Due Diligence: Where Real Estate Investors Actually Make Their Money

Learn about Due Diligence for real estate investing.

When I help clients evaluate a property, the most important conversations happen long before we ever write an offer.

They happen during due diligence.

I have seen investors reach financial independence because they treated due diligence as a discipline.

I have also seen investors lose tens of thousands because they treated it as a formality.

When I rebuilt my own real estate portfolio after bankruptcy, due diligence became non-negotiable.

It became the filter between properties that quietly compound wealth and properties that slowly bleed it away.

As I explain in The Caveman’s Guide to Deal Analysis Inputs, hope is not a strategy.

Due diligence is.

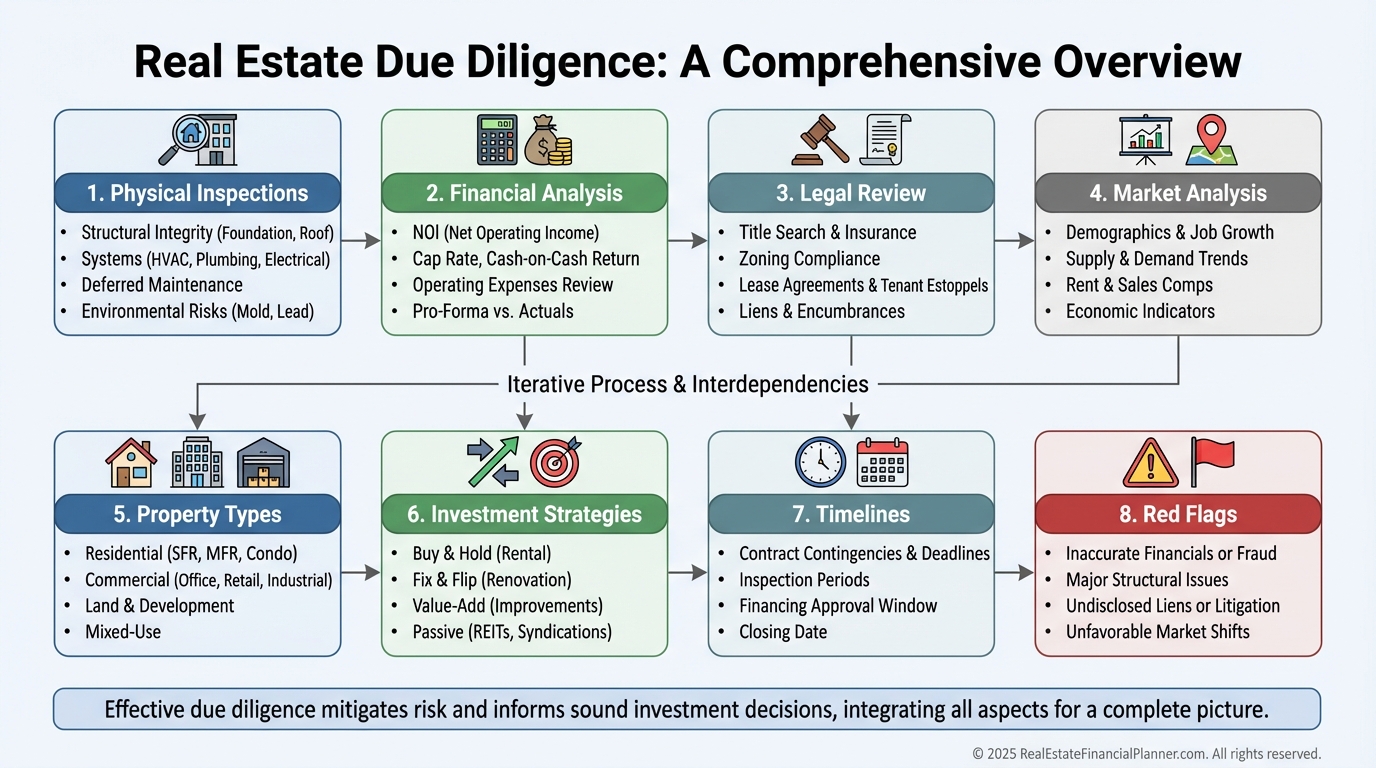

What Due Diligence Really Is

Due diligence is the systematic process of verifying everything about a property before you close.

It is not just inspections.

It is not just running numbers.

