HUD-1s Decoded: The Investor’s Guide to Cutting Junk Fees and Protecting Returns at Closing

Learn about HUD-1s for real estate investing.

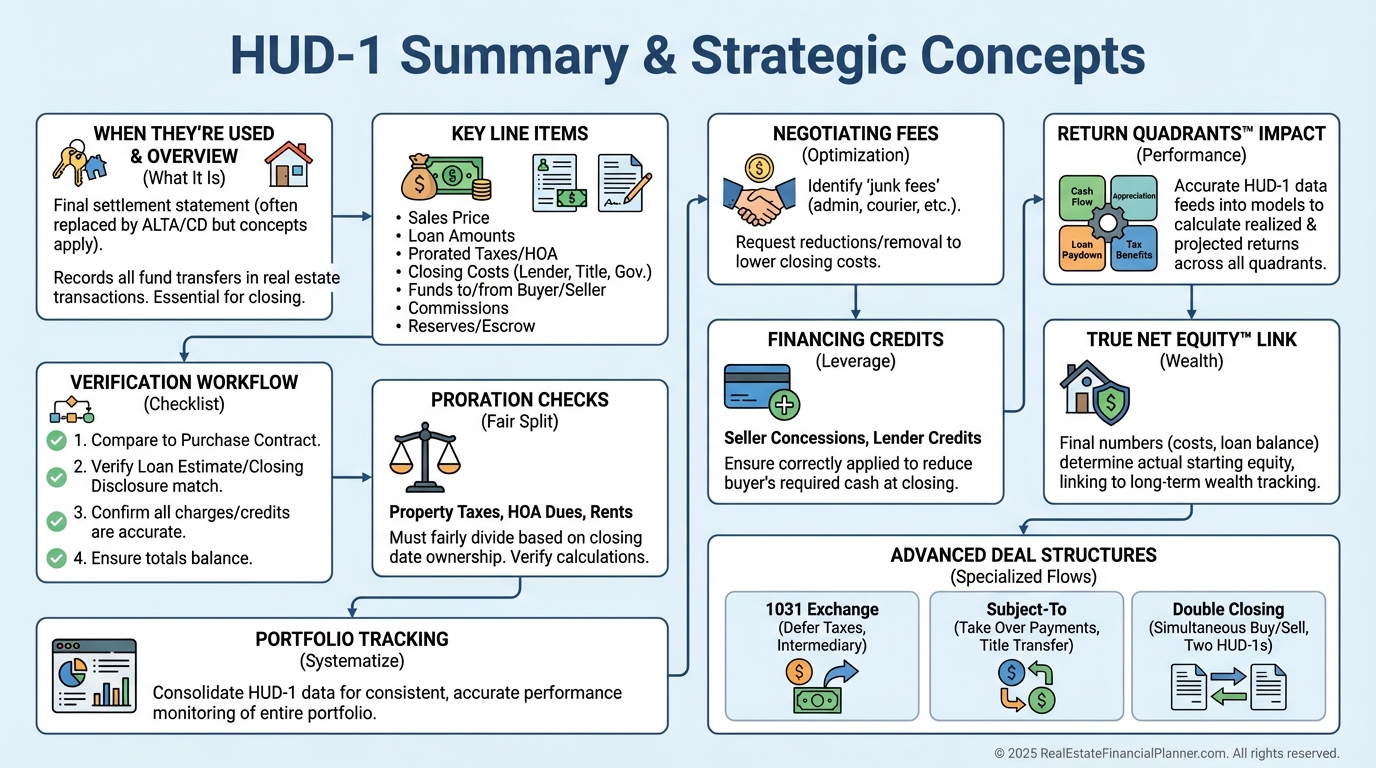

Why HUD-1s Decide Your Real Returns

When I help clients review closings, the “found money” from fixing a HUD-1 often beats the last $10K they haggled off list price.

I once audited a duplex purchase where a client missed $3,400 in padded title and courier fees.

That single oversight clipped 11% off their first-year cash-on-cash.

HUD-1s are not paperwork. They are your closing P&L.

Treat them like the financial instrument they are and your returns will reflect it.

