General Partnerships in Real Estate: The Exact Playbook I Use to Structure, Fund, and Scale Deals

Learn about General Partnerships for real estate investing.

Why Partnerships, Why Now

When I help clients scale beyond a couple rentals, the limiting factor is rarely hustle. It’s capacity.

General partnerships let you bolt on capital, skills, and deal flow so you can do bigger, safer, smarter deals without waiting years.

I’ve watched well-structured partnerships compress a five-year plan into eighteen months. I’ve also watched handshake deals implode in ninety days.

The difference is structure, not luck.

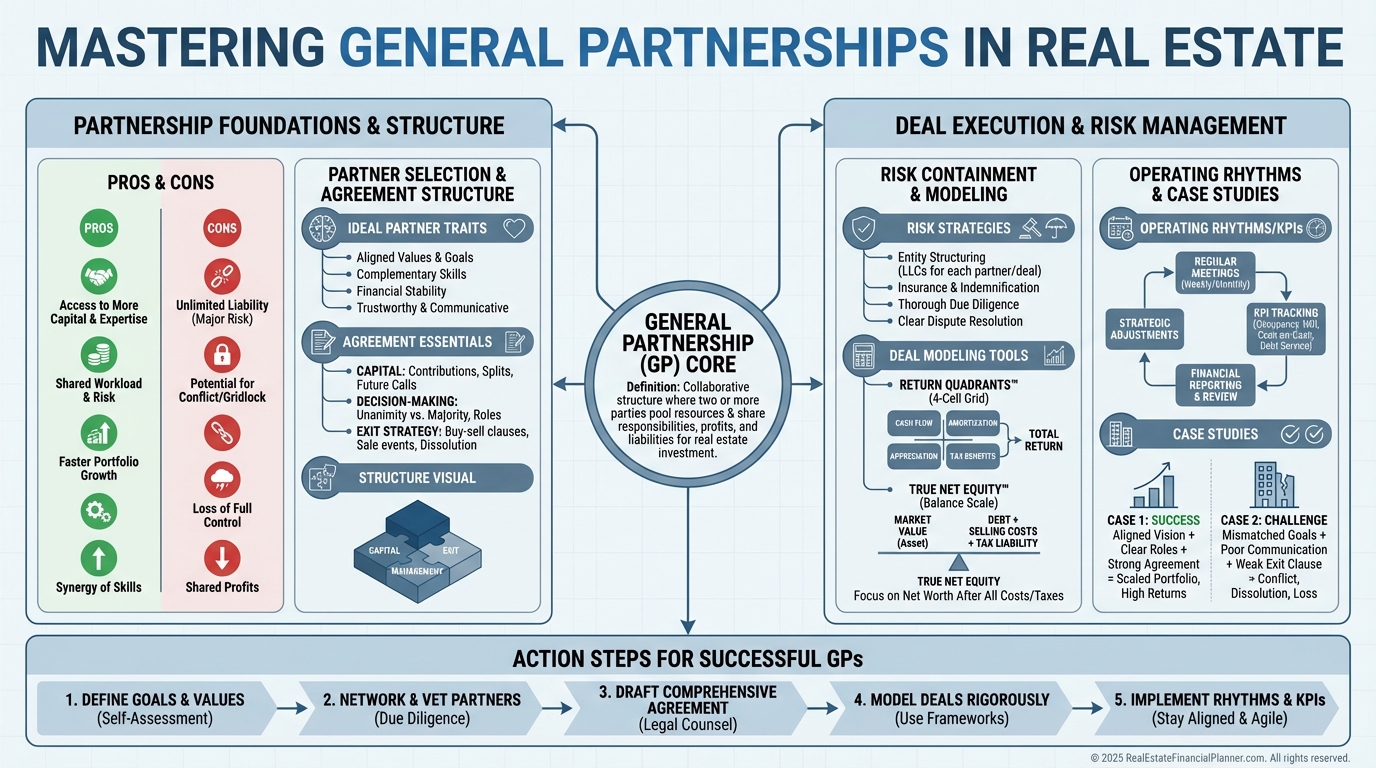

What Is a General Partnership

A general partnership (GP) forms the moment two or more people invest together and share profits and control. No filing is required in most states.

