Why Every Smart Investor Needs an Electrician on Their Real Estate Dream Team

Learn about Electrician for real estate investing.

When I help clients evaluate rental properties, electrical systems are one of the first things I quietly worry about.

After rebuilding my own portfolio following bankruptcy, I became much more conservative about unseen risks.

Electrical issues are high on that list because they combine safety risk with expensive surprises.

An electrician isn’t optional on your dream team.

They are part of how you protect cash flow, equity, and sleep.

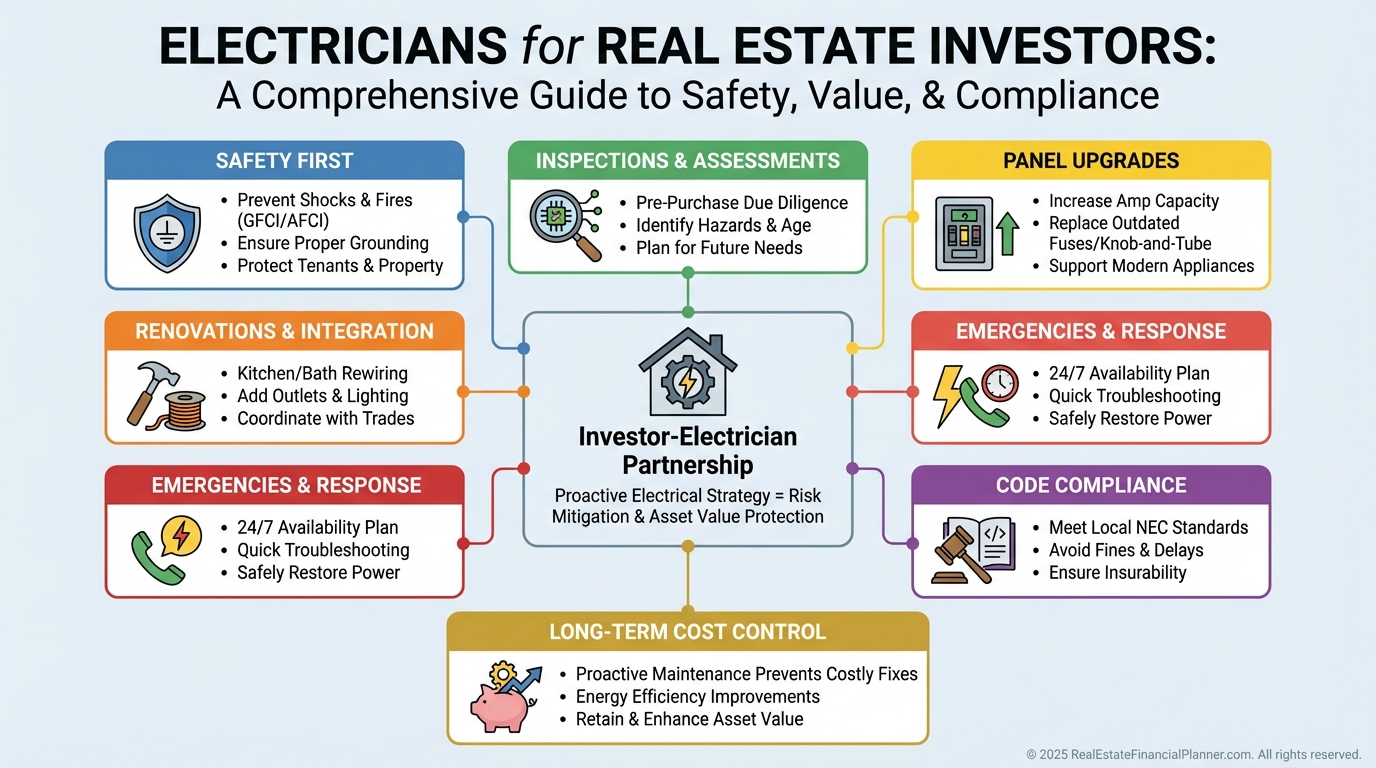

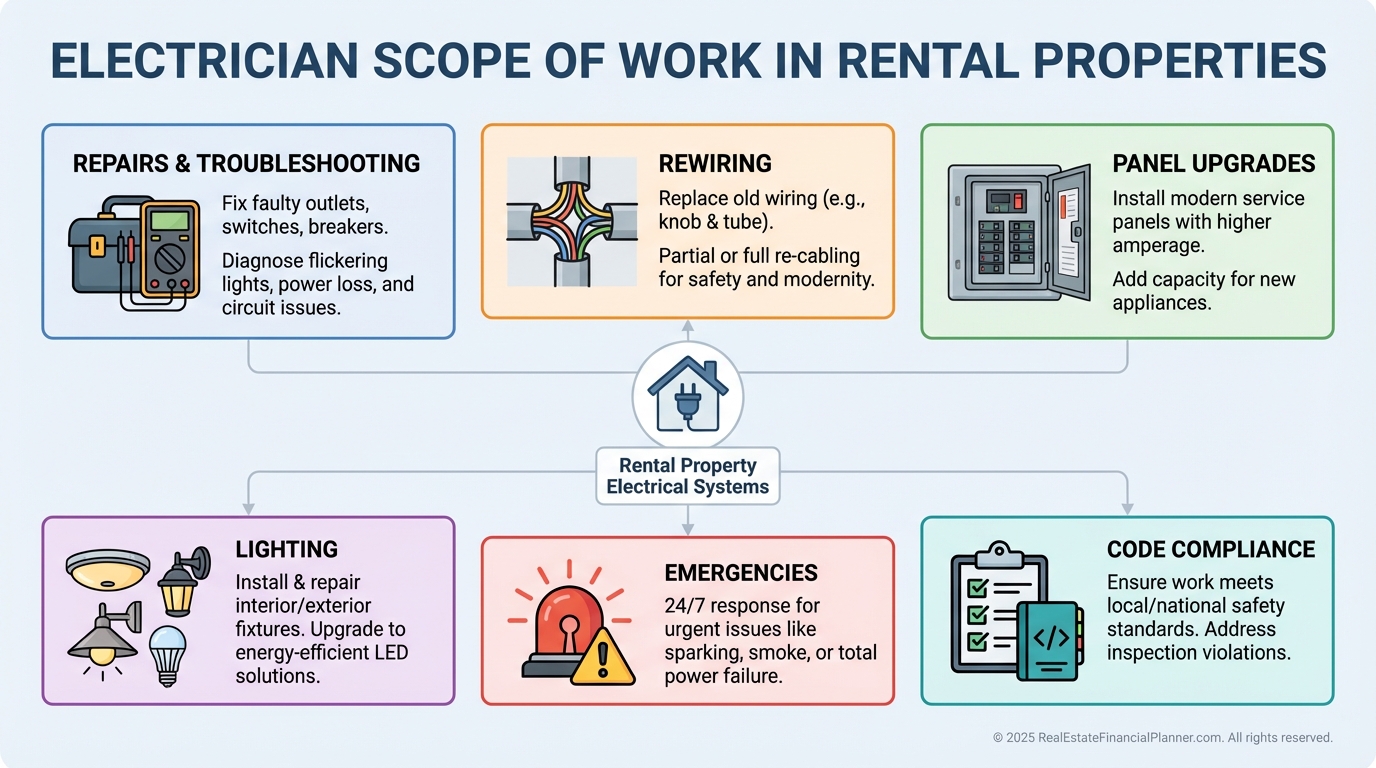

What an Electrician Actually Does for Investors

Most investors underestimate how broad an electrician’s role really is.

It’s not just “fixing outlets.”

It’s risk management.

Here’s what I expect electricians to handle on investment properties:

Electrical Repairs and Troubleshooting

Diagnosing flickering lights, dead outlets, tripping breakers, and mystery power losses before they become hazards.

New Wiring and System Installations

Supporting renovations, added outlets, appliance upgrades, and increased electrical demand from modern tenants.

Electrical Panel Upgrades

Replacing undersized, obsolete, or dangerous panels that quietly cap a property’s future usefulness.

Lighting Installation and Replacement

Interior upgrades, exterior security lighting, and energy-efficient conversions that improve tenant satisfaction.