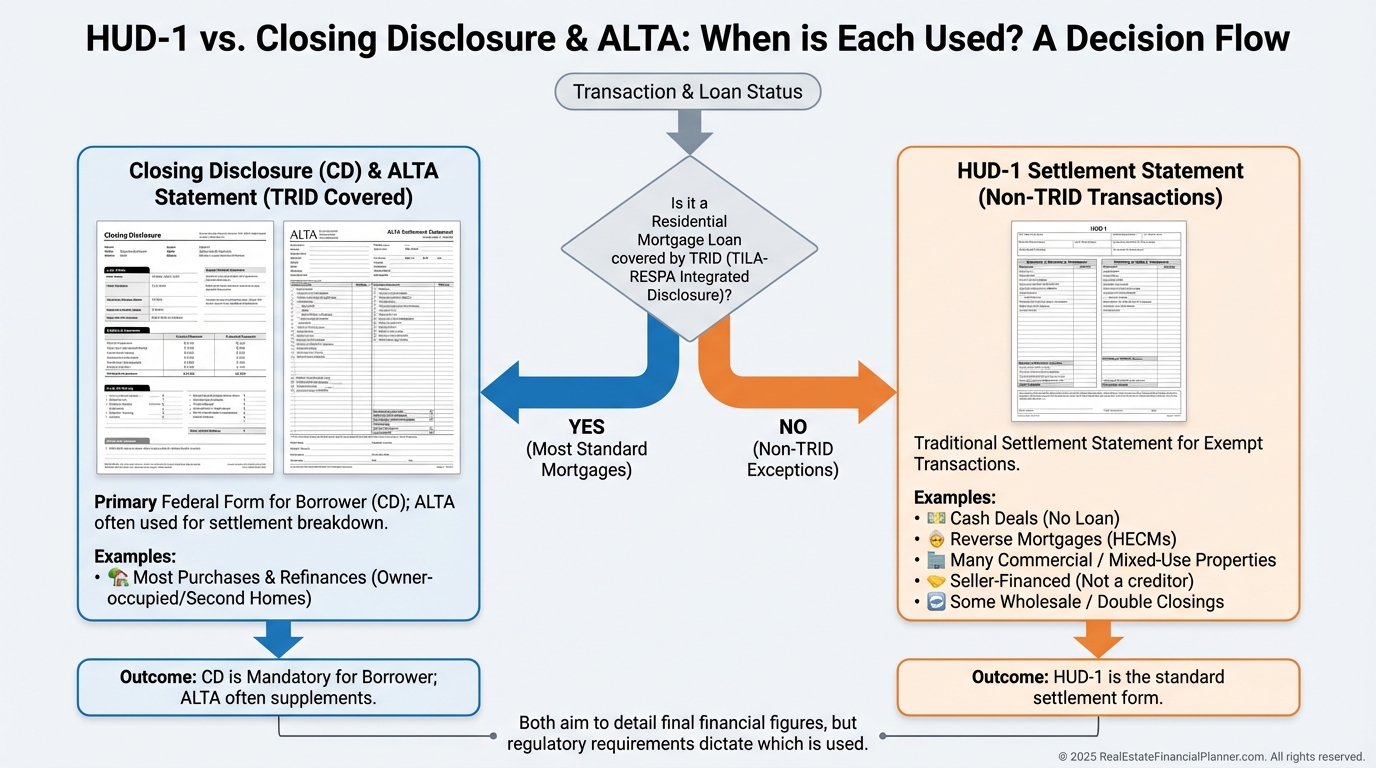

What HUD-1s Are (and How They Differ)

A HUD-1 Settlement Statement itemizes every dollar in a real estate closing.

It shows what the buyer pays, what the seller receives, and the fees in between.

Since 2015, most owner-occupied residential loans use a Closing Disclosure instead.

But HUD-1s remain standard for cash, reverse mortgages, many commercial or mixed-use deals, and creative or seller-financed transactions.

Many title companies also produce an ALTA Settlement Statement that mirrors HUD-1 structure with cleaner presentation.

If you invest, you’ll see all three. Know how to read them interchangeably.

