Passive Income in Real Estate: What’s Actually Passive (And What Secretly Isn’t)

Learn about Passive Income for real estate investing.

Why Most “Passive Income” From Rentals Isn’t Passive

When I help clients unwind portfolios, the pattern is obvious.

They didn’t buy passive income. They bought a second job with nights and weekends.

Even with a property manager, you still approve roofs, refinance decisions, and capital plans.

You still carry liability, compliance, and the final say when something goes sideways.

That’s not passive. That’s active with fewer phone calls.

What Investors Really Mean By Passive Income

Most clients want three things.

Time freedom, reliable cash flow, and minimal decision fatigue.

You can have most of that. But you will trade control to get it.

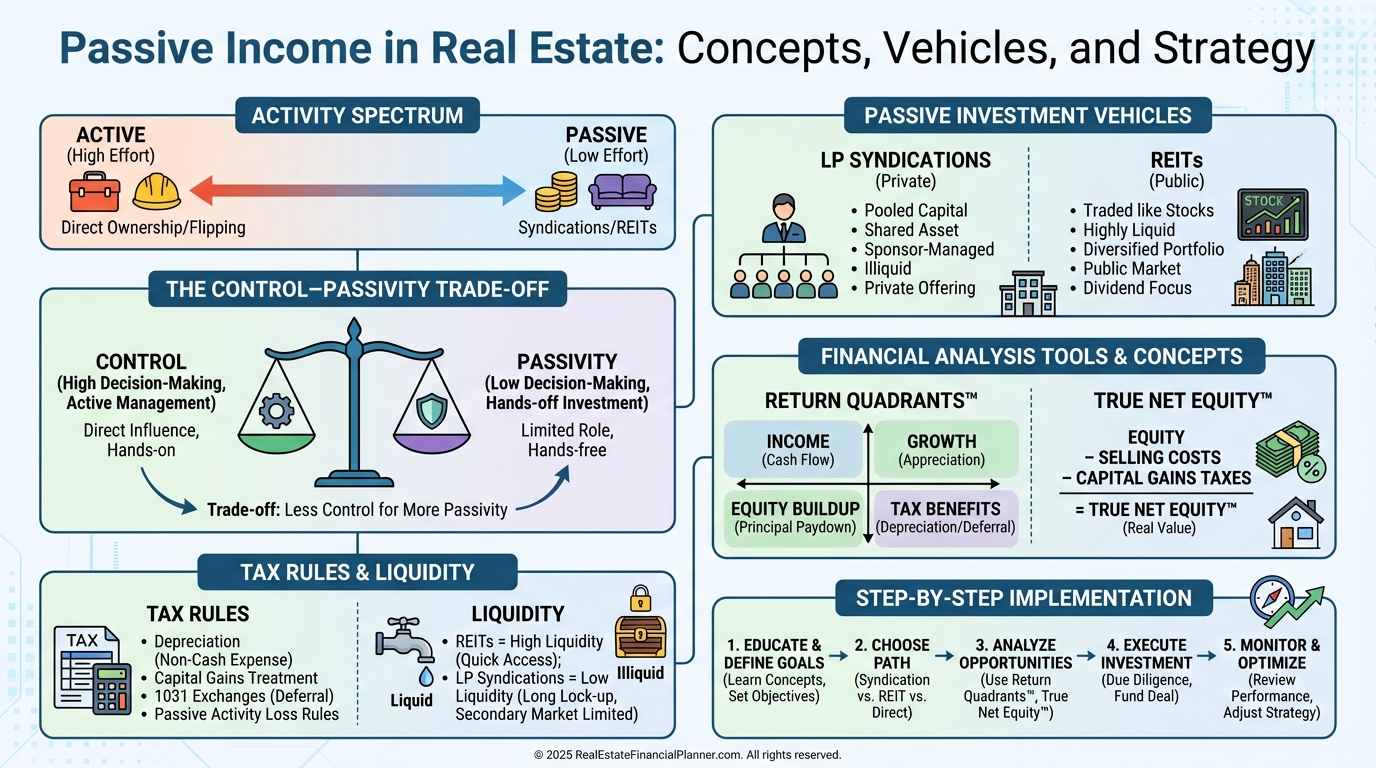

The Passive-Income Spectrum in Real Estate

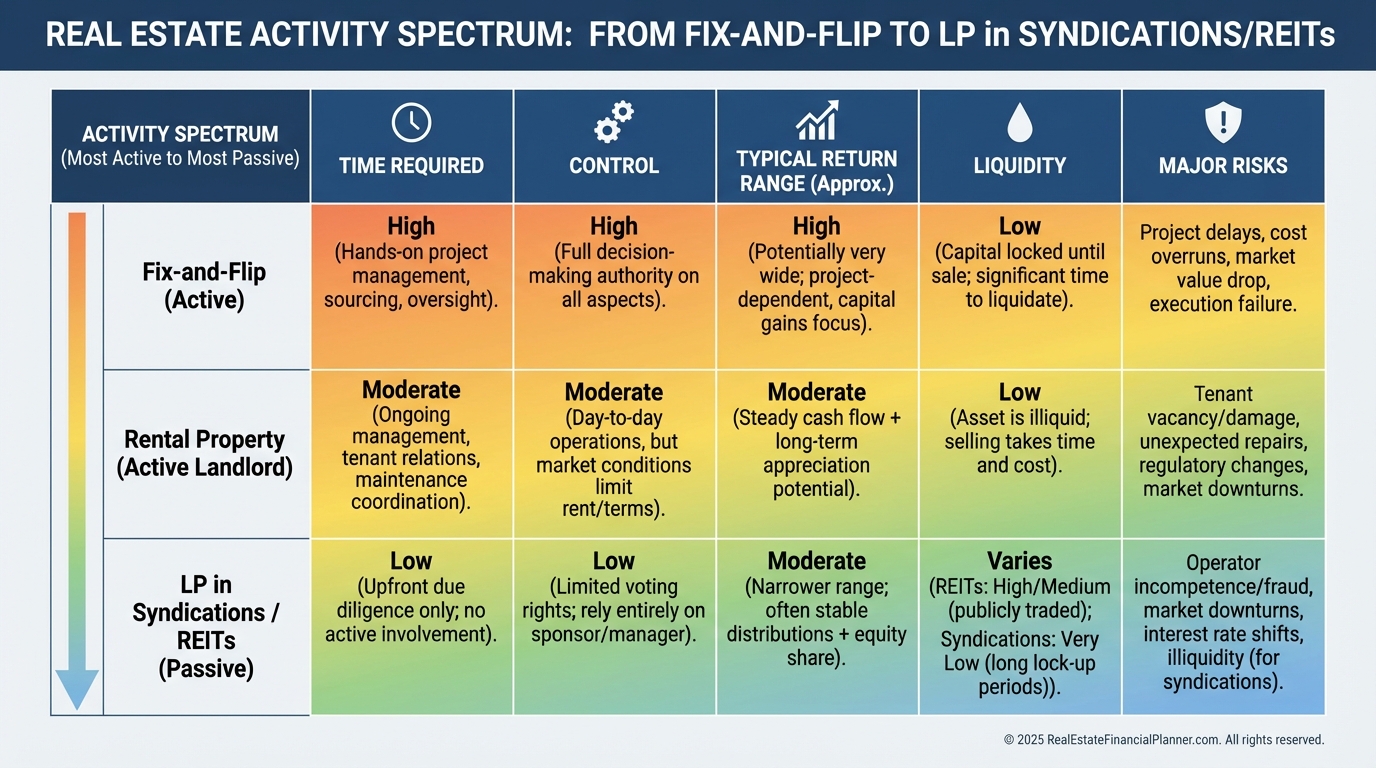

The spectrum runs from “you do everything” to “you do nothing.”

On one end, you swing hammers and chase permits.

On the other, you read quarterly reports and cash distributions.

Here’s how I frame it for clients.

•

•

Moderately Active: Long-term rentals with management, small multis, note investing.

