Capitalization Rates: The Metric That Decides Whether You Get Rich or Overpay

Learn about Capitalization Rates for real estate investing.

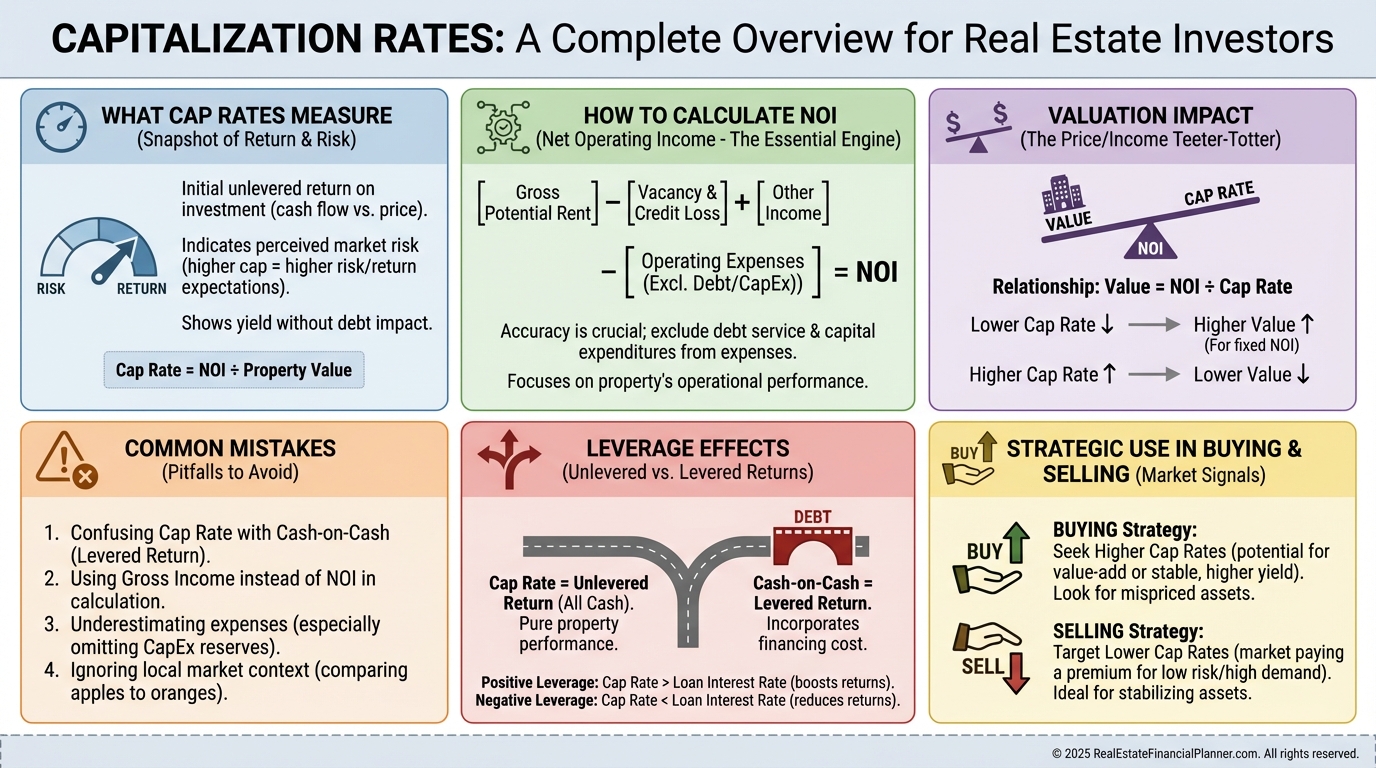

Capitalization Rates Overview

When I help clients analyze rental properties, capitalization rates are one of the first numbers I look at.

Not because cap rates predict the future, but because they expose bad assumptions immediately.

I’ve seen investors lose hundreds of thousands of dollars by misunderstanding this one metric. I’ve also seen cap rates save people from deals that looked “fine” on the surface and disastrous underneath.

After rebuilding my portfolio following bankruptcy, I stopped trusting gut feelings. Cap rates forced discipline. They still do.