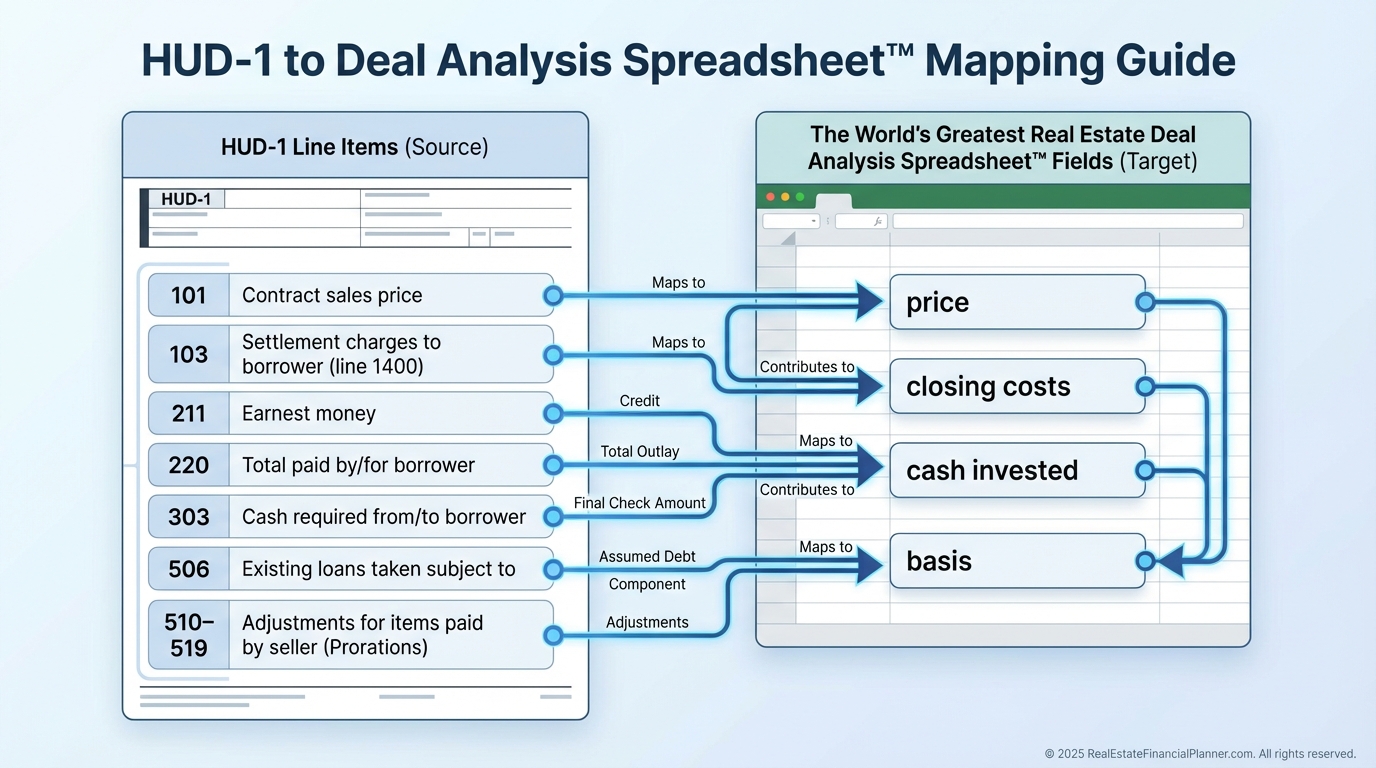

Why HUD-1s Matter to Your Deal Analysis

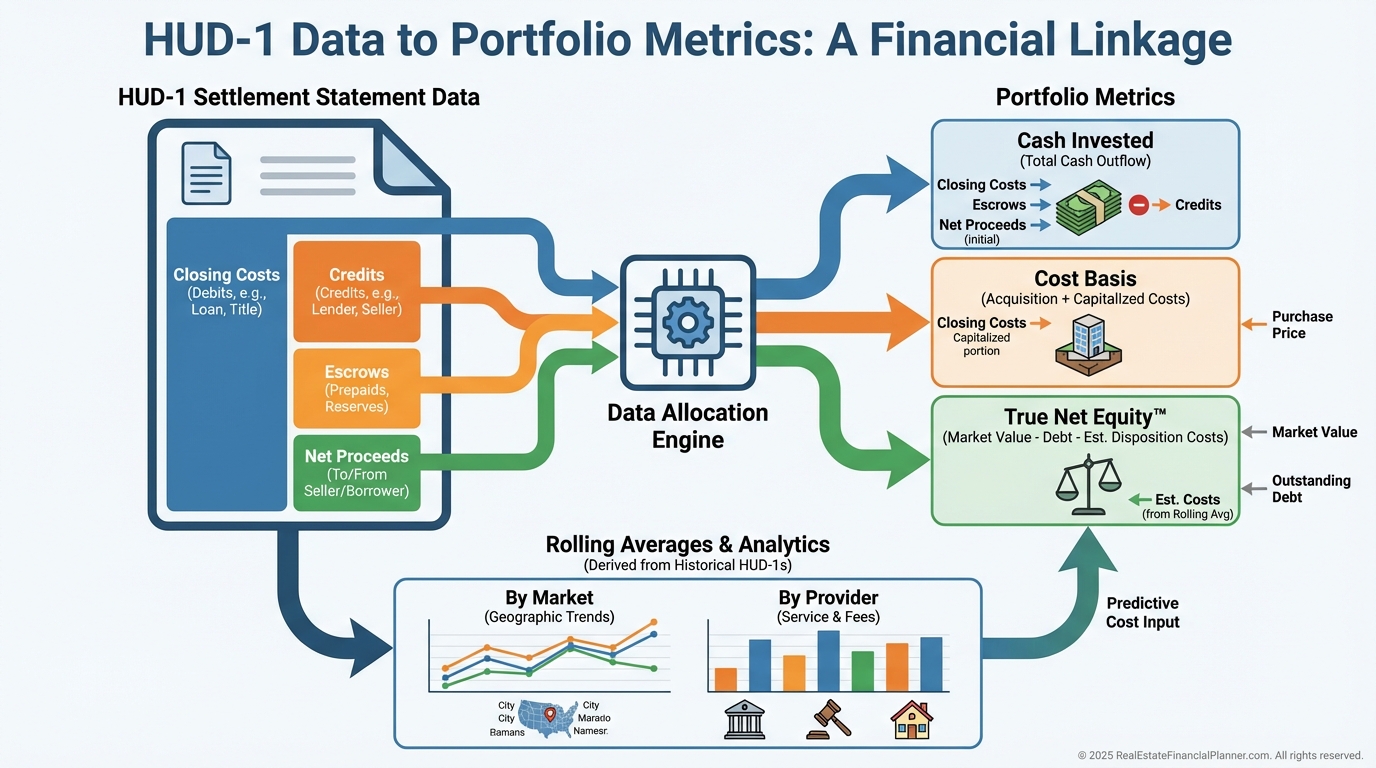

Your spreadsheet is only as accurate as the cash you truly invest.

On The World’s Greatest Real Estate Deal Analysis Spreadsheet™, Line 303 of the HUD-1 feeds your “Total Cash to Close,” which drives ROI.

Line 103 feeds your total settlement charges, which ripple through cost basis and tax planning.

