Agreement for Deed Explained: Powerful Creative Financing Without the Bank

Learn about Agreement for Deed for real estate investing.

Agreement for Deed: The Deal Banks Don’t Want You to Understand

When I help investors analyze creative financing deals, Agreement for Deed transactions usually raise the most questions and the most red flags.

They look simple.

They feel flexible.

And they can quietly destroy returns if you misunderstand how equity, risk, and control actually work.

An Agreement for Deed is not a mortgage.

It is not ownership.

And it is not forgiving when things go wrong.

Used correctly, it can unlock deals that traditional financing cannot.

Used poorly, it creates false equity, legal exposure, and asymmetric risk.

What an Agreement for Deed Really Is

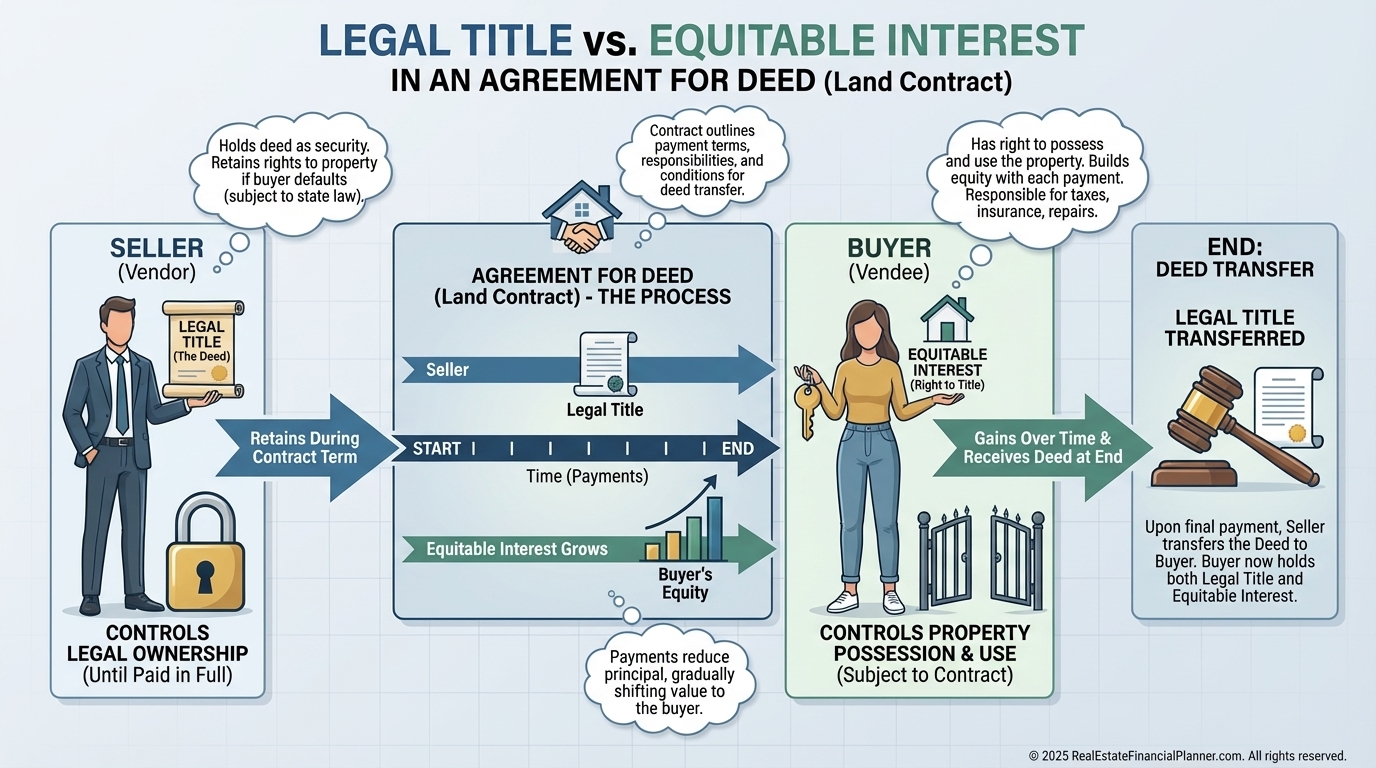

An Agreement for Deed is a seller-financed transaction where the seller keeps legal title until the buyer completes all payments.