What Capitalization Rates Actually Measure

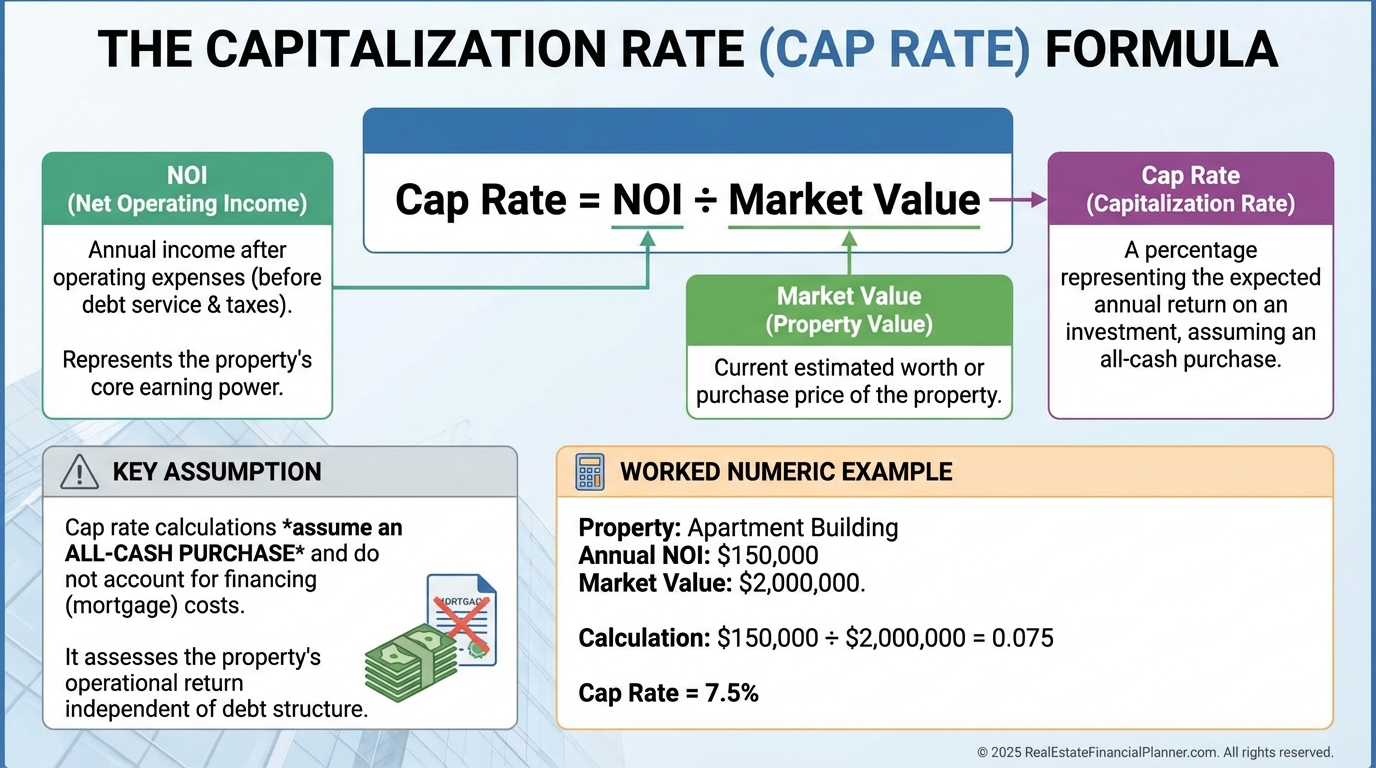

A capitalization rate is simple in theory.

Cap Rate = Net Operating Income ÷ Market Value.

That’s it.

It tells you what return the property produces if you bought it all-cash, with no loans and no leverage.

If a property produces $35,000 in annual net operating income and is worth $500,000, the cap rate is seven percent.