•

Mostly Passive: Crowdfunded eREITs, diversified private credit, private lending.

•

Truly Passive: Real estate syndications as an LP, publicly traded REITs.

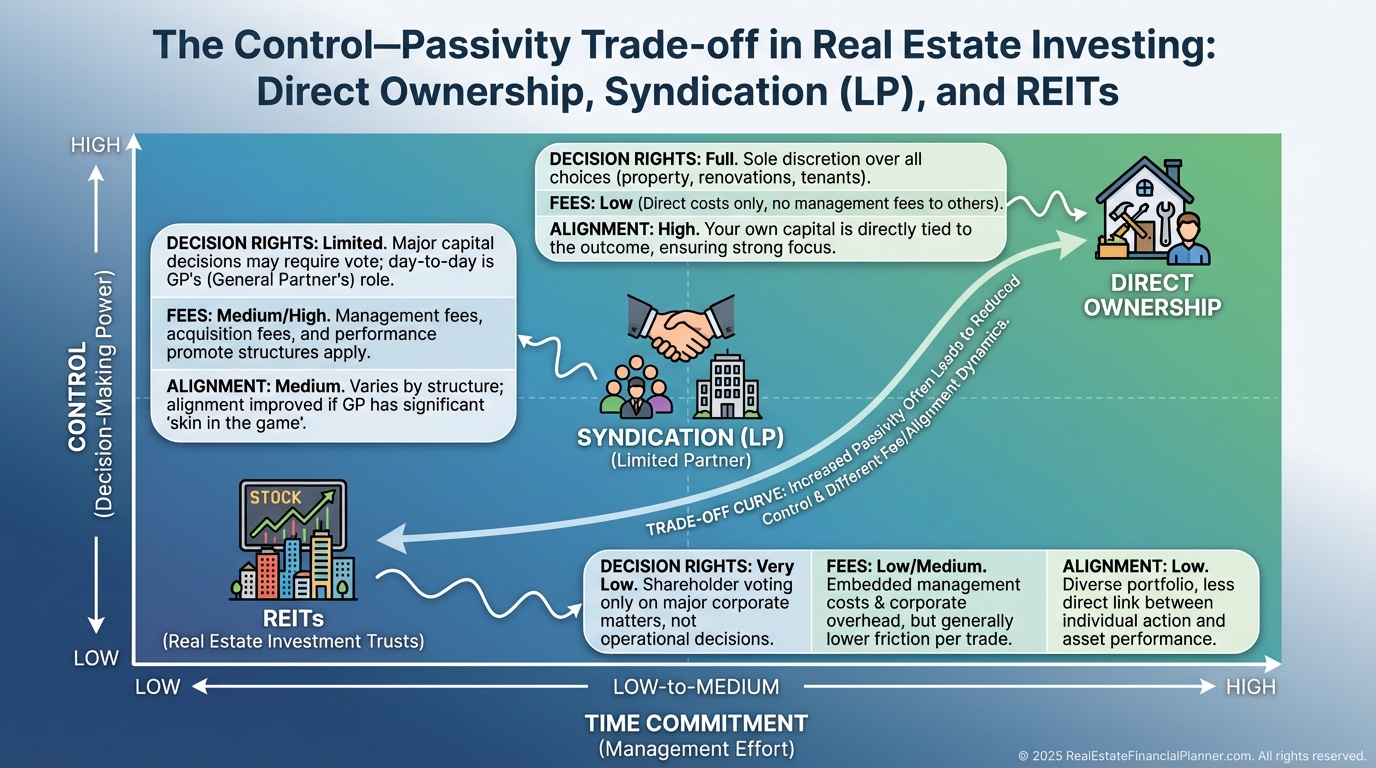

Control vs. Passivity: The Trade You Must Make

Every step toward passivity surrenders control.

As a landlord, you set rents, pick tenants, and time your sale.

As an LP or REIT investor, you trust pros to do that job.

You gain time, but you accept their decisions and timelines.

