Real Estate Commissions After the NAR Settlement: The Investor Playbook to Cut Costs and Boost True Net Equity™

Learn about Real Estate Commissions for real estate investing.

Why This Commission Shift Matters Now

When I help clients evaluate deals today, I start by asking, “What would this look like if you had to write a check for your agent?” because that is the new reality in many markets.

If you’re still underwriting with yesterday’s assumptions, your cash flow and exit math are wrong.

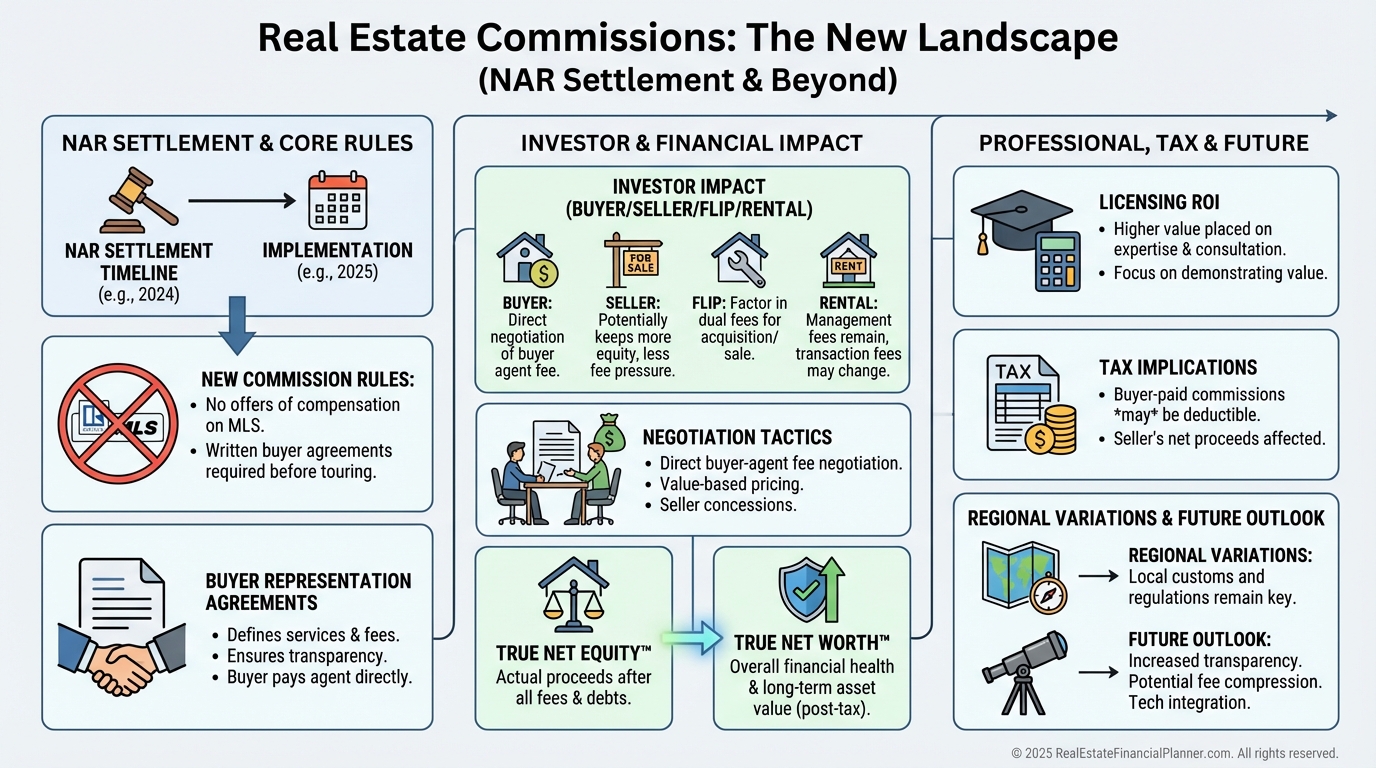

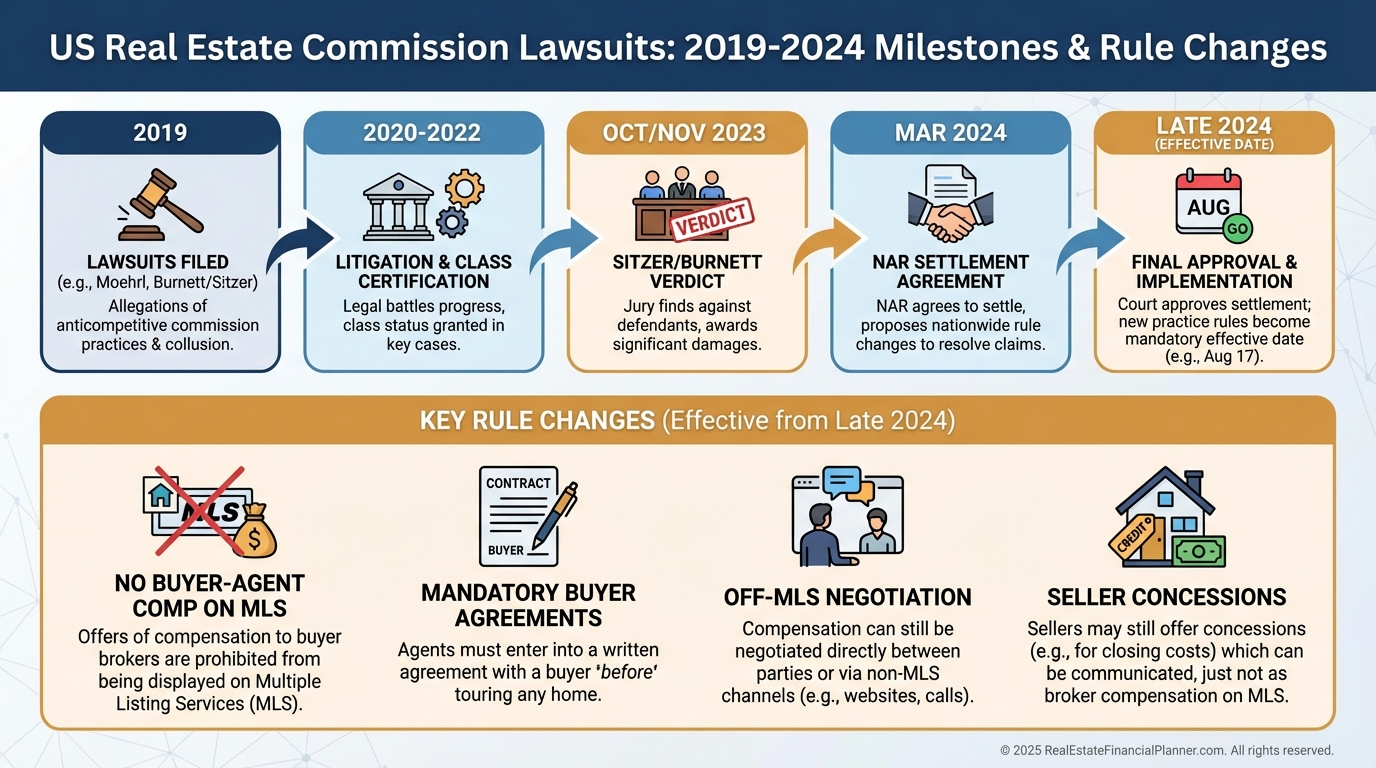

The Settlement That Rewired the System

It didn’t end commissions; it ended the way they were communicated and who initiates the conversation.

