USDA Loans for Nomads and Early Investors: Zero-Down Rules, Math, and Mistakes to Avoid

Learn about USDA Loans for real estate investing.

Why USDA Loans Matter for Nomads and Early Investors

When I help clients break into ownership in rural and exurban markets, USDA loans are often the only true zero-down path that still delivers competitive rates.

For Nomad™ buyers, USDA can be the first rung on the ladder—just know the program is built for primary residences, not rentals, so you must plan your sequence and timing carefully.

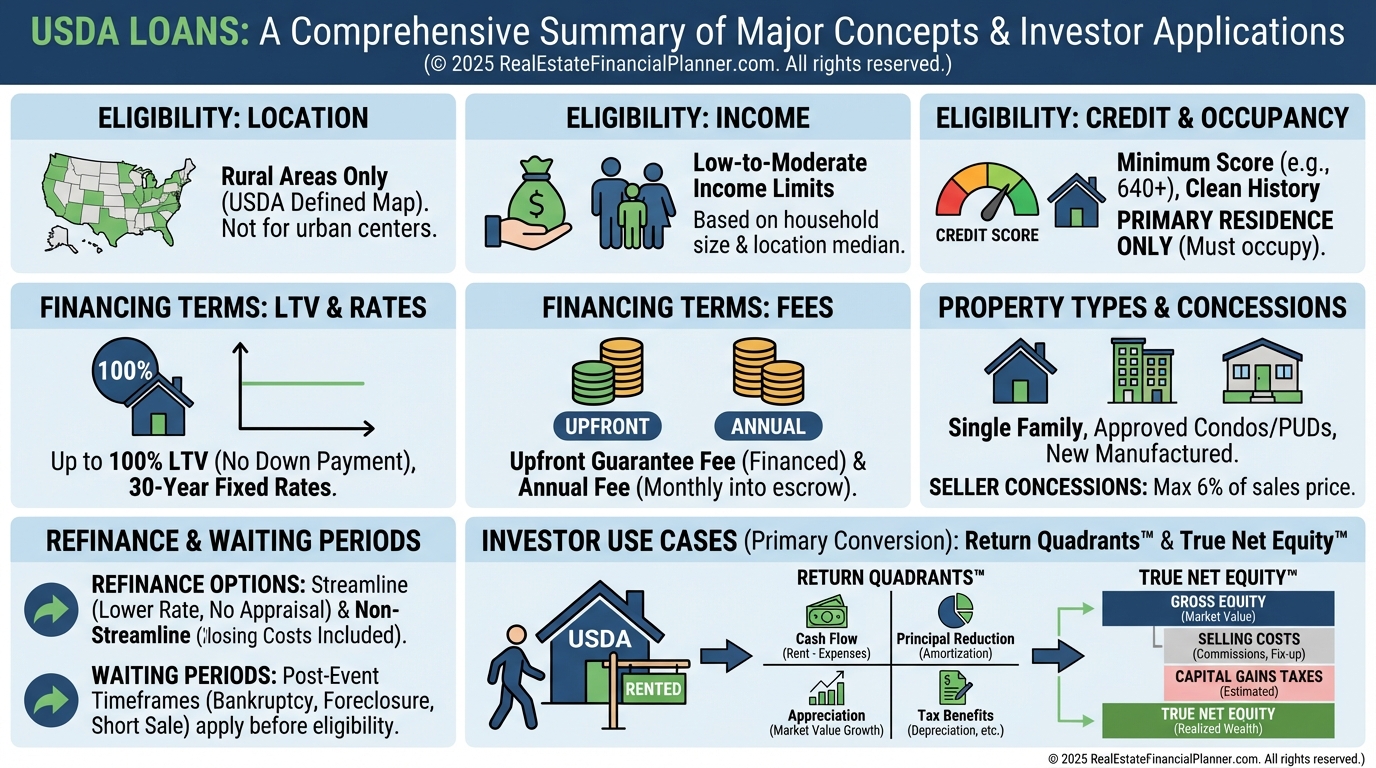

Eligibility: Location, Income, and Credit

USDA requires the property to be in a designated rural area per the USDA map. Many suburbs on the fringe qualify, so check addresses before ruling them out.

