Property Manager Playbook: How to Protect Returns, Reduce Risk, and Scale Without Chaos

Learn about Property Manager for real estate investing.

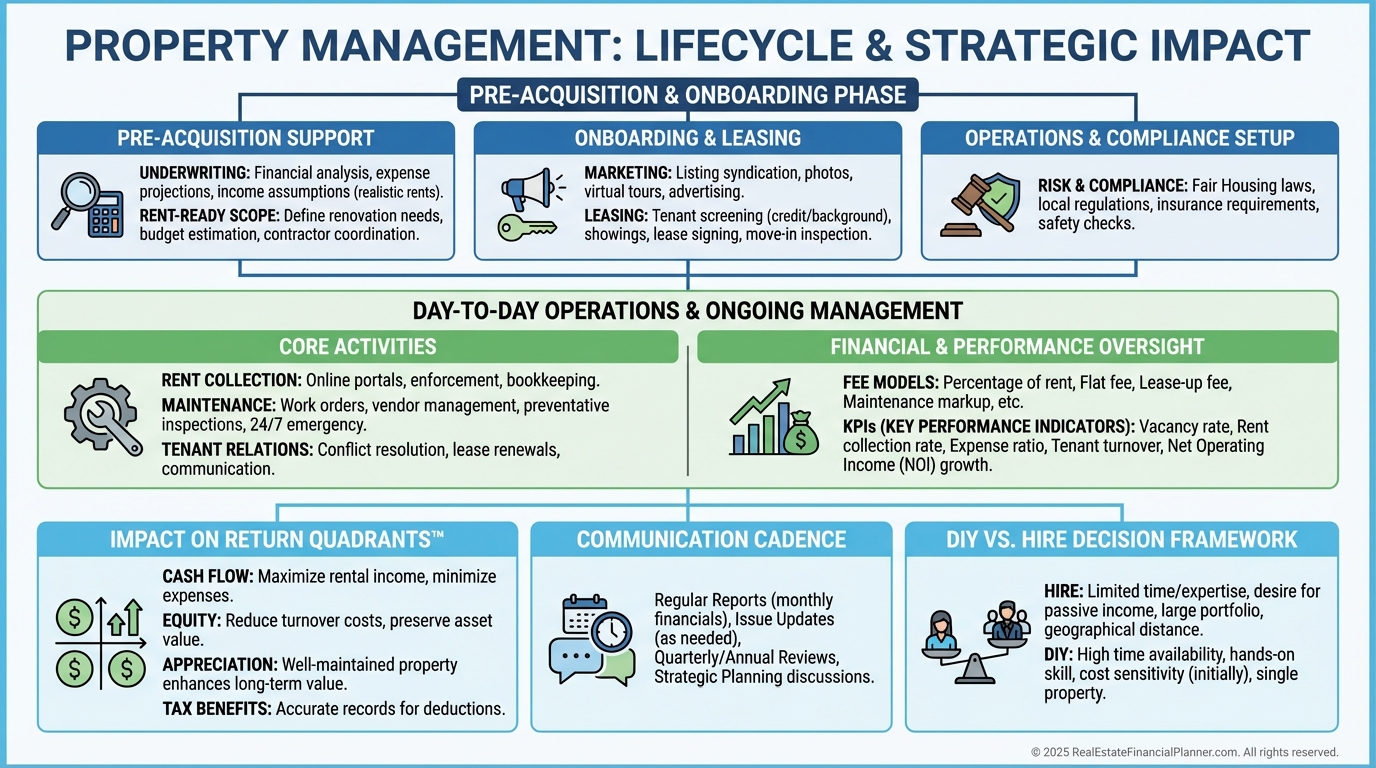

Why Your Property Manager Is a Strategic Hire

When I help clients scale past three doors, the bottleneck isn’t capital—it’s time, systems, and compliance.

