Private Mortgage Insurance for Investors: The Precise Way to Calculate, Reduce, and Remove PMI

Learn about Private Mortgage Insurance for real estate investing.

Why Professionals Obsess Over PMI

When I help clients audit their portfolios, I start with one question: where is PMI quietly draining cash flow?

PMI looks small on a closing disclosure, but it compounds into slower acquisitions and weaker returns if you let it linger.

I’ve watched investors unknowingly bleed $200–$500 per month per door for years.

Once we model PMI correctly and remove it quickly, their savings fund the next down payment faster.

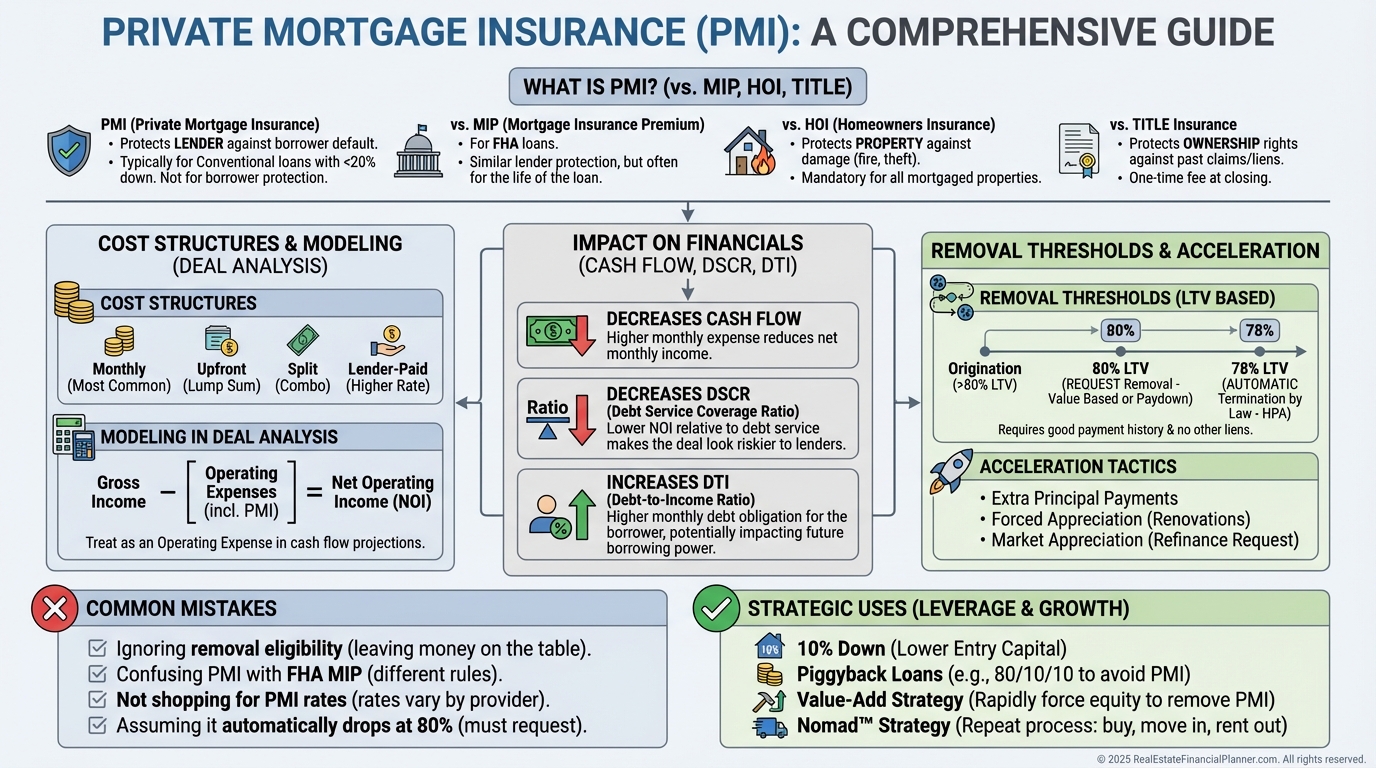

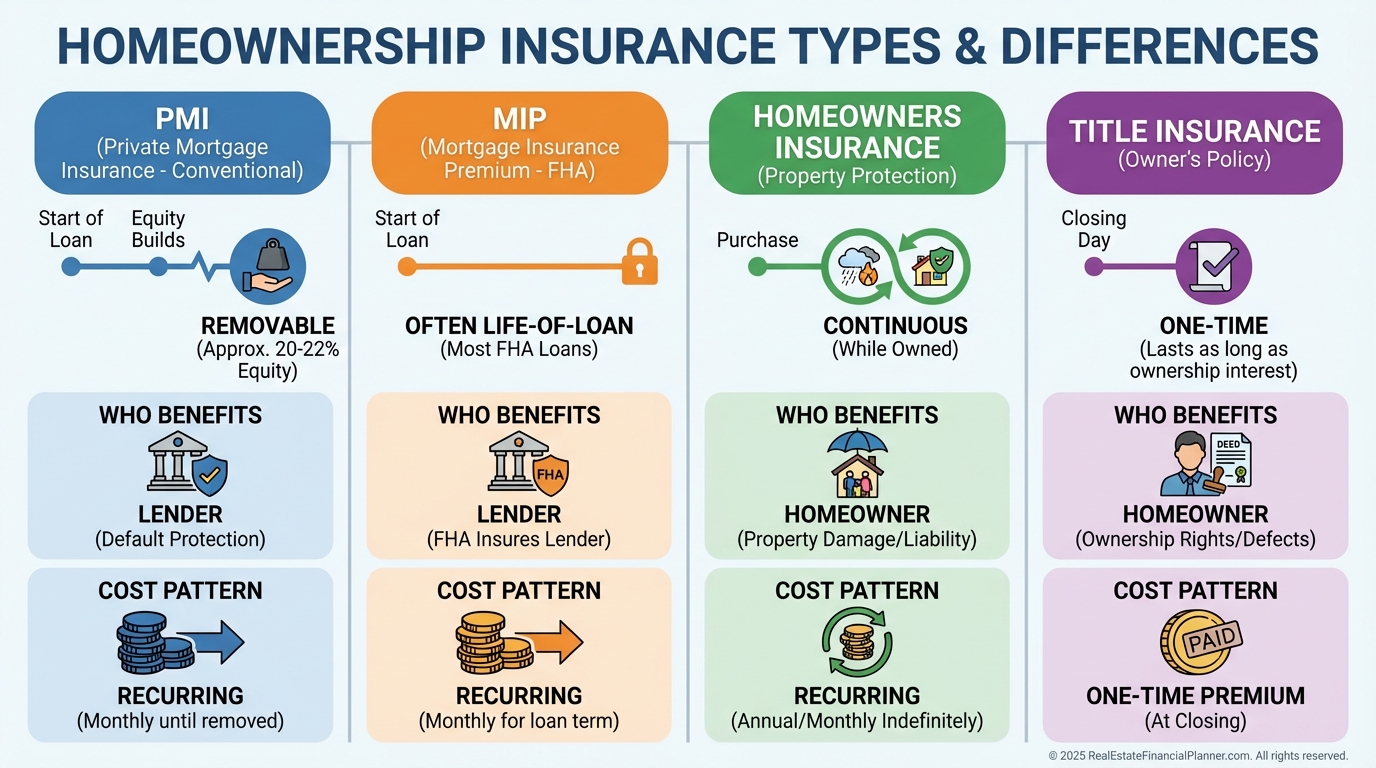

What PMI Is—and Isn’t

Private mortgage insurance protects the lender when your down payment is under 20% on a conventional loan.

You pay the premium, but you never benefit directly from a claim.

