Portfolio Lenders: The Flexible Financing Strategy Most Investors Ignore (and How to Scale Past 10 Loans)

Learn about Portfolio Lenders for real estate investing.

Why Most Investors Cap Out Early

They default to conventional loans, hit the 10-financed-property wall, and leave leverage, speed, and cash-on-cash returns on the table.

Sarah did everything right on eight rentals.

Perfect payments, clean books, and strong cash flow.

But the next duplex died in underwriting because she had “too many financed properties.”

Then she met a portfolio lender.

Three years later she held 24 doors, not because deals got easier, but because her financing finally matched her strategy.

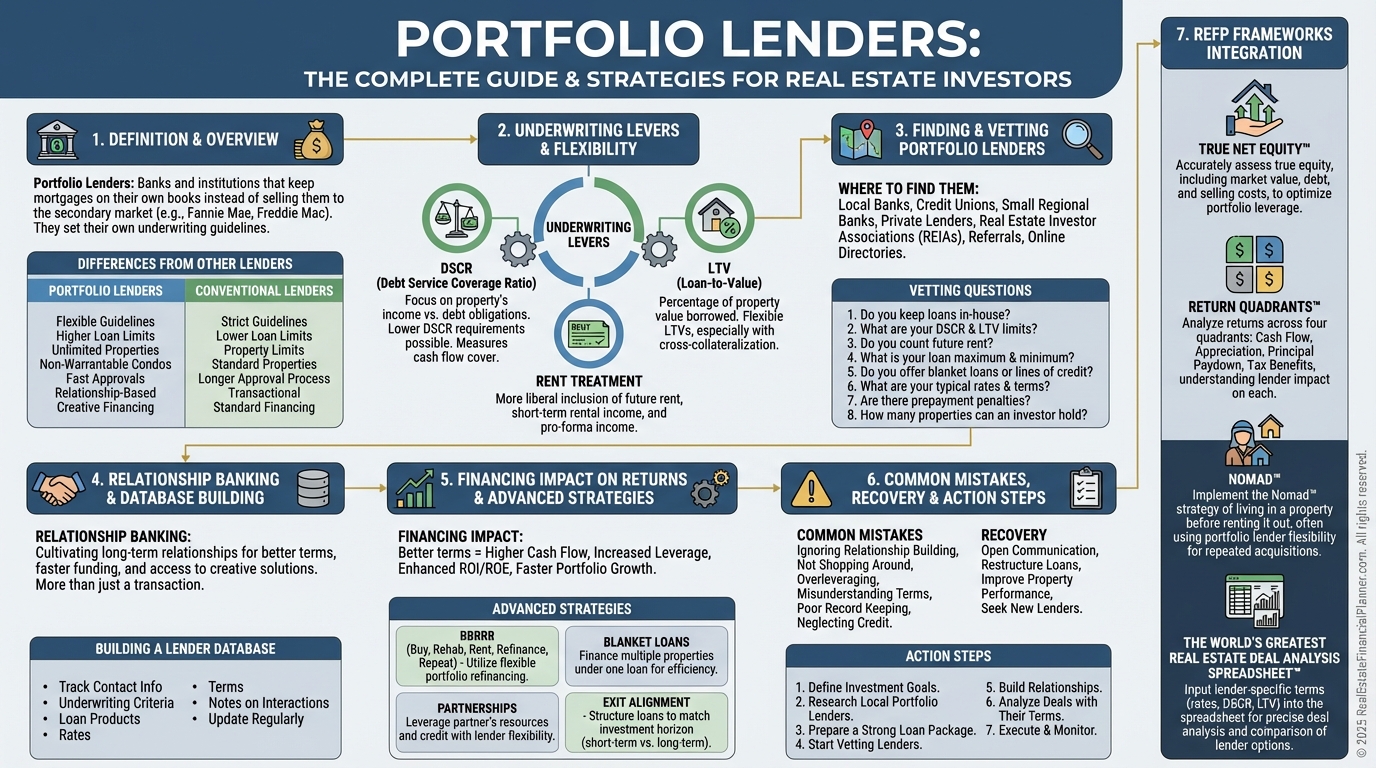

What Are Portfolio Lenders?

