Limited Partnerships: The Serious Investor’s Guide to Passive Real Estate—Vetting Sponsors, Waterfalls, Fees, and Taxes

Learn about Limited Partnerships for real estate investing.

Why Limited Partnerships Belong in a Serious Portfolio

When I help clients design passive income, I look for levers with professional execution, tax efficiency, and scale.

Real estate limited partnerships deliver all three—if you pick the right sponsor and structure.

I’ve seen LPs complement active portfolios, smooth cash flow, and open doors to institutional-quality assets an individual could never buy alone.

What Is a Real Estate Limited Partnership?

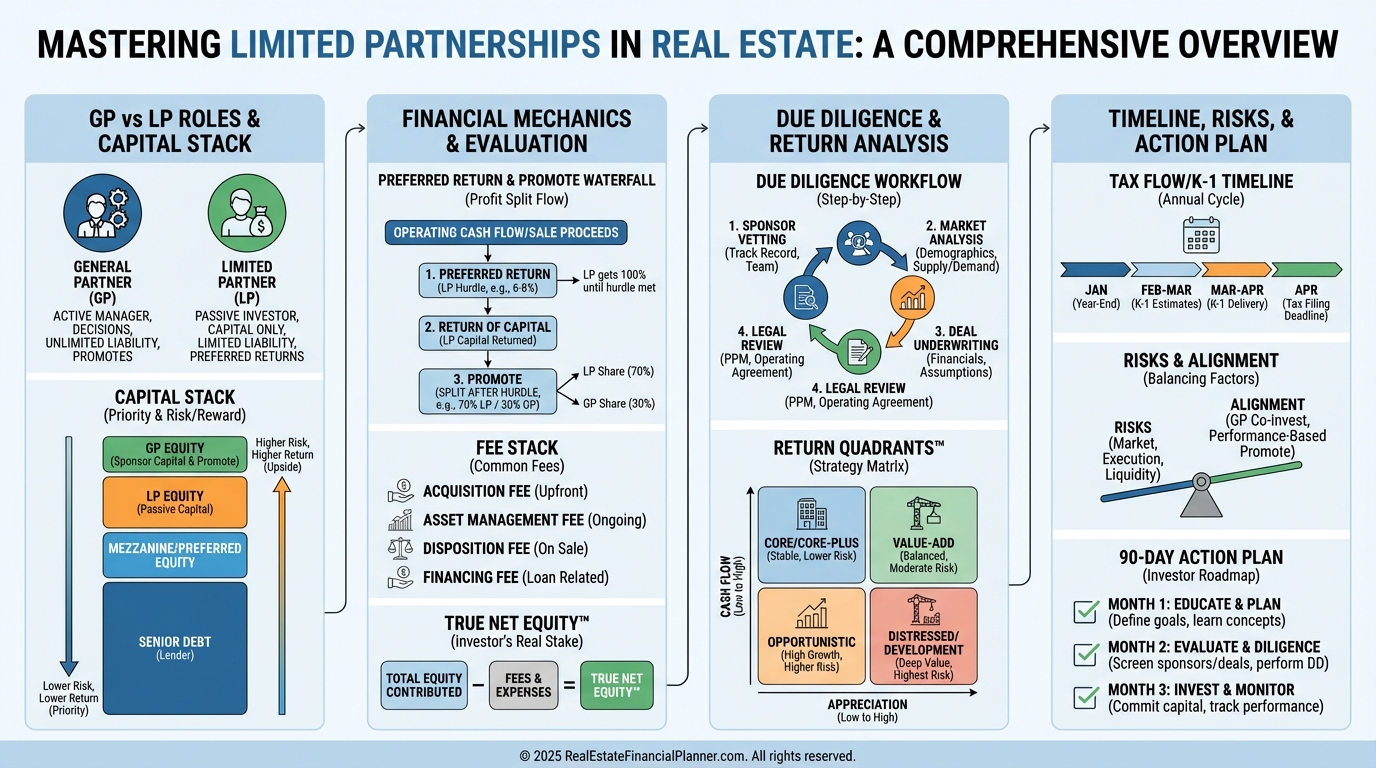

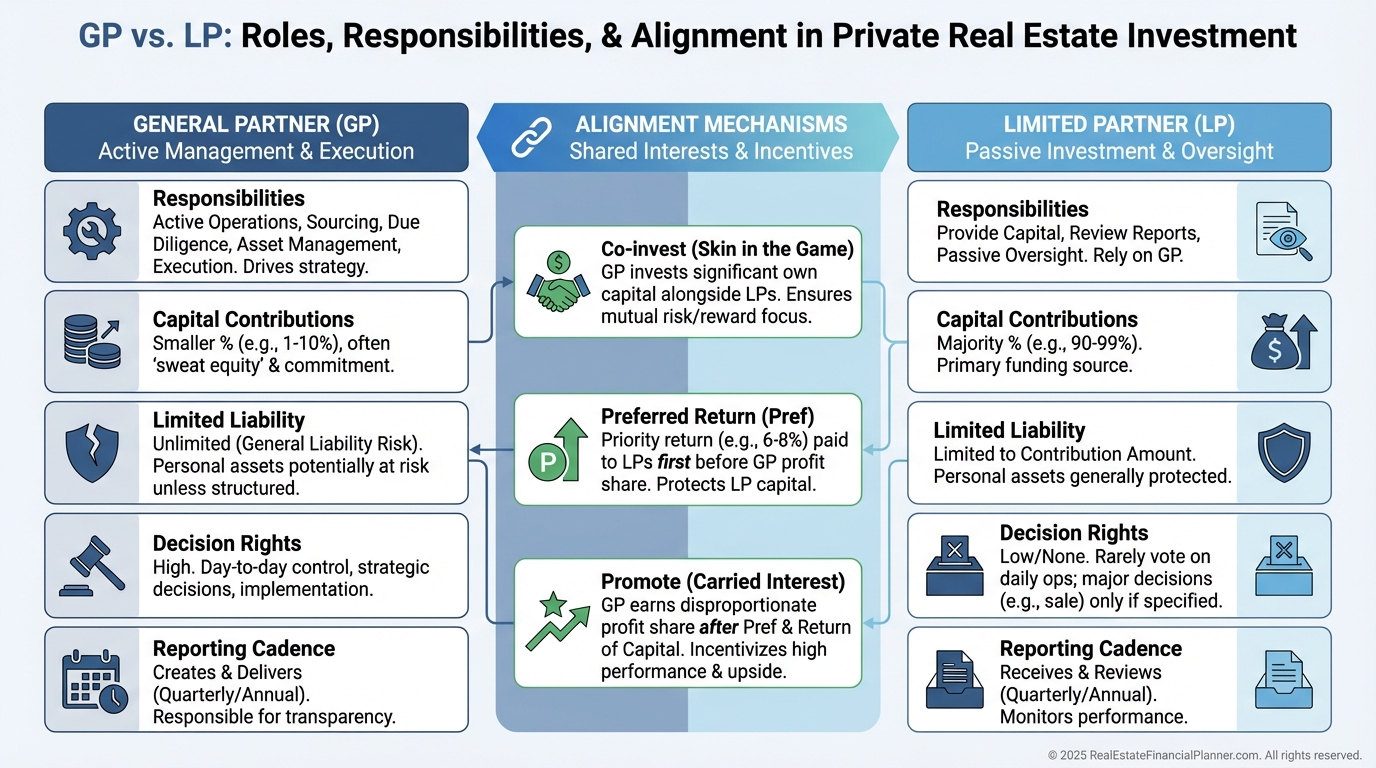

A limited partnership (LP) is a structure where a general partner (GP) runs the deal and limited partners supply capital.

The GP sources, underwrites, finances, operates, and exits. LPs are passive and receive distributions and tax benefits based on their ownership.

