Rate and Term Refinances: Investor Playbook to Lower Payments, Raise DSCR, and Accelerate Returns

Learn about Rate and Term Refinances for real estate investing.

Why Most Investors Leave Money on the Table

When I help clients review their loans, I often find five-figure savings hiding in plain sight.

Not because they bought the wrong property, but because they never optimized the debt.

When we modeled it, she’d missed $47,000 in cash flow improvements that could have funded her next down payment.

You don’t need more doors to earn more.

You need better debt.

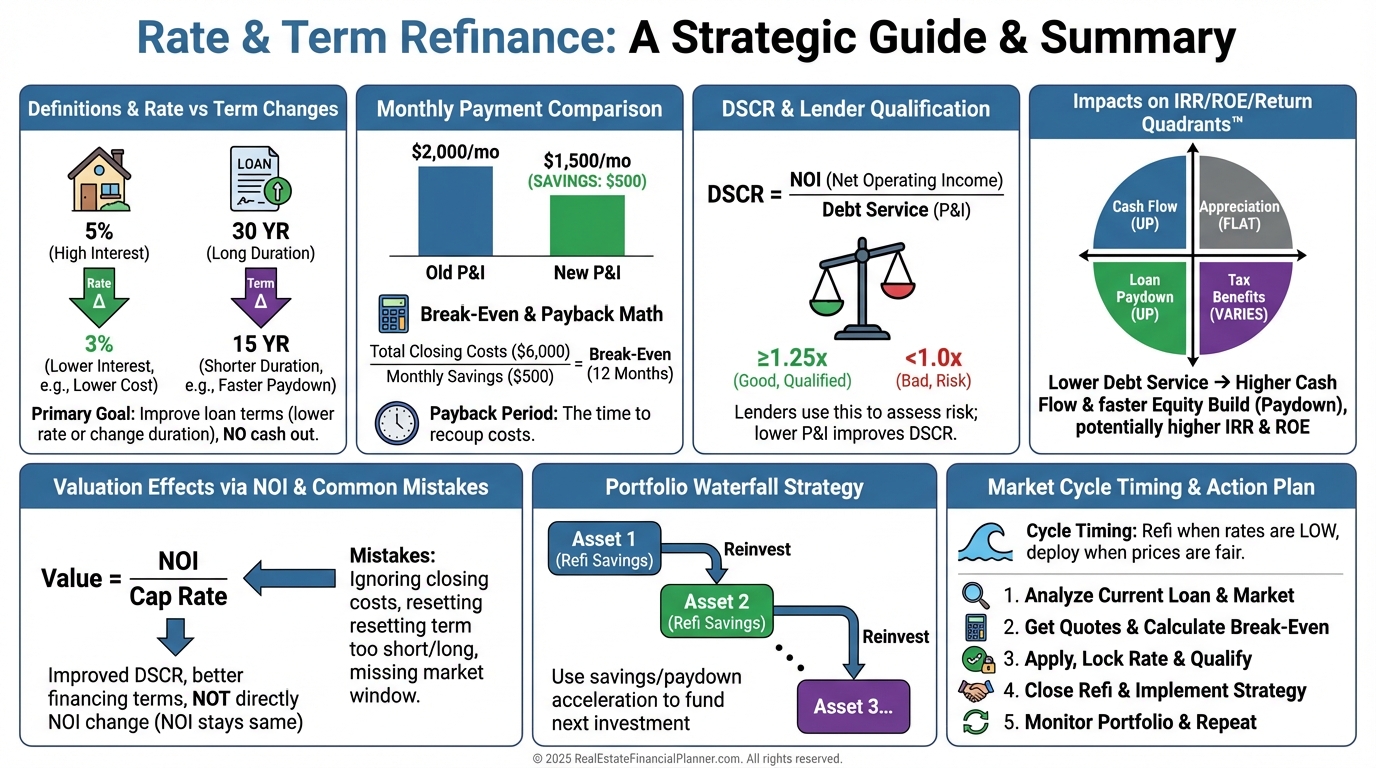

What Rate and Term Refinances Really Are

A rate and term refinance replaces your current mortgage with a new one that changes the interest rate, the term, or both—without pulling extra cash out.