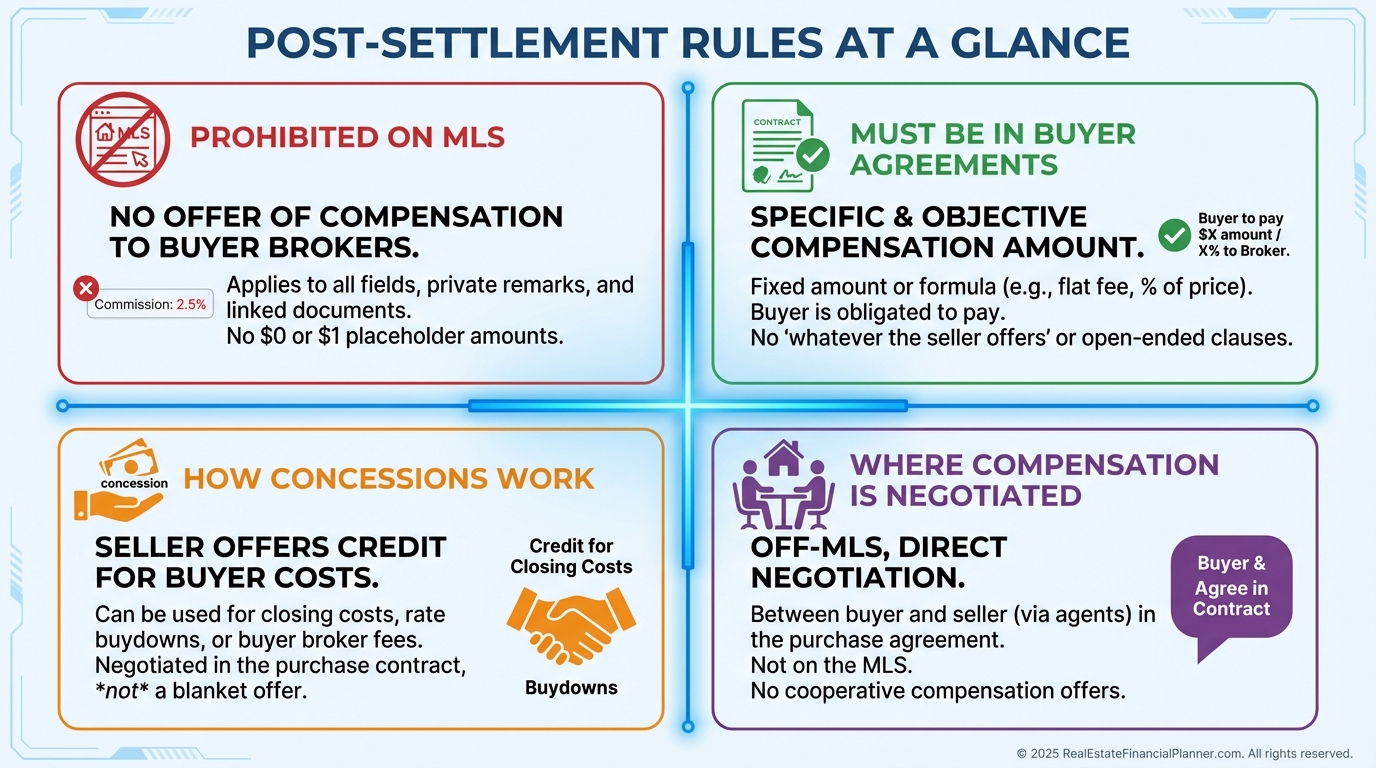

The New Rules: How Commissions Now Work

You won’t see buyer-agent compensation in the MLS anymore. That discussion happens privately and it is fully negotiable.

Buyer agents must have signed representation agreements before showing property, with clear, conspicuous compensation disclosures.

Sellers can still offer concessions that buyers can apply toward closing costs, which can include agent fees where allowed.

Agents are handling compensation by phone, email, and within offers instead of advertising it publicly.

How I Re-Underwrite Deals for Clients

I model three offers for buyers: buyer-pays-agent, seller-pays-via-concession, and split-fee structures that fit lender rules.

For sellers, I model offering a buyer-agent incentive in slow markets and removing it in hot ones, then compare time-to-sale and net proceeds.

When I rebuilt after a market setback years ago, the habit that saved me was always underwriting multiple exit paths. That’s mandatory again.