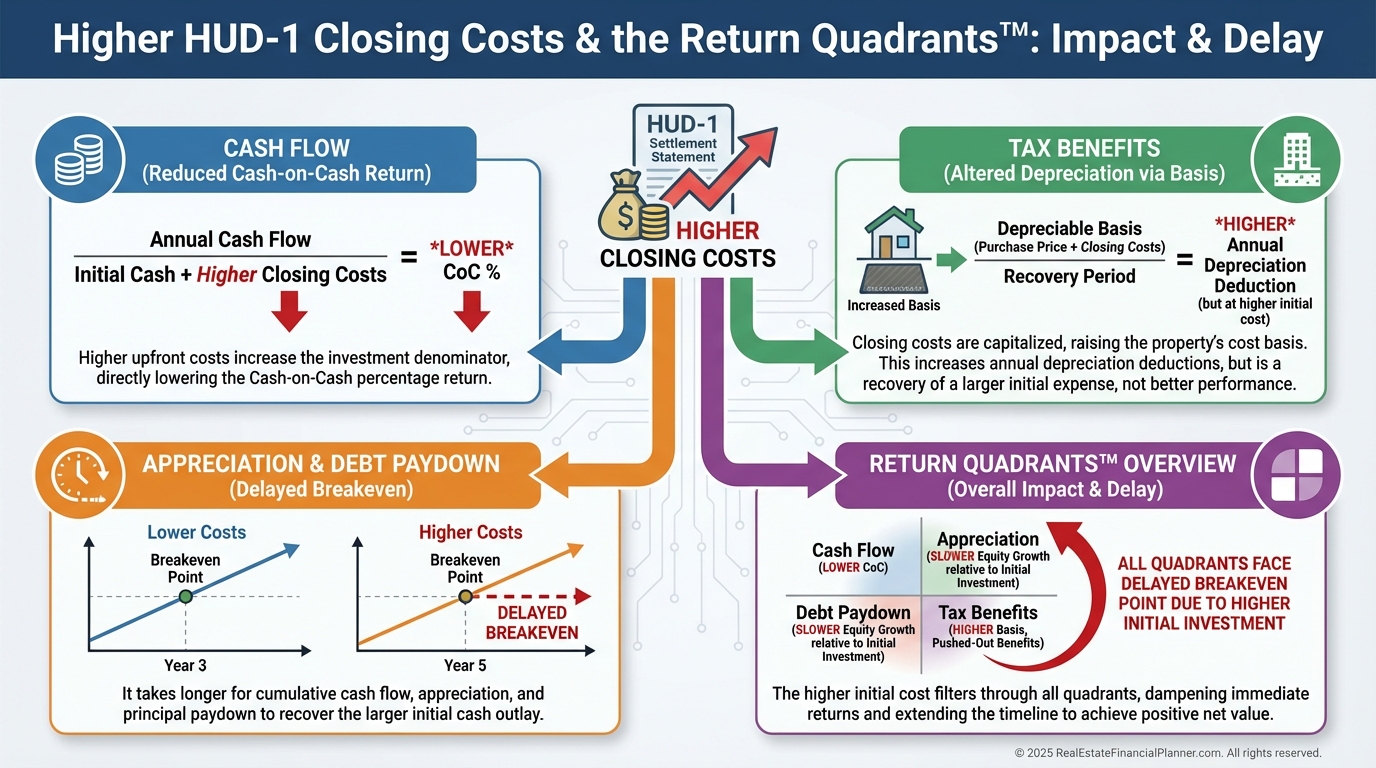

Miss $2,000 here and your Return Quadrants™—cash flow, appreciation, debt paydown, and tax benefits—get distorted from day one.

