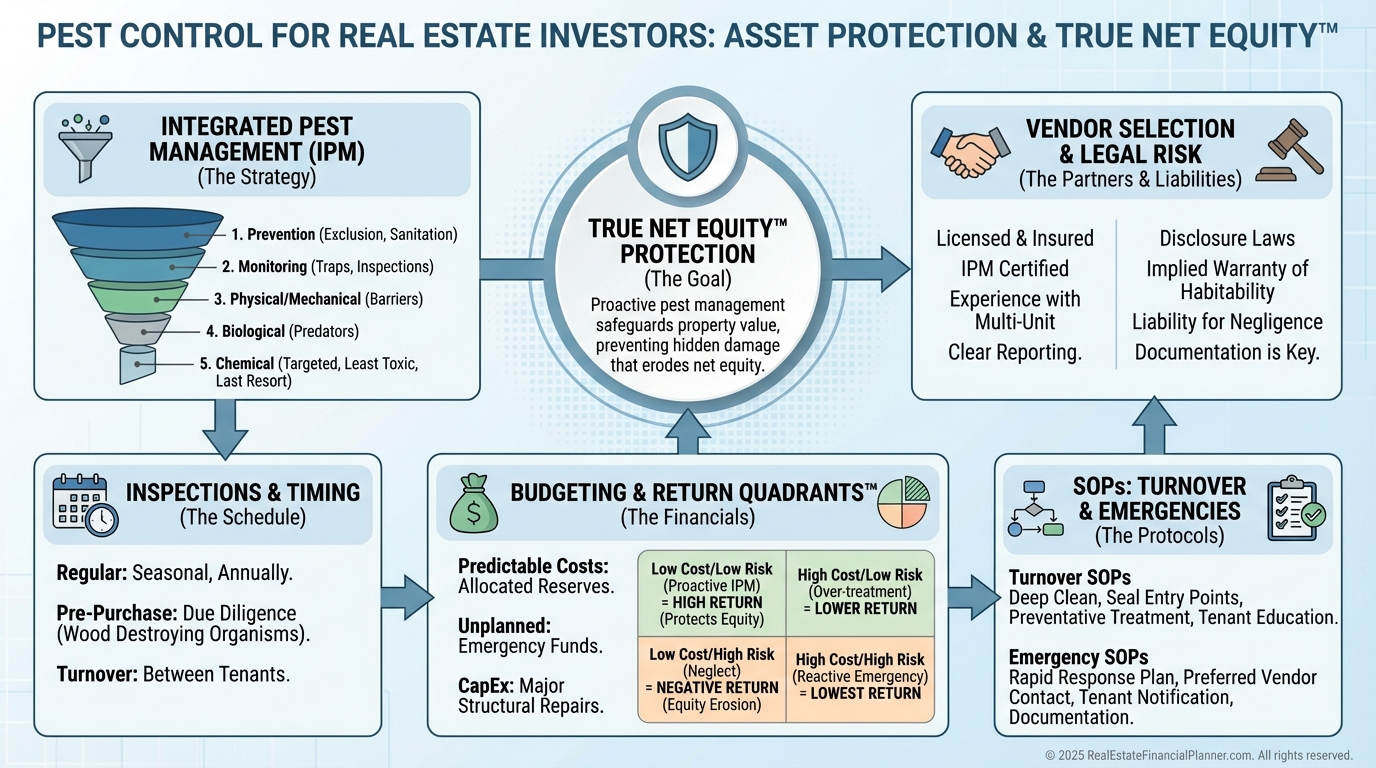

Pest Control for Real Estate Investors: A Preventive System to Safeguard Cash Flow and True Net Equity™

Learn about Pest Control for real estate investing.

Why Pest Control Belongs in Your Investment Model

When I help clients underwrite deals, I add a distinct line item called Pest/IPM right under repairs and maintenance.

A single untreated termite colony or bed bug outbreak can erase a year of cash flow and ding future appreciation if the property sits stigmatized and vacant.