It is not just reading leases, walking neighborhoods, or reviewing title.

It is all of it, done with intent.

And it is your only chance to uncover what the seller did not tell you—and what the property is trying to hide.

I tell clients this constantly: you make your money during due diligence.

Closing just confirms the decision.

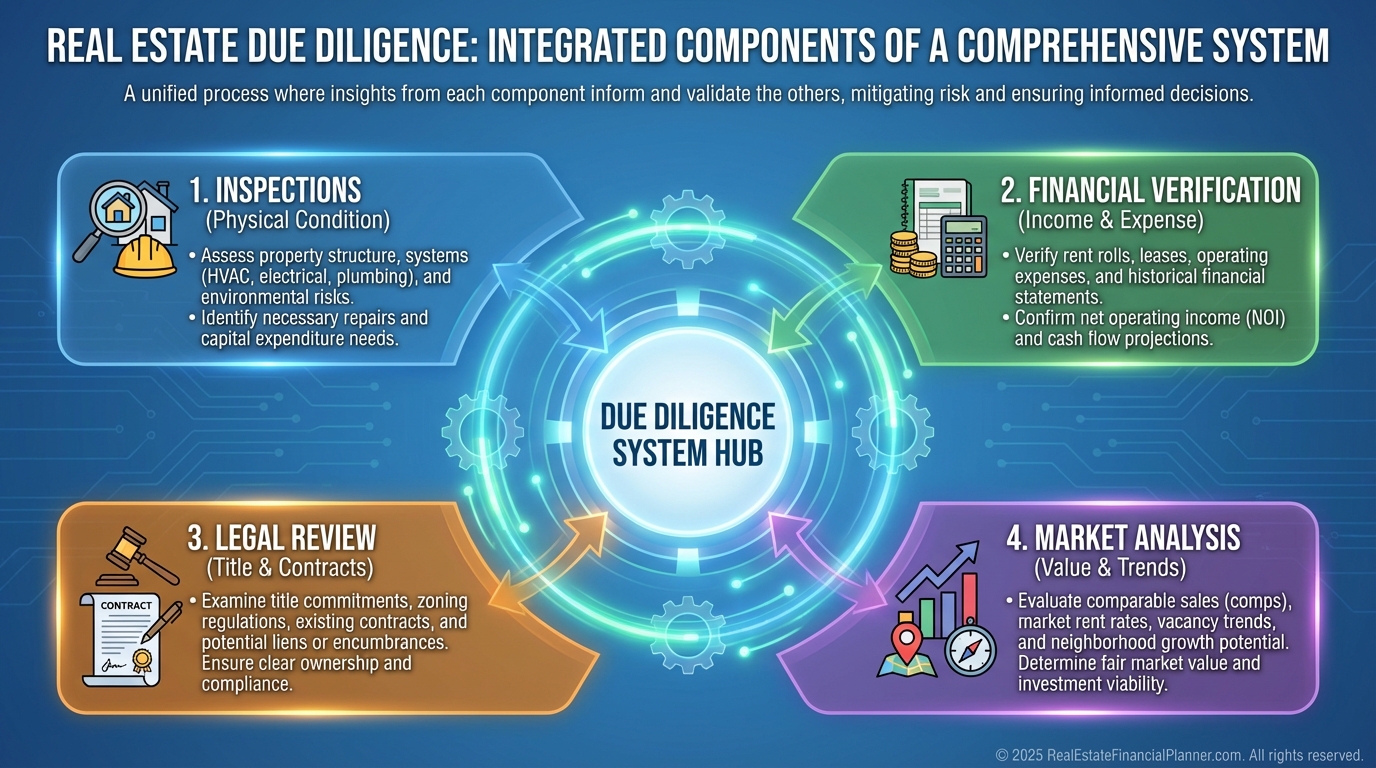

The Four Pillars of Due Diligence

Every property is different.

But every successful due diligence process rests on four pillars.

Physical, financial, legal, and market analysis.

When even one of these is weak, the investment eventually cracks under pressure.