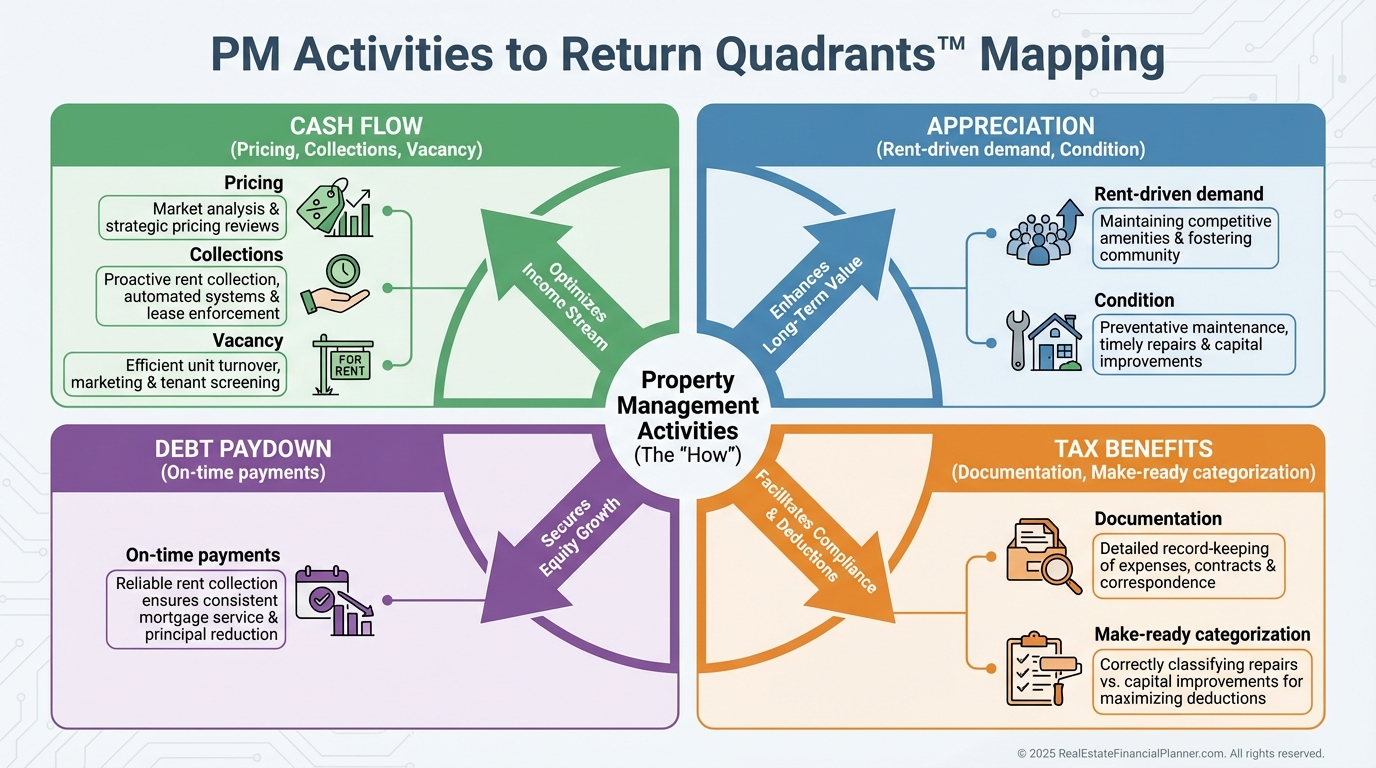

I treat the PM as an operating partner whose decisions show up directly in your Return Quadrants™.

They influence cash flow, appreciation capture via rent-driven demand, debt paydown reliability, and even tax benefits through documentation discipline.

What a Great PM Does Before You Buy

Before I write an offer, I ask a PM for rent comps that mirror the subject’s bed/bath, school boundary, parking, pet policy, and condition.

We adjust for amenities, seasonality, and concessions to set a realistic pro forma, not a rosy one.

I also ask for their expected days on market, required rent-ready scope, and an honest “rent-to-list ratio” based on last quarter’s leases.

That one email often changes the max price I’m willing to pay.

If the property is tenant-occupied, I have the PM audit leases, deposits, estoppels, and any promises the seller made.

We plan the handoff so cash flow isn’t interrupted by missing keys, unpaid utilities, or illegal deposits.