Every partner can bind the business. Every partner has unlimited personal liability for partnership obligations. Taxes pass through to each partner’s return.

That simplicity is powerful, but the liability is real. I treat GPs like power tools—high leverage when handled correctly, dangerous when not.

Benefits You Can Actually Bank On

Pooling cash and credit expands your buy box. Better neighborhoods. Larger properties. Multiple projects at once.

Complementary skills create throughput. One partner hunts deals while another runs ops and a third manages capital.

Shared workload reduces burnout. You no longer wear every hat.

Credibility improves with lenders and brokers. Two resumes beat one.

Learning compounds. You skip mistakes your partner already paid for.

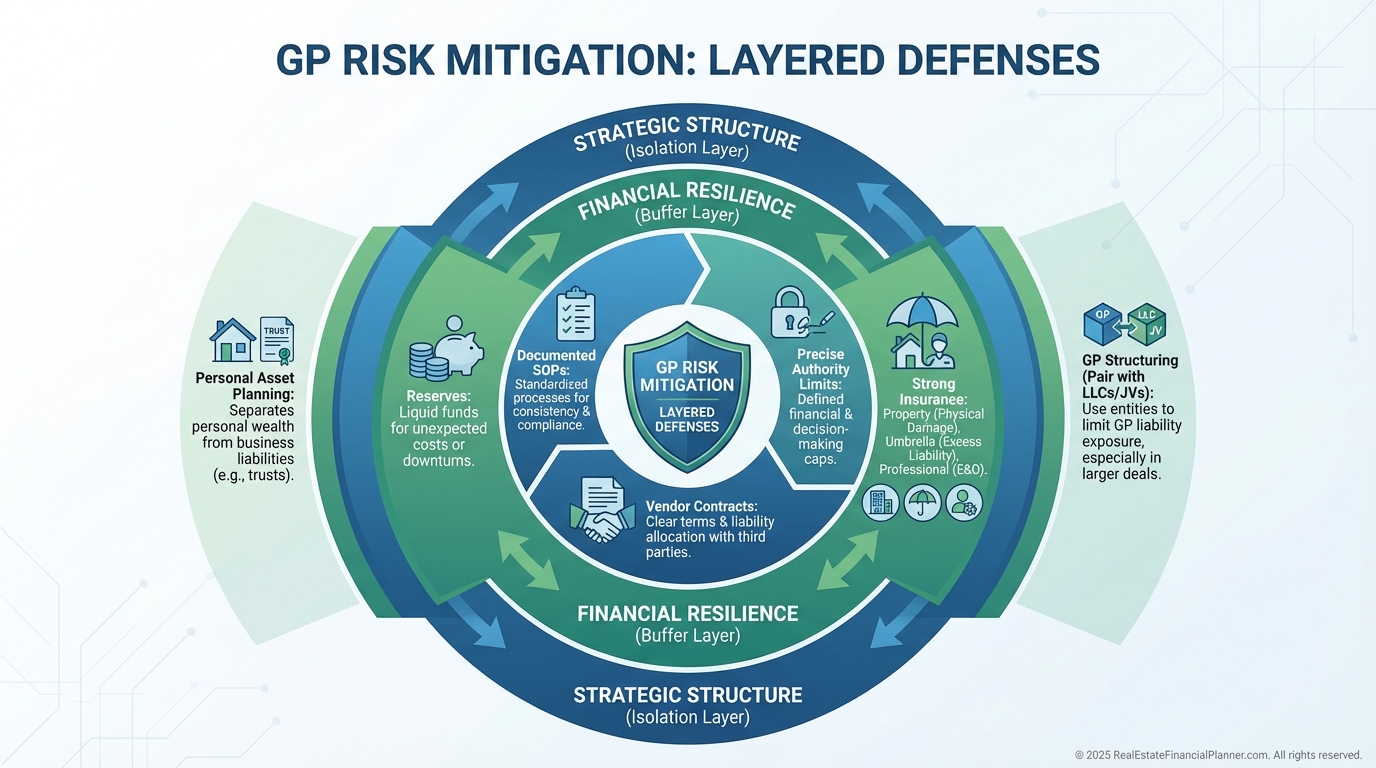

Risks You Must Contain

Unlimited liability means your partner’s mistake can become your lawsuit. That’s the headline risk.

Partners can commit the partnership without you. Credit lines, leases, vendor contracts—this is why we define authority precisely.

Debt appears on everyone’s profile. Your future borrowing can be constrained.

Misaligned effort or vision corrodes trust. Without clarity, 50/50 quickly feels 70/30.

Exits get messy when agreements are vague. That’s when good deals die on the courthouse steps.