What “Truly Passive” Looks Like

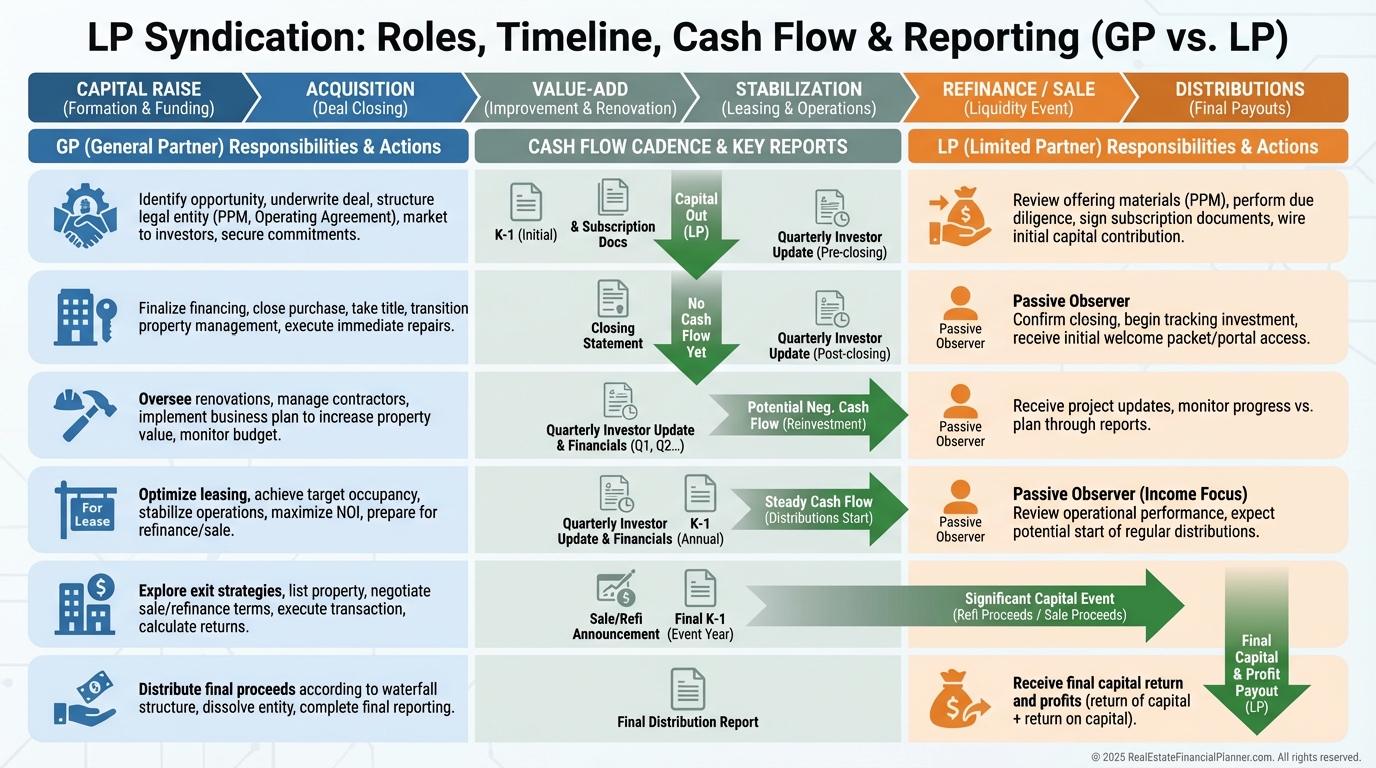

Limited partnership (LP) investments in syndications are the closest thing to true passivity in physical real estate.

You wire funds, read updates, and collect distributions.

The general partners do everything else.

Sourcing, due diligence, financing, asset management, and exit.

Most target 12–20% project-level returns, with $25k–$100k minimums.

But underwriting quality and sponsor integrity drive outcomes more than the brochure.

When I vet deals, I look for boring execution, conservative leverage, and rational pro formas.

If I can’t break the model with stress tests, I don’t wire.

