For Sale By Owner: The Investor’s Hidden Deal Flow Most People Miss

Learn about For Sale By Owner for real estate investing.

When I help clients analyze deal flow, For Sale By Owner properties almost always get underestimated.

Most investors chase MLS listings, bidding wars, and agent-filtered opportunities.

FSBO deals quietly sit outside that system, often misunderstood, sometimes mispriced, and frequently mishandled by sellers who just want a solution.

Roughly seven to ten percent of U.S. home sales happen without agents.

That is hundreds of thousands of transactions every year where you are negotiating directly with the decision-maker.

When I rebuilt my business after bankruptcy, FSBO sellers were some of the first people willing to talk to me.

No gatekeepers. No scripts. Just problems that needed solving.

What “For Sale By Owner” Really Means

FSBO does not mean amateur.

It means unrepresented.

Some FSBO sellers are experienced investors.

Some inherited property and want it gone.

Others are accidental landlords or burned-out rental owners who want out without paying commissions.

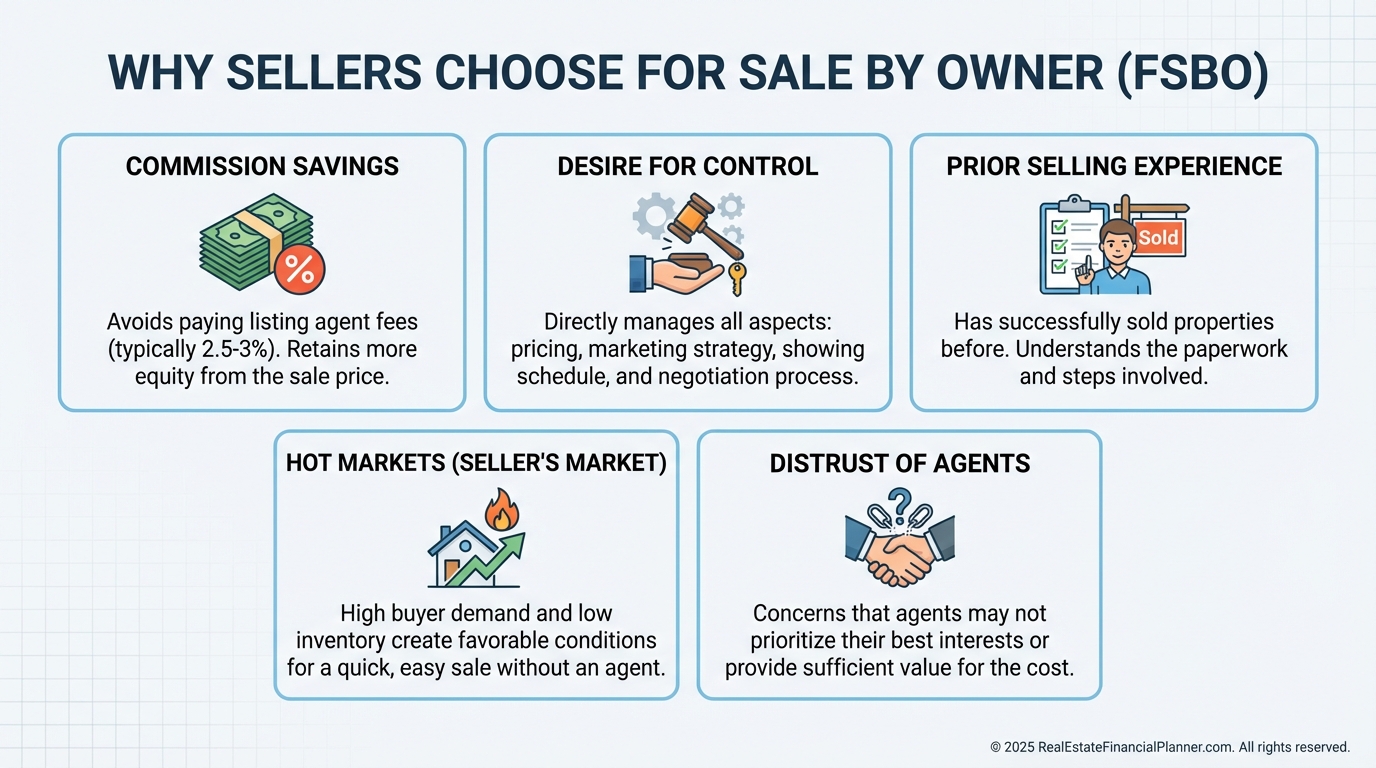

The common thread is control.