Portfolio lenders originate loans and keep them in-house rather than selling to Fannie Mae or Freddie Mac.

Because they hold the paper, they can create guidelines that fit real investors, not just check boxes.

They look at your track record, your global portfolio performance, and your business plan.

They’re underwriting a relationship, not a one-off file.

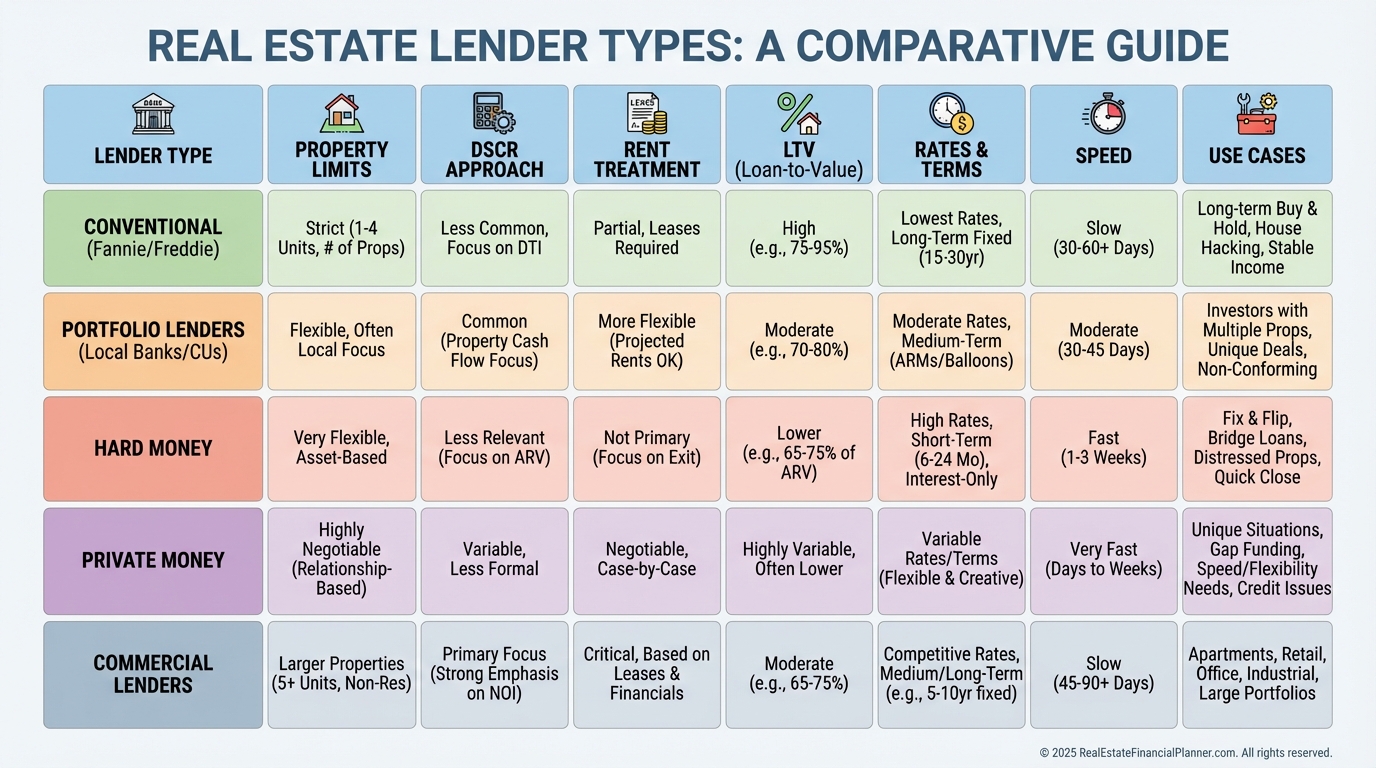

Key Differences You’ll Feel in the Real World

Conventional lenders follow rigid agency rules.