You get possession immediately.

You make payments like an owner.

But the deed stays with the seller.

When I explain this to clients, I tell them to think in terms of control versus ownership.

You control the property.

You do not own it yet.

The buyer holds equitable interest.

The seller holds legal title.

That difference matters far more than most investors realize.

Why Investors Use Agreement for Deed Transactions

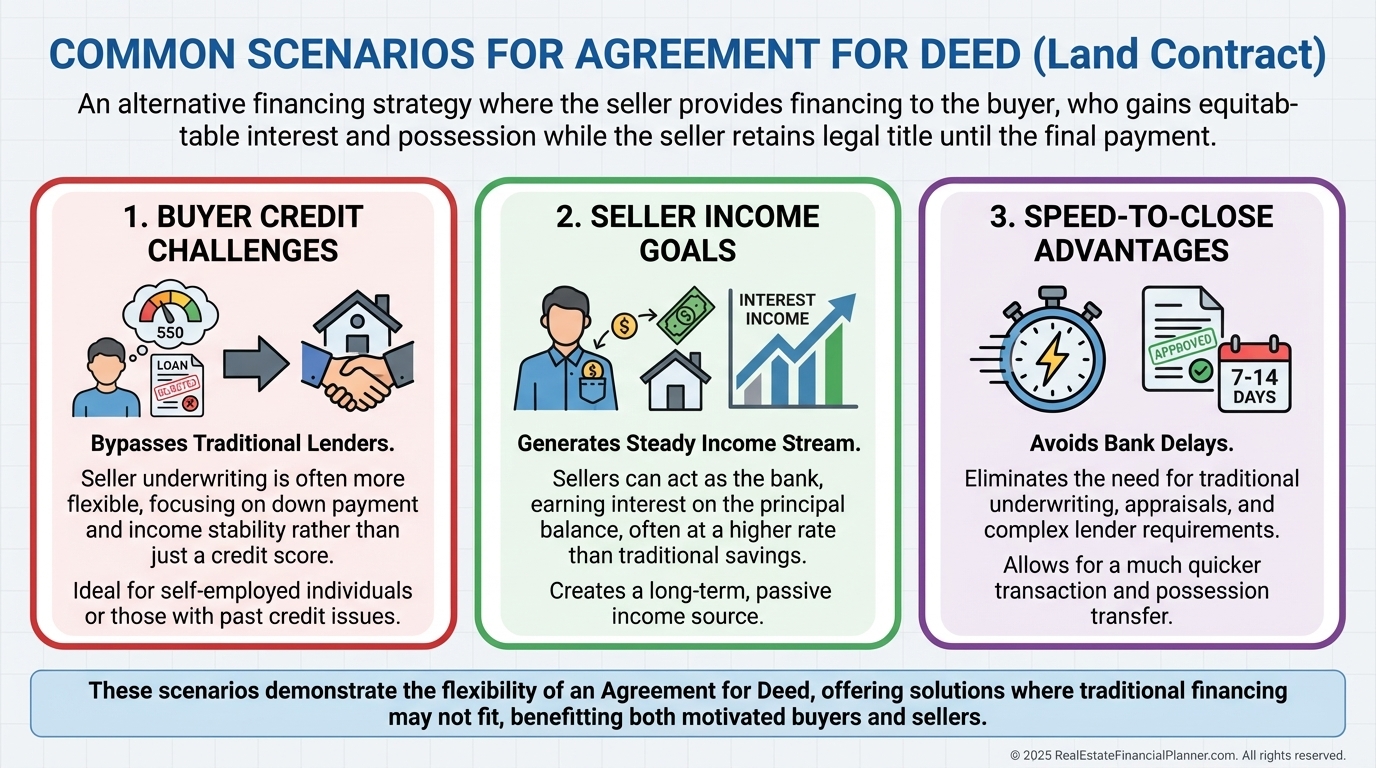

I usually see Agreement for Deed deals show up in three situations.

