Cash Flow in Real Estate: The Truth Most Investors Miss

Learn about Cash Flow for real estate investing.

Cash Flow Reality Check

Most investors believe they understand cash flow.

When I sit down with clients and rebuild their numbers from scratch, that confidence usually disappears within minutes.

I’ve watched people proudly claim hundreds of dollars per month in “positive cash flow,” only to discover they were quietly losing money every single month once we added the expenses they hoped wouldn’t matter.

I’ve been there myself.

When I was rebuilding after bankruptcy, I learned the hard way that sloppy cash flow math doesn’t just reduce returns. It forces bad decisions, traps you in mediocre properties, and can end an investing career early.

Cash flow is not a vibe.

It’s not a feeling.

It’s math.

And the math does not forgive optimism.

What Cash Flow Really Means

Cash flow is the money left over after every real expense is paid and every future obligation is respected.

If money leaves your pocket at any point to support the property, it belongs in the calculation.

That includes the expenses you don’t want to think about yet.

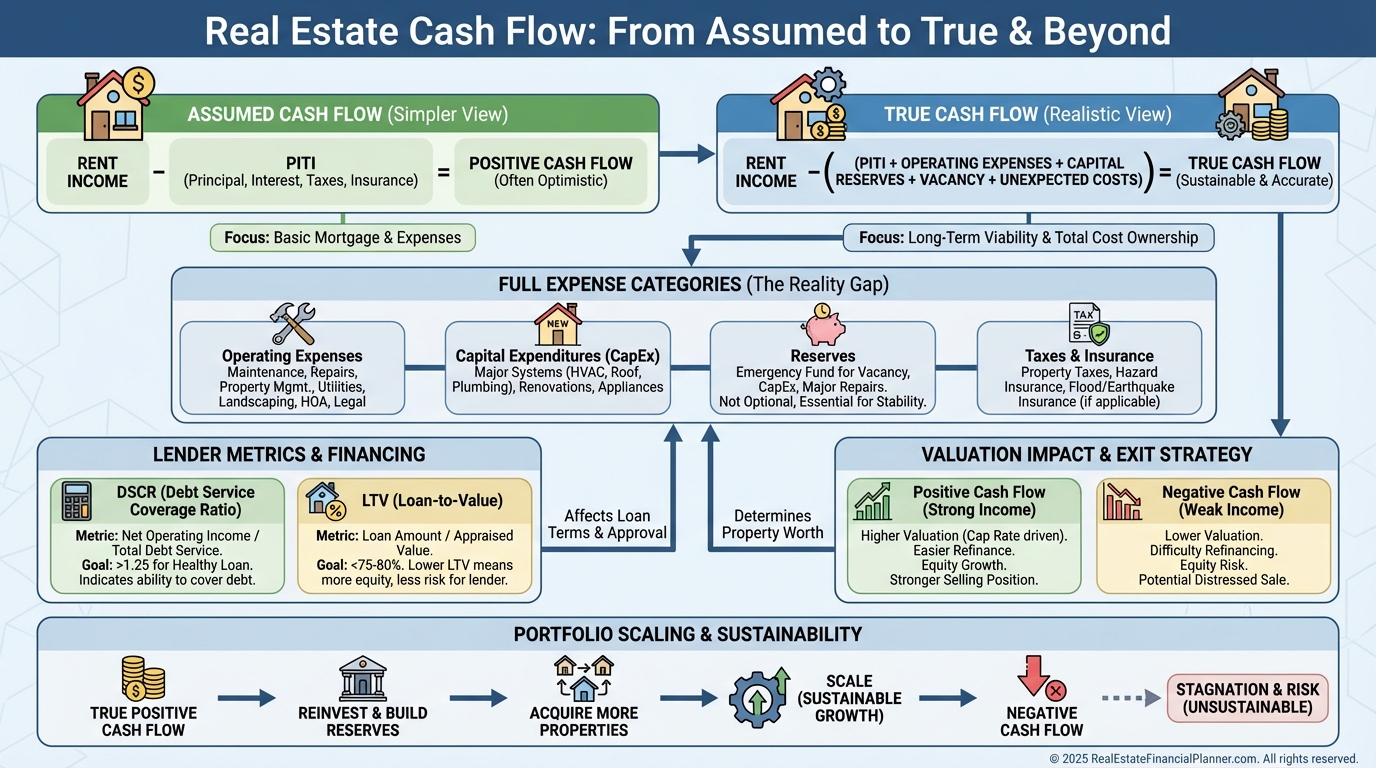

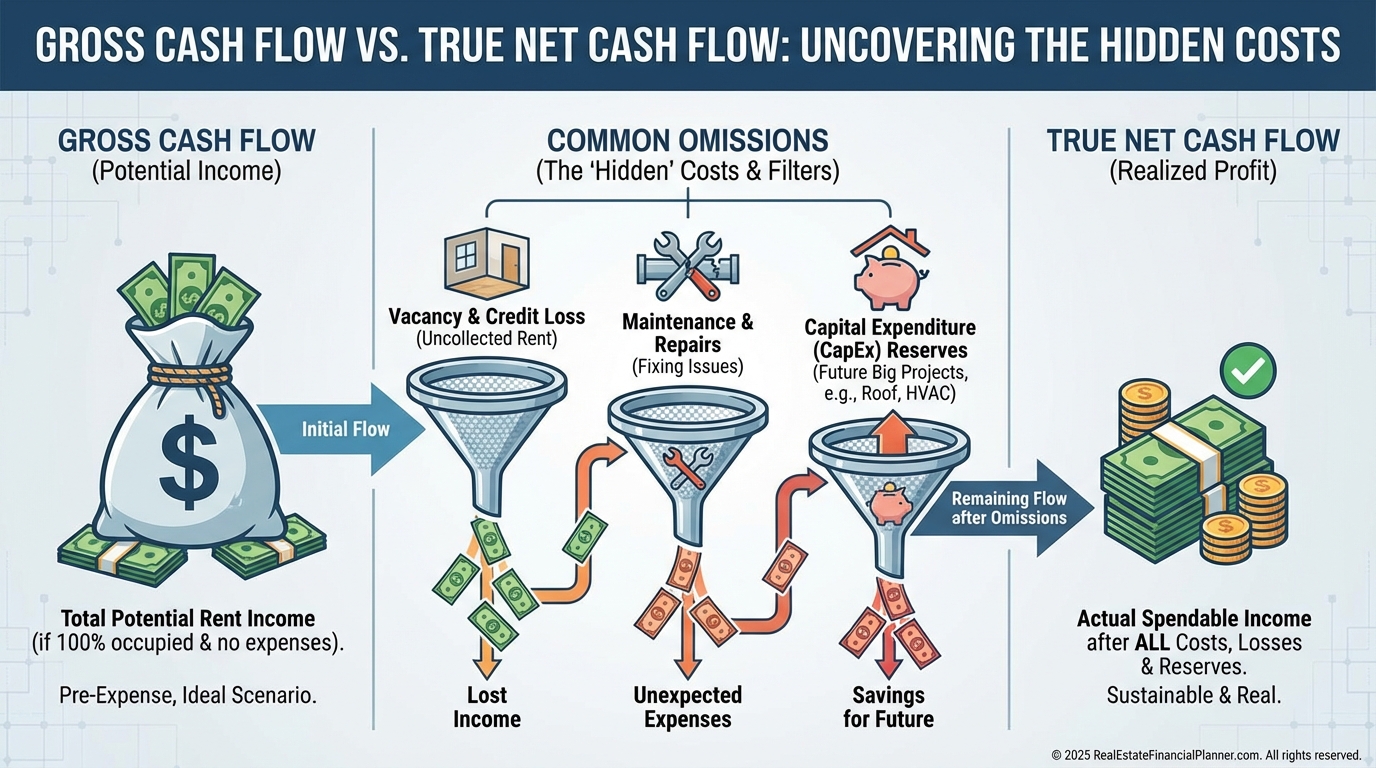

Gross vs True Cash Flow

Most investors stop too early.

They subtract the mortgage from the rent and call the remainder “cash flow.”

That number is fiction.

True cash flow accounts for vacancy, operating expenses, debt service, and reserves for future capital expenses.

If you cannot stop working tomorrow and still keep the property afloat, it is not cash flowing.

Cash Flow vs Cash-on-Cash Return

Cash flow is measured in dollars.

Cash-on-cash return measures efficiency.

When I review deals, I always check both, because they answer different questions.

Cash flow answers, “Does this property support itself and my lifestyle?”

Cash-on-cash return answers, “Is this the best use of my invested capital?”

A property producing $300 per month might be incredible or terrible depending on how much cash you tied up to get it.

Monthly vs Annual Reality

Monthly numbers lie by omission.

Annual math tells the truth.

Property taxes, insurance, snow removal, major repairs, and capital expenses don’t happen evenly every month, but they must be averaged as if they do.