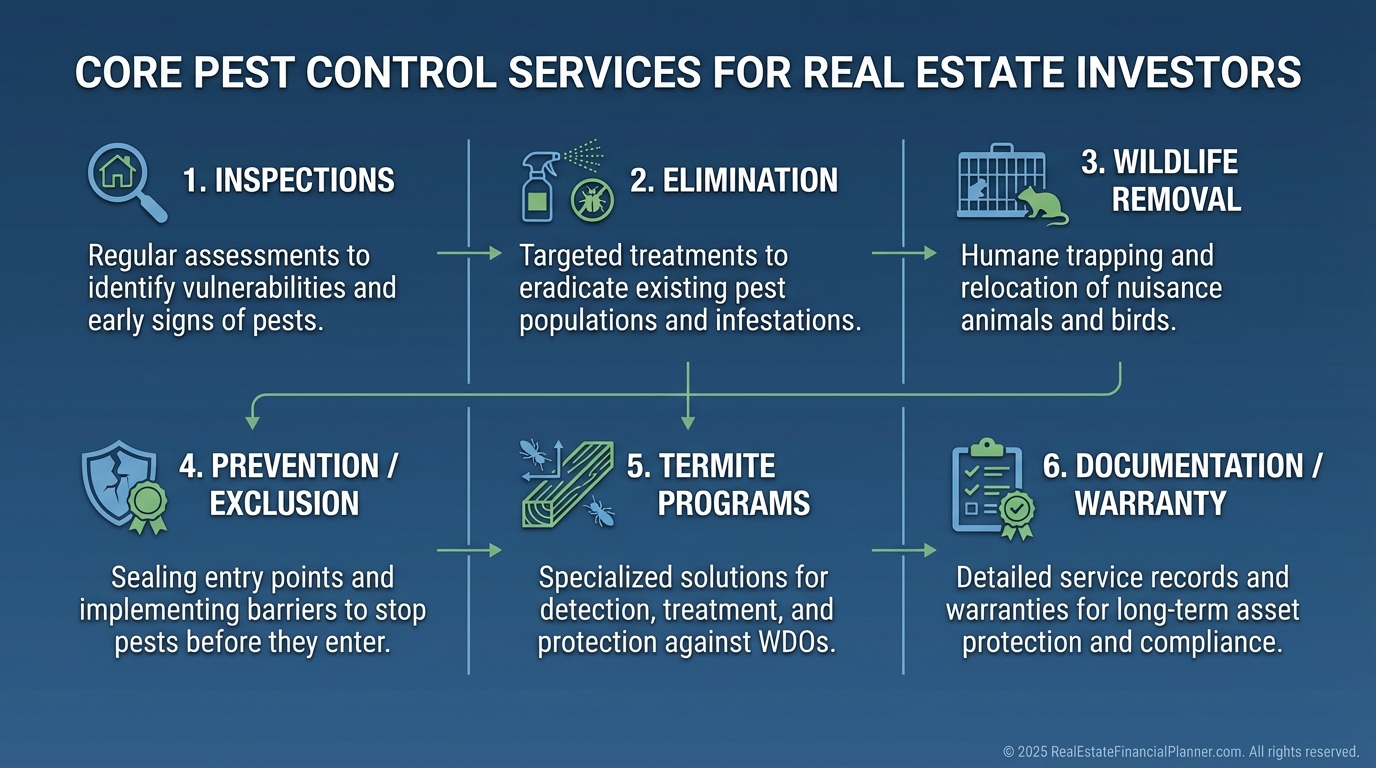

What a Pest Control Pro Actually Does

Pest professionals do four core things investors need.

They find issues early through routine inspections.

They block pests from entering with prevention and IPM.

They eliminate infestations fast with targeted treatments.

They document, warranty, and follow up so problems do not boomerang.

Here is how that translates to your operations.

•

Routine inspections of interior, exterior, attic, crawlspace, and utility penetrations

•

Preventive perimeter treatments, exclusion work, sealing gaps, and bait/monitor stations

•

Rapid-response elimination of rodents, roaches, ants, bed bugs, wasps, and other pests

