Equity Stripping: How Smart Investors Unlock Trapped Wealth Without Selling

Learn about Equity Stripping for real estate investing.

Most real estate investors spend their time hunting for the next deal.

When I help clients review their portfolios, the real opportunity is almost always hiding in plain sight.

It’s the equity they already own and aren’t using.

I’ve seen investors with seven-figure net worths struggle to buy their next property because all their wealth is trapped inside paid-down rentals. On paper, they look rich. In practice, they’re illiquid.

That’s where equity stripping comes in.

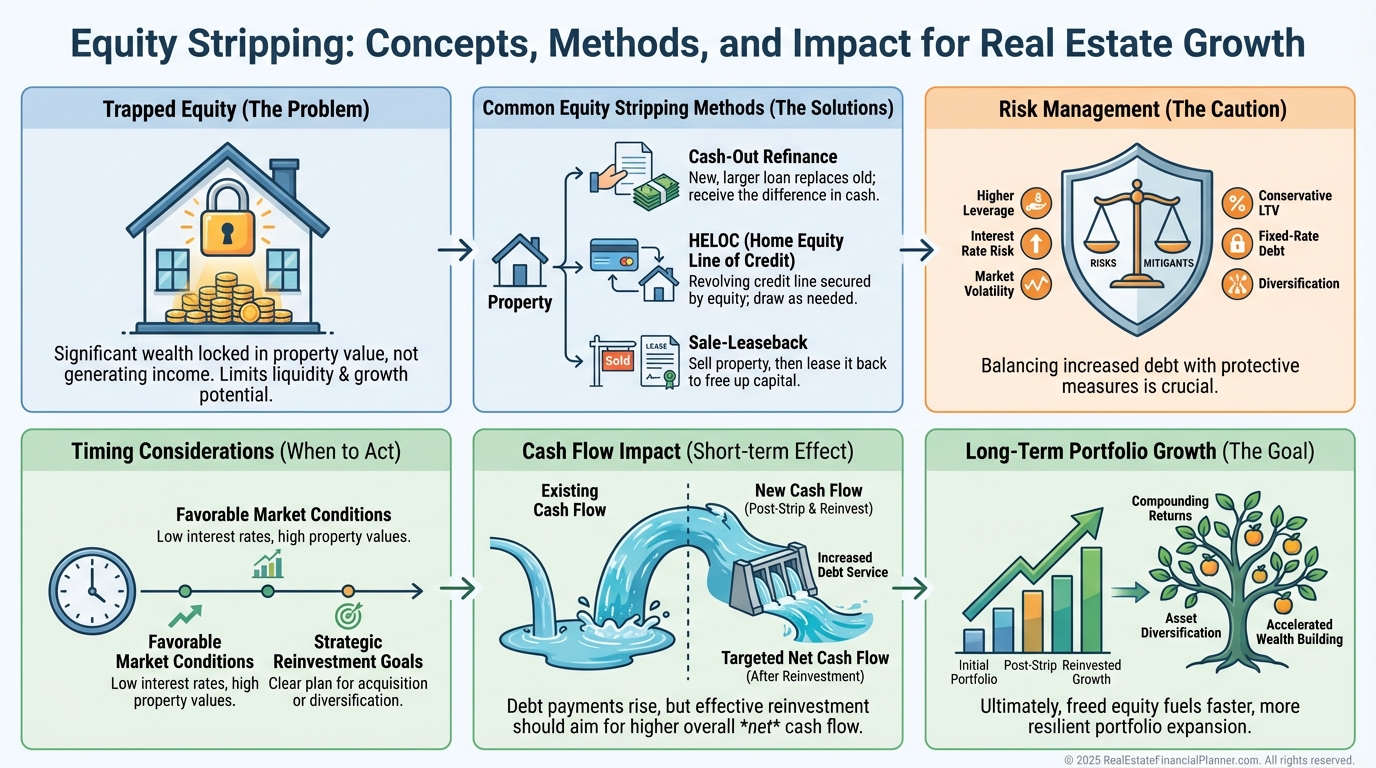

Equity stripping is the deliberate process of converting illiquid real estate equity into deployable capital while you keep ownership of the property.

Done correctly, it accelerates portfolio growth. Done carelessly, it magnifies risk and destroys cash flow.

When I rebuilt my own portfolio after bankruptcy, I treated equity as something that had to work for me, not something that just looked good on a net worth statement.

