Distressed Properties Explained: How Smart Investors Find Discounts Others Miss

Learn about Distressed Properties for real estate investing.

Most investors think a distressed property is just an ugly house.

When I help clients analyze deals, that assumption alone costs them tens of thousands of dollars. They overpay for properties that are merely outdated while missing truly distressed opportunities hiding in plain sight.

After rebuilding my own portfolio following bankruptcy and foreclosures, I learned this lesson the hard way. Distress is not about condition. Distress is about motivation, constraints, and pressure.

Once you understand that, the entire game changes.

What Distressed Properties Really Are

A distressed property is one where the seller values speed, certainty, or relief more than price.

That distress can come from the property itself, the owner’s finances, or life circumstances that have nothing to do with paint colors or countertops.

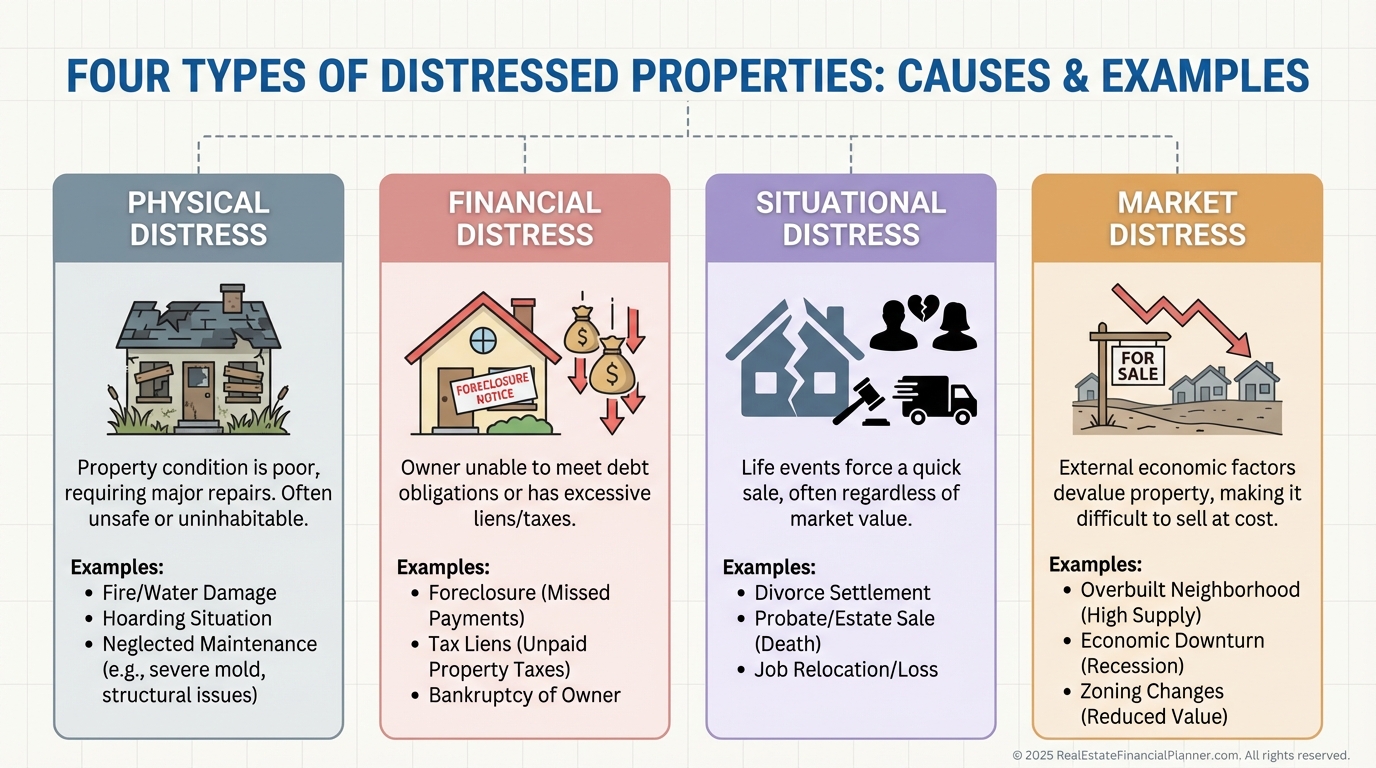

Physical Distress

These are properties with deferred maintenance, failed systems, or structural problems.