•

Termite inspections, soil and wood treatments, bait systems, and repair guidance

•

Wildlife assessment and safe removal when applicable

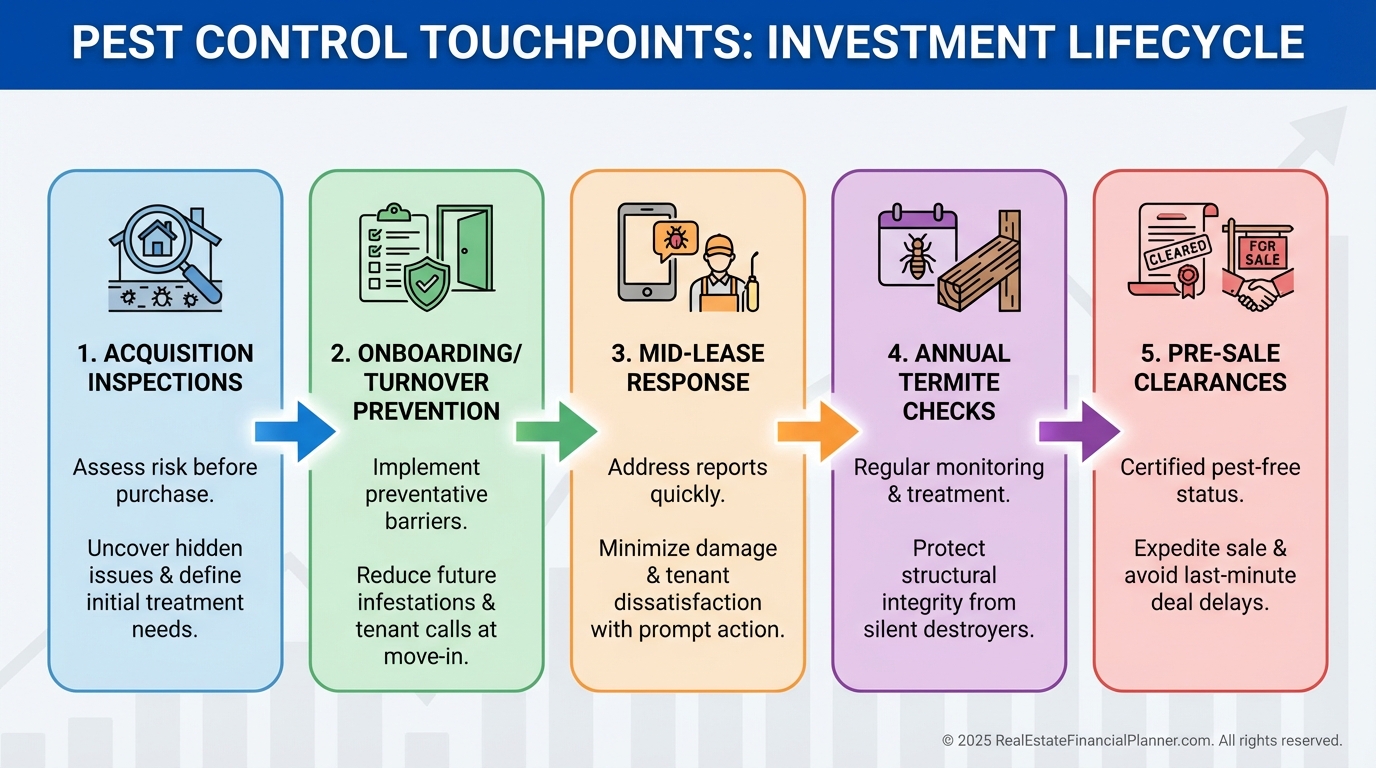

When to Involve Pest Control

During acquisition, I schedule a pest and termite inspection alongside the general inspection.

At tenant turnover, I combine a full inspection with preventive treatments and any needed exclusion work.

During tenancy, I respond to reports within 24 hours and triage by risk: bed bugs, rodents, and wasps get immediate dispatch.

For disposition, I obtain a termite clearance or treatment documentation to keep the buyer’s underwriter comfortable.

