Deed Types Explained: How Investors Protect Themselves (or Get Burned)

Learn about Deed Types for real estate investing.

When I help real estate investors buy or sell property, deed types are one of the most misunderstood risks hiding in plain sight.

Most people assume a deed is just paperwork.

It is not.

A deed determines who is responsible when something goes wrong years later, long after the deal feels “done.”

After rebuilding from bankruptcy, I became obsessive about hidden risks that do not show up in cash flow spreadsheets. Deed choices fall squarely into that category.

This guide walks you through the deed types investors actually encounter, how they interact with title insurance, and how to avoid becoming the deep-pocketed defendant in someone else’s title problem.

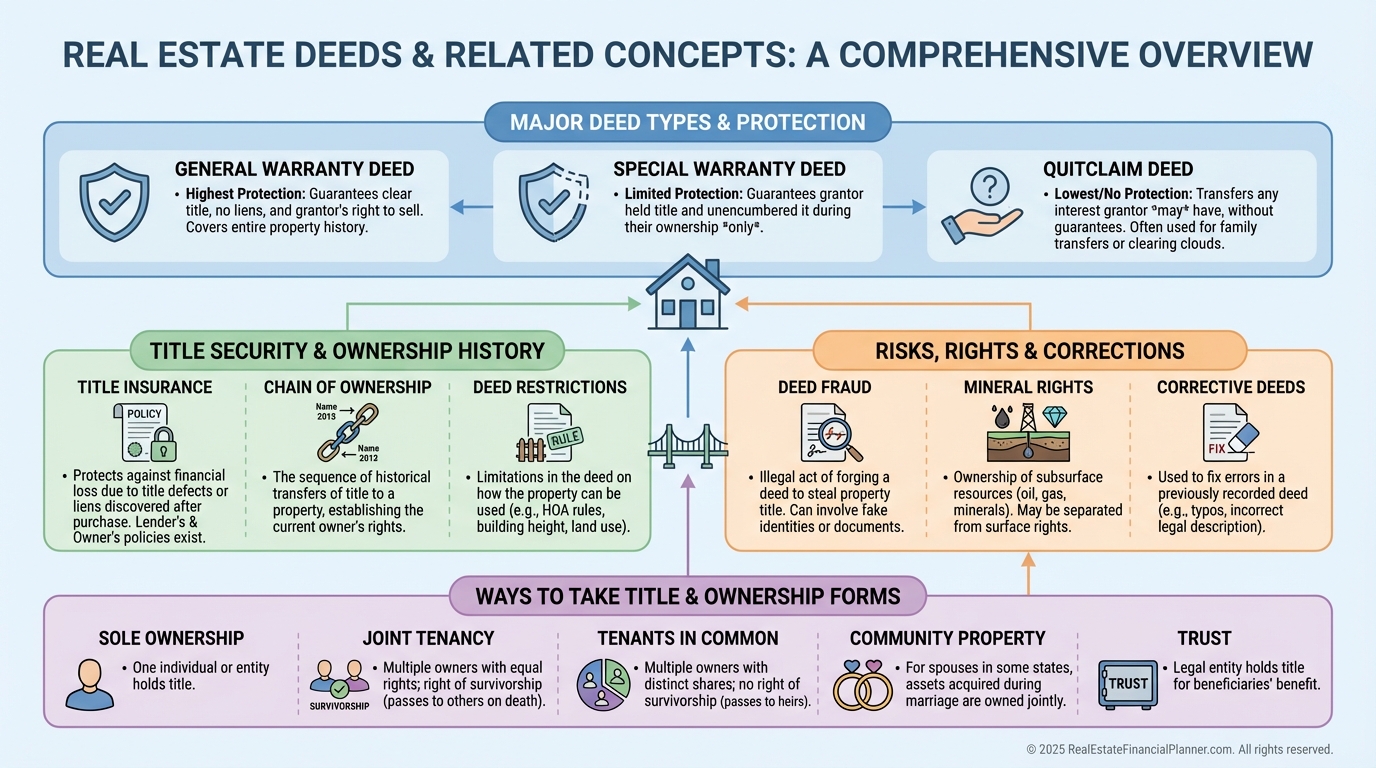