It is a pure optimization move focused on payment, total interest, and alignment with your plan.

I coach clients to view it as maintenance for your balance sheet, like tuning an engine.

Small changes compound.

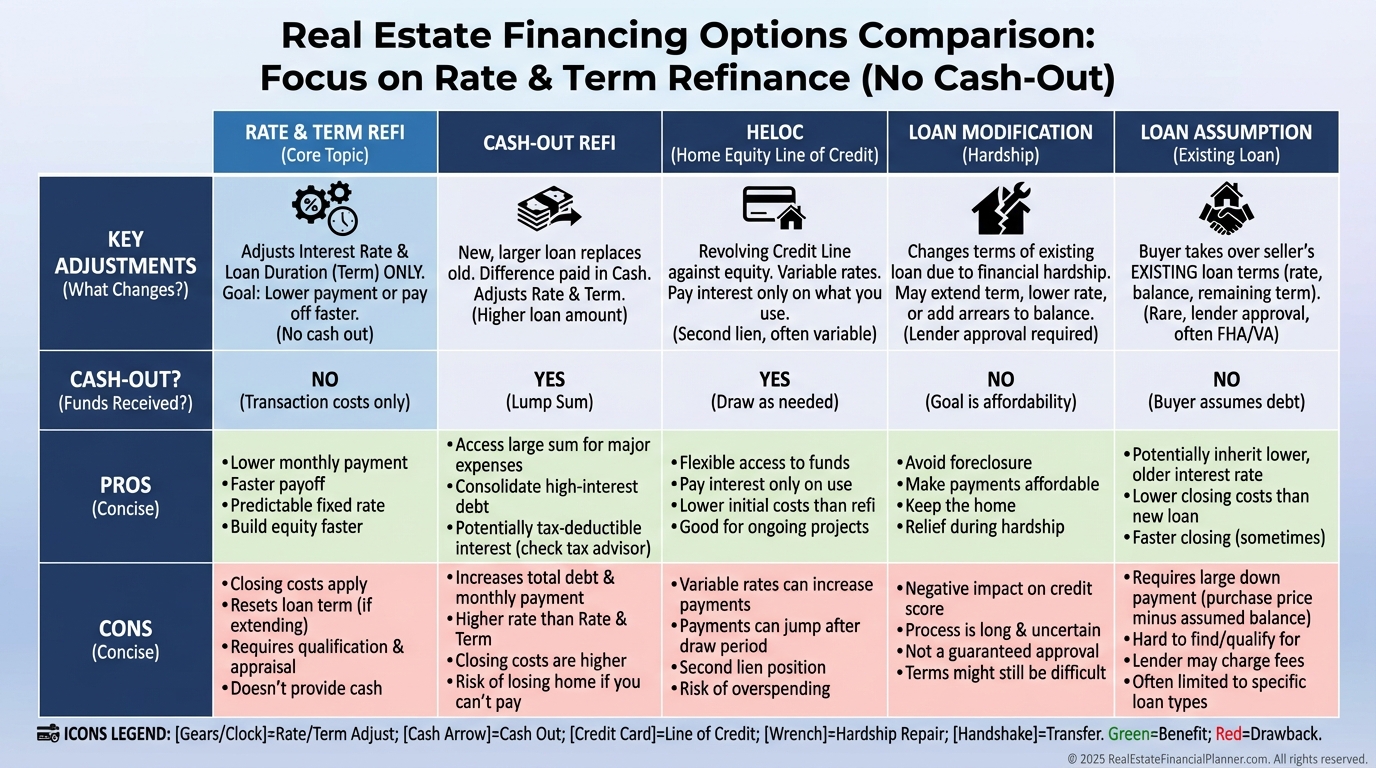

How It Differs From Other Options

Cash-out refi increases loan balance to harvest equity.