If you don’t spread them out, your cash flow will feel great until it suddenly doesn’t.

And that surprise usually arrives at the worst possible time.

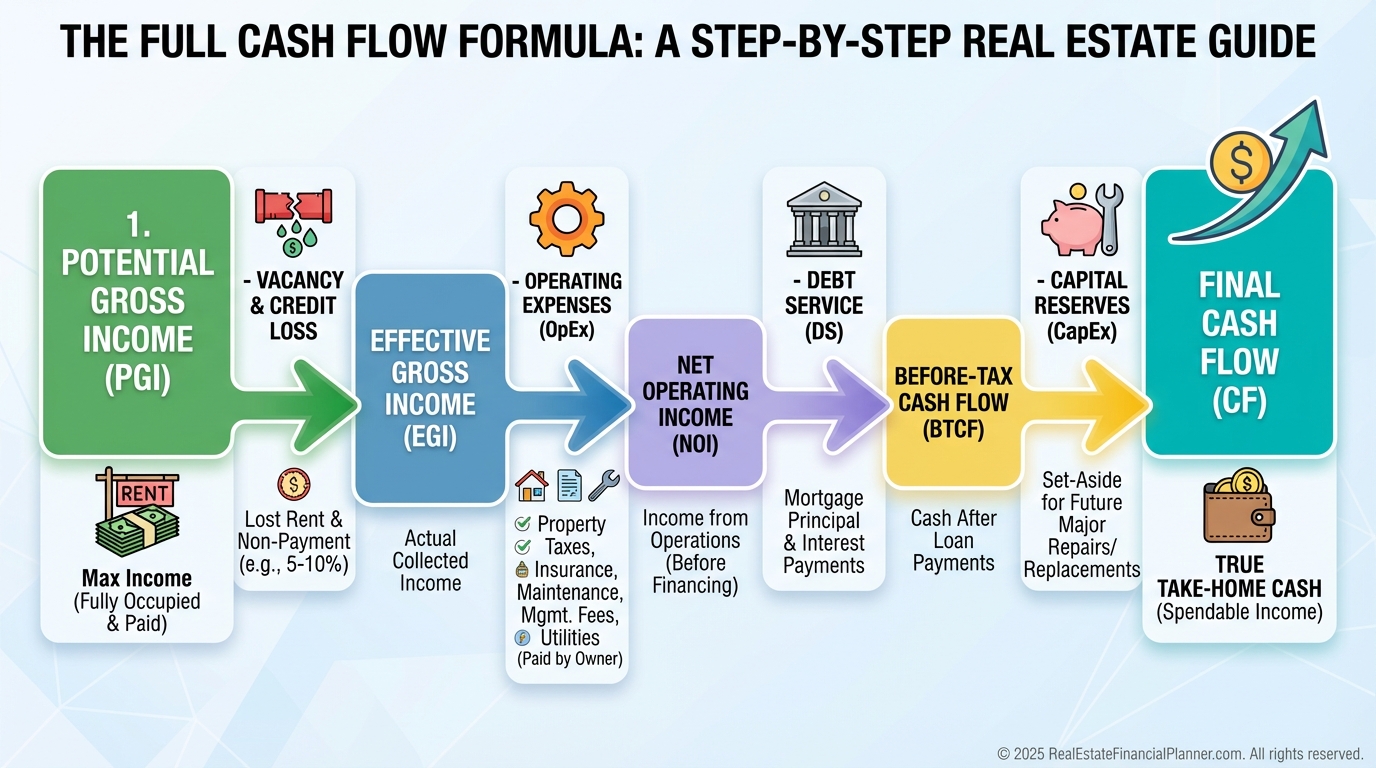

The Complete Cash Flow Formula

True cash flow follows a simple structure, but every line must be honest.

The Complete Cash Flow Formula

Net Cash Flow =

Effective Gross Income

– Operating Expenses

– Debt Service

– Capital Reserves

There are no optional lines.

Gross Rental Income Must Be Adjusted

Rent is not guaranteed.

When I model deals in Real Estate Financial Planner™, I always reduce rent for vacancy and collection loss, even in strong markets.

Five percent is a minimum assumption.

In softer markets, eight to ten percent is far more realistic.

Operating Expenses Are Where Deals Die

Operating expenses are not guesses.

They are patterns.

Property taxes, insurance, maintenance, management, utilities, licenses, legal costs, and administrative overhead all show up whether you like it or not.

If you self-manage, your time still has value.

Ignoring that cost does not make it disappear.