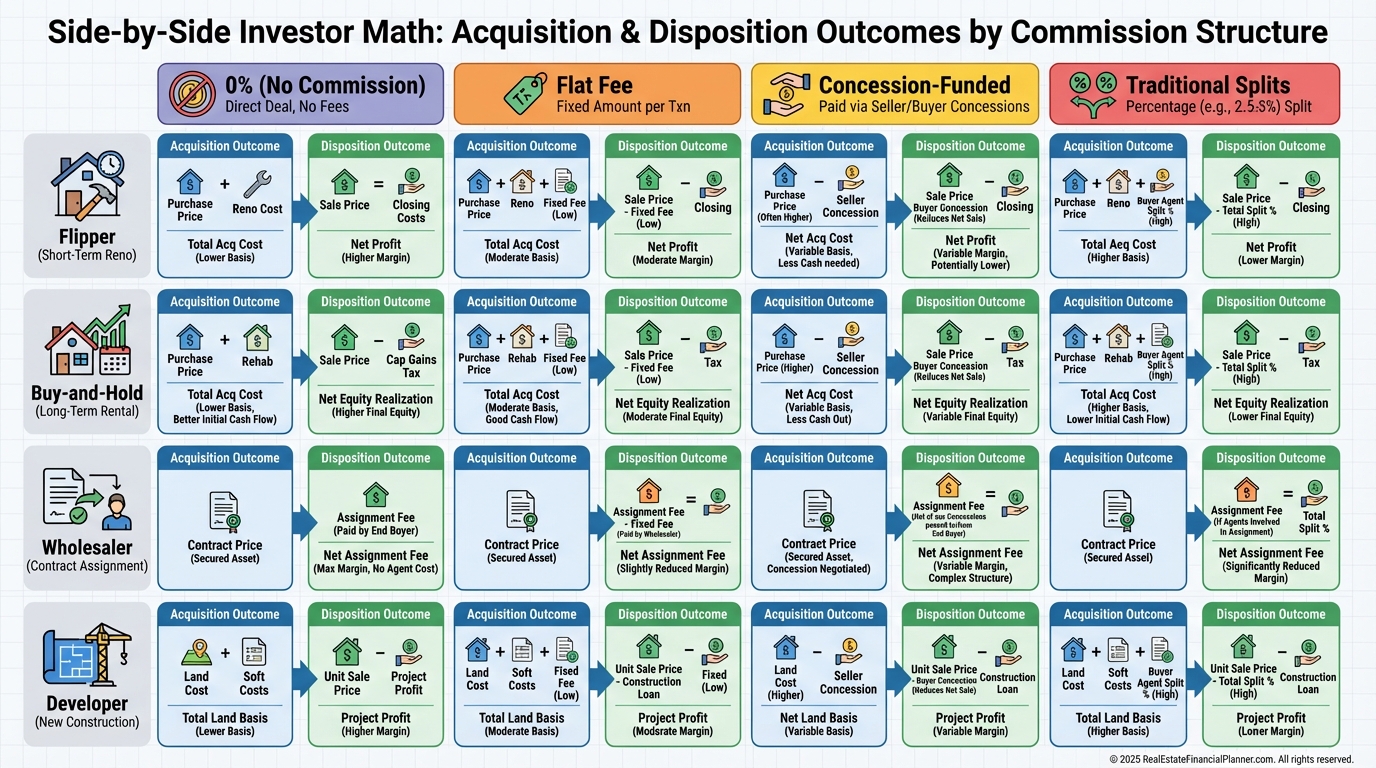

Investor Impact by Role

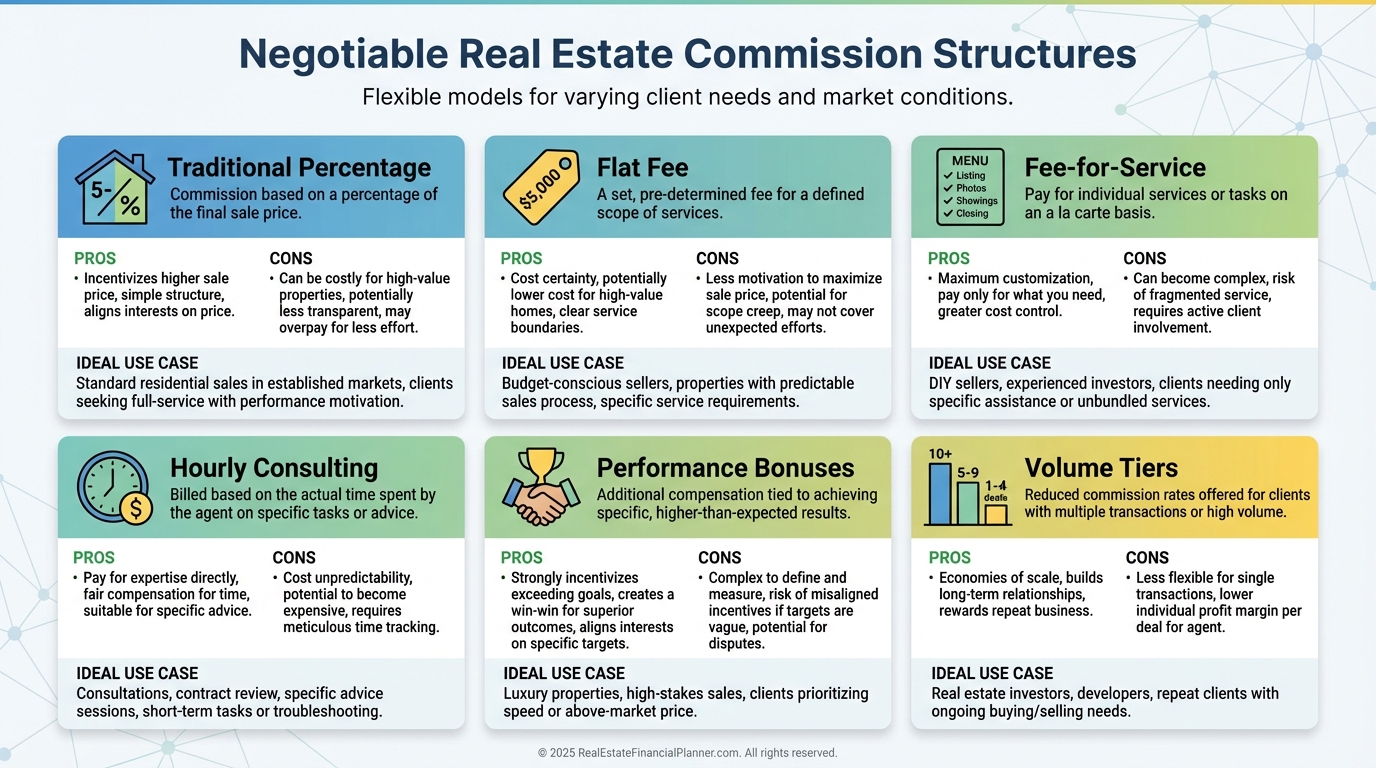

As a buyer, expect to sign a representation agreement early and be explicit about fee caps and scope. Negotiate fee-for-service or flat fees for clean deals.

As a seller, decide whether a buyer-agent incentive increases exposure enough to move the needle on price and days on market.

Flippers feel it on both sides, so run sensitivity analyses at 0%, 2%, and 3% buy-side compensation plus your listing side. It changes which rehabs pencil.

Rental owners feel it at entry and exit. Across a 10-door portfolio, shaving one to two points off average transaction costs can fund a down payment every few years.

Creative Tactics to Reduce or Eliminate Commissions

Lease-options with the Nomad™ lease-option exit let your tenant-buyer purchase without listing, saving sell-side commissions and often reducing vacancy and make-ready costs.

Before you list a rental, make a direct offer to your resident and to tenants in your other units. I’ve seen this beat the market by eliminating showings and make-readies.

Review your property management agreement. I’ve flagged clauses that force owners to list with the manager or pay a fee if the tenant buys. Negotiate those out upfront.

Use FSBO strategically if you have time, systems, and local demand. Pair it with a buyer-agent incentive only if it accelerates absorption enough to improve net.