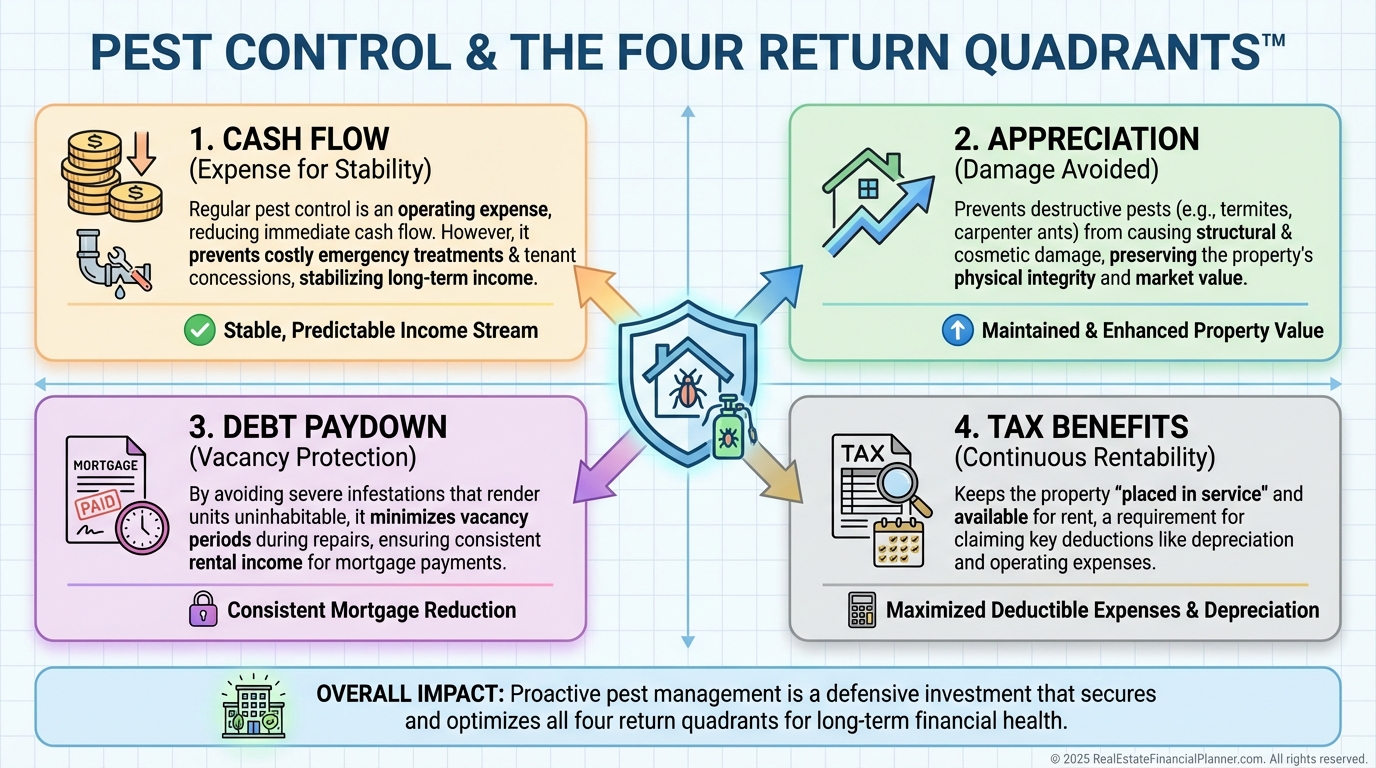

Modeling Costs and ROI with Return Quadrants™

Pest control shows up as an expense in the Cash Flow quadrant of Return Quadrants™.

But the right program protects Appreciation by preventing damage, Preserves Debt Paydown by reducing vacancy risk, and Defends Tax Benefits by keeping the asset rentable.

When I model portfolios, I budget $8–$18 per door per month for routine IPM, plus reserves for events:

•

Termites: $800–$2,500 for localized treatment; $2,000–$6,000 for full treatment, market dependent

•

Bed bugs: $500–$2,000 per unit depending on heat vs chemical and number of rooms

•

Rodents/exclusion: $250–$1,500 depending on entry points and remediation

I then stress test vacancy: add 0.25–0.50 months of potential vacancy per year for properties without a plan. With a standing plan and SLA, I set vacancy risk to baseline and reduce emergency premiums.

That change alone can swing an iffy deal to acceptable in Return Quadrants™.