It usually comes with a rate premium and higher risk.

HELOCs and home equity loans sit behind your first mortgage.

They add flexibility but often bring variable rates and shorter amortization.

Loan modifications change terms with the same lender and typically require hardship.

They’re rarely the best optimization lever for investors.

Assumption helps buyers take over your low-rate loan.

It can boost exit value but may limit your flexibility.

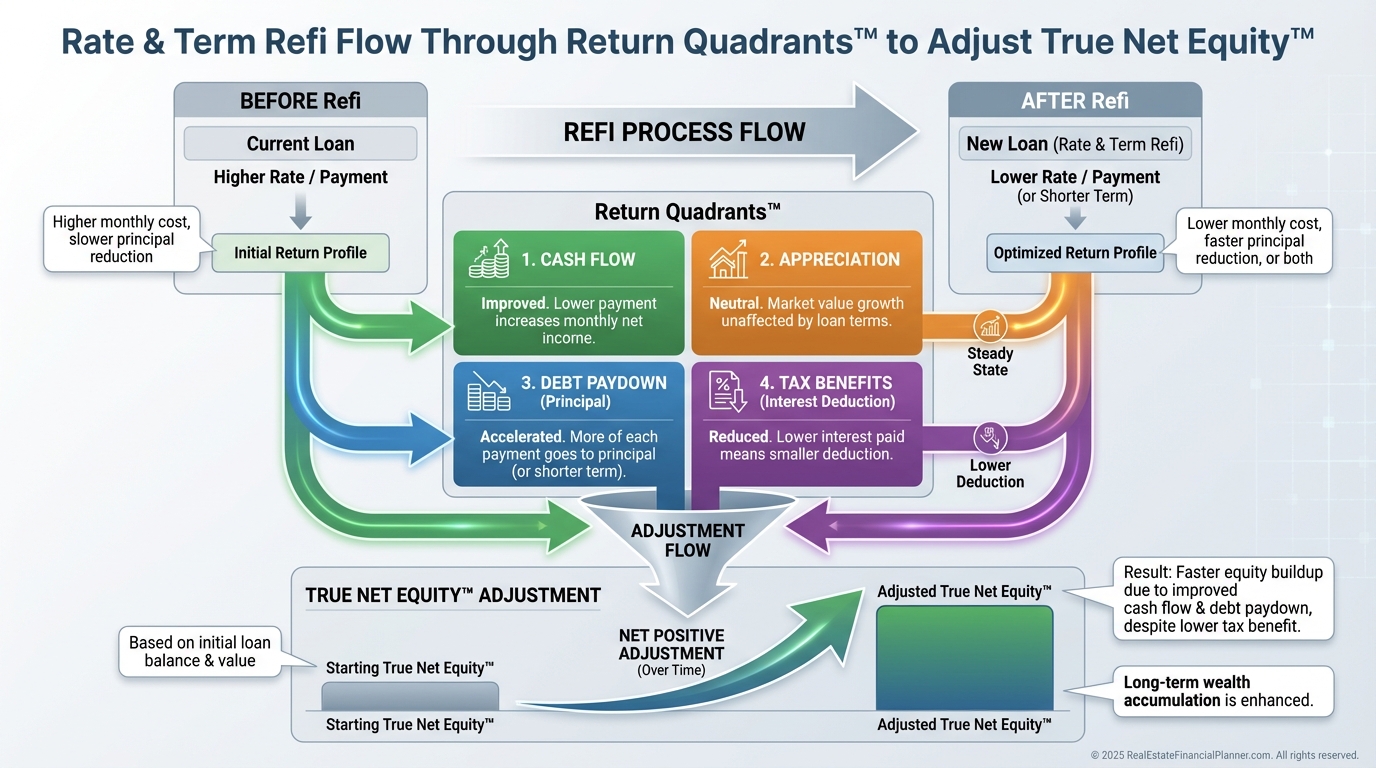

Where the Returns Show Up

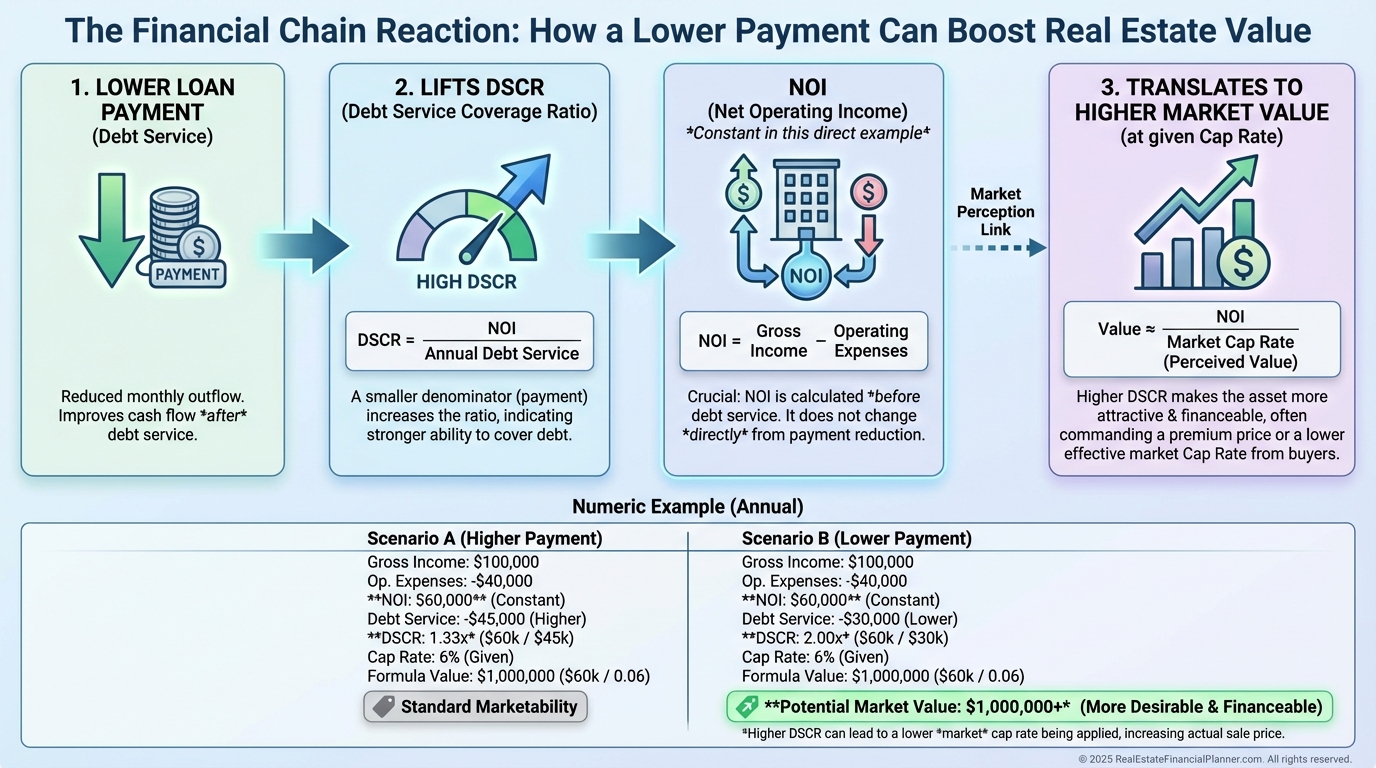

Refinancing touches every part of the Return Quadrants™: appreciation, cash flow, debt paydown, and tax benefits.

Lower payments directly boost cash flow and DSCR.