Household income is capped—generally up to 115% of area median income, adjusted for family size and county.

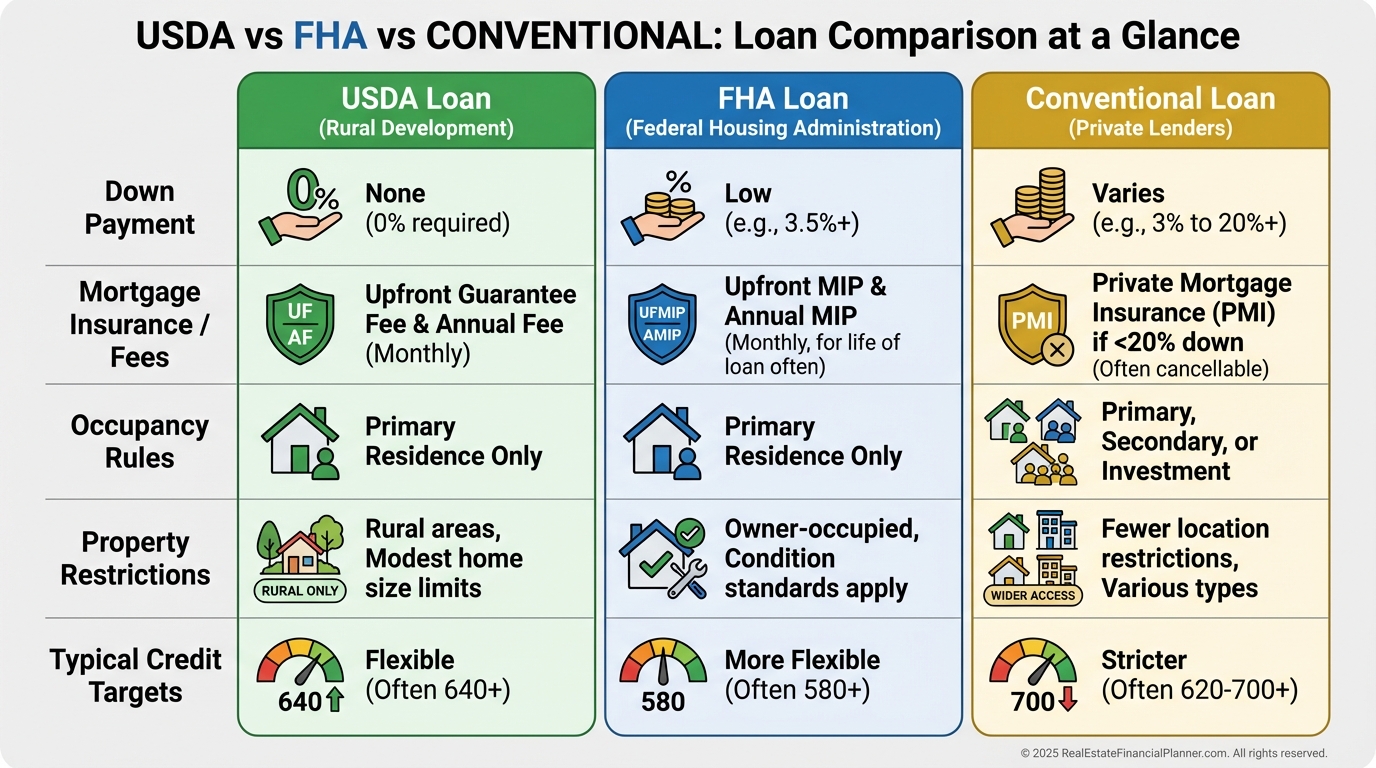

Most lenders target a 640+ score for automated approvals. Lower scores may be manually underwritten with compensating factors and strong recent payment history.

Typical debt-to-income benchmarks are about 29% front-end and 41% back-end, though automated approvals can flex.

