Conventional Financing Explained for Real Estate Investors

Learn about Conventional Financing for real estate investing.

Conventional financing is the backbone of most real estate investor portfolios.

When I help clients buy their first rental property, this is usually the loan we start with. It is flexible, widely available, and works extremely well with long-term strategies like buy-and-hold, house hacking, and Nomad™.

It is also one of the easiest loans to misuse if you do not understand the rules.

This guide walks through how conventional financing actually works, what I model inside Real Estate Financial Planner™, and where investors tend to get into trouble.

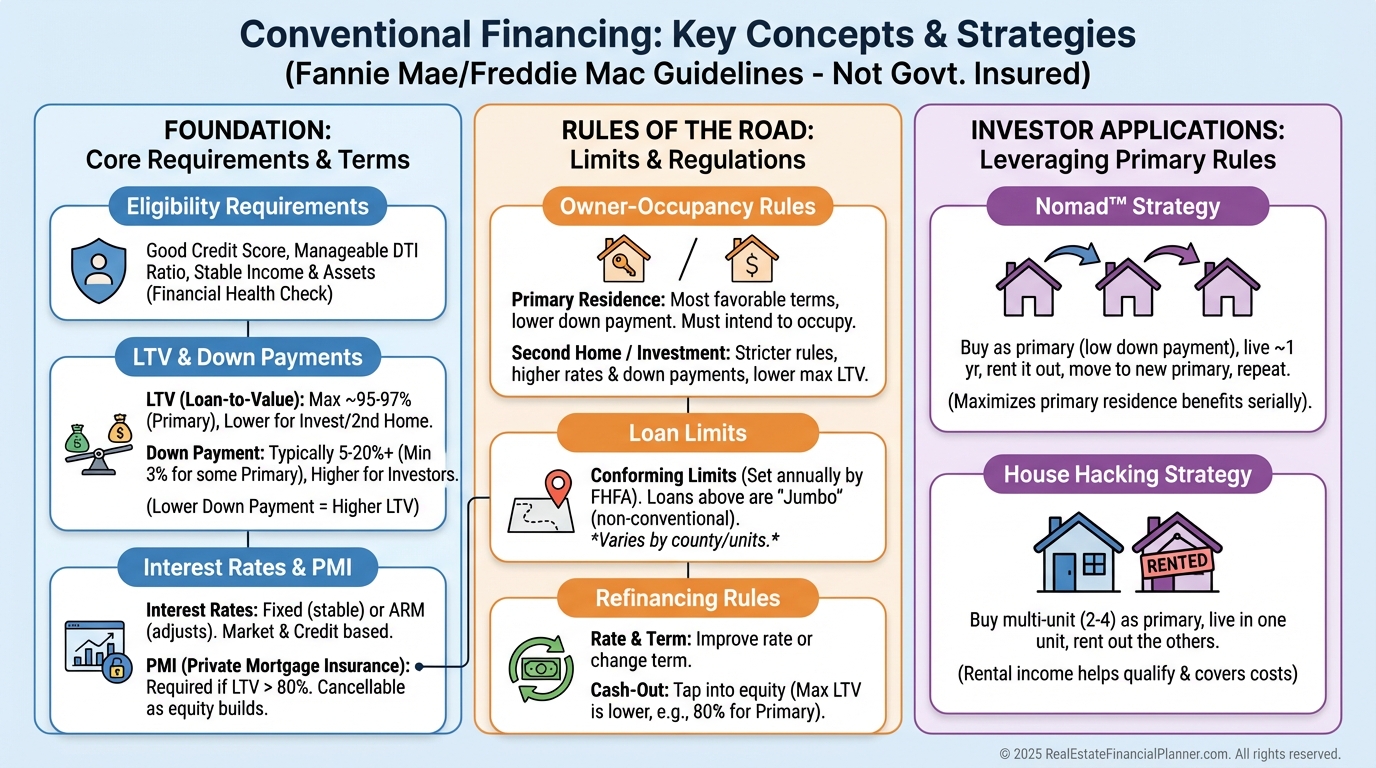

What Is Conventional Financing?

Conventional loans are mortgages backed by Fannie Mae or Freddie Mac rather than the federal government.

They are used for one- to four-unit residential properties and can be owner-occupied or investment properties.

Most of the rentals I personally own started as conventional loans.