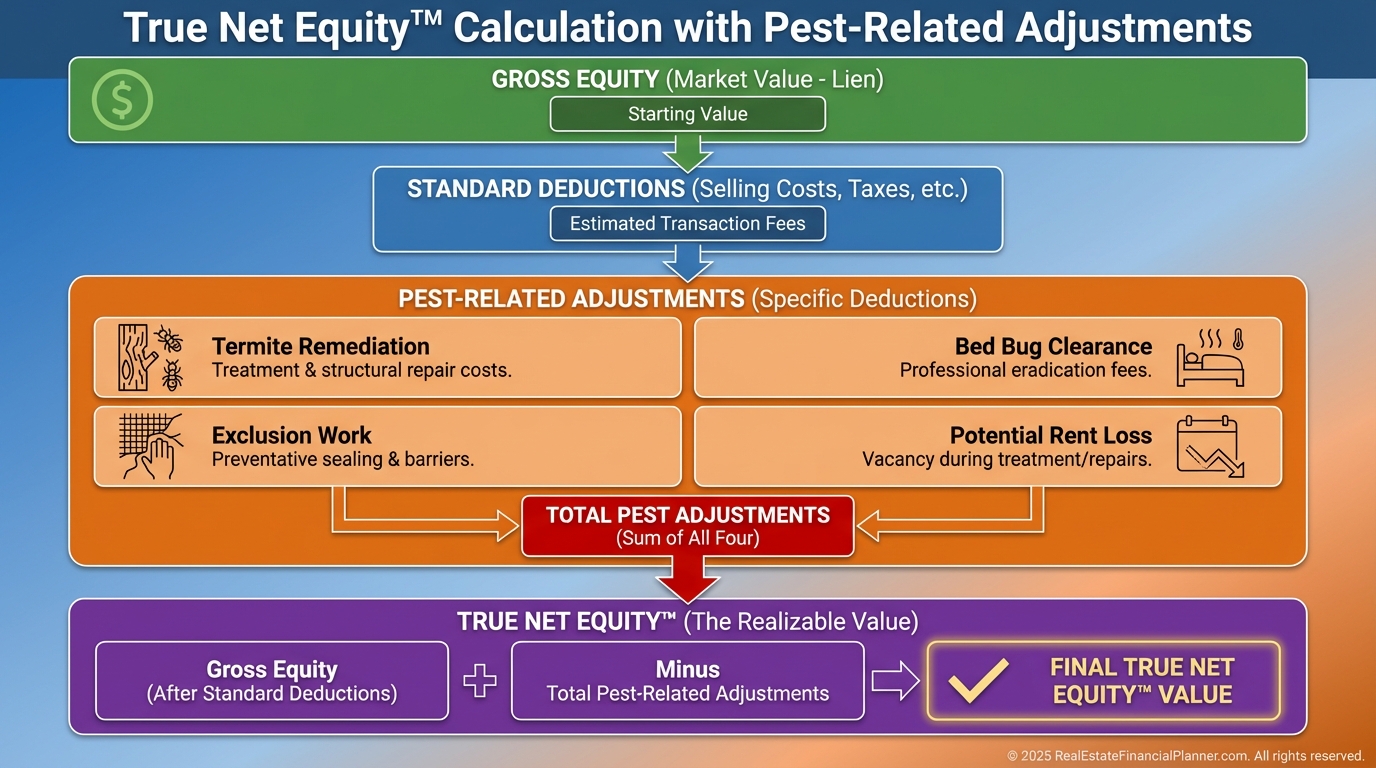

Protecting True Net Equity™

True Net Equity™ is market value minus what it would really cost to sell, fix, and make the property financeable and habitable.

Hidden pest damage is one of the fastest ways to overstate equity.

In my True Net Equity™ calc, I include:

•

Estimated termite remediation if inspection history is missing

•

Cosmetic repair for stigma and lost rent if bed bugs were reported without proof of clearance

•

Cost-to-cure for exclusion work if rodent entry points are evident

Adjusting for these items gives you a truer read on sell-ready equity.

