Bond for Deed Explained: How Smart Investors Create Win-Win Seller Financing Deals

Learn about Bond for Deed for real estate investing.

Bond for deed is one of those strategies that looks simple on the surface and gets dangerous fast if you don’t understand the details.

When I help clients evaluate creative financing deals, bond for deed is always on the short list—but only when it’s structured deliberately and analyzed correctly.

Let’s break it down the way I walk investors through it.

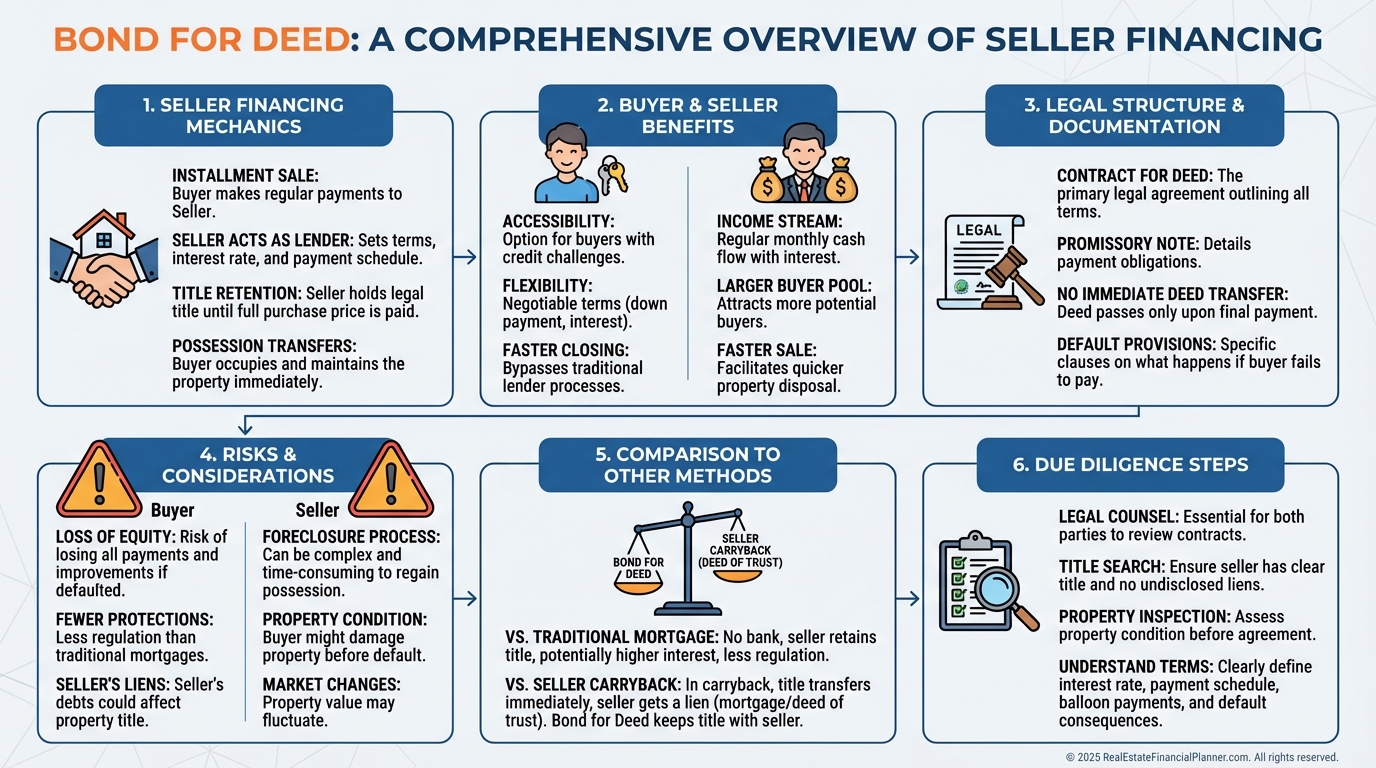

Understanding Bond for Deed Fundamentals

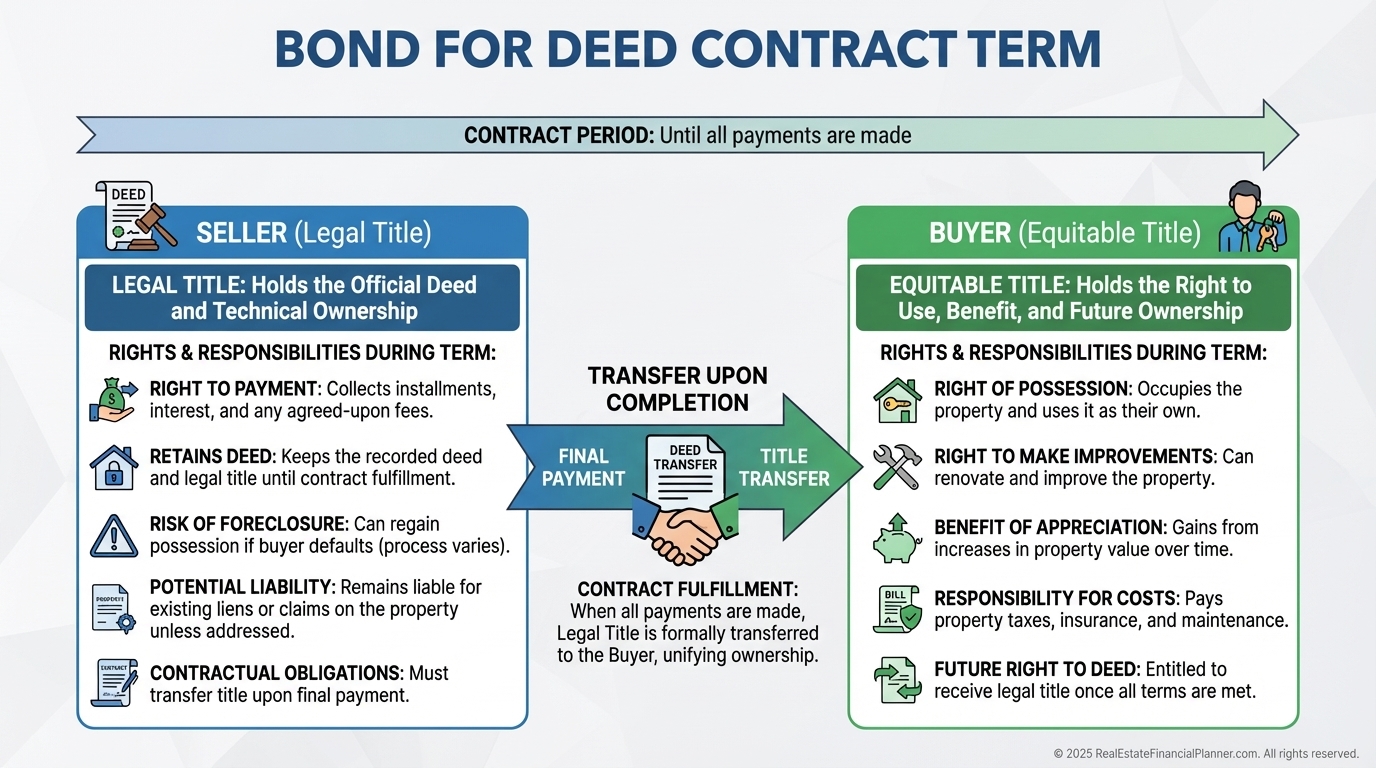

At its core, a bond for deed is seller financing paid over time.

You make payments directly to the seller instead of a bank.

The key difference is ownership timing.

The seller keeps legal title until you’ve completed the agreed payments.

You receive equitable title and possession immediately.

That distinction matters more than most investors realize.

You can live in the property.

You can rent it.

You can improve it.

But you don’t own it outright until the contract is completed.

That’s why documentation, recording, and state law matter so much here.

The Documents That Actually Matter

Every bond for deed deal lives or dies by paperwork.

When I review deals, I want to see these pieces clearly separated and consistent:

•

Bond for Deed Agreement defining terms, payments, defaults, and remedies

•

Promissory Note spelling out the debt and interest

•

Deed Held in Escrow ready to transfer title at payoff

•

Recording or Memorandum providing public notice

If any of those are missing or sloppy, I slow the deal down immediately.