They tend to offer fixed rates, long amortization periods, and predictable payments, which is exactly what you want when you are building cash flow and equity over decades.

Eligibility and Credit Requirements

Most investors qualify for conventional financing sooner than they expect.

You generally need a minimum credit score around 620 to qualify, but that is not the score I aim for when advising clients.

When I model deals, I assume a stronger borrower profile because interest rate differences compound over time.

A credit score of 740 or higher usually unlocks the best pricing and the lowest PMI costs.

There are also special programs like HomeReady® and Home Possible® that can reduce down payments for owner-occupants, especially on early properties.

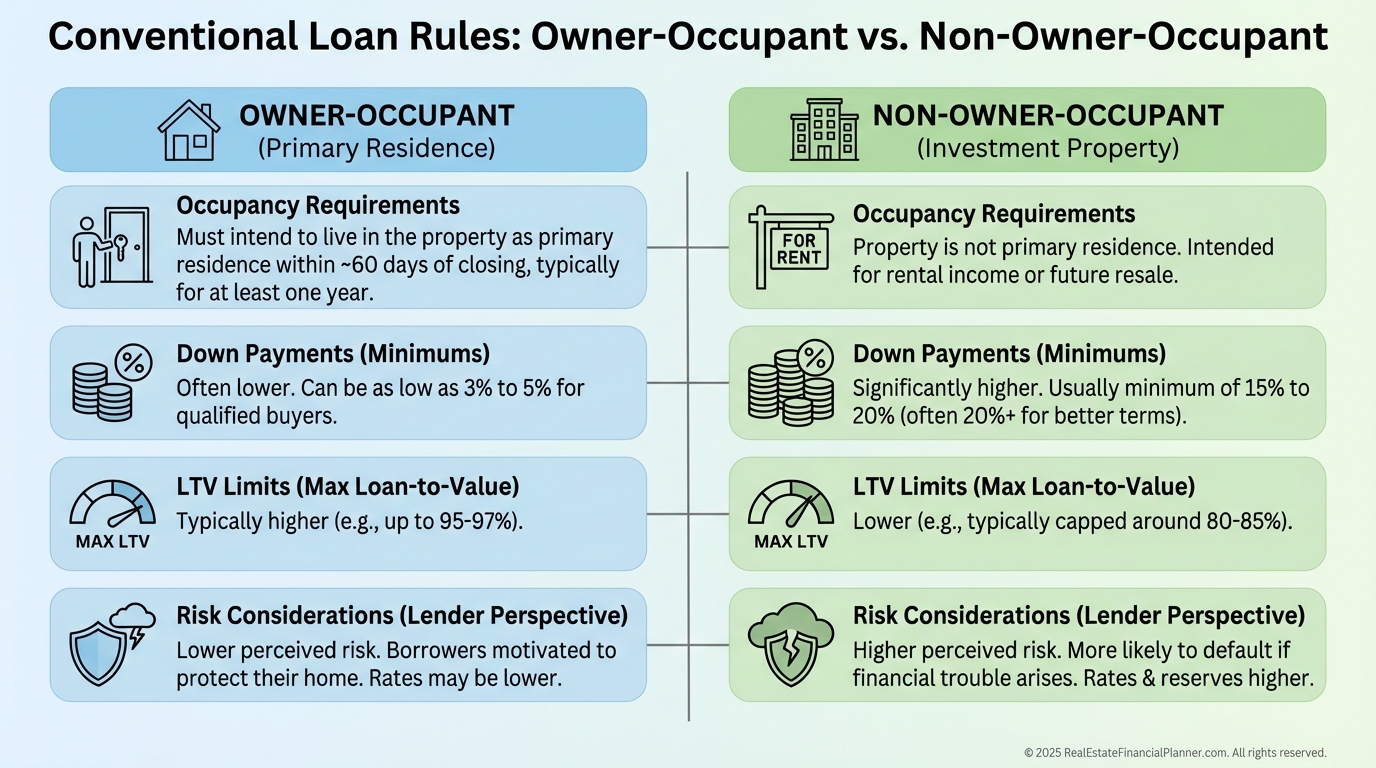

Owner-Occupancy Rules and Why They Matter

If you are buying as an owner-occupant, you must actually live in the property.

That sounds obvious, but this is where some investors get reckless.