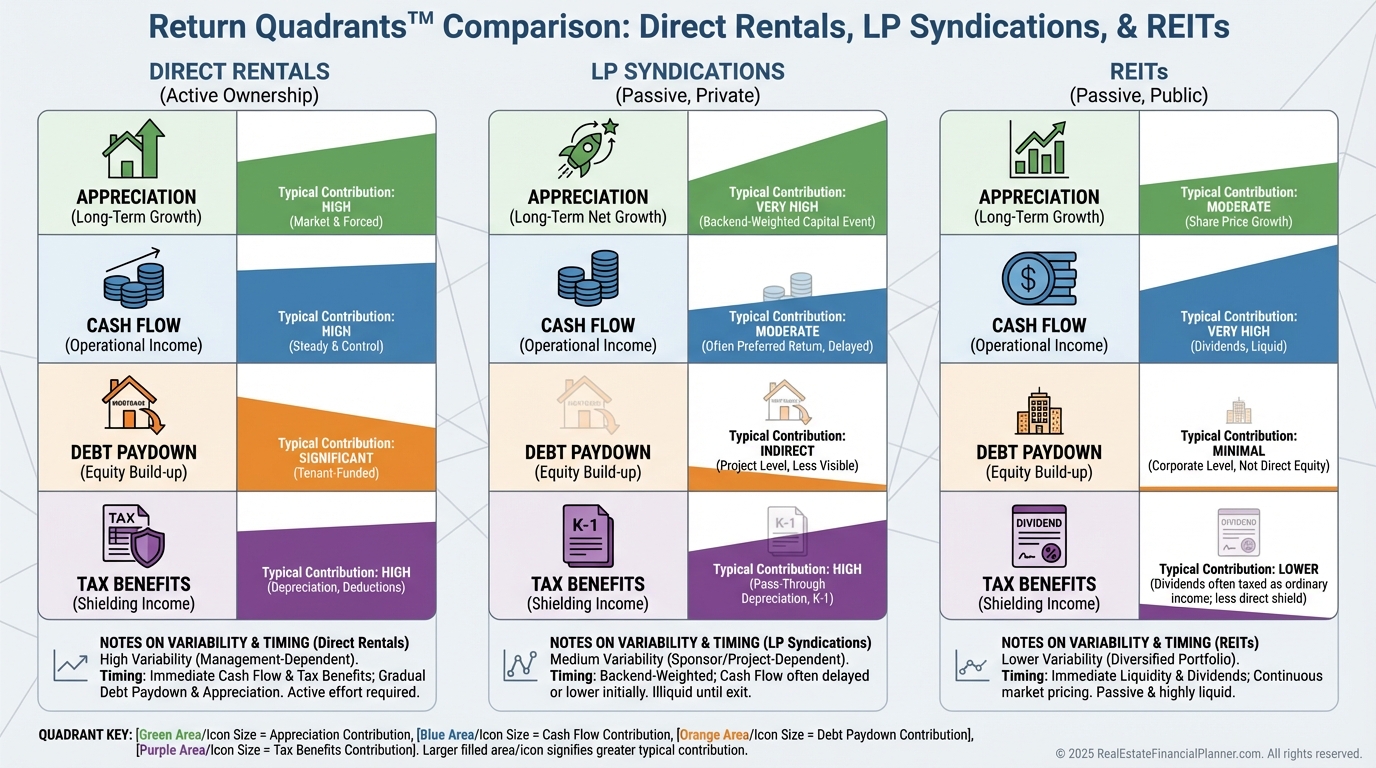

How I Model It With Return Quadrants™

When I coach clients, we start with Return Quadrants™.

Appreciation, cash flow, debt paydown, and tax benefits.

Then we layer risk and time required.

For a managed rental, a typical year might look like this:

•

Appreciation: 4% on property value.

•

Debt Paydown: 3–5% on invested capital, depending on amortization.

•

Tax Benefits: Often 2–6% via depreciation, sheltered by passive rules.

For an LP multifamily deal, it’s different.

•

Cash Flow: 5–8% preferred, paid quarterly.

•

Appreciation: Back-loaded at sale, often the majority of return.

•

Debt Paydown: Embedded in the equity multiple.