How LPs Get Paid: Preferred Returns, Splits, and Waterfalls

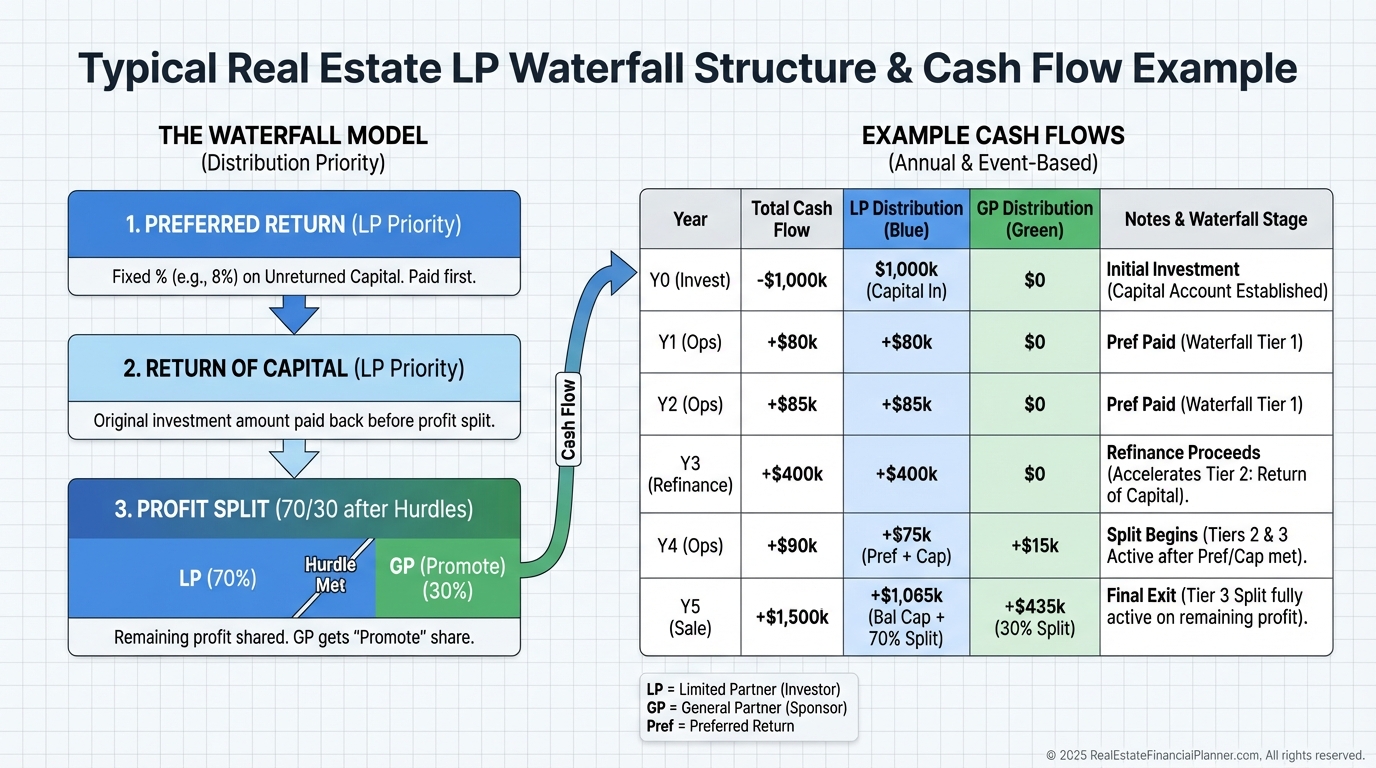

Most LPs pay a preferred return (often 6–8%) that accrues before the GP shares profits.

After your capital is returned, remaining profits split by the promote (frequently 70/30 or 80/20) and sometimes step up at IRR hurdles.

Refinances can return a chunk of capital mid-hold while keeping you in the deal, which boosts your Return on Invested Capital.

When I model waterfalls, I test timing. A 12-month delay in renovations can crush IRR even if the total profit is unchanged.

What I Model Before Investing

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to re-underwrite the sponsor’s pro forma.