Owner-occupant conventional loans require you to move in and typically live there for at least one year before converting the property to a rental.

That rule is what makes strategies like house hacking and Nomad™ so powerful.

It is also a legal requirement, not a suggestion.

Failing to move in is loan fraud. Lenders do verify occupancy, and the consequences are serious.

When I rebuilt after bankruptcy, I was extremely careful to follow these rules to the letter. Trust with lenders matters more than any single deal.

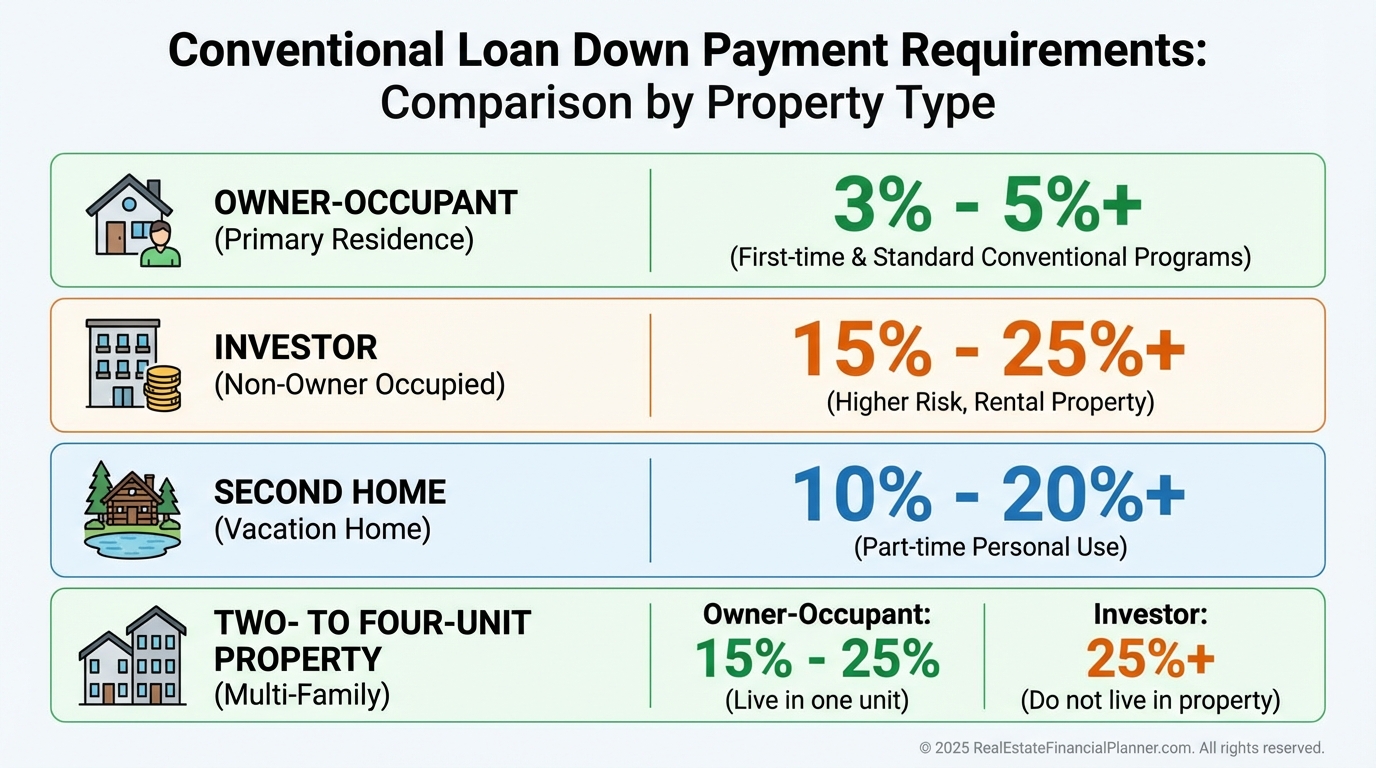

Down Payments by Use Case

Down payment requirements change depending on how you plan to use the property.

Owner-occupants can often put down as little as three to five percent, usually with PMI.

Non-owner-occupant investors typically need fifteen to twenty percent down.

Second homes often require around ten percent down, and small multifamily properties usually require more than single-family homes.

When I run Nomad™ scenarios in REFP, I typically model five percent down to stay conservative and realistic.