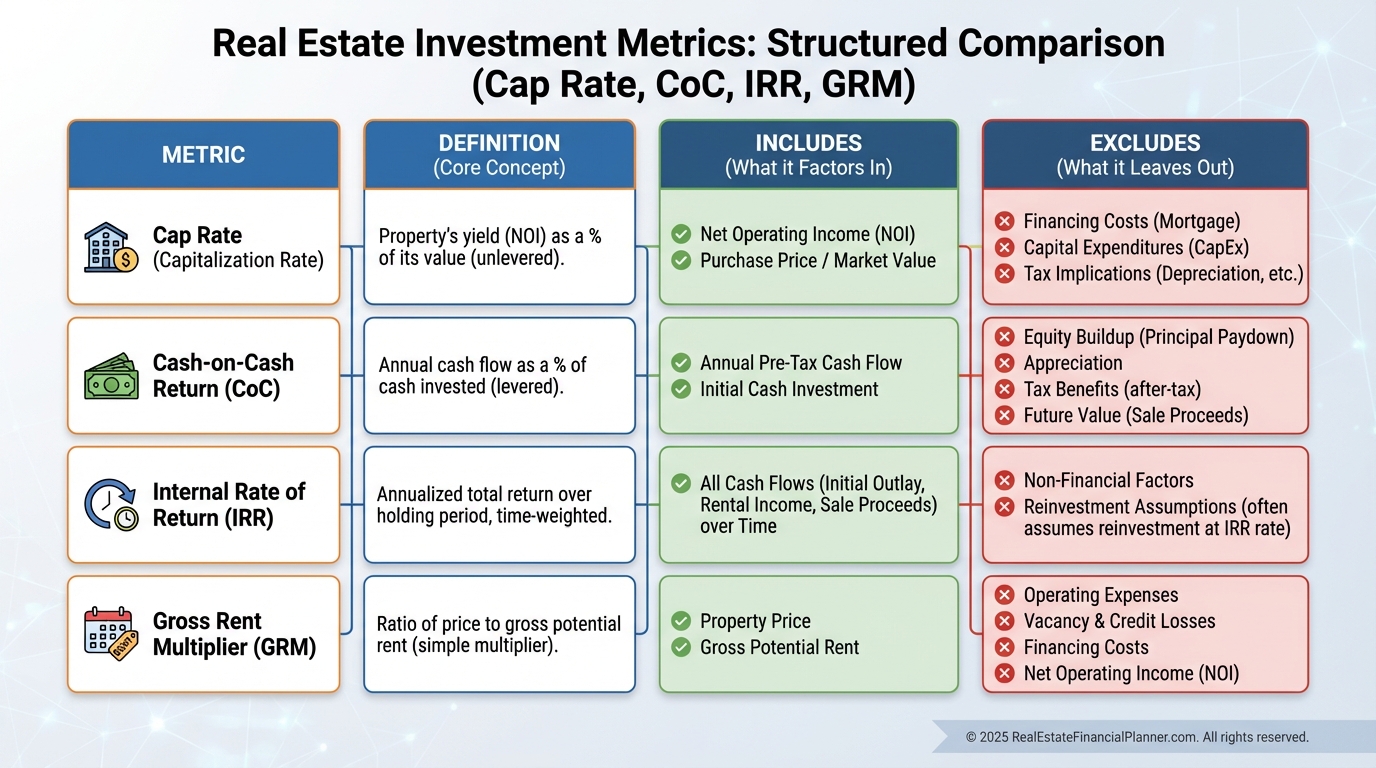

Cap rates are not your return.

They are the property’s return.

That distinction matters more than most investors realize.

Cap Rate Formula Explained

Why Cap Rates Are Not Your Actual Returns

When someone tells me, “This deal has an eight percent cap rate,” my next question is always the same.

“At what price, using what expenses?”

Cap rates ignore financing entirely. That’s the point.

They strip away loan terms, down payments, interest rates, and personal tax situations so you can compare properties objectively.

Cap rate answers one question only:

“How strong is this property on its own?”

This is why I treat cap rates as a screening tool, not a decision tool.