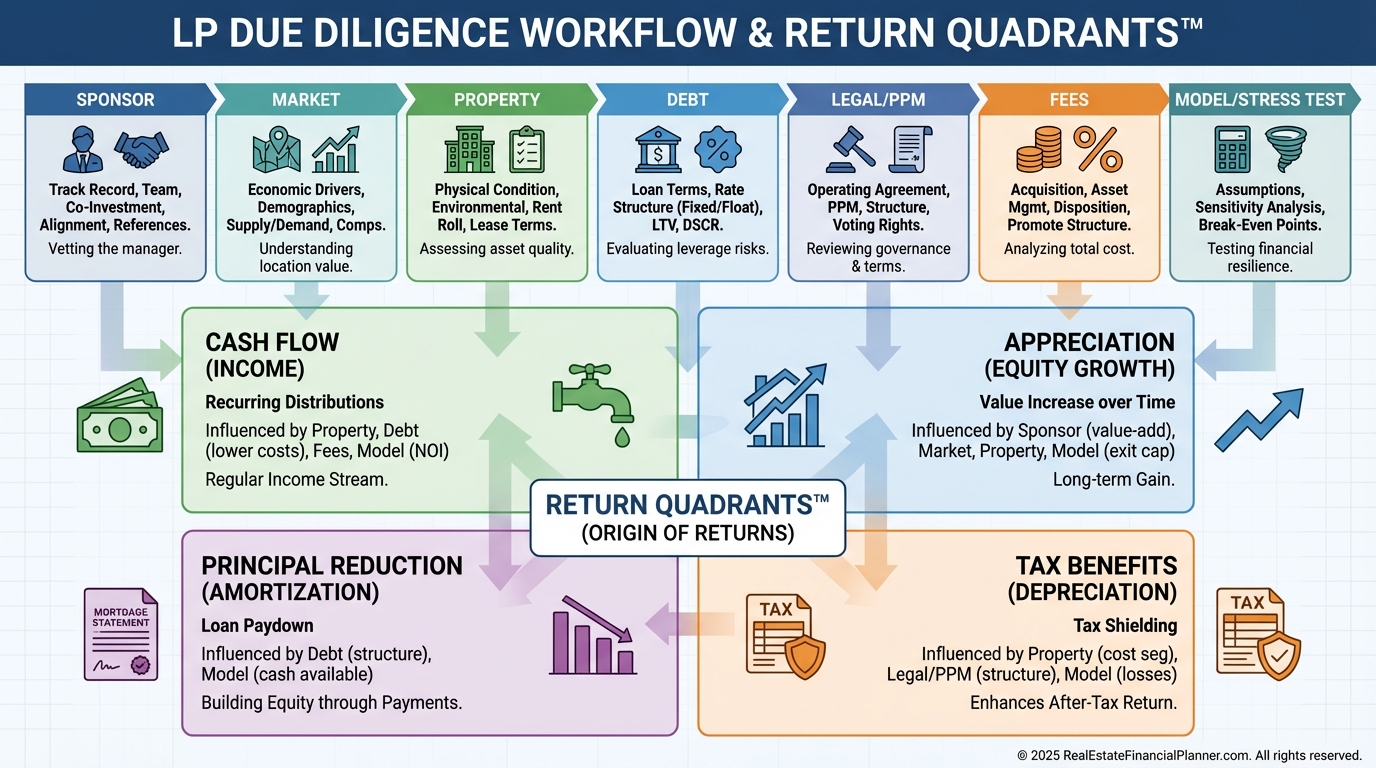

Then I map returns using Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits. For LPs, debt paydown and appreciation often dominate the equity multiple.

I also estimate True Net Equity™. That’s your after-tax, after-fee, after-sale-cost equity if the asset sold today. With LPs, I haircut any sponsor-reported “NAV” before computing TNE.

When I rebuilt after the 2008 downturn, I refused any deal that didn’t survive two stress scenarios: slower rent growth and higher exit cap. I still do that today.

Sponsor Due Diligence: What I Verify Every Time

Track record matters, but transparency under stress matters more.

I ask for a full deal list, realized vs. projected results, capital call history, investor communications, and references I choose, not just those provided.

I want to see GP co-investment, clearly disclosed fees, and a written playbook for executing the business plan.

If I can’t understand it in two pages, I pass.

Market and Property: Assumptions I Refuse to Stretch

Population and income growth should be real, not modeled optimism.

I verify competitive rent comps, renovation scope, contingency, lease-up timelines, and exit scenarios.

I’d rather underwrite conservative rent growth and be pleasantly surprised.

