Contract for Deed Explained: Creative Financing Most Investors Misunderstand

Learn about Contract for Deed for real estate investing.

Contract for deed is one of those strategies investors either misuse badly or avoid entirely.

That’s unfortunate, because when it’s structured correctly, it solves problems traditional financing simply cannot.

When I help clients analyze creative deals, contract for deed often shows up when banks say “no,” timelines are tight, or one party needs flexibility more than perfection.

I’ve also seen it wipe out years of equity when investors didn’t understand the risks they were taking.

This article explains how contract for deed actually works, where it fits, and how I evaluate it inside a real financial plan.

What a Contract for Deed Really Is

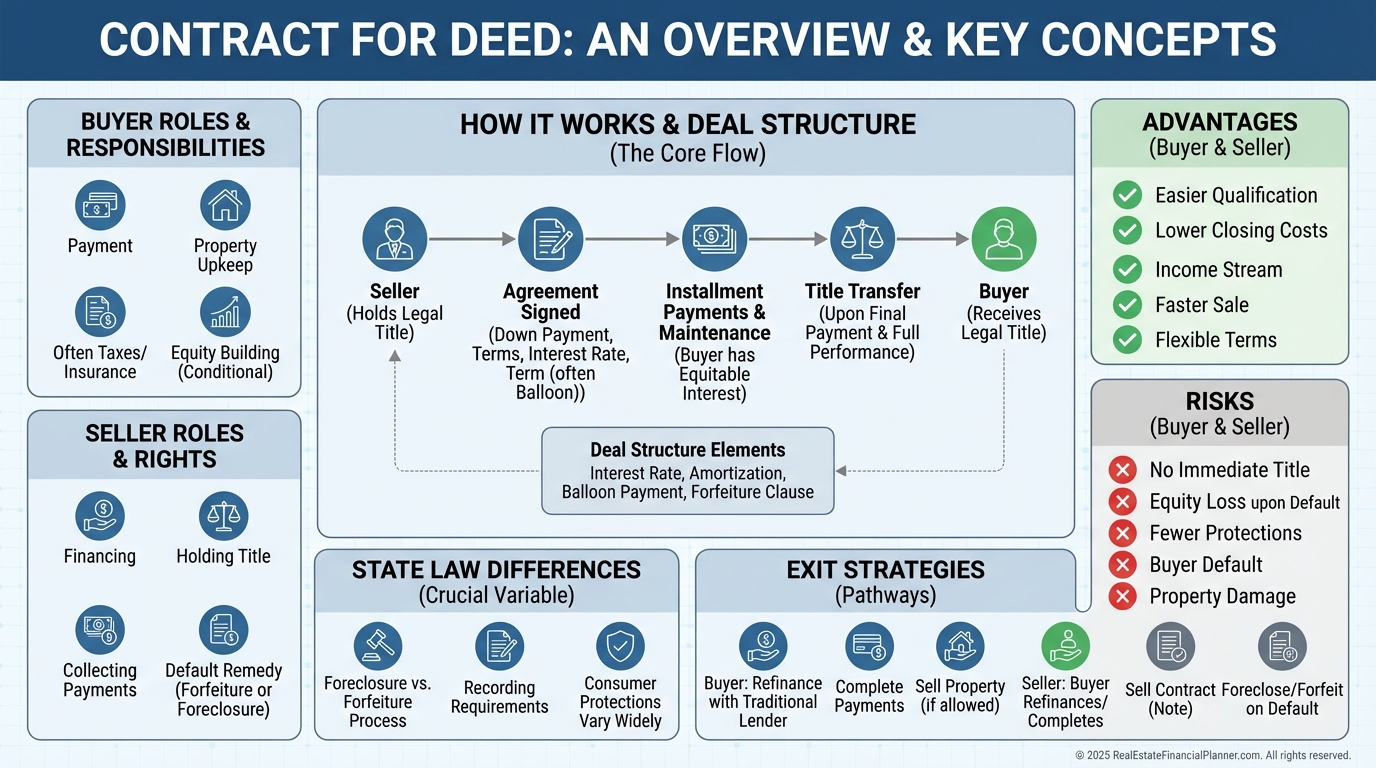

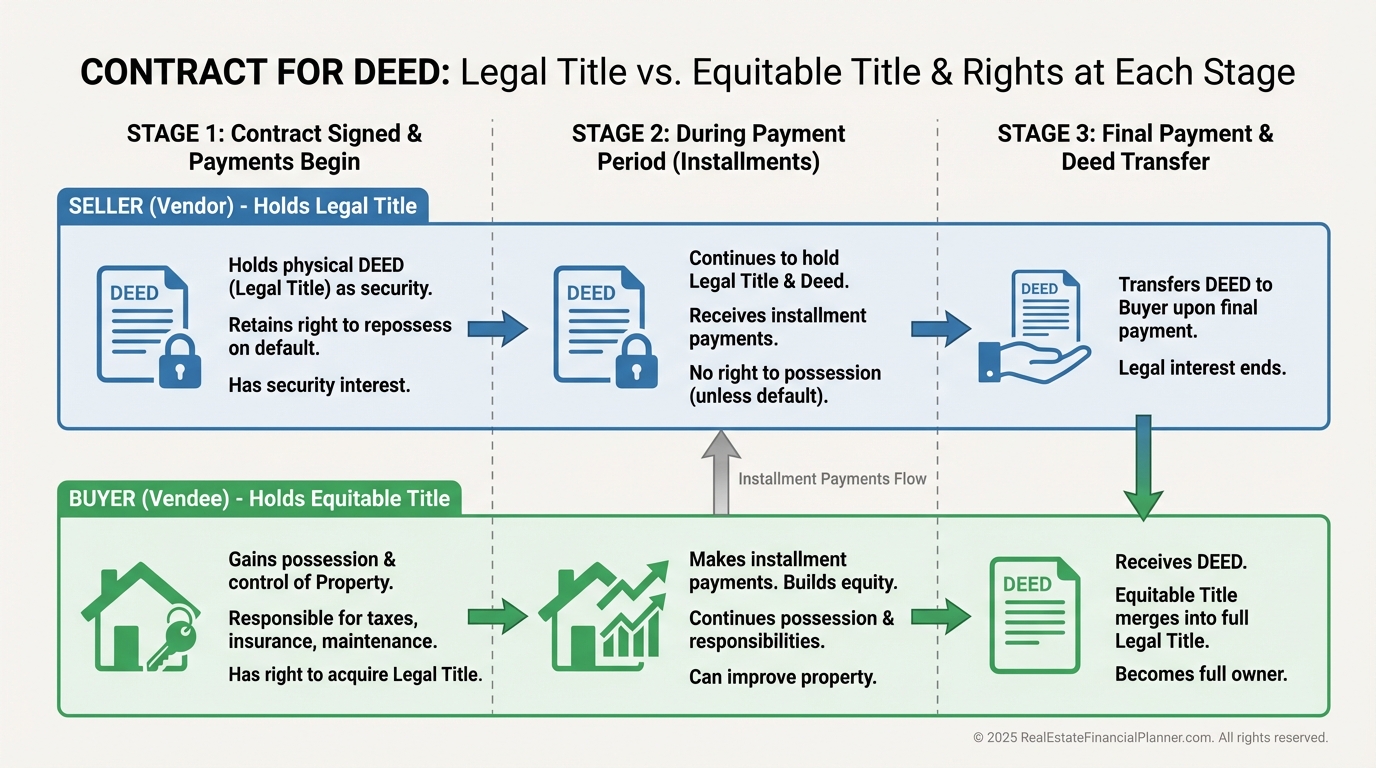

A contract for deed is seller financing where the seller keeps legal title until the buyer completes the contract.

The buyer gets possession and equitable interest, but not the deed.

That distinction matters more than most investors realize.

You’re not “almost the owner.”

You’re an owner with strings attached.

From day one, the buyer usually pays:

Maintenance and repairs

That’s very different from a lease option.

It’s closer to ownership, but without the safety net of recorded title in many states.

Why Investors Use Contract for Deed Anyway

Because it solves problems banks can’t.

When I rebuilt after bankruptcy, I learned quickly that deal structure often matters more than deal location.