Cap Rate vs Other Return Metrics

The One Place Most Investors Get Cap Rates Wrong

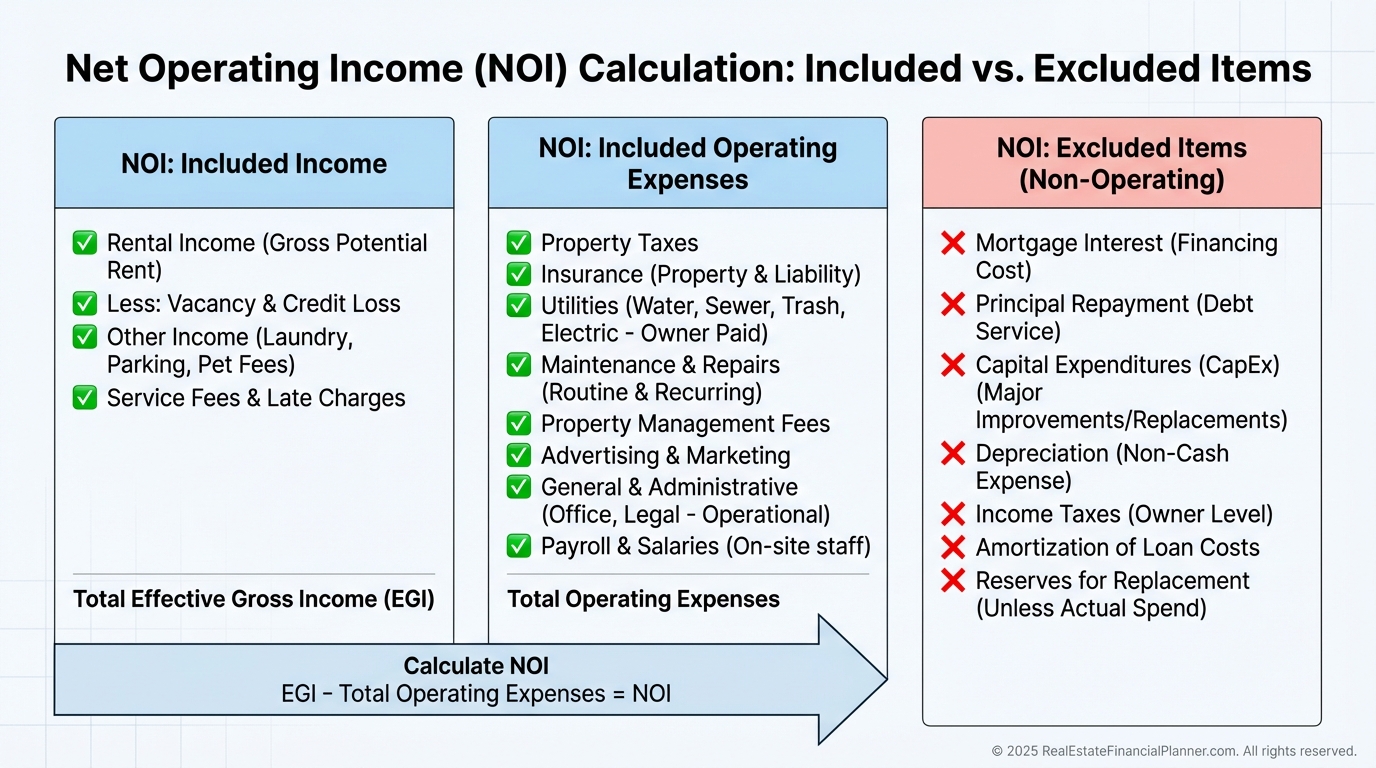

Net operating income is where deals go to die.

Almost every bad cap rate calculation I see comes from a fantasy version of NOI.

NOI includes all income the property actually produces.

NOI subtracts all operating expenses required to keep it producing.

NOI does not include mortgage payments, depreciation, income taxes, or capital improvements.

When investors inflate NOI, they inflate cap rates. That leads to overpaying.

Every time.

What Belongs in NOI (And What Doesn’t)

A Real Cap Rate Calculation Example

I once reviewed a triplex where the seller advertised an “eight percent cap rate.”

The rents looked decent. The price looked reasonable. The math did not.

Gross rent was $3,600 per month. Expenses were conveniently understated. Management was “optional.” Reserves were ignored.

After adding realistic expenses and reserves, the true cap rate landed just under four percent.

The seller wasn’t lying. They were just wrong.

That mistake alone would have cost the buyer six figures over time.