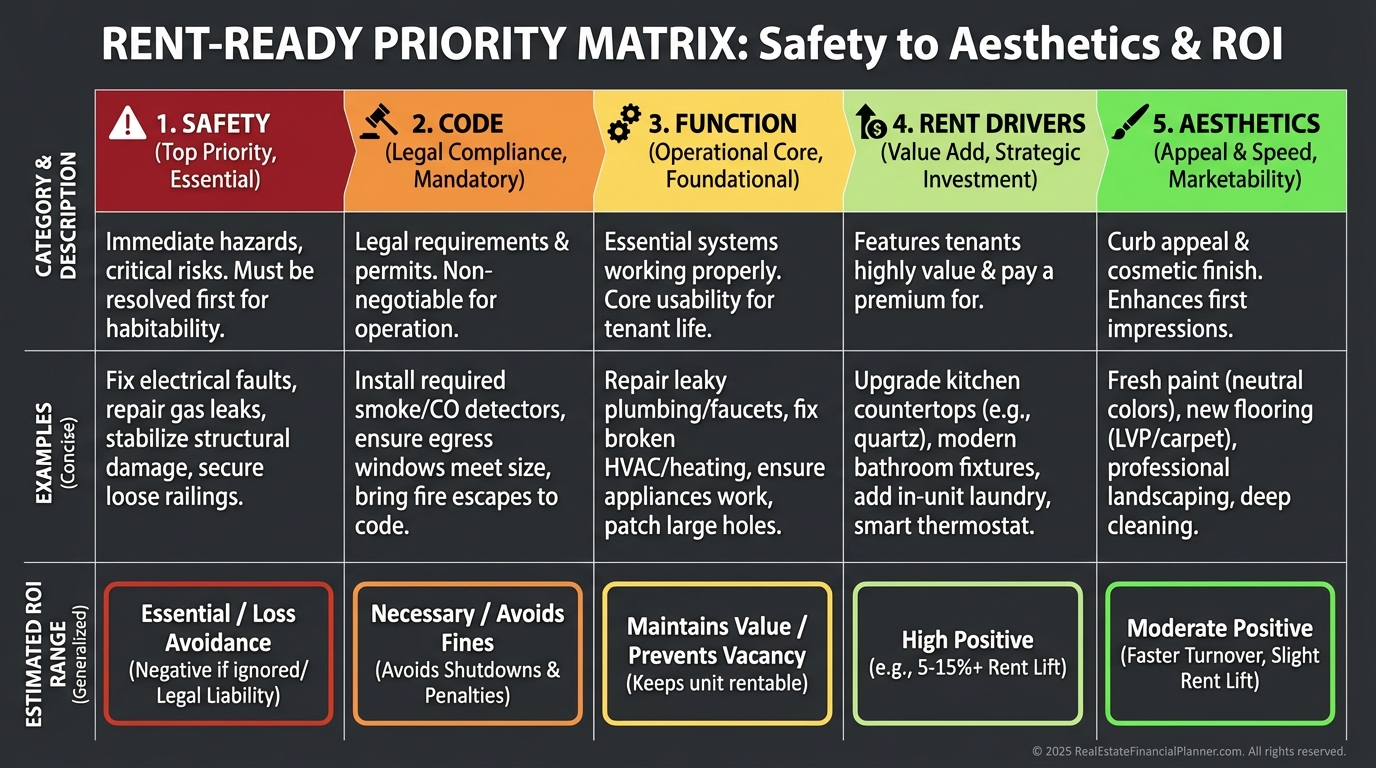

On rent-ready standards, a PM helps separate must-do safety and habitability items from rent-driving upgrades.

I use a simple rule with them: life safety first, code next, then upgrades that add more than a dollar of rent for each dollar spent.

PMs also bring a vetted vendor bench.

During due diligence, I lean on their electricians, plumbers, and cleaners with pre-negotiated SLAs, so the first month isn’t chaos.