They cap property counts, haircut rental income, and compute DTI with little regard for your actual operations.

Hard money is fast but expensive and short-term.

It’s a tool, not a portfolio solution.

Private money can be flexible, but it’s inconsistent, personality-driven, and usually pricier.

Commercial lenders excel with 5+ units, yet they often bring heavier documentation and committee layers.

Portfolio lenders bridge the gap.

They work in the 1–4 unit space with commercial-style flexibility and residential-style speed.

How Portfolio Lenders Underwrite Investors

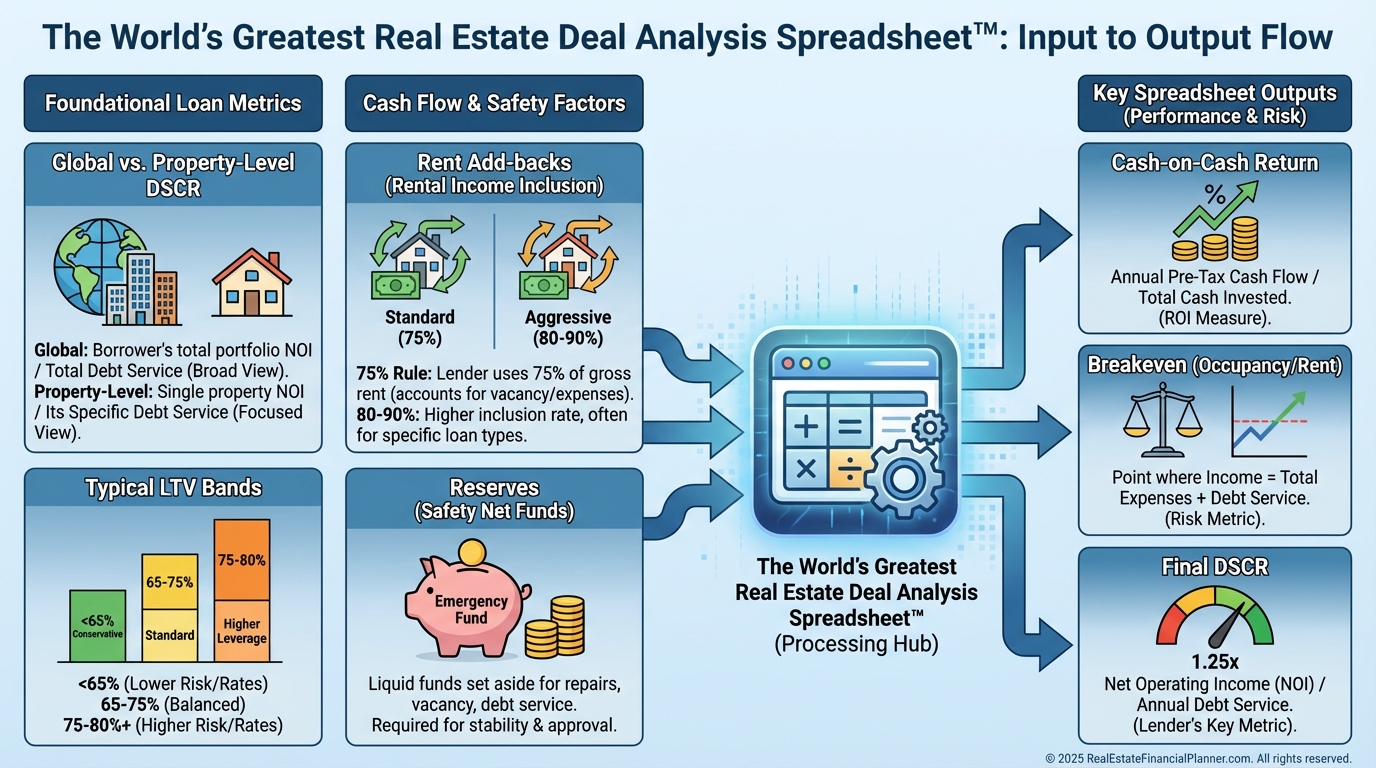

When I model loans with clients, I look at what portfolio lenders actually care about.