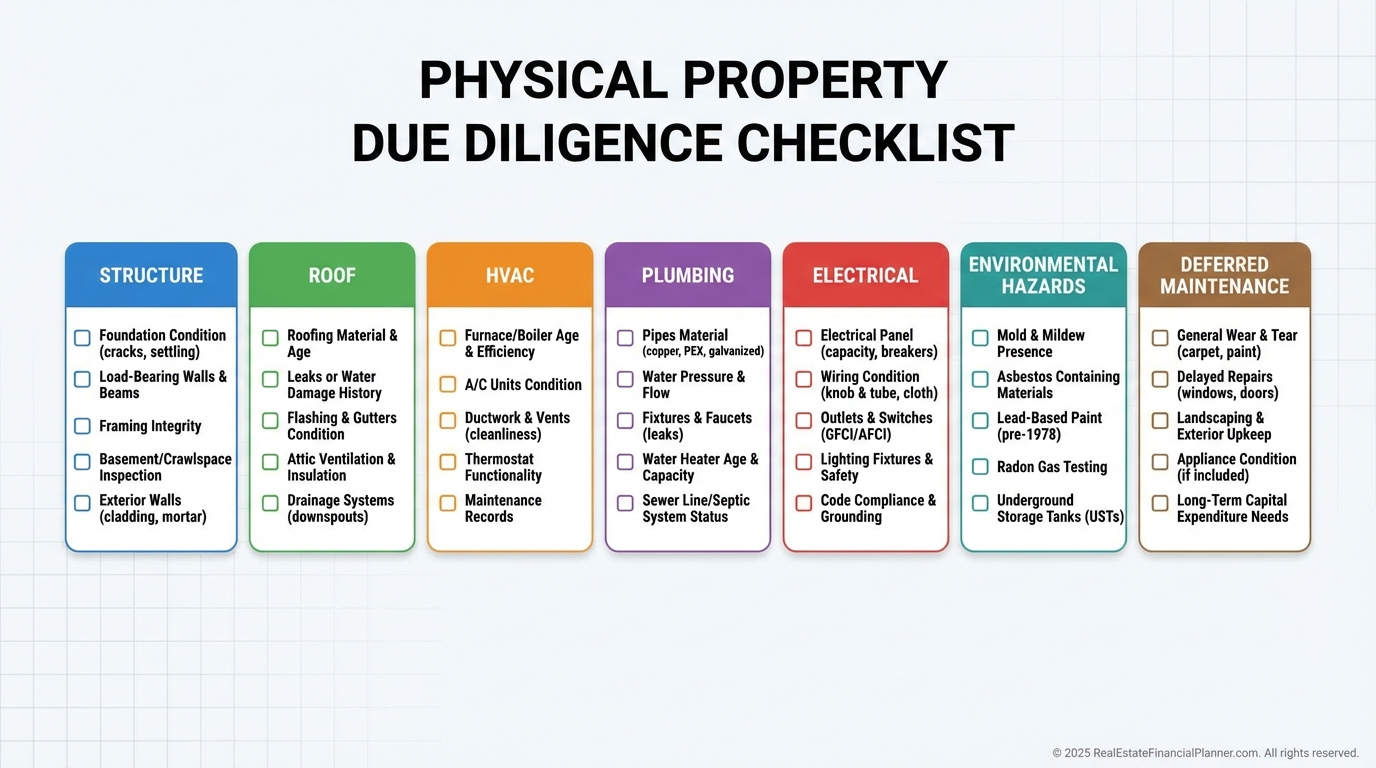

Physical Property Inspection

The physical condition of a property determines repair risk, future expenses, and even tenant quality.

When I walk properties with clients, I look for the big things first.

Foundations.

Roofs.

Mechanical systems.

Those are where deals quietly die.

A proper inspection goes far beyond a walkthrough.

You are evaluating structure, roof life, HVAC, plumbing, electrical, environmental risks, and deferred maintenance.

When investors skip this step, they are not skipping risk.

They are absorbing it.