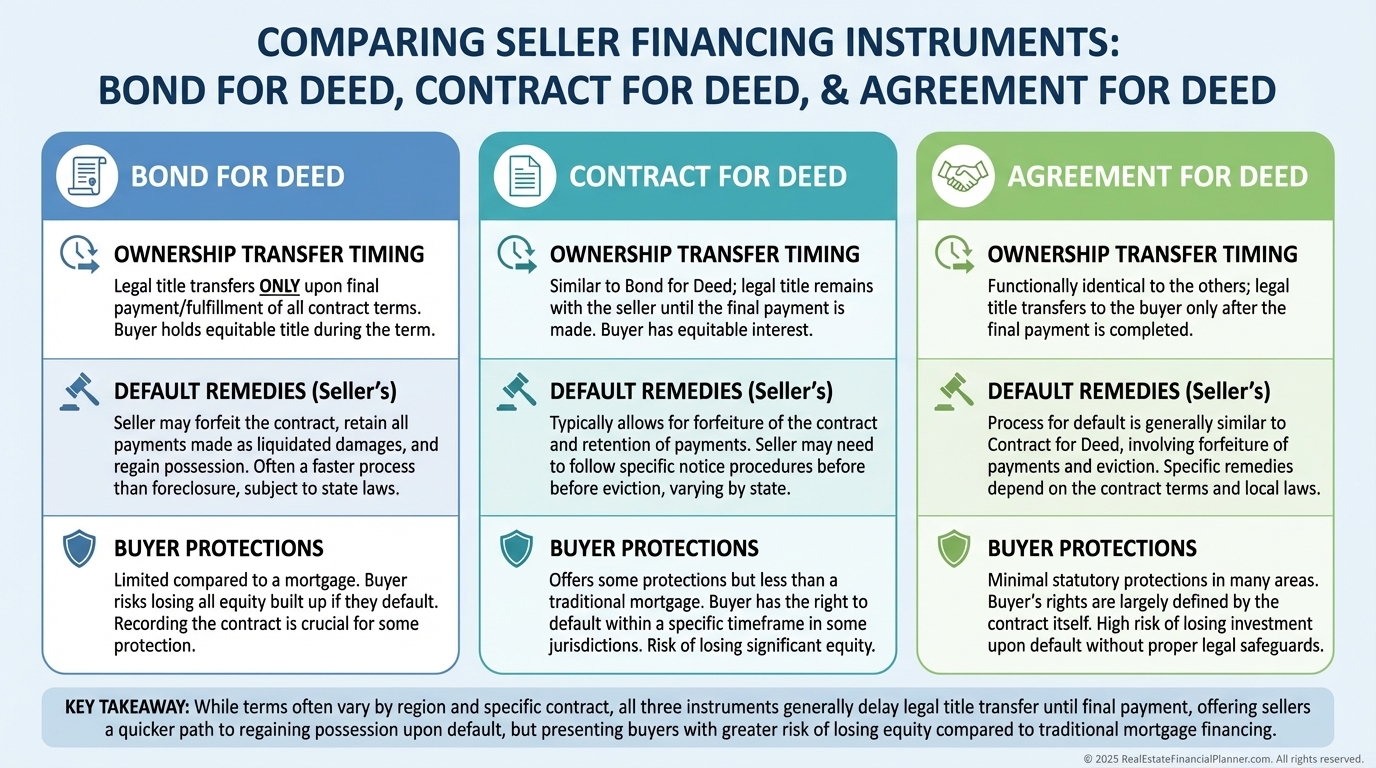

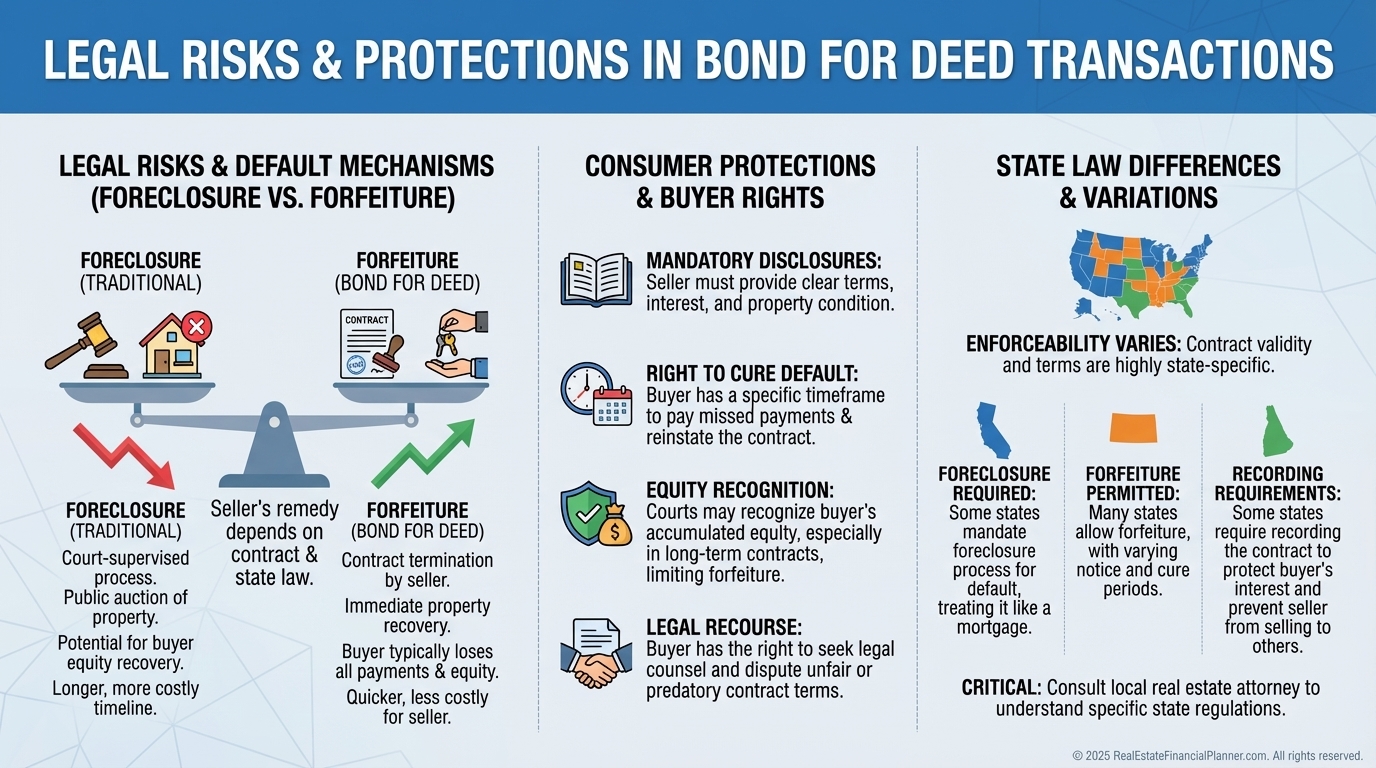

Bond for Deed vs Other Seller Financing Structures

Investors often lump bond for deed together with contract for deed or agreement for deed.

That’s a mistake.

The names sound interchangeable, but the legal outcomes often aren’t.

In some states, default means foreclosure.

In others, it means forfeiture.

That difference determines whether you walk away bruised—or devastated—if something goes wrong.

This is why I never let investors assume structure based on name alone.

We always start with state law first.

Why Sellers Say Yes to Bond for Deed

Bond for deed works when you understand seller motivation.

When I rebuilt after bankruptcy, creative financing wasn’t optional.

It was survival.

The sellers who said yes usually wanted one of five things:

•

Predictable income

•

Tax deferral through installment sales

•

Relief from management without losing cash flow

•

Flexibility timing the market

•

Help transferring property to family

Once you see those drivers, structuring the deal gets easier.