What Equity Stripping Really Means

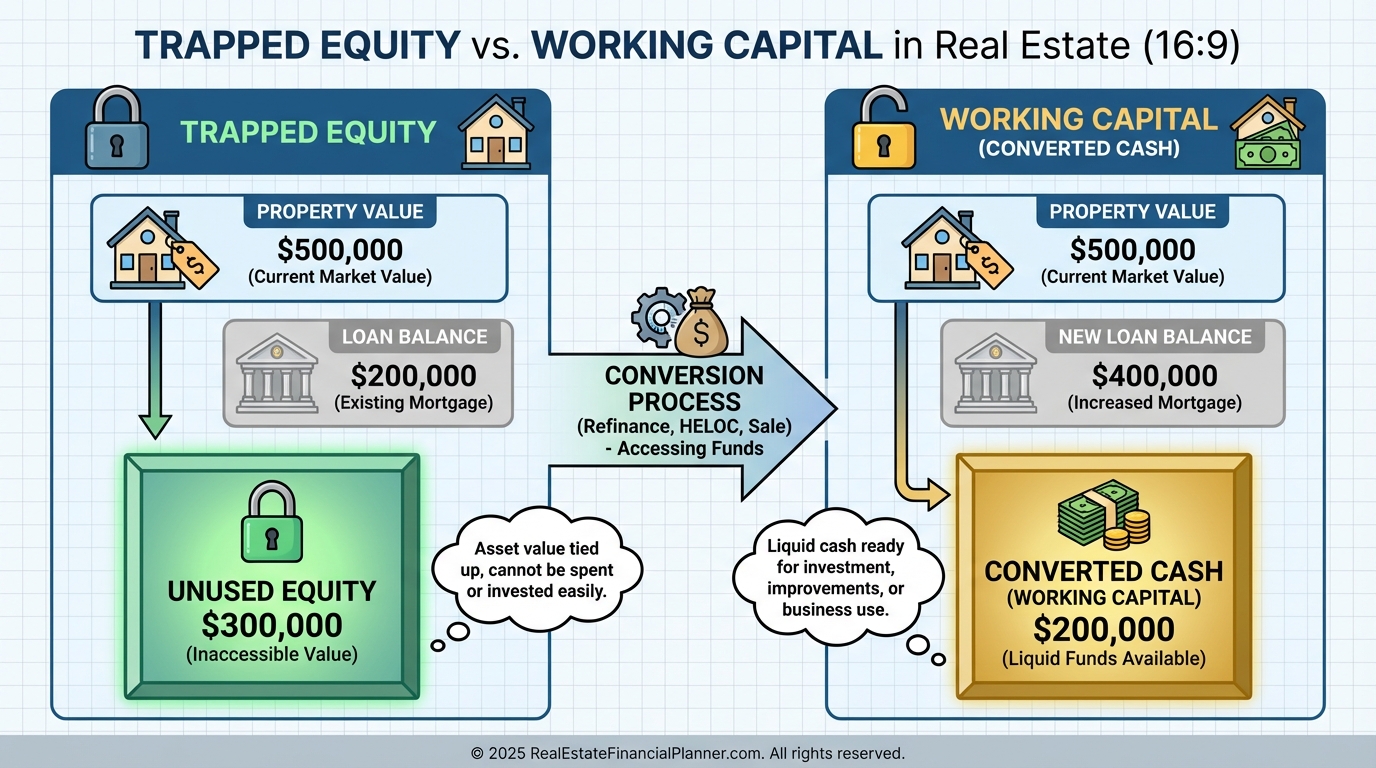

Equity is not money you can spend.

Equity is potential.

Until you convert it into usable capital, it does nothing for your lifestyle, your portfolio growth, or your resilience.

A $500,000 property with a $200,000 loan has $300,000 in equity, but that equity cannot fund another purchase, cover emergencies, or rebalance risk.

Equity stripping is how you activate that potential.

This is not about desperation.

The best time to strip equity is when you do not need it.

That’s when lenders offer better terms, and you can deploy capital intentionally instead of emotionally.

Common Myths That Keep Investors Stuck

When I walk investors through this concept, I hear the same fears repeatedly.

They usually sound like this.

“It’s too risky.”

Risk comes from poor execution, not leverage itself. Proper equity stripping often reduces overall risk by diversifying where your capital lives.

“It will kill my cash flow.”

That only happens when investors strip equity without modeling debt service, reserves, and downside scenarios.

“This is only for aggressive investors.”

In reality, conservative investors benefit the most because they use equity stripping strategically and sparingly.

I always remind clients that risk is not leverage. Risk is leverage without a plan.

