Who Is the Beneficiary of Your Real Estate—and What It Really Costs Your Heirs If You Get It Wrong

Learn about Beneficiary for real estate investing.

When I help clients analyze real estate deals, we spend hours modeling cash flow, appreciation, and returns using The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

But one of the most expensive mistakes I see has nothing to do with the deal itself.

It’s failing to name the right beneficiary.

I’ve watched families lose rental income for months, pay unnecessary legal fees, and fight over properties simply because beneficiary designations were outdated, missing, or contradictory.

If you own real estate, a beneficiary is not just “who gets the property.”

A beneficiary is who takes over responsibility, risk, income, and decision-making the moment you’re gone.

Understanding Beneficiaries in Real Estate

A beneficiary is the person or entity that inherits your property interests when you die.

In real estate, that inheritance comes with immediate obligations.

Unlike stocks or cash, real estate does not pause while your estate sorts itself out.

How beneficiaries receive property depends entirely on how you hold title.

If the property is in your personal name, it usually goes through probate unless a transfer-on-death strategy exists.

If the property is in a trust, the trust controls who inherits and when.

This is where most investors get tripped up.

They assume their will controls everything.

It doesn’t.

Beneficiary designations override your will every time.

The Main Ways Real Estate Investors Name Beneficiaries

When I review investor portfolios, I typically see one of four structures.

Each has trade-offs.

Trust beneficiaries are the gold standard.

A properly drafted revocable living trust avoids probate, maintains privacy, and allows you to control timing, management, and protections for heirs.

You can give income at one age and ownership later.

You can protect properties from divorces, lawsuits, and bad decisions.

LLC beneficiaries are often forgotten.

If you own rentals in an LLC, the deed does not matter at death.

The operating agreement controls who inherits.

If it says nothing, that LLC interest goes straight into probate.

That can freeze bank accounts and paralyze property management.

Transfer-on-death deed beneficiaries work in some states.

Where available, TOD deeds allow property to pass directly to a named beneficiary without probate.

They are simple and inexpensive, but they offer no creditor protection and no management instructions.

Joint tenancy with rights of survivorship works well for married couples.

When one spouse dies, the other automatically owns the property.

This can be effective for primary residences and simple portfolios but offers limited flexibility.

Primary and Contingent Beneficiaries Matter More Than You Think

I always tell clients to name backups.

Primary beneficiaries inherit first.

Contingent beneficiaries step in if the primary beneficiary dies, disclaims, or cannot inherit.

Without contingents, assets fall into probate by default.

With real estate, that delay can mean missed rent, unpaid bills, and angry tenants.

Tax Implications Every Beneficiary Should Understand

This is where beneficiary planning can create—or destroy—six figures of wealth.

Most inherited real estate receives a step-up in basis.

That means the tax basis resets to market value at death.

When I model True Net Equity™ for clients, this single adjustment often wipes out decades of built-in capital gains.

But certain actions destroy this benefit.

Gifting property during your lifetime transfers your low basis.

Improper trust structures can eliminate the step-up.

Joint ownership only steps up the deceased owner’s portion.

State taxes add another layer.

Some states impose estate taxes.

Some impose inheritance taxes.

Some impose both.

Your beneficiary plan must account for where the property is located, not just where you live.

