Monthly Rent: Calculate, Forecast, and Boost Cash Flow

Learn about Monthly Rent for real estate investing.

Why Monthly Rent Decides Your Results

When I help clients evaluate deals, I start with one question: what is the true, supportable monthly rent today.

Everything else cascades from that single number.

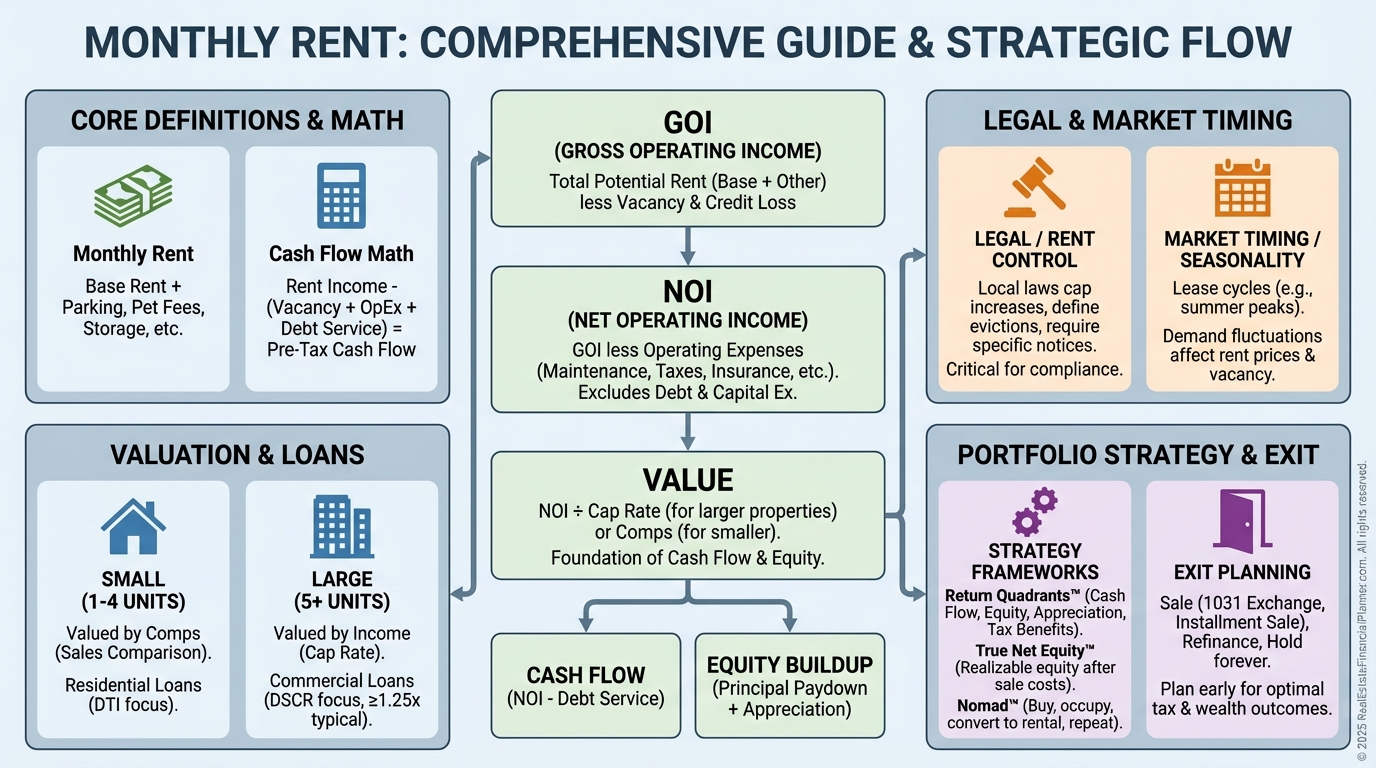

Monthly rent powers your Gross Operating Income, feeds your Net Operating Income, and, for larger assets, dictates value.

On The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I model monthly rent first, then test everything that depends on it.

What Monthly Rent Actually Represents

Monthly rent is your primary revenue, but it’s not the whole picture.