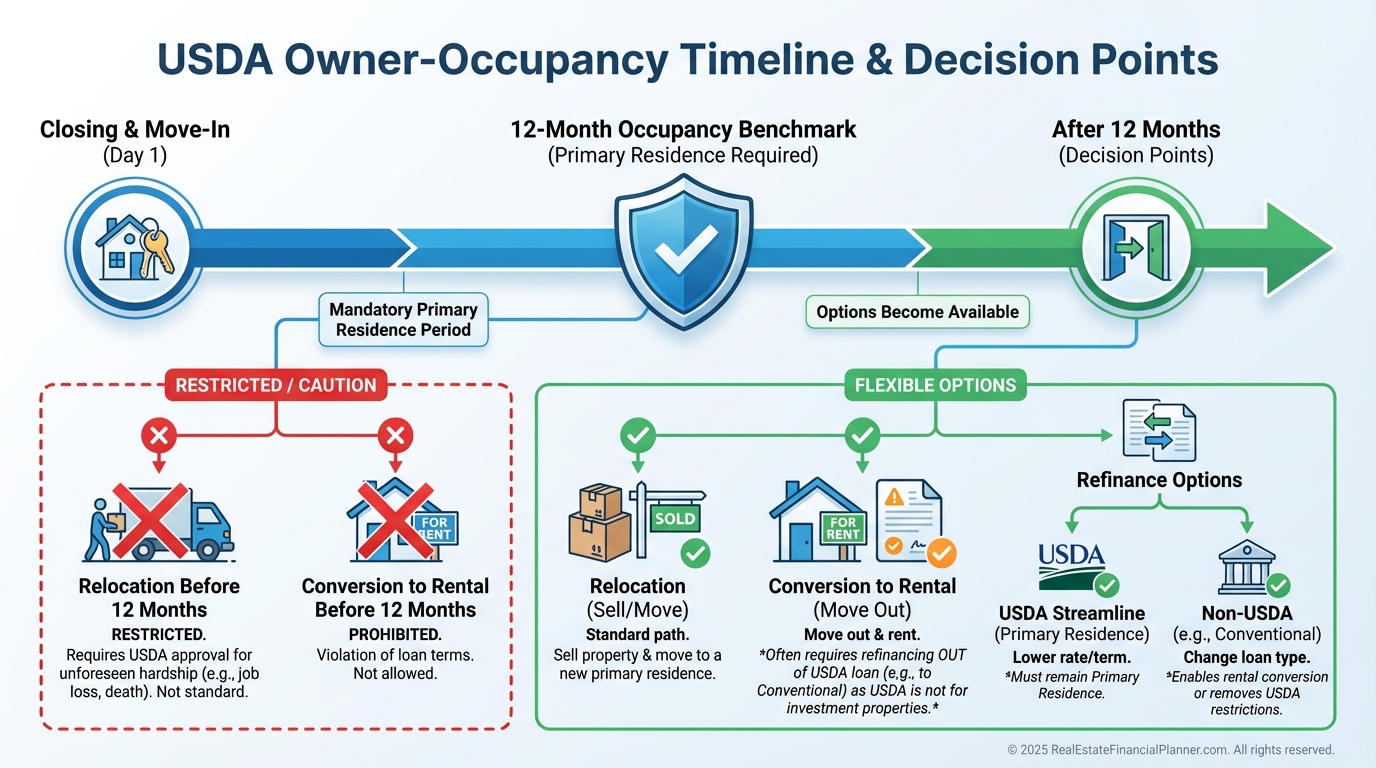

Owner-Occupancy Rules and Investor Boundaries

USDA loans are for primary residences. You must intend to occupy the home, typically within 60 days, and not use it as an investment purchase.

Plan to live in the property at least 12 months before contemplating any conversion. If life changes force a move sooner, talk to your servicer first and document the change.

You can’t buy multi-unit or income-producing properties under USDA. Renting rooms while you occupy can be lender/servicer-specific—get written guidance before assuming it’s allowed.

Avoid trying to “house hack” in ways that conflict with program intent. I have clients model alternative paths if roommate income is essential to qualify.