A better amortization schedule can improve debt paydown efficiency.

On the RealEstateFinancialPlanner.com calculator and The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I also track True Net Equity™.

That’s equity after selling, refinancing, and closing costs—because that’s the equity you can actually use.

As equity grows, your return on equity (ROE) usually falls.

The right refi resets leverage and can lift ROE without the risks of cash-out.

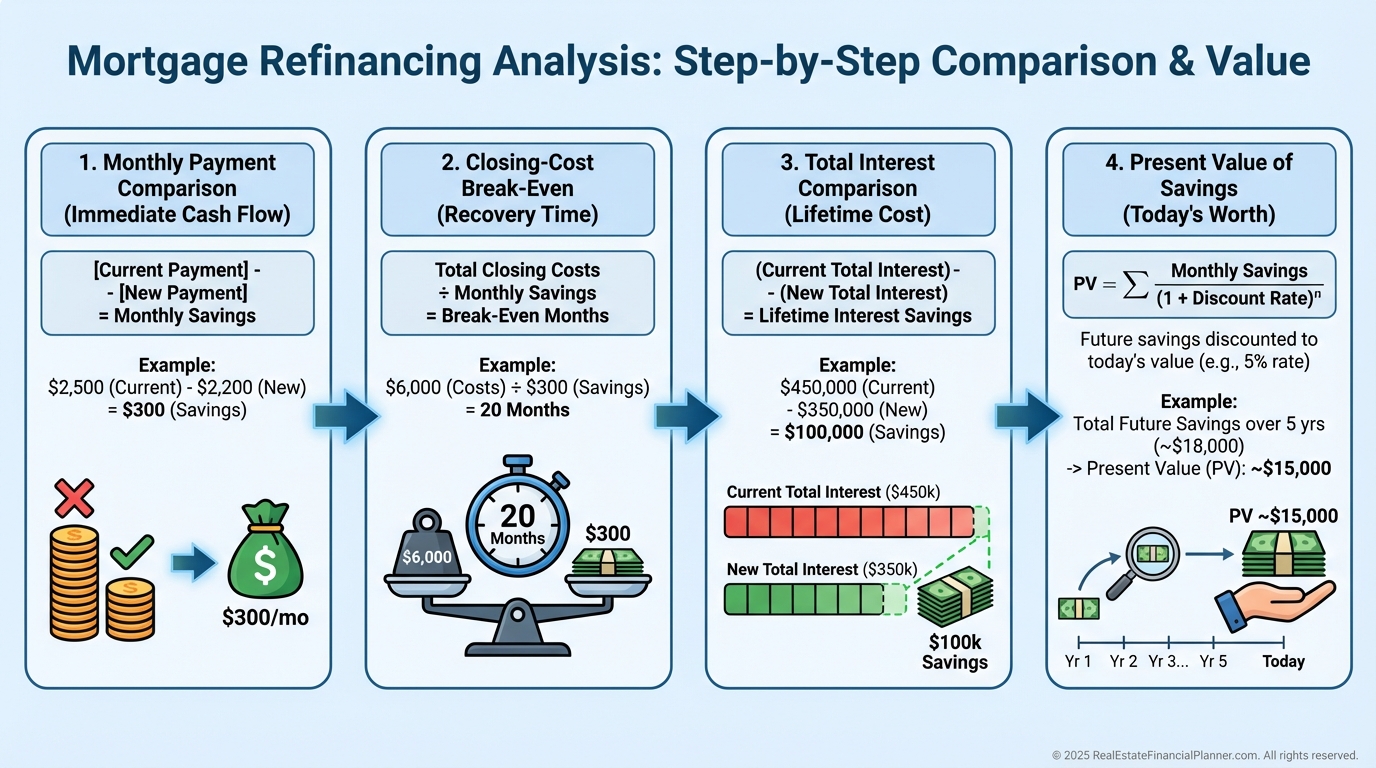

The Core Math I Use With Clients

Start with the payment comparison.