PMI is not FHA mortgage insurance (MIP), homeowners insurance, or title insurance.

Each serves a different purpose, has different timelines, and behaves differently in your deal analysis.

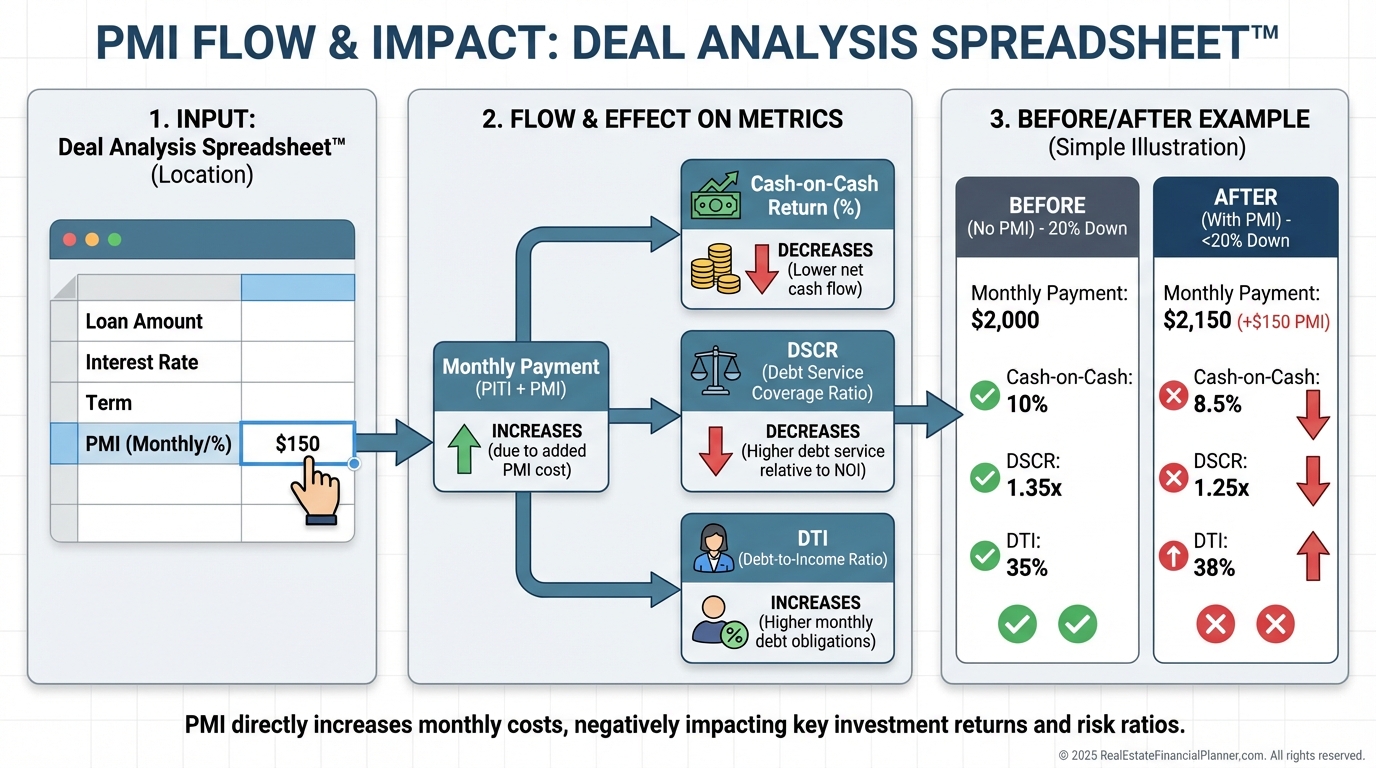

Where PMI Lives in Your Numbers

PMI hits cash flow immediately, lowers cash-on-cash returns, and can shrink DSCR enough to jeopardize your next loan.

When I model a purchase in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I enter PMI as a monthly expense, toggle scenarios by down payment and PMI type, and run sensitivity on removal timing.