Roof failures, foundation movement, outdated electrical, or major code violations create fear and uncertainty. Fear drives discounts.

Financial Distress

The house may be pristine, but the owner cannot keep it.

Late payments, tax liens, foreclosure filings, or balloon loans coming due create urgency regardless of condition.

Situational Distress

This is where many of the best deals live.

Divorce, death, inheritance, job loss, or relocation can force a fast decision even when the property needs little work.

Market Distress

Location matters.

Crime spikes, environmental stigma, employer closures, or neighborhood decline can suppress values even for well-maintained homes.

What Distressed Properties Are Not

Not every fixer-upper is distressed.

When I review deals with clients, I often see landlords selling outdated rentals calmly and strategically. That is not distress. That is repositioning.

Bank-owned properties are also commonly misunderstood. By the time a property becomes REO, most of the easy profit has already been removed.

Short sales can be distressed, but they require patience, expertise, and a tolerance for uncertainty that many investors underestimate.

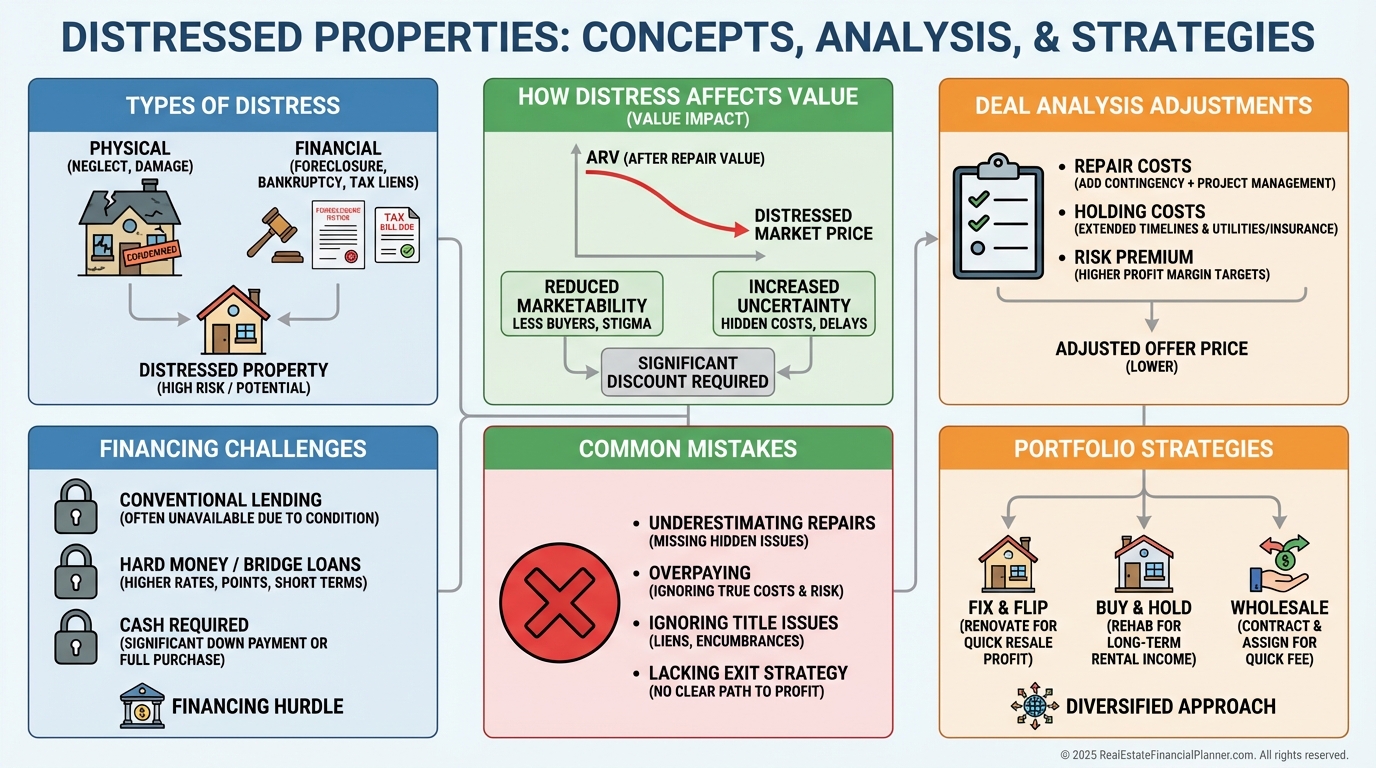

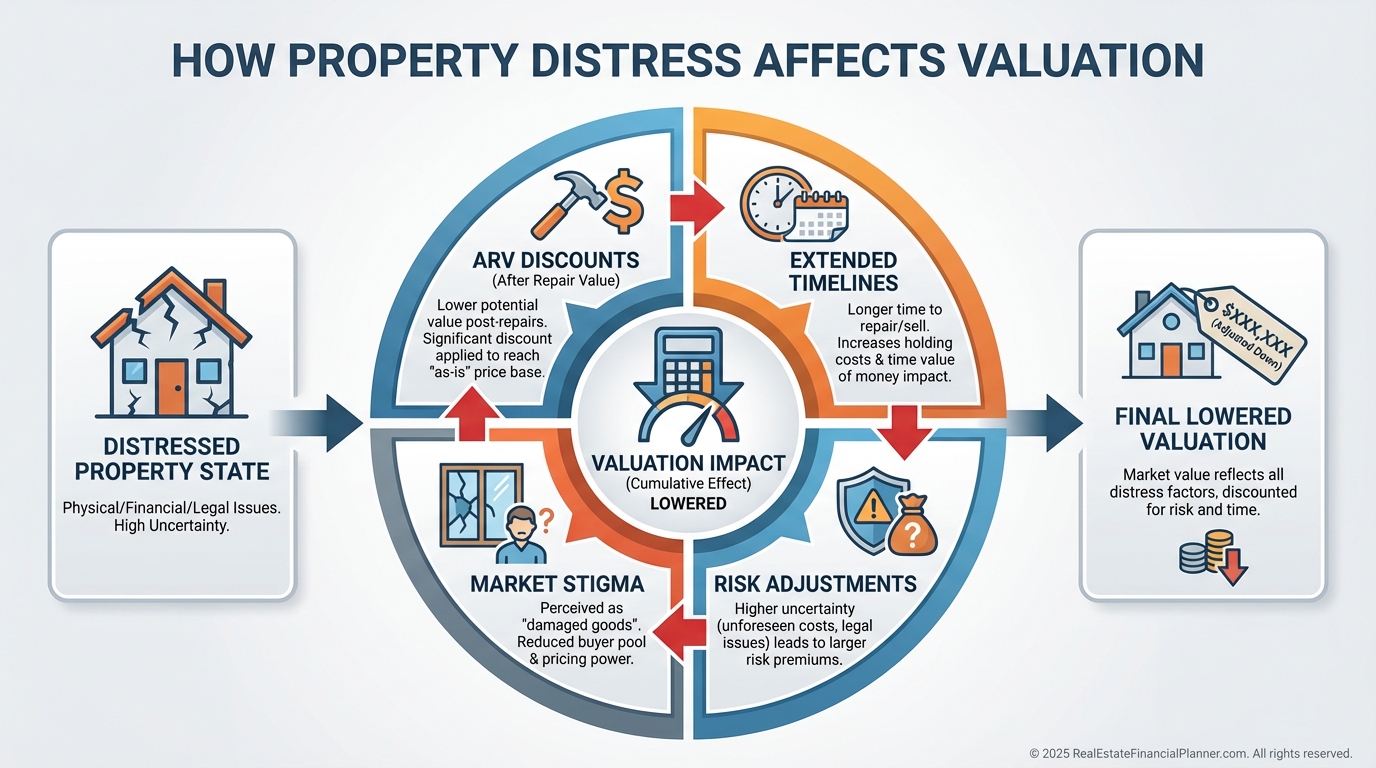

How Distress Changes Value

Distressed properties do not follow retail valuation rules.

This is where many investors destroy returns by using the wrong formulas.