How Capitalization Rates Drive Property Values

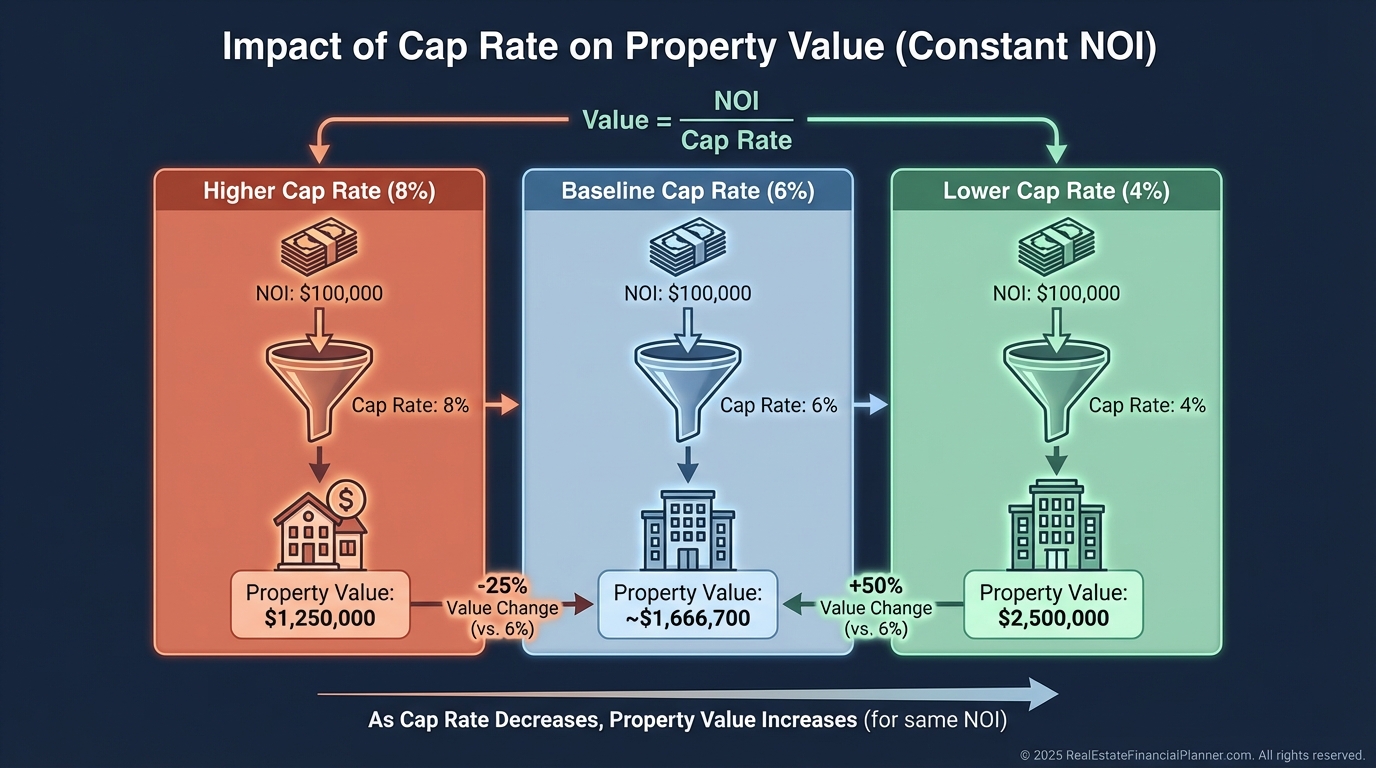

Cap rates and values move in opposite directions.

Value = NOI ÷ Cap Rate.

That equation explains why small cap rate changes create massive swings in value.

When cap rates compress, values explode.

When cap rates expand, values collapse.

This is why I always stress-test deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™. A one percent change in cap rates can erase years of appreciation.