The Main Equity Stripping Strategies

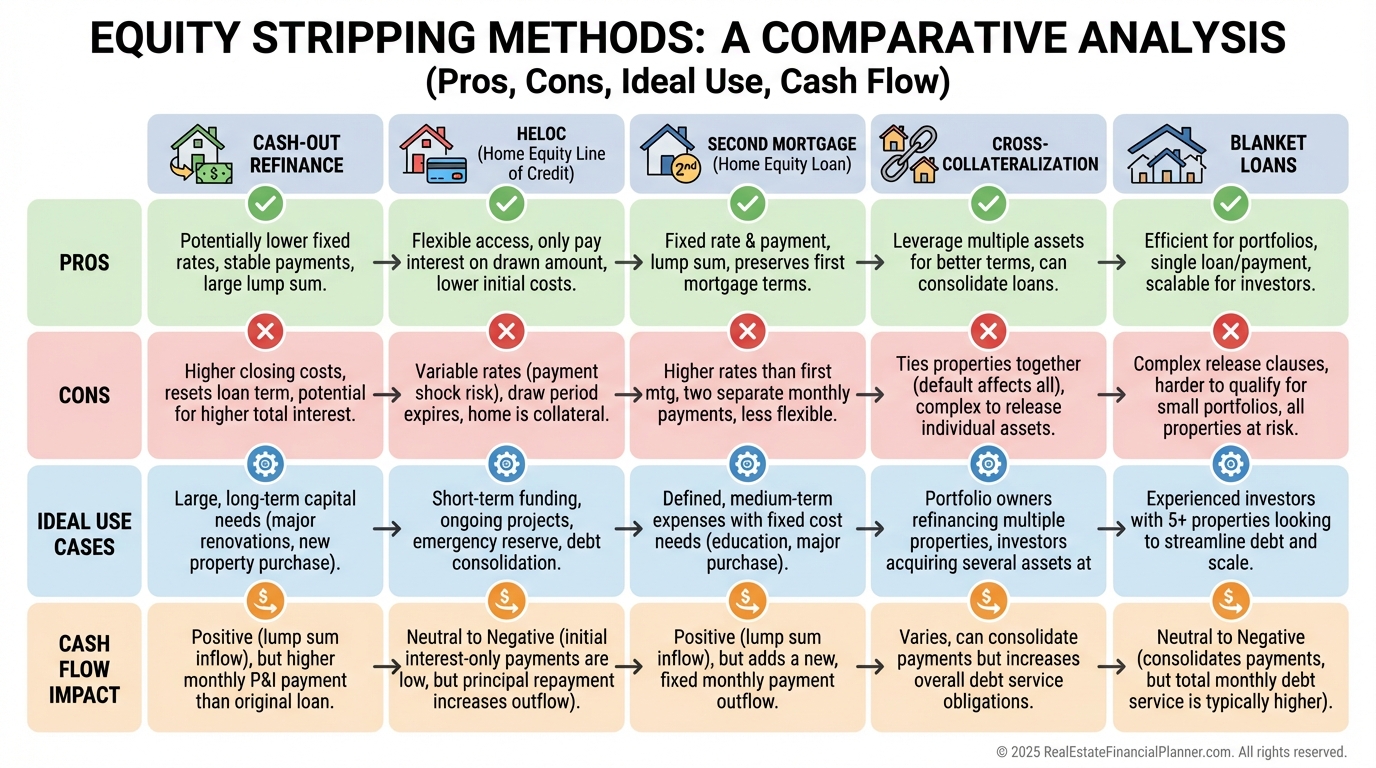

There is no single “best” equity stripping method.

Each one solves a different problem.

Cash-Out Refinance

You replace an existing loan with a larger one and pull out the difference. This works best when rates are favorable and the property has strong cash flow margins.

HELOC or Portfolio Line of Credit

This gives you flexibility. You only pay interest on what you use, which is why I often see experienced investors use this for opportunistic deals.

Second Mortgages

You preserve an excellent first mortgage while layering additional debt. Higher rates, but better optionality.

Cross-Collateralization and Blanket Loans

Advanced tools for portfolio-level optimization. Banks like them because they reduce lender risk, but investors must understand the downside if one property underperforms.

When I model these in Real Estate Financial Planner™, I compare them using Return on Equity, Return on True Net Equity™, and long-term cash flow resilience.