First, when buyers cannot qualify for traditional financing.

Second, when sellers want steady income instead of a lump sum.

Third, when speed matters more than perfection.

From a strategy perspective, this is about solving constraints, not chasing cleverness.

The mistake I see investors make is assuming flexibility equals safety.

It does not.

Agreement for Deed vs Other Creative Financing

Different states use different names.

Agreement for Deed.

Contract for Deed.

Land Contract.

Bond for Deed.

These are functionally the same structure.

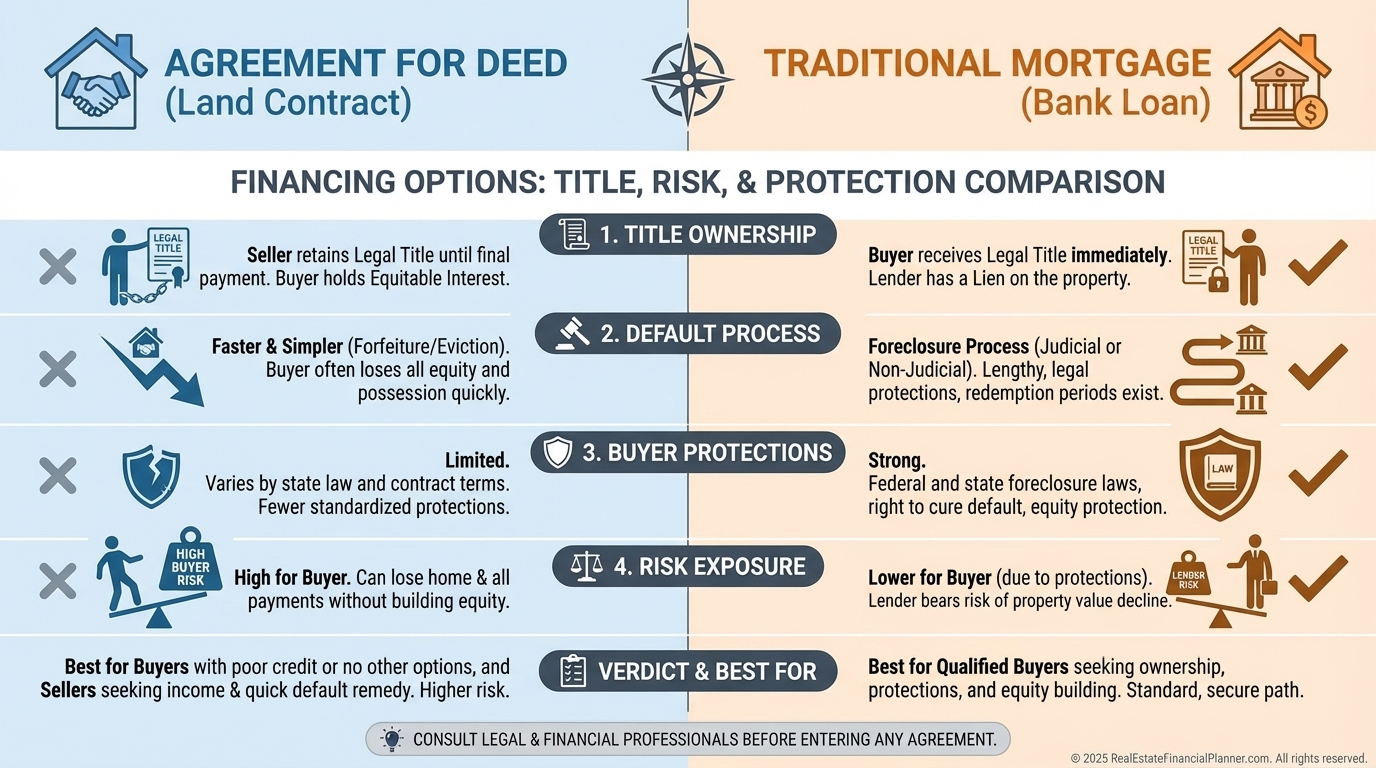

The real comparison that matters is against a traditional mortgage.