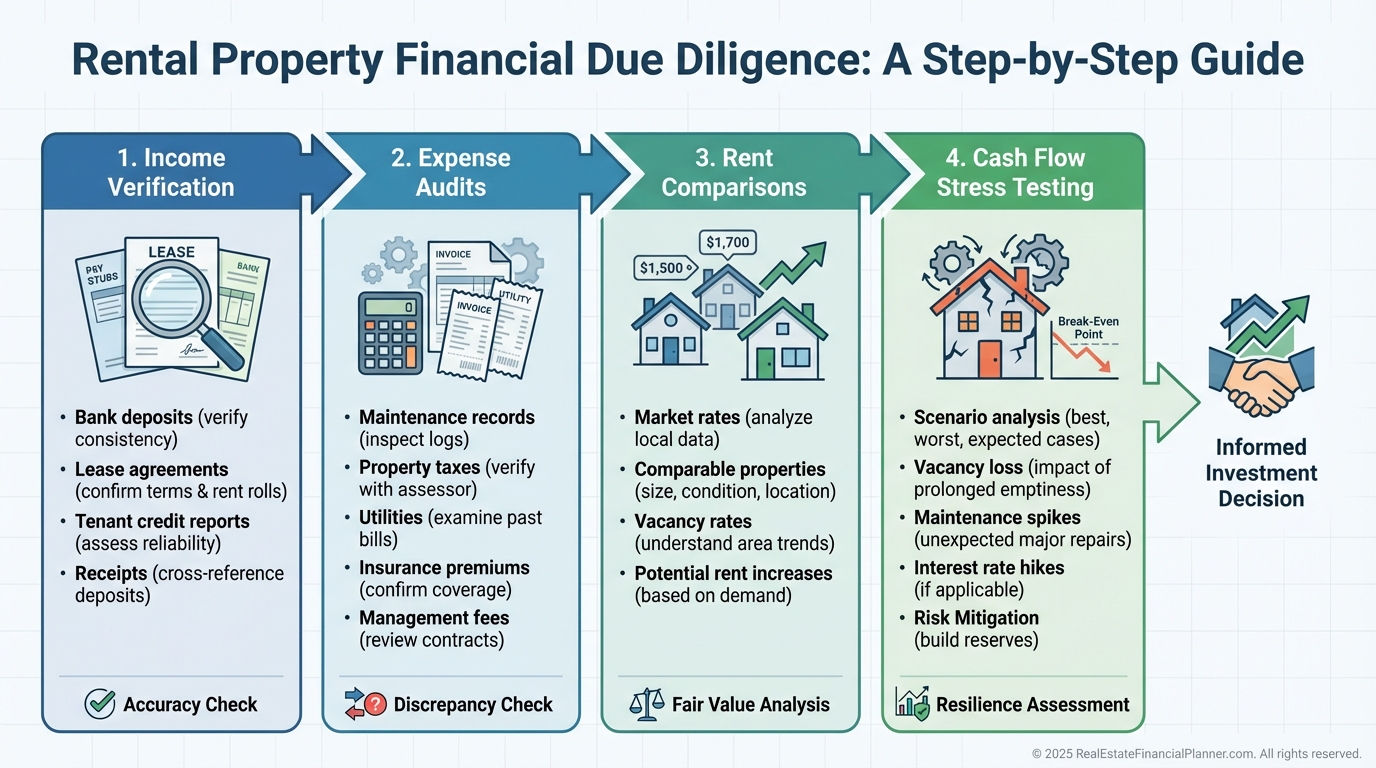

Financial Analysis

Real estate lies.

Numbers do not.

Financial due diligence is where you validate every assumption the seller wants you to believe.

I have reviewed countless deals with beautiful pro formas and glossy marketing packages.

Most fall apart once we replace assumptions with actual data.

This is where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ becomes the truth serum.

It forces the property to tell you who it really is.

Legal and Title Review

Legal due diligence reveals problems you cannot renovate away.

I once reviewed a deal that looked perfect on paper and passed inspection with flying colors.

Title work uncovered an unresolved boundary dispute from decades earlier.

The deal ended immediately.

Legal due diligence includes title search, title insurance, zoning verification, easement review, and lease analysis.

Miss something here and no spreadsheet will save you.