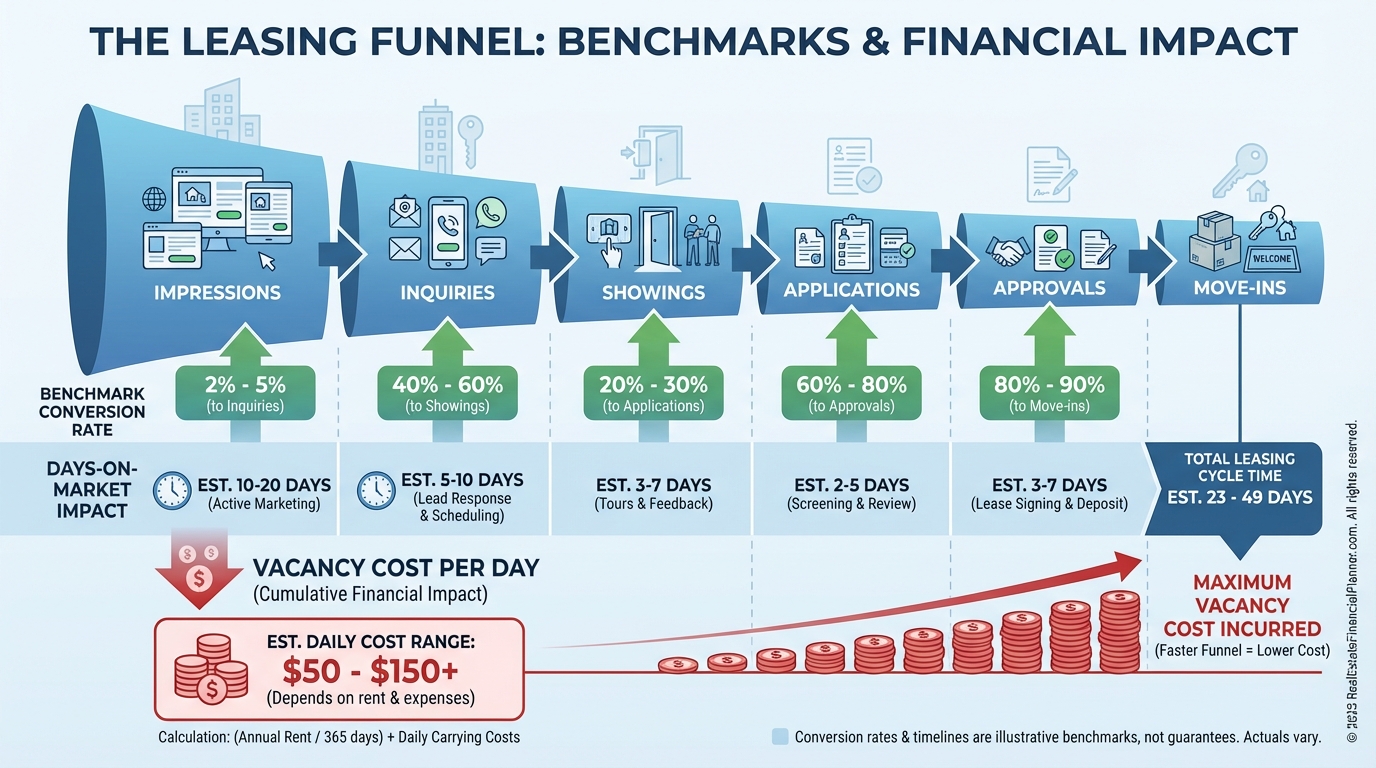

Onboarding and Marketing That Reduces Vacancy

Your PM controls the two levers that kill cash flow most often: pricing and speed.

I align on a pricing ladder (list, soft drop, hard drop) and a 72-hour marketing sprint with pro photos, floorplan, and syndication.

Great listings answer the top objections with facts—utility averages, pet fees, parking, and school zones—so prospects convert quickly.

We agree upfront on showing cadence, application turnaround time, and written criteria to avoid fair housing mistakes and delays.

Day-to-Day Management That Protects Returns

Daily, a PM screens tenants, enforces leases, collects rent, triages maintenance, and communicates with clarity.

They are your first layer of risk management on fair housing, reasonable accommodations, habitability, and notice requirements.

I insist on written screening criteria, documented adverse action notices, and a maintenance triage tree to avoid over-spending.

Quarterly interior checks and annual preventative maintenance keep surprises off your P&L.

Fees, Alignment, and What I Model

Fees are less important than alignment and transparency, but we still model them precisely.