Debt Service Is Relentless

Loans demand payment every month.

Principal, interest, second mortgages, seller financing, and lines of credit all count.

Lenders never accept “but rent was late” as an excuse.

Neither should you.

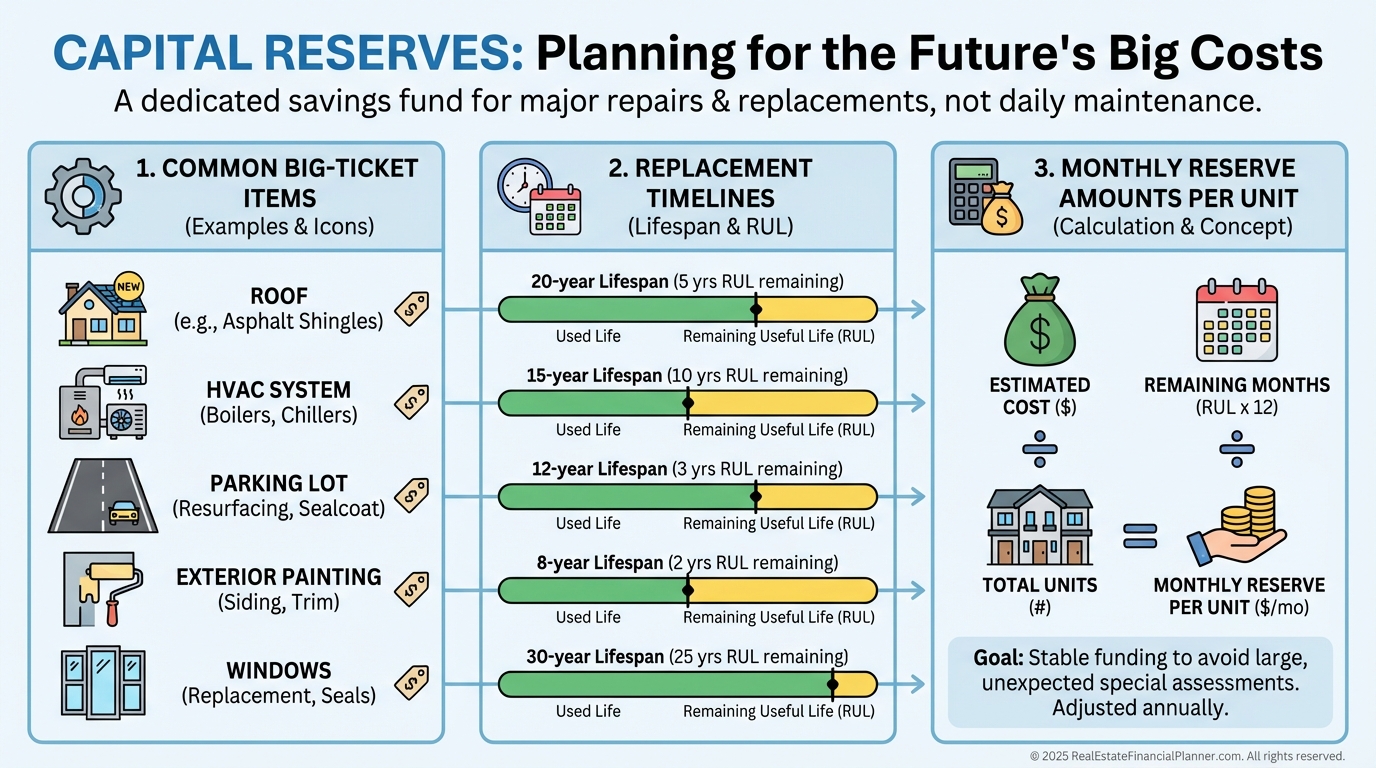

Capital Reserves Separate Investors From Amateurs

This is the line most people skip.

And it’s the line that ruins them.

Roofs, HVAC systems, flooring, appliances, and plumbing all fail on predictable timelines.

If you are not reserving monthly for these expenses, you are borrowing from your future self at terrible terms.

Why Capital Reserves Are Non-Negotiable

A Real-World Cash Flow Wake-Up Call

When I run examples for clients, the result is often uncomfortable.

A property that “cash flows” on a listing sheet frequently turns negative once reserves are included.

That discomfort is a gift.

It saves you from discovering the truth after you’ve already bought the deal.

How Cash Flow Impacts Financing

Lenders care deeply about cash flow, even if investors don’t.