Marcus had a $200,000, 6.5%, 30-year loan costing $1,264 per month.

After five years, he owed about $180,000.

At 4.5% for 30 years, the new payment would be about $912.

That’s $352 per month in additional cash flow without raising rents or cutting expenses.

Over 25 years, that compounds to over $105,000 in improved cash flow.

Then I run break-even.

Divide total closing costs by monthly savings.

If Marcus pays $4,500 to refinance, $4,500 ÷ $352 ≈ 12.8 months to break even.

I also model total interest.

Compare old versus new interest over the hold, not just life-of-loan figures.

Finally, I discount future savings to present value at a required return rate.

At 10%, Marcus’s projected savings had a present value around $38,000.

Data Sources and Guardrails

I start with the current mortgage statement and note balance, rate, term, escrow, and prepayment penalties.

I cross-check rates on Bankrate and LendingTree, then add 0.25–0.50% for non-owner-occupied pricing.

Next, I request fee worksheets from at least three lenders, including points, lender credits, and third-party costs.

For investment property loans, I budget 2–5% of the loan amount for closing costs.

Then I model scenarios in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and verify DSCR and ROE shifts.

How Refinancing Affects Value and Financing

Lower payments increase net operating income (NOI) when you underwrite a buyer’s debt service reality.

A $352 monthly cut boosts annual NOI by $4,224.

At a 7% cap, that can imply roughly $60,000 in value support.

On the lending side, DSCR improves.

Moving a payment from $1,264 to $912 can push DSCR from about 1.15 to roughly 1.35, which often unlocks new financing.

Better cash flow can also help your personal DTI for conventional loans.

Portfolio lenders love to see smart refinancing discipline.

Common Mistakes I Warn Clients About

Chasing tiny rate drops rarely pays.

A 0.25% improvement often takes too long to recover, especially on small loans.

Resetting to 30 years can lower payments but increase lifetime interest.

Always check total interest paid for your actual hold period.

Prepayment penalties can erase years of gains.

Confirm yield maintenance or step-down penalties before you refinance.

Timing perfection is a myth.

Investors waiting for “the bottom” at 3% in 2021 missed 3.5% and faced 7% later.

And don’t forget tax impact.

Your marginal rate and interest deductibility thresholds change the true benefit.

David refinanced four times in three years, chasing tiny rate cuts.

He spent about $20,000 on costs for $147 per month in savings, with an 11+ year payback and a 7-year hold.

That’s negative optionality.