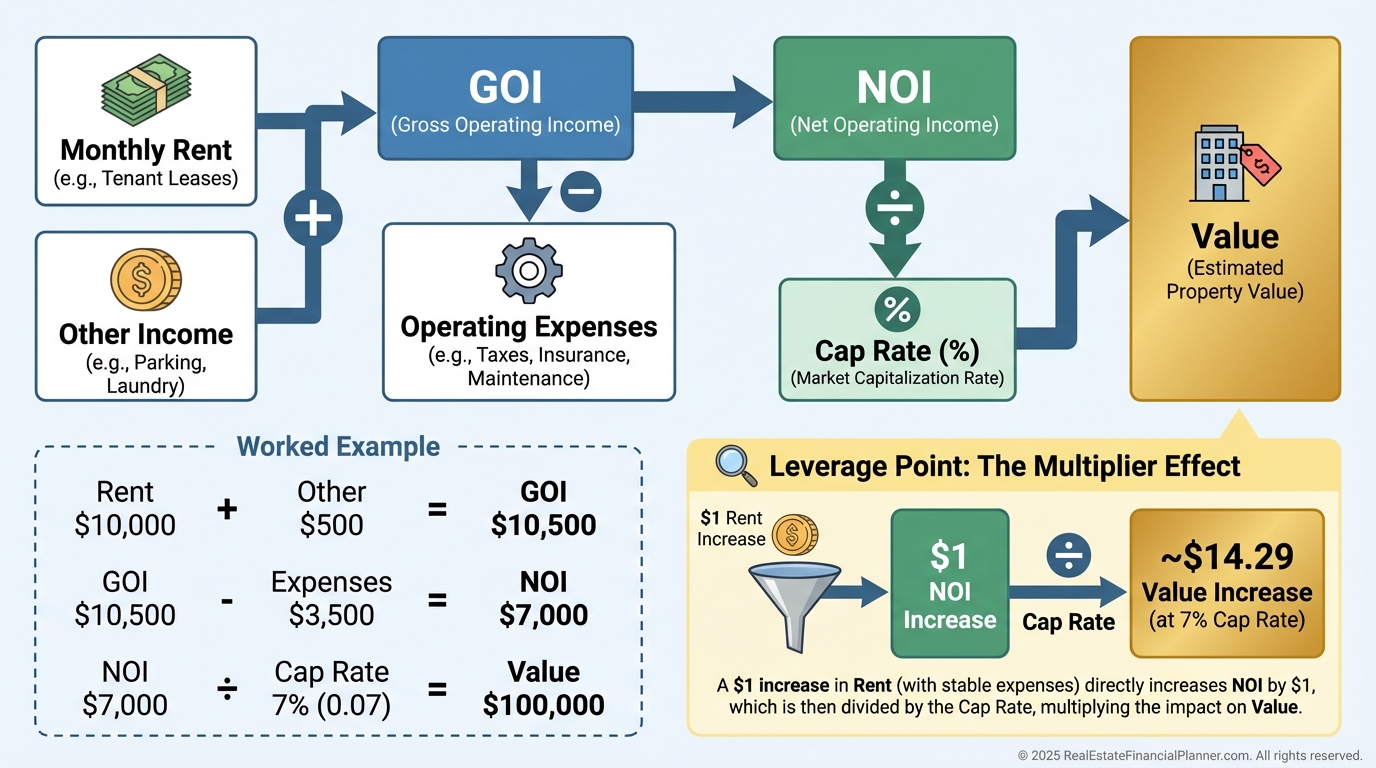

Monthly Rent plus Monthly Other Income equals Gross Operating Income.

From there, subtract operating expenses to get Net Operating Income.

NOI pays debt, buffers risk, and, in income-cap markets, sets value.

When I rebuilt after a tough market cycle, I learned to treat rent as a system, not a wish.

I verify comps, adjust for terms, and model ranges instead of single points.