With a mortgage, you receive the deed at closing.

With an Agreement for Deed, you earn the deed later.

That single difference changes default risk, remedies, and equity protection.

This is where inexperienced investors get hurt.

They assume they are building equity the same way.

They are not.

The Equity Illusion Problem

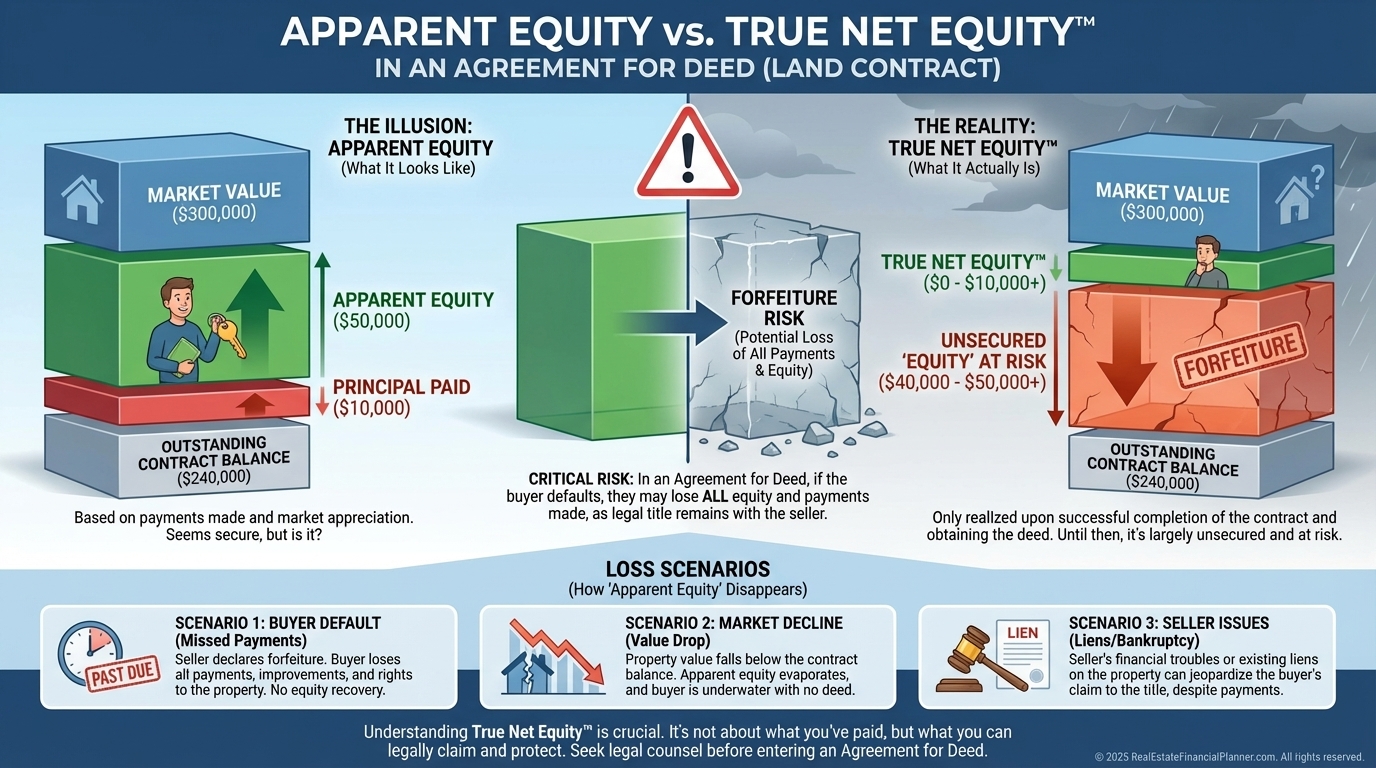

One of the first things I model in REFP is True Net Equity™.

With an Agreement for Deed, your apparent equity can look great on paper while being extremely fragile in reality.

Miss payments.

Violate terms.

Fail to cure properly.

You can lose years of payments with no deed to show for it.

This is why I never analyze these deals using purchase price alone.