Global debt service coverage ratio (DSCR) across your whole portfolio, not just the subject property.

Practical rent treatment—often 80–90% of market or actual rent for experienced operators.

Reasonable LTVs—commonly 80–85%—with terms that match your plan.

And yes, they’ll still verify your capacity and reserves, but with common sense.

Using The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I check two stacks of numbers.

First, property-level DSCR, cash-on-cash, and breakeven occupancy.

Second, portfolio-level DSCR and liquidity to ensure the deal strengthens—not stresses—the entire system.

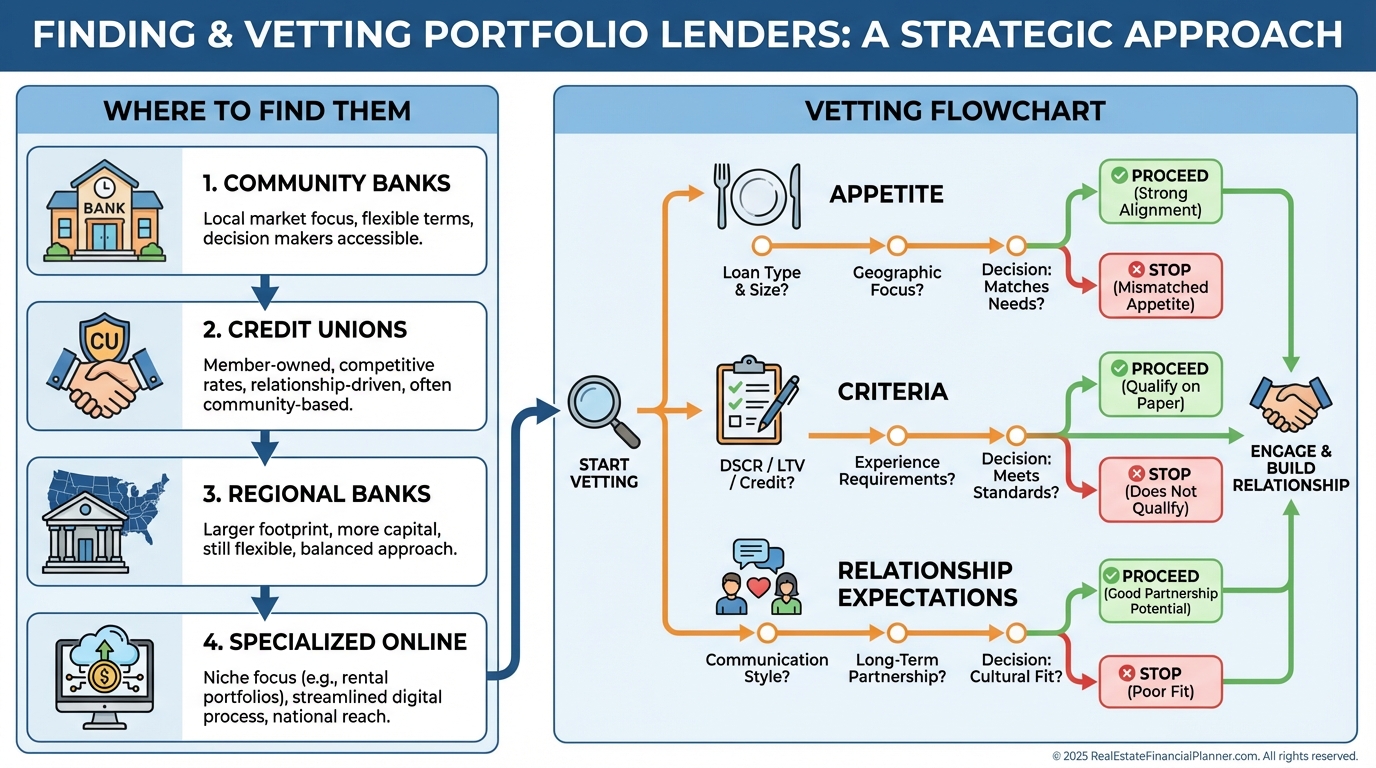

Where to Find Portfolio Lenders (and How I Vet Them)

You won’t find the best portfolio lenders by sorting rate tables.