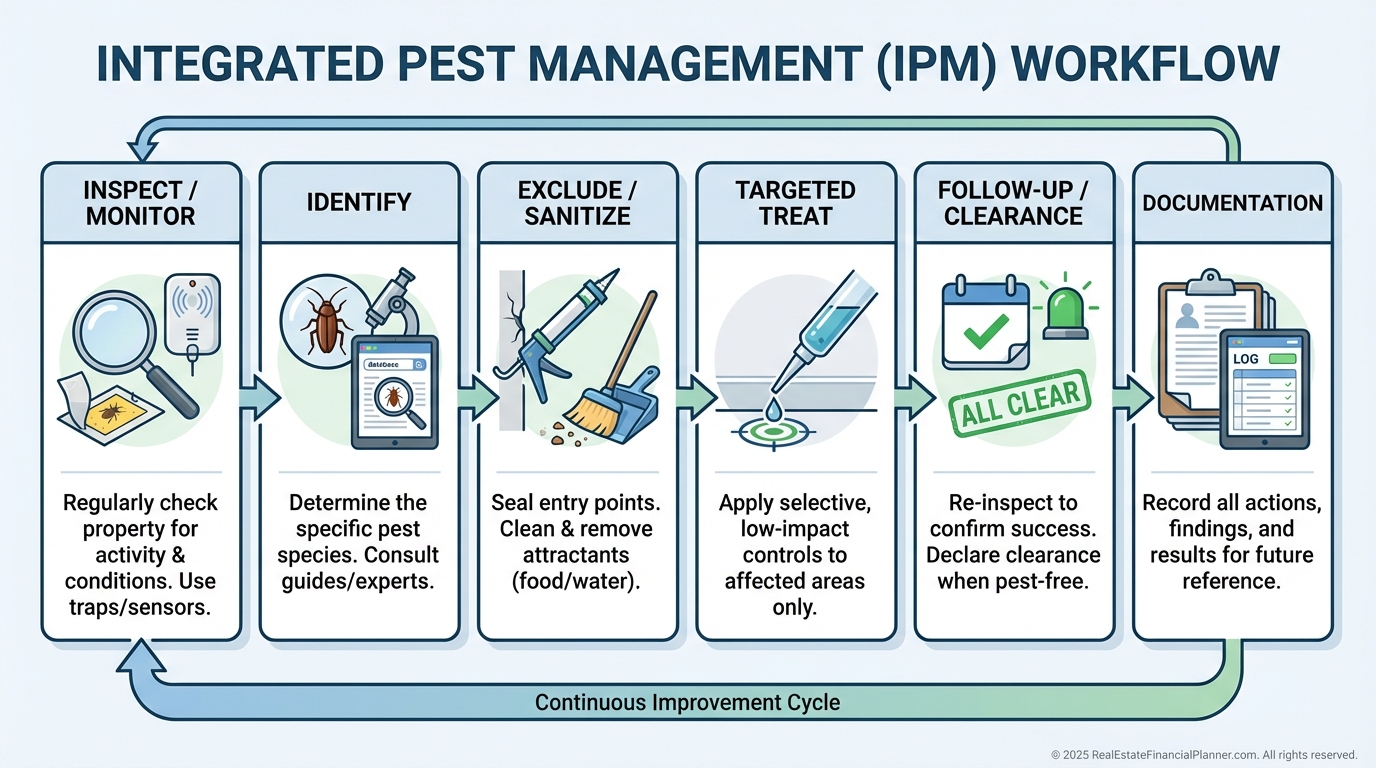

Build an IPM (Integrated Pest Management) SOP

I coach clients to implement IPM, not “spray and pray.”

Here is the SOP we deploy.

•

Inspection and monitoring: quarterly exterior, semiannual interior, annual attic/crawlspace

•

Exclusion: seal utility penetrations, repair door sweeps and screens, trim vegetation, fix drainage

•

Sanitation standards: lease addendum requires food storage and trash practices; cleaner standards at turnover

•

Targeted treatments: baits, gels, and limited residuals; escalate to heat/fumigation for severe cases

•

Proof and follow-up: pictures, labels, maps of bait/monitor stations, and a dated clearance

