure most deals.

•

Option fee: target 5%–7% of today’s price, non-refundable, credited toward their down payment when they buy.

•

Term: 12–36 months, long enough to mortgage-qualify and save.

•

Price: set today with reasonable appreciation baked in, or use a pre-agreed escalator.

•

Rent: premium vs market due to option value and reduced management.

•

Repairs: tenant-buyer handles minor items; you handle major systems per law and agreement.

•

Credits: I rarely offer rent credits; they complicate underwriting and appraisals.

•

Legal: have a local attorney draft state-specific documents; follow your state’s treatment of options, equitable interest, and default rules.

When I vet tenant-buyers, I underwrite the path to mortgage readiness before I accept their option fee.

I want today’s score, a plan to cure, and an RMLO or lender’s pre-screen for high odds of closing.

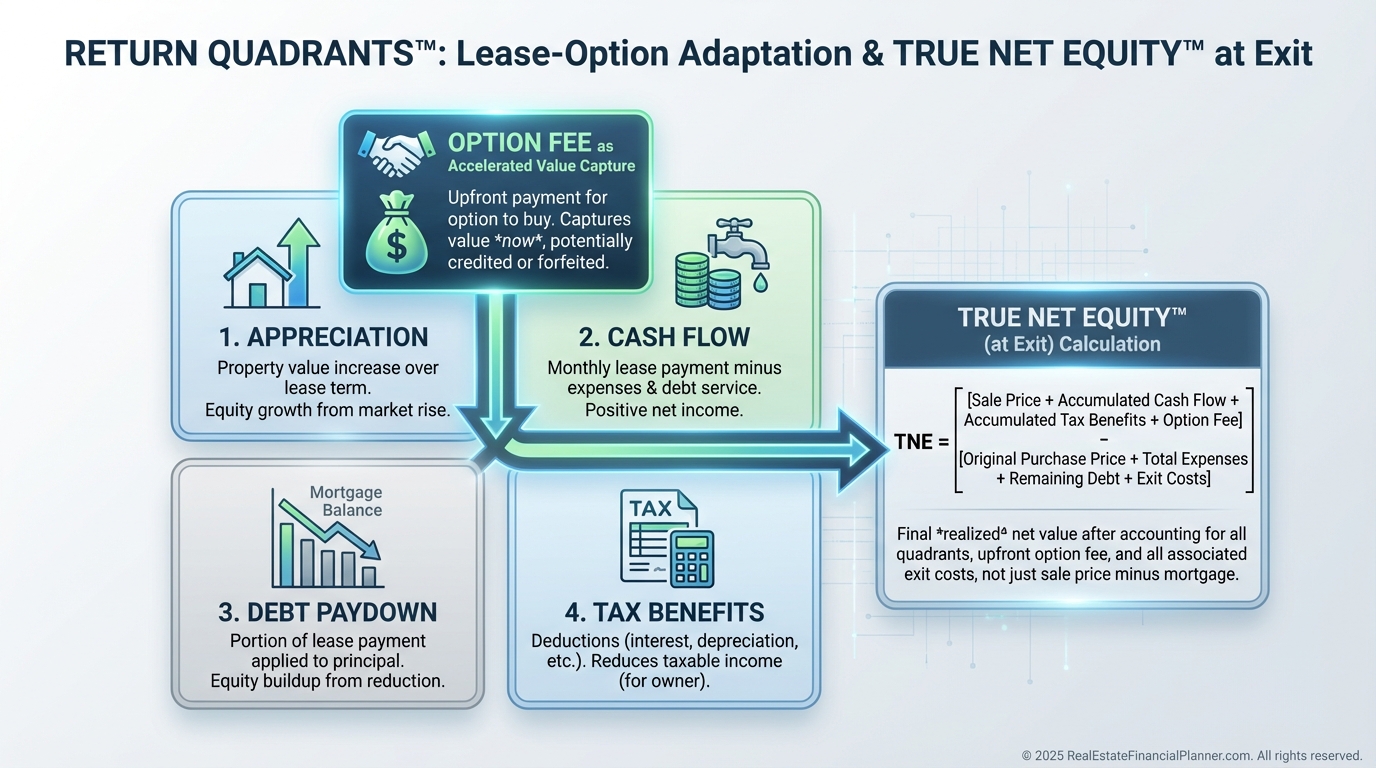

The Math: Return Quadrants™ + True Net Equity™

I teach clients to view returns through Return Quadrants™.