Why Deeds Matter to Investors

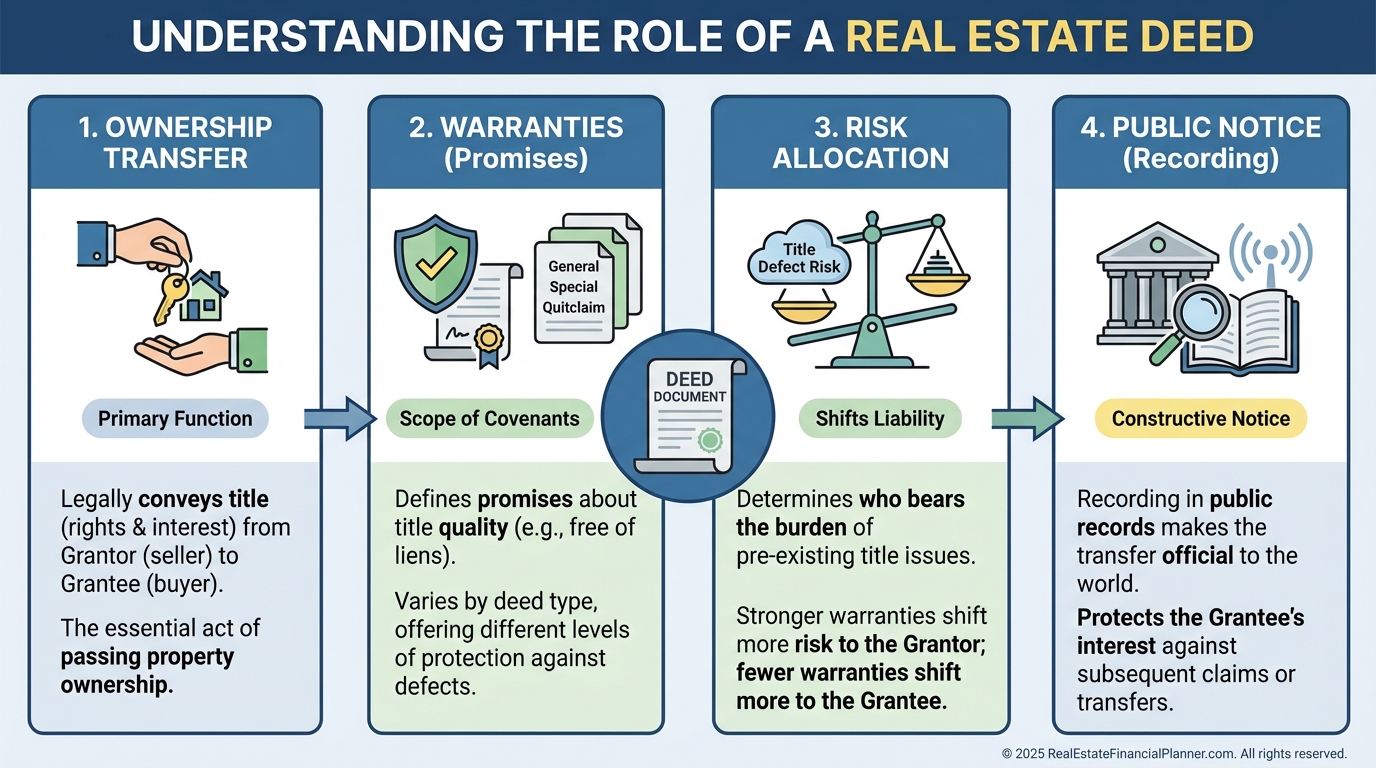

A deed is the legal instrument that transfers ownership.

Without a valid deed, ownership is unclear, unenforceable, or both.

As an investor, the type of deed you receive or provide directly affects your long-term liability.

Some deeds shift nearly all historical risk to the seller.

Others quietly leave you exposed.

State law matters here, which is why I always tell clients to treat deeds as a legal decision, not a clerical one.

Title insurance reduces risk, but it does not eliminate it, especially if you provide broad warranties when you sell.

The Two Deeds You See Most Often

Most investor transactions involve one of two deeds.

Understanding the difference protects both your assets and your future flexibility.