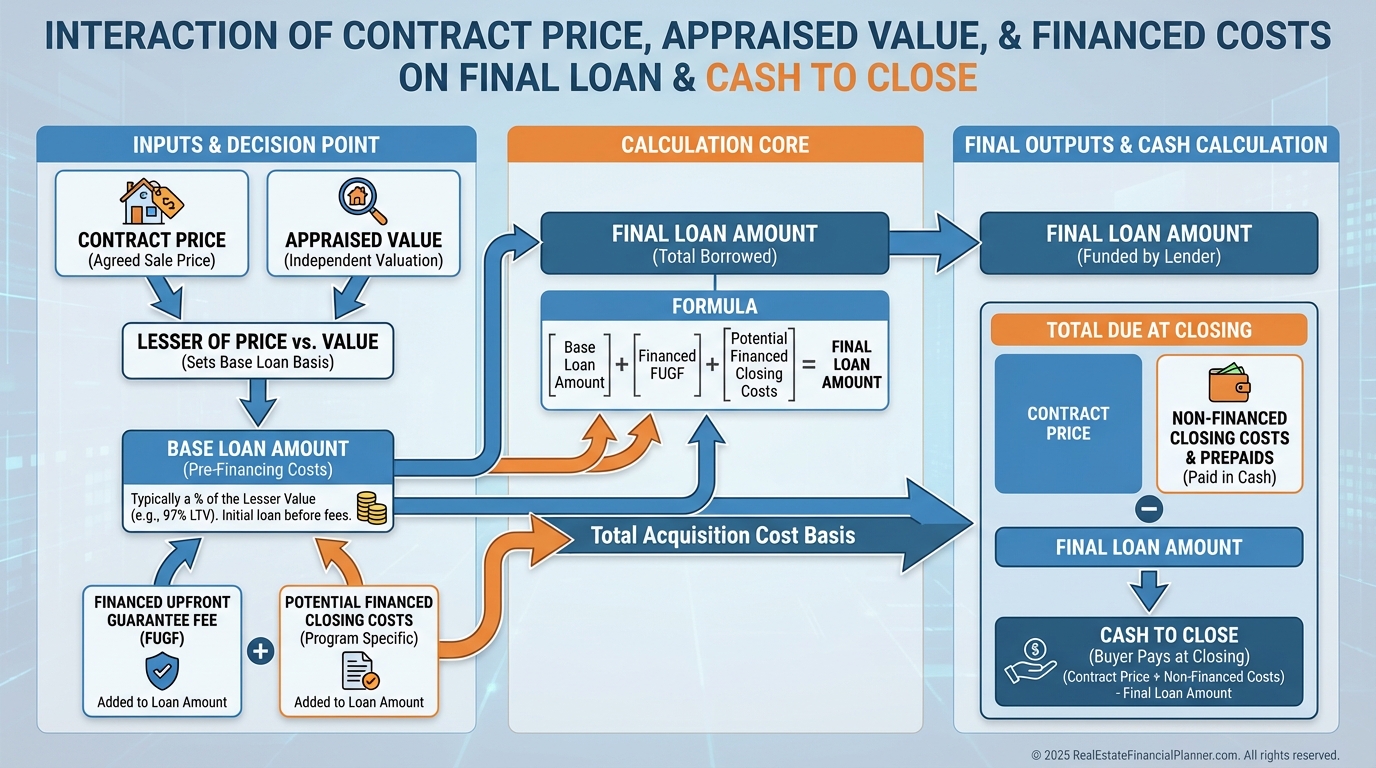

Financing Mechanics: LTV, Rates, Fees, and Payment

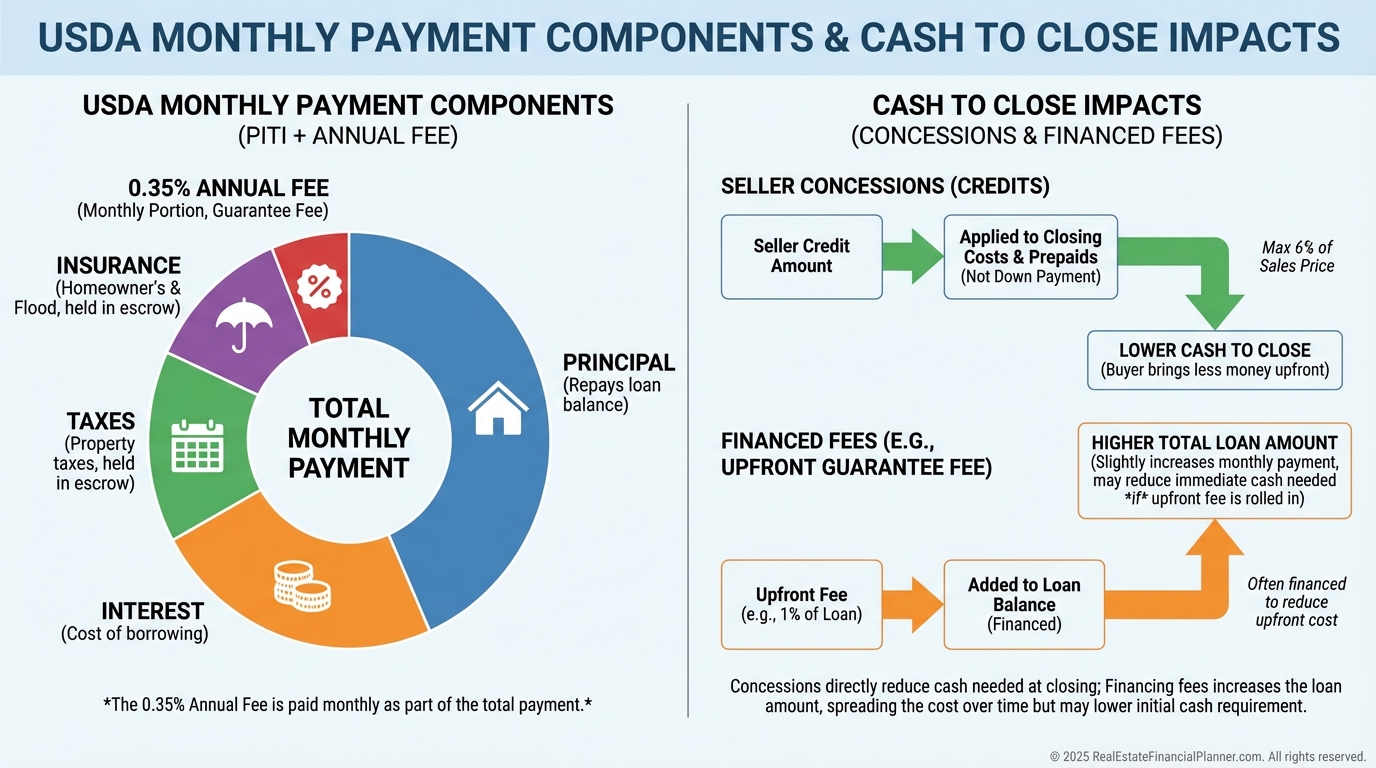

USDA financing is 100% of appraised value. The 1.0% upfront guarantee fee can be rolled into the loan, and some closing costs can be financed if the appraisal supports it.

Most terms are 30-year fixed at competitive rates. That stability helps when I stress-test payment shock for clients.

Sellers can contribute up to 6% toward closing costs and prepaid items. I coach clients to negotiate concessions instead of inflating price beyond appraised value.

Property Types and Appraisals

Eligible properties are modest, single-family primary residences, including certain condos, PUDs, modular, and some manufactured homes meeting USDA guidelines.

No 2–4 units, no investment or income-producing features (like rentable ADUs intended for separate occupancy), and land value must be typical for the area.

USDA appraisals confirm value and that the property is safe, sound, and sanitary. Rural appraisal timelines can run longer; I set expectations on contract dates accordingly.

Loan Size and “Limits”

USDA doesn’t have standard loan limits like FHA. Instead, the maximum loan is whatever you can qualify for within income limits and program guidelines for a modest home.

Practically, your debt-to-income ratio and the property’s appraised value do the limiting.

