Capital Gains Taxes: The Hidden Cost That Destroys Real Estate Profits

Learn about Capital Gains Taxes for real estate investing.

Capital Gains Taxes for Real Estate Investors

When I sit down with clients to run numbers, capital gains taxes are almost always the biggest blind spot.

They know the property went up in value.

They know the sale will produce a large check.

They rarely know how much of that check actually belongs to the IRS.

When I rebuilt my own portfolio after bankruptcy, this lesson became painfully clear.

You cannot judge a property’s performance without understanding what taxes do to your proceeds.

Capital gains taxes shape when you sell, what you sell, how you refinance, how you plan retirement, and even where you choose to live.

This is the part most investors skip until it’s too late.

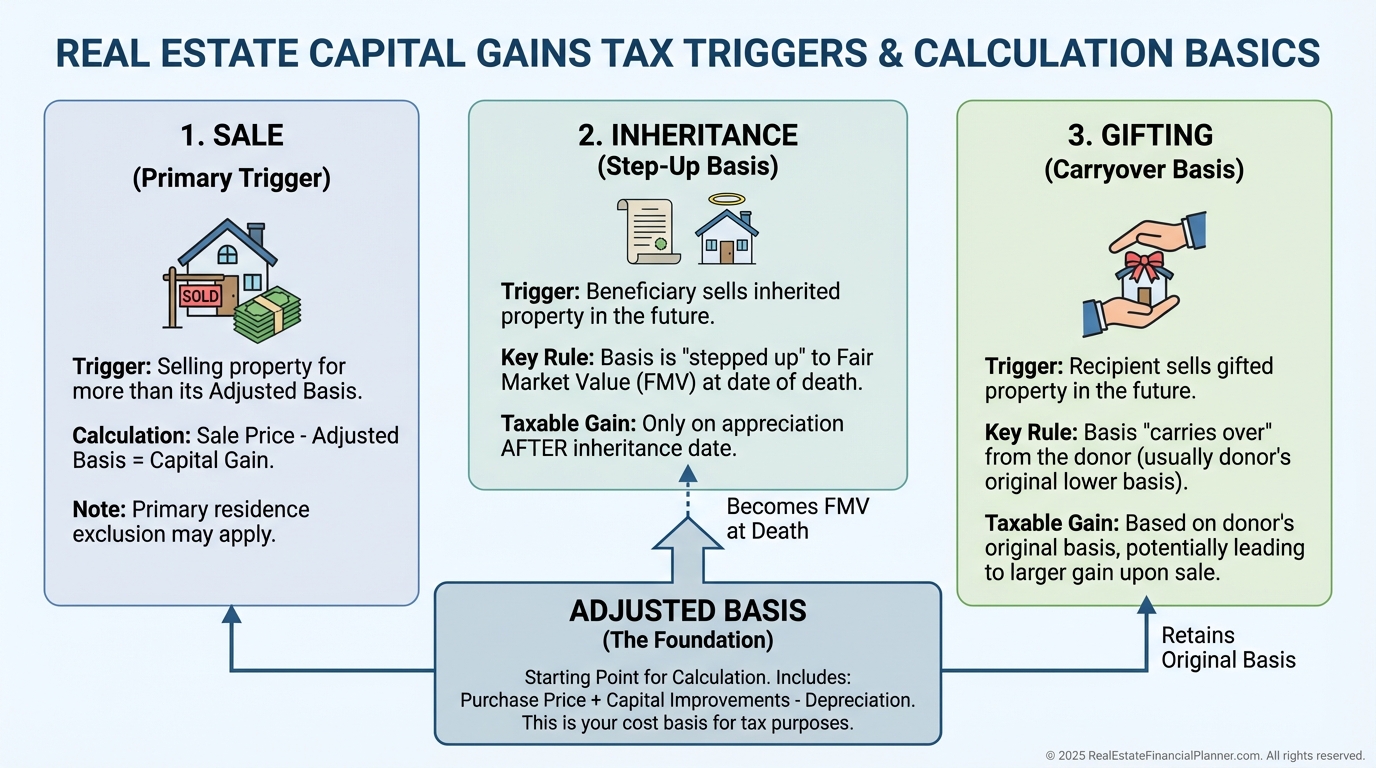

What Really Triggers Capital Gains Taxes

Capital gains taxes show up when you dispose of a property for more than its adjusted basis.