Electrical Emergencies

Fast response to failures that could otherwise cause fires, water damage, or tenant displacement.

Code Compliance

Making sure work meets current codes so inspections, insurance claims, and future sales don’t blow up.

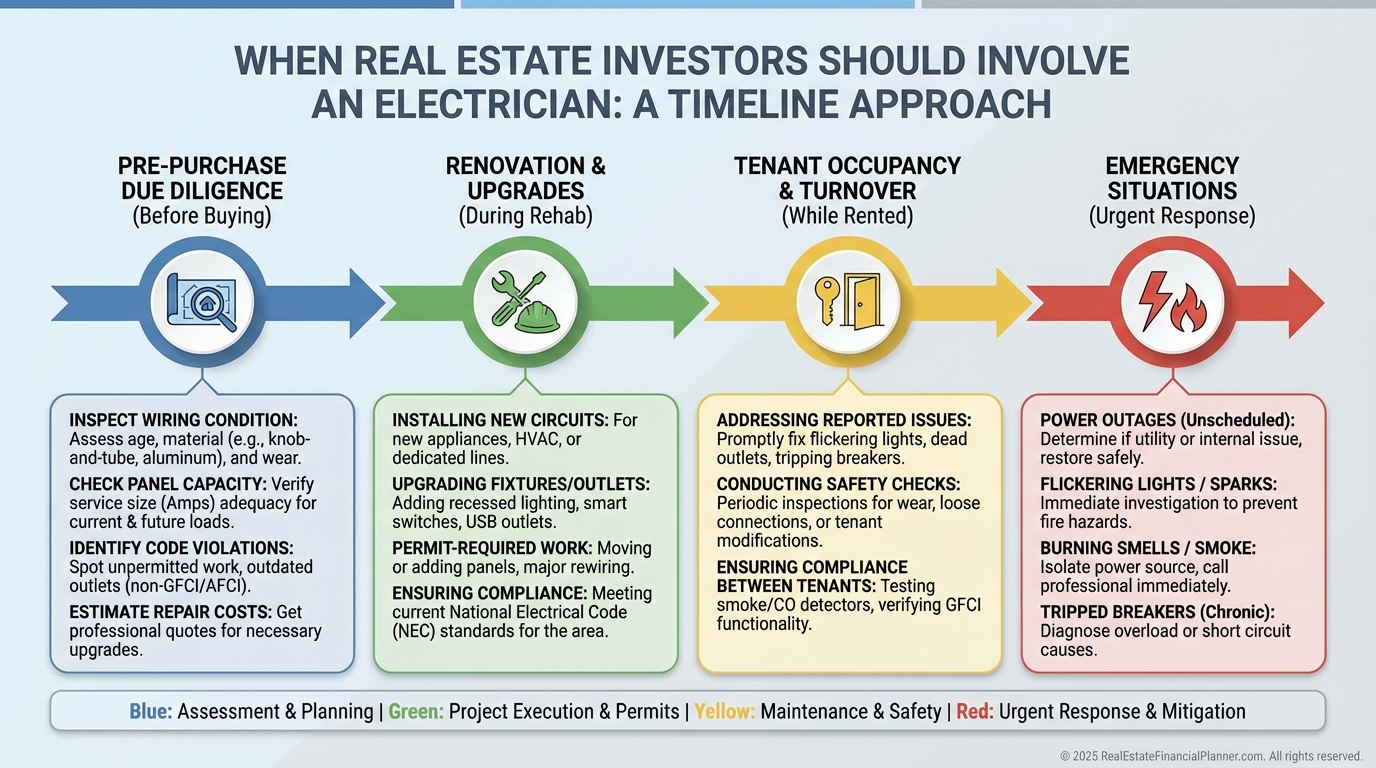

When You Should Involve an Electrician

Timing matters more than most investors realize.

I involve electricians at four key moments:

Before You Buy

I want hidden risks identified before they show up in my repair budget or appraisal conditions.

During Renovations

This is when you can fix problems cheaply instead of retrofitting later at full retail cost.

During Ownership

Ongoing maintenance prevents small problems from becoming insurance claims.