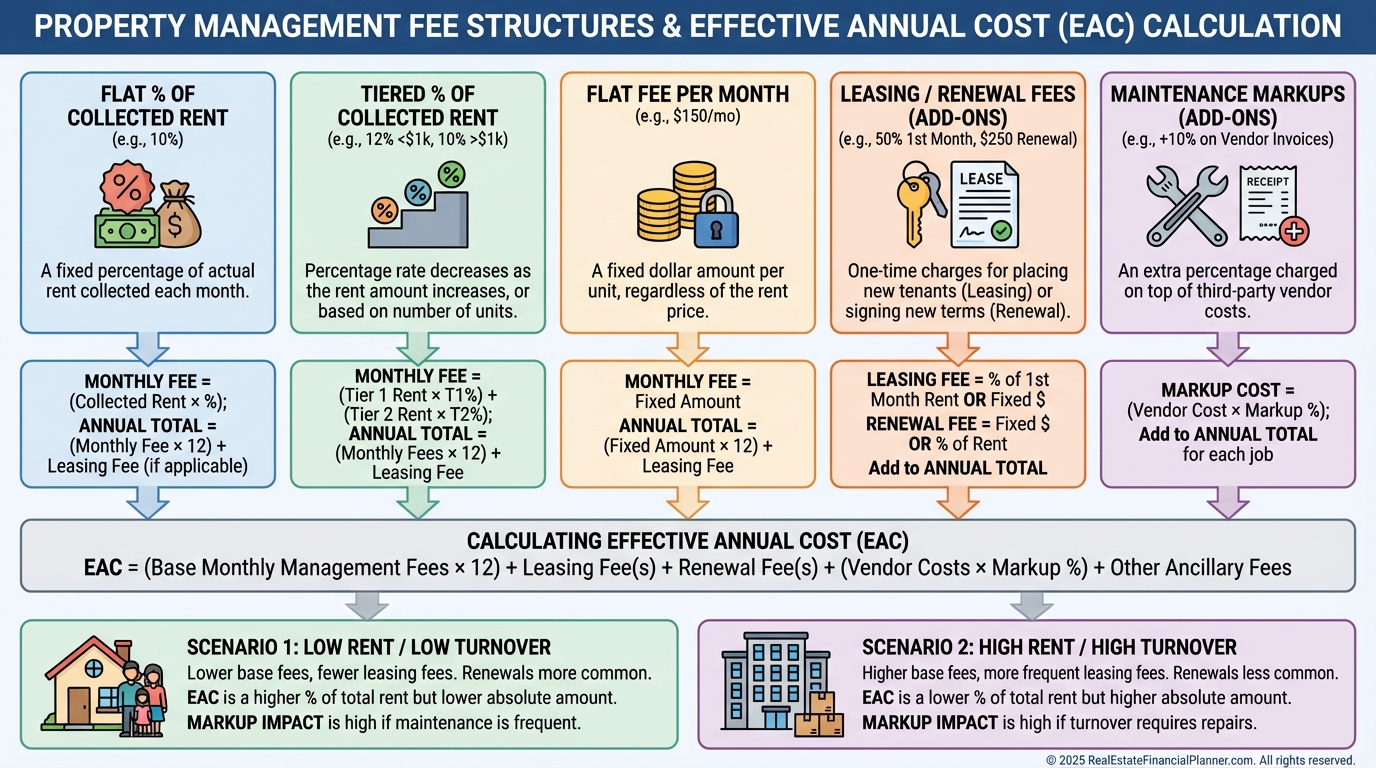

Expect a monthly management fee, leasing fee, renewal fee, setup fee, inspection fees, and sometimes maintenance markups or after-hours charges.

I convert all fees to an effective annual percentage of collected rent and compare PMs apples-to-apples.

In the Real Estate Financial Planner, I model PM fees, vacancy changes, turnover timelines, and make-ready reserves, then watch the impact on True Net Equity™ over 10 years.

Often, a strong PM lowers vacancy and delinquency enough to more than offset their fee.