Loan-to-Value Ratios

Loan-to-value is simply how much you borrow compared to the property’s value.

Owner-occupants can go as high as ninety-seven percent LTV on their first property.

Most subsequent owner-occupant purchases require at least five percent down.

Investors usually cap out at eighty percent LTV, although some loans allow eighty-five percent with PMI and higher rates.

Higher leverage can accelerate growth, but it also increases risk. That is why I always evaluate leverage using Return on Equity and cash flow resiliency, not just excitement about buying faster.

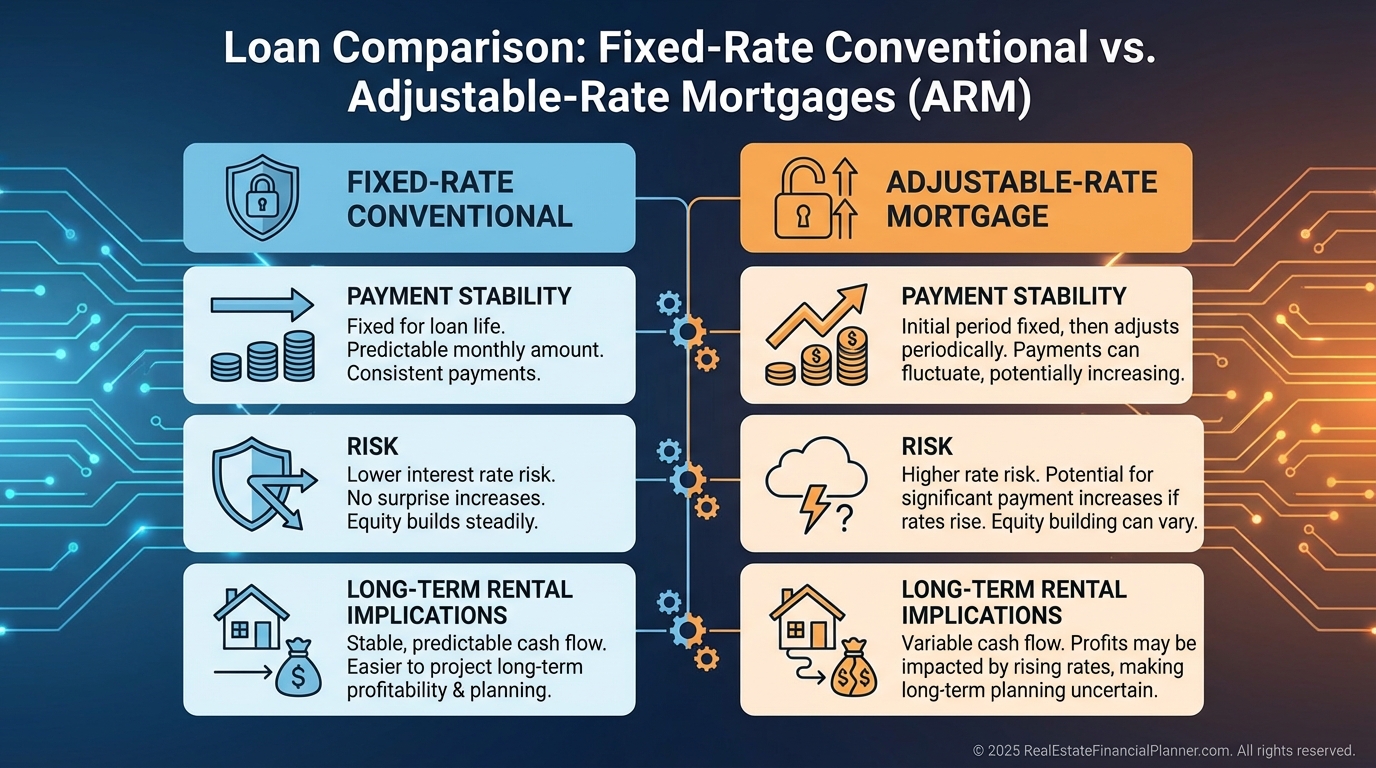

Interest Rates and Loan Structure

Most conventional loans are fixed-rate, and that is what I strongly prefer for rentals.

A fixed rate gives you certainty. Your payment does not change while rents and inflation do.

Adjustable-rate mortgages exist, but they add risk without offering enough upside for long-term investors.