Contract for deed creates flexibility around:

Credit history

Self-employment income

Property condition

Speed of closing

It turns “unfinanceable” into “financeable.”

That doesn’t mean it’s free money.

It means the risk just moved somewhere else.

Contract for Deed Compared to Other Creative Financing

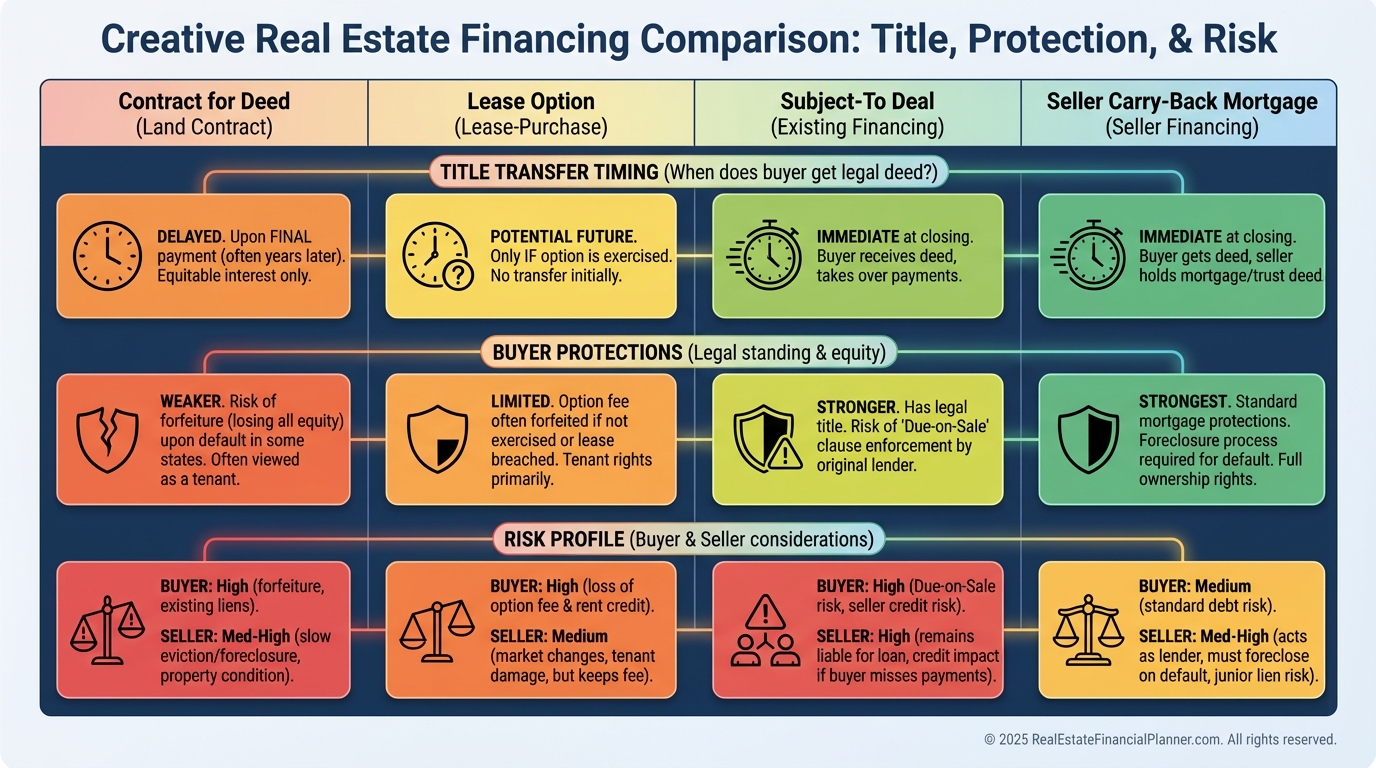

Many investors lump all seller financing together.

That’s a mistake.

Key differences I always walk clients through:

Contract for Deed: Title transfers at the end. Seller holds leverage.

Seller Carry-Back: Title transfers immediately. Buyer has more protection.

Subject-To: Title transfers, loan stays. Different risk entirely.

Lease Option: No ownership until option exercised.

If you confuse these, you will misprice risk.