Most investors oversimplify this as, “I sold the property, so I owe taxes.”

It’s more nuanced than that.

Inherited properties often receive a step-up in basis.

Gifted properties transfer the original low basis and embedded tax liability.

If you misunderstand basis, every downstream decision breaks.

What Triggers Capital Gains Taxes

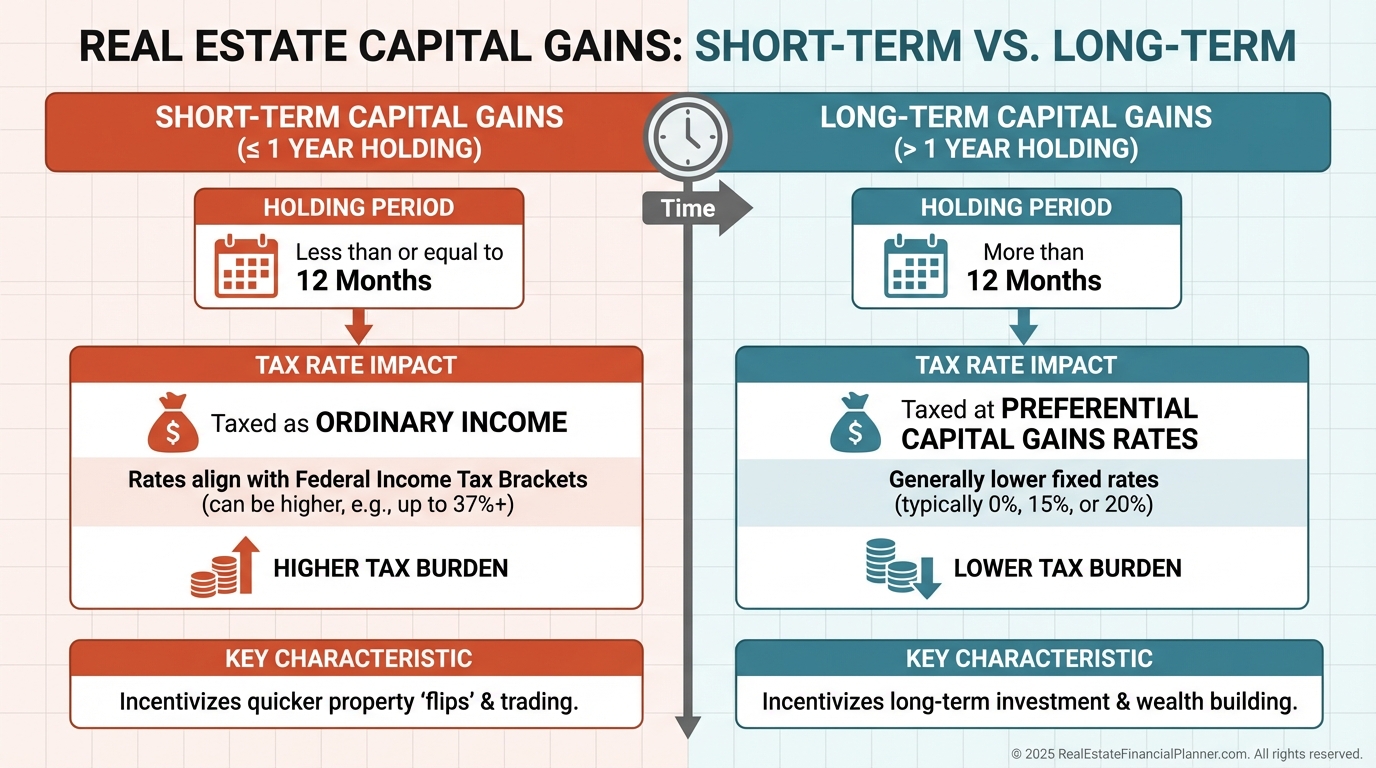

The One-Year Rule That Saves or Costs Tens of Thousands

Short-term capital gains are taxed like ordinary income.

Long-term capital gains receive preferential treatment.

I’ve had clients ready to sell in month eleven.

When I model the tax bill inside the Real Estate Financial Planner™, the reaction is instant.