That quick exercise often changes buy/no-buy decisions.

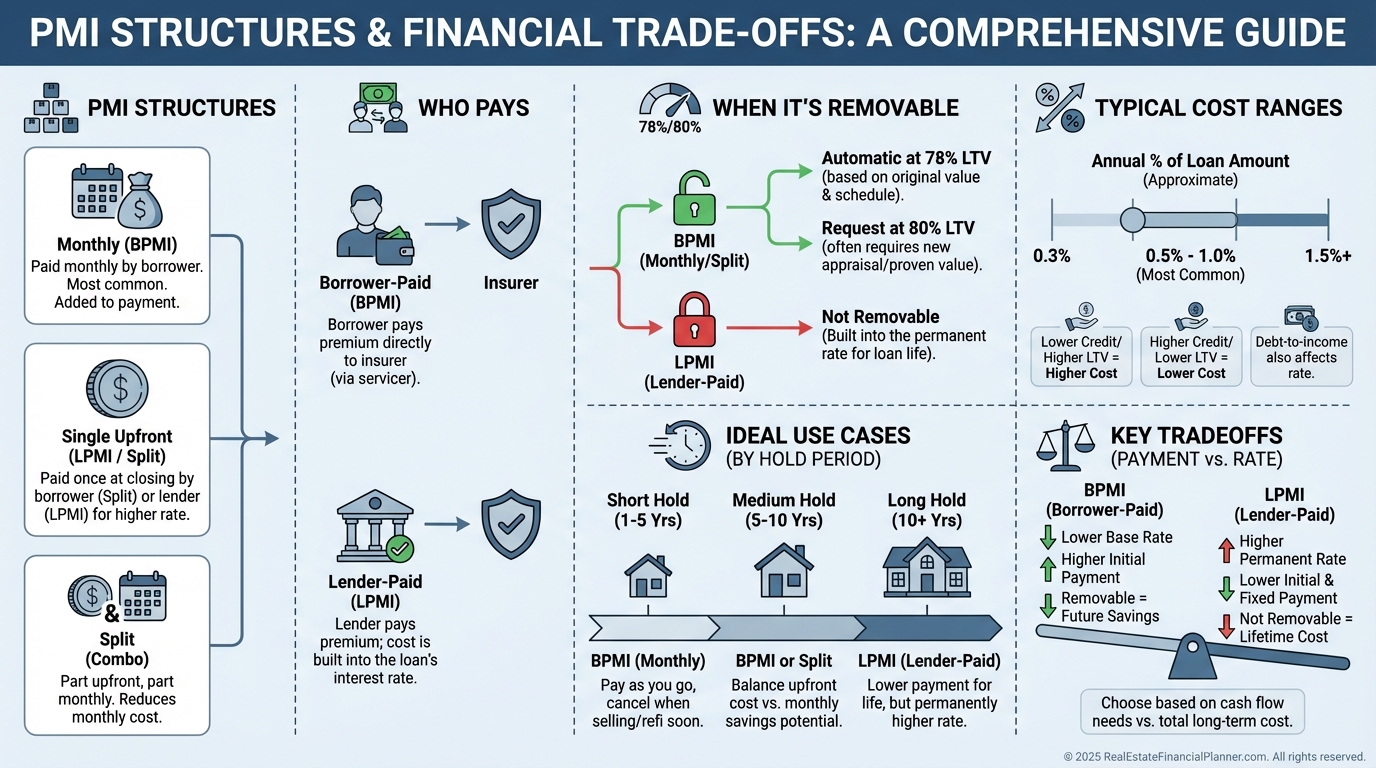

PMI Cost Structures You Can Choose

PMI isn’t one product.

It comes in four structures with different math and ideal use cases.

•

Borrower-paid monthly: visible, removable, great if you plan to remove in 1–5 years.

•

Single premium: pay upfront or finance it; best when holds are short and removal is uncertain.