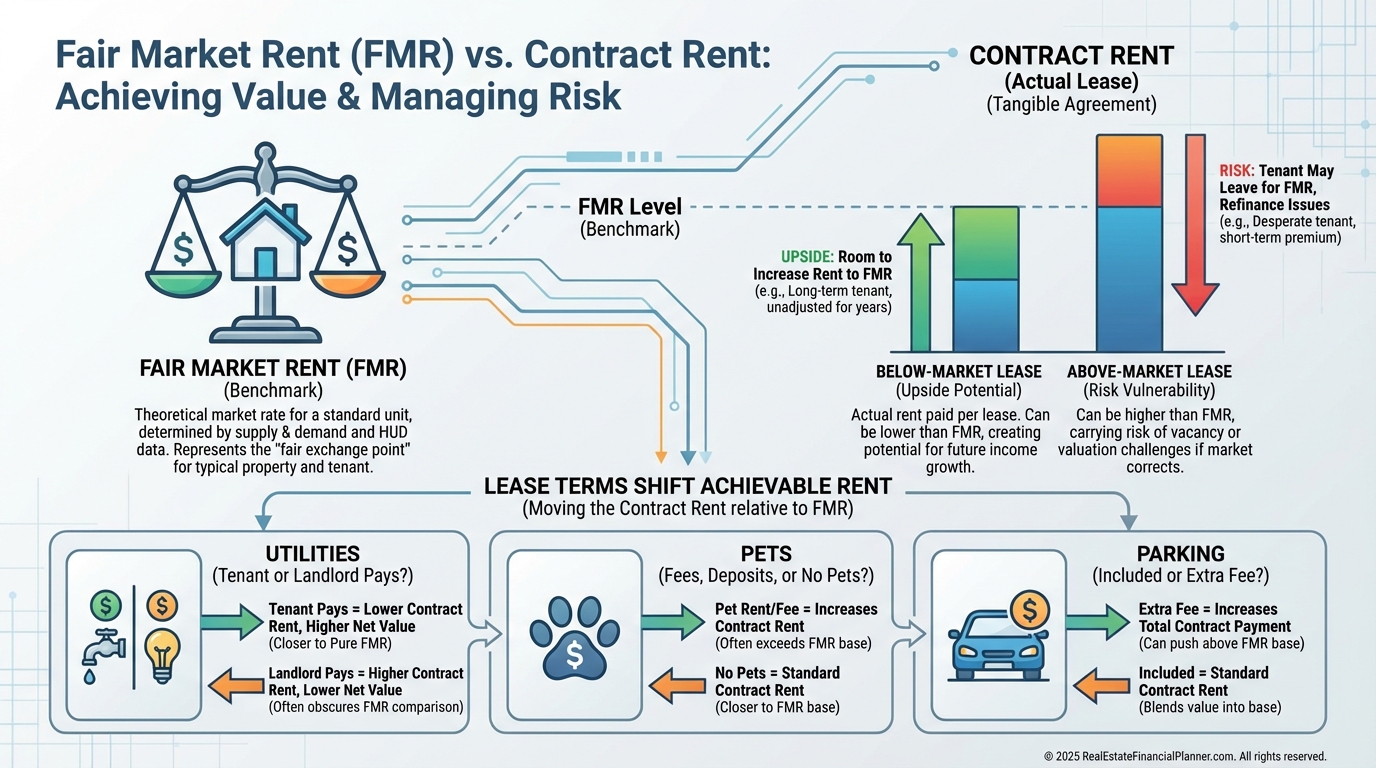

Finding Fair Market Rent You Can Defend

Fair Market Rent is what the market supports today for your unit type, features, and terms.

Contract rent is what you actually collect.

I separate them because upside and risk live in the gap.

When I comp rents, I insist on true comparables, not nearest-adjacent addresses.

I adjust for renovations, included utilities, amenities, parking, pets, and lease flexibility.

Then I create a rent range and test best-, base-, and worst-case outcomes in the Spreadsheet.

This is where many investors lose returns: they price hope, not evidence.