Strategic Uses I Recommend

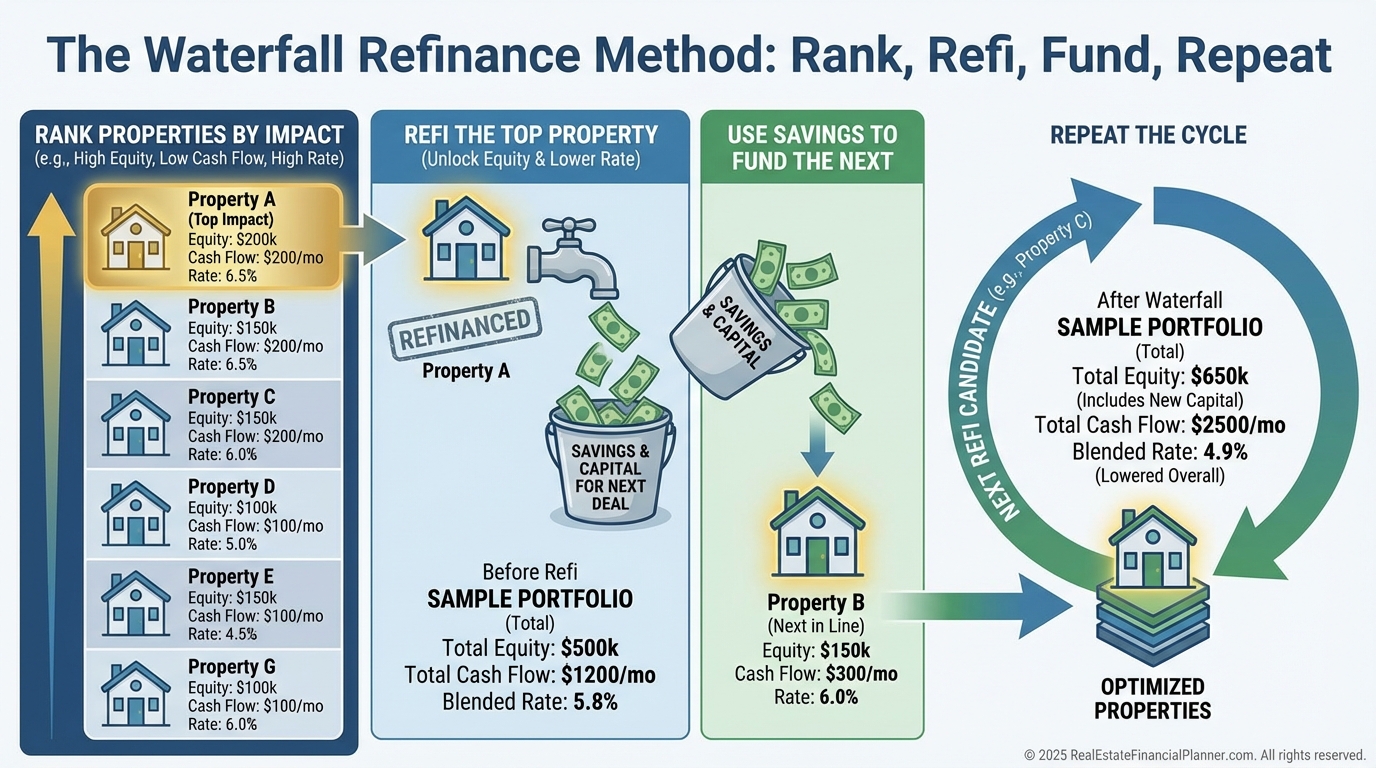

The Waterfall Refinance Method prioritizes the biggest wins first.

Line up every property by current rate, payment, DSCR, and remaining term.

Refinance the highest-impact property, then use monthly savings to fund the next closing costs.

Rachel bought four rentals at an average 7.25%.

We sequenced refis to 4.5%.

Her portfolio cash flow rose by about $31,000 per year without buying more doors.

If your goal is maximum cash flow, extend to 30 years on stable, long-hold assets.

If you want faster equity build, consider 15-year terms on your best performers while keeping others at 30.

That hybrid approach balances income today with wealth tomorrow.

For BRRRR, consider using rate and term instead of cash-out to preserve better pricing.

You still “recycle” via improved free cash flow, often at meaningfully lower risk.

Positioning for Exit

Two to three years before selling, I’ll often lock attractive fixed rates that are assumable.

When rates rise, below-market, assumable financing can be worth a premium.

I tighten operations so DSCR and trailing NOI look great to buyers and lenders.

Good story, good numbers, good loan.

That’s how you sell quickly and well.