•

Lender-paid: higher interest rate instead of a line-item; often costs more over long holds.

•

Split premium: partial upfront to reduce monthly; a good middle ground when you want lower payment and early removal optionality.

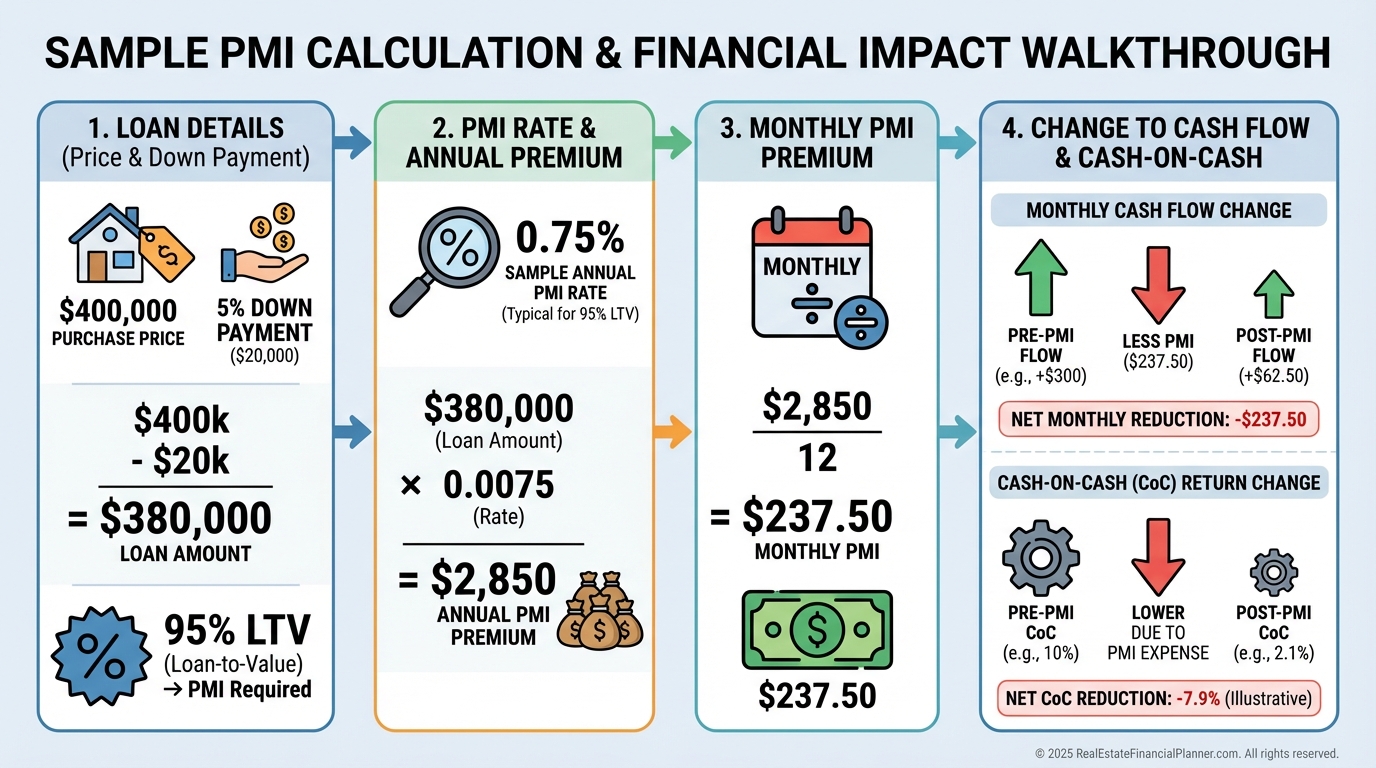

A Quick Calculation Walkthrough

Here’s a duplex example I use in client training.

