Seller's Property Disclosure: How Savvy Buyers Read It, Model It, and Negotiate Better Deals

Learn about Seller's Property Disclosure for real estate investing.

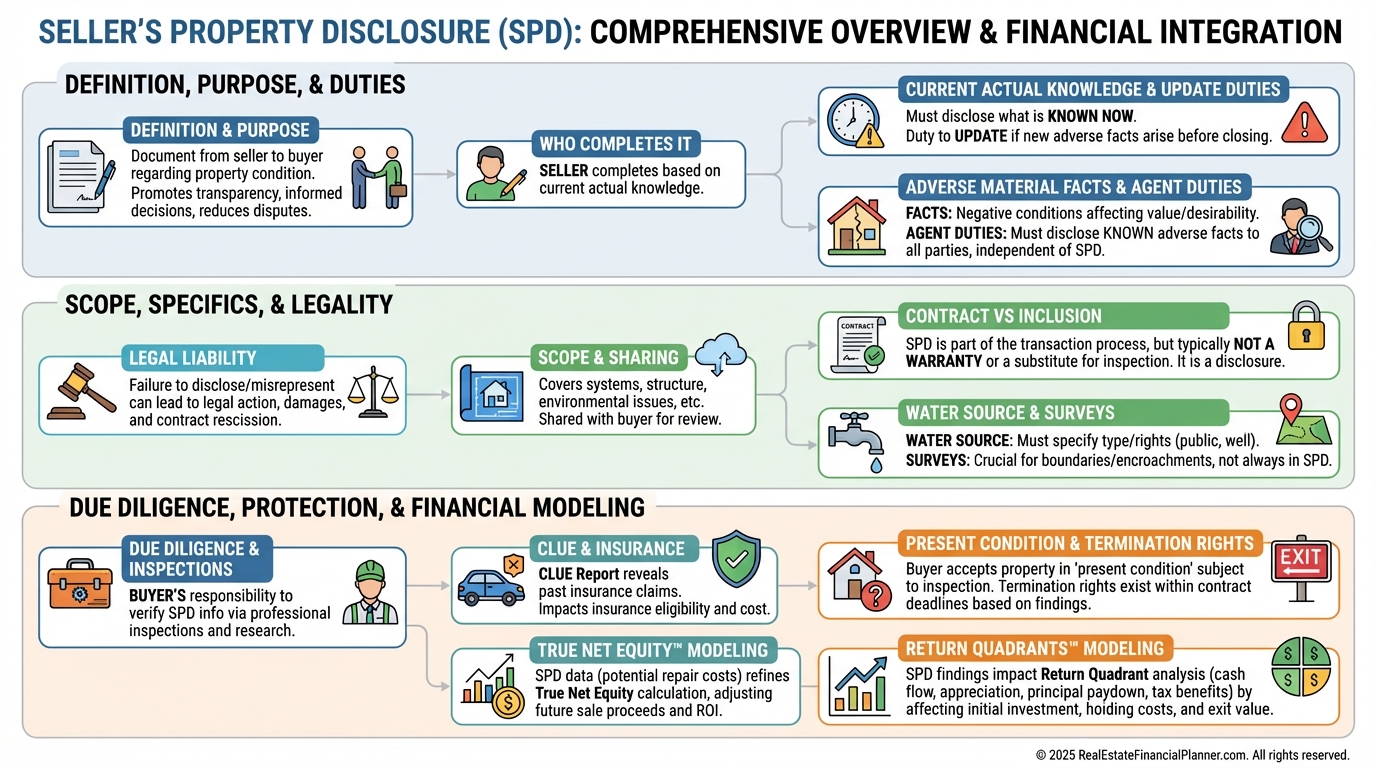

Why the Seller’s Property Disclosure Matters

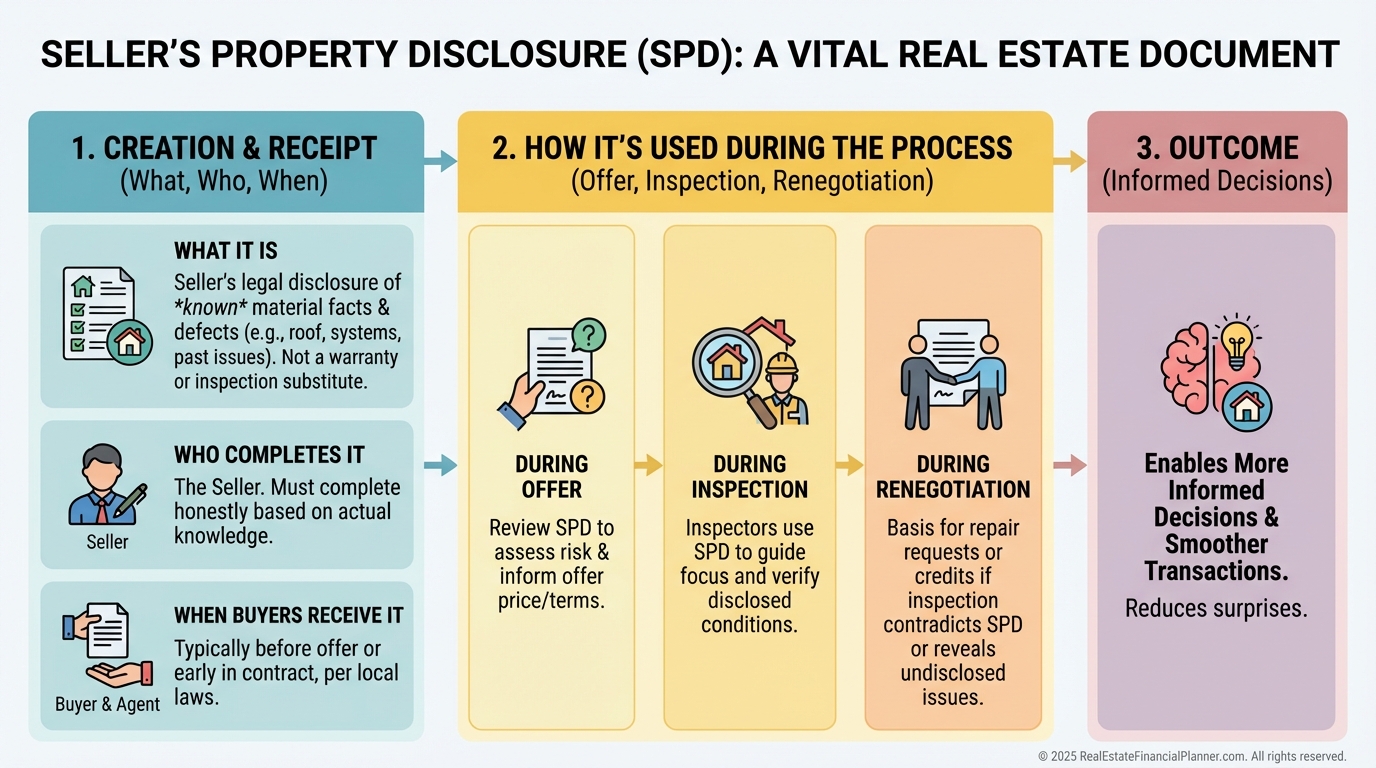

When I help clients buy, I treat the Seller’s Property Disclosure (SPD) as a risk map, not a brochure.

It’s a seller-prepared snapshot of what they know today, and it directly influences pricing, terms, and future CapEx.

Local rules vary by state and association.

Your agent will bring you the correct form and deadlines in your market.

Who Completes It (And Why That Protects You)

The seller fills it out, not the broker.

They have current, actual knowledge of leaks, repairs, claims, and quirks the agent can’t certify.

When I rebuilt after bankruptcy, I stopped relying on third-party “assurances.”

I wanted the seller on record, in writing, in their own words.