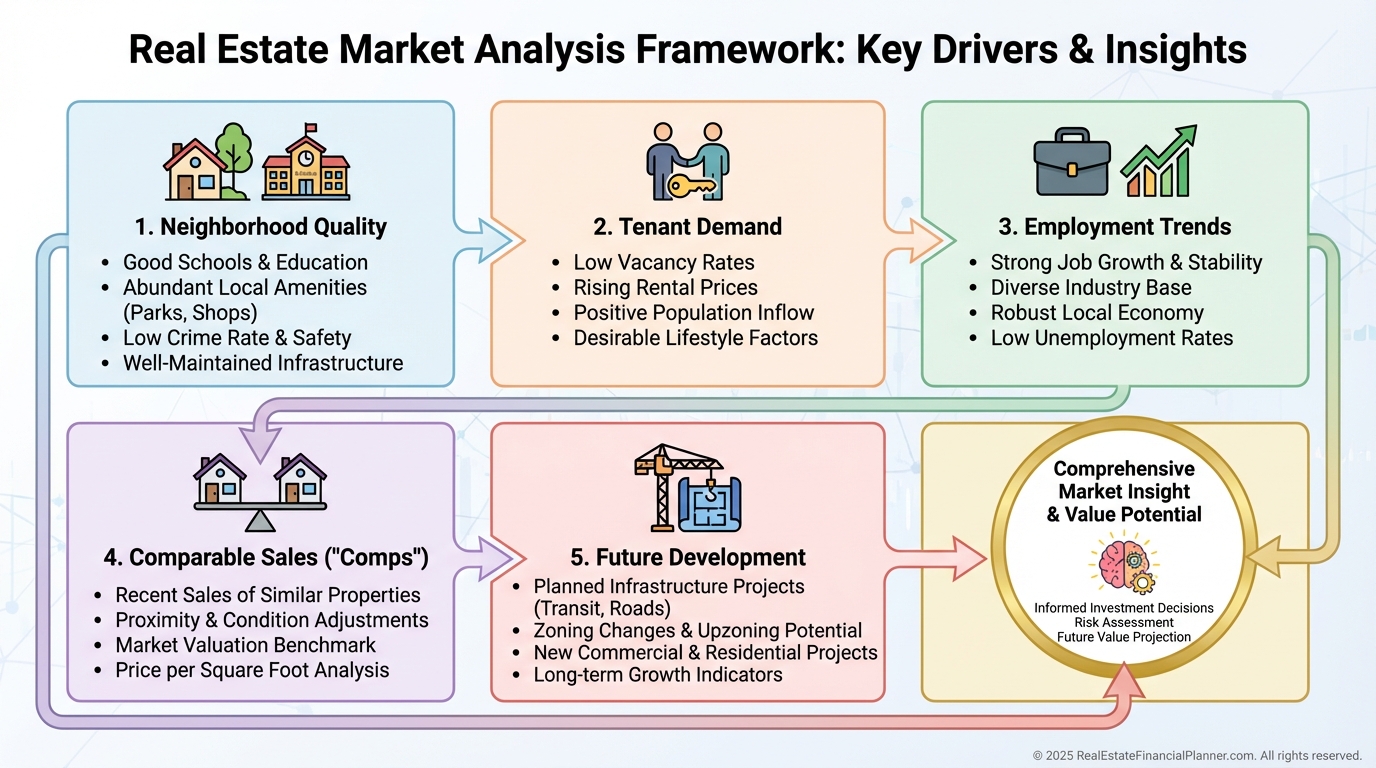

Market Analysis

Properties do not exist in isolation.

They live inside markets.

And markets decide whether your investment appreciates, stagnates, or declines.

When I teach market analysis, I warn investors not to fall in love with properties.

Markets determine long-term outcomes.

You must evaluate tenant demand, neighborhood trends, comparable values, employment drivers, and planned development.

This is where you assess the future, not just the present.