•

Price: $250,000

•

Down payment: 10% ($25,000)

•

Loan: $225,000

•

PMI rate: 0.75% annually

•

Annual PMI: $1,687.50

•

Monthly PMI: $140.63

If gross rents are $2,400 and all-in expenses (PITI, maintenance, management) are $1,800 before PMI, cash flow is $600.

Add PMI and cash flow drops to $459.37, a 23.4% hit you must see before you write an offer.

When I rebuilt after bankruptcy, I refused to buy anything that didn’t pencil with PMI included and a realistic removal timeline.

That discipline alone saved me from thin deals in flat markets.

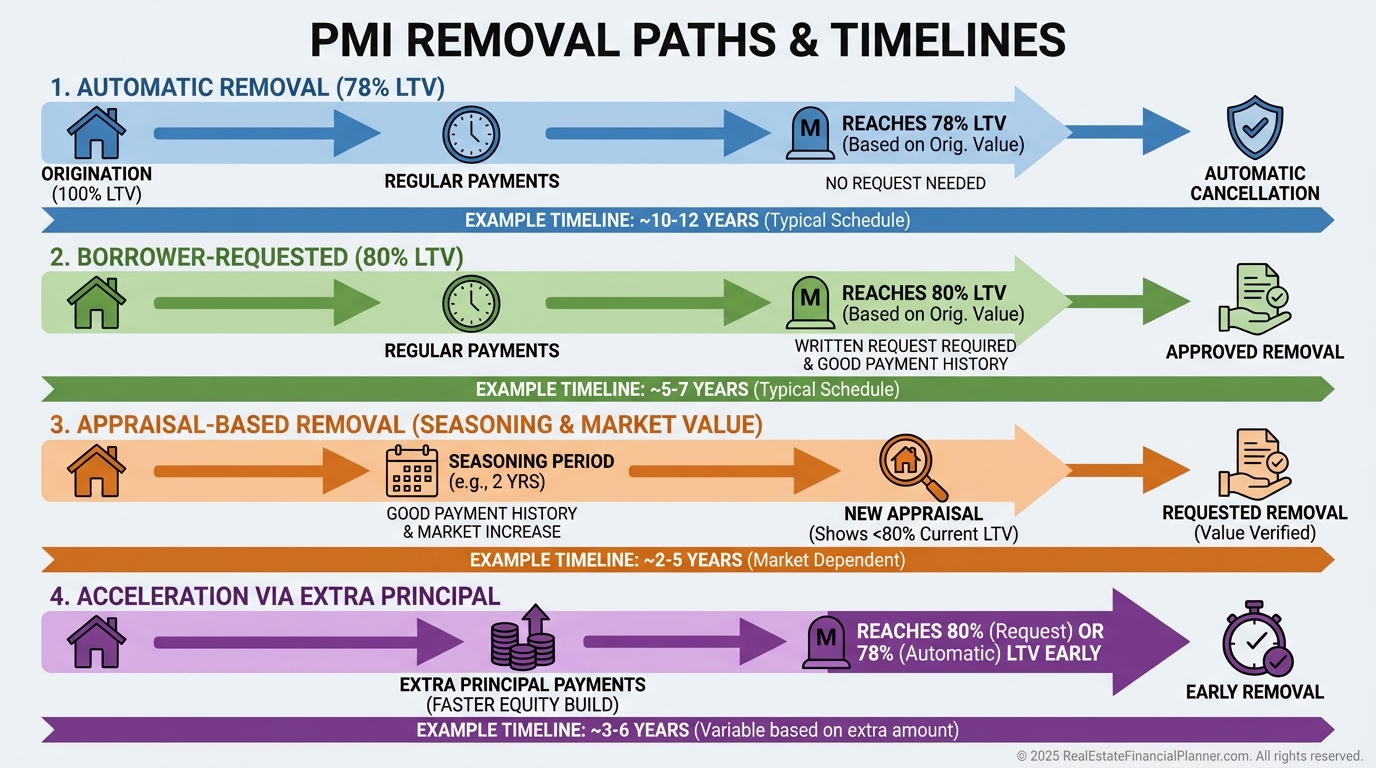

Removal Rules Most Investors Miss

Conventional loans offer two main removal paths.