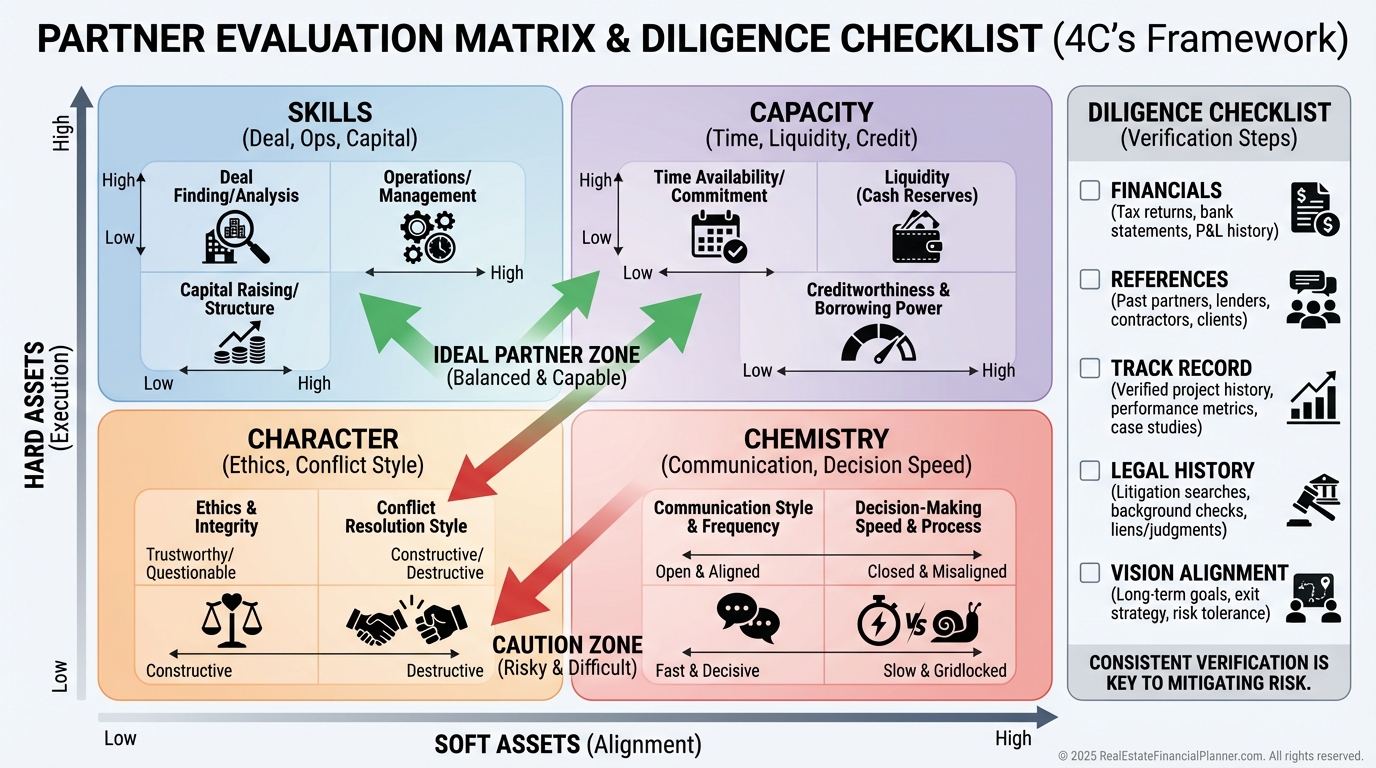

Finding the Right Partner(s)

Start with you. I have clients map skills, capital, time, and temperament before they meet anyone. Clarity attracts complementary partners.

I verify bankability, liquidity, and debt-to-income before we talk roles. Promises don’t fund closings.

I align vision up front: buy/hold vs. flip, markets, leverage limits, risk tolerances, renovation appetite, and exit windows. If we disagree here, we don’t proceed.

I run reference checks, review prior deals, and look for litigation history. Trust, but verify.

My red flags are rushing, opacity, and too-good-to-be-true claims. I’ve never regretted walking away.

Modeling Deals Together (Before Anyone Signs)

When I facilitate partnerships, we start inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™. Numbers disarm opinions.

