Insurance for Real Estate Investors: Protect Your Portfolio

Learn about Insurance for real estate investing.

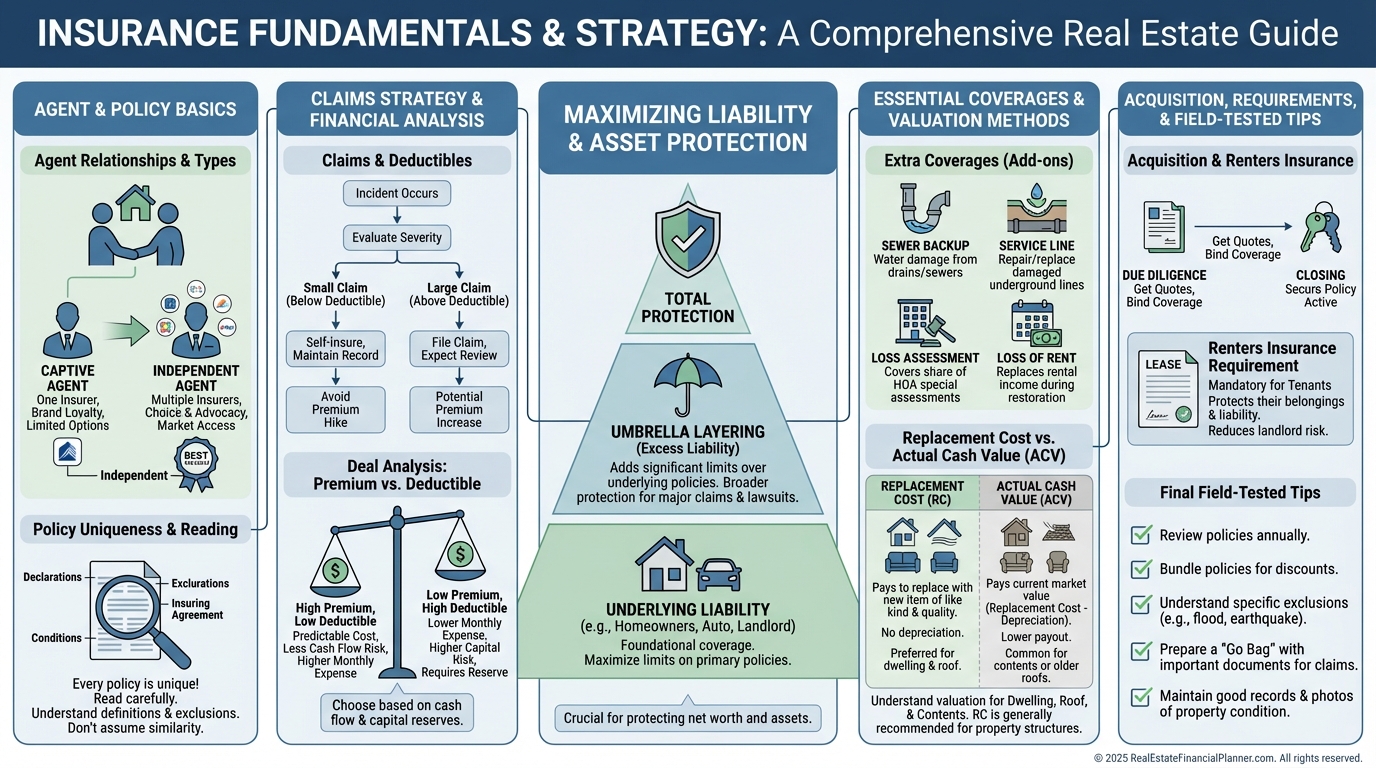

Insurance Is Asset Protection You Can Price

When I help clients map their 10-year plan, I treat insurance like priced defense.

Cheap defense that fails is expensive when it matters.

Penny-wise, pound-foolish looks like shopping only on price and ignoring exclusions, sublimits, and claims handling.

Decide now what you want covered, what you’ll self-insure, and what risks you will not take.

If you’re leveraged, your lender already decided some of this for you.

If you’re free and clear, recognize you just became the lender and the guarantor.

Build a Pro-Level Relationship With Your Agent

Your agent is part of your investing dream team.

Mine keeps a living memo of my properties, occupancies, dogs, pools, and add-on coverages.

I ask them to translate policy legalese into plain language and to model “what if” claims.

Before I file a claim, I call my agent and ask two questions.

Will this trigger a nonrenewal or a surcharge that costs me more than I’ll get?

What are my alternatives if I pay cash and keep the loss off my CLUE report?

A strong agent saves you money by helping you avoid bad claims and by tuning coverage as your portfolio evolves.