Automatic removal happens at 78% LTV using the original value, based on the amortization schedule.

Borrower-requested removal is typically available at 80% LTV; many servicers require a good payment history, no junior liens, and acceptable seasoning.

On investment properties, expect stricter rules and seasoning requirements, and you may need a new appraisal to prove today’s value is high enough.

In the duplex example, automatic removal may take around 9.5 years via normal amortization.

But if you add $200 per month to principal, you can often bring removal forward by several years.

In appreciating markets, a new appraisal after 24 months can qualify you even faster, especially if you completed value-add improvements.

Financing Friction: DSCR, DTI, and Reserves

PMI increases your monthly obligation, which pushes DTI up and DSCR down.

That can stall portfolio growth if you’re at underwriting limits.

Portfolio lenders also count PMI in global cash flow and in reserve requirements.

When I coach clients, we sequence acquisitions so PMI removal on Property A unlocks the next loan for Property B.

Timing matters more than most realize.

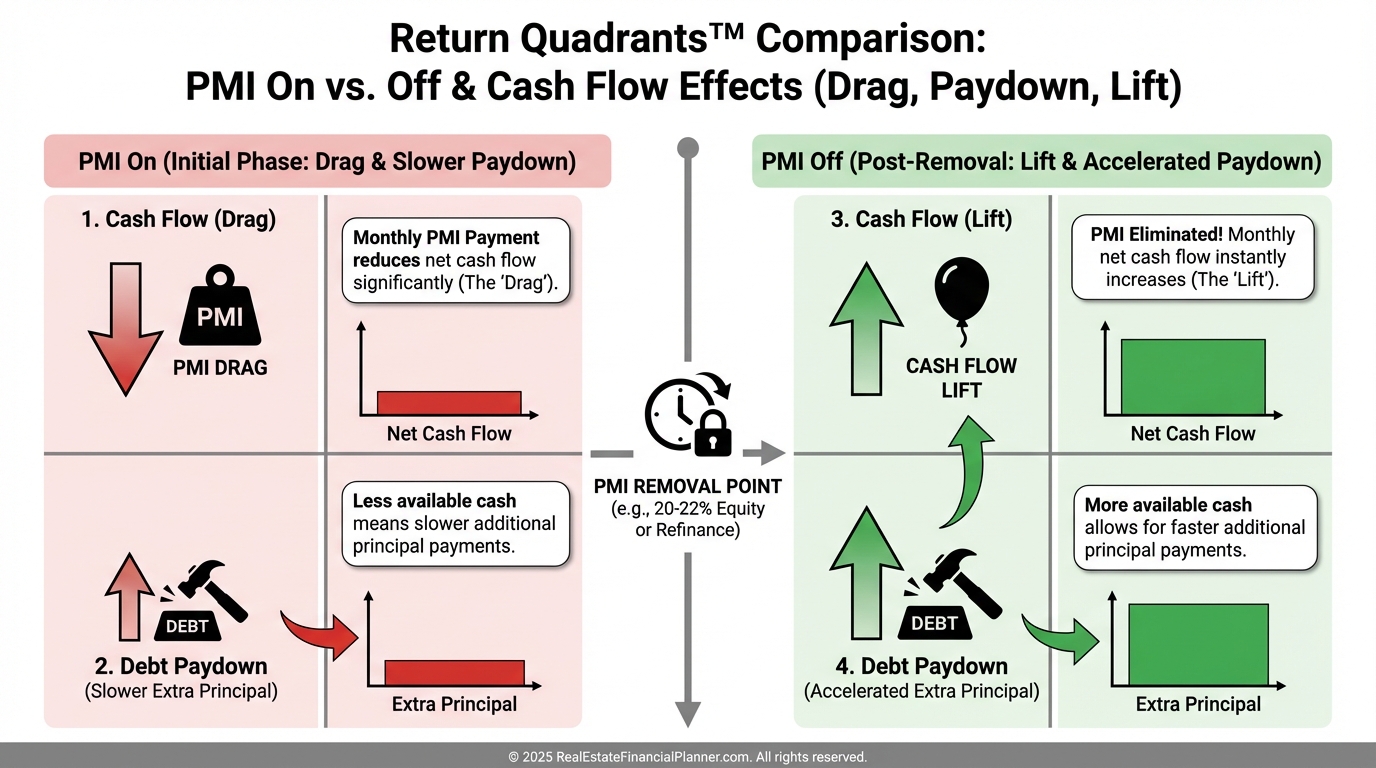

How PMI Changes Your Return Quadrants™

In the Return Quadrants™ framework—Appreciation, Cash Flow, Debt Paydown, and Tax Benefits—PMI directly reduces the Cash Flow quadrant.

If you pay extra principal to accelerate removal, you tilt some return toward Debt Paydown.

Once PMI drops off, the Cash Flow quadrant steps up permanently, compounding your savings into faster down payment accumulation.

True Net Equity™ doesn’t change the moment PMI disappears, but higher monthly cash flow improves your path to liquidity events and increases your ability to deleverage or refinance on your terms.

Common PMI Mistakes I See Weekly

•

Not requesting removal at 80% LTV and overpaying for months or years.

•

Ignoring appreciation or value-add improvements that could justify an appraisal-based removal.

•

Picking lender-paid PMI for convenience, then paying a higher rate for decades.

•

Omitting PMI from deal analysis and misjudging cash-on-cash and DSCR.

•

Accepting the first PMI quote instead of shopping insurer options via your loan officer.