I analyze equity durability, not just equity growth.

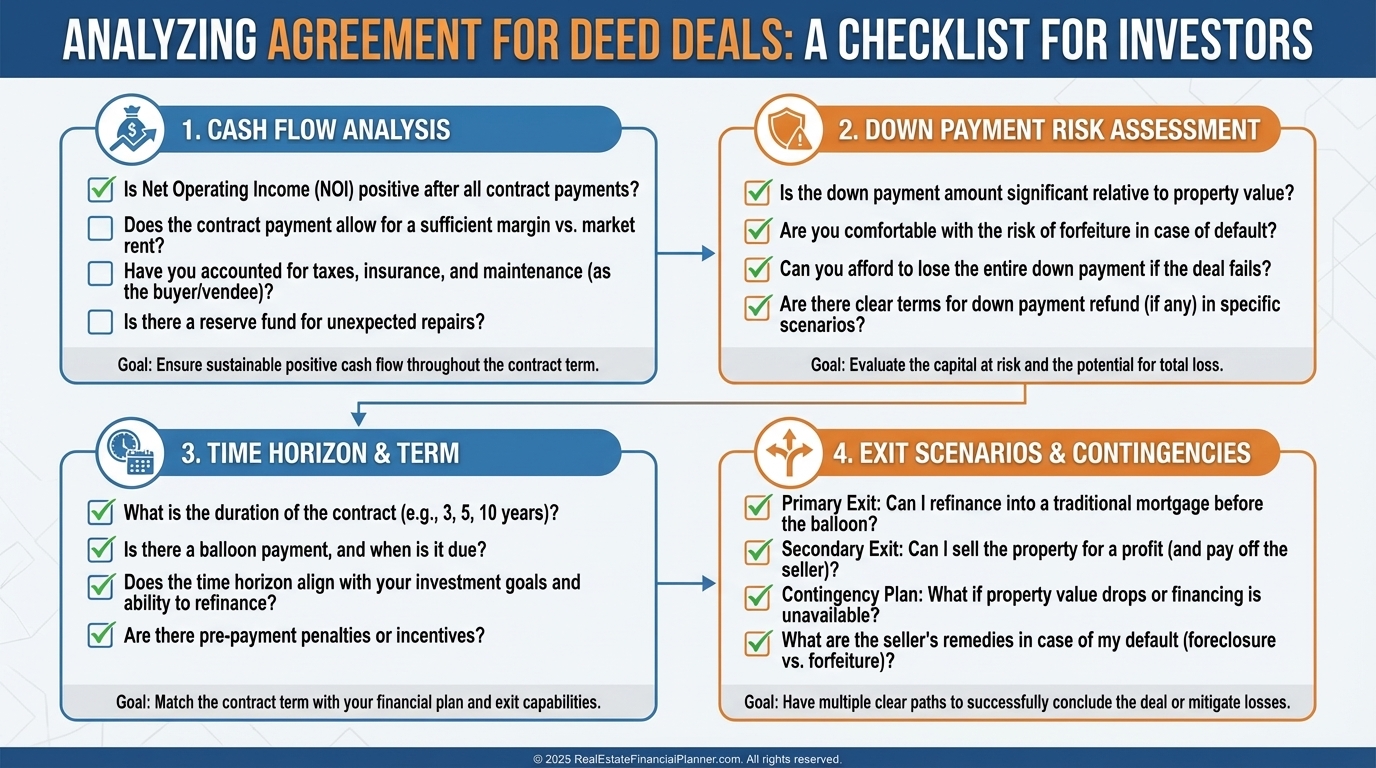

How I Analyze Agreement for Deed Deals

When I run these through The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I treat them differently from traditional loans.

I focus on:

Cash flow durability

Down payment at risk

Time to deed transfer

Opportunity cost of trapped capital

Exit scenarios if things go sideways

I also stress test defaults.

What happens if rents drop?

What happens if you need to sell early?

What happens if the seller dies or refinances?

If those answers are unclear, the deal is not ready.