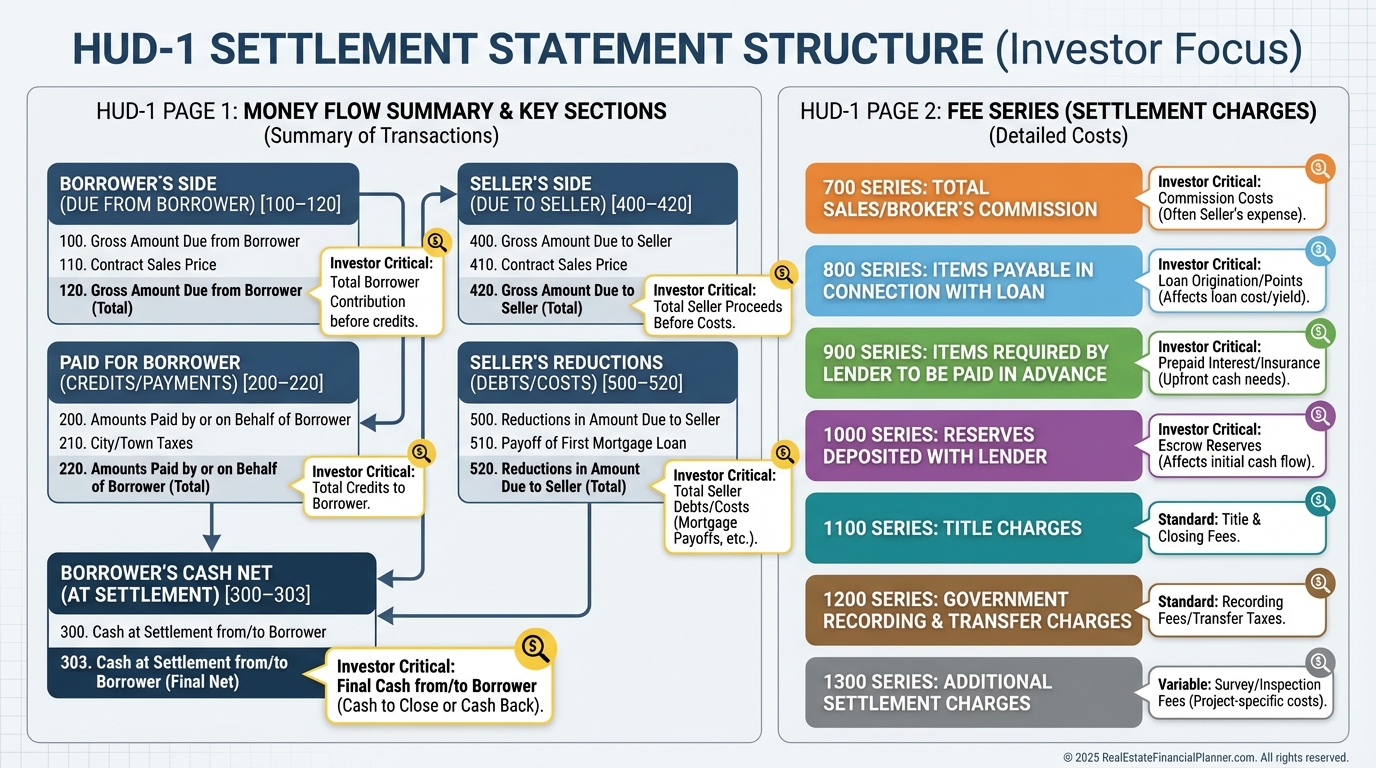

The Anatomy of a HUD-1: What I Check First

Page 1 is the money flow summary.

Page 2 is the fee breakdown.

On Page 1, I scan Sections 100–120 for the buyer’s totals, 200–220 for credits like earnest money, and 300–303 for the exact cash to bring.