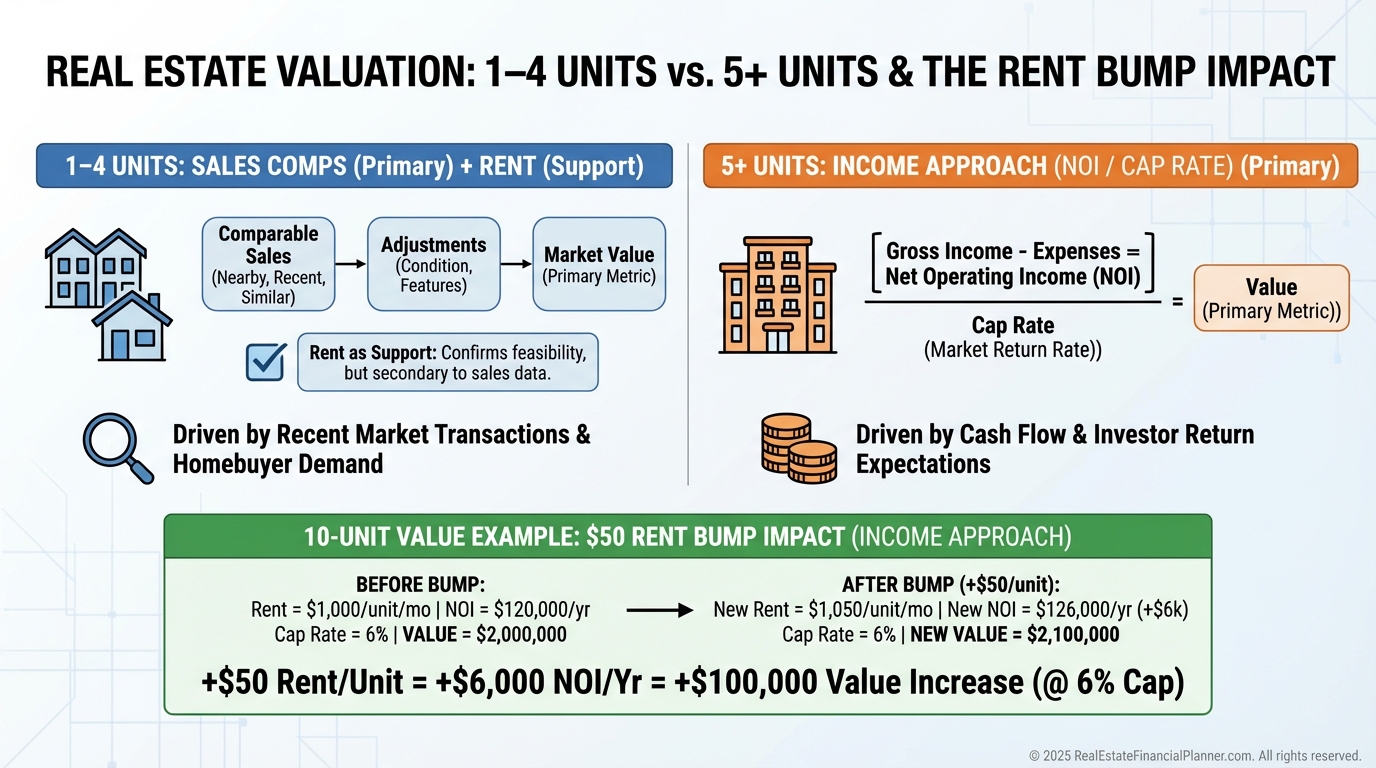

How Monthly Rent Drives Property Valuation

Small properties rely on sales comps.

Large multifamily lives and dies by income.

The larger the deal, the more every rent dollar compounds into value via NOI and cap rate.

I teach clients to speak both languages because lenders, appraisers, and buyers do.

A simple flow makes this real.

Monthly rent per unit times units equals total monthly rent.

Multiply by twelve for annual rent.

Add other income to reach GOI.

Subtract operating expenses to reach NOI.

Divide NOI by cap rate for value.

On a 10-unit at $1,000 per month, total rent is $10,000 monthly, $120,000 annually.

If expenses consume one-third, NOI is $80,000.

At a 7% cap, value approximates $1,142,857.