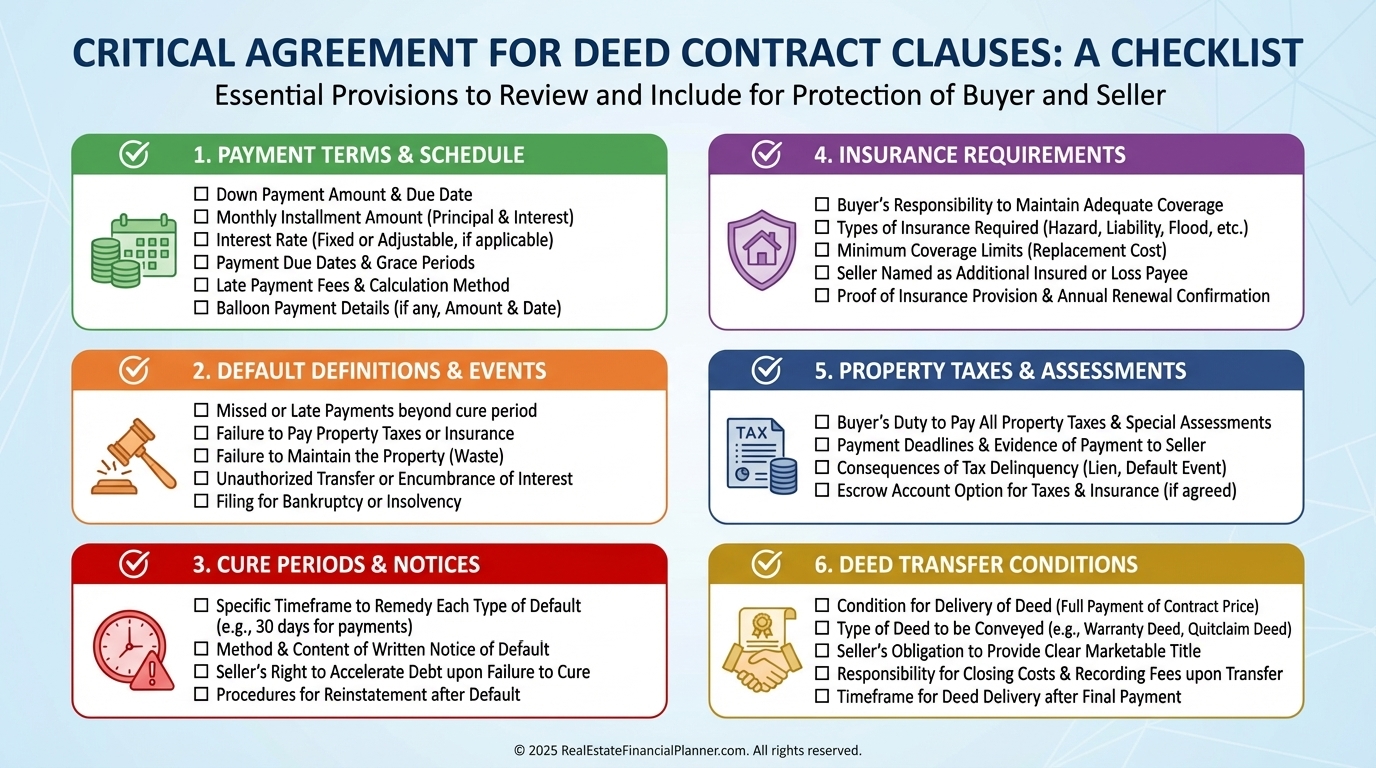

Structuring Terms That Don’t Blow Up Later

Good Agreement for Deed contracts are boring.

Clear payment terms.

Clear default definitions.

Clear cure periods.

Clear transfer mechanics.

When clients show me “handshake-style” contracts, I tell them the same thing every time.

That contract will matter most on your worst day, not your best one.

This is not where you save money by skipping an attorney.