Advantages for Buyers and Sellers

Buyer Advantages

Contract for deed helps buyers who are capable, but temporarily blocked.

That’s an important distinction.

No Bank Underwriting: Income documentation and credit overlays disappear.

Negotiable Down Payments: Structure beats rigid loan programs.

Speed: Deals close when motivation is high.

Equity Growth: Payments build ownership, not just shelter.

From a Return Quadrants™ perspective, buyers still capture:

Tax Benefits

Even without holding the deed yet.

Seller Advantages

Sellers often underestimate how valuable financing really is.

Larger Buyer Pool: Financing creates demand.

Price Premiums: Flexibility is expensive, and buyers pay for it.

Monthly Income: Often better than bonds or CDs.

Installment Sale Taxes: Spread gains over time.

But sellers are also taking on enforcement risk.

That risk needs to be priced correctly.

Where Investors Get Burned

This is the part I slow people down on.

Buyer Risks I Warn About

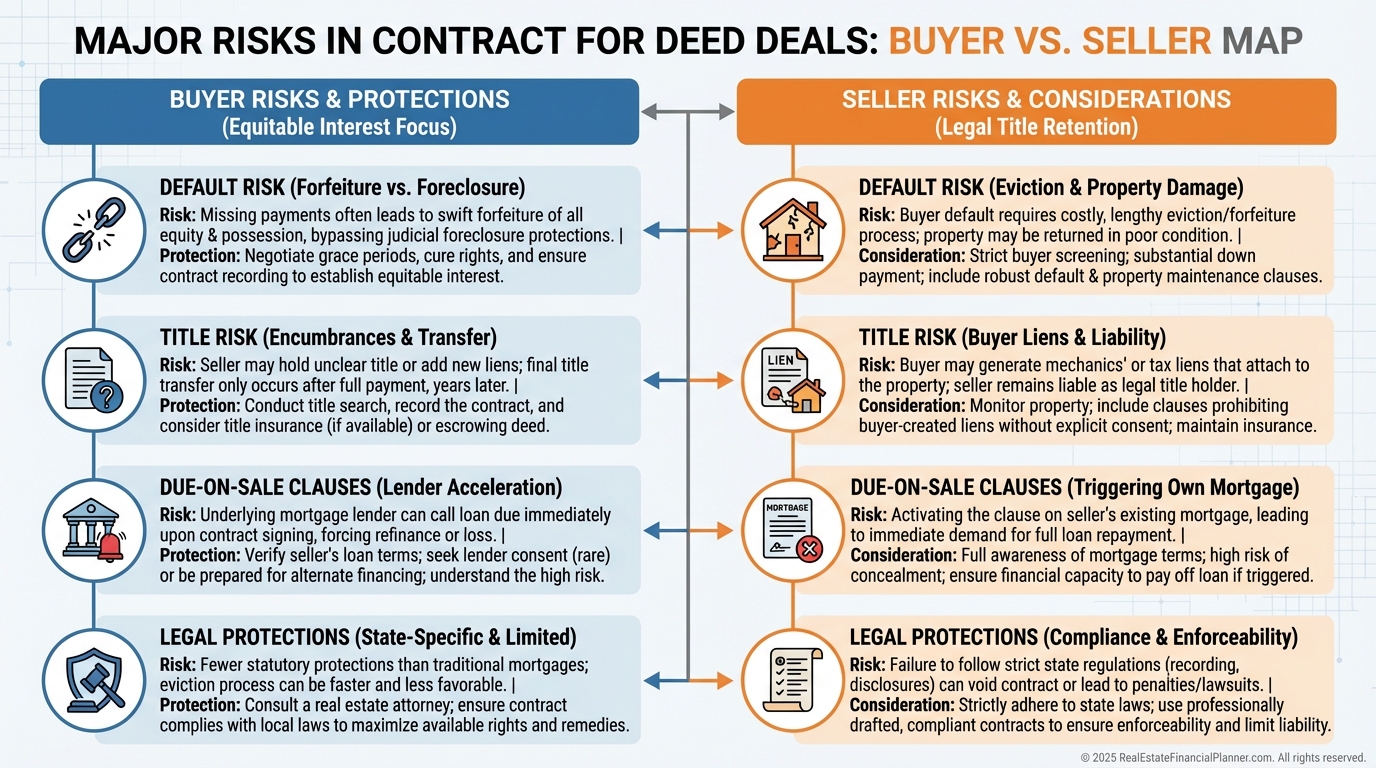

You don’t control the seller’s mortgage behavior.