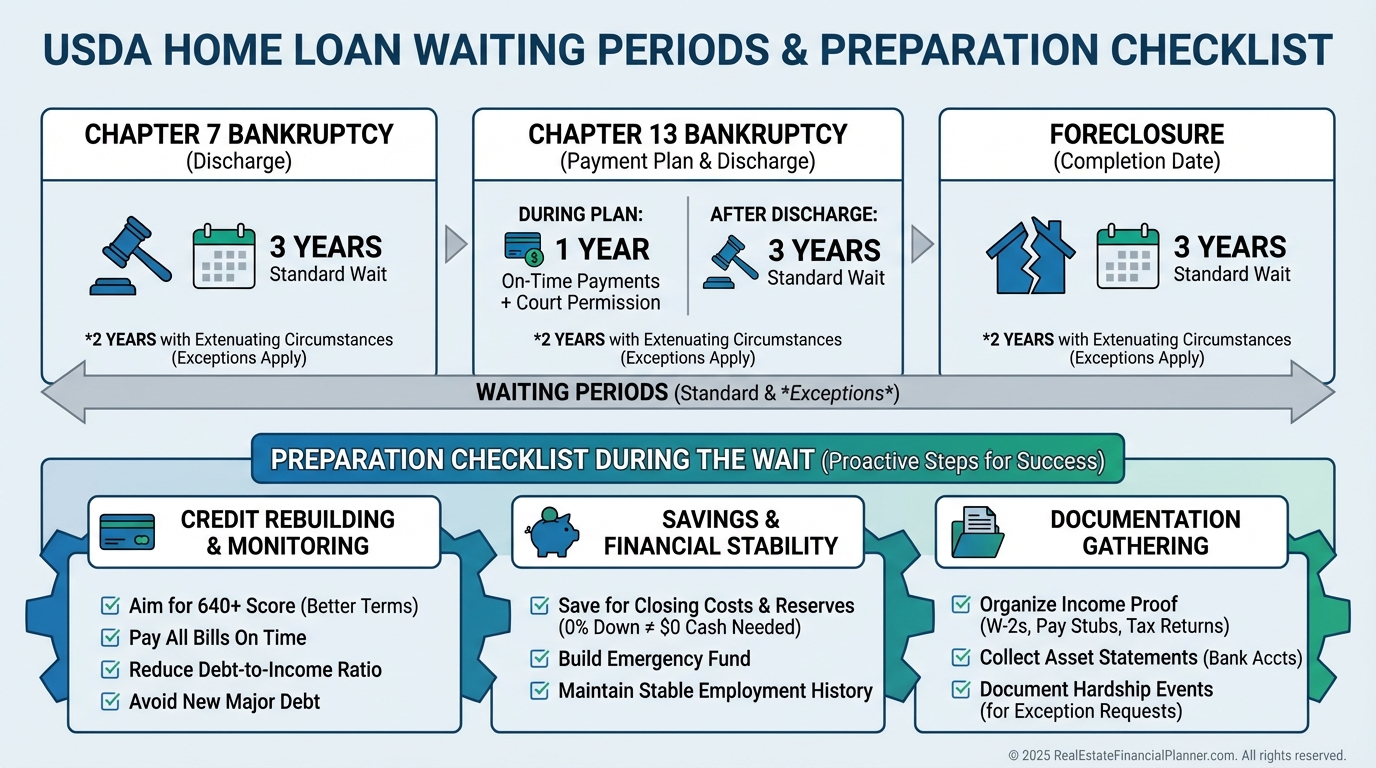

Waiting Periods After Major Credit Events

Bankruptcy Chapter 7 generally requires a three-year wait from discharge.

Chapter 13 can be eligible after 12 months of on-time plan payments with trustee/court approval.

After a foreclosure, plan on a three-year wait.

When I rebuilt after bankruptcy, these timelines shaped my purchase sequence. I tell clients to use the waiting period to shore up reserves and habits.

Refinancing, Recasting, and Exits

USDA offers streamlined refinance paths (including Streamlined-Assist) to lower your rate after 12 on-time payments, with limited documentation.

There’s no cash-out refinance under USDA, and recasting is generally not available. If you want cash-out or flexibility, plan a future conventional refi.

My playbook for Nomad™ clients is to refinance to a conventional loan before converting the home to a rental. That removes the USDA annual fee and avoids program-intent conflicts.