When I help clients choose loans, we plan for the property’s rental life, not just the first year.

Amortization Period and Cash Flow

Thirty-year amortization is the default for a reason.

It keeps payments lower and preserves cash flow.

Fifteen-year loans exist and may offer slightly lower rates, but they often destroy cash flow on rentals.

I almost always prioritize monthly flexibility early in a portfolio and let equity build quietly in the background.

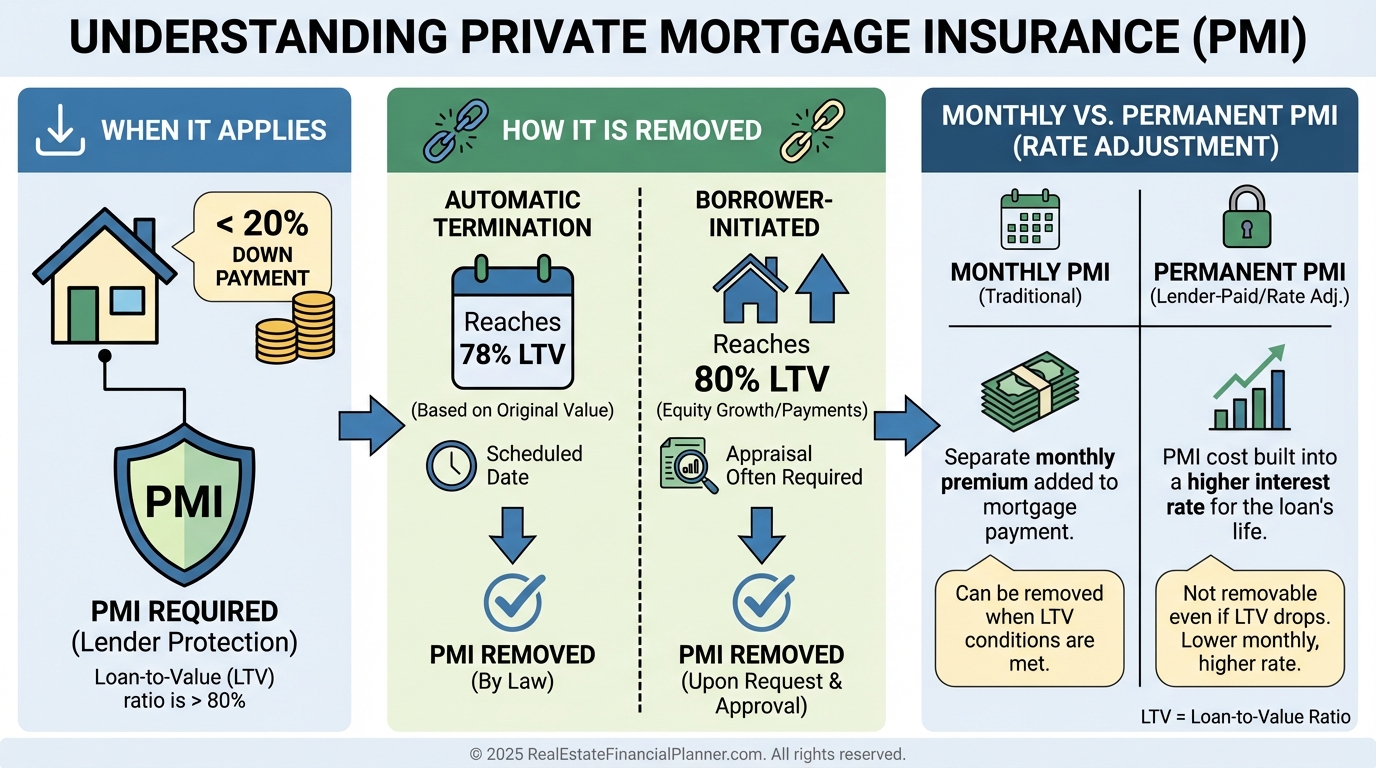

Private Mortgage Insurance

If you put less than twenty percent down, you will have PMI.

That is not automatically bad.

PMI can be removed once you reach twenty percent equity through appreciation or principal paydown.

What I caution investors against is rolling PMI into the interest rate, which makes it permanent.

In REFP, I always model PMI explicitly so investors can see the real cost and the exit strategy.