Then I review 400–420 for what the seller gets and 500–520 for reductions like existing liens and seller credits.

On Page 2, I focus on the 800s (loan fees), 1100s (title charges), and 1300s (miscellaneous) where junk fees hide.

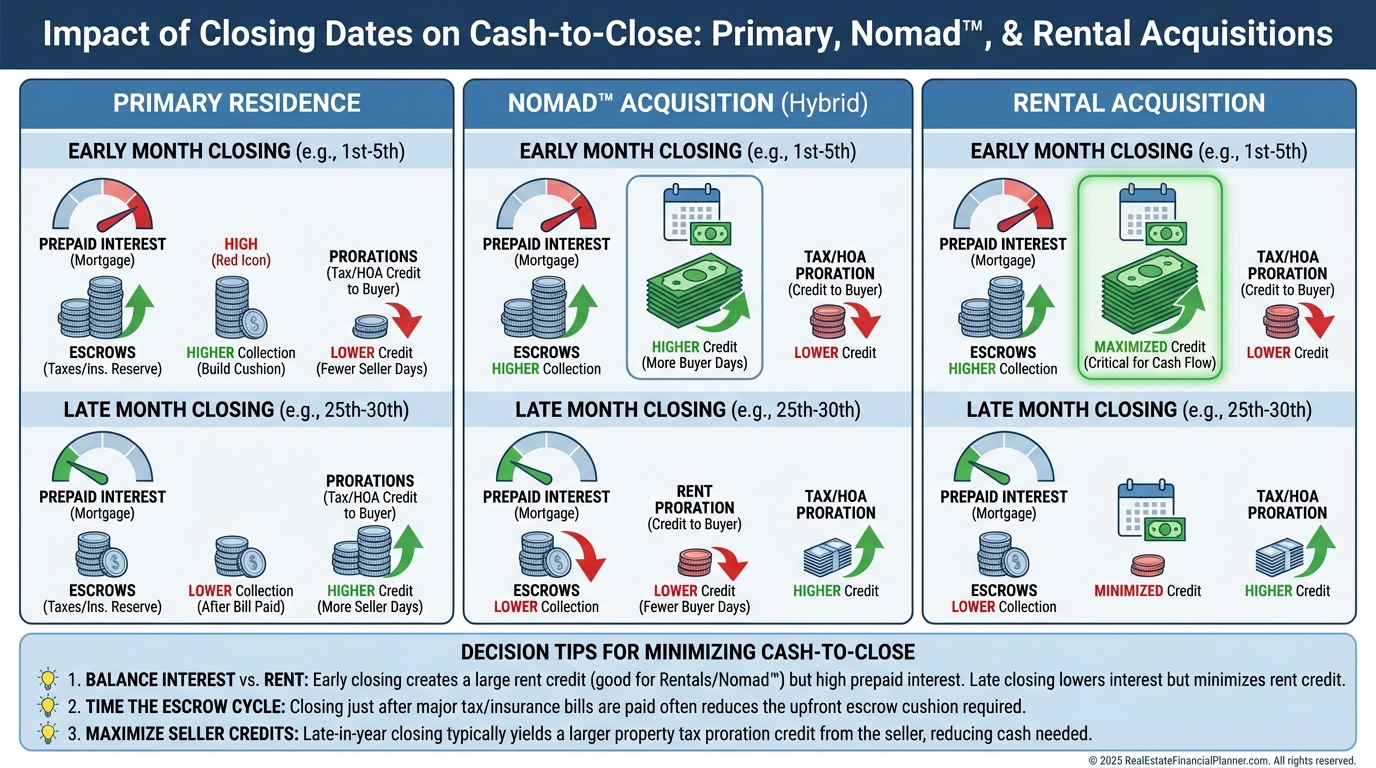

I also check 900s (prepaids) and 1000s (escrows) because they inflate cash-to-close and can be optimized with timing.