You find them by shaking hands.

Start with community banks and credit unions.

Then expand to regional banks with a real estate investor focus.

I ask three groups of questions.

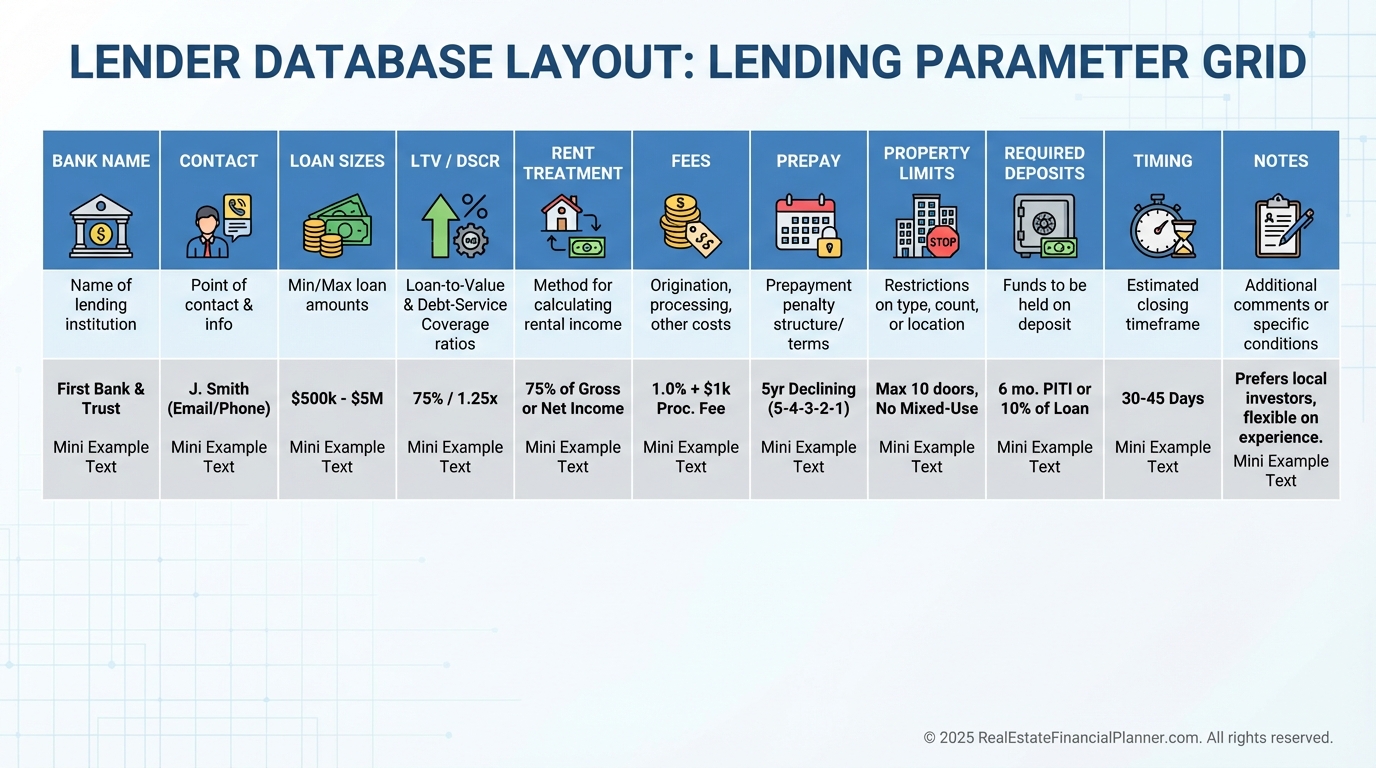

Their appetite: What percent of loans stay on balance sheet? Typical loan sizes? Preferred asset types?