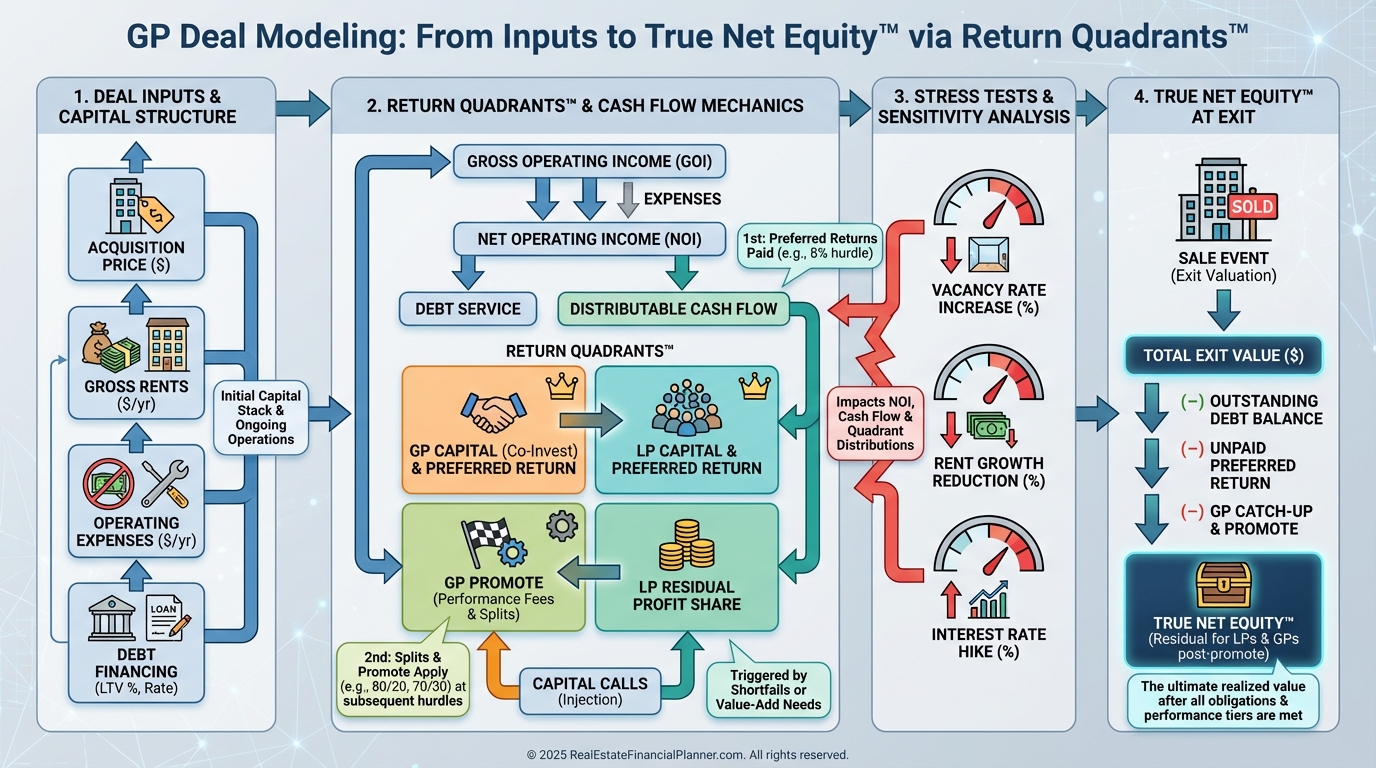

We model Return Quadrants™: appreciation, cash flow, debt paydown, and tax benefits. Partners see where returns come from—and who drives them.

I calculate True Net Equity™ to show what partners could actually take home after selling: sales costs, make-ready, debt payoff, and taxes. Paper equity lies; True Net Equity™ tells the truth.

We map capital calls, preferred returns, and profit splits through the hold period and sale. No one should be surprised by their distributions—ever.

Structuring the Partnership Agreement

I don’t let clients default to 50/50. We split profits by value created and risk carried.

Define capital: initial contributions, future capital calls, missed-call consequences, and whether loans from partners earn interest.