KPIs I Require in the Management Agreement

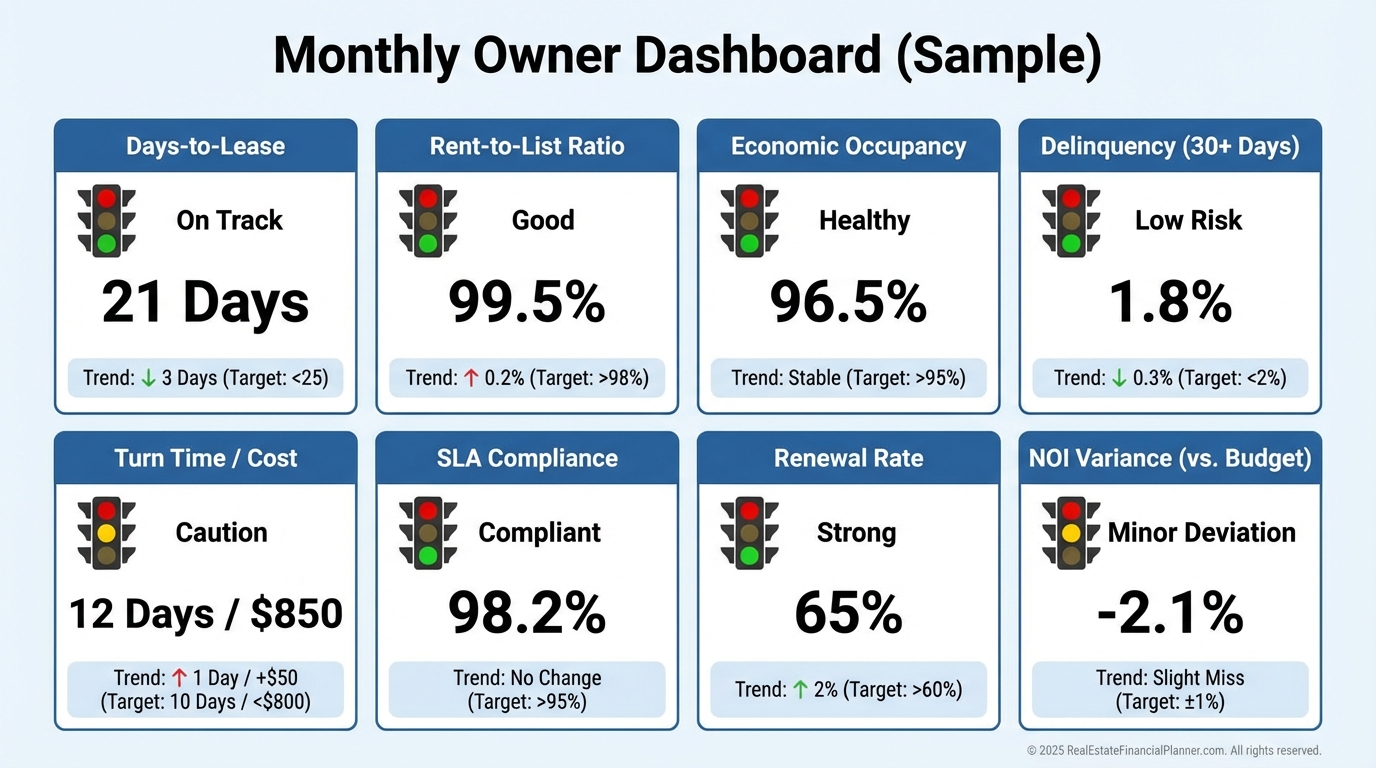

I manage the manager with numbers.

Here are the non-negotiables I track monthly:

•

Days to lease and rent-to-list ratio.

•

Economic occupancy, delinquency rate, and bad debt.

•

Make-ready days and average turn cost per door.

•

Work order SLA (emergency, urgent, routine) and first-fix rate.

•

Renewal offer timeline and acceptance rate.

•

NOI variance versus pro forma and explanation.

•

Resident satisfaction (NPS) and complaint resolution time.