I once reviewed a client’s triplex where PMI should have been removed 18 months earlier.

Those dollars would have funded upgrades that boosted rents and NOI.

Strategic Uses of PMI—When It’s Worth It

PMI is a tool when it allows you to buy earlier, buy better, or buy more.

•

10% Down Scaling: Two 10% down deals with PMI often outperform one 20% down deal when purchased at a discount or with clear upside.

•

Piggyback Loans (80/10/10): A second mortgage can avoid PMI entirely and sometimes beat PMI on total cost.

•

Value-Add Acceleration: Force appreciation, reappraise, and request early removal.

•

Smart Refis: Time refinances to cross 80% LTV and exit PMI while improving rate and term.

For Nomad™ investors, PMI is common on the owner-occupant purchase.

The move-out plan should include a removal checkpoint so you convert to a rental with higher cash flow.

How I Optimize PMI with the REFP Toolset

In the Deal Analysis Spreadsheet™, I:

•

Enter PMI correctly and tag its structure (monthly, single, lender-paid, split).

•

Sensitivity-test removal timelines: amortization-only vs. extra principal vs. appraisal.

•

Compare down payments side-by-side to see which path maximizes True Net Equity™ over 10–30 years.

•

Model global DTI and DSCR to ensure PMI won’t choke the next loan.

When a client needs speed, we prioritize PMI removal on the property where each dollar of principal eliminates the most PMI the fastest.

That “PMI snowball” frees cash flow to attack the next property, and the next.

Your PMI Action Plan

•

Audit: List every loan, current balance, original value, current value estimate, payment history, and PMI type.

•

Model: Use the Spreadsheet to compare scenarios—no extra principal, with extra principal, and appraisal-based removal.

•

Shop: Ask your loan officer for multiple PMI insurer quotes and structure options.

•

Remove: Set calendar reminders for 80% LTV and call the servicer to request removal; be ready to order an appraisal if warranted.

•

Sequence: Align removals with future loan applications to keep DTI/DSCR inside guidelines.

When I run these five steps with clients, PMI usually falls off months or years earlier than they expected.

That’s money you can redirect into renovations, reserves, or the next down payment.