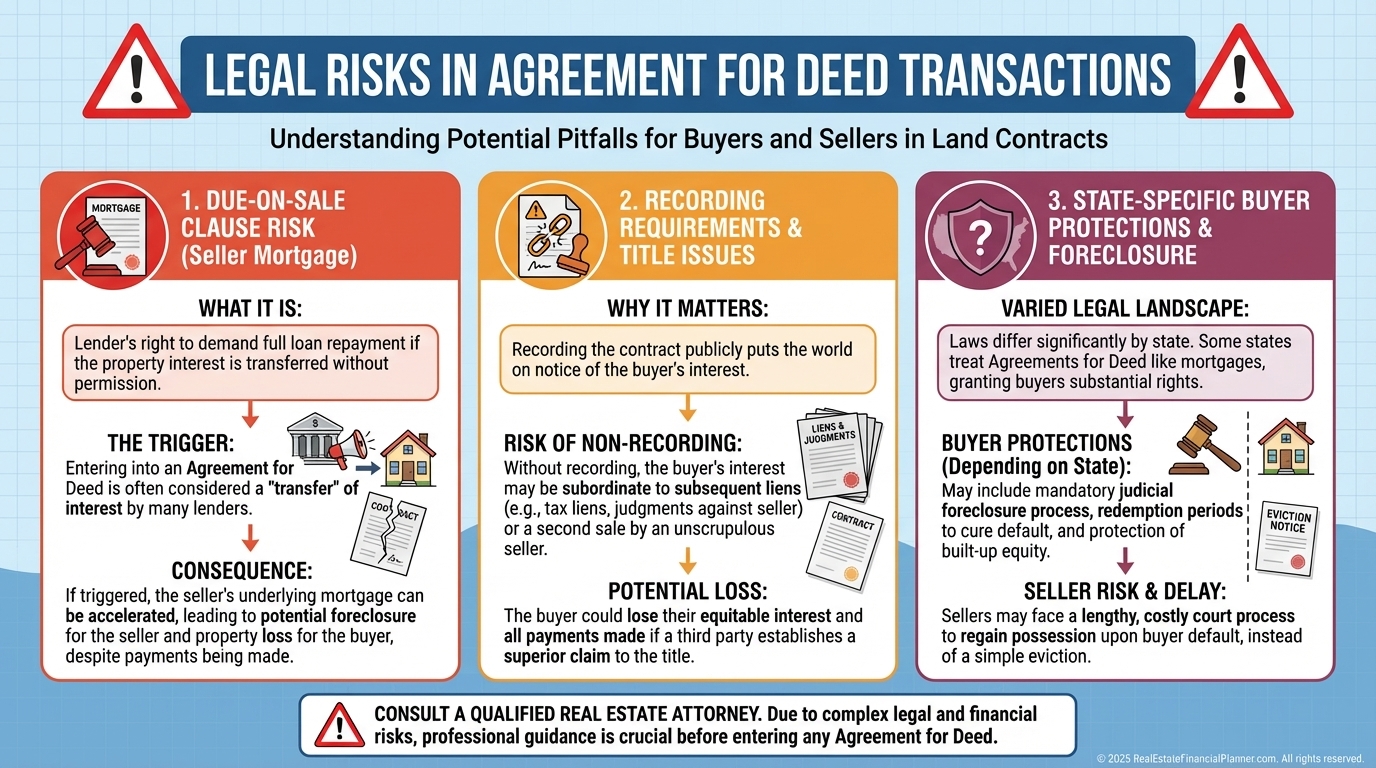

Legal and Due-on-Sale Risks

One of the most dangerous blind spots is existing financing.

If the seller has a mortgage with a due-on-sale clause, an Agreement for Deed can technically trigger it.

Sometimes lenders ignore it.

Sometimes they do not.

I model this risk as binary downside, not probability-based upside.

Hope is not a strategy.

Final Thoughts

Agreement for Deed transactions are powerful tools.

They are not beginner tools.

When structured correctly, they solve real problems for both buyers and sellers.

When misunderstood, they quietly transfer risk in ways most investors never model.

I’ve rebuilt portfolios after bankruptcy.

I’ve seen what happens when leverage, legal structure, and optimism collide.

If you use Agreement for Deed deals, analyze them with the same seriousness you would bring to any long-term ownership decision.

Understand where the equity is real.

Understand where it is conditional.

And never confuse possession with ownership.