A seller default can wipe you out.

Refinancing options are limited until payoff.

Some states treat buyers harshly in default.

This is where True Net Equity™ matters.

Equity that disappears due to legal structure isn’t real equity.

Seller Risks I Warn About

Buyer neglect damages long-term value.

Insurance coordination failures create gaps.

Due-on-sale clauses can surface unexpectedly.

Enforcement still costs time and money.

No deal is “set it and forget it.”

How I Structure Contract for Deed Deals

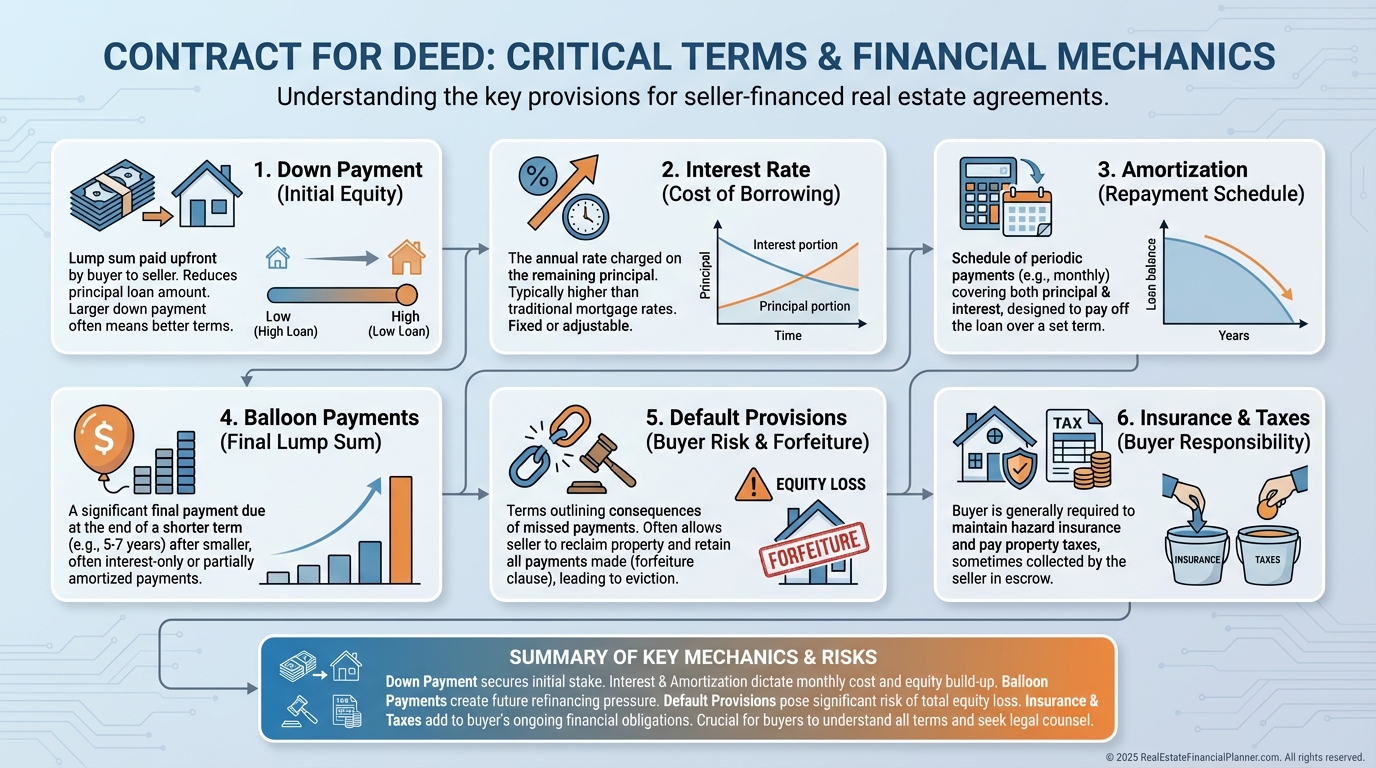

Every term matters.