•

Appreciation: value growth while you own.

•

Cash Flow: usually improved with rent-to-own premiums.

•

Debt Paydown: principal reduction continues.

•

Tax Benefits: Cash Flow from Depreciation™ offsets taxable income while rented.

Add the option fee as accelerated value capture.

Use True Net Equity™ to see what you really own after cost to access: payoff, closing costs, concessions, and taxes.

When you sell to your tenant-buyer, commissions are often minimized or eliminated, improving True Net Equity™ vs an MLS sale.

Money Required (And Where It Comes From)

You’ll need a down payment, closing costs, rent-ready funds, marketing, legal, and reserves.

Early on, you can front the down payment, then reimburse with the option fee.

Or require the option fee before their move-in and use it for your next purchase.

I model cumulative negative cash flow as “deferred down payment.”

If you’d put more down, it would be lower; since you didn’t, set aside a safety buffer.

Aim for 6+ months of expenses in reserves.

Duration, Workload, and Capital Expenses

Most clients hold each home 2–5 years with this variation.

Workload is higher than traditional Nomad™ due to marketing, screening, and occasional sales.

Reward: you often sell before roofs, furnaces, or big turns hit, avoiding capital expense shocks.

That’s a silent boost to your Return on Equity and cash flow.

Exit Channels and Buyer Financing

Primary exit is your tenant-buyer exercising the option.

Expect VA/USDA 0% down, Conventional 3%–5% down, or FHA 3.5% down.

Sometimes they pay cash.

If they don’t buy, your options are simple: re-option, rent traditionally, or sell on the open market.