Waiting a few weeks can save five figures.

Your holding period is a tax lever.

Use it intentionally.

Short-Term vs Long-Term Capital Gains

How Capital Gains Rates Actually Work

On paper, capital gains rates look simple: zero percent, 15 percent, or 20 percent.

In practice, your real rate depends on your total income and whether the Net Investment Income Tax applies.

Sell during a high-income year and your tax bill balloons.

Sell during a low-income year and you might owe nothing.

This is why I help clients plan multi-year disposition strategies instead of one-off sales.

Timing matters more than most investors realize.

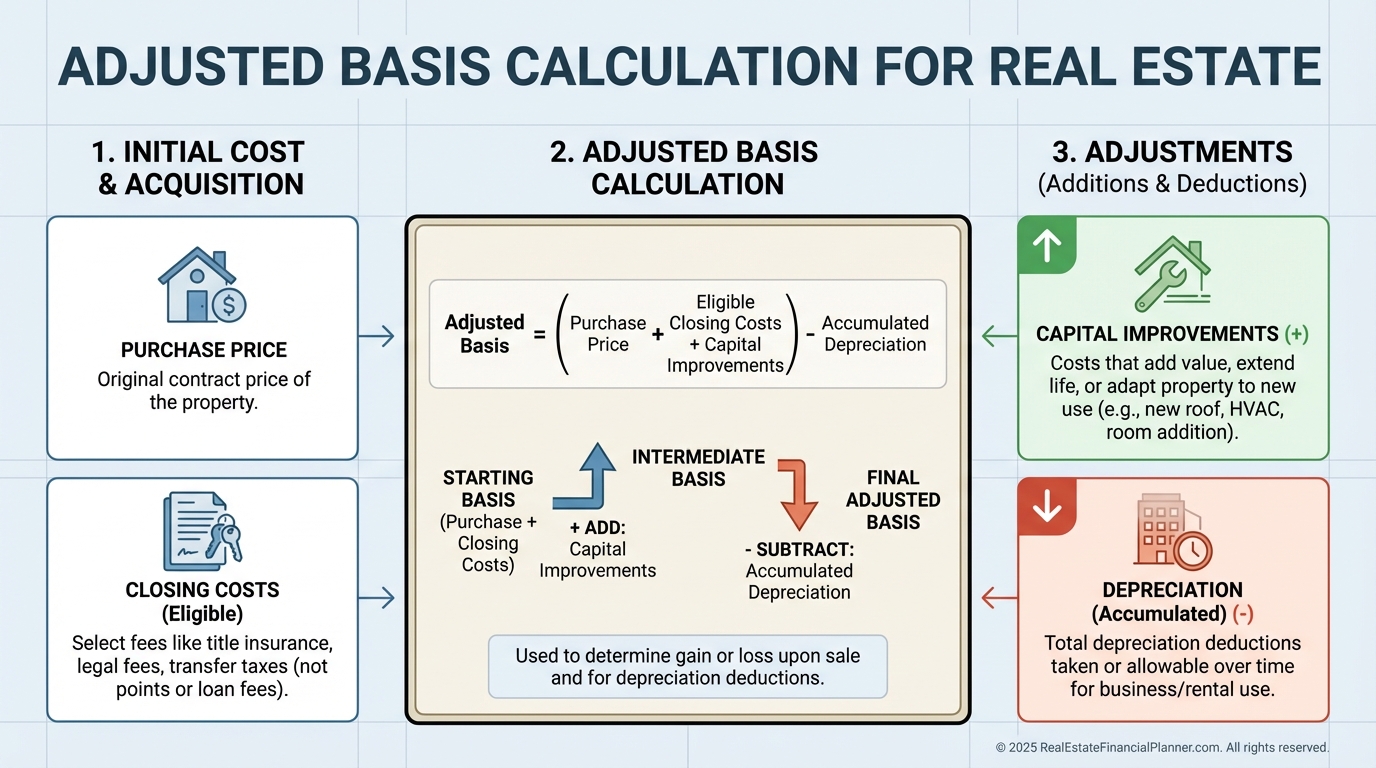

Understanding Basis: Where Most Investors Get Lost

Your basis includes the purchase price, certain closing costs, capital improvements, and depreciation adjustments.