During Emergencies

Speed matters when safety and habitability are at risk.

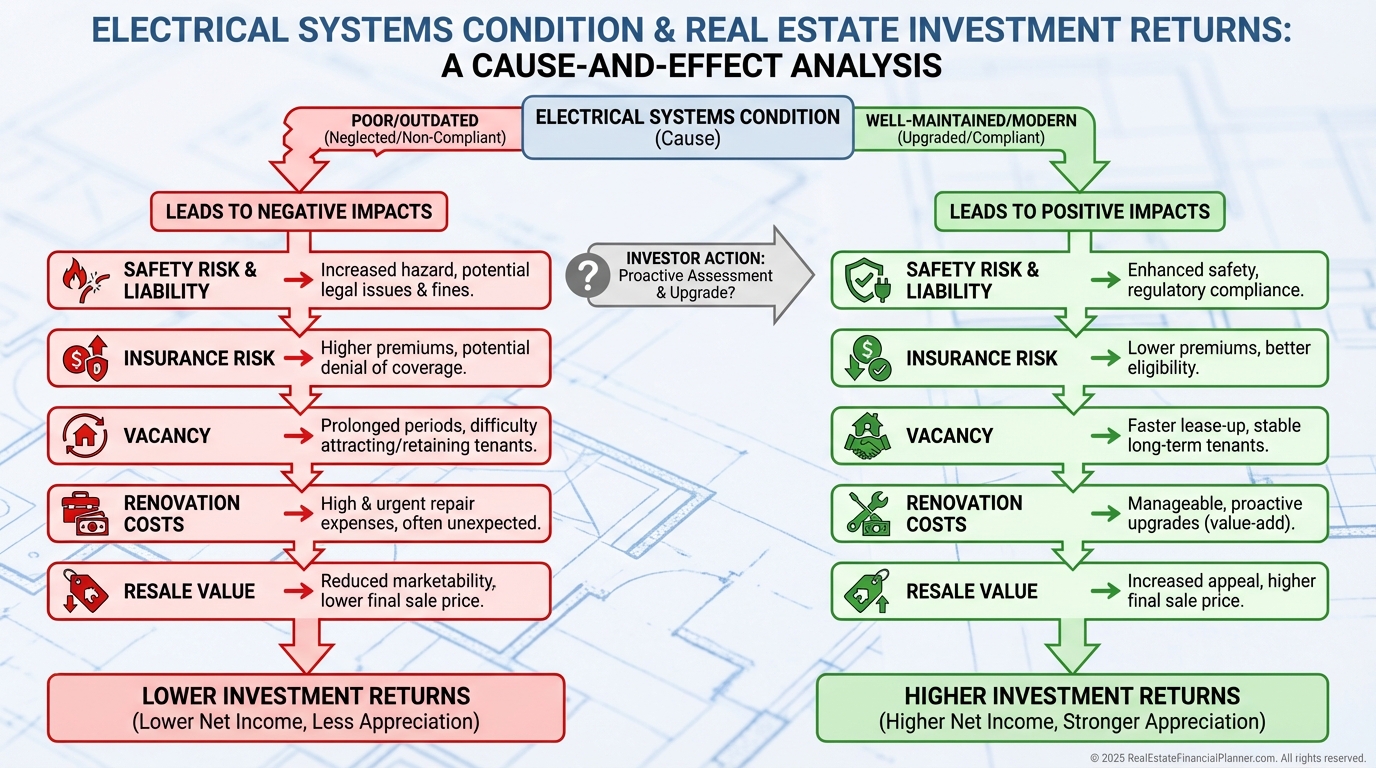

Why Electricians Directly Impact Your Returns

Electrical work doesn’t feel “strategic,” but it is.

Here’s how electricians protect your numbers:

Tenant Safety and Liability

Electrical fires destroy more than buildings. They destroy portfolios.

Modern Electrical Demand

Older wiring limits what tenants can safely use, which limits rent growth.

Preventing Expensive Repairs

Early fixes preserve True Net Equity™ by avoiding catastrophic losses.

Inspection and Insurance Approval

Failed inspections stall deals and reduce leverage options.