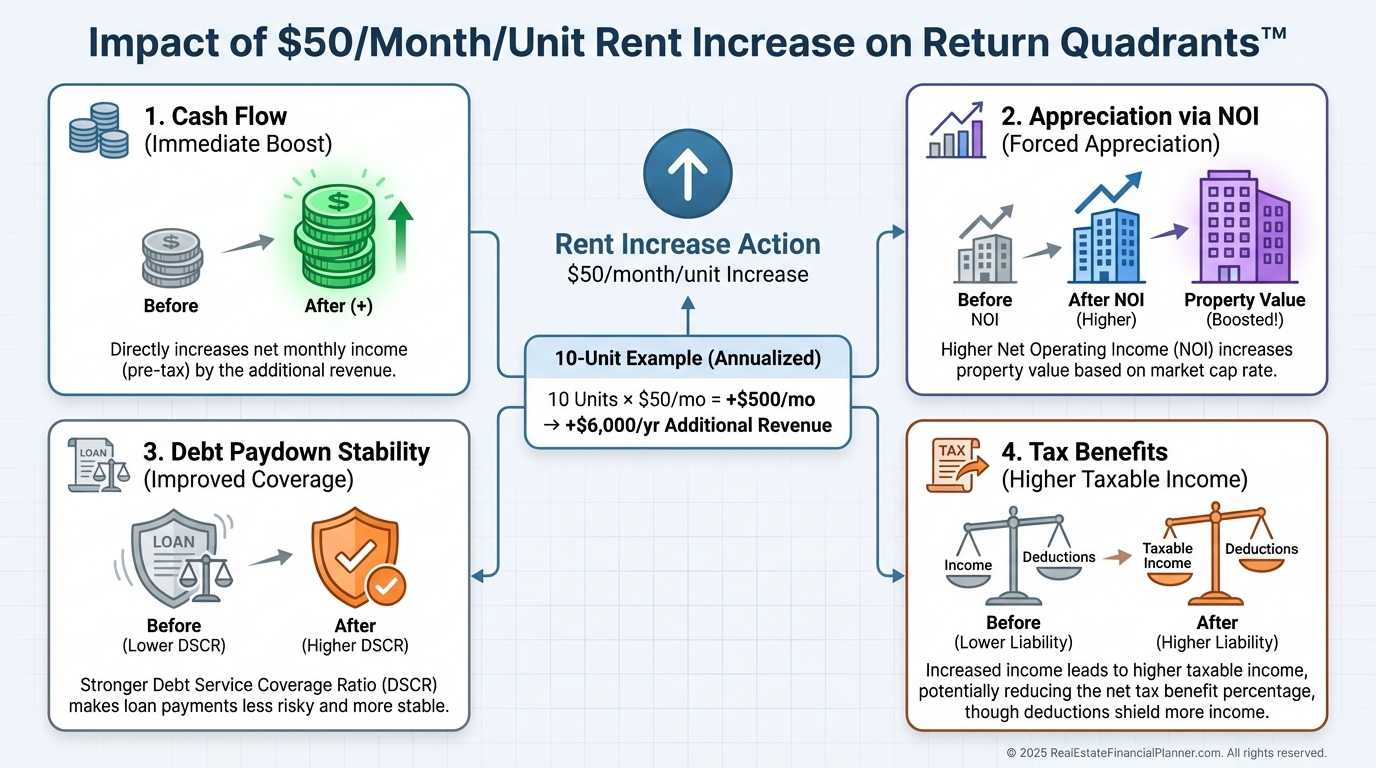

Add $50 per unit per month.

That’s $6,000 more per year in rent.

Assume 33% operating ratio, NOI improves by about $4,000.

At a 7% cap, that $4,000 increases value by roughly $57,143.

Small rent moves create big valuation shifts.

