Flood Insurance for Real Estate Investors: What Most Policies Don’t Cover Until It’s Too Late

Learn about Flood Insurance for real estate investing.

Flood insurance is one of those topics investors ignore right up until it destroys them.

I have seen investors do flawless deal analysis, negotiate great prices, and build solid cash flow, only to have one storm wipe out years of progress in a matter of hours.

When I help clients analyze rental properties, flood risk is one of the quiet variables that can turn a “safe” deal into a portfolio-level threat.

Most investors assume their property insurance has them covered.

It doesn’t.

Standard property insurance excludes flood damage entirely.

That exclusion is not a technicality. It is a line in the sand that can erase your equity, your cash flow, and your momentum overnight.

Flood insurance is not about fear.

It is about understanding how insurers define risk, how claims are denied, and how one overlooked assumption can collapse your numbers.

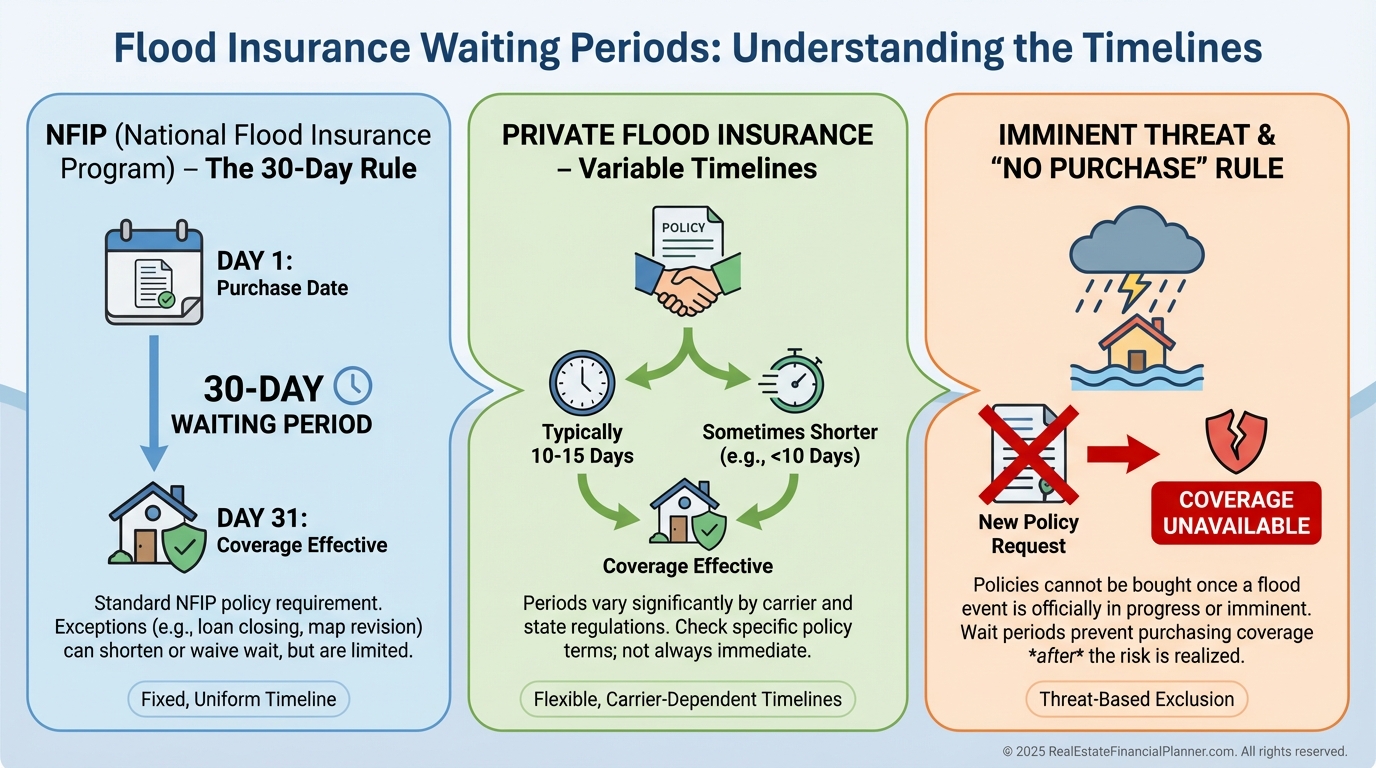

Why You Cannot Buy Flood Insurance at the Last Minute

This is the rule investors learn too late.