Model True Net Equity™ First, Not Last

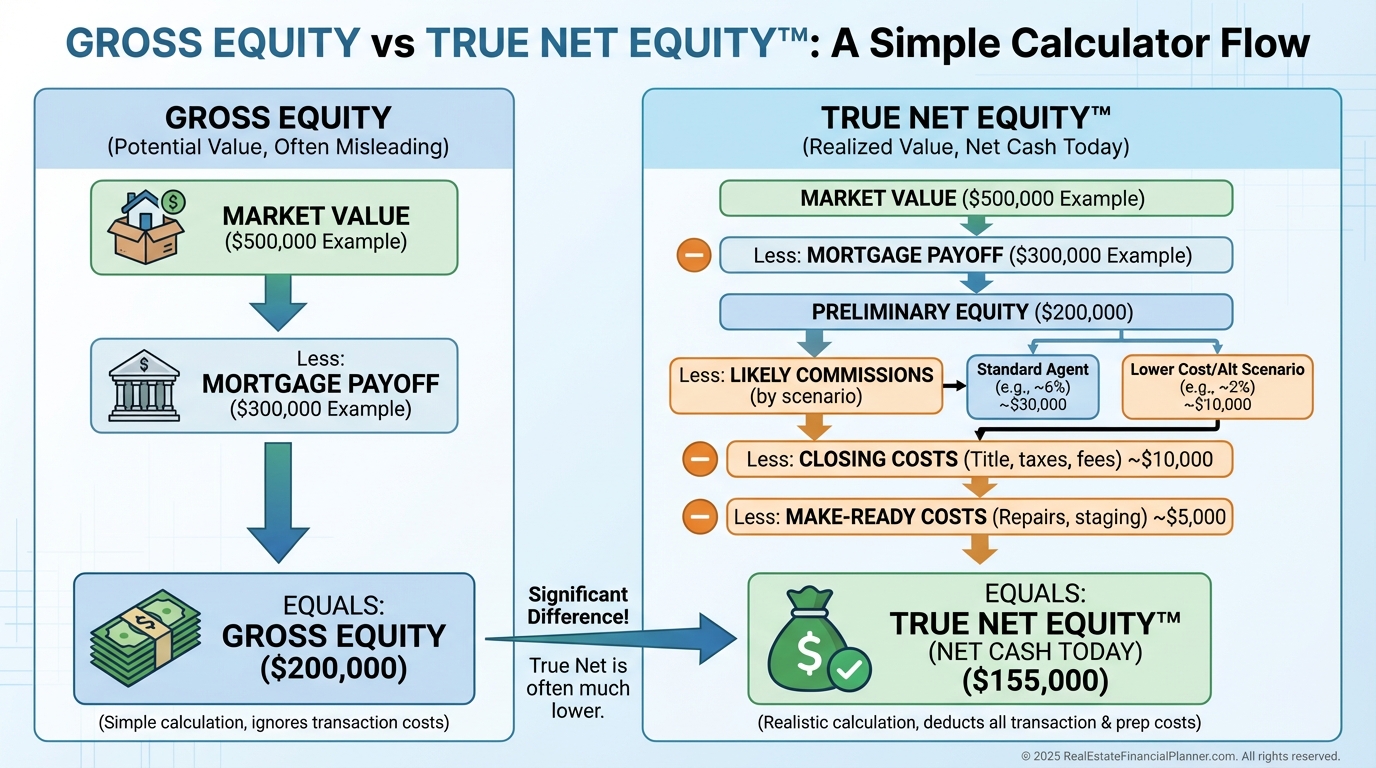

Investors overstate wealth by ignoring transaction costs. I don’t.

When we calculate True Net Equity™, we subtract payoff, commissions (by scenario), seller concessions, closing costs, and probable make-ready to estimate “walk-away” cash today.

Portfolio View: True Net Worth™

One door can fool you; ten doors will not.

We roll True Net Equity™ across the portfolio to get True Net Worth™, then stress test with different exit mixes: traditional listings, lease-options, direct-to-tenant, and holds.

This reveals which properties are keepers and which are ready for a tax-efficient harvest.

Return Quadrants™ and Commission Drag

Return Quadrants™ remind us that returns come from appreciation, cash flow, debt paydown, and tax benefits.

Commission drag hits appreciation harvesting and increases effective acquisition basis, so it shifts where returns show up and when you realize them.

I highlight this for clients so they don’t mistake a great hold for a mediocre sale.

Negotiation Playbook for Investors

Leverage volume for better rates. Promise repeat business in writing and ask for a standing fee schedule with performance bonuses.

Consider flat-fee, fee-for-service, or hourly structures for clean transactions where you carry more of the workload.

Use tech-enabled brokerages that fit the complexity of the deal. Simple houses need simple fee structures.