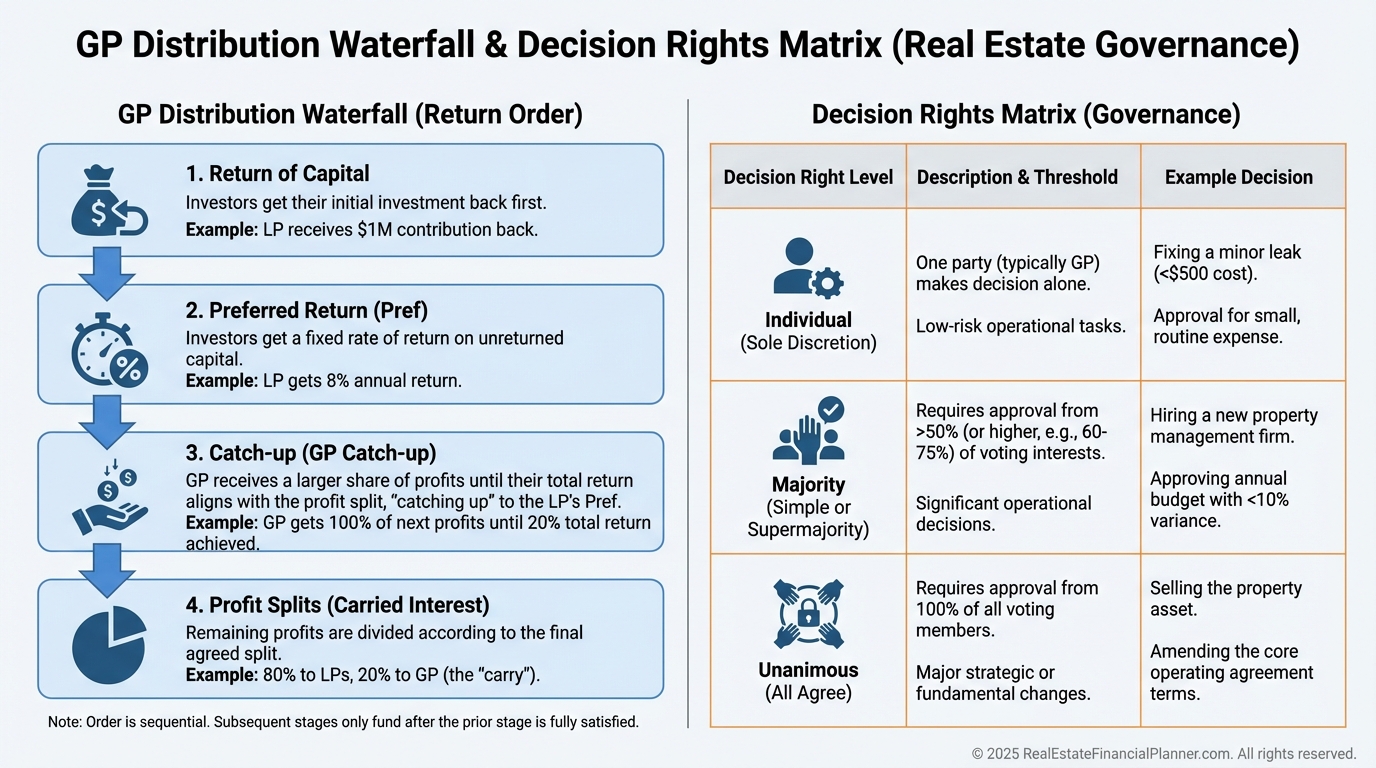

Spell out authority. What can any partner approve alone (repairs under $2,500)? What needs a majority (leasing, vendor changes)? What requires unanimous consent (refi, sale, new debt, admitting partners)?

Assign roles. Who manages property, bookkeeping, renovations, lenders, tax filings, investor relations? Titles don’t move projects—owners do.

Design the distribution waterfall. Return of capital, then preferred return, then profit splits. Map this in the spreadsheet so everyone sees the math.

Build exits while you still like each other: buy-sell triggers, valuation formulas, rights of first refusal, drag/tag rights, death/disability coverage, and dispute resolution.