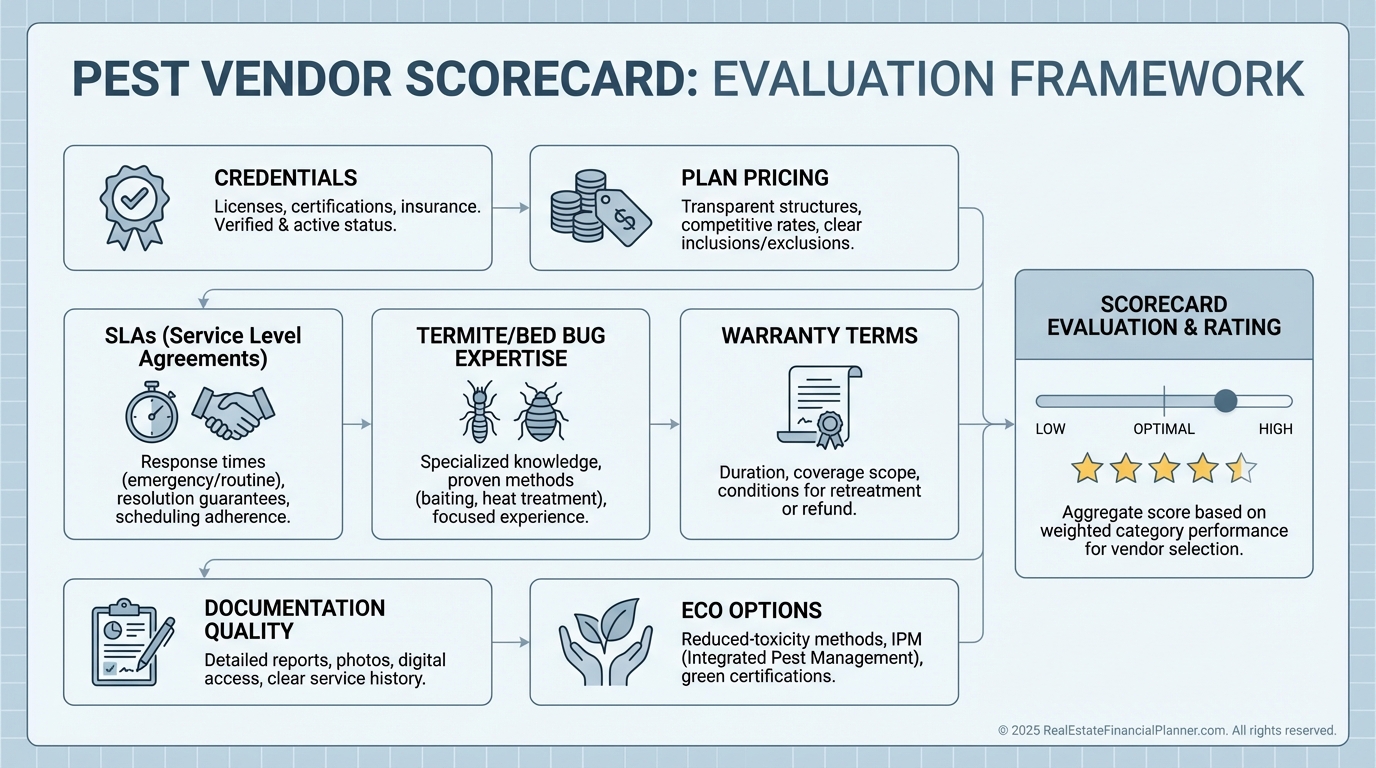

Vendor Selection, Pricing, and Warranties

I only hire licensed, insured firms with technicians certified for the specific treatments we need.

Ask for a service plan with tiered response times, bed bug and termite expertise, and written warranties.

I compare:

•

Monthly/quarterly plan pricing per door

•

Emergency dispatch fees and SLAs

•

Termite program terms, retreat guarantees, and transferability at sale

•

Eco-friendly options for sensitive tenants or local ordinances

Request sample reports. Sloppy documentation is a red flag.

Legal, Habitability, and Documentation

Most jurisdictions view infestations as habitability issues. That makes speed and documentation non-negotiable.

I time-stamp tenant reports and dispatch logs. I keep treatment labels, SDS, and clearance letters in the property file.

If a dispute arises, this record shows you acted promptly and responsibly.

Consult local counsel on who pays for bed bugs. In some markets, it is clearly the landlord unless you can prove tenant-caused.

Special Cases: Multifamily, STRs, and Nomad™

In multifamily, a unit with roaches usually means the stack needs treatment. Scope your response to adjacent and vertical neighbors.

Short-term rentals need stricter turnover checklists and mattress encasements to reduce bed bug risk.

For Nomad™ investors, schedule a preventive treatment and a full inspection during the owner-to-tenant handoff. It is the cleanest point to set the standard for the next lease.

Tenant Communication that Prevents Problems

I add a one-page pest addendum to the lease with photos of common signs, reporting instructions, and do/do not guidance.

At move-in, I hand tenants a “See Something, Say Something” card and make it easy to report in the portal.

Fast reporting shrinks both cost and vacancy.

A 90-Day Implementation Plan

Days 1–7: Select a vendor, negotiate plan pricing and SLAs, and obtain sample reports.

Days 8–21: Baseline inspection of all units, place monitors, and complete exclusion punch list.

Days 22–45: Add lease addendum, train your team on the SOP, and post reporting instructions.

Days 46–90: Quarterly service starts, termite plan in place, and dashboard metrics live.

I track five metrics: time-to-dispatch, time-to-clearance, number of repeat treatments, cost per door per month, and pest-related vacancy days.

If any metric trends the wrong way for two consecutive quarters, I revisit scope and vendor fit.

The Investor’s Bottom Line

Pest control is not a can of spray. It is a system.

Model the cost. Install the SOP. Demand documentation.

You will protect cash flow, preserve True Net Equity™, and keep tenants longer.

That is how professionals run property operations that scale.