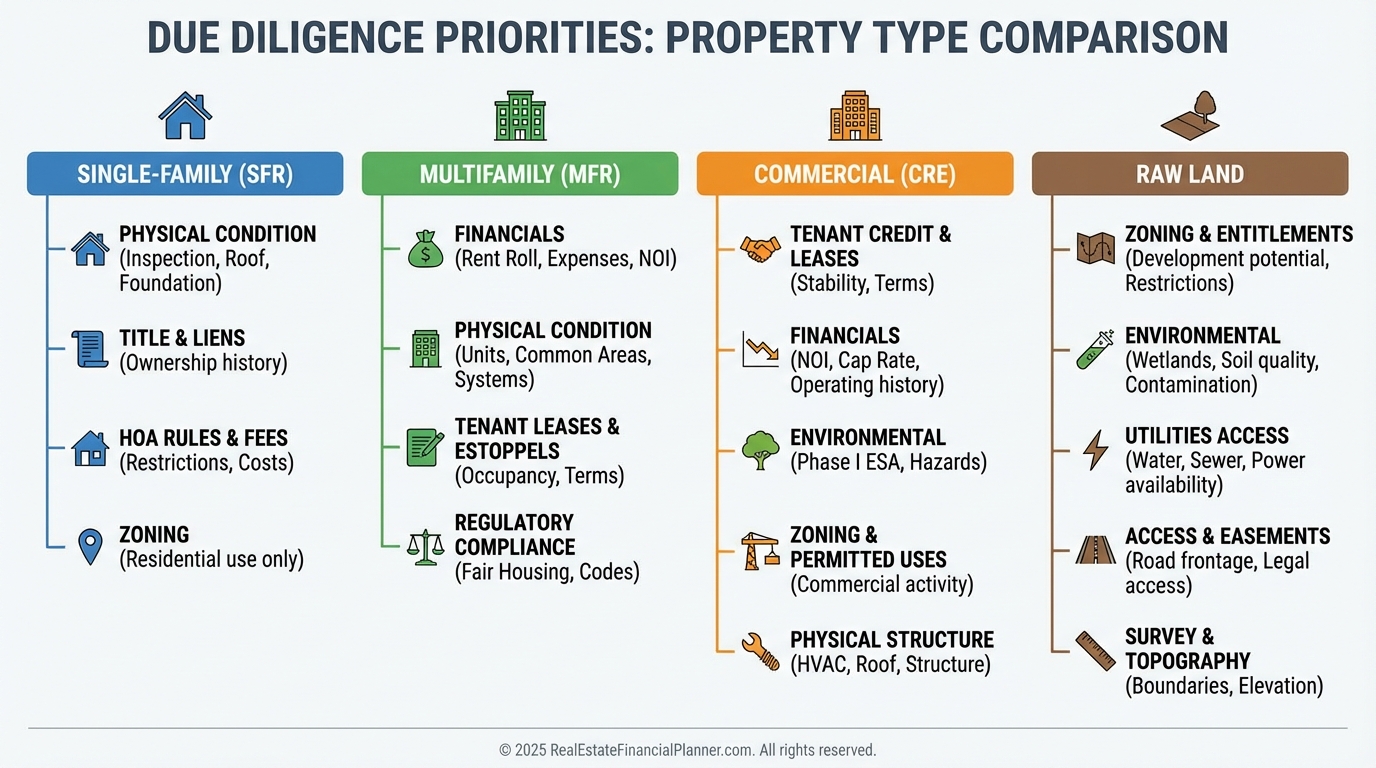

Due Diligence by Property Type

Different properties hide different risks.

When I help clients analyze deals, I adjust due diligence based on what we are buying.

Single-Family Rentals

Single-family homes look simple.

They are not.

For these properties, I focus on maintenance history, neighborhood stability, owner-occupancy rates, school quality, and HOA restrictions.

A great house in a weak neighborhood is still a weak investment.

Multifamily Properties

Multifamily amplifies everything.

Cash flow, complexity, management, and mistakes.

I look for patterns in rent rolls, turnover, maintenance quality, and management effectiveness.

Inconsistent data tells stories.

You just have to listen.

Commercial Properties

Commercial deals live and die by leases.

Tenant strength and lease terms matter more than paint or flooring ever will.

Commercial due diligence requires tenant financial review, lease analysis, parking and access evaluation, and ADA compliance.

The building is only as good as the paper the leases are written on.

Raw Land and Development

Land looks cheap until it proves itself.

I have seen investors fall in love with “potential.”

Potential is expensive until verified.

Land due diligence includes soil tests, utility access, zoning limits, environmental assessments, and development restrictions.

The most expensive mistake in land investing is assuming it can be built on.