They believe selling without an agent gives them more control over price, terms, and timing.

That belief creates opportunity for investors who understand numbers better than emotions.

Most FSBO sellers focus on saving commissions.

They often miss the hidden costs of pricing mistakes, weak marketing, and poor negotiation.

That gap is where investors step in.

The Real FSBO Advantage for Investors

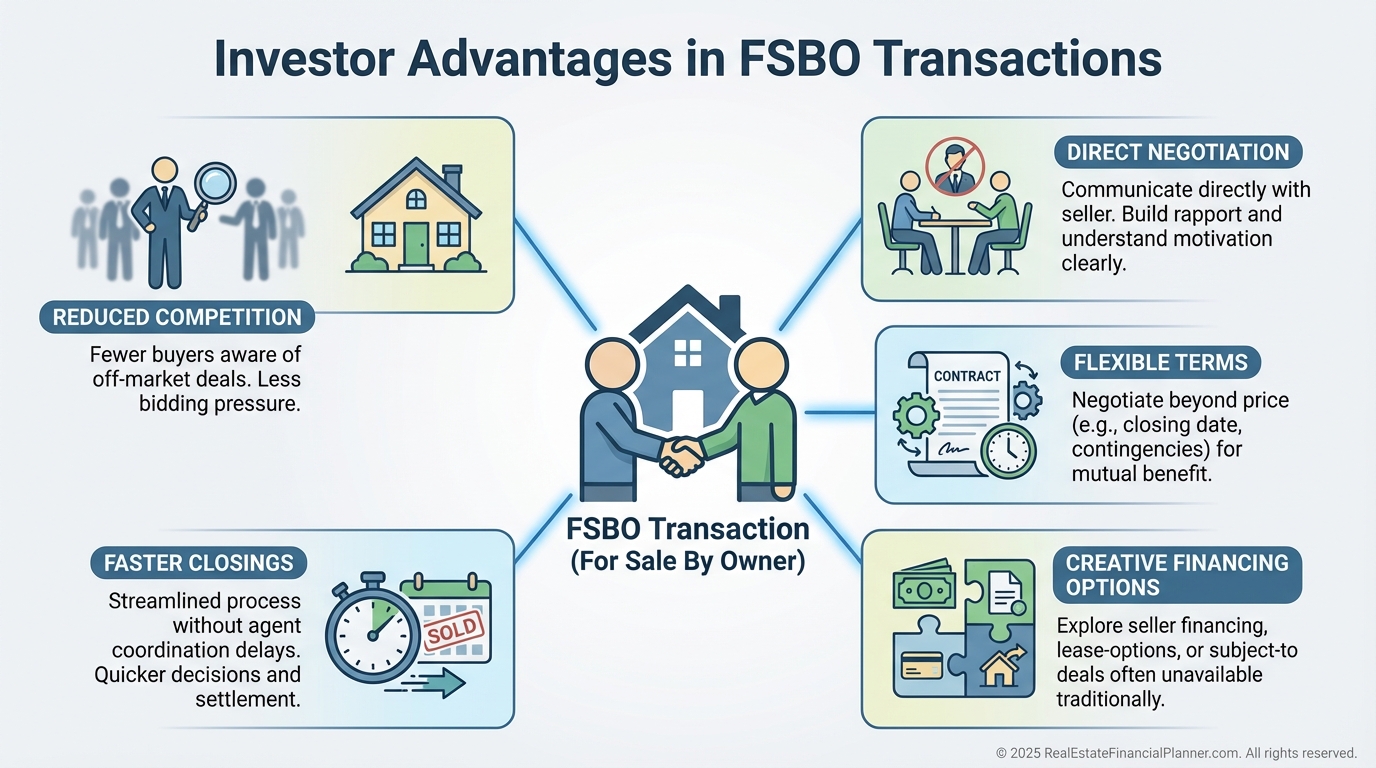

The biggest advantage is not price.