I don’t model electrical upgrades as optional expenses.

I model them as insurance against downside risk.

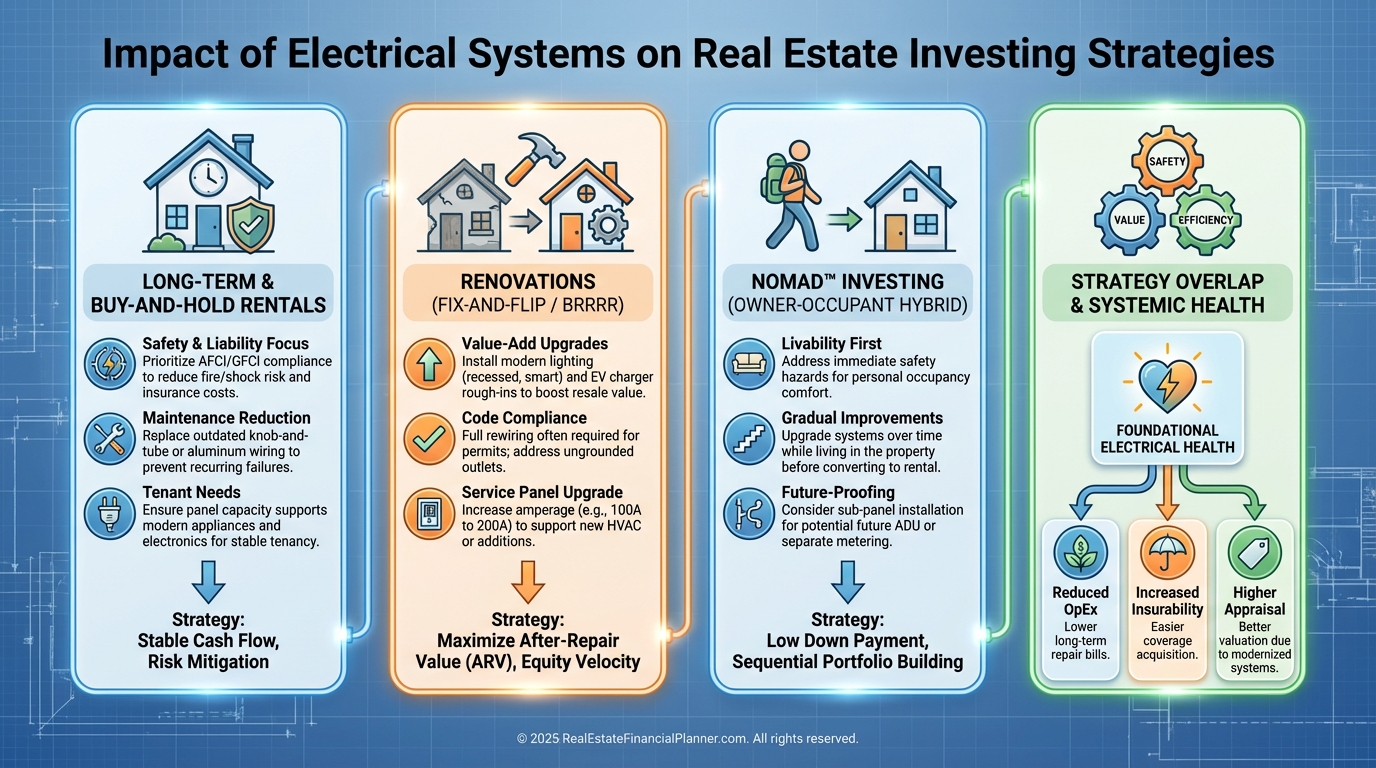

Electrical Systems and Long-Term Strategy

Electrical capacity affects strategy more than most investors realize.

For example:

Nomad™ properties often need upgrades as you convert from owner-occupant to rental use.

Long-term holds need scalable electrical capacity to support future improvements.

Properties with weak systems quietly limit appreciation and rent growth.

Ignoring electrical systems narrows your future options.