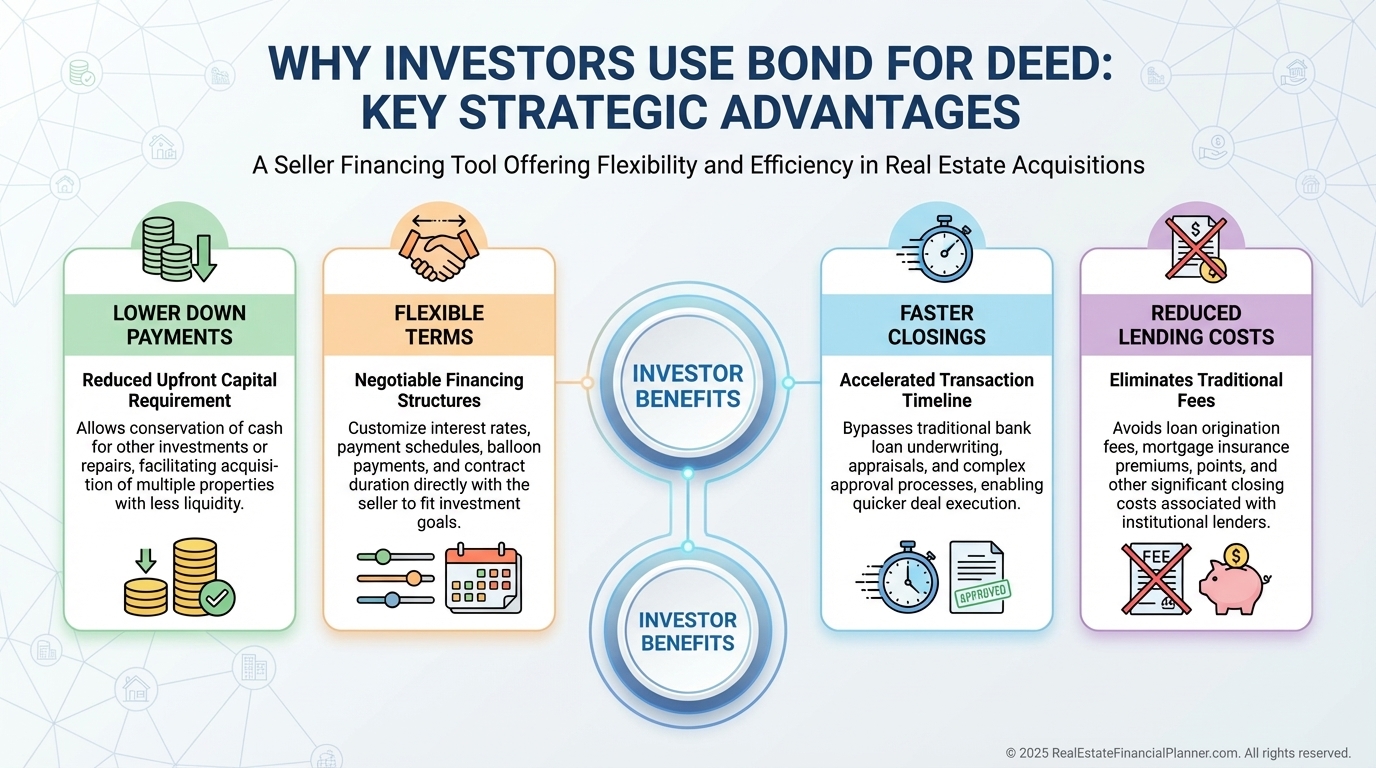

Why Investors Use Bond for Deed

From the investor side, bond for deed solves different problems.

You’re often trading a slightly higher price for better terms.

That trade-off is easy to model.

This is where I bring in Return Quadrants™ thinking.

Lower cash invested plus similar cash flow usually means stronger cash-on-cash returns, even if appreciation stays the same.