It is access.

You get earlier conversations.

You hear motivation directly.

You can propose solutions agents are trained to avoid.

When I run FSBO deals through the Return in Dollars Quadrant™, the leverage usually shows up in flexibility, not appreciation assumptions.

Speed matters.

Certainty matters.

Clean terms matter.

Price is often secondary.

How I Find FSBO Deals That Actually Convert

Most investors look once and quit.

FSBO requires repetition.

I set alerts on Zillow FSBO, Facebook Marketplace, Craigslist, and local groups.

Then I focus on listings that have been sitting.

Time reveals motivation.

Driving for dollars still works.

FSBO signs that have been up for weeks usually mean no traction.

When clients ask what converts best, I tell them this:

Polite persistence beats clever marketing.

Analyzing FSBO Deals Without MLS Guardrails

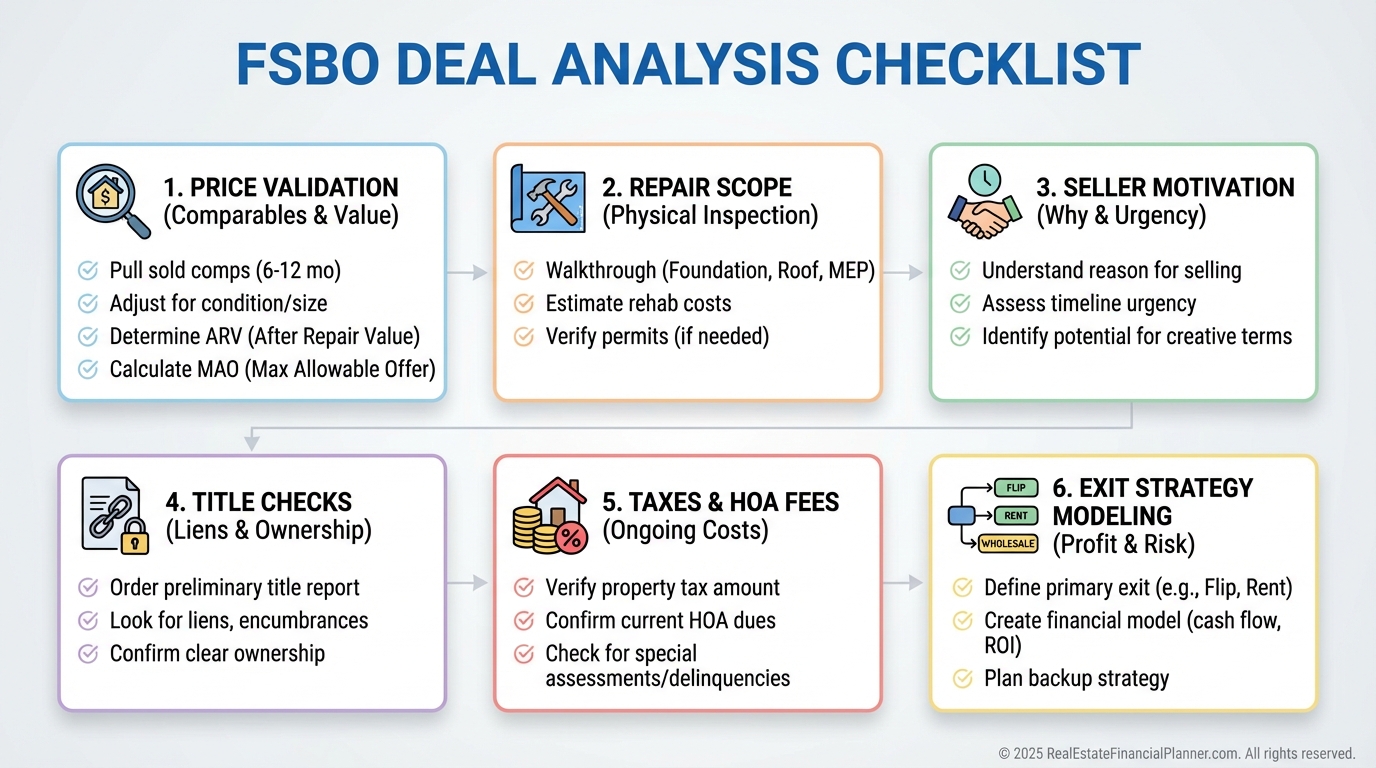

FSBO sellers often rely on online estimates.