DIY vs Hire: A Simple Decision Framework

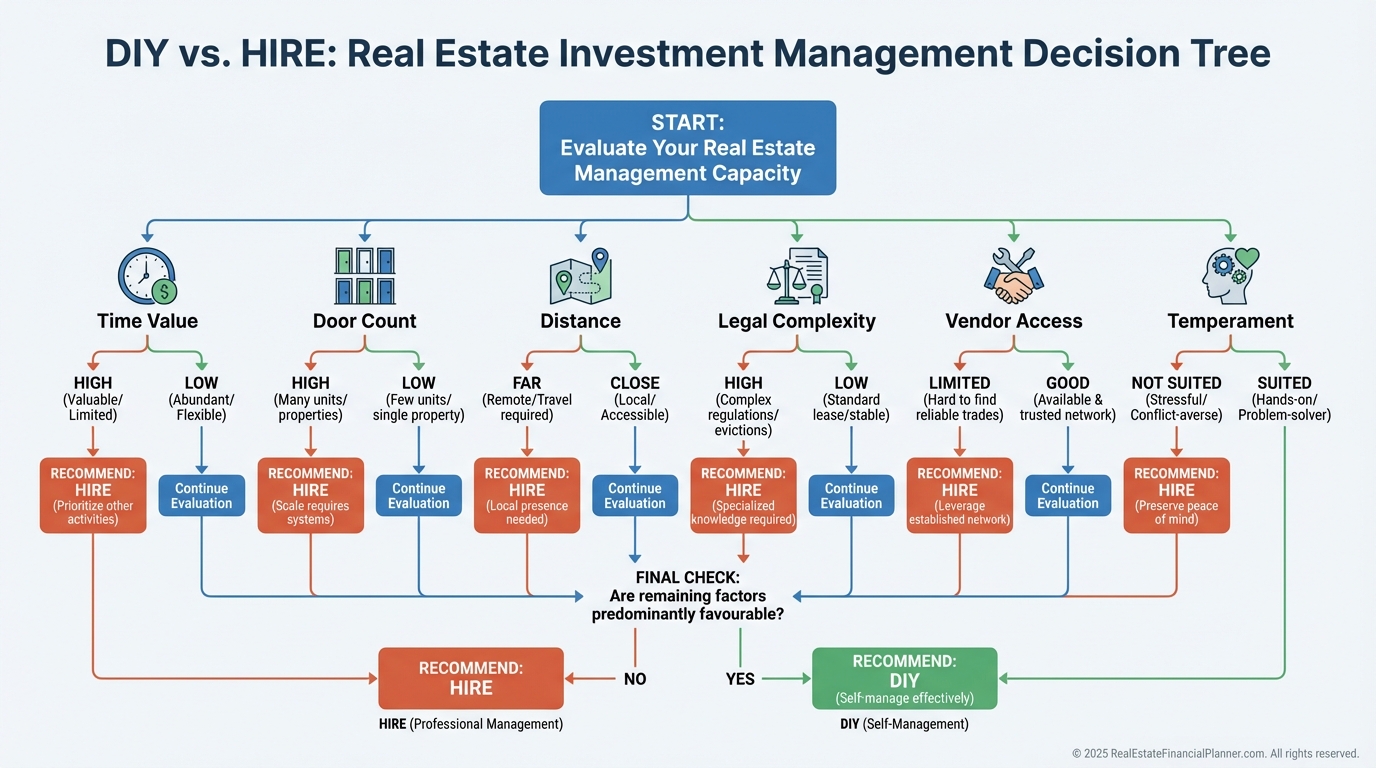

If you value your time at $75/hour and self-managing takes 8–10 hours per door per month during turns, the math is clear.

I recommend hiring when either of these is true: you’re over three doors, you live more than 30 minutes away, or your market has complex landlord-tenant rules.

For Nomad™ investors, many self-manage year one while living in the property, then hand off once they move and convert it to a rental.

Your risk tolerance matters too; one fair housing mistake can erase a year of cash flow.

Selecting and Onboarding the Right Manager

I use a scorecard to compare PMs: references, sample owner statements, sample leases, tech stack, communication cadence, and after-hours coverage.

I ask about screening criteria, renewal process, rent increase philosophy, maintenance markup caps, and trust account reconciliation.

Negotiate clarity on deposit handling, pet policy and fees, eviction steps, and termination for cause with a clean data handoff.

Onboarding should include keys, lease files, deposits, warranties, HOA contacts, utility auth, insurance certificates, and a 30-60-90 day communication plan.

Risk, Compliance, and Insurance You Can’t Ignore

Your PM must follow fair housing, handle assistance animals correctly, and document adverse actions.

Deposits need to be collected, held, and accounted for per state law, with detailed move-in and move-out reports.

I require the PM to carry appropriate insurance and name you as additional insured where applicable.

Insist on secure handling of tenant PII and clear breach protocols.

Modeling the Impact on Returns

In REFP, I run two scenarios: self-manage and hire-a-PM.

I adjust vacancy (e.g., 5% DIY versus 3% with a strong PM), turn time, delinquency, and repair costs to reflect vendor pricing and speed.

Then I compare 10-year True Net Equity™ and the shape of Return Quadrants™.

Consistently, better operations flatten volatility and lift long-run equity, even if year-one cash flow is slightly lower after fees.

A Quick Example

On a $400,000 home renting for $2,500, an 8% fee is $2,400 per year.

If the PM cuts vacancy from 5% to 3% and reduces average turn cost by $400 through vendor pricing, you’re ahead after fees.

Now add fewer delinquent accounts and faster leasing, and the compounding shows up in your True Net Equity™ curve.

Red Flags I Avoid

Owner draws that arrive late without explanation.

Trust account reconciliation that isn’t done monthly.

High eviction rates relative to the market, vague screening, or missing move-in photos.

Vendors with undisclosed ownership ties and open-ended markups.

When I see these, I exit cleanly and follow a documented offboarding checklist.

The Bottom Line

A great PM is an asset, not an expense.

Involve them before you buy, measure them by the right KPIs, and model the impact in your plan.

That’s how you scale without chaos and protect returns when the market gets noisy.