When I analyze distressed deals inside Real Estate Financial Planner™, I automatically adjust for three things.

First, I haircut the after-repair value to account for stigma and slower resale.

Second, I increase repair budgets with larger contingencies. Distress hides surprises.

Third, I extend timelines. Time is expensive, and distressed projects take longer.

This is why I focus on True Net Equity™, not just projected profit. What matters is what you can actually access after costs, risk, and time.

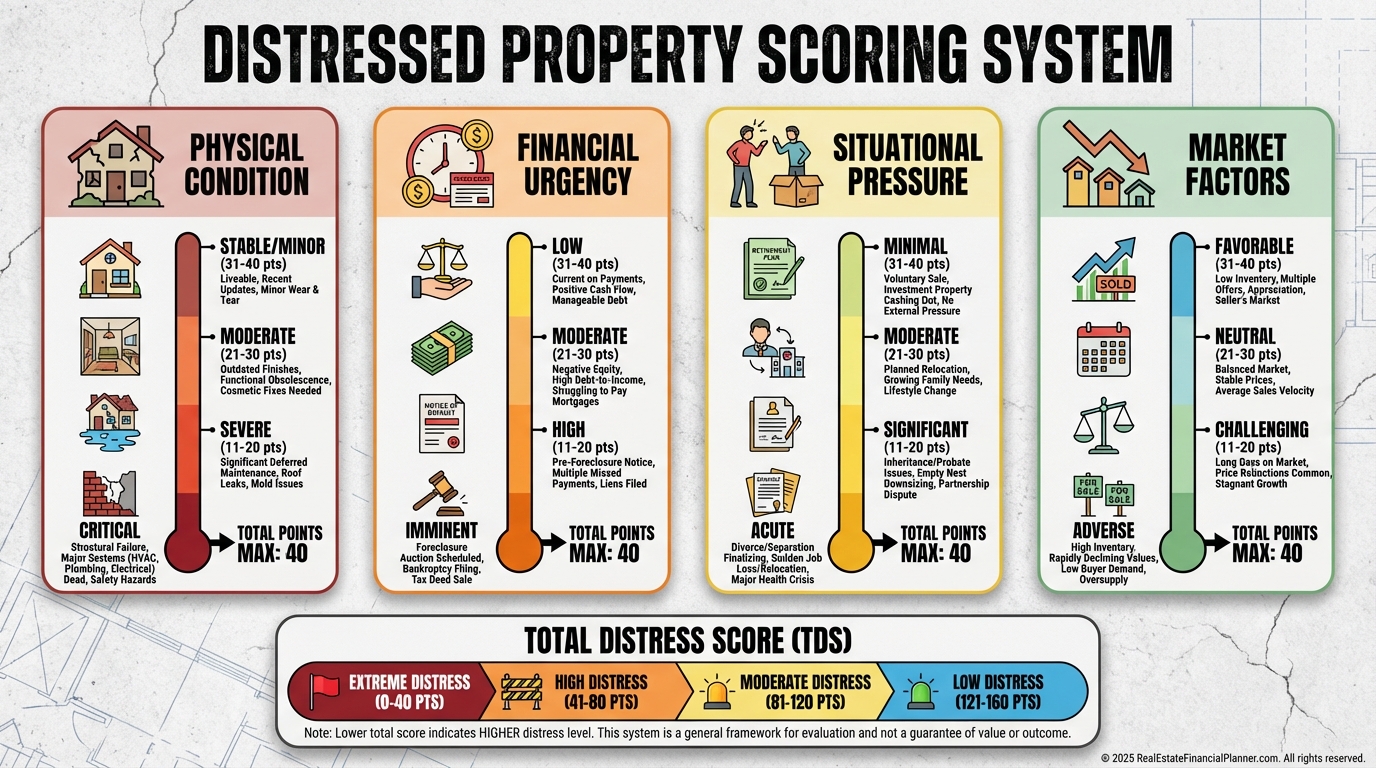

Scoring Distress Instead of Guessing

Emotion kills distressed property profits.

A systematic scoring approach keeps you disciplined when a deal “feels” exciting.

When a property scores high on multiple distress factors, deeper discounts are justified.