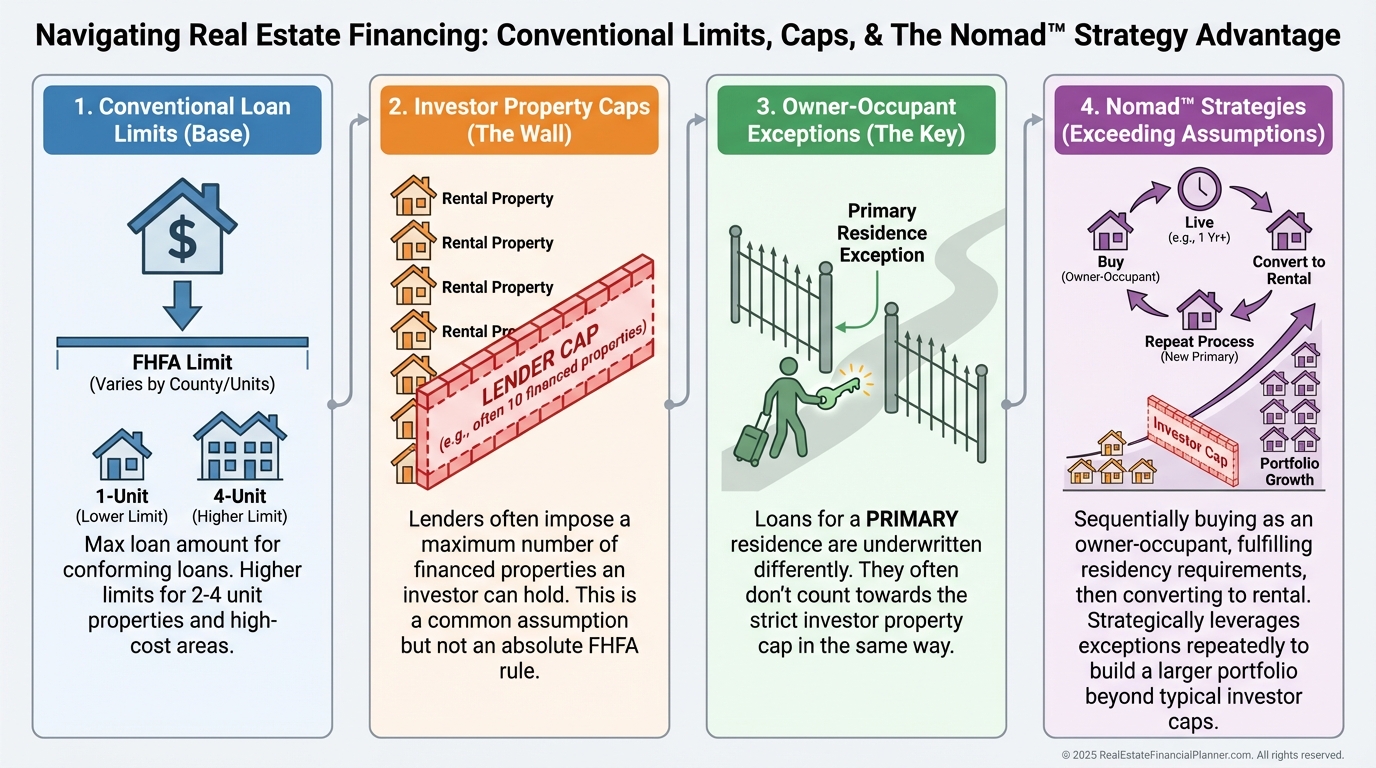

Loan Limits and Property Counts

Conventional loan limits vary by county and change over time.

Most investors hit portfolio limits before loan size limits.

Fannie Mae and Freddie Mac typically allow up to ten conventional investor loans.

There is no limit on owner-occupant loans, which is why Nomad™ can exceed what most investors think is possible.

If you and your spouse both qualify, you may be able to hold even more, though underwriting scrutiny increases.

Seller Concessions

Seller concessions can help reduce your cash needed at closing.

They cannot be used for the down payment.

Owner-occupants may receive up to six percent in concessions depending on down payment.

Investors are typically capped at two percent.

I always negotiate concessions strategically to preserve reserves, not to stretch deals that do not work.

Waiting Periods After Bankruptcy or Foreclosure

Conventional financing is forgiving, but not immediate.