Operating the Partnership Day to Day

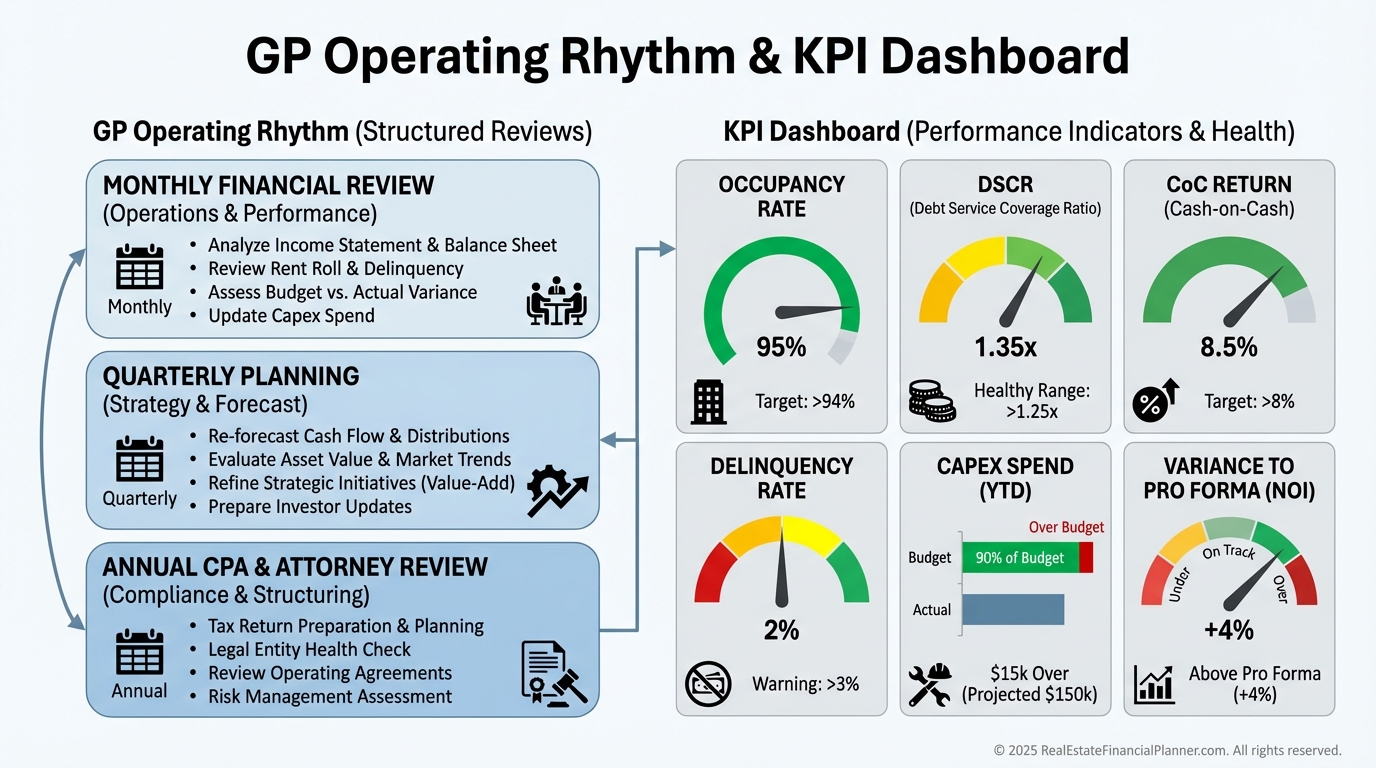

Cadence beats chaos. I set monthly performance reviews and quarterly strategy sessions from day one.

We share bank visibility, monthly financials, and variance reports. Transparency is cheaper than suspicion.

We track KPIs: occupancy, rent growth vs. underwriting, DSCR, delinquency, maintenance turns, capex burn, and cash-on-cash. If a metric drifts, a person owns the fix.

We keep reserves sacred. I prefer three to six months of expenses, plus a capex sleeve, before distributions.

We date-stamp decisions. Email for documentation, calls for urgency, meetings for forks-in-the-road. It keeps memories honest.

Financing and Credit Realities

Lenders underwrite both the deal and the people. Plan for personal guarantees and cross-liability.

I ask who can carry the loan on their personal DTI and who should avoid new credit. We model this before we write offers.

If one partner’s credit is fragile, we adjust roles or compensation to match risk.

Insurance and Safeguards

I layer coverage: property, liability, umbrella, and sometimes professional liability if a partner provides paid services.

We revisit coverage annually as rents, values, and risks change.

Tax and Compliance

Pass-through taxation is straightforward, but reporting isn’t. We set K-1 delivery deadlines early to preserve relationships.

Our CPA reviews depreciation strategy, bonus depreciation eligibility, and 1031 or installment sale options. Tax tail shouldn’t wag the deal, but it matters.

I keep cap tables current. Nothing erodes trust like messy ownership records.

Case Studies: One Win, One Lesson

A client duo—one ops, one capital—acquired 12 rentals in four years. They used the spreadsheet to confirm a 7% pref, 70/30 split, and a clear buyout formula tied to True Net Equity™. Fewer debates, faster closings.

Another group skipped a written agreement. When one partner needed cash fast, they pushed for fire-sale exits. Without buy-sell terms, it devolved into lawsuits. Good people, bad structure.