You cannot buy flood insurance once flooding is imminent.

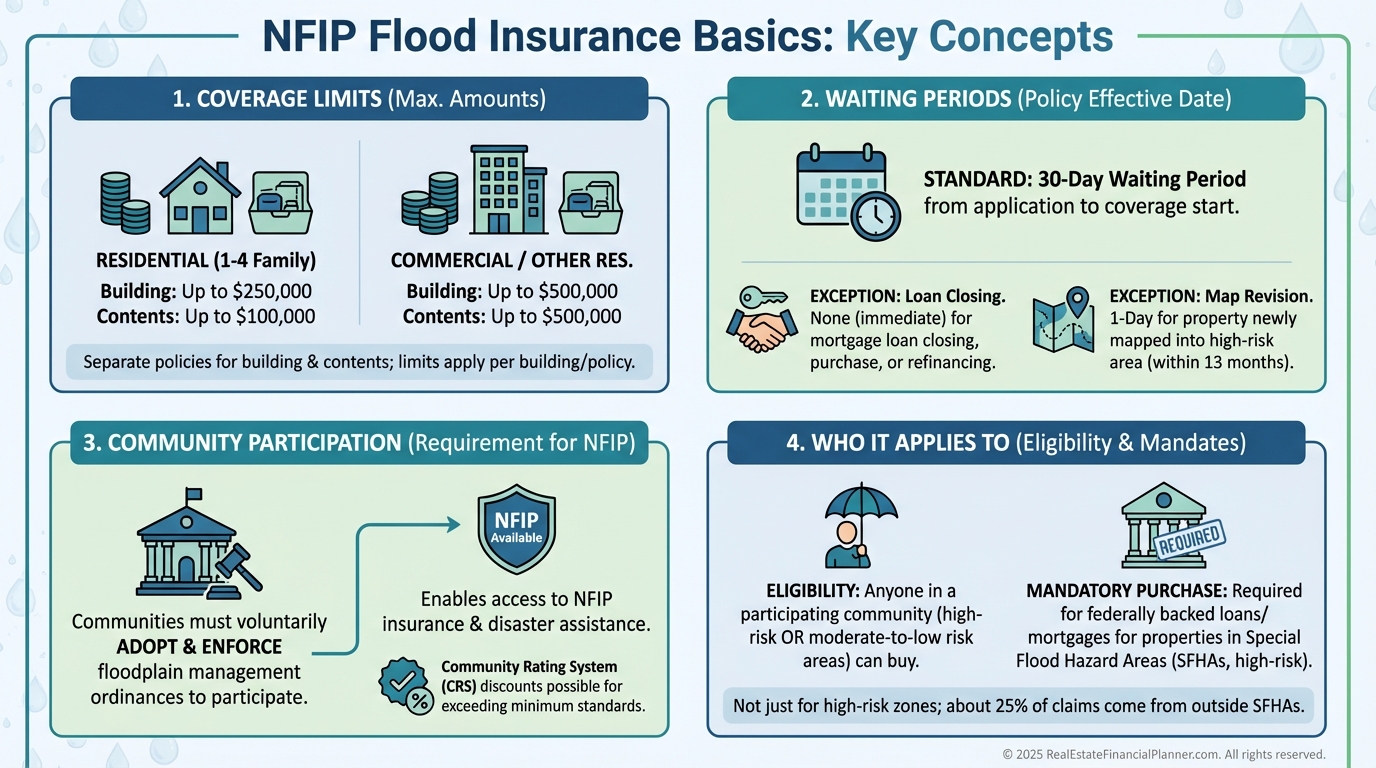

The National Flood Insurance Program enforces a standard 30-day waiting period.

Most private flood insurers still require 10 to 14 days before coverage begins.

When flood warnings show up on your phone, your window has already closed.

Insurance only works when risk is pooled during calm periods.