Their criteria: LTV caps, DSCR targets, rent treatment, property count, cash‑out stance, prepayment penalties, personal guarantees.

Their relationship expectations: Operating accounts, minimum balances, treasury services, and decisioning timelines.

Build Your Portfolio Lender Database

I have clients use FDIC’s BankFind to shortlist banks with $100M–$5B in assets headquartered near them.

Then we crowdsource winners at REIA meetings, from property managers, and from investor masterminds.

Track everything in a simple sheet.

Include contact info, product notes, property-type sweet spots, LTV/DSCR norms, rent treatment, fees, required deposits, and closing speed.

Update it quarterly.

Banks change.

Your database becomes an advantage most investors never develop.

Strategy Shifts Once You Use Portfolio Lenders

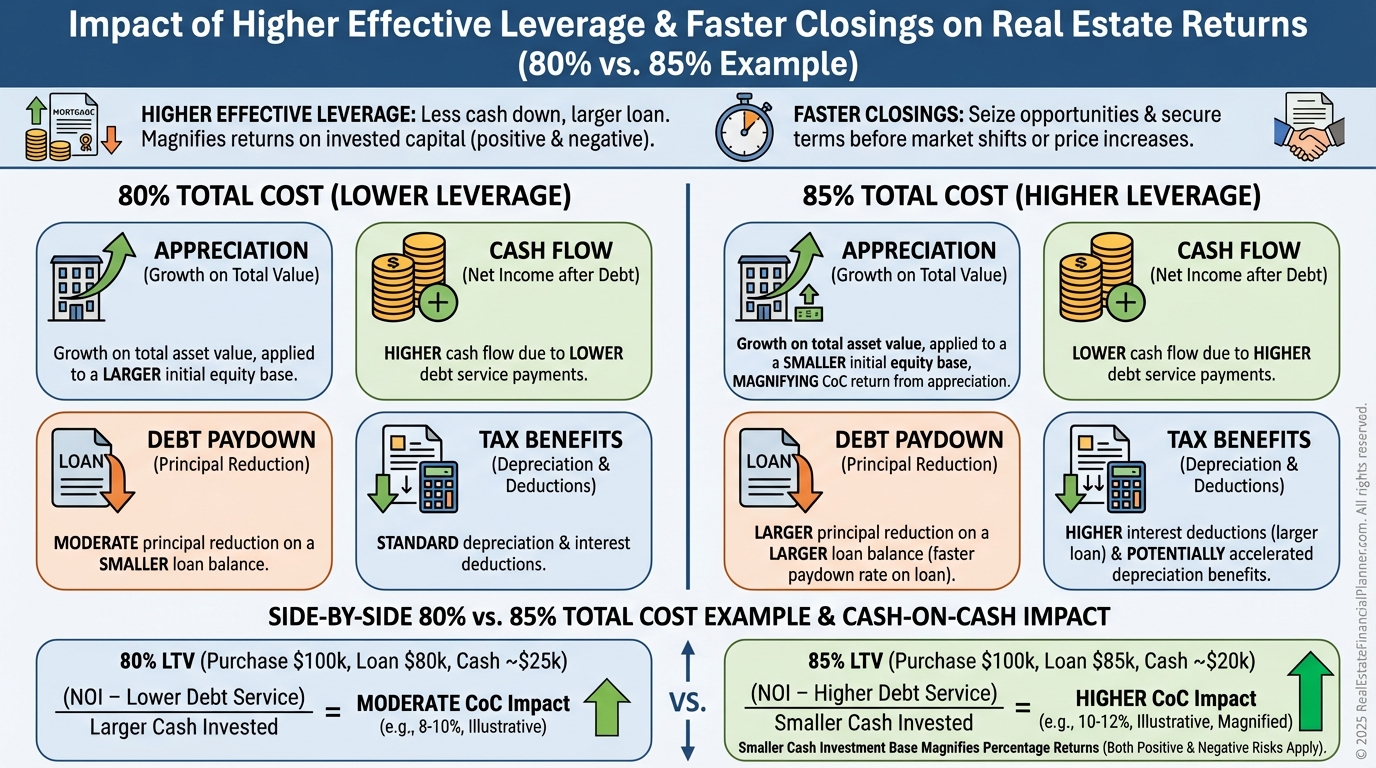

This is where the math changes.