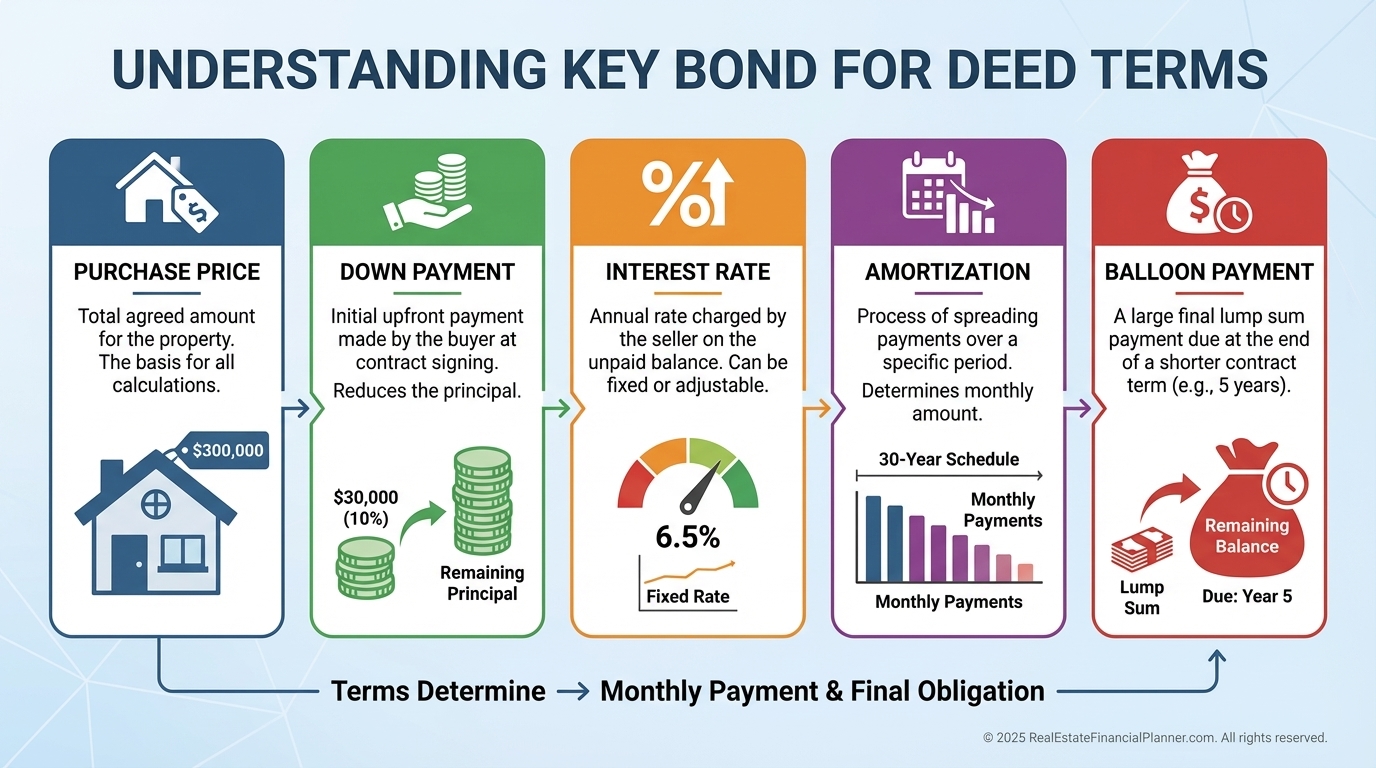

Structuring the Deal Correctly

Structure is everything.

Here’s what I focus on first:

•

Purchase price relative to cash alternatives

•

Down payment big enough to align incentives

•

Interest rate that beats the seller’s alternatives

•

Balloon timing you can realistically refinance or sell into

Then I model exit scenarios.

What does True Net Equity™ look like at year five?

What happens if rents stagnate?

What happens if refinancing isn’t available?

If the deal only works in a perfect world, it doesn’t work.