Buying coverage while water is rising would collapse the entire system.

I warn clients about this constantly because investors assume insurance is a switch you can flip.

It is not.

Once water enters your property, any uninsured damage is yours to absorb.

No appeals. No exceptions. No retroactive coverage.

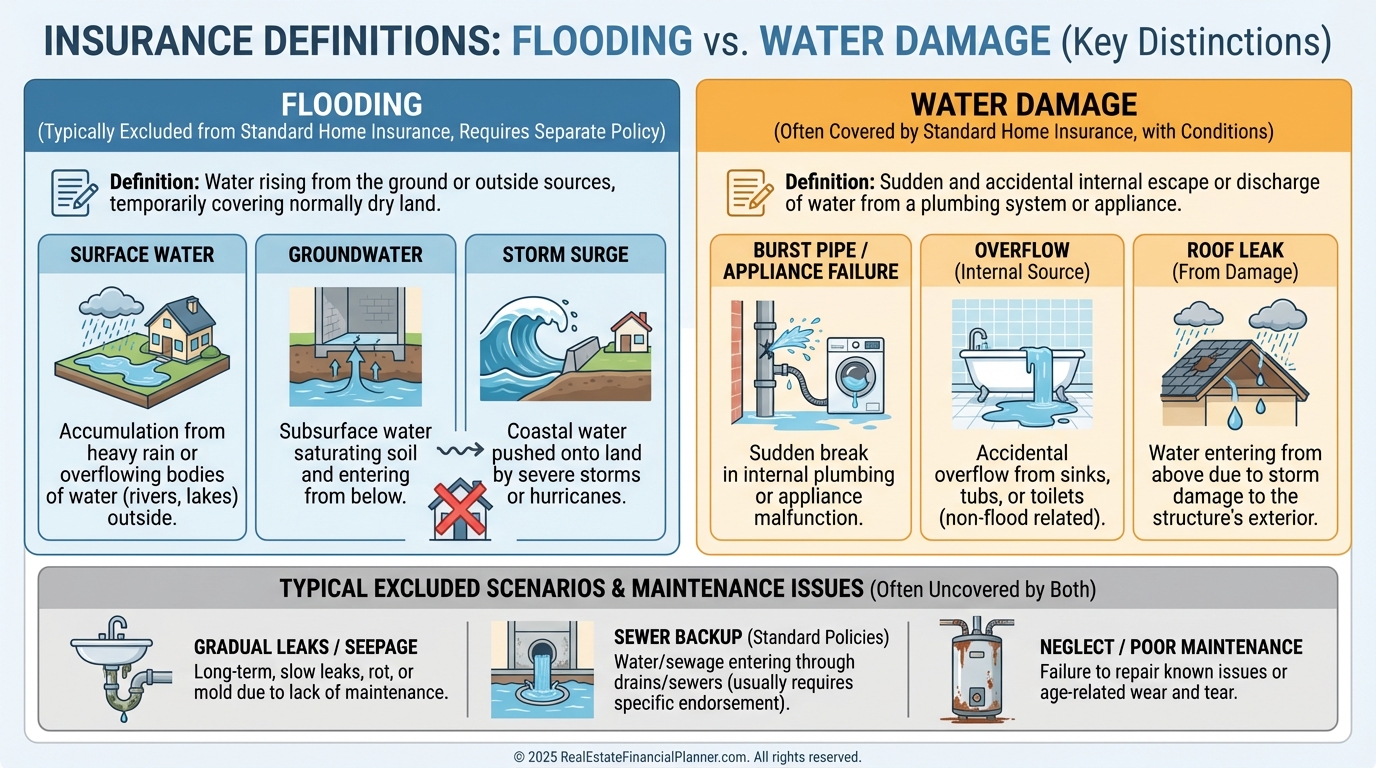

What Insurance Companies Actually Mean by “Flooding”

This is where many experienced investors still get blindsided.

Insurance companies define flooding far more broadly than most people realize.

Flooding is any water that touches the ground before entering the structure.

That definition creates brutal coverage gaps.

Here is an example I use with clients.

A pipe bursts upstairs and water damages the first floor.

Covered.

That same water flows out the front door, pools in the yard, and seeps back through the foundation.