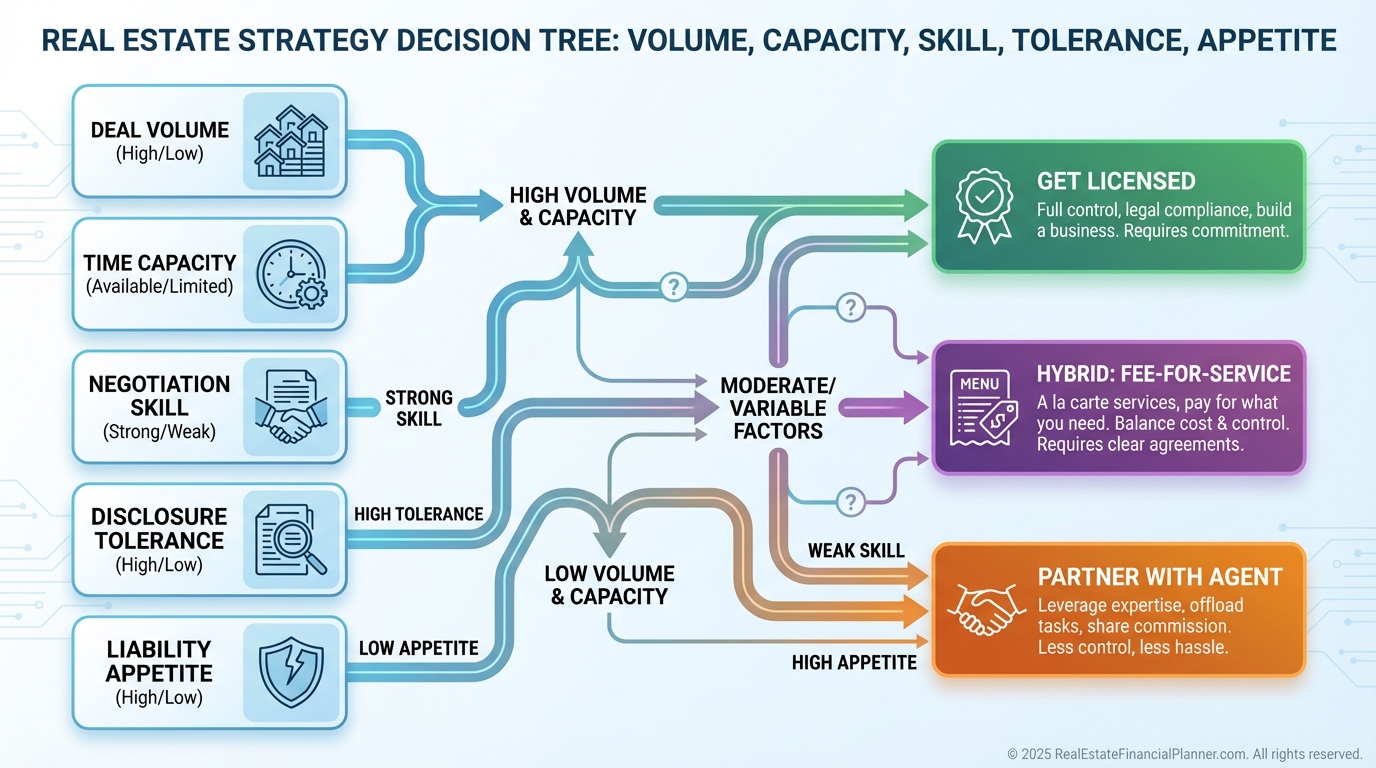

Should You Get Your License?

Run the math, not the dream.

Add licensing, MLS, brokerage splits, E&O, and CE time cost, then divide by your typical deal commission to find your break-even transaction count.

The Ultimate Real Estate Agent Retirement Plan™ pairs Nomad™ acquisitions with your own commission to reduce cash to close or principal, compounding over time.

But I warn clients: being licensed adds disclosures, liability, and distraction. Even I hire an agent when I need negotiation distance.

Buyer Mechanics Under the New Rules

Expect to sign a buyer representation agreement before touring. Cap compensation and outline when it’s due.

Budget for buyer-agent fees if the seller won’t pay, or negotiate concessions that your lender allows to cover them.

I sanity-check lender rules for each client’s loan type so we don’t craft an offer the underwriter will kill.

Seller Mechanics Under the New Rules

Decide up front whether offering a buyer-agent incentive will expand your buyer pool enough to speed absorption or raise price.

When I list, I test pricing with and without incentives in my net sheet, then choose the path with the highest probability-adjusted net.