When it does not, the price should reflect that reality, even if the house looks ugly.

This one framework alone prevents most overpayment mistakes I see.

Finding Distressed Properties Where Others Don’t Look

MLS searches rarely surface true distress.

When I help investors build deal flow, we focus on sources that reveal motivation before listing photos exist.

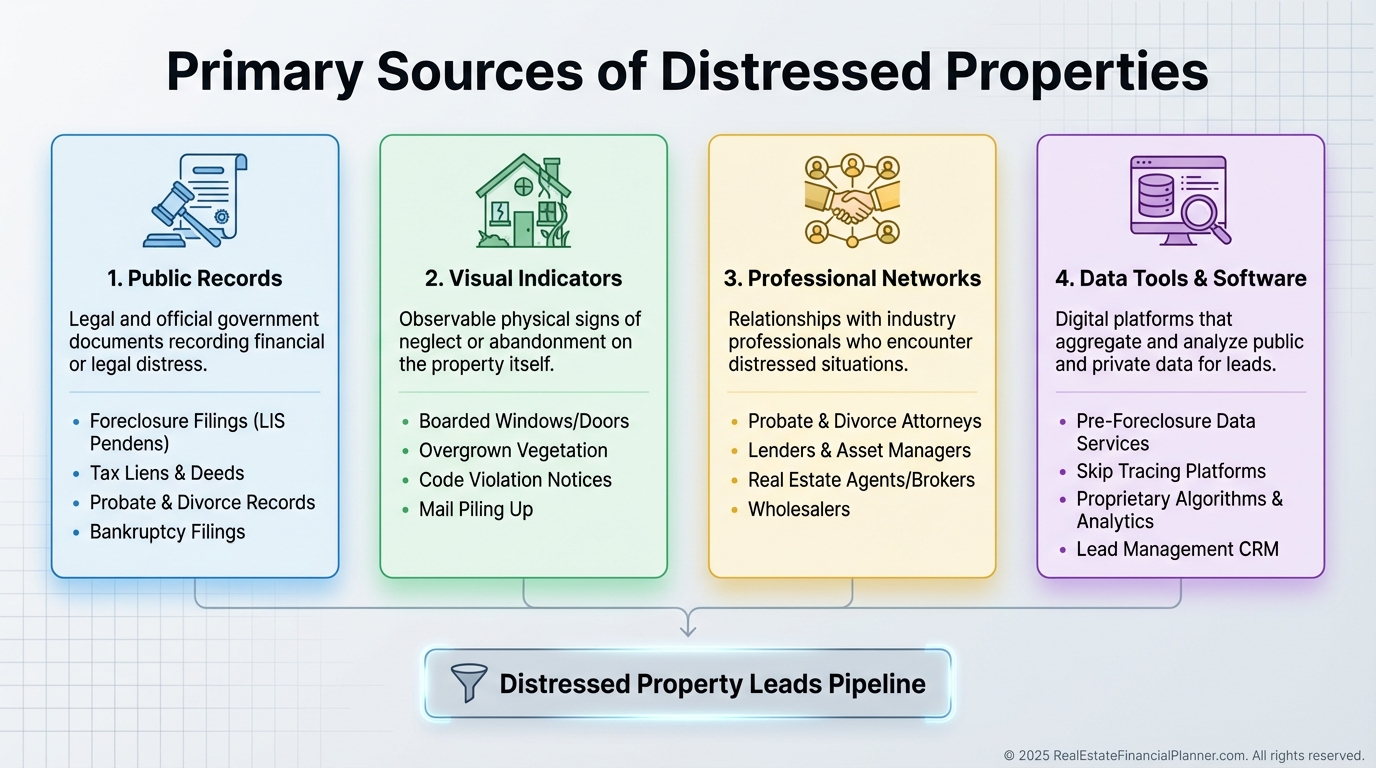

Public records, probate filings, tax delinquencies, and code violations all signal pressure.

So do overgrown lawns, boarded windows, and neglected roofs if you know how to interpret them.

Relationships matter more than technology here. Attorneys, wholesalers, and contractors often know about distress long before listings appear.

Financing Changes Everything

Distressed properties break traditional financing rules.