Now it is flood damage.

Same water. Same source. Completely different outcome.

Flood exclusions typically include surface water, storm surge, mudflow, overflowing rivers, and groundwater intrusion.

If water touches dirt before it touches your building, you are likely uncovered.

This is why reading your policy matters more than assuming intent.

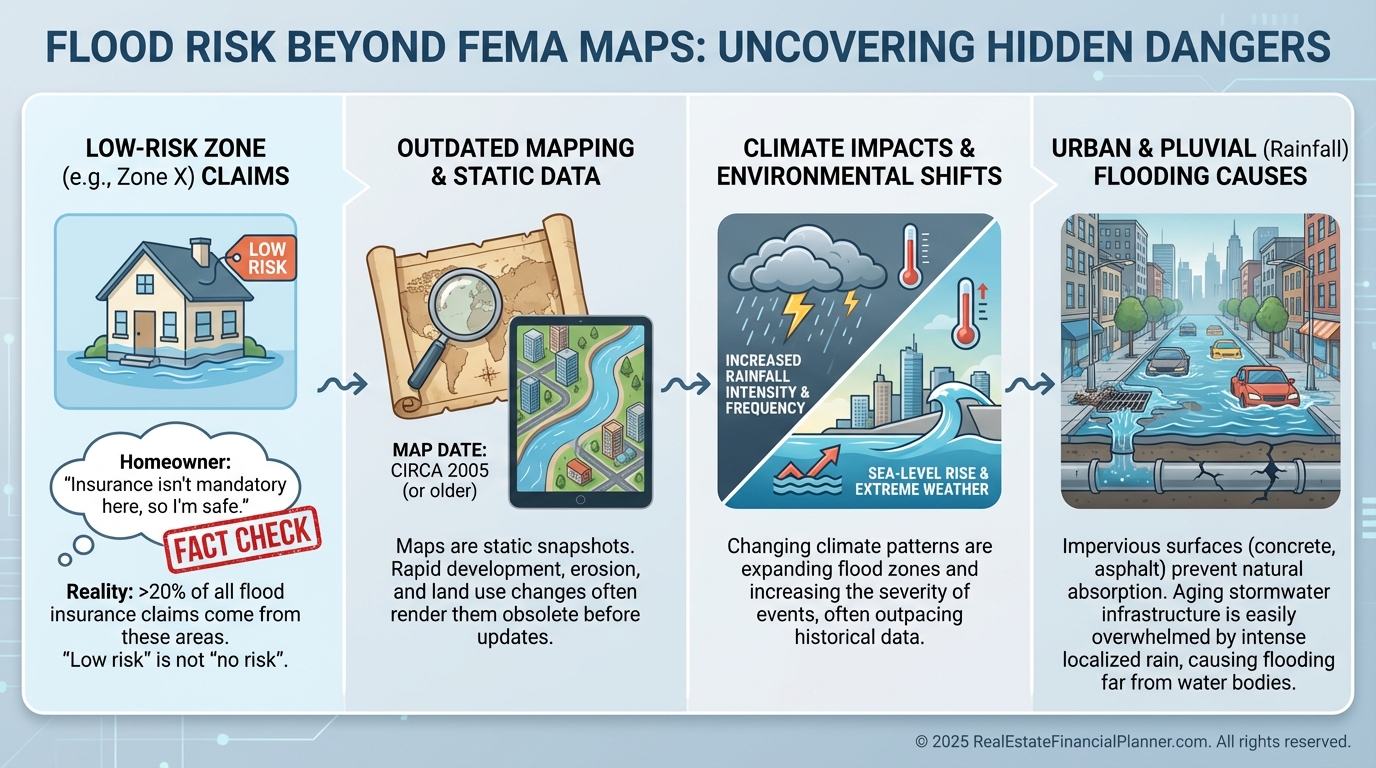

Understanding Flood Risk Beyond FEMA Maps

Many investors check the FEMA map and stop there.

That shortcut no longer works.

Roughly one-quarter of flood claims occur in low-to-moderate risk zones.

Urban drainage failures, flash floods, snowmelt, and overwhelmed storm systems cause damage far from rivers and coastlines.