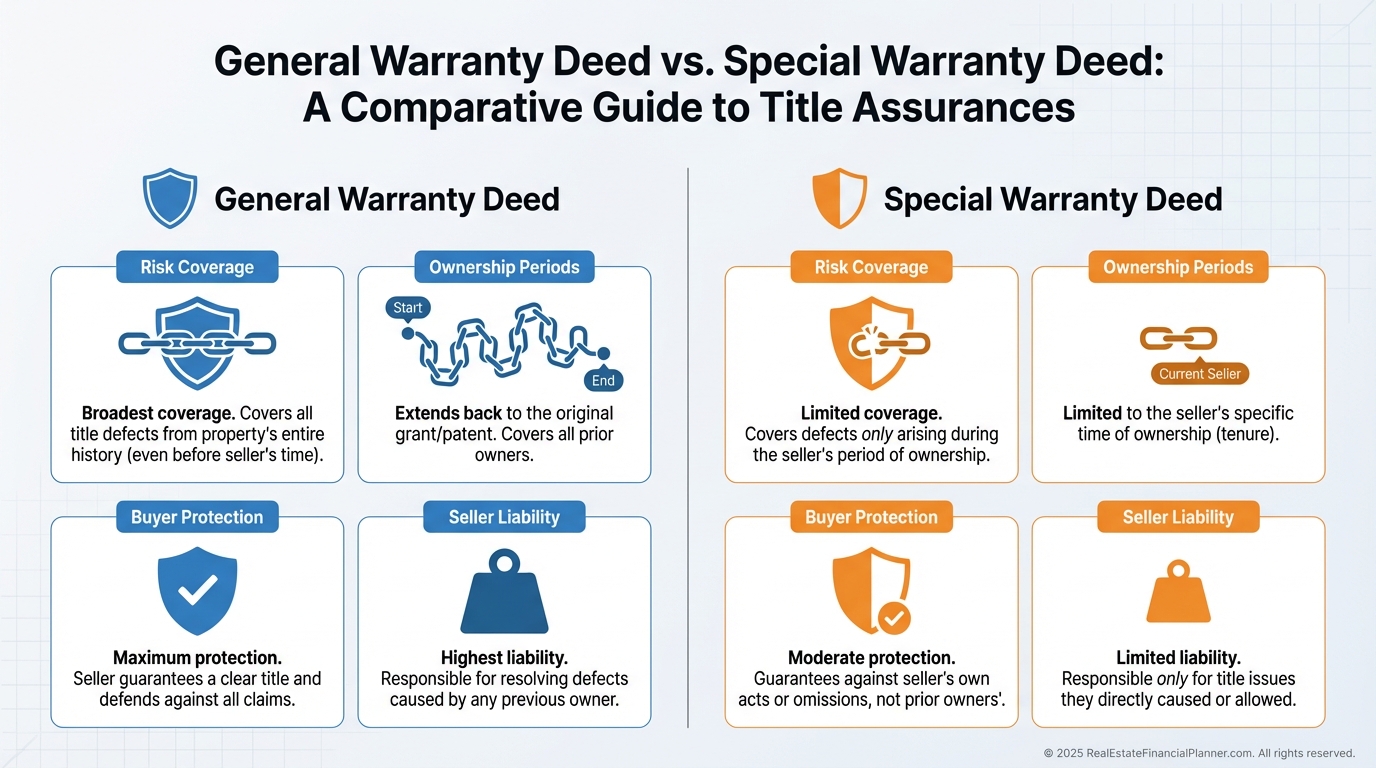

General Warranty Deed

This is the most buyer-friendly deed.

It guarantees clear title for the entire history of the property, not just during the seller’s ownership.

If a title problem emerges decades later, the seller is still on the hook.

Buyers love this deed.

Investors who sell frequently should be very cautious providing it.

Special Warranty Deed

This deed limits the seller’s guarantee to the time they owned the property.

Anything that happened before is not the seller’s responsibility.

When I sell properties for clients who are actively recycling capital, this is usually the deed we push for.

It limits long-tail liability without harming marketability in most investor transactions.