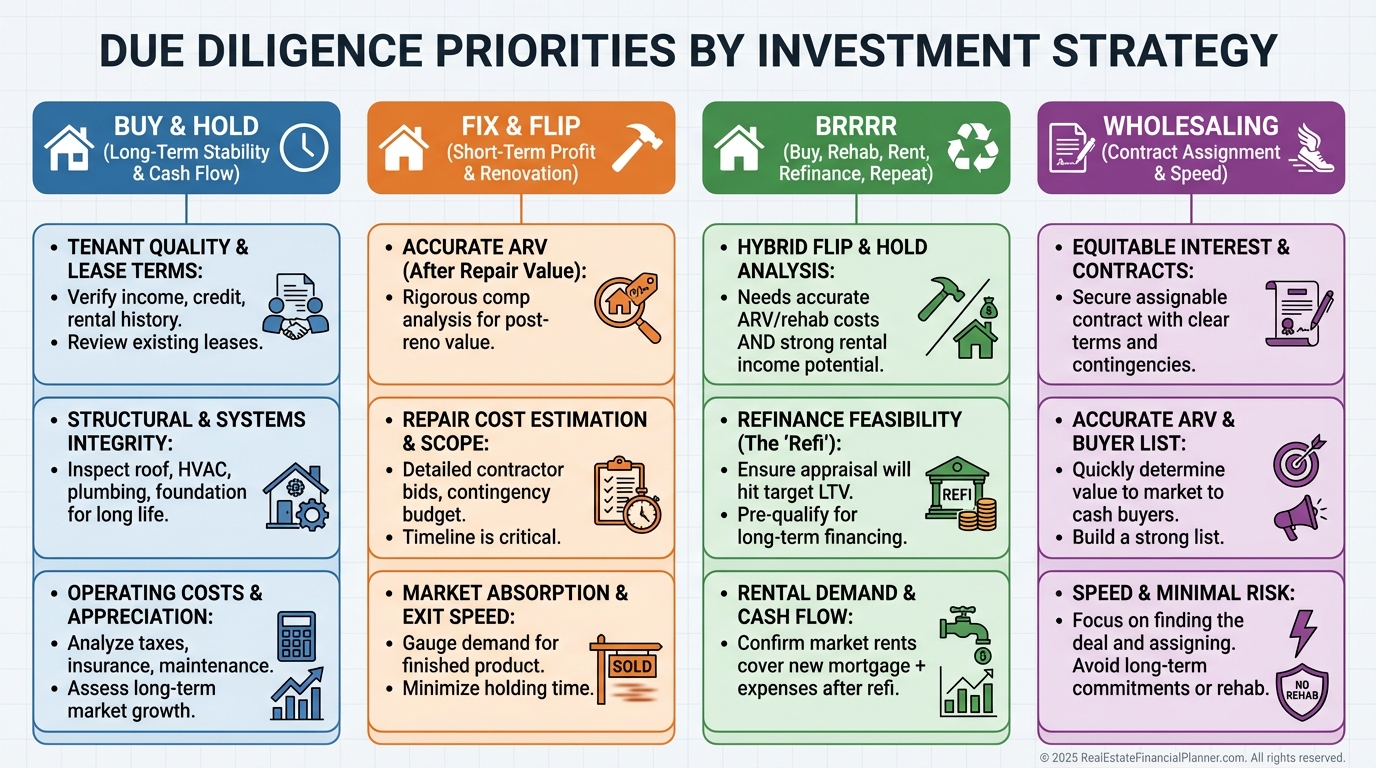

Due Diligence by Investment Strategy

Your strategy defines your risk.

Risk defines your due diligence priorities.

Buy-and-hold investors must analyze long-term market health, capital improvements, and cash flow sustainability.

Fix-and-flip investors must validate renovation costs, ARV accuracy, contractor reliability, and absorption rates.

BRRRR investors must verify both the refinance and rental exit.

A BRRRR without a refinance is just an expensive flip.

Wholesalers need speed, but not sloppiness.

They must verify title, assignment clauses, ARV, repairs, and buyer fit—while staying compliant with local laws.

Direct Purchase vs Partnership or Syndication

When you invest passively, you are not just buying real estate.

You are buying the sponsor.

Direct buyers control inspections, documents, and decisions.

They also carry full responsibility.

Syndication investors must vet sponsor experience, fee structures, exit plans, and compliance.

A strong property cannot save a weak sponsor.

If you would not trust someone with your retirement account login, do not trust them with your syndication capital.

Due Diligence Timeline and Red Flags

Due diligence must be structured and time-bound.

You cannot improvise your way through it.

A strong process organizes tasks, schedules inspections, sets decision points, and tracks findings inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Rushed due diligence is expensive due diligence.

Major structural issues, unresolvable title defects, environmental contamination, false financials, and declining markets should stop deals cold.

That said, one investor’s deal-breaker may be another investor’s specialty.

Know your skill set.

Believe what the property shows you.

Final Thoughts

Due diligence is not optional.

It is the shield that protects your capital and the lens that reveals truth.

It does not guarantee success.

But skipping it guarantees risk.