Miss an improvement.

Forget a closing cost.

Lose documentation.

Each mistake artificially inflates your taxable gain.

Accurate basis tracking is wealth preservation.

How Adjusted Basis Is Calculated

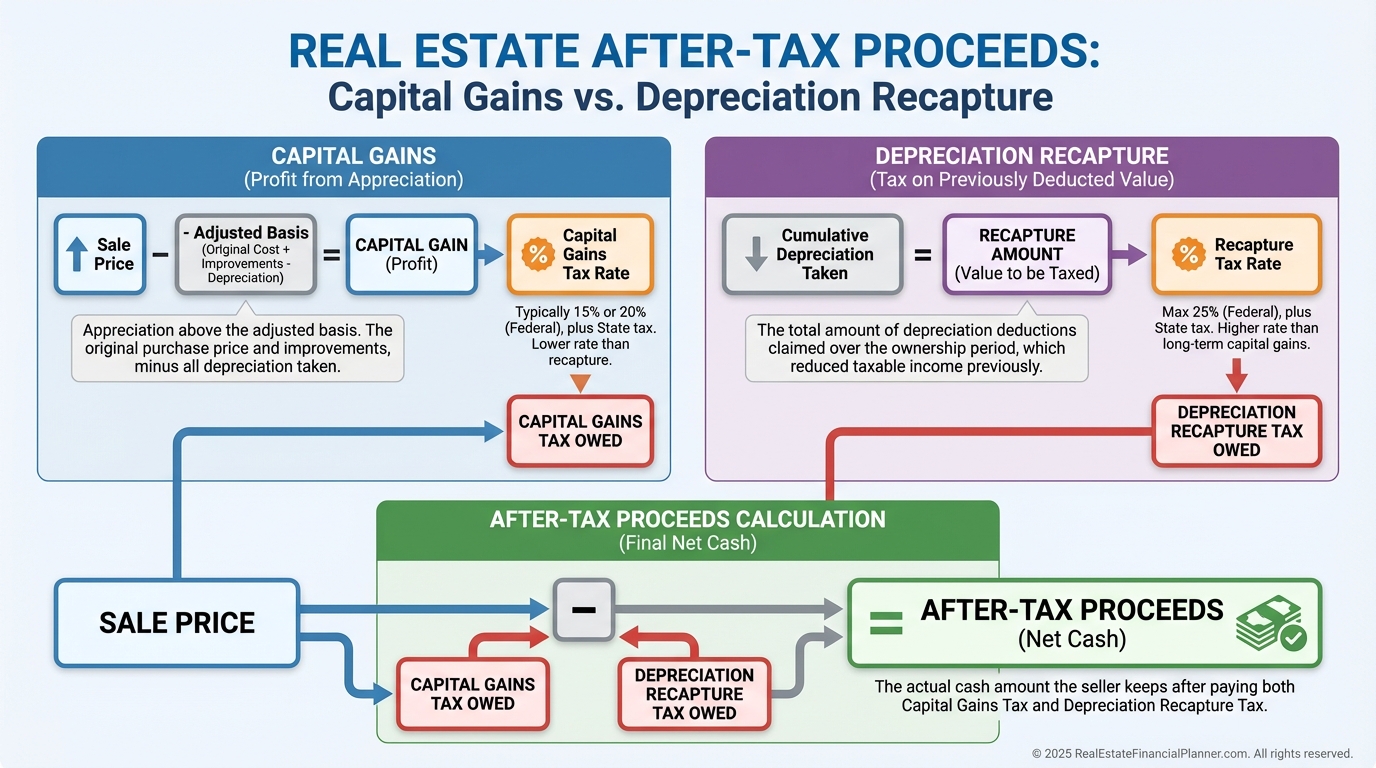

Depreciation Recapture: The Tax Almost Everyone Forgets

Depreciation recapture blindsides more investors than any other tax.

Every dollar you depreciate reduces taxable income today.

Every dollar increases taxable gain later.

When I walk clients through a sale, this is usually the shock moment.

Their gain isn’t one tax.

It’s two.

This is why True Net Equity™ exists.

If you don’t subtract both capital gains taxes and depreciation recapture, your numbers lie.