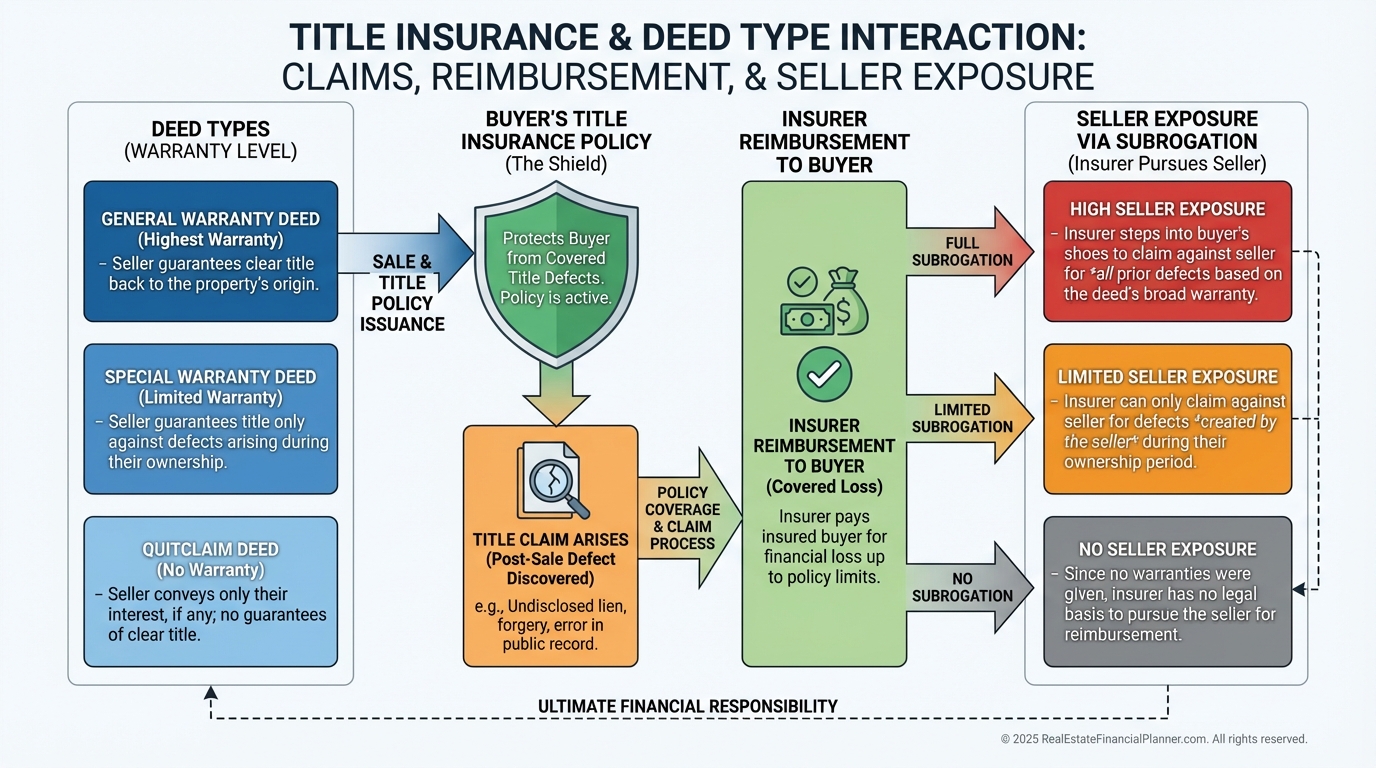

How Title Insurance Really Works with Deeds

Title insurance is not optional protection for investors.

It is the backstop when recorded history fails.

You buy title insurance when you purchase.

You provide it when you sell.

Here is the nuance most investors miss.

If you provide a General Warranty Deed and a claim arises, the title company may pay the buyer, then pursue you for reimbursement.

They follow the money.

If prior owners are broke and you are not, guess who becomes the target.

Limiting warranties limits exposure.

Chain of Ownership Risk in the Real World

When I explain chain-of-title risk to clients, I emphasize one uncomfortable truth.

You can do everything right and still inherit someone else’s mistake.

Unrecorded deeds, forged documents, or forgotten transfers can surface generations later.

Title searches reduce risk.

They do not eliminate it.

This is why deed selection and title insurance must work together.

If you provide broad warranties, you are insuring the entire past, even parts you never touched.