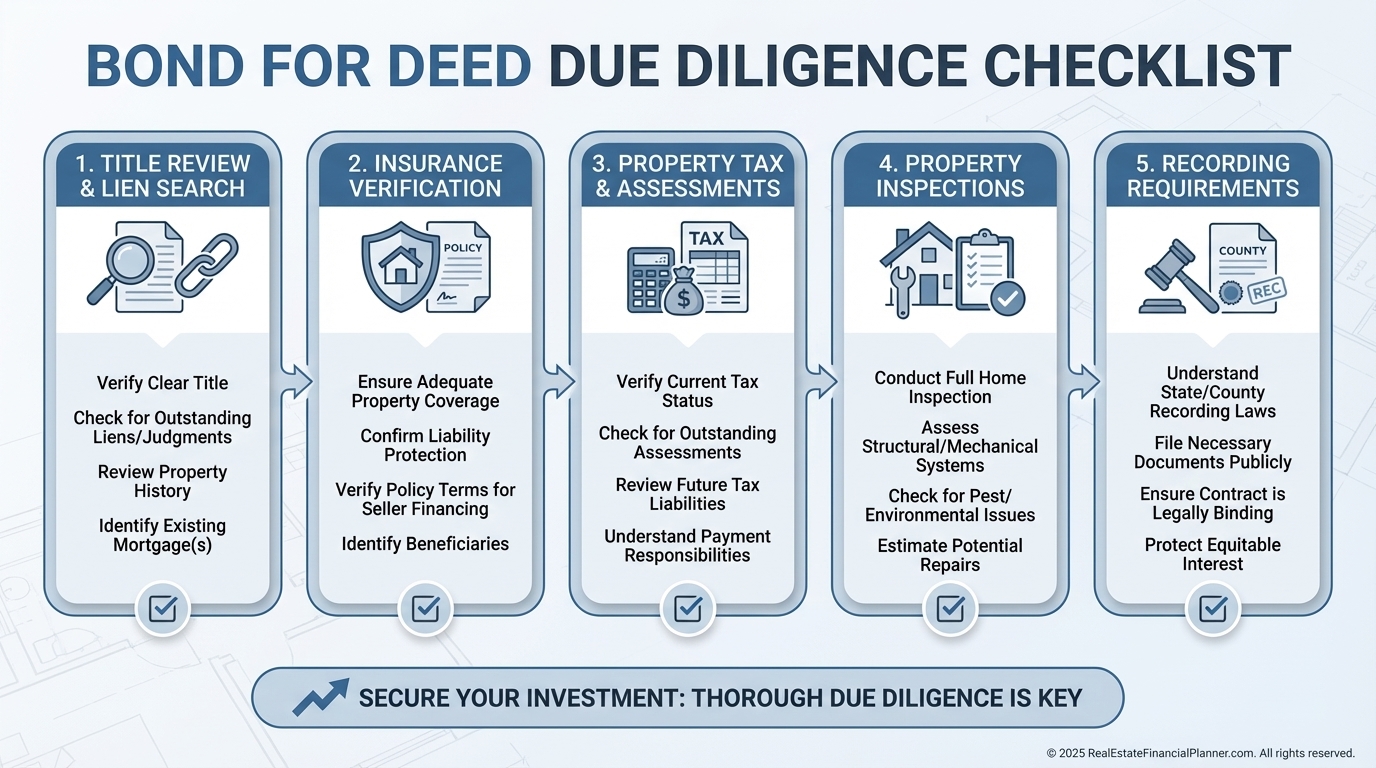

Risk Management Most Investors Skip

Bond for deed magnifies mistakes.

That’s why due diligence matters more, not less.

I insist on:

•

Title review even when there’s no lender

•

Insurance naming both parties

•

Clear tax and maintenance responsibility

•

Explicit default cure timelines

Most disasters come from assumptions, not bad intentions.

Legal Reality Check

This is not a DIY contract.

State law controls remedies, disclosures, interest limits, and recording.

A good attorney costs money.

A bad bond for deed costs years.

I’ve seen both.

How Bond for Deed Fits a Real Portfolio

Bond for deed isn’t a replacement for traditional financing.

It’s a supplement.

It shines when:

•

Sellers own free and clear

•

Timing matters more than price

•

Flexibility beats leverage

•

You need terms banks won’t allow

Used strategically, it can bridge you to a refinance, a sale, or your next Nomad™ move.

Final Thoughts

Bond for deed rewards investors who slow down, model carefully, and respect the legal structure.

If you’re willing to do that work, it can unlock opportunities most buyers never see.

If you’re not, it’s a shortcut to stress.

Use it deliberately.

Structure it cleanly.

Model the exits before you sign.

That’s how you turn bond for deed into a long-term advantage instead of a cautionary tale.