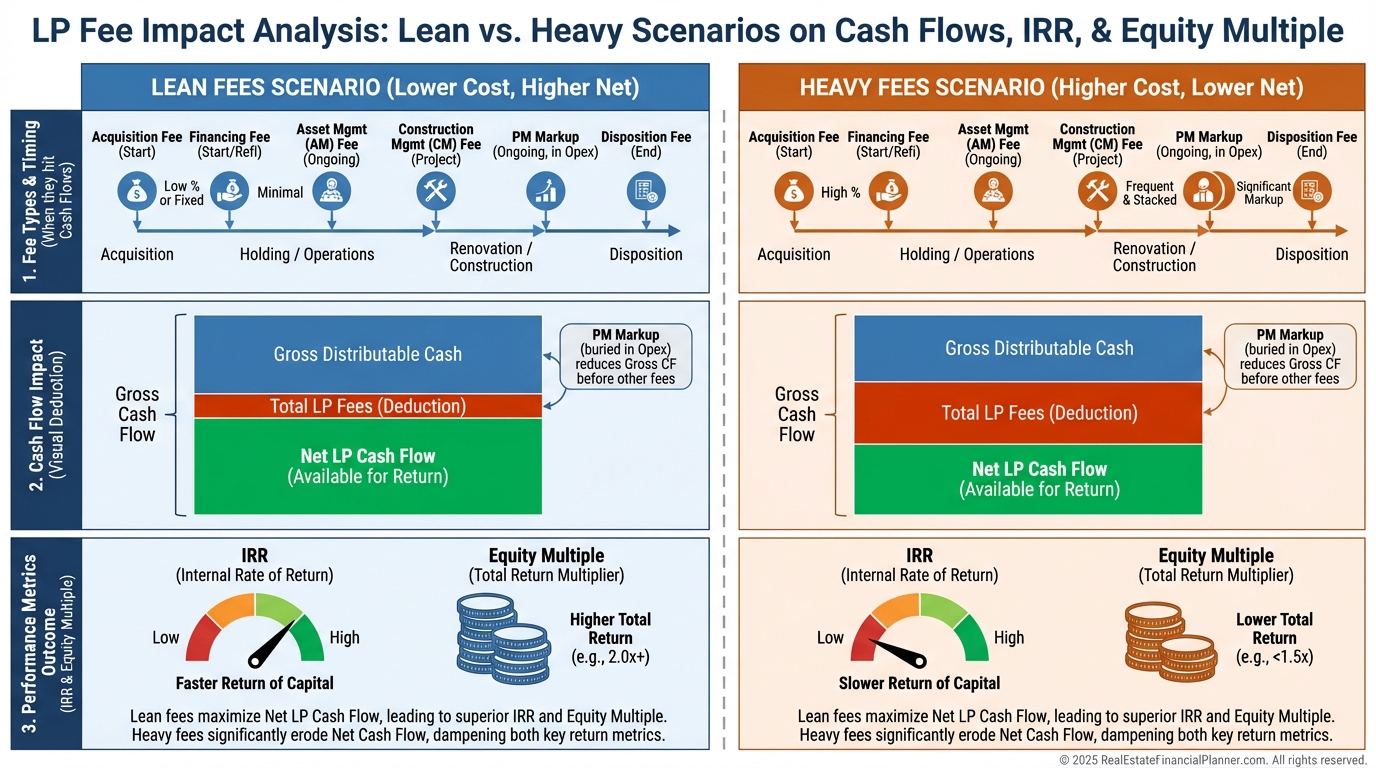

Fees: Know the Stack and the Impact on Returns

Fees pay for professional work, but a heavy stack can quietly erode your IRR.

Common fees include acquisition (1–2%), asset management (1–2%), construction or development management, financing, disposition, and property management markups.

I model fees line-by-line. If fees plus aggressive promote leave LPs thin on upside, I renegotiate or walk.