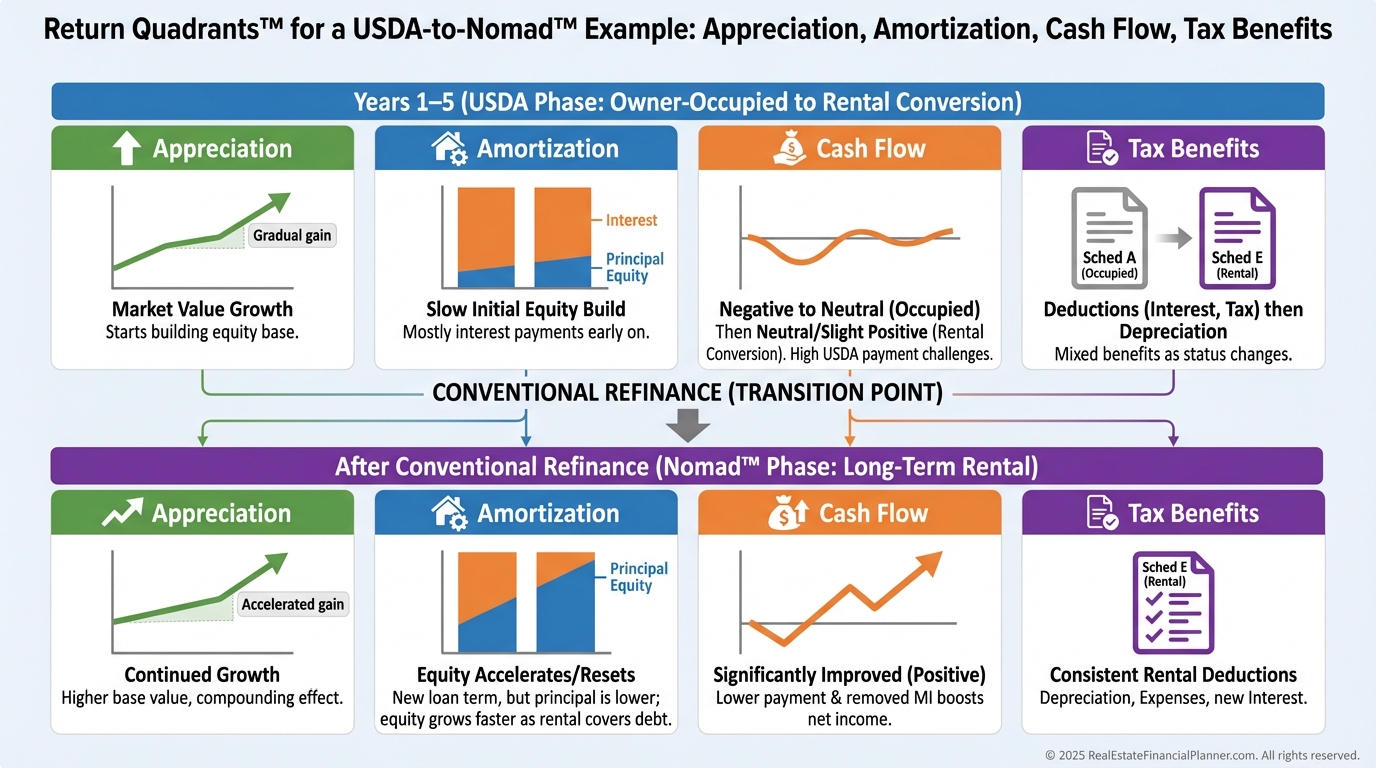

Using USDA with the Nomad™ Strategy

Here’s a clean USDA-to-Nomad™ sequence I have clients model:

•

Buy an eligible rural primary with 0% down.

•

Live there at least 12 months while improving income, credit, and reserves.

•

Track Return Quadrants™ monthly: appreciation, amortization (debt paydown), cash flow (often negative if converted), and tax benefits.

•

Refinance to conventional when equity and income support it.

•

After refinancing, convert to a rental if it still pencils based on your True Net Equity™ and risk tolerance.

A Quick Numbers Walkthrough

Assume a $280,000 purchase at 0% down, 30-year fixed, market rate, 1.0% upfront fee financed, and the 0.35% annual fee.

As an owner-occupant, payment stability plus seller concessions can make cash to close near zero.

When I project this to a rental later, the cash flow line in Return Quadrants™ is often thin or negative, but amortization is steady and appreciation compounds.