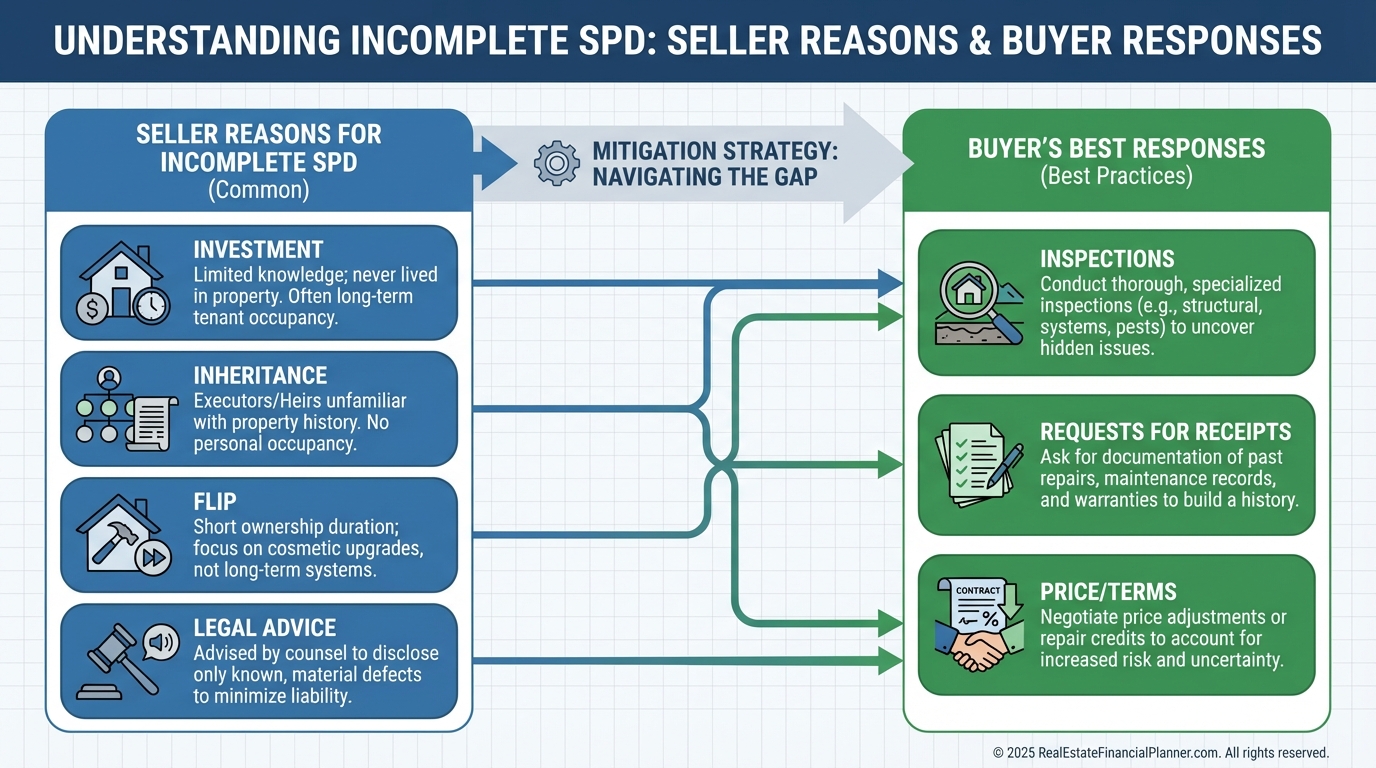

When Sellers Don’t Provide One

Sometimes you get a line through the form with “did not live in property.”

Common reasons include investment ownership, inheritance, or a recent flip.

Some lawyers advise against filling it out, while others argue disclosure reduces liability.

In practice, very few owners know nothing about a property they held.