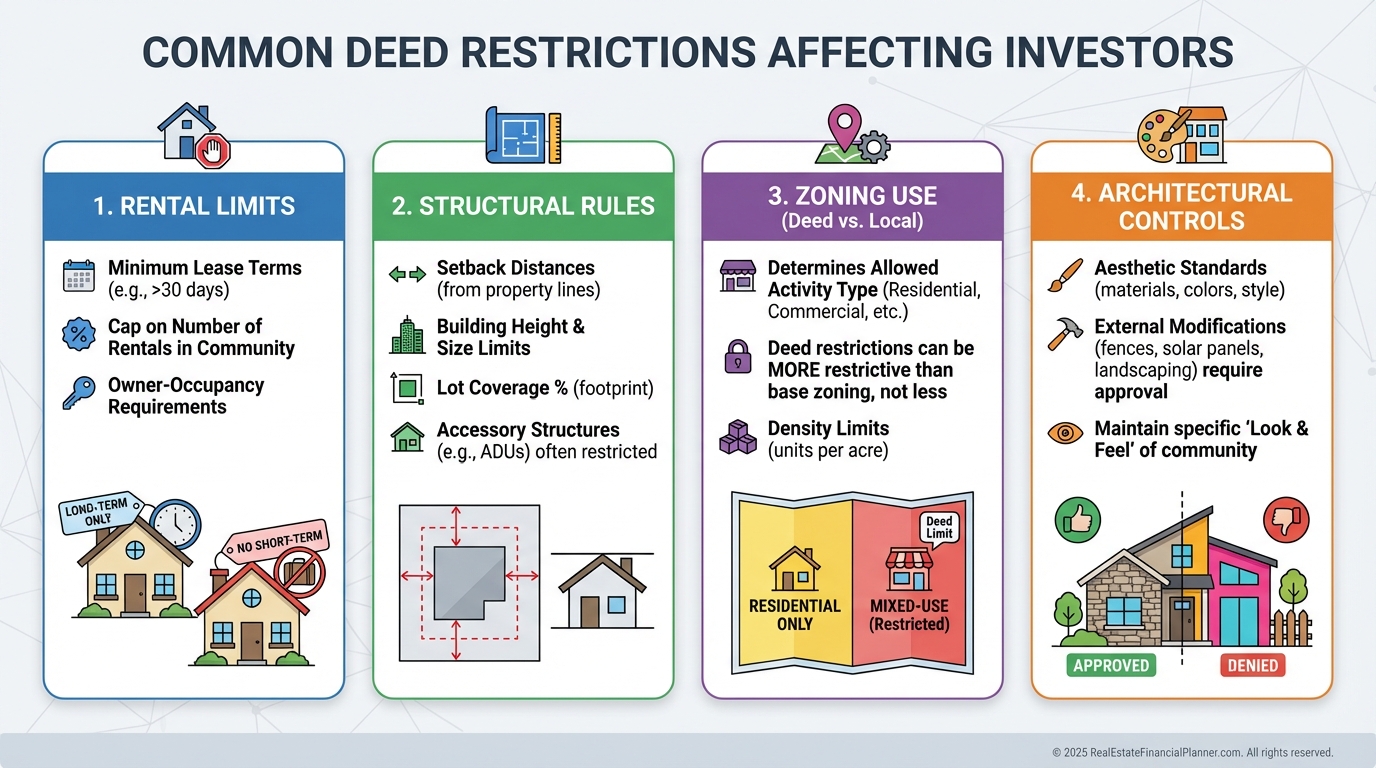

Deed Restrictions Investors Overlook

Deed restrictions limit use.

They often survive ownership changes.

Rental bans, architectural controls, and usage limits can quietly destroy an otherwise solid deal.

I tell clients to personally read the deed during the title period.

Agents are not trained to interpret legal language.

Attorneys and title companies are.

Restrictions matter more to investors because flexibility is value.

Deed Fraud and Why Vacant Properties Are Targets

Deed fraud is real.

It disproportionately impacts vacant, distressed, or lightly monitored properties.

Forged deeds, fraudulent transfers, and identity theft can cloud ownership overnight.

Prevention depends on competent professionals and vigilance.

Title insurance usually solves the aftermath, not the trauma.