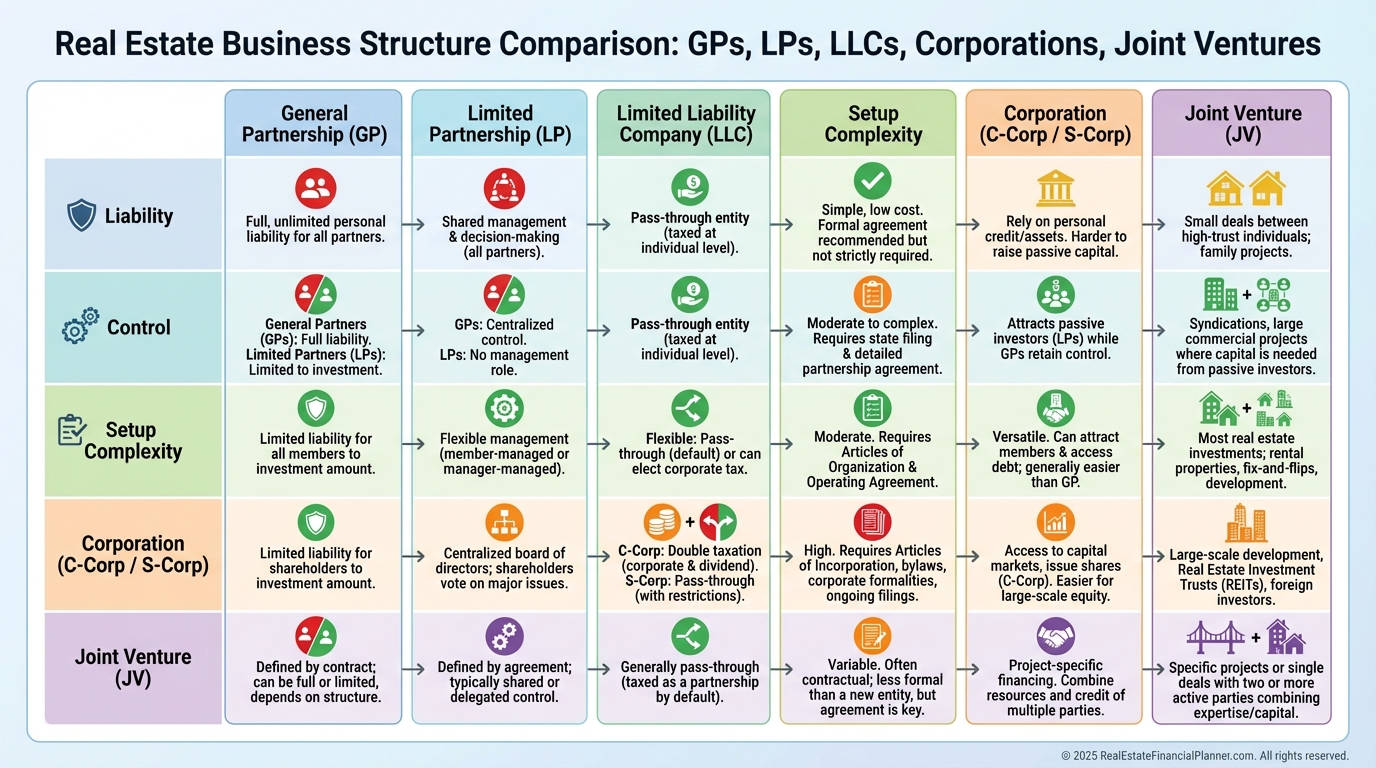

When a GP Is Not the Right Tool

If liability cannot be contained, choose an LLC or LP structure. If the project is one-and-done, consider a joint venture.

If you need passive investors, GPs are the wrong vehicle. Explore syndications with proper securities compliance.

If effort is wildly asymmetric, price it in with fees or promote, or don’t do the deal.

Advanced Tweaks I Use

We add performance-based promotes tied to Return Quadrants™ outcomes, like hitting DSCR or NOI milestones.

We sometimes integrate Nomad™ acquisitions when one partner plans to owner-occupy for a year, then convert to rental inside the partnership plan.

We build buyout formulas that reference appraisals, broker opinions, or a fixed multiple of NOI to reduce valuation fights.

Action Steps

•

Map your personal strengths, capital, time, and risk tolerance.

•

Shortlist partners who complement—not clone—your abilities.

•

Model three deals together inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with full stress tests.

•

Draft a working term sheet: capital, authority, roles, waterfall, exits.

•

Engage a real estate attorney and CPA to finalize documents and tax strategy.

•

Start with one asset, run the operating rhythm, then scale what works.

I’ve seen partnerships create wealth faster than any solo plan. I’ve also seen them destroy value when they rely on hope, not design.

Design wins.