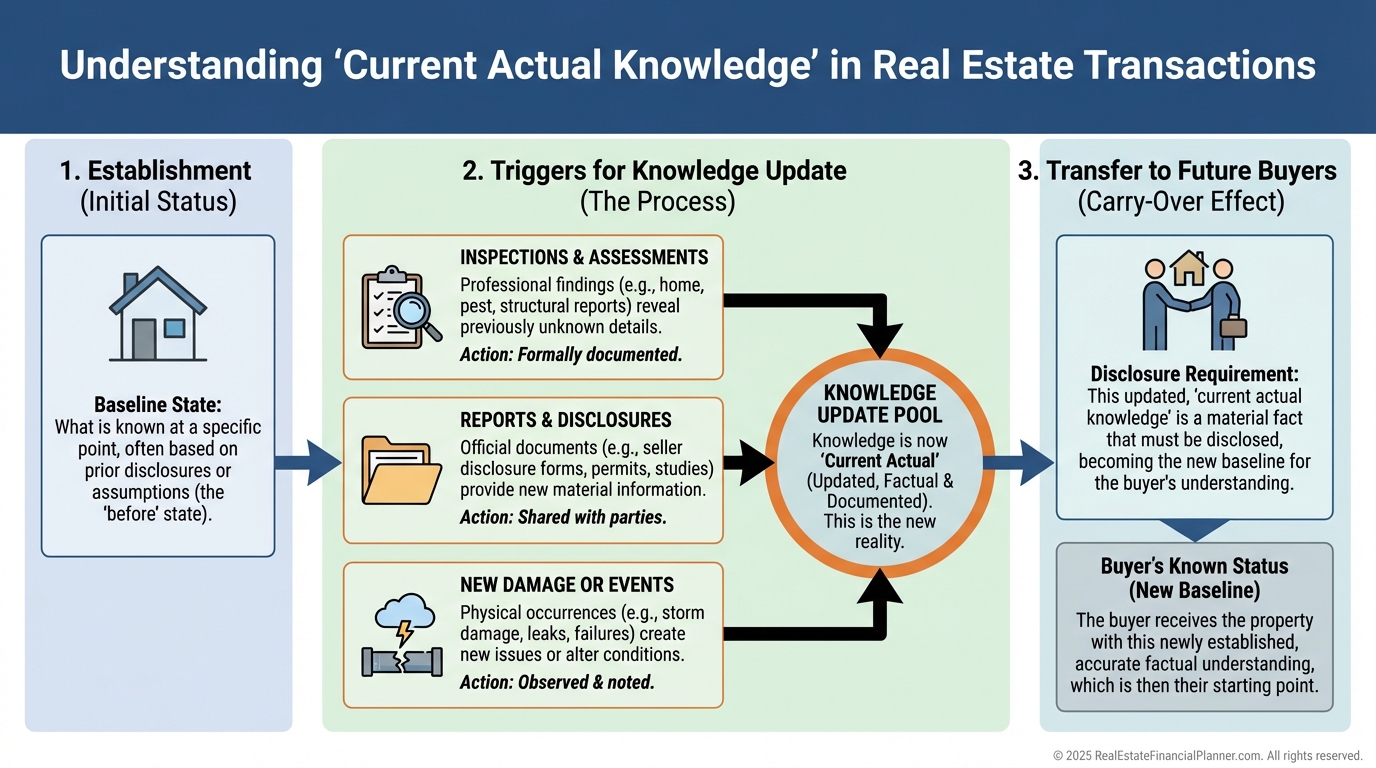

Current Actual Knowledge and Updates

SPDs speak to the seller’s current actual knowledge on the day they sign.

If new facts emerge, they should update and disclose.

If your inspection reveals a foundation issue and you share the report, the seller now knows.

They must disclose it to the next buyer, which sharpens your leverage today.

Legal Liability and Why Transparency Wins

Failing to disclose a known material defect can create legal liability.

Courts can award damages, order repairs, or unwind the deal entirely.

When I coach sellers, I advise complete candor to reduce risk.

When I coach buyers, I assume under-disclosure and verify with third-party pros.