I have seen investors lose properties in neighborhoods that had never flooded before.

Climate volatility and development patterns have changed the math.

Flood risk now exists almost everywhere.

If your analysis assumes “this area has never flooded,” you are betting your equity on the past repeating itself.

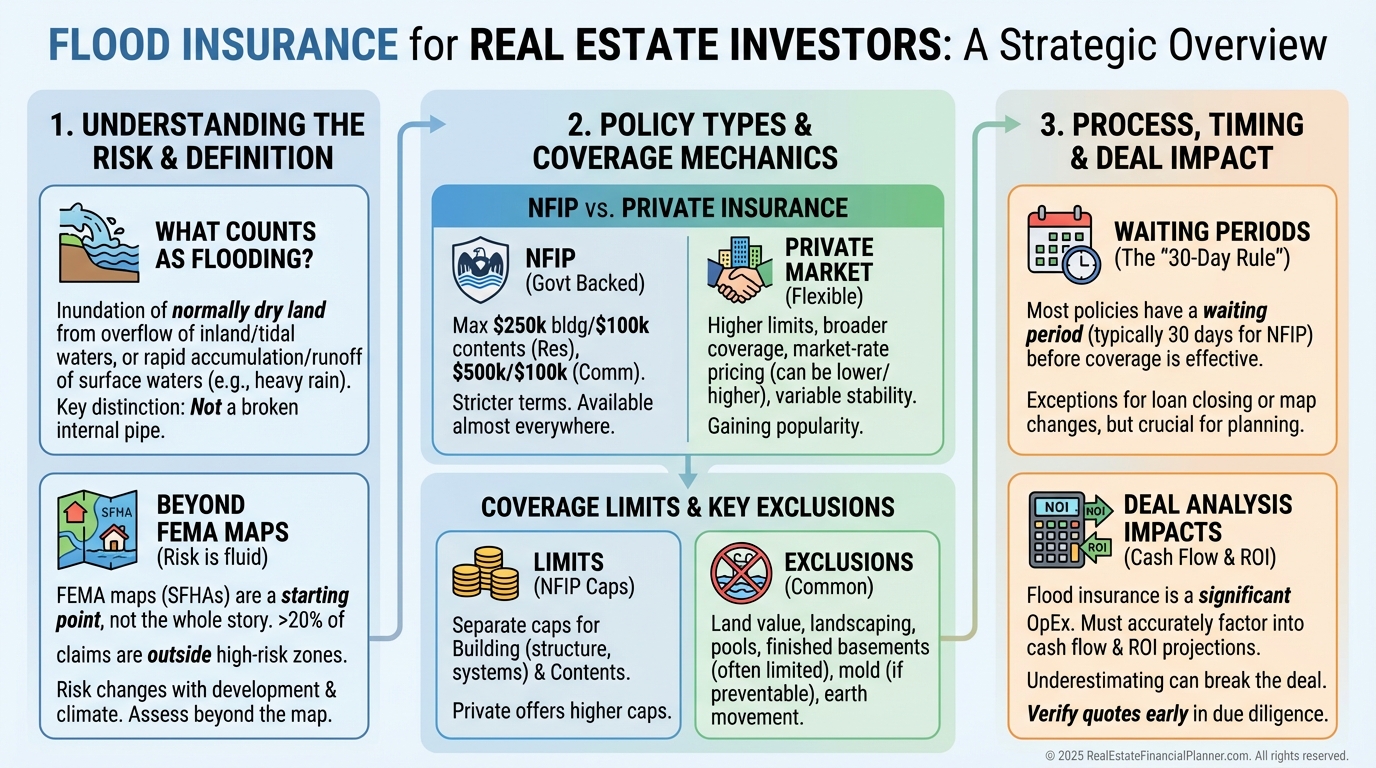

How the National Flood Insurance Program Works

The NFIP is the backbone of flood insurance in the United States.

It provides standardized coverage through participating communities.

Residential building coverage is capped at $250,000.

Contents coverage is capped at $100,000 and must be purchased separately.

Those limits are often insufficient for multi-unit rentals or higher-value properties.

Recent pricing changes under Risk Rating 2.0 also mean premiums can rise faster than many investors expect.