Banks want certainty. Distress creates uncertainty.

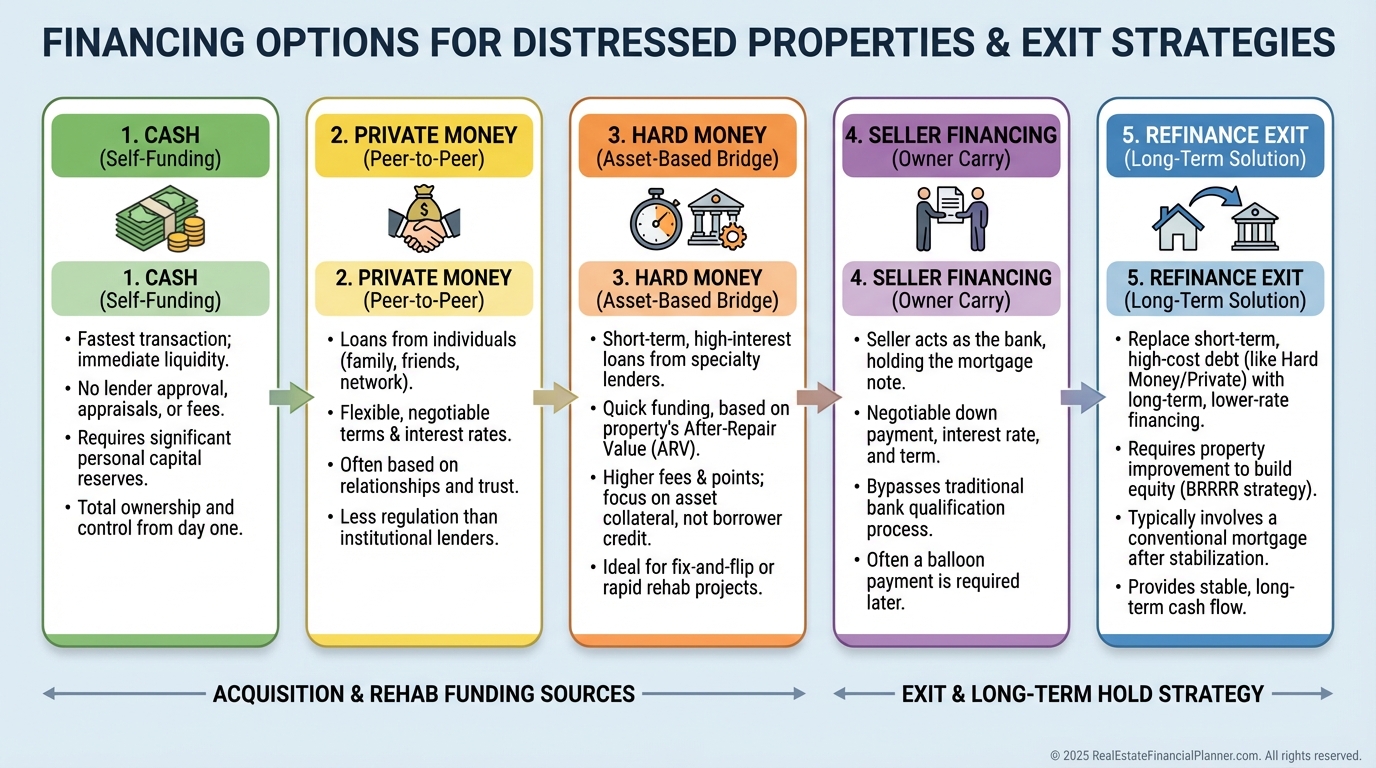

Cash, private money, and hard money dominate these deals.

When I model these scenarios, I always include financing costs explicitly inside the Return Quadrants™. High interest rates are not a deal killer if the discount is real. They are disastrous if it is not.

Mistakes That Turn Discounts into Disasters

Every distressed property investor has scar tissue.

The most common failures I see are predictable and preventable.

Skipping inspections, trusting surface-level repairs, and assuming timelines will cooperate destroys returns.

This is why I always recommend conservative underwriting. You can survive being wrong on the upside. You cannot survive being wrong on risk.