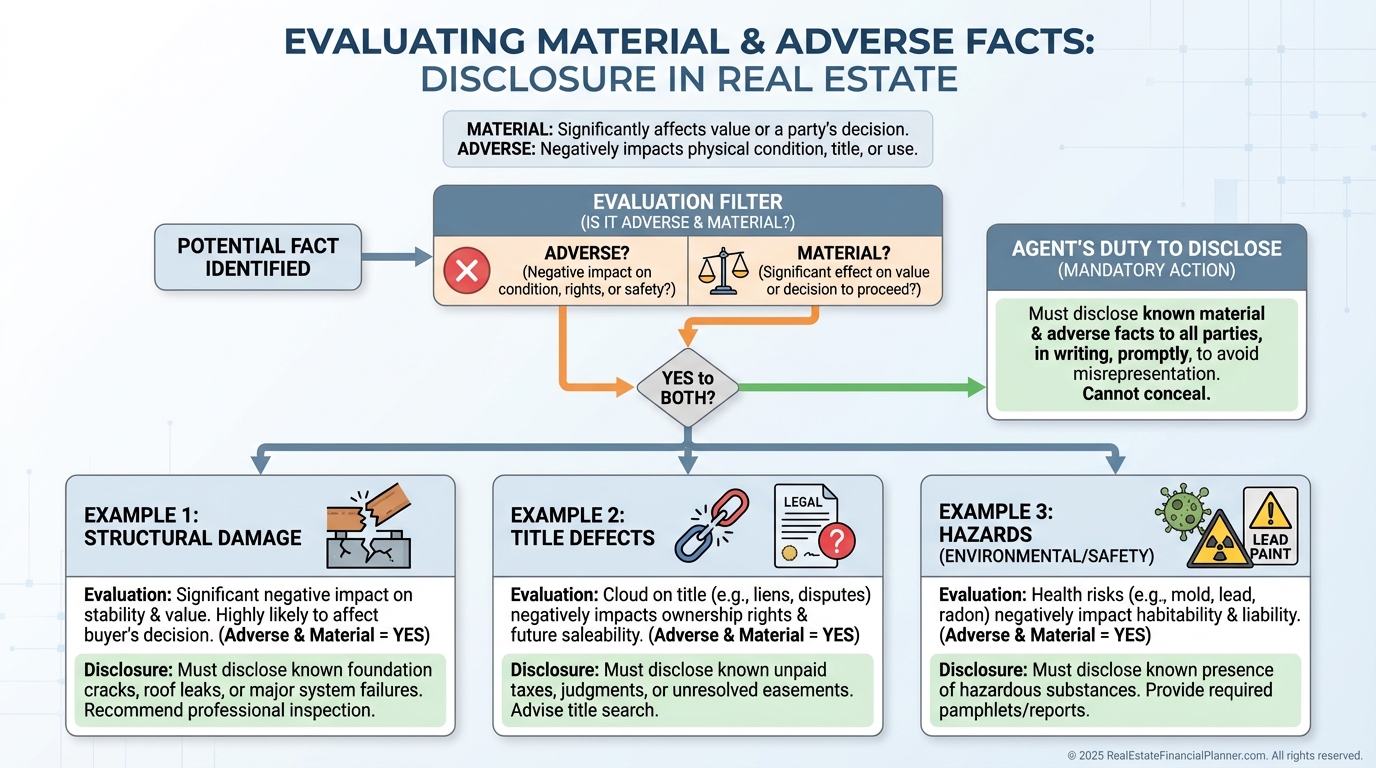

Not Just What’s on the Form

The SPD is not a “checklist loophole.”

Adverse material facts must be disclosed even if that exact line item doesn’t exist on the form.

If it matters to value, safety, habitability, or use, it belongs in the disclosure.

Agents Must Disclose Adverse Material Facts Too

Brokers must disclose adverse material facts they actually know.

This includes physical issues, title defects, and environmental hazards.

They are not required to disclose facts they don’t know or stigmas barred by state law.

What Counts as an Adverse Material Fact

Ask two questions: is it material and is it adverse.

Material means a reasonable person would want to know to decide or negotiate.

Adverse means it negatively affects a party’s position, value, or risk.

Scope: It’s About This Property or Unit

Generally, the SPD covers the specific property or unit.

Events in other units or buildings are usually outside scope, with narrow exceptions.

If it directly affects this property’s value or safety, it belongs.

Sharing the SPD

Most forms authorize the broker to share the SPD with prospective buyers.

Assume anything you write can be seen by the next buyer.

That’s one reason honest disclosure is the safest path for sellers.