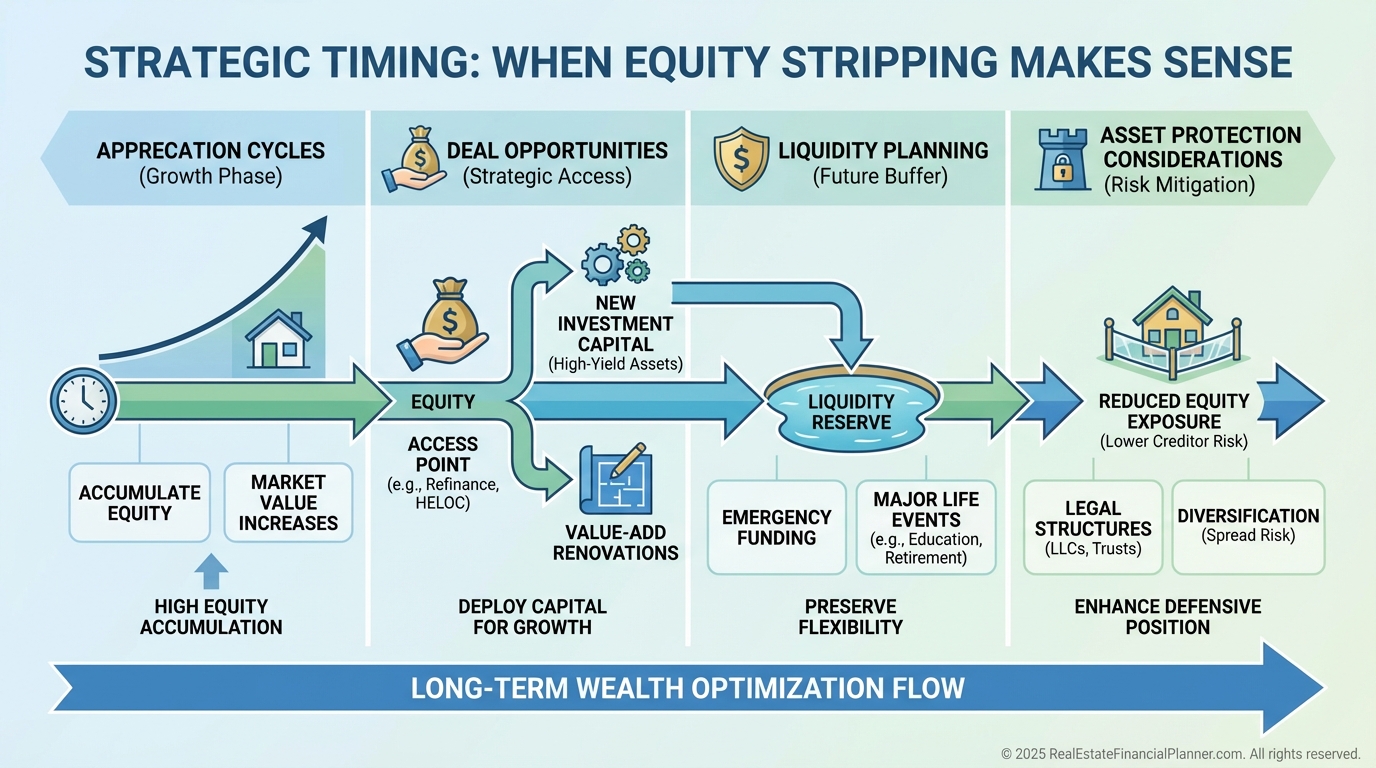

When Equity Stripping Makes Sense

Timing matters more than people realize.

Equity stripping works best when it is proactive, not reactive.

I encourage clients to consider equity stripping when:

Property values have appreciated meaningfully.

They have a specific reinvestment plan.

They want liquidity without triggering taxes.

They are improving asset protection by reducing visible equity.

The worst time to strip equity is when you are financially stressed. That’s when mistakes compound.