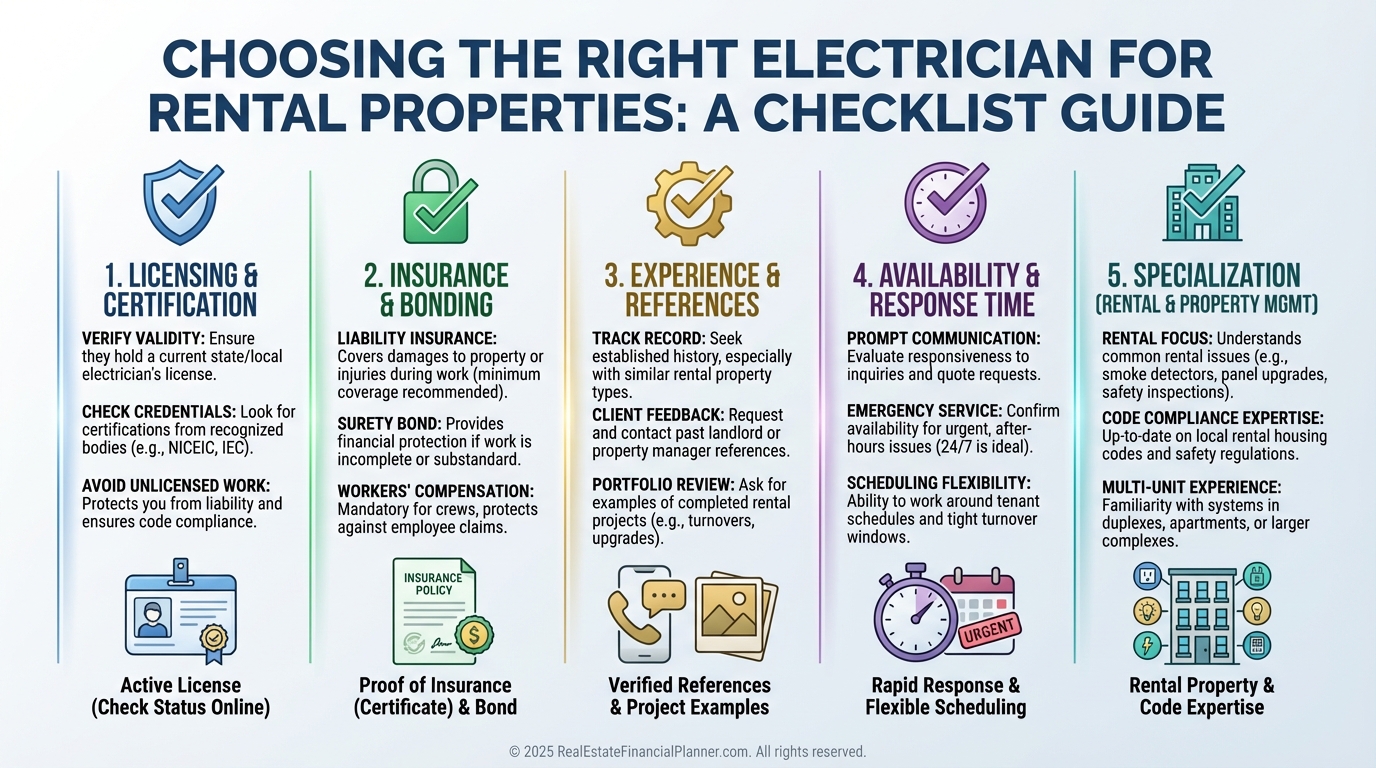

What I Look for When Hiring an Electrician

Not all electricians are a good fit for investors.

My non-negotiables:

Licensed and Insured

This protects both you and your tenants.

Experience with Older Properties

Rentals reveal problems new construction never sees.

Emergency Availability

Electrical issues don’t respect business hours.

Long-Term Relationship

Familiarity with your properties saves time and money over decades.

The Investor Mindset Shift

Electricians aren’t just repair people.

They are part of your financial defense system.

When investors skip proper electrical work, they usually pay for it later through vacancies, insurance claims, or forced upgrades at the worst possible time.

When investors treat electricians as core team members, properties last longer, cash flow stabilizes, and equity compounds quietly in the background.