Chapter 7 bankruptcies usually require a four-year wait.

Foreclosures often require seven years, though exceptions exist.

I rebuilt after bankruptcy myself, and this waiting period forced me to focus on fundamentals, credit rebuilding, and conservative growth.

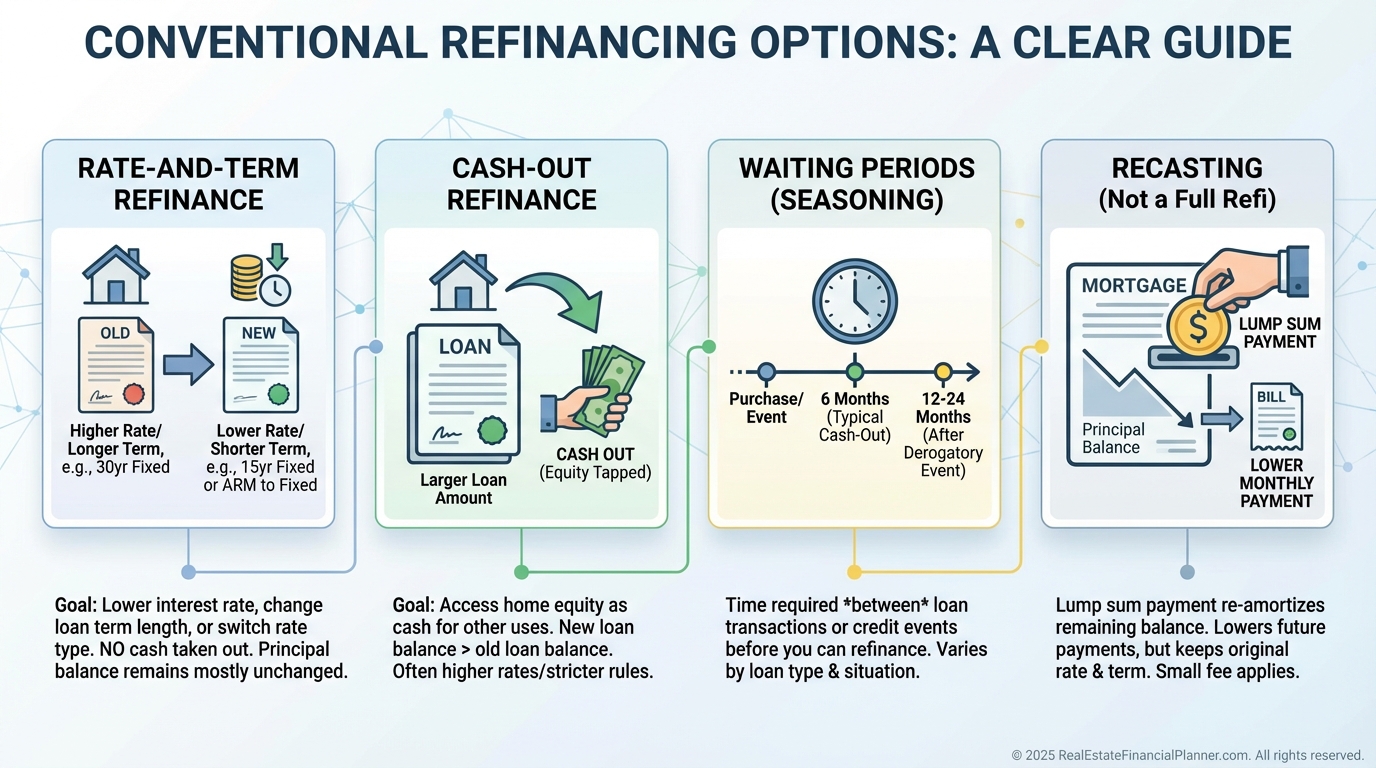

Refinancing Rules

Rate-and-term refinances usually have no waiting period.

Cash-out refinances require at least twelve months.

Some loans allow recasting, but availability varies by lender.

When evaluating refinances, I always compare Return on True Net Equity™ before and after, not just the payment change.

Risks and Strategic Considerations

Interest rates on early properties matter more than most investors realize.

You may not be able to refinance every property later.

Lock rates early when possible and think in decades, not months.

Conventional financing rewards patience, compliance, and disciplined modeling.

When used correctly, it quietly builds wealth while you sleep.