Capital Gains vs Depreciation Recapture

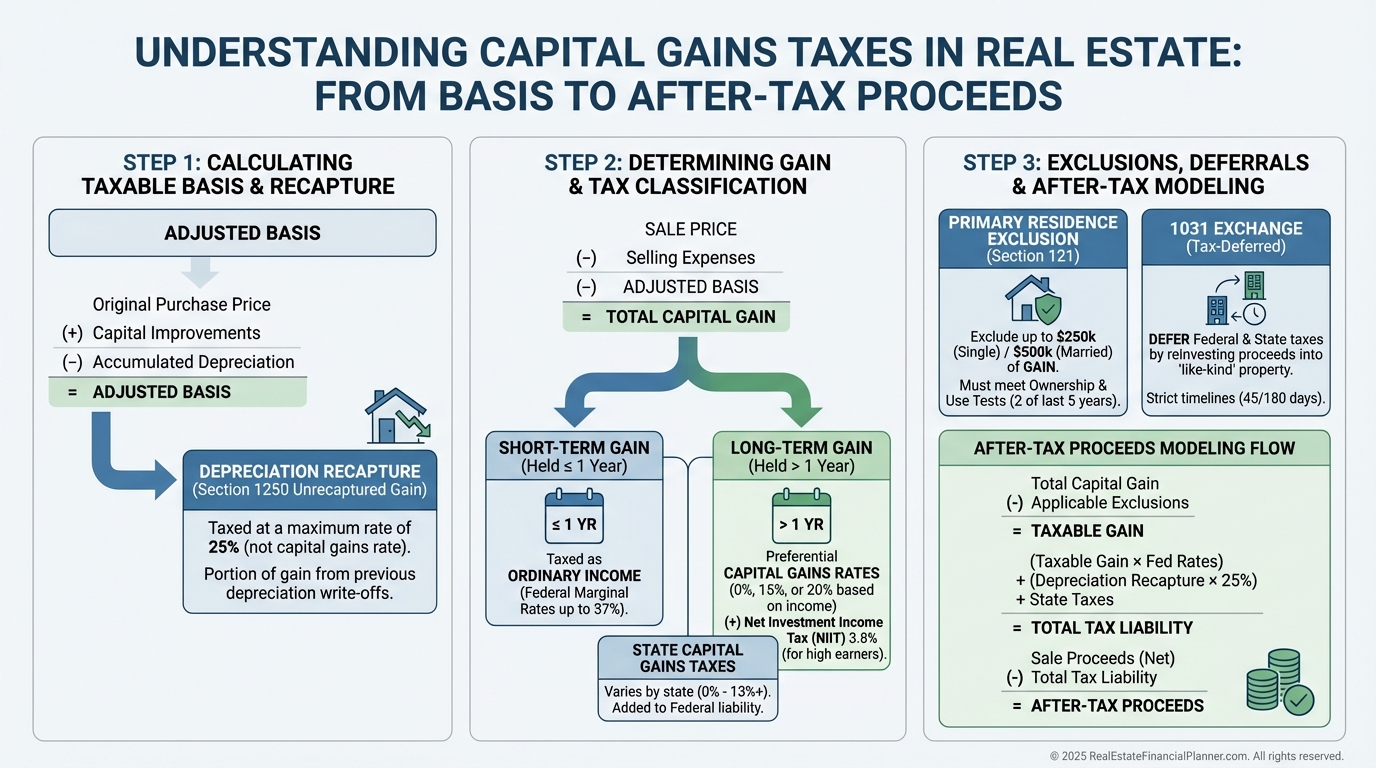

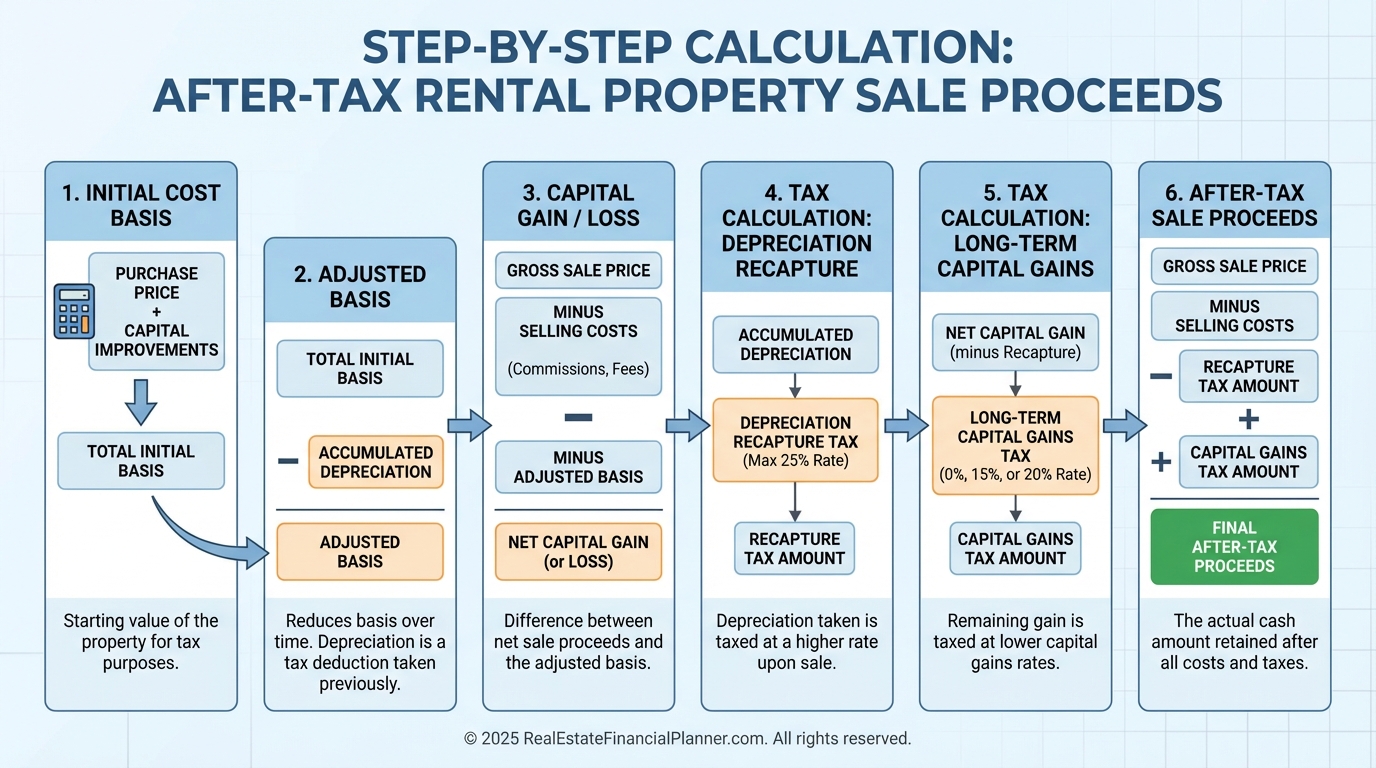

The Calculation Every Investor Should Know

When evaluating a sale, I run clients through the same sequence every time.

Adjusted basis.

Total depreciation taken.

Selling expenses.

Total gain.

Recapture portion.

Long-term portion.

After-tax proceeds.

Return on True Net Equity™ for hold versus sell.

When investors see after-tax proceeds instead of raw equity, the correct decision usually becomes obvious.

After-Tax Sale Proceeds Calculation

Special Rules Every Investor Should Understand

The primary residence exclusion allows you to exclude up to $500,000 of gains if you lived in the property two of the last five years.

Depreciation still gets recaptured.

The rest may be tax-free.

Installment sales can spread income across years and reduce bracket impact.

They are powerful when structured correctly.

1031 exchanges can defer taxes entirely.

They are devastating when executed sloppily.

Each tool has a place.

None should be used blindly.