•

Tax Benefits: Large year-1 depreciation flowing via K-1, typically passive.

I sanity-check each quadrant against the sponsor’s pro forma and my own stress tests.

If two or more quadrants require perfection, I pass.

True Net Equity™ and the Cost of Your Time

Equity isn’t what your Zillow estimate says.

True Net Equity™ is what you’d actually keep after selling.

I subtract transaction costs, payoff, taxes, and depreciation recapture.

Then I compare the yield on that True Net Equity™ to what you could earn passively.

If your rentals earn 5% on True Net Equity™ after all friction, but a quality LP can target 12–15% with no time cost, the decision becomes clearer.

When I rebuilt a client’s plan last year, we sold three low-yield single-family rentals.

We redeployed into two LPs and a diversified REIT sleeve for liquidity.

Their monthly hours dropped from eight to one.

Their projected return on True Net Equity™ doubled.

Time, Liquidity, and Sequence Risk

Passive investments still carry trade-offs.

LPs are illiquid for 3–7 years.

REITs are liquid daily, but prices are volatile.

Direct rentals can be sold, but not instantly and not without costs.

Match the tool to your timeline, not your ego.

If you might need principal within 24 months, you’re not an LP.

If you need stability with liquidity, blend REITs and T-Bills.

If you want max control and have the hours, keep the rentals.