Tax Implications You Can Use

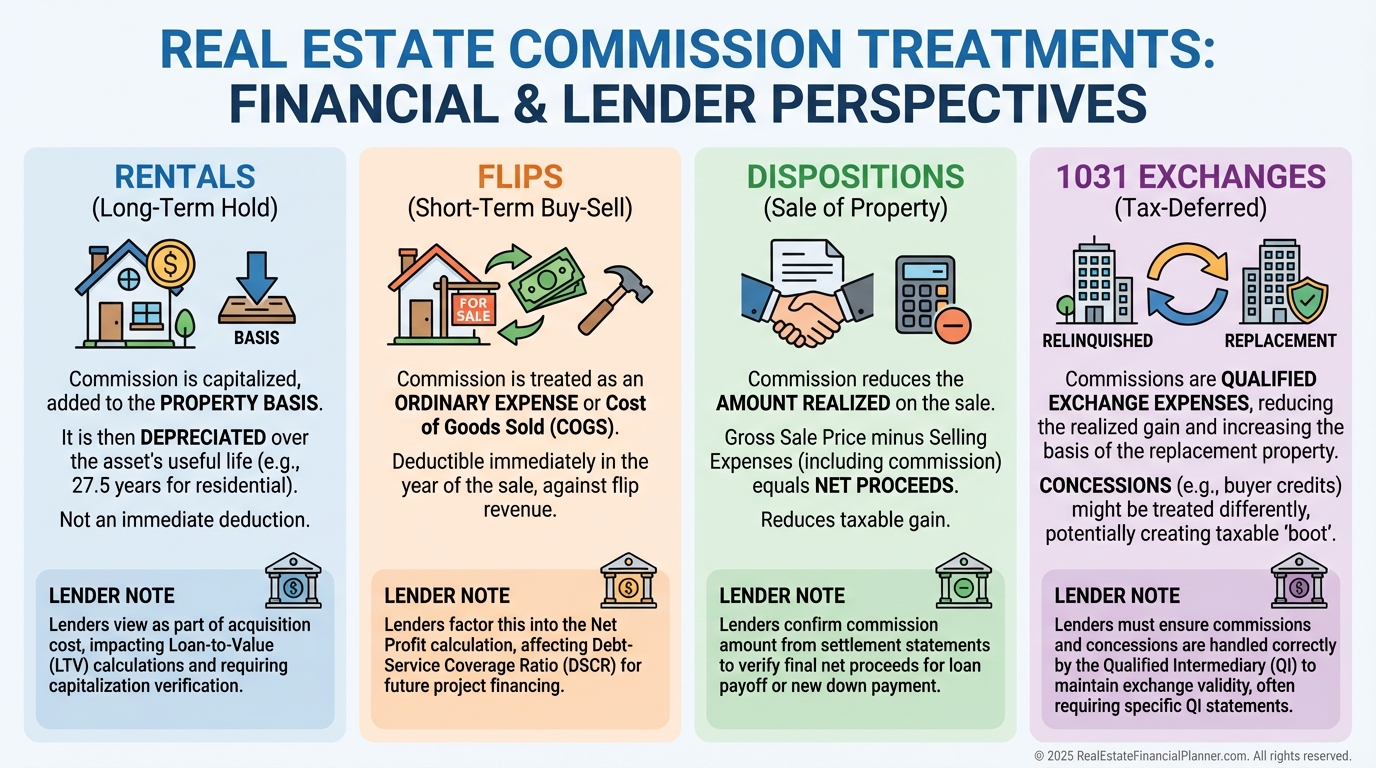

On acquisitions, buyer-paid commissions increase basis and therefore depreciation for rentals.

On dispositions, commissions reduce proceeds and therefore capital gains. For flips, they’re ordinary expenses.

Structure concessions and credits carefully, especially in 1031 exchanges, to avoid boot or basis mistakes.

Regional and Market Variations

Some states already required buyer agreements, so the transition is calmer there.

In hot markets, buyers often shoulder their agent fees to win. In soft markets, sellers reintroduce incentives to drive activity.

Know your MLS’s implementation details and your state’s rebate rules before you write your plan.

Future Outlook and How I’m Preparing Clients

Average fees are likely to drift lower and fragment into more à la carte services.

Expect more AI-enabled search, valuation support, and compliance checks, but humans will still negotiate and manage risk.

I build flexibility into pro formas so a deal still works if the commission structure shifts mid-transaction.

Alternative Strategies That Sidestep Commissions

Wholesaling, subject-to, seller financing, probate direct, and auctions often bypass traditional commission structures.

Syndications replace agent fees with sponsor fees; underwrite those as your “transaction cost.”

Use lease-purchase or lease-option to control property, defer tax, and reduce transaction friction.

What I Model, Check, and Avoid for Clients

I model multiple commission paths on every acquisition and exit so we don’t get surprised at closing.

I check PM agreements for gotcha listing clauses. I verify lender rules on concessions before we write them in.

I avoid assuming “the seller will pay it.” That’s no longer a default and assumptions kill deals.

Your Next Steps

Rebuild your underwriting templates with commission scenarios.

Calculate True Net Equity™ and True Net Worth™ portfolio-wide.

Line up an agent relationship that fits your volume and complexity, or formalize fee-for-service support.

If you do this now, you’ll buy more confidently and sell more profitably in the new era.