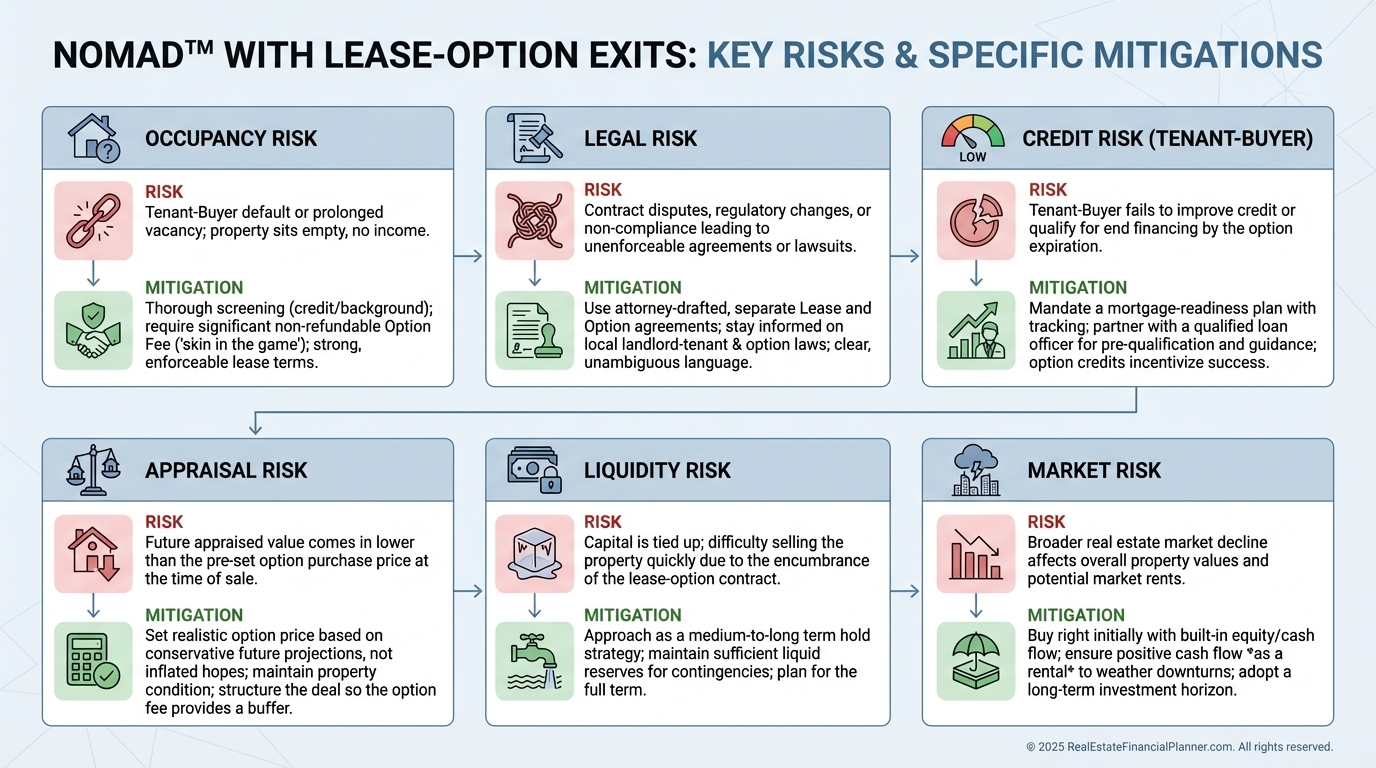

Risk Controls I Require

I treat this as a medium-risk strategy with asymmetric upside when done right.

Here’s what I check and avoid.

•

Occupancy integrity: live in 12+ months.

•

Legal clarity: no gray-area paperwork; use a local attorney.

•

Credit pathing: confirm their route to mortgage approval upfront.

•

Appraisal risk: price reasonably; avoid gimmicky credits.

•

Liquidity: maintain reserves and a line for surprises.

•

Market sensitivity: don’t count on aggressive appreciation; model flat cases.

•

Documentation: paper the option fee for lender use; keep clean, auditable files.