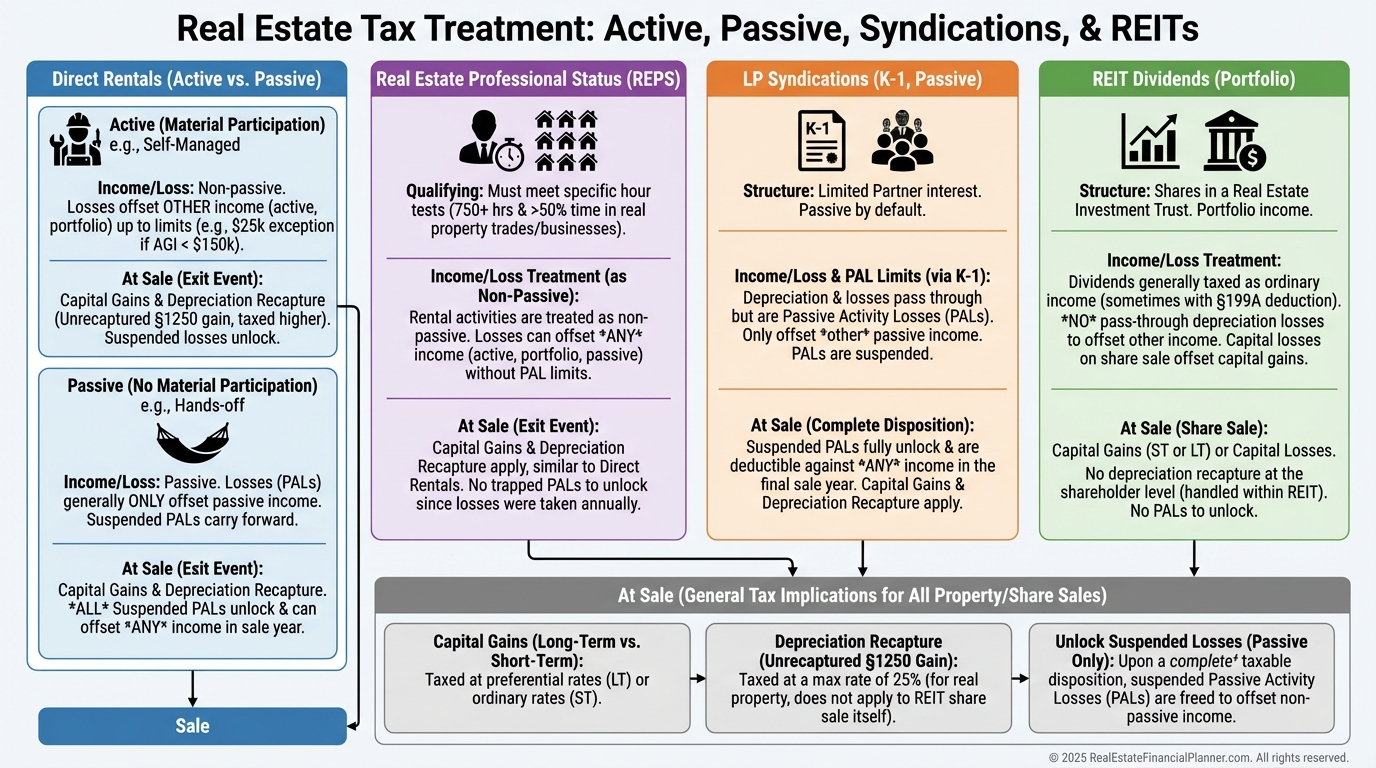

Taxes: Passive vs. Active Rules You Must Know

The IRS doesn’t care how many calls you took this month.

Without material participation, rental income is passive.

Passive losses offset passive income, not W-2 wages.

Most landlords with property managers fail the material participation tests.

Real estate professional status changes the game.

It requires 750+ hours and more time in real estate than anything else.

If you qualify, rental losses can offset other income.

LPs pass depreciation via K-1s, but it’s still passive unless you qualify as a RE pro.

REIT dividends are mostly ordinary income with a potential 199A deduction.

And you can’t 1031 out of a syndication’s sale as an LP.

When I model taxes, I assume passive loss limitations, then quantify the shelter against distributions.

I also model exit taxes so the pro forma doesn’t ignore recapture and capital gains.

Case Study: From Landlord to Passive

A client owned four single-family rentals worth $1.6M with $600k equity.

True Net Equity™ after costs and taxes was $520k.

Their annual net cash flow was $24k before CapEx and their time.

That’s 4.6% on True Net Equity™.

We sold two, refinanced one, and kept the best performer.

We placed $350k into two LPs targeting a blended 14% IRR and $75k into liquid REITs.

We held $95k in T-Bills for reserves.

Within 12 months, they cut their hours by 80% and improved projected retirement readiness by five years.

The Return Quadrants™ shifted from cash-flow light with time-heavy to time-light with tax-shielded distributions.

Implementation Playbook

Here’s how I guide clients, step-by-step.

•

Inventory holdings and calculate True Net Equity™ per property.

•

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model hold vs. sell.

•

Quantify time spent monthly. Price it at your hourly rate.

•

Define your required liquidity window.

•

Build a target mix: LPs for yield and appreciation, REITs for liquidity, T-Bills for ballast.

•

Underwrite sponsors. Verify track record, debt terms, capex scope, and exit logic.

•

Stage capital over 12–18 months to diversify by sponsor, asset, and vintage.

What I Check, Model, and Avoid

I check debt structure first.

Fixed vs. floating, caps in place, and refinance risk timing.

I model exit cap rates 75–150 bps higher than entry.

I haircut rent growth below inflation.

I avoid deals where fees crowd out LP returns or where the business plan relies on perfection.

I prefer sponsors who return capital before promote, communicate candidly, and underwrite with humility.

Comparing to Non-Real Estate Passive Options

S&P 500 index funds are the gold standard for passivity.

Buy, hold, reinvest, and go live your life.

Historical returns hover near 10% with daily liquidity.

Dividend stocks, bonds, and high-yield savings add stability and income.

But they don’t deliver real estate’s depreciation benefits.

That’s why many clients blend index funds with LPs.

You get liquidity and tax efficiency in the same plan.

The Nomad™ Note

It can accelerate wealth with low down payments and owner-occupant financing.

But it’s not passive.

It’s a lifestyle strategy that trades convenience for long-term equity growth.

Use it when your time horizon is long and your energy is high.

The Bottom Line

Passive income is real.

But in real estate, it requires giving up control.

For many, that’s a smart trade.

Move from landlord to LP, add liquid REITs, keep only your best rentals, and measure everything using Return Quadrants™ and True Net Equity™.

Do the heavy diligence once.

Then let your money work while you get your time back.