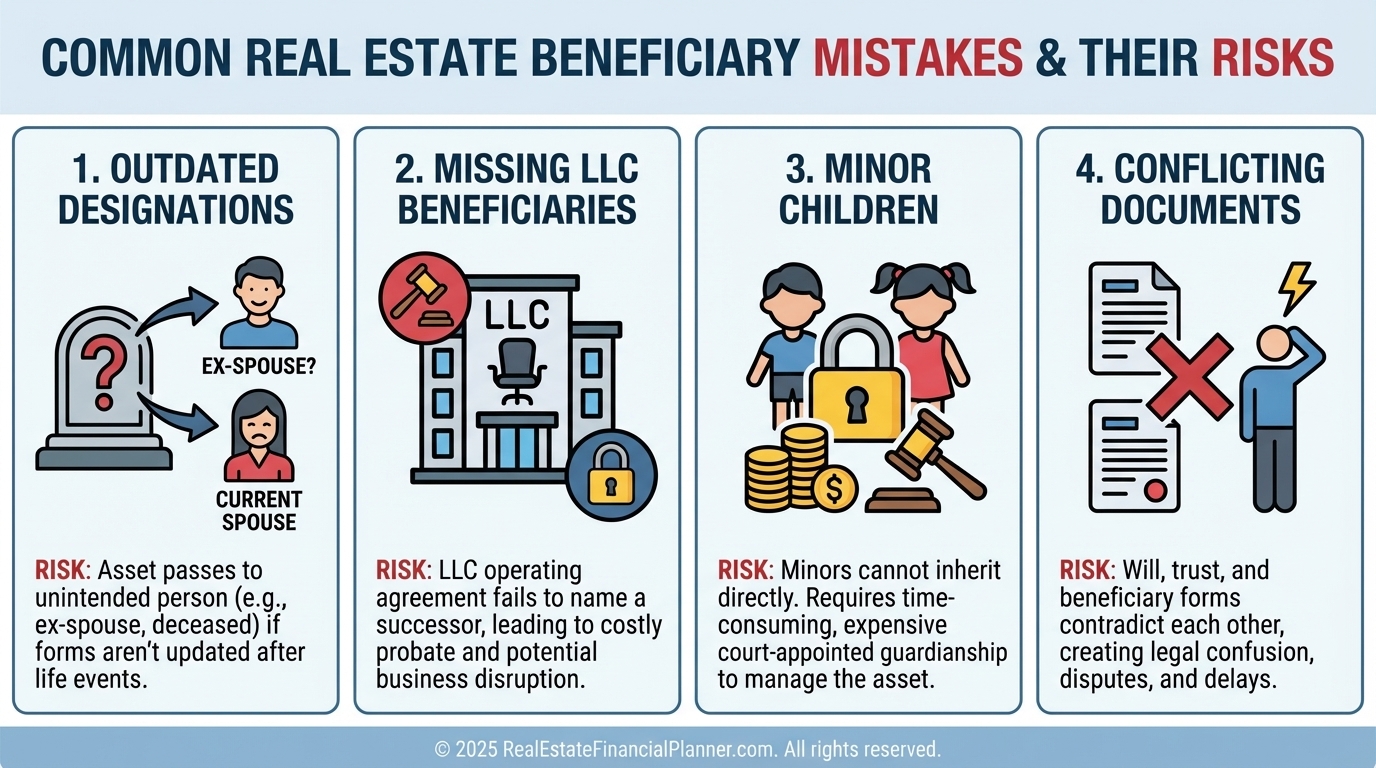

The Most Common Beneficiary Mistakes I See

Even experienced investors make these errors.

They forget to update beneficiaries after divorce or remarriage.

They name minor children directly, forcing court supervision.

They ignore LLC operating agreements entirely.

They create conflicting instructions across wills, trusts, and deeds.

They leave properties unprotected from heirs’ creditors.

Every one of these mistakes shows up later as legal fees, family conflict, or forced sales.