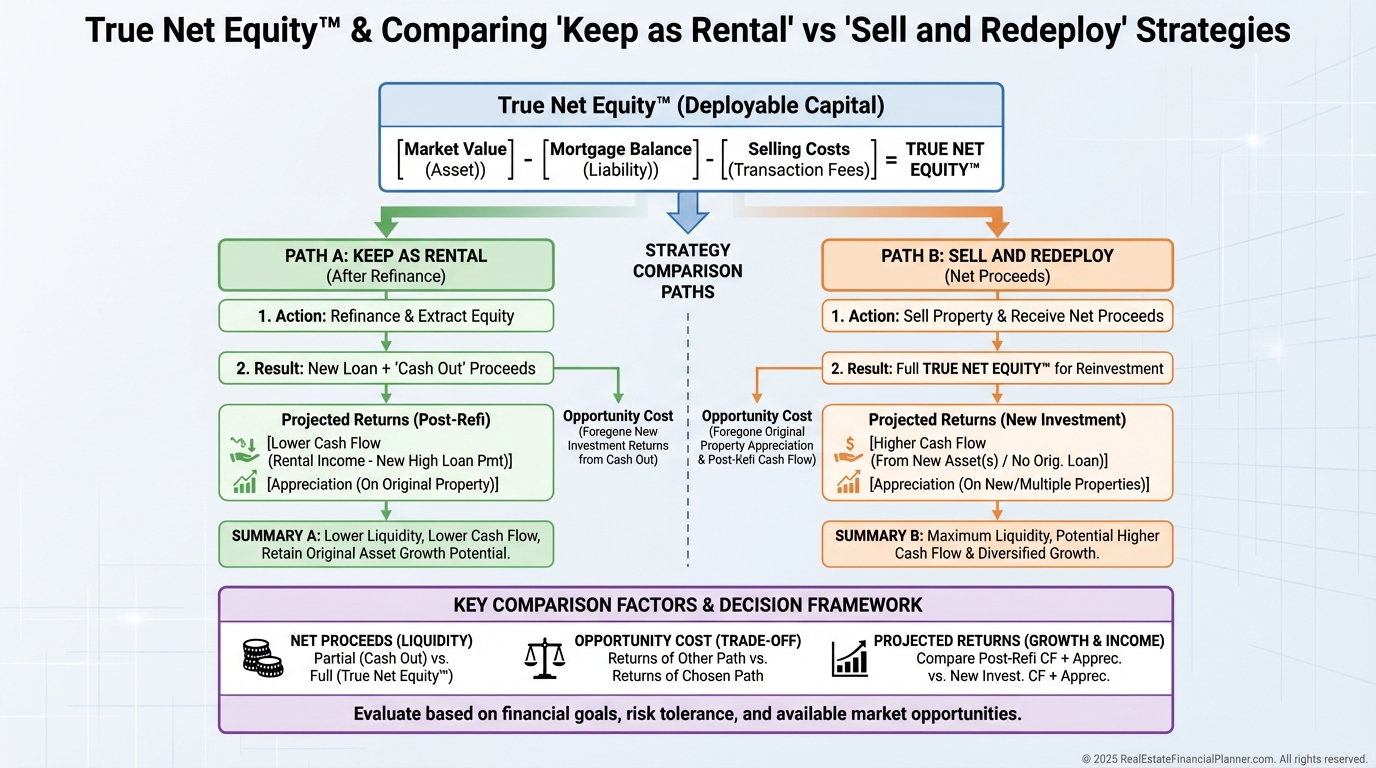

Before converting, I calculate True Net Equity™ by subtracting selling costs, payoff, and taxes from an updated value. Then I ask: does keeping it as a rental beat selling and redeploying?

Risks and Common Mistakes

Buying purely for the loan without loving the location. Rural living and commute patterns are real—test them.

Ignoring income caps or trying to include ineligible properties or features.

Renting too soon or without lender/servicer guidance, which can violate program intent.

Underestimating appraisal timelines in rural markets.

Not comparing long-term costs. The USDA annual fee is light, but a later conventional refi may cut costs further if you hold long term.

Action Checklist

Verify eligibility with the USDA map and income limit for your county and household size.

Get quotes from at least two USDA lenders—rates and fees vary.

Underwrite your own deal with Return Quadrants™ and calculate True Net Equity™ under both keep and sell scenarios.

Negotiate seller concessions up to 6% to reduce cash to close.

Plan your Nomad™ timeline, including a target date to refinance to conventional before conversion.

Document occupancy, keep great records, and communicate with your servicer if your plans change.