Using Distress for Long-Term Wealth

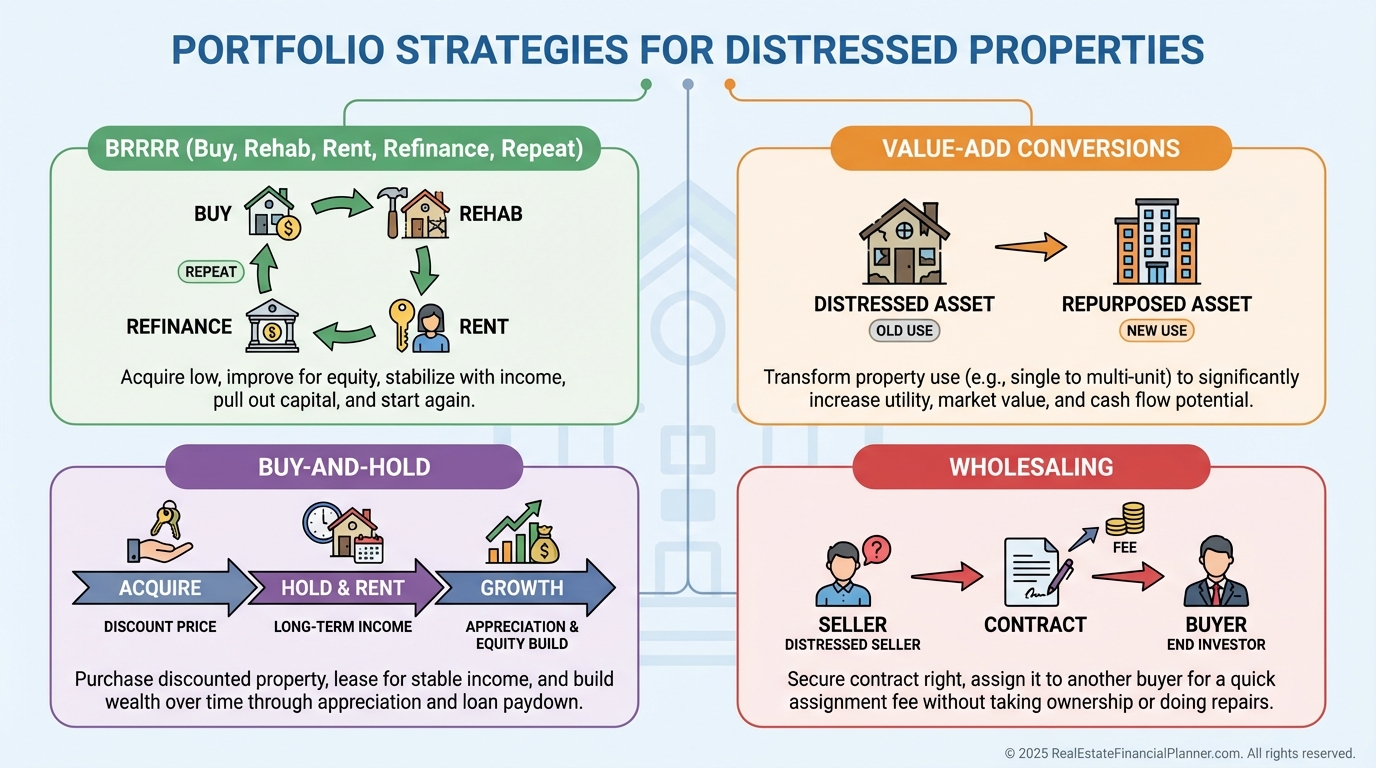

Distressed properties are not just flip opportunities.

When paired with the right strategy, they become long-term portfolio accelerators.

They pair exceptionally well with forced appreciation strategies, Nomad™ exits, and refinance-based capital recycling.

The key is flexibility. Every distressed deal should have multiple exits before you ever make an offer.

Final Thoughts

Distressed properties are not about bravery or hustle.

They are about analysis, structure, and discipline.

When you understand why a property is distressed, how that distress affects value, and how it changes risk, you gain access to opportunities most investors never see.

The best deals rarely look good at first glance. They look complicated, inconvenient, and uncomfortable.

That discomfort is where the discounts live.