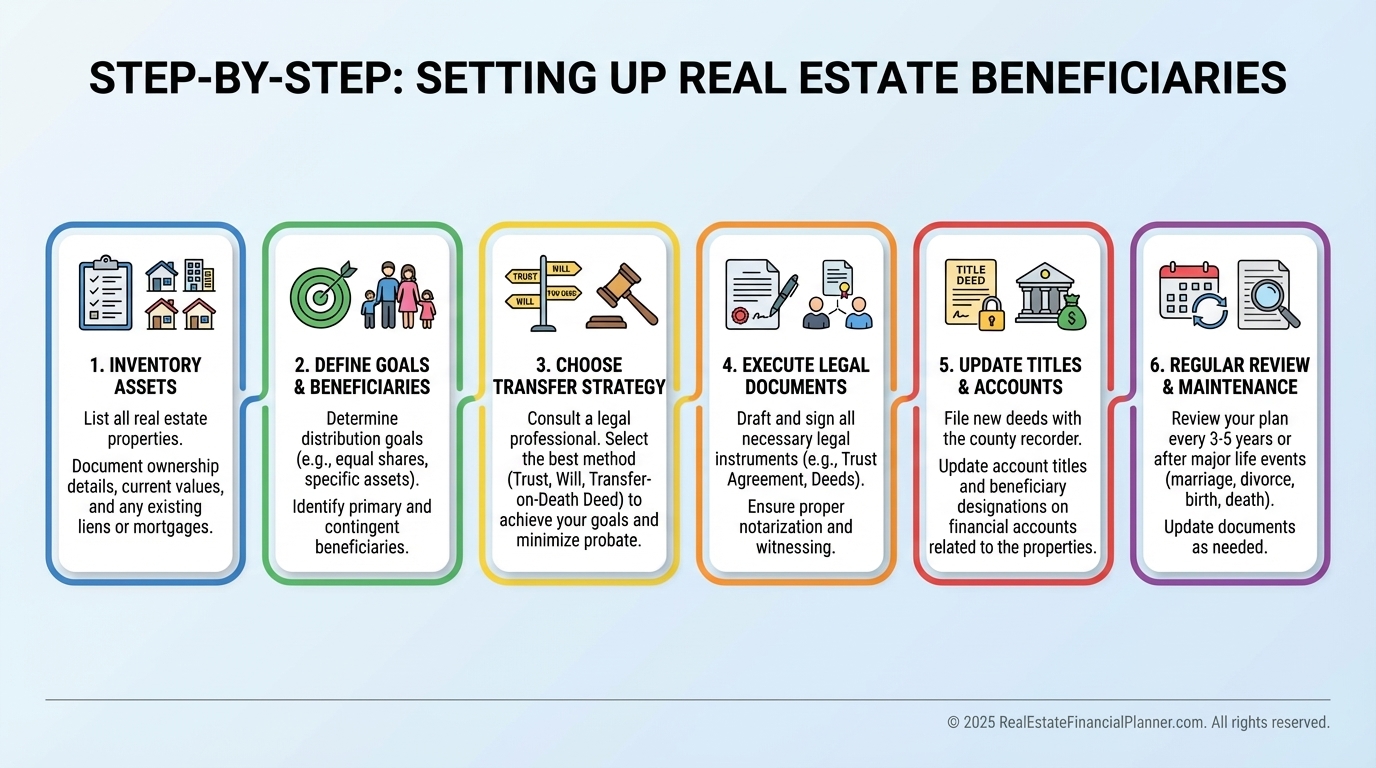

How I Walk Clients Through Beneficiary Setup

I don’t start with documents.

I start with inventory.

We list every property.

We identify how each is titled.

We note mortgages, reserves, and cash flow.

We then design beneficiary rules that match how the portfolio actually operates.

Only then do attorneys draft documents.

This prevents overengineering and keeps costs under control.

Special Considerations for Mom and Pop Investors

If you own one to five properties, complexity is the enemy.

You don’t need exotic trusts.

You need continuity.

That means uninterrupted income for a spouse.

Clear authority to manage or sell.

Enough liquidity to cover six to twelve months of expenses.

Simple tools like TOD deeds, basic trusts, and POD bank accounts often accomplish ninety percent of the goal at a fraction of the cost.

Your Legacy Is Part of the Deal Analysis

When I rebuilt after bankruptcy, I learned that wealth isn’t just what you accumulate.

It’s what survives bad timing, bad paperwork, and bad assumptions.

Beneficiary planning is not optional for real estate investors.

It is part of responsible ownership.

The same way you analyze returns, you should analyze transfer risk.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ helps you track numbers.

A good beneficiary plan protects the people behind those numbers.

Start by reviewing one property.

Then one account.

Momentum builds faster than you think.