Investor-Critical Line Items (The Fast Pass)

I teach clients to start with five lines.

Line 103 for total settlement charges.

Line 211 for earnest money match.

Line 220 for total paid by/for borrower.

Line 303 for cash needed at closing.

If those are right, the rest is usually clean. If not, we escalate.

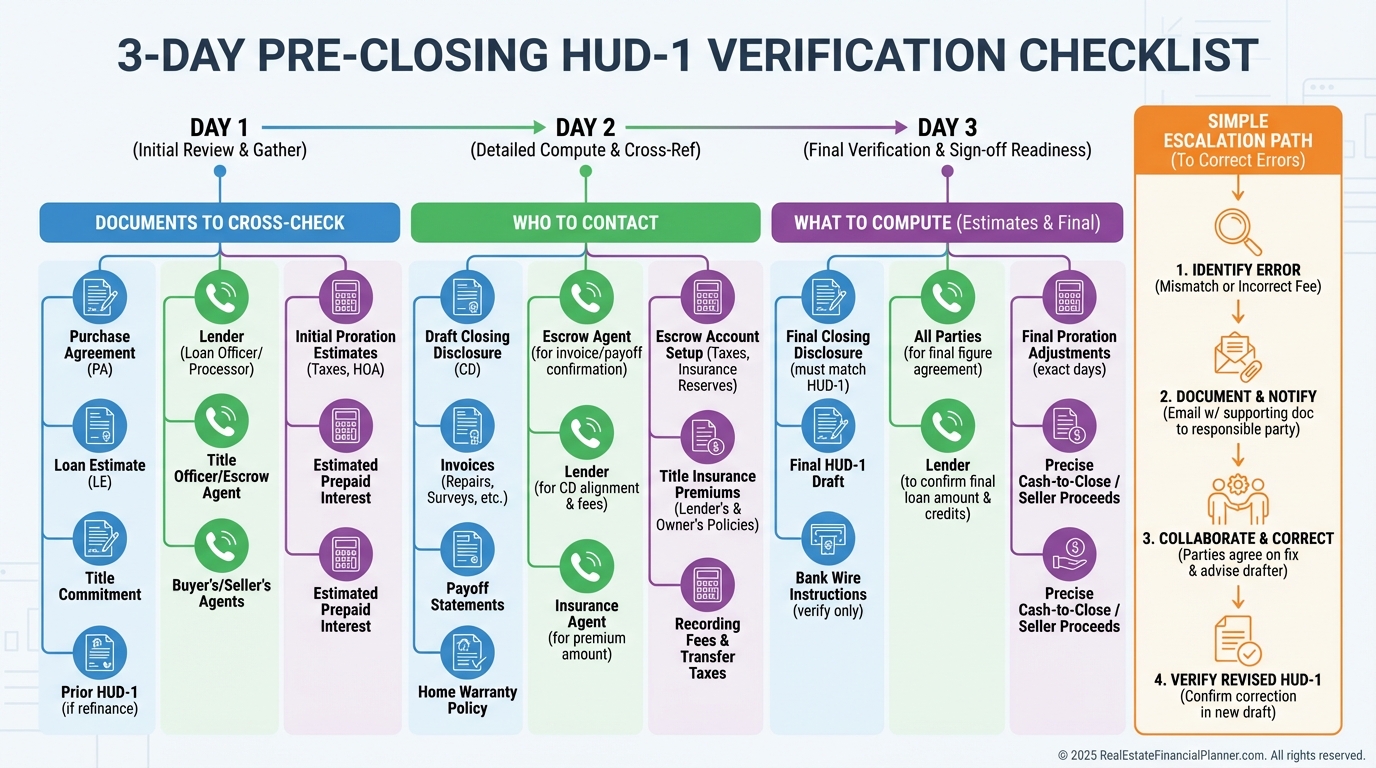

Verification: My Pre-Closing Workflow

I request a draft HUD-1 three business days before closing.