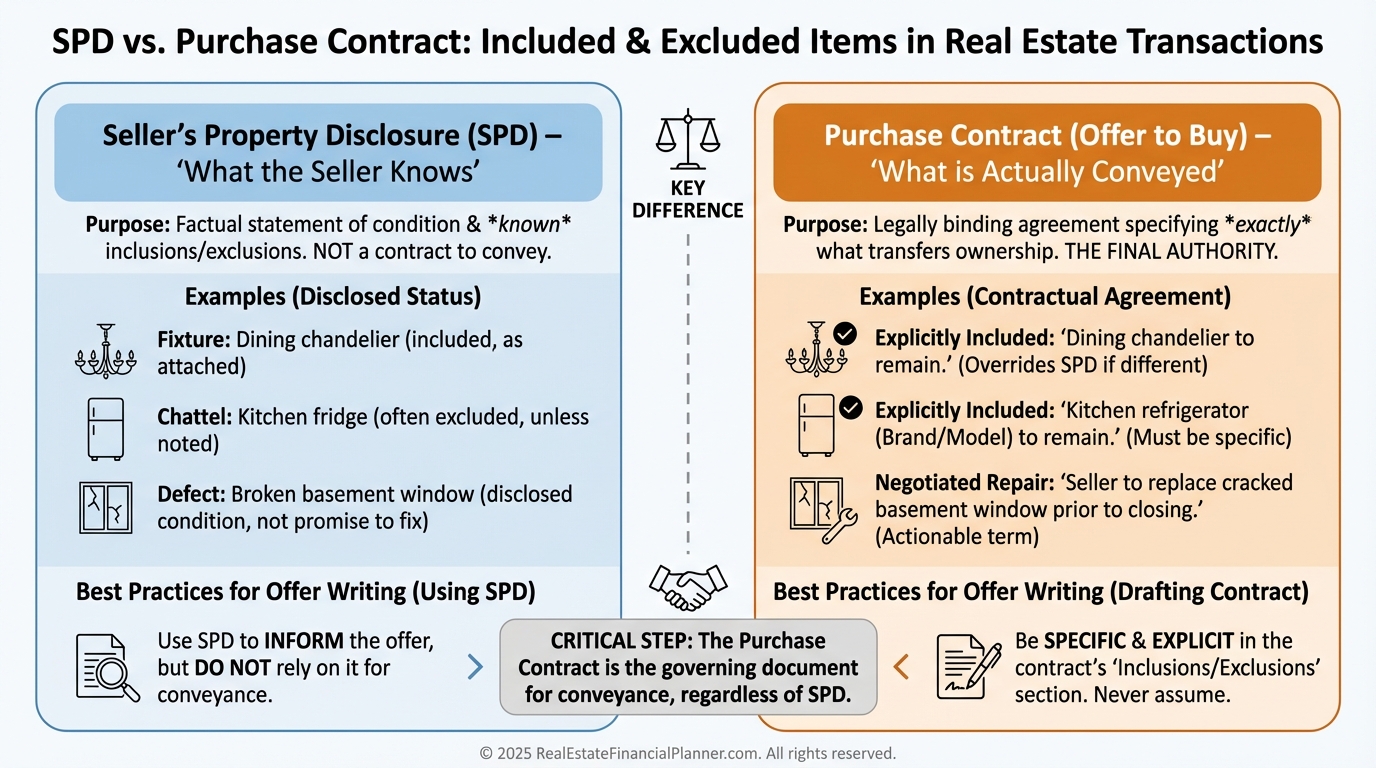

The SPD Doesn’t Decide What’s Included

The contract, not the SPD, controls what conveys.

If there’s a hot tub on the SPD, it still may be excluded unless the contract includes it.

When I draft offers, I mirror the inclusion language to remove ambiguity.

Water Source Matters

Many SPDs require disclosure of water source or attach a Source of Water Addendum.

Water rights, service reliability, and quality impact habitability, insurance, and value.

For rural or well properties, I request flow tests, potability, and well logs.

Brokers Don’t Warrant the SPD

Brokers don’t guarantee the SPD’s accuracy.

It’s not a substitute for inspections, testing, or specialized evaluations.

I budget and schedule due diligence as if the form could be incomplete.

Bold Advisory Sections Exist for a Reason

SPDs often remind sellers and brokers that adverse material facts will be disclosed.

Expect that structural, soil, environmental, or code issues come to light.

Plan your analysis with that transparency in mind.

You Still Have to Inspect

An SPD does not replace inspections.

Order whole-home, sewer scope, roof, radon, mold, pest, and any specialized tests the property warrants.

Use the SPD as a map of where to push deeper.

Sellers Don’t Have a Duty to Inspect for You

Sellers must disclose what they actually know.

They are not required to investigate to find problems they don’t know exist.

That’s your role with pros you hire.

Get More Information and Expert Advice

Call local, state, and federal agencies when needed.

Verify permits, zoning, floodplain maps, soils, and environmental data.

When a disclosure seems unusual, I loop in an attorney or CPA before going firm.

Get a Survey When Lines Are Fuzzy

Boundaries, fences, driveways, and hedges can create disputes.

A survey clarifies encroachments and easements.

It’s cheaper than litigating later.

No Seller Warranty of Fitness

SPDs don’t promise suitability for your intended use.

Align your business plan with what’s actually permitted.

Buyer Acknowledgment

You’ll sign to acknowledge receipt, not agreement.

It proves transparency and starts the clock for certain deadlines.

Note the dates and integrate them into your contract timeline.

When You Typically Receive the SPD

Late delivery can be a seller default, depending on your contract.

I ask for prior SPDs from older listings for pattern recognition.