That is dangerous for them and helpful for you.

I run every FSBO deal through The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Then I look at cash flow, True Net Equity™, and multiple exit paths.

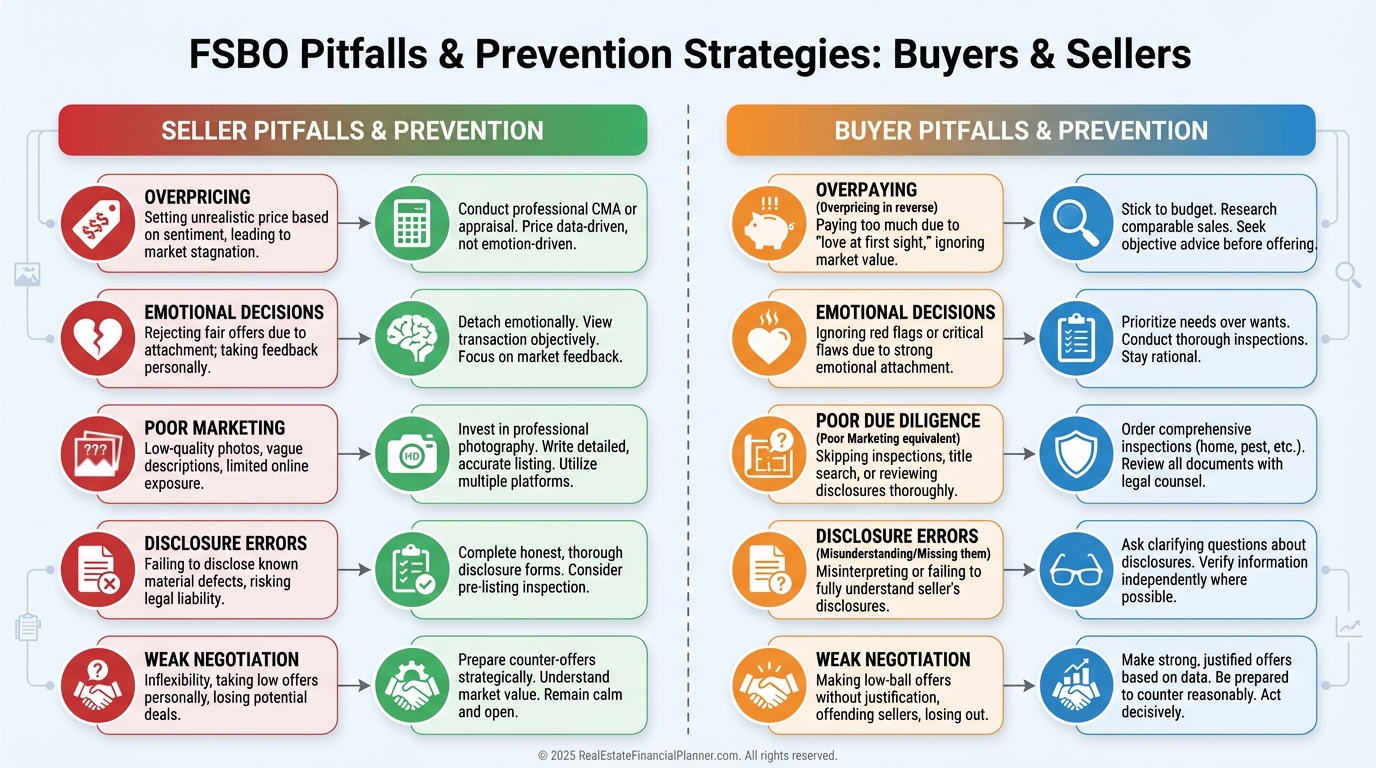

FSBO deals demand tighter margins because disclosures are weaker.