Then I reconcile it against the purchase contract, loan estimate, title commitment, insurance binder, and actual tax bills.

For loans, I match points, underwriting, processing, and per diem interest to the most recent lender disclosures.

For title, I verify the promulgated premium and endorsements and call out padded “admin,” “doc prep,” or “courier” fees.

For prorations, I calculate daily amounts independently and confirm the occupancy date used.

Negotiating Fees Without Blowing Up the Deal

When I push back, I am specific and unemotional.

I cite the line, reference the governing document, and suggest the correct number.

I shop title and closing services in advance and share written quotes to anchor expectations.

I ask lenders for a fee worksheet early so “last-minute surprises” are hard to justify.

And I time closings to reduce prepaids and escrows when it makes sense.

The Real-World Impact: A Fourplex That Lost 1.3% Cash-on-Cash

An investor I coach bought a fourplex at $350,000.

We projected $8,000 in closing costs, but the HUD-1 landed at $12,500.

It included $1,200 in unexpected lender fees, $1,800 higher title charges, $800 in extra inspections, and $700 of padded processing.

Their year-one cash-on-cash slid from 8.2% to 6.9%.

On the Return Quadrants™, the hit showed up in lower cash flow and reduced after-tax returns because initial basis and escrows were higher.

Financing Rules That Interact With HUD-1s

Your HUD-1 documents seller credits, assignment fees, and cash-to-close sourcing.

Conventional loans cap seller credits from about 3–9% based on down payment, FHA allows up to 6%, and VA permits around 4% for certain costs.

Check your program overlays, because lender rules can be tighter than the agency maximums.

If you’re taking a property subject-to, verify payoff, arrears, and escrow transfers so your cost basis is accurate.

Wholesalers must disclose assignment fees clearly to keep the file compliant.

Prorations: Tiny Math, Big Money

One wrong day on taxes or HOA can move $30–$50 on a mid-priced property.

Over multiple lines, it adds up.

I verify daily rates from the actual tax bill and HOA statement, not estimates.

For rentals, I confirm rent prorations match occupancy and security deposit handling is documented.

Common HUD-1 Mistakes I See Weekly

Investors wait until the signing table to read the HUD-1.

By then, the social pressure to close is enormous.

They accept padded “processing” and “email” fees because the amounts look small.

They let lenders over-collect escrow beyond the two-month cushion allowed without questioning it.

They forget to confirm repair credits and concessions show on Lines 204–209.

They don’t shop title insurance or endorsements even though those are highly negotiable.

They fail to reconcile assignment fees and seller credits with program limits, which can crash financing late.

Portfolio-Level Wins: Systems Beat One-Off Skill

When I rebuilt after bankruptcy, I tracked every closing cost by market, asset type, and provider.

That database paid me for years.

We now benchmark closing costs as a percentage of purchase price and reward vendors who keep us under 2%.

We also connect every HUD-1 to our True Net Equity™ model so our equity is measured after realistic selling costs, taxes, and debt payoff.

This creates tighter pro formas and fewer rude surprises.

Advanced Moves for Savvy Investors

For double closings, coordinate A-B and B-C HUD-1s so your resale covers your acquisition and fees cleanly.

For 1031 exchanges, ensure the qualified intermediary is properly listed and proceeds never touch you.

For seller financing, use HUD-1s to streamline costs by eliminating lender-only fees and documenting taxes, insurance, and escrows clearly.

In subject-to acquisitions, document arrears, reinstatement, and escrow shortages precisely so your basis and cash invested are correct.

Your 30-Minute HUD-1 Playbook Before Every Closing

Ask for the draft HUD-1 three days early.

Reconcile Lines 101, 103, 211, 220, 303, and 510–519.

Confirm title premiums and endorsements from the commitment, not the invoice total.

Recalculate per diem interest and all prorations.

Challenge every 1300-series fee that doesn’t directly tie to a delivered service.

Update The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with the final numbers and recheck ROI.

Then walk into closing with confidence and a smaller cashier’s check.

The Compounding Edge

Every dollar you keep at closing is a dollar that compounds.

Trim $2,000 per deal across five properties and you just created the down payment for the sixth.

That’s the quiet math that builds portfolios.

Master HUD-1s and you’ll stop leaking returns in the last mile of the acquisition.