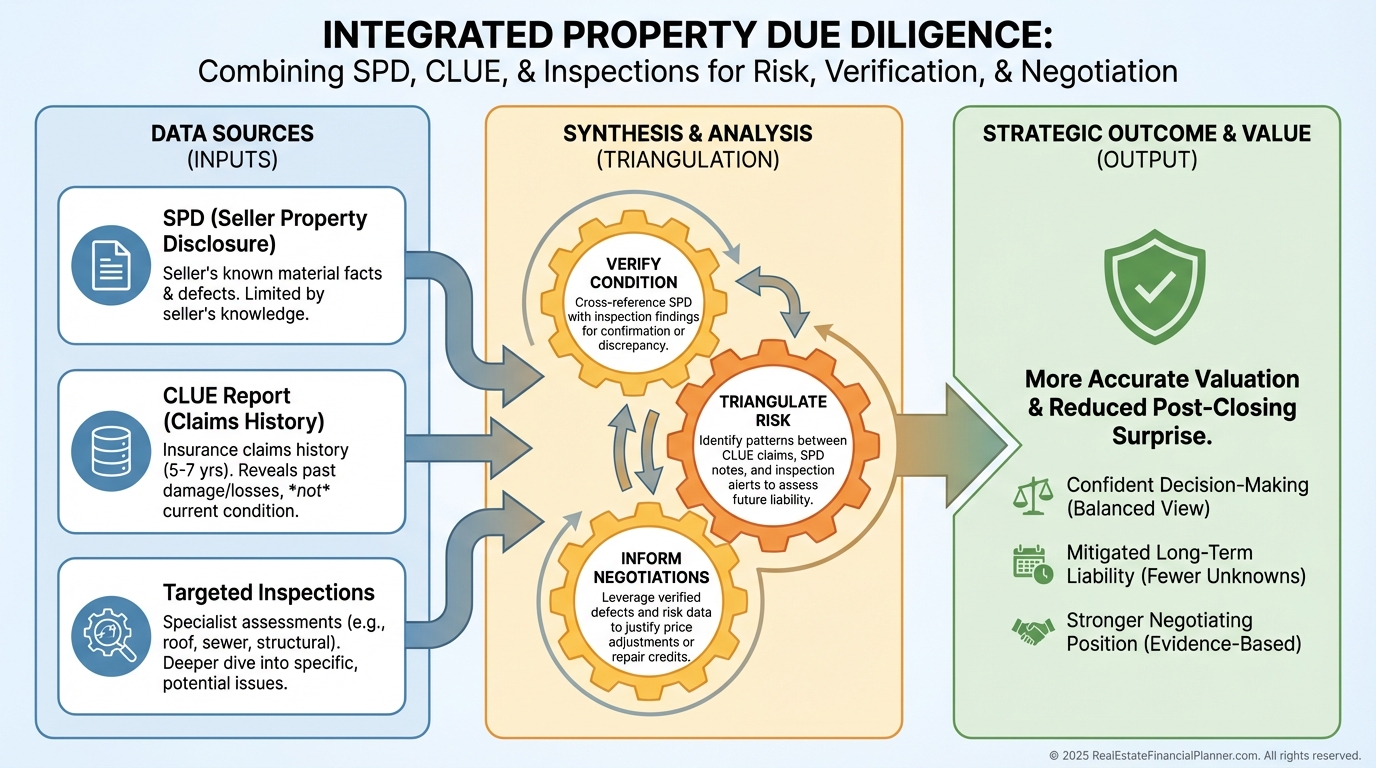

Using the SPD for Insurance and CLUE

Share the SPD with your insurance agent to price risk.

Ask for a CLUE report to see claim history and related repairs.

I confirm repair documentation matches CLUE entries and dates.

Using the SPD During Inspection

Bring the SPD and CLUE to the inspection.

Tell your inspector to prioritize disclosed hotspots and related systems.

This is how you turn anecdotes into evidence.

•

Fixed and durable: note warranty, date, and installer.

•

Fixed but fragile: plan monitoring and future CapEx.

•

Not fixed: get bids and timelines.

•

Unknown: order specialist evaluations.

Contract Duties: Latent Defects, Updates, and Rights

Contracts typically require sellers to disclose known adverse material facts and to update if new ones emerge.

If new adverse facts arrive, buyers often can terminate within a stated window or through closing.

“As Is” doesn’t erase the duty to disclose known defects.