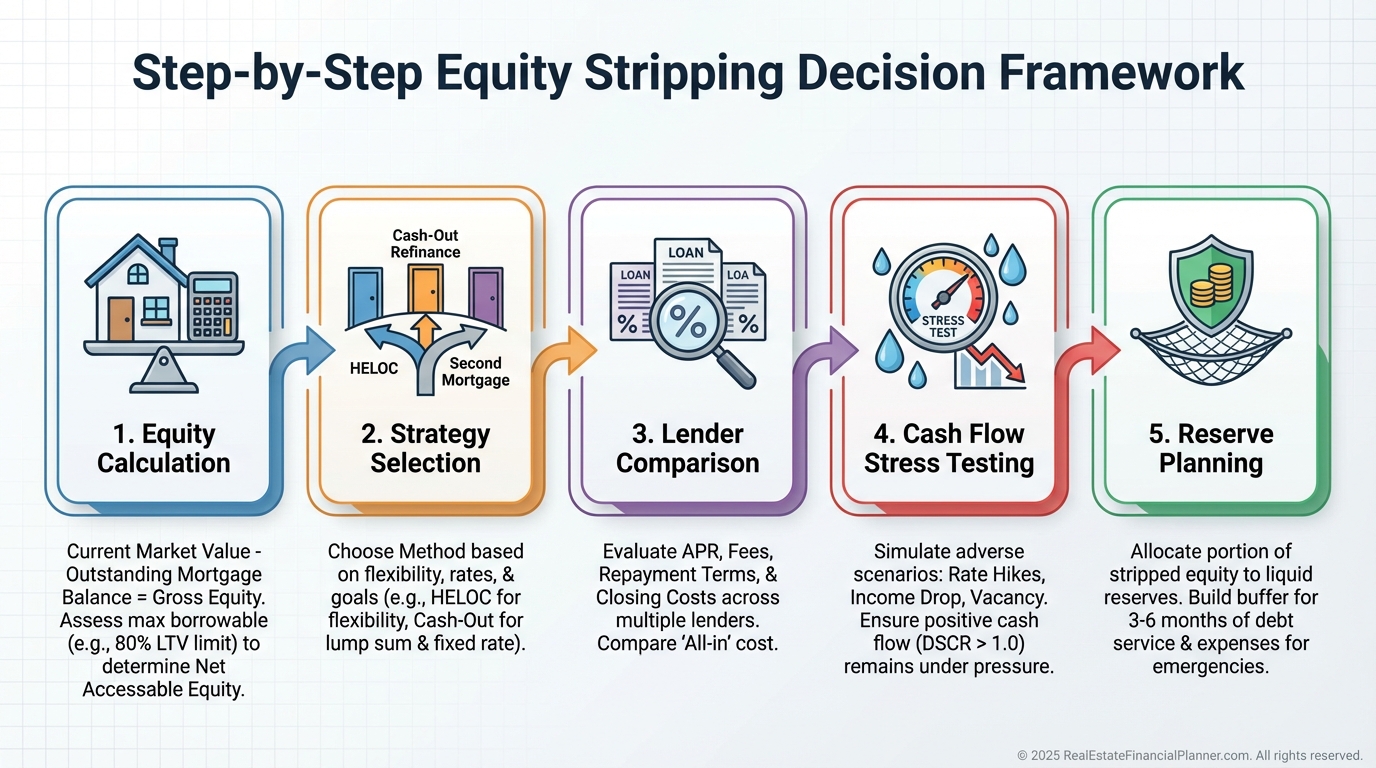

How I Walk Clients Through Implementation

I never start with the loan.

I start with the math.

First, we calculate True Net Equity™, not headline equity. That means accounting for selling costs, taxes, and friction.

Then we model:

New debt service.

Cash flow impact under stress scenarios.

Reserve requirements.

Exit flexibility if conditions change.

If the numbers do not work under conservative assumptions, we do not proceed.

Equity stripping should increase optionality, not reduce it.

The Risks Most Investors Underestimate

Leverage magnifies everything.

That includes mistakes.

The most common problems I see come from:

I generally prefer leaving at least 20–25 percent equity as a buffer unless the portfolio is exceptionally strong.

Real-World Example: Small Portfolio, Big Shift

One client owned a single rental with significant equity and modest cash flow.

On paper, it looked boring.

We used a conservative HELOC to access part of the equity and redeployed it into two additional properties with stronger cash flow.

The original property barely noticed the change. The portfolio, however, changed dramatically.

Cash flow increased. Optionality improved. Risk diversified.

That is what equity stripping should do.

Taxes and Long-Term Planning

Borrowed money is not income.

That is one of the most misunderstood advantages of equity stripping.

Loan proceeds are not taxable, interest is typically deductible on investment property, and depreciation continues unchanged.

However, equity decisions today affect options like future refinances, portfolio sales, and 1031 exchanges.

I always tell clients to treat equity stripping as part of a long-term plan, not a one-off tactic.

The Mistake That Costs the Most

The biggest mistake is doing nothing.

Trapped equity quietly drags on portfolio performance.

Equity that never gets deployed never compounds.

Equity stripping, when done conservatively and intentionally, turns real estate from a passive holding into an active wealth engine.

Final Thoughts

Equity stripping is not about being aggressive.

It is about being deliberate.

Your properties are not just income-producing assets. They are financial tools.

When you understand how to activate equity without sacrificing stability, your portfolio stops growing linearly and starts growing strategically.

The difference is not the number of properties you own.

It is how intelligently your equity works for you.