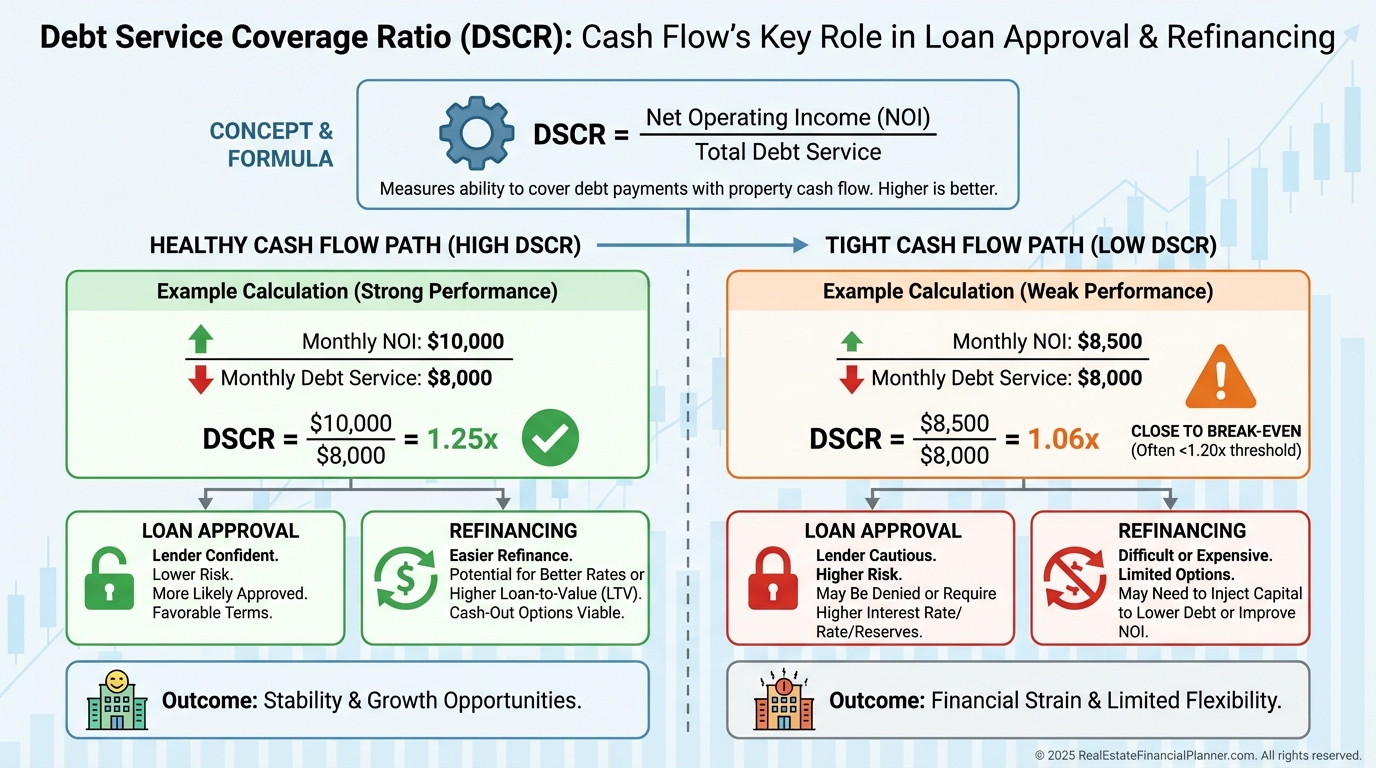

Cash Flow and DSCR Explained

Debt Service Coverage Ratio measures how comfortably a property pays its debt.

Weak cash flow limits your ability to refinance, scale, or survive a downturn.

Strong cash flow opens doors.

It also protects you when markets shift.

Cash Flow Drives Property Value

Cash flow and value are directly connected.

Every additional dollar of sustainable annual cash flow increases property value through the capitalization rate.

Improve cash flow, and you manufacture equity.

Ignore cash flow, and equity quietly evaporates.

This is why I teach investors to focus on controllable variables instead of betting everything on appreciation.

Portfolio-Level Cash Flow Thinking

Single-property analysis is not enough.