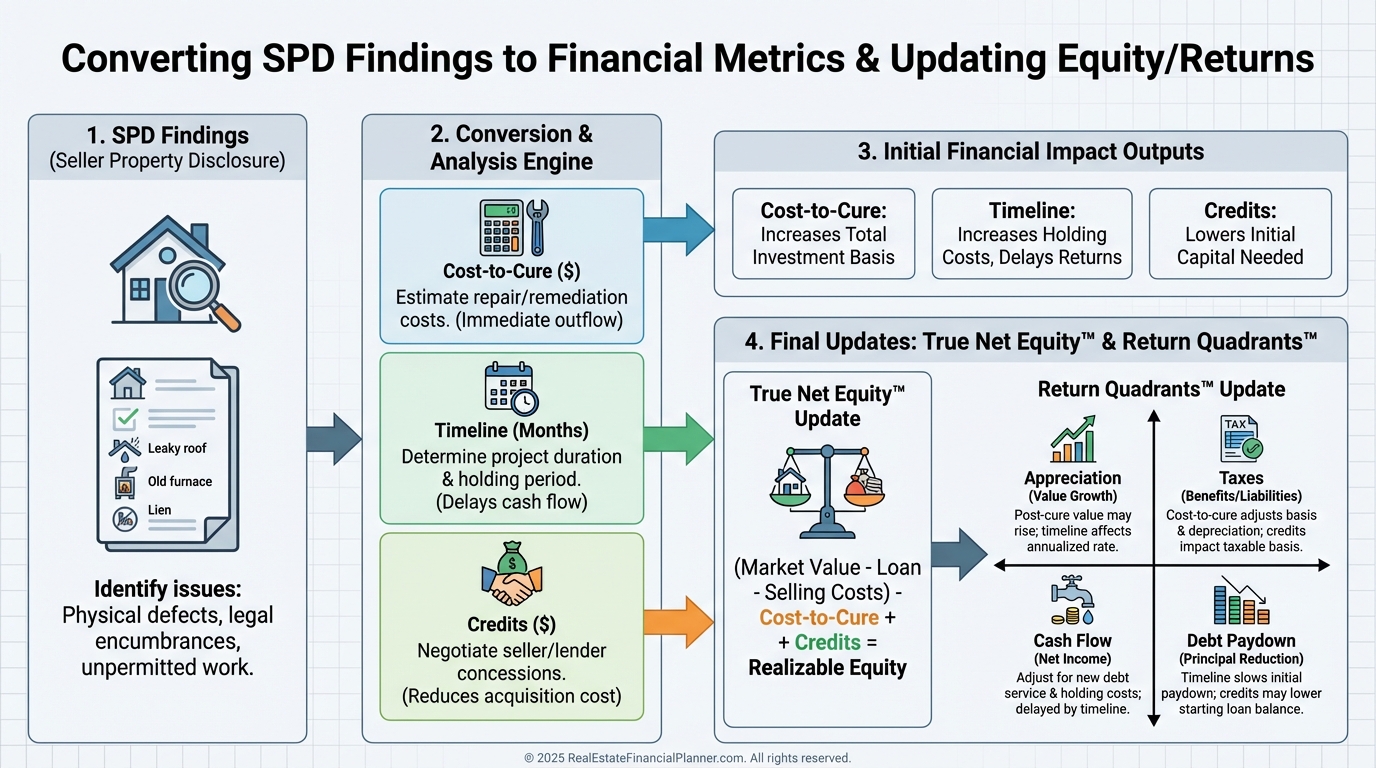

Turning the SPD into Numbers Investors Can Use

I translate SPD items into dollars and timeline.

Then I update my True Net Equity™ and Return Quadrants™ for the deal.

True Net Equity™ adjusts your equity for cost-to-cure, seller credits, and time-to-complete.

Return Quadrants™ shifts as CapEx, rent-ready delays, and reserves change cash flow, appreciation risk, and taxes.

When an SPD reveals a sewer line near end-of-life, I add replacement cost, vacancy for work, and contingency.

If the seller credits the repair at closing, I model the credit versus doing the work post-close and reprice my risk-adjusted returns.

A Note for Nomad™ Buyers

Owner-occupants who plan to convert to rentals later need habitability nailed day one.

Use the SPD to confirm safety items, insurance readiness, and lender-required repairs before move-in.

Then underwrite the CapEx curve for the first rental year.

How I Coach Clients to Use the SPD

Read it once for facts, then again for what’s missing.

Corroborate with CLUE, permits, invoices, and inspector findings.

Convert every material item into a dollar, a date, and a risk rating, then put it in your model.

If risks expand, adjust price, terms, credits, or walk.

That’s how you buy eyes-wide-open and protect returns.