No preset property limit.

Speedy, in-house decisions.

Practical structures like cross-collateralization, interest‑only periods, and blanket loans for multi‑property refinances.

When I rebuilt after bankruptcy years ago, speed and relationship trust were my lifelines.

Portfolio lenders closed in weeks, not months, and that velocity compounded returns.

Consider a duplex at $120,000 renting for $2,400, needing $15,000 in repairs.

A conventional 80% LTV leaves you funding purchase plus rehab with more cash, dragging cash-on-cash.

A portfolio lender at 85% of total project cost might cut your cash in roughly in half.

Same asset, same operations—better leverage and a faster Return Quadrants™ flywheel.

Appreciation, cash flow, debt paydown, and tax benefits all accelerate when your capital turns faster.

Avoidable Mistakes (and How to Recover)

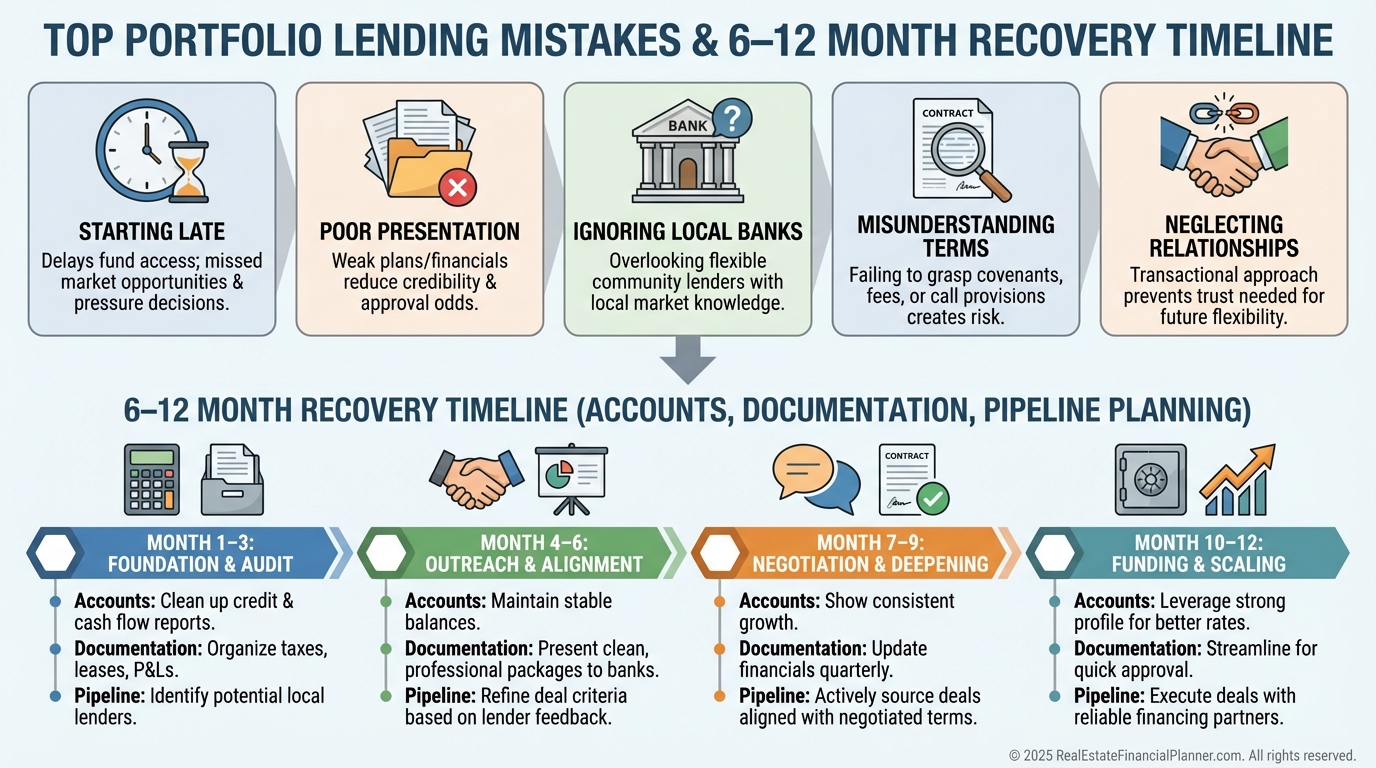

The biggest mistake is waiting until file number ten to make your first introduction.

Start with two or three properties so you negotiate from strength.

Keep professional books.

When I sit with a banker, I bring a clean portfolio summary, rent roll, Schedule E tie-outs, trailing 12s, liquidity snapshot, and business plan.

Don’t assume terms.

Many portfolio loans offer fixed rates and no balloons.

If there is a balloon, I align it to my hold plan and set calendar reminders 12 and 6 months before maturity.

Respect the relationship.

Move the operating account.

Use their treasury services.

Become a profitable client, and approvals get easier.

If you’ve already stumbled, recover in three moves.

Consolidate accounts, upgrade your documentation, and outline a 6–12 month financing roadmap the banker can support.

Advanced Applications for Serious Investors

Portfolio lenders scale BRRRR.

Faster purchases, rehab-to-perm options, and smoother refinances let you recycle capital every 4–6 months instead of annually.

They simplify multi-property packages.

One blanket loan can refinance five houses at once, cutting appraisals and closing costs.

They’re friendly to partnerships and operating entities.

That unlocks syndications and JV structures that conventional lenders often avoid.

I also align exit terms to strategy.

If I plan a 5–7 year hold, a fixed period with a balloon at year seven can be cheaper and still safe.

If I’m building a legacy portfolio, I hunt for long fixed terms.