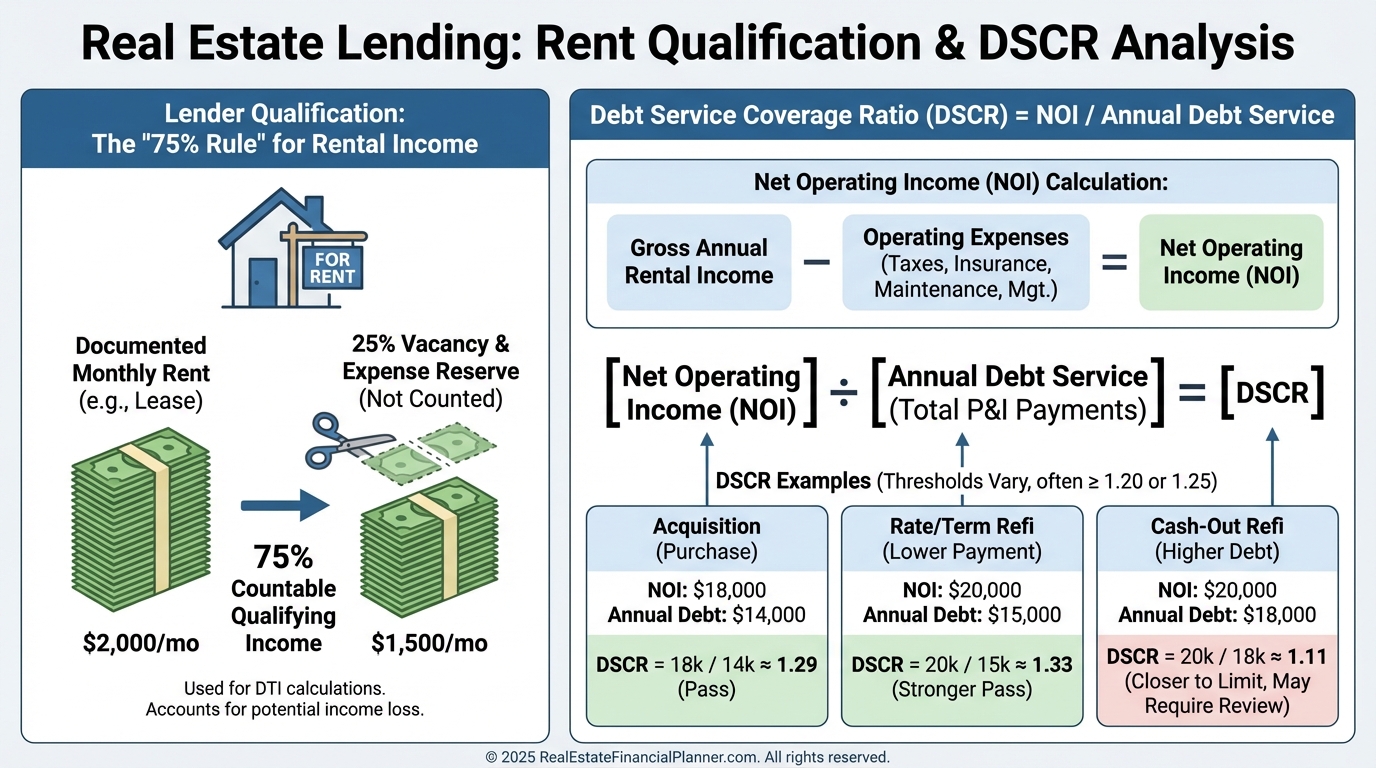

Monthly Rent and Loan Qualification

Lenders underwrite proof, not projections.

Most will count 75% of documented rent toward qualifying income.

For DSCR loans, monthly rent is the engine.

Higher rent strengthens NOI and DSCR, often unlocking better terms and larger proceeds.

When I prep a file, I package signed leases, a clean rent roll, bank statements showing deposits, and a simple variance note if seasonality applies.

If the property is new to you, I include a rent comp packet and the seller’s leases.

On the Spreadsheet, I toggle DSCR scenarios to see the rent level needed for approval.

Then I decide: improve rent first, or accept smaller proceeds now.

Income Documentation That Wins with Underwriters

I structure leases with clear line items.

Base rent is separate from pet rent, parking, storage, rubs, and short-term premiums.

I include renewal mechanics and planned escalations that are compliant locally.

I keep a living rent roll, showing current rent, deposit, lease start/end, and next step.

Simple, consistent documentation gets loans approved faster and with fewer conditions.