Cap Rate Changes and Property Value

Cap Rates, Interest Rates, and Leverage Risk

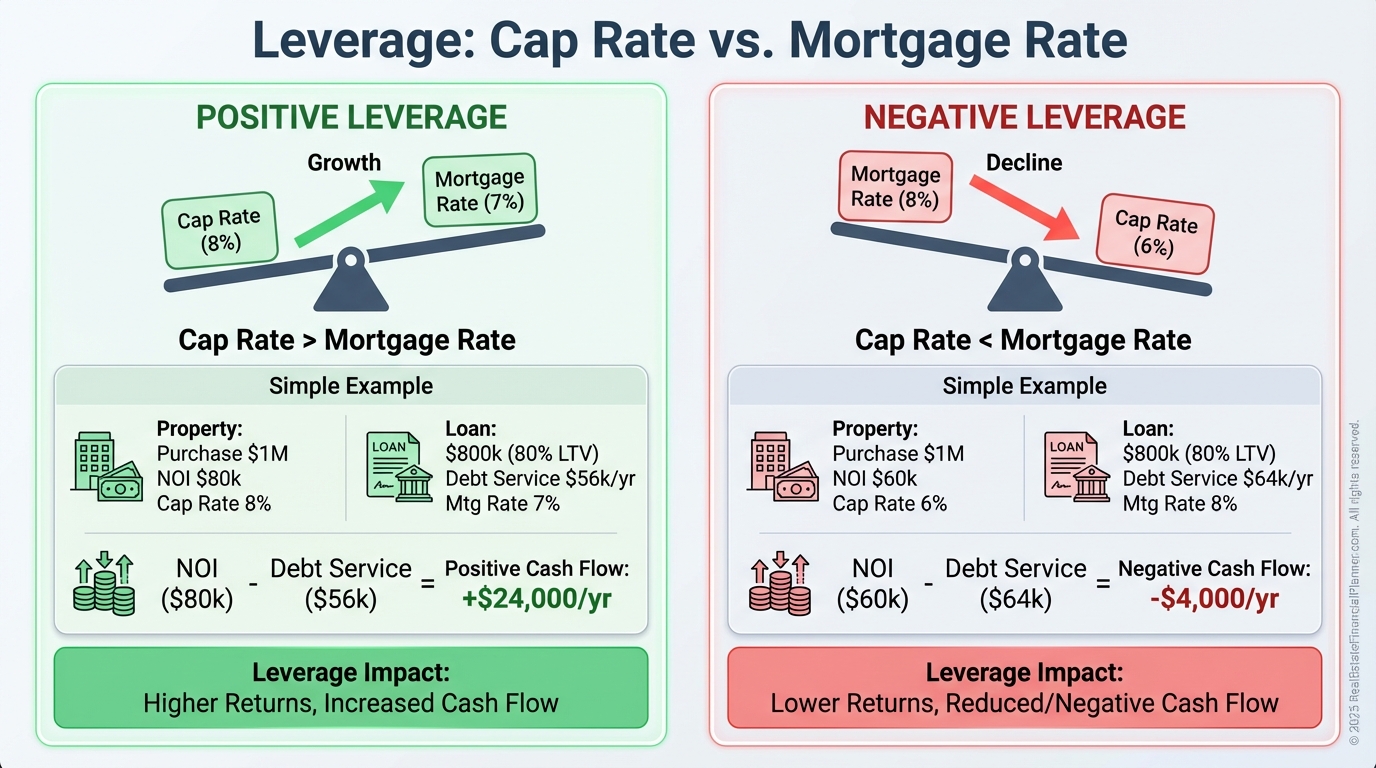

Cap rates don’t move independently of interest rates, even though they’re not perfectly linked.

When borrowing costs rise, investors demand higher cap rates.

When borrowing costs fall, cap rates tend to compress.

The spread between your mortgage rate and the cap rate determines whether leverage helps or hurts.

Positive leverage occurs when the property earns more than the cost of debt.

Negative leverage occurs when it doesn’t.

I’ve seen investors buy positive-cap-rate properties that still lose money every month because the financing was wrong.

Positive vs Negative Leverage

The Most Common Cap Rate Mistakes I See

These mistakes show up constantly in deal reviews.

Investors use asking price instead of true market value.

They ignore management because they plan to self-manage.

They forget reserves because nothing has broken yet.

They compare single-family homes to apartment buildings.

They include loan payments in operating expenses.

Every one of these errors pushes cap rates in the wrong direction.

Cap rates are only useful if they are honest.

Using Cap Rates Strategically, Not Emotionally

Cap rates help you decide where to focus.

High cap rate markets often favor cash flow.

Low cap rate markets often favor appreciation and equity growth.

I track cap rates across my portfolio to decide when to hold, refinance, or sell.