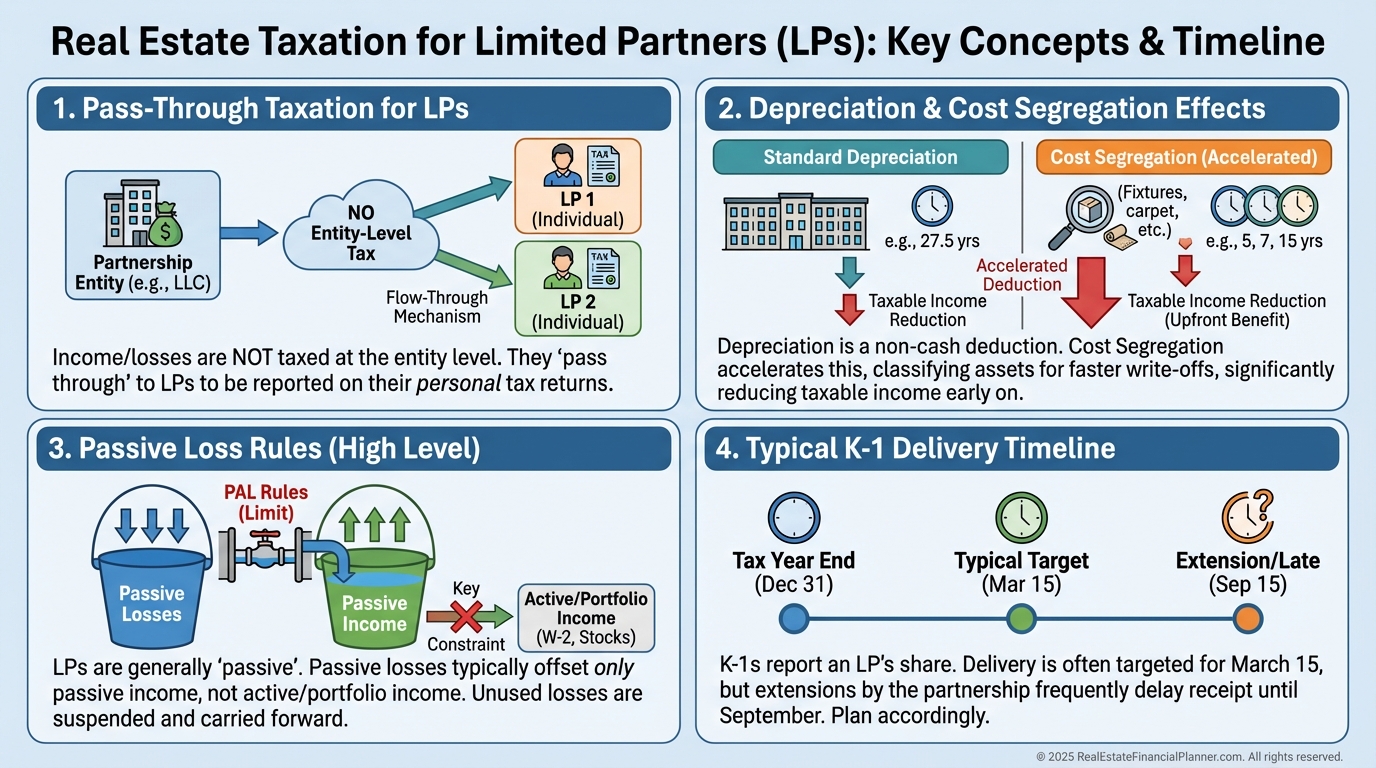

Taxes and K‑1s: Turning Paper Losses into Real Advantages

LPs receive pass-through tax treatment via a Schedule K‑1.

Depreciation and cost segregation can create paper losses that may offset passive income from other sources.

I coordinate with a CPA to respect passive activity rules and track suspended losses that later free up at exit.

If a deal contemplates a 1031 exchange, I ask early how LP interests will be handled. It’s possible, but structure and timing matter.