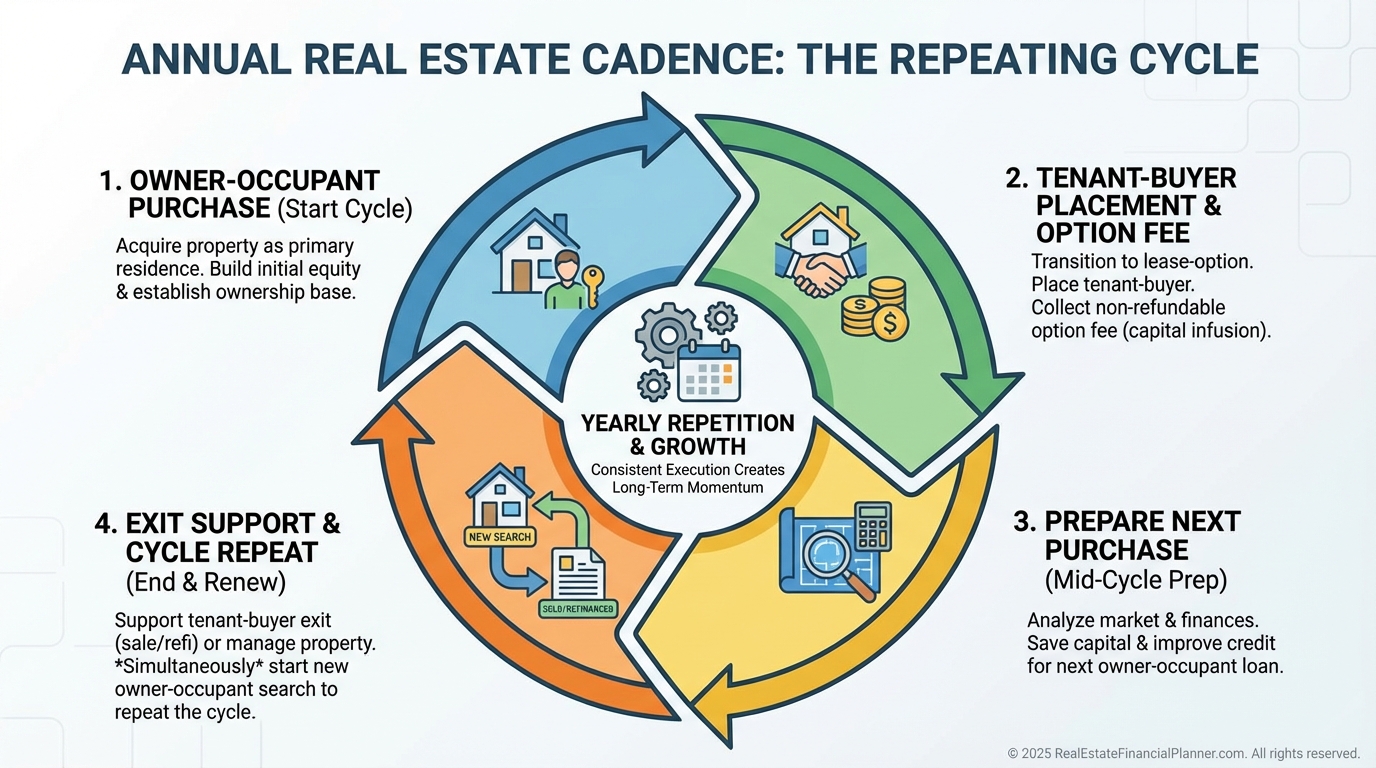

Scalability and the “Unlimited Down Payments” Effect

The option fee from last year’s home funds this year’s down payment.

Sale proceeds later supercharge the model.

Owner-occupant rates improve debt-to-income and cash flow, which helps qualify for the next loan.

This is how clients add properties faster than traditional 20% down investing.

Finding Deals That Tenant-Buyers Want

I prioritize homes mainstream buyers want to own.

•

MLS: target clean, low-CapEx homes in strong school and commute zones.

•

FSBO: flexible sellers and fewer eyes.

•

Wholesalers: occasionally a gem, but verify condition and financeability.

When I walk a property, I ask, “Would my best tenant-buyer be proud to purchase this in 24 months?”

Analyzing Deals (Use Our Free Spreadsheet)

Download it free at: https://RealEstateFinancialPlanner.com/spreadsheet

Input purchase, rent, taxes, insurance, and maintenance.

Then use Overrides to model option fee timing, premium rent, probable sale year, and exit costs.

Project Return Quadrants™ and True Net Equity™ year-by-year to validate the plan.

Market Conditions: Where This Shines

This excels in markets with steady appreciation, decent rent-to-price ratios, and strong owner-occupant demand.

It’s harder in flat/declining markets or where lease-options are constrained by local law.

Always verify your state’s rules and use compliant documents.

Skills That Matter

You’ll develop these quickly.

•

Acquisition financing with owner-occupant rules.

•

Lease-option structuring and legal coordination.

•

Marketing and screening for tenant-buyers.

•

Deal analysis using Return Quadrants™ and True Net Equity™.

•

Exit coordination and reinvestment discipline.

If you lack one today, borrow the skill from your team while you learn.

Your 12-Month Cadence

Here’s the rhythm I coach.

•

Months 0–2: buy owner-occupant, move in.

•

Months 3–11: improve, learn the area, prep next purchase criteria.

•

Month 12+: shop next home and market current for lease-option.

•

Before closing new home: accept option fee, document properly.

•

Months 13–24: support tenant-buyer’s mortgage-readiness, keep files pristine.

•

Years 2–5: they buy; you redeploy profit; repeat.

Common Mistakes I See (And How We Avoid Them)

•

Counting on appreciation to bail out bad buys.

•

Accepting underqualified tenant-buyers with small option fees.

•

Offering rent credits that kill underwriting later.

•

Ignoring reserves and then selling under pressure.

•

DIY legal docs from another state found online.

•

Failing to document the option fee for lender use at exit.

We model conservative cases, screen hard, and keep legal airtight.

A Quick Example

A client bought at 3% down, lived there 12 months, then placed a 6% option-fee tenant-buyer.

Premium rent improved cash flow; the option fee funded the next 5% down.

Two years later the tenant-buyer closed, minimizing sales costs and boosting True Net Equity™.

They repeated the process and accelerated to financial independence ahead of schedule.

Final Word

This is an entrepreneurial variation of Nomad™.

It asks more of you.

But it also pays you sooner and more often—option fees now, better cash flow during, and optimized True Net Equity™ at exit.

If you want a strategy that funds its own growth without betting the farm, Nomad™ with Lease-Option Exits belongs in your plan.