I never look at these deals casually.

What I focus on first:

Down payment as commitment, not just cash

Interest rate as risk pricing

Balloon timing as exit control

Cure periods that balance fairness and leverage

Then I model the deal.

Not just monthly payment, but:

Cash flow under stress

Exit scenarios

Opportunity cost versus other strategies

This is where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ earns its keep.

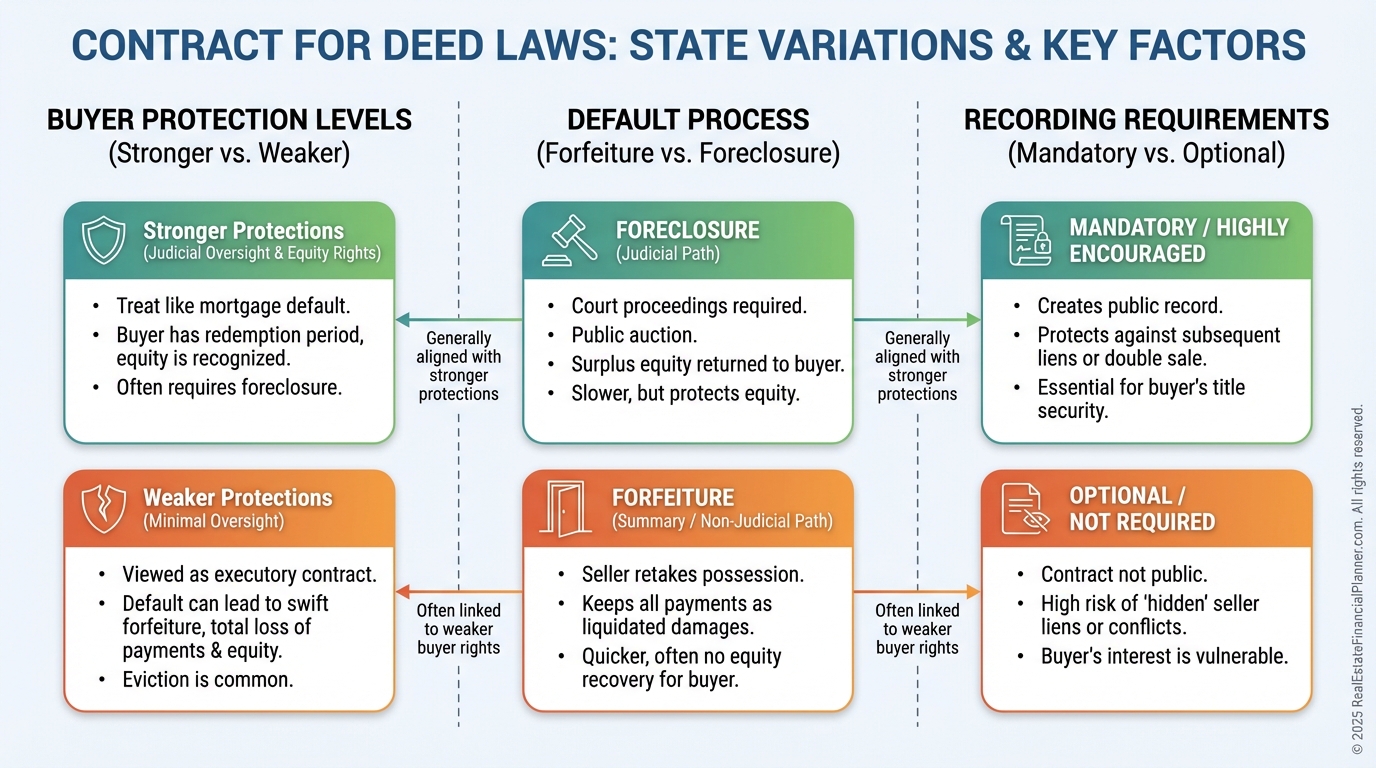

State Law Is Not a Footnote

This is non-negotiable.

Some states protect buyers heavily.

Others protect sellers.