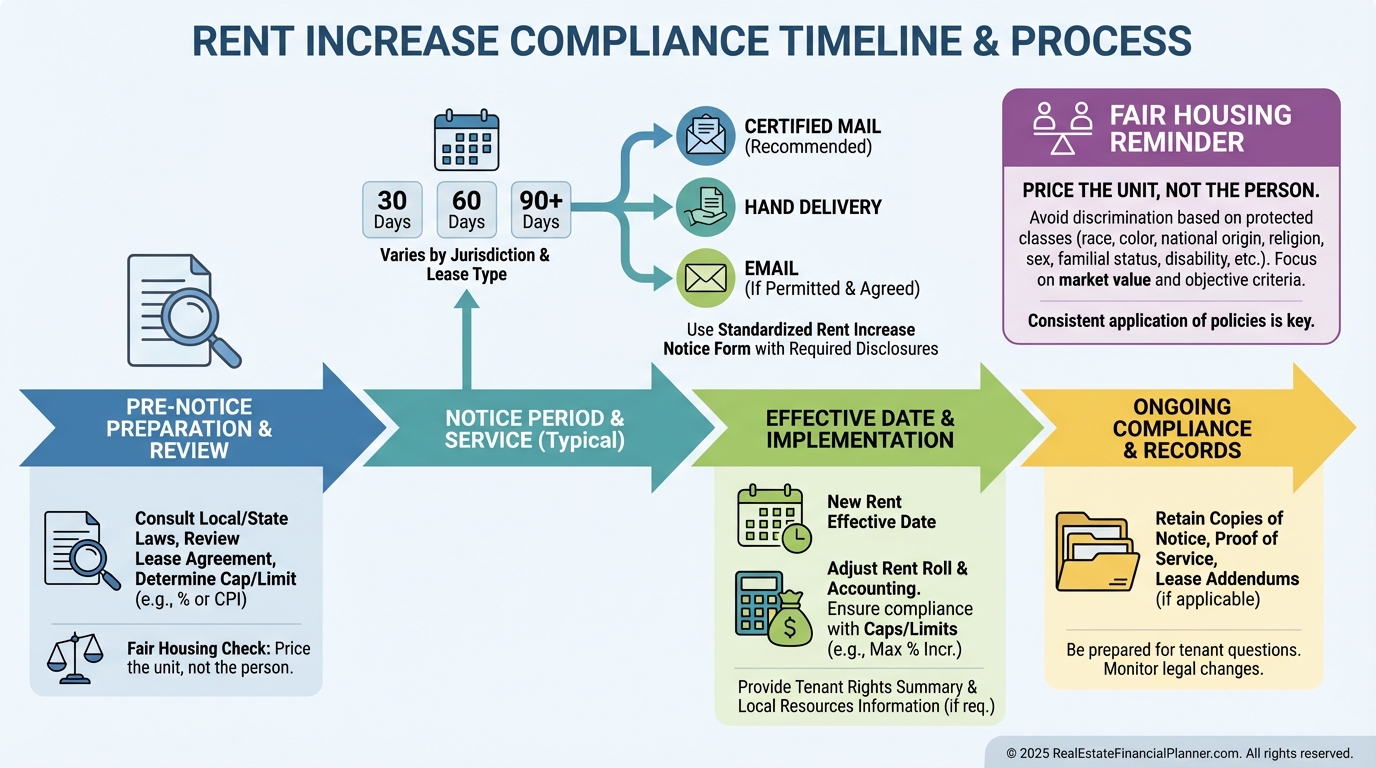

Legal and Regulatory Considerations

Before you set or raise rent, check your local rules.

Rent control and rent stabilization frameworks vary by city and asset age.

They dictate caps, timing, notice, and documentation.

Fair housing laws prohibit pricing based on protected classes.

Price the unit, not the person.

I keep a compliance checklist and a tickler for renewal timing so I don’t miss notice windows.