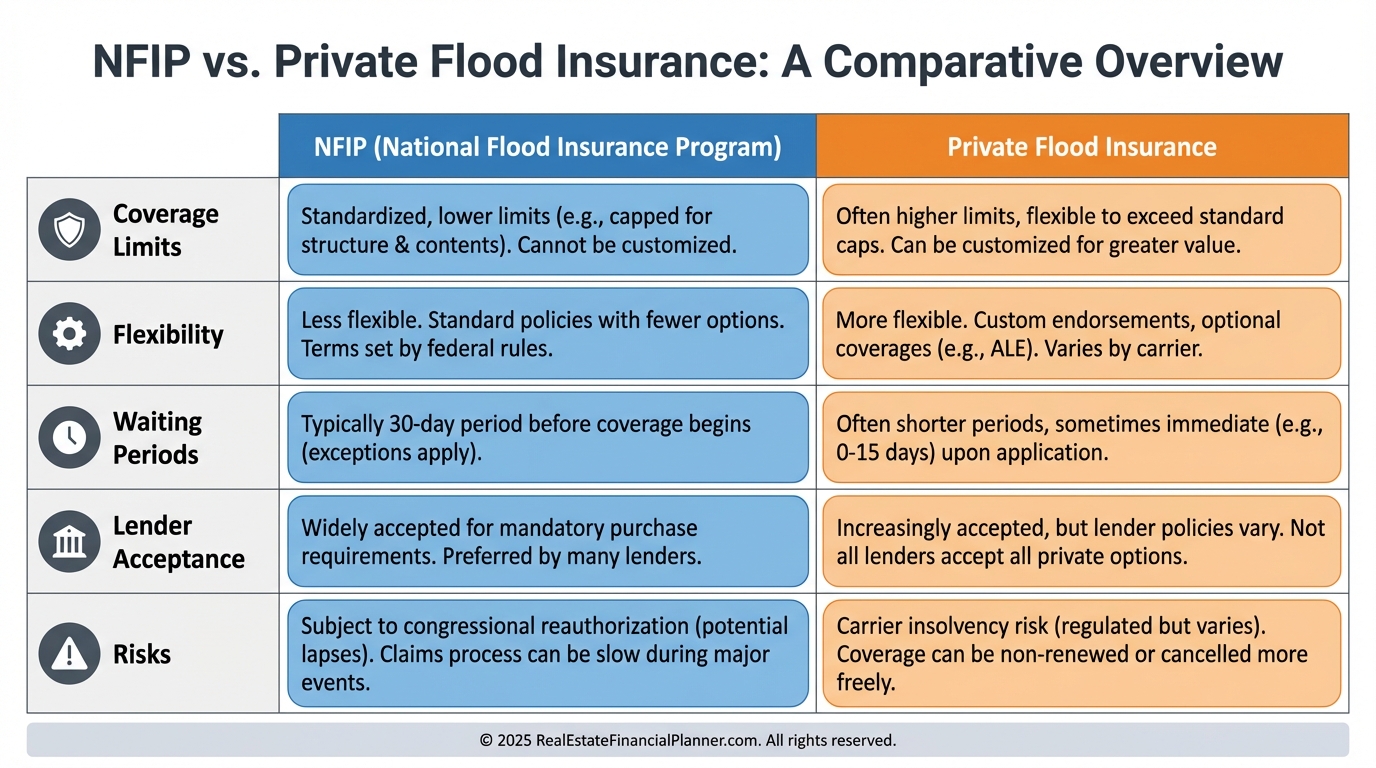

NFIP is predictable, but it is not flexible.

Private Flood Insurance and When It Makes Sense

Private flood insurance has improved dramatically.

Many policies offer full replacement cost, higher limits, loss of rent coverage, and faster claims handling.

Private insurers also price risk more precisely.

Properties with elevation advantages or mitigation features often receive better rates than NFIP.

The tradeoff is stability.

Private insurers can exit markets or decline renewals.

NFIP cannot.

When I model deals, I compare both options and stress-test cash flow under each.