Negotiating Directly With FSBO Sellers

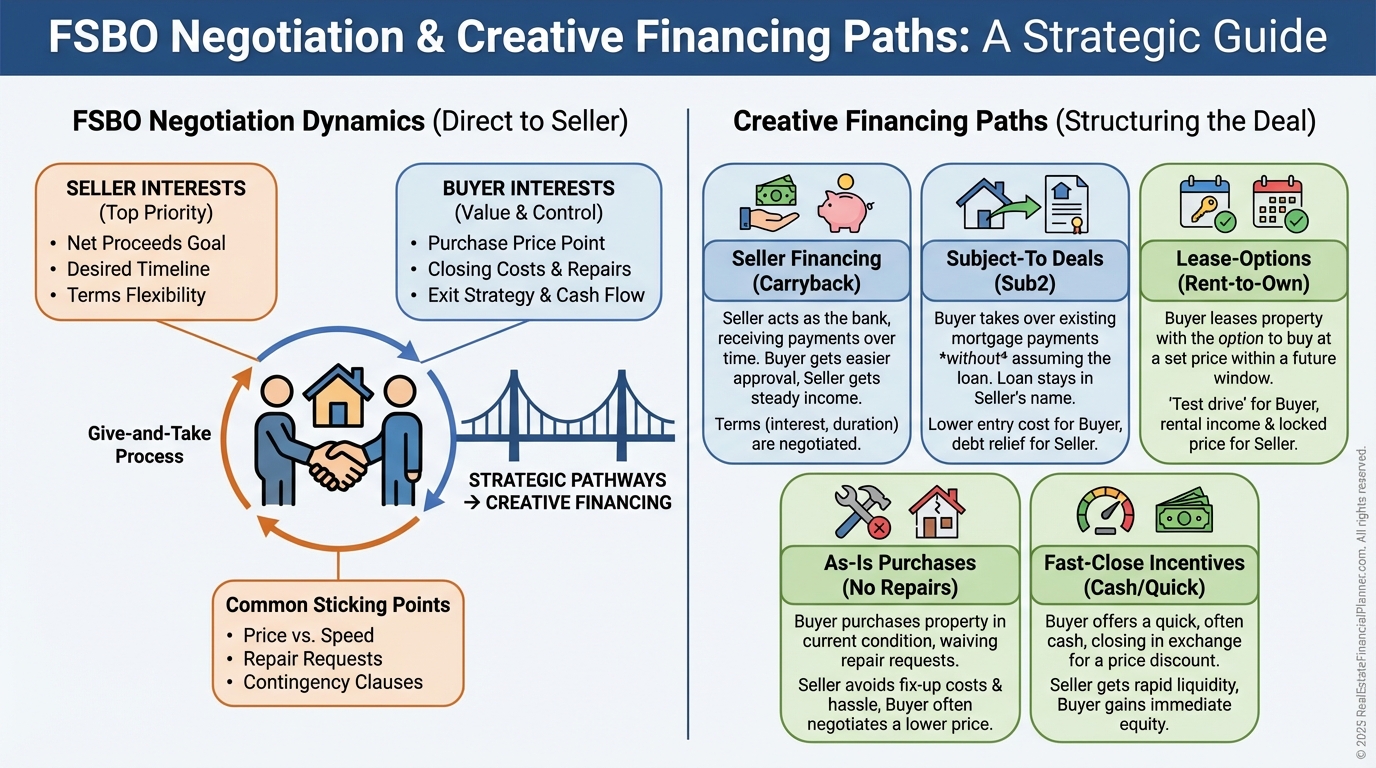

FSBO negotiations are emotional.

There is no agent buffering reactions.

I teach clients to lead with clarity, not pressure.

Explain the math. Show the tradeoffs. Let silence do the work.

When sellers see how your offer solves their timeline, repairs, or financing stress, resistance drops fast.

This is where creative financing shines.

Seller financing, subject-to, and lease-options appear far more often in FSBO deals than MLS transactions.