This is where our frameworks pay off.

True Net Equity™ helps me avoid overestimating equity by subtracting selling costs, prepayment penalties, and any balloon-related refi friction.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ keeps assumptions consistent.

And the Nomad™ strategy still fits early in your journey—owner-occupy to secure great terms, then transition into portfolio lending when the investor engine needs scale.

Action Plan: 30–60–90 Days

30 Days:

•

Identify 5–10 local and regional banks with $100M–$5B in assets using FDIC BankFind.

•

Build your lender database and book three introductory meetings.

•

Prepare a professional portfolio packet: property summaries, rent roll, trailing 12s, PFS, liquidity, and a one-page business plan.

60 Days:

•

Open an operating account with your top candidate bank and start using it.

•

Run two live deals through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and review them with your banker for feedback.

•

Document each lender’s DSCR, LTV, rent treatment, prepay, and timeline.

90 Days:

•

Execute your first purchase or refi with your chosen portfolio lender.

•

Update your Return Quadrants™ projections to reflect new leverage and speed.

•

Recalculate True Net Equity™ across the portfolio and set your next capital recycling target date.

A Quick Case Study

Robert owned six single‑family rentals financed conventionally, producing $3,500 a month after expenses.

He found a four‑plex at $320,000 that would add roughly $1,200 a month.

Conventional terms required 25% down, a 45‑day close, and he was inching toward the 10‑loan cap.

His portfolio lender offered 85% LTV based on his track record, a 21‑day close, a competitive fixed rate, no prepay, and a 25‑year amortization.

The slightly higher rate was offset by lower cash in, pushing cash‑on‑cash from about 15% to 22% in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

He preserved $32,000 for the next acquisition and grew from six to eighteen doors in 18 months.

That compounding came from financing, not luck.

Closing Thought

The investors who win aren’t finding magic deals.

They’re building bankable relationships and matching financing to strategy.

Start those conversations now, before you need them, and let portfolio lenders become the quiet engine behind your next decade of growth.