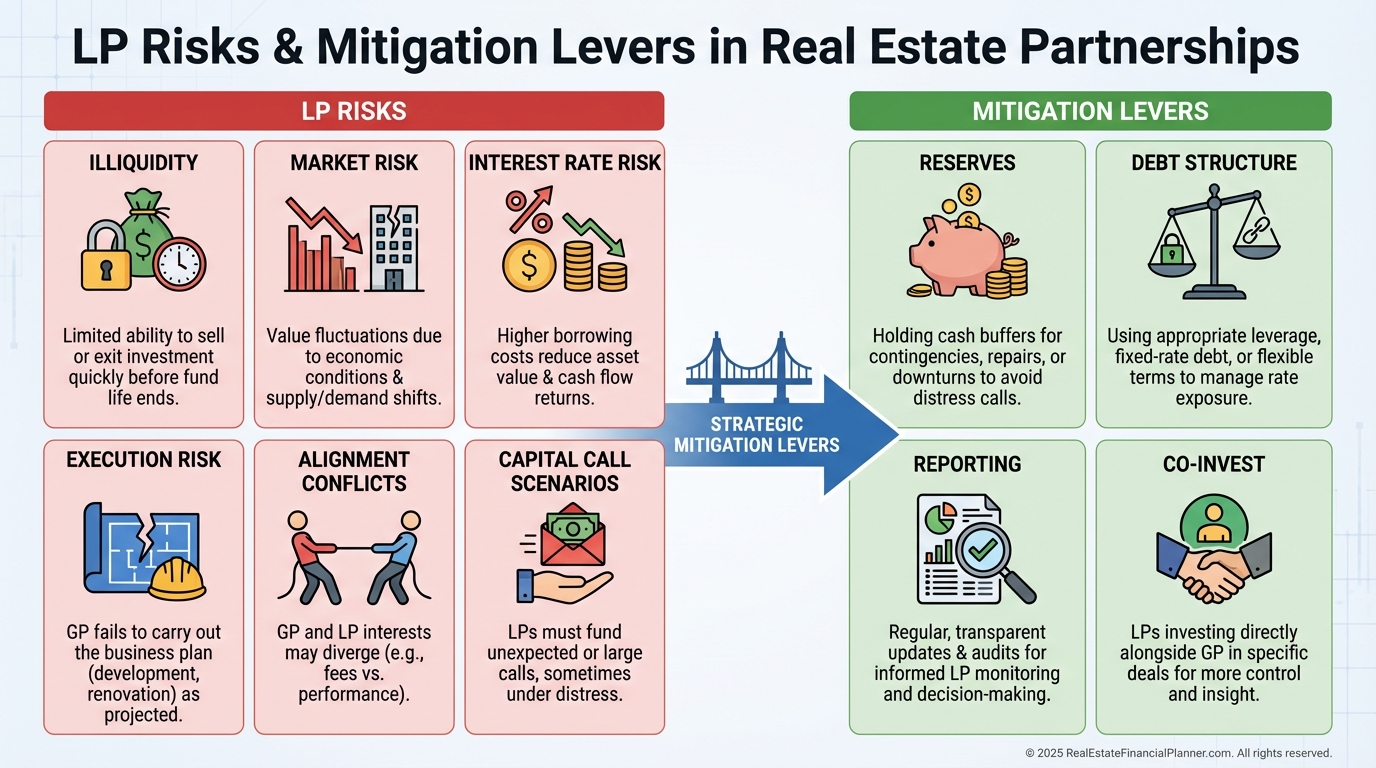

Risks, Controls, and Alignment

You trade control for passivity. That’s the bargain. So alignment is everything.

I look for strong reserves, fixed or hedged debt, realistic renovation pacing, and transparent quarterly reporting.

Capital calls happen. I ask how they were handled in past funds. I also want clarity on key-man risk and decision-making thresholds.

LP interests are illiquid. I plan on a 3–7 year hold with no need to sell my stake.

Getting Started: A 90-Day Plan

Days 1–30: Define criteria, confirm accredited status, and assemble your diligence toolkit: The World’s Greatest Real Estate Deal Analysis Spreadsheet™, sponsor questionnaire, reference script, and a conservative underwriting template.

Days 31–60: Build deal flow. Attend two sponsor webinars per week, request data rooms, and underwrite three deals end-to-end with stress tests.

Days 61–90: Make one small allocation with a seasoned sponsor whose communication you’ve tested, then schedule a 30/60/90-day review of actuals vs. pro forma.

Portfolio Design: Blending LPs with Your Other Strategies

Many of my clients use Nomad™ for their first few rentals to build equity and skills.

Then they layer LPs for scale, diversification, and passivity while we track True Net Equity™ and Return Quadrants™ across the whole portfolio.

Your goal is a predictable, tax-efficient income stream—not a heroic IRR that only works on paper.

What I Avoid—Every Time

Opaque reporting. Thin reserves. Unhedged floating debt. Overpaying for “story.”

Pro formas with aggressive exit caps or rent growth that outpace local incomes.

If a sponsor can’t explain the downside in 60 seconds, I decline the upside.

Conclusion: Move Forward with Discipline

Limited partnerships can deliver professional execution, tax-advantaged returns, and time freedom.

Choose alignment over sizzle, underwrite with discipline, and let compounding do the heavy lifting.

If you want a second set of eyes, run the numbers through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and stress test like a pro.