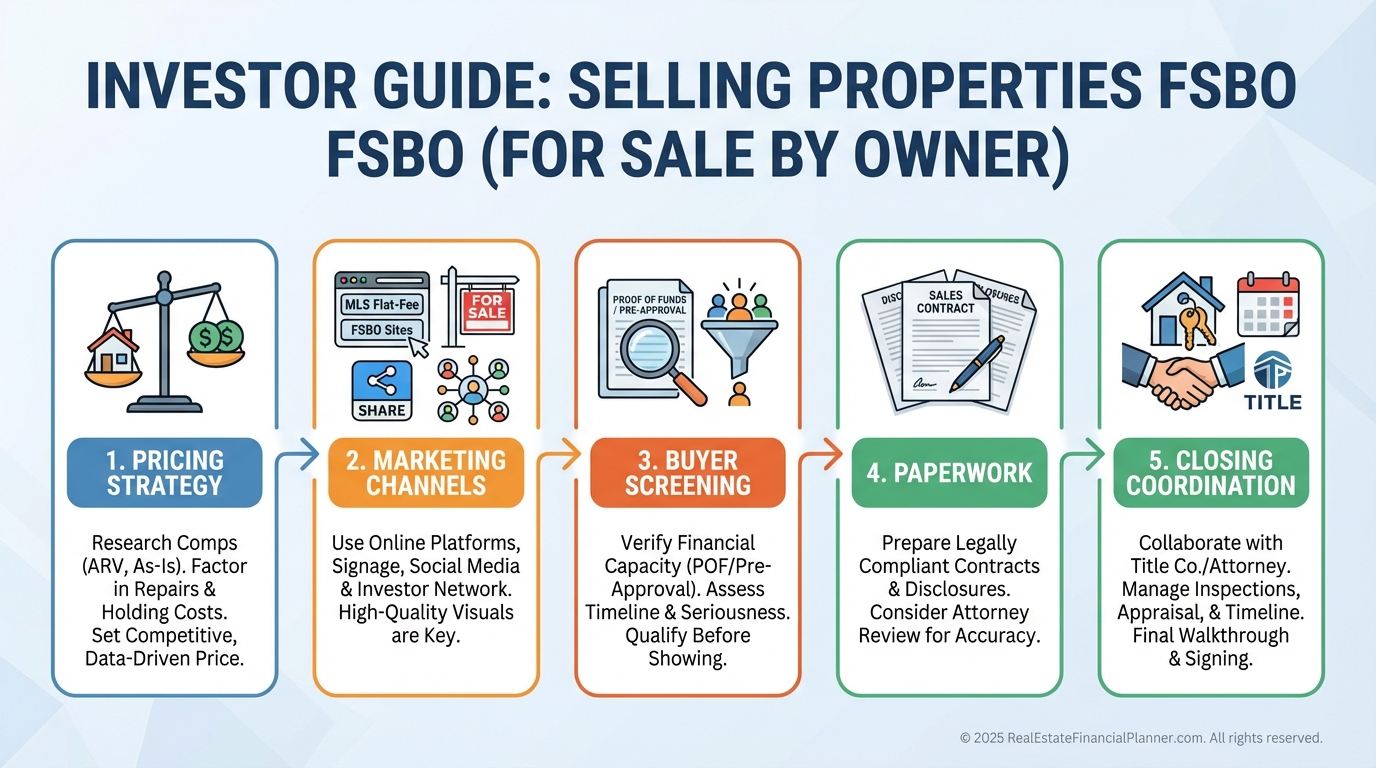

Selling Your Own Investment Property FSBO

I have sold properties both ways.

FSBO keeps more money but demands more discipline.

On a $400,000 sale, skipping commissions can add twenty thousand dollars or more to your bottom line.

That matters when you track returns on True Net Equity™.

FSBO works best when selling to other investors, in hot markets, or when you already have demand.

It fails when marketing is lazy or pricing is emotional.

Legal and Risk Mistakes I Warn Clients About

FSBO does not mean casual.

Disclosure mistakes create lawsuits years later.

Title issues derail closings.

Bad contracts destroy leverage.

I always recommend an attorney review contracts and a title company experienced with FSBO closings.

The cost of prevention is trivial compared to the cost of fixing a mistake after the fact.

Common FSBO Errors Investors Can Exploit or Avoid

Overpricing kills deals.

Emotion kills negotiations.

Silence kills momentum.

Investors who win in FSBO focus on systems, not opinions.

If the numbers do not work, you walk.

If they do, you move decisively.

Final Perspective

FSBO is not easier than MLS investing.

It is different.

When you understand motivation, structure offers clearly, and model outcomes correctly, FSBO becomes a repeatable advantage.

Start on one side of the transaction.

Build competence.

Then scale.