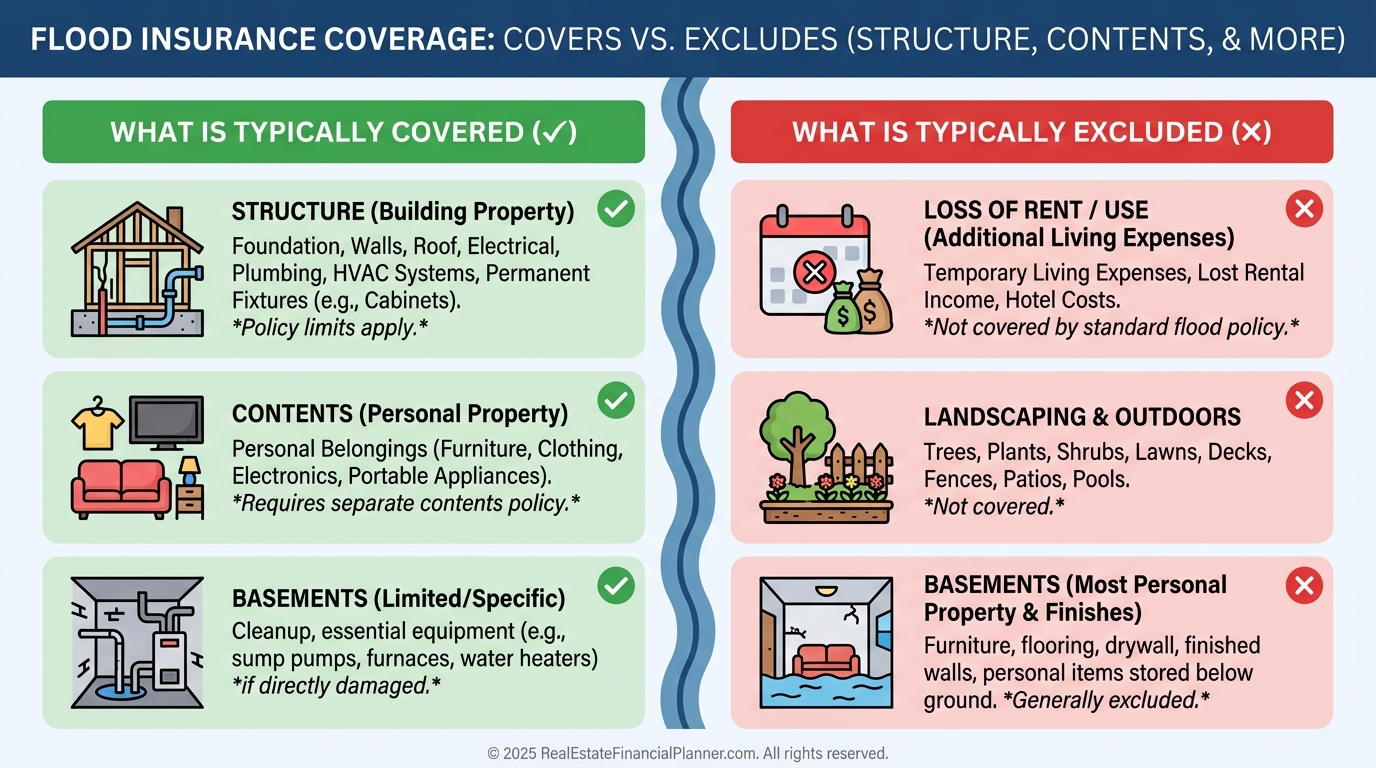

What Flood Insurance Covers and What It Does Not

Flood insurance covers structure and certain systems.

It does not cover loss of rental income under standard policies.

Finished basements receive minimal protection.

Landscaping, pools, and exterior improvements are excluded.

This matters when you calculate cash flow resiliency.

Mortgage payments continue while repairs drag on.

If your deal barely cash flows without flood insurance gaps, it may not survive a claim event.