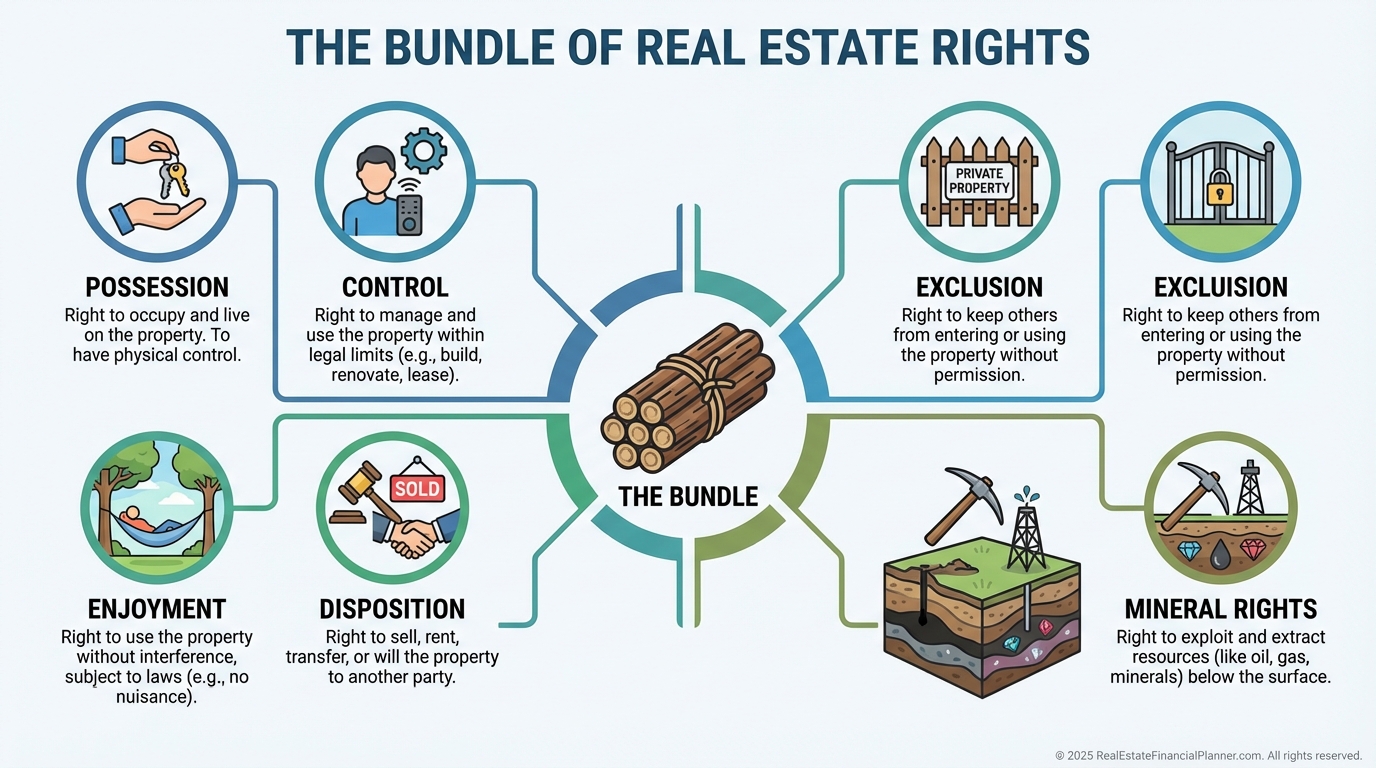

Mineral Rights and the Bundle of Rights

Ownership is not all-or-nothing.

Mineral, water, and air rights can be separated from surface ownership.

I have seen investors buy land only to discover they do not control what lies beneath it.

This matters more in rural and resource-heavy markets, but it can affect value anywhere.

Always confirm what rights you are actually receiving.

Other Deed Types Investors Encounter

Quitclaim deeds transfer whatever interest exists, if any.

Bargain and sale deeds imply ownership but offer no warranties.

Grant deeds offer limited assurances and are state-specific.

Sheriff’s deeds come with foreclosure risk.

Deeds-in-lieu require extra title scrutiny.

Executor and administrator deeds depend on probate authority.

Each has a place.

Each carries different risk.

Ways to Take Title

Deeds transfer ownership.

Title defines how ownership is held.

Severalty, joint tenancy, tenants in common, community property, and tenancy by the entirety all affect control, inheritance, and liability.

LLCs can hold title, but co-ownership rules still apply when multiple parties are involved.

This is where legal and tax advice must work together.

Corrective Deeds and Closing Discipline

Small errors become big problems later.

Misspelled names.

Incorrect legal descriptions.

Wrong vesting language.

I always tell clients to slow down at closing.

Fixing mistakes later is possible, but avoidable.