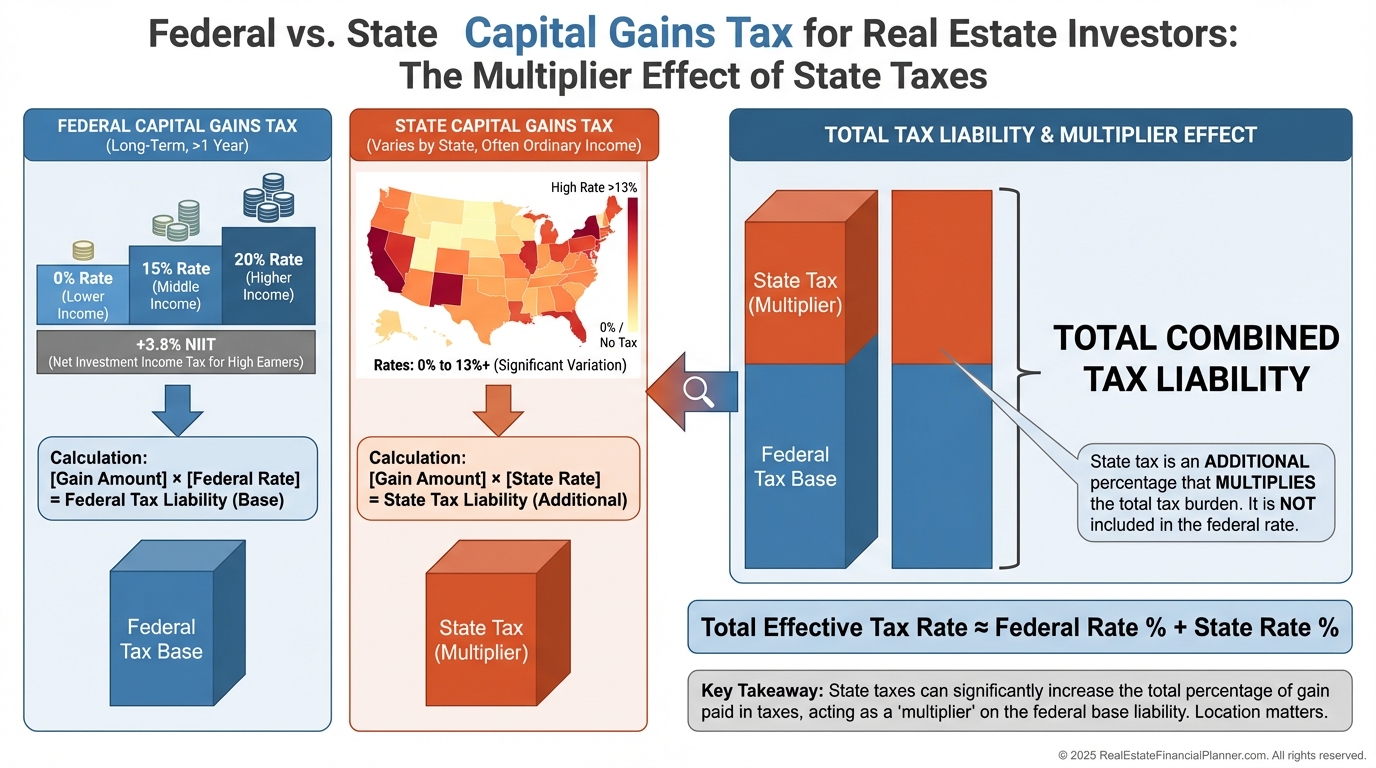

State Taxes: The Silent Multiplier

State taxes often double the pain.

Some states add another large layer of tax.

Others eliminate it entirely.

I’ve seen strategic relocation save investors six figures.

Ignoring state taxes leads to wildly inaccurate projections.

Federal vs State Capital Gains Taxes

How Capital Gains Taxes Fit Into Your Bigger Strategy

Raw equity is meaningless.

Only True Net Equity™ matters.

A rental with mediocre cash flow may still be an exceptional investment once selling taxes are modeled.

Sometimes the right move is to sell.

Sometimes the right move is absolutely not to sell.

You only know when you model it.

Common Mistakes That Cost Investors Money

These are mistakes I’ve made and watched clients make.

Forgetting depreciation recapture.

Miscalculating basis.

Losing documentation.

Breaking a 1031 exchange.

Selling too early.

Ignoring state taxes.

Guessing instead of modeling.

In my opinion, these mistakes destroy more wealth than bad deals.

Once you understand them, you can avoid them.

Planning and Documentation

Pros track basis annually.

Pros document improvements.

Pros model disposition scenarios years in advance.

Pros know their tax bill before listing.

Capital gains taxes are something you plan around, not react to.

Adopt this mindset, and your entire investing strategy improves.