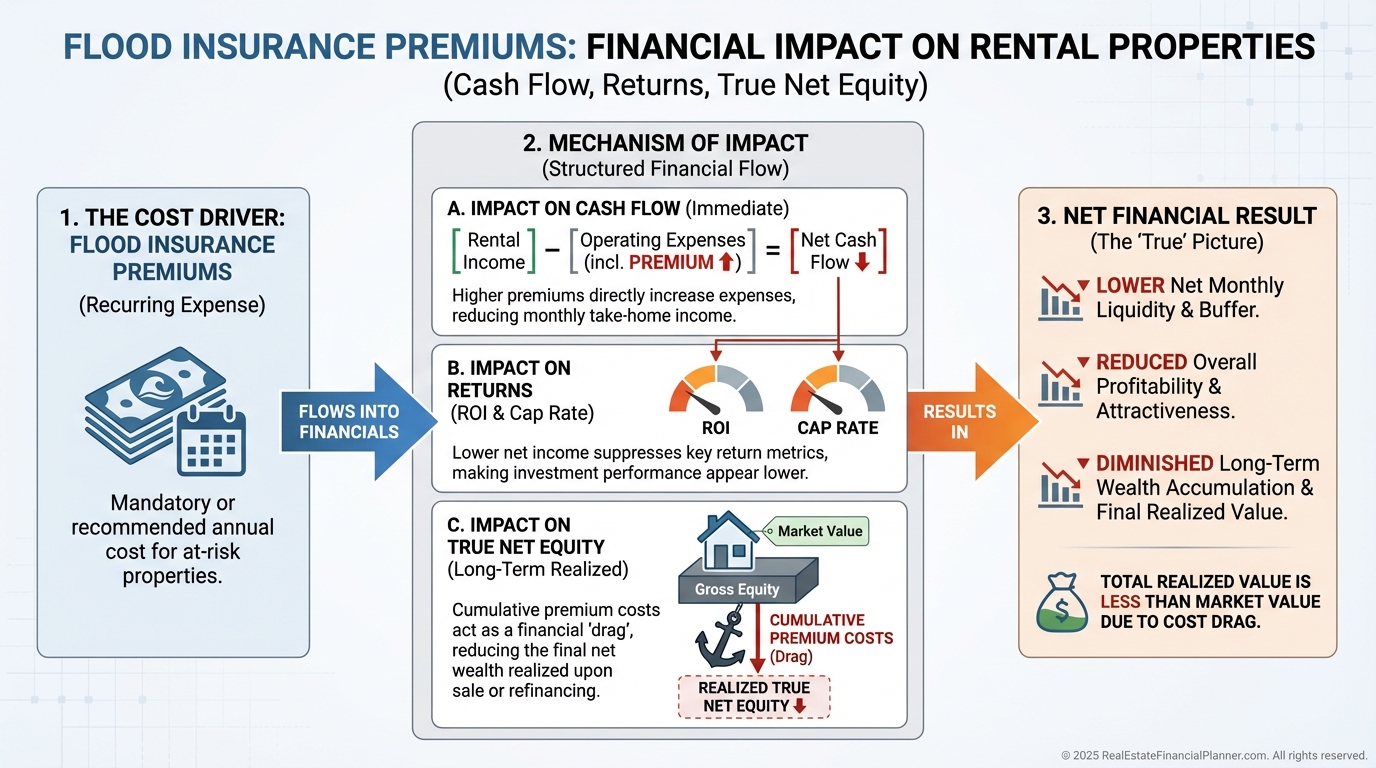

Flood Insurance in Deal Analysis and True Net Equity™

Flood insurance is not just an expense line.

It directly affects return on equity, return on investment, and long-term portfolio survivability.

When I run numbers, I model premiums over the full holding period.

I also adjust True Net Equity™ to reflect uninsured downside risk.

Saving $1,500 per year on premiums does not matter if a single flood wipes out $200,000 in equity.

This is where investors confuse probability with consequence.

Low probability events with catastrophic consequences still require protection.

How Smart Investors Think About Flood Insurance

Flood insurance is portfolio insurance, not property insurance.

One uninsured flood can erase the gains from multiple successful deals.

Spreading properties across different elevations and drainage profiles helps.

But diversification does not eliminate risk.

I tell investors the same thing every time.

You do not buy flood insurance because flooding is likely.

You buy it because the damage is unrecoverable if you are wrong.

That mindset is what separates resilient portfolios from fragile ones.

Flood insurance is boring.

Until it saves everything you have built.