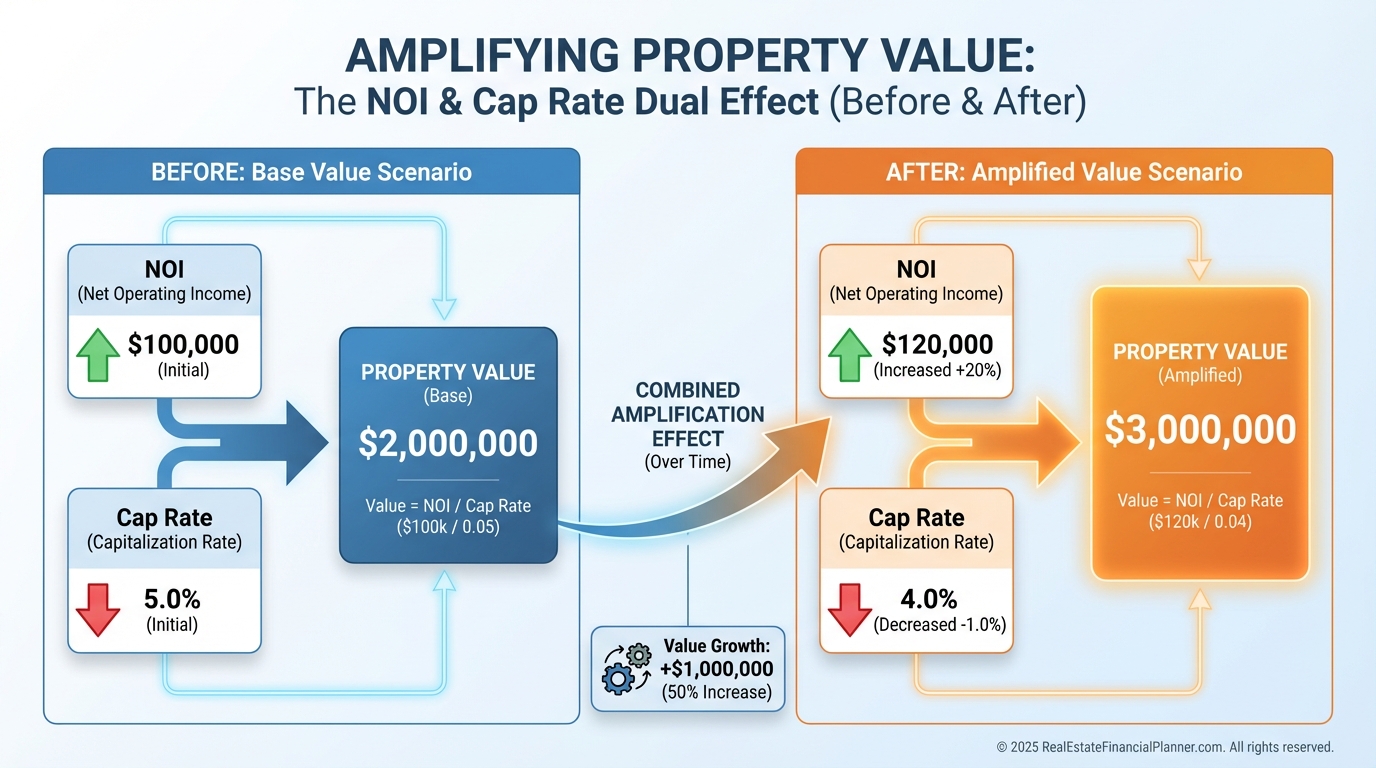

When cap rates compress after NOI improvements, exits become attractive.

When cap rates expand, patient buyers gain leverage.

The most powerful deals combine NOI growth with cap rate compression. That’s how value-add investors manufacture equity instead of waiting for the market.

Value Creation Through NOI Growth and Cap Compression

Why Cap Rates Matter More Than Ever

Cap rates force you to confront reality.

They don’t care about your optimism.

They don’t care about seller stories.

They don’t care about appreciation hopes.

They care about income, expenses, and price.

When I rebuilt after bankruptcy, cap rates became my guardrail. They still protect me today.

If you understand capitalization rates, you buy better.

If you ignore them, you gamble.

And in real estate, gambling is expensive.