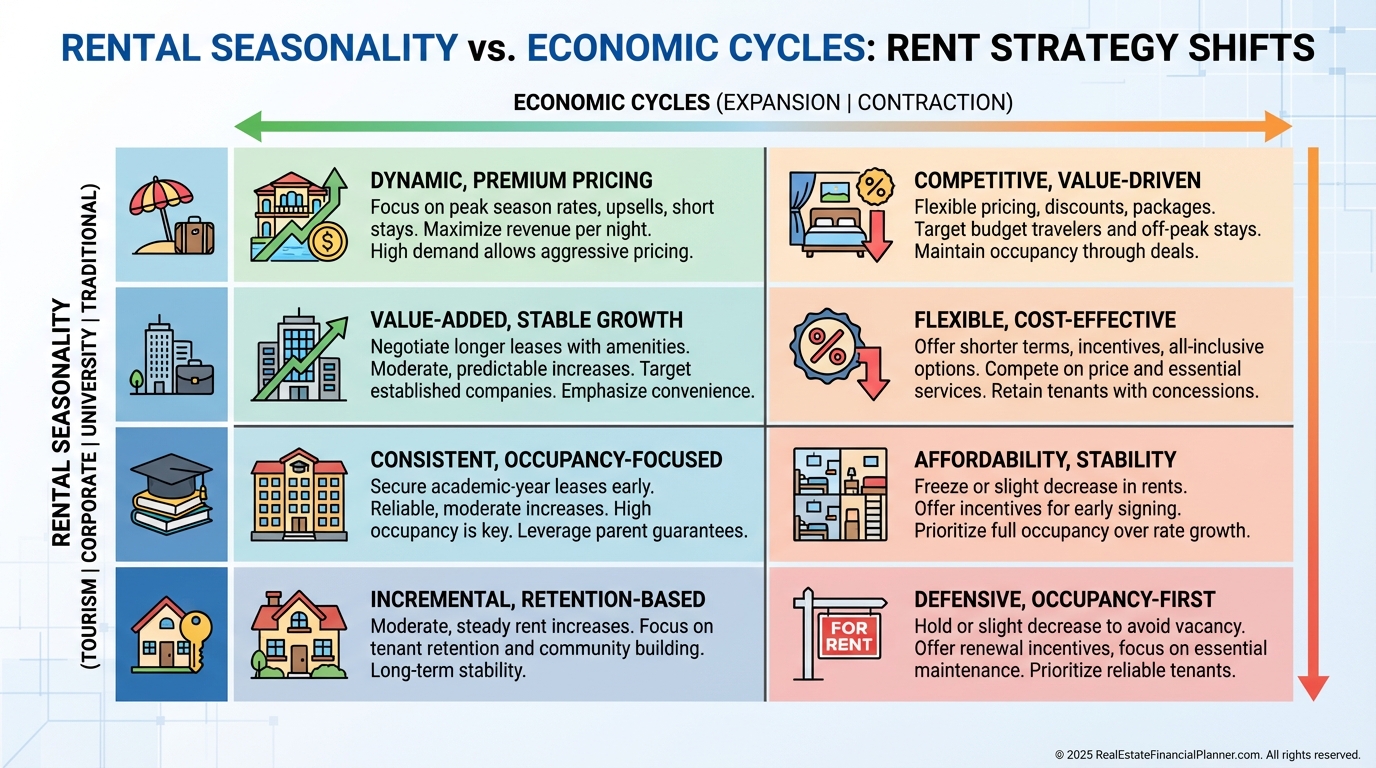

Market Timing and Rent Analysis

Rents move with seasons, cycles, and local dynamics.

Traditional markets peak from April to September.

University markets obey the academic calendar.

Tourism and corporate relocation markets have their own rhythms.

When I buy in winter, I plan turns so the unit hits peak demand, not February slush.

I also adjust comps by season, so I don’t model July rents for December reality.

Economic cycles matter.

Expansions lift rents, but leases delay the effect.

Downturns can shift would-be buyers to rentals, boosting demand at some price points.

Interest rates can trap households in place or keep them renting longer.

Jobs drive everything.

Follow employers, not headlines.

Local Market Dynamics You Can’t Ignore

New construction can cap rents for older stock.

Luxury supply pressures premium tiers more than workforce housing.

Gentrification lifts rents, but politics and policy can intervene.

Transit projects and zoning changes create winners and losers.

I underwrite with a sensitivity table: if Class A supply grows 10%, how does that ripple to B/C.

Then I decide if my value proposition still holds after renovations and rent positioning.

Long-Term Rent Strategy and Portfolio Impact

Small, consistent rent increases compound into large outcomes.

They raise cash flow today and NOI-driven value tomorrow.

In the REFP Return Quadrants™, a rent increase shows up in Cash Flow and in Appreciation via cap-rate math on NOI.

That dual impact accelerates wealth.

I reinvest those gains, not my lifestyle.

The Spreadsheet lets me test how a $50 increase across the portfolio affects cash-out refis, DSCR, and equity velocity.

I also track True Net Equity™.

That’s your equity after transaction costs and realistic taxes.

When rent growth boosts value and enables better financing, True Net Equity™ can grow much faster than the raw appraisal suggests.

I want equity I can actually convert, not theoretical paper gains.

Nomad™ strategies can leverage rent too.

Live in, move out, keep as a rental, repeat.

When I coach Nomads, we model conservative rents and seasonality so each move adds strength, not stress.

Practical Steps I Model, Check, and Avoid

I model three rent cases: conservative, likely, and stretch.

I check comps quarterly and on every renewal.

I avoid long vacancy chasing $50 more when turnover costs erase the gain.

I warn clients not to anchor to the seller’s pro forma.

I calculate DSCR break-even rent and set renewal targets with enough runway to document increases before financing.

For legal, I time notice windows and use jurisdiction-approved forms.

For value, I prioritize improvements tenants will actually pay for.

In older buildings, that’s often storage, laundry, and parking clarity, not quartz counters.

For exit, I document everything.

A buyer will pay more for a clean rent story than a messy but slightly higher rent roll.

Exit Strategy: Make Your Rent Story Transferable

Buyers pay for stability, growth, and documentation.

If I plan to sell, I stagger lease expirations, lock in compliant escalations, and maintain a spotless rent file.

I package market rent analysis, upgrade plans, and a trailing-12 income statement that matches bank deposits.

That turns your monthly rent into a premium valuation, not a debate.

Conclusion

Monthly rent is not a line item.

It’s your business model.

Price it with evidence, document it with discipline, and model it with the Spreadsheet.

Do that, and rent becomes the lever that improves cash flow, financing, valuation, and exit options across your entire portfolio.