Your deal structure must match your jurisdiction.

Generic contracts are where lawsuits are born.

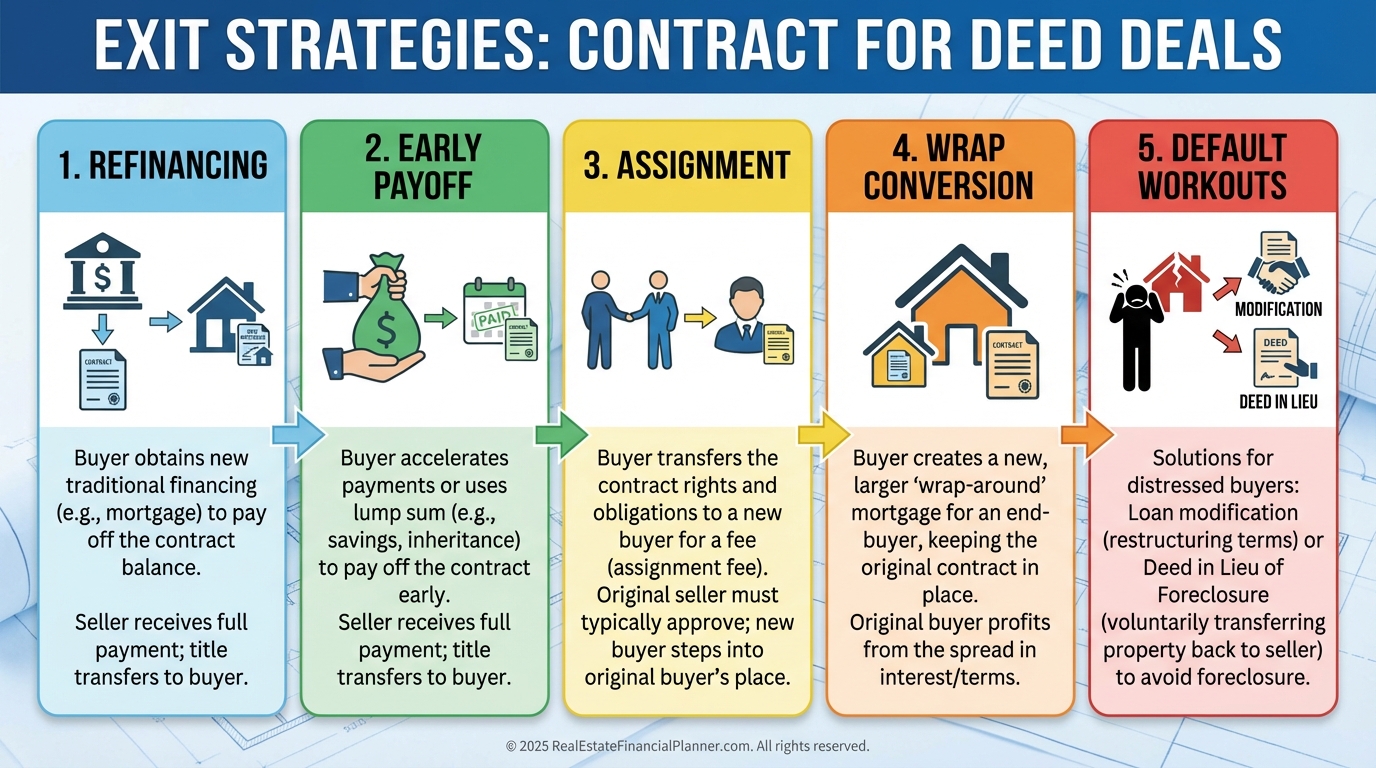

Exit Planning Comes First, Not Last

If you don’t know how this deal ends, don’t start it.

Most buyers plan to refinance.

That means:

Credit repair timelines

Income documentation strategy

Loan seasoning requirements

I treat that path as part of the deal, not an assumption.

When Contract for Deed Makes Sense

Contract for deed is not a hack.

It’s a tool.

It works best when:

Both parties understand the risks

The numbers work conservatively

Legal documentation is airtight

Exit strategies are realistic

When those boxes are checked, it closes deals others can’t.

When they’re ignored, it quietly destroys portfolios.