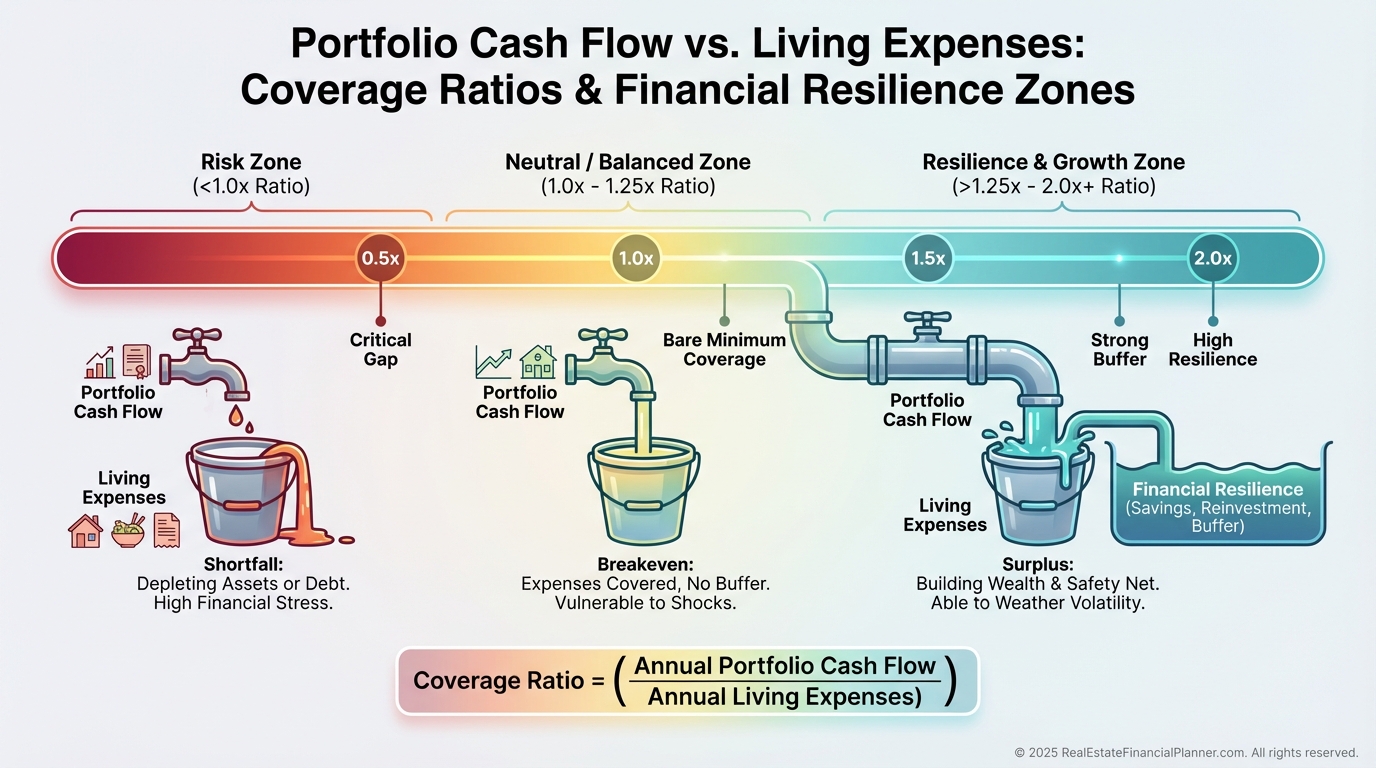

When I review portfolios, I look at total cash flow relative to lifestyle needs.

Portfolio Cash Flow vs Living Expenses

Cash flow is what allows you to sleep at night.

It absorbs vacancies, repairs, and economic stress without forcing panic decisions.

This is where financial independence becomes real instead of theoretical.

Common Cash Flow Mistakes I See Constantly

I see the same errors over and over.

Ignoring vacancy because “units rent fast.”

Underestimating maintenance because “the property looks good.”

Skipping management costs because “I’ll just do it myself.”

Avoiding reserves because “cash is tight right now.”

Betting on appreciation to justify negative cash flow.

Every one of these mistakes compounds.

They don’t fail loudly at first.

They bleed you slowly.

Strategic Uses of Cash Flow

Cash flow is not just survival money.

It is a strategic weapon.

It funds down payments.

It improves lending terms.

It increases resilience.

It accelerates portfolio growth.

Small monthly improvements matter.

An extra $100 per month across several properties becomes another purchase over time.

That is how portfolios quietly scale while others stall.

Final Thoughts

Cash flow is the foundation everything else sits on.

Appreciation is uncertain.

Tax benefits change.

Financing tightens and loosens.

Cash flow pays the bills no matter what.

When you master true cash flow analysis, investing becomes calmer, clearer, and far more durable.

The investors who last are not the most aggressive.

They are the most honest with their numbers.