Timing It With the Market

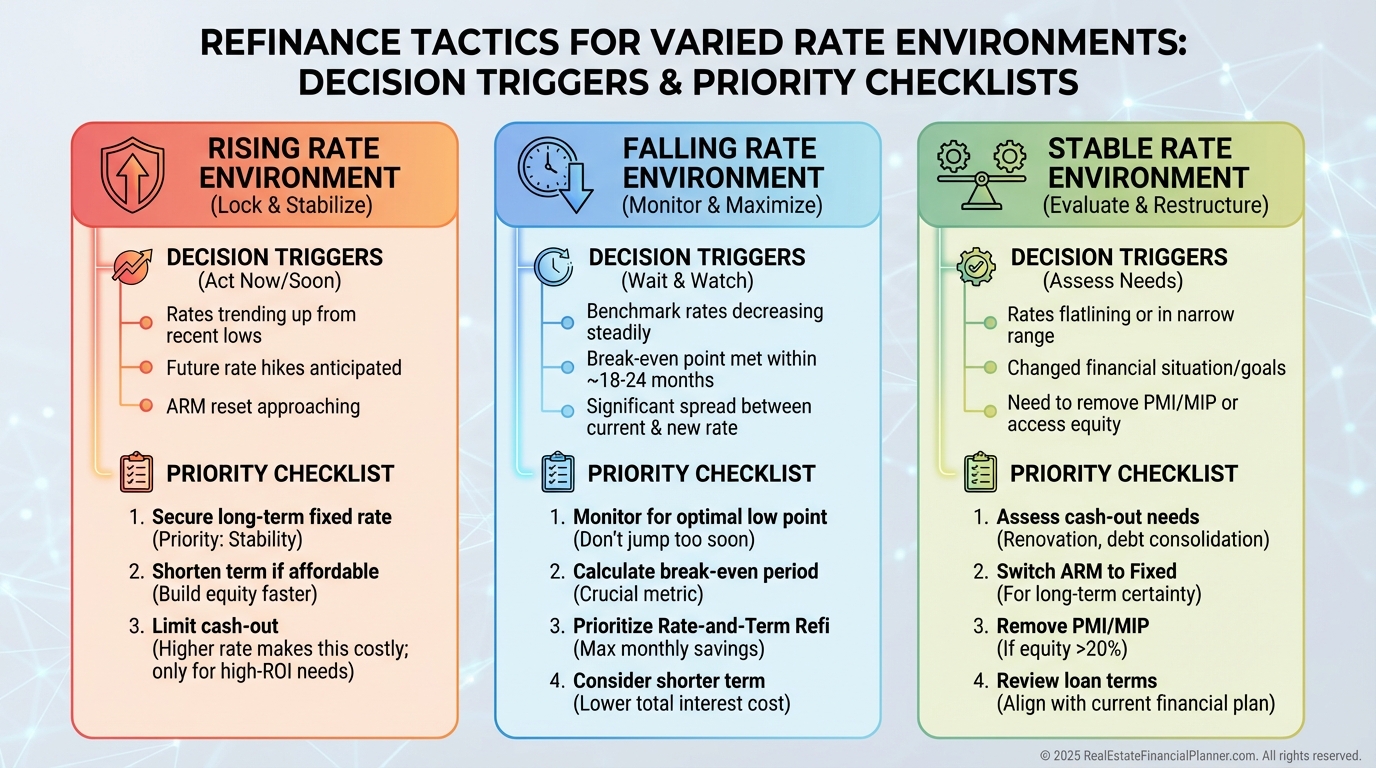

In rising-rate cycles, I move fast on any adjustables or maturities.

I’d rather lock “good” than miss “great.”

In falling-rate cycles, I set triggers.

If market rates fall 0.75% below the current note rate, I re-run the numbers.

In stable cycles, I improve loan features.

I’ve helped clients move from ARMs to fixed and eliminate prepayment landmines even when rates are flat.

Your Action Plan This Week

Step one: list every property with address, current rate, balance, payment, maturity, DSCR, and any prepay penalty.

Step two: pull current quotes from three lenders and request itemized fee worksheets.

Step three: model scenarios in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ including payment, DSCR, ROE, True Net Equity™, total interest, and payback.

Step four: set calendar reminders every six months to revisit rates and triggers.

Small improvements, compounded, finance your next down payment.

When I rebuilt after a tough stretch, I didn’t buy more properties first—I fixed my loans.

The cash flow paid for the comeback.

The difference between average and exceptional portfolios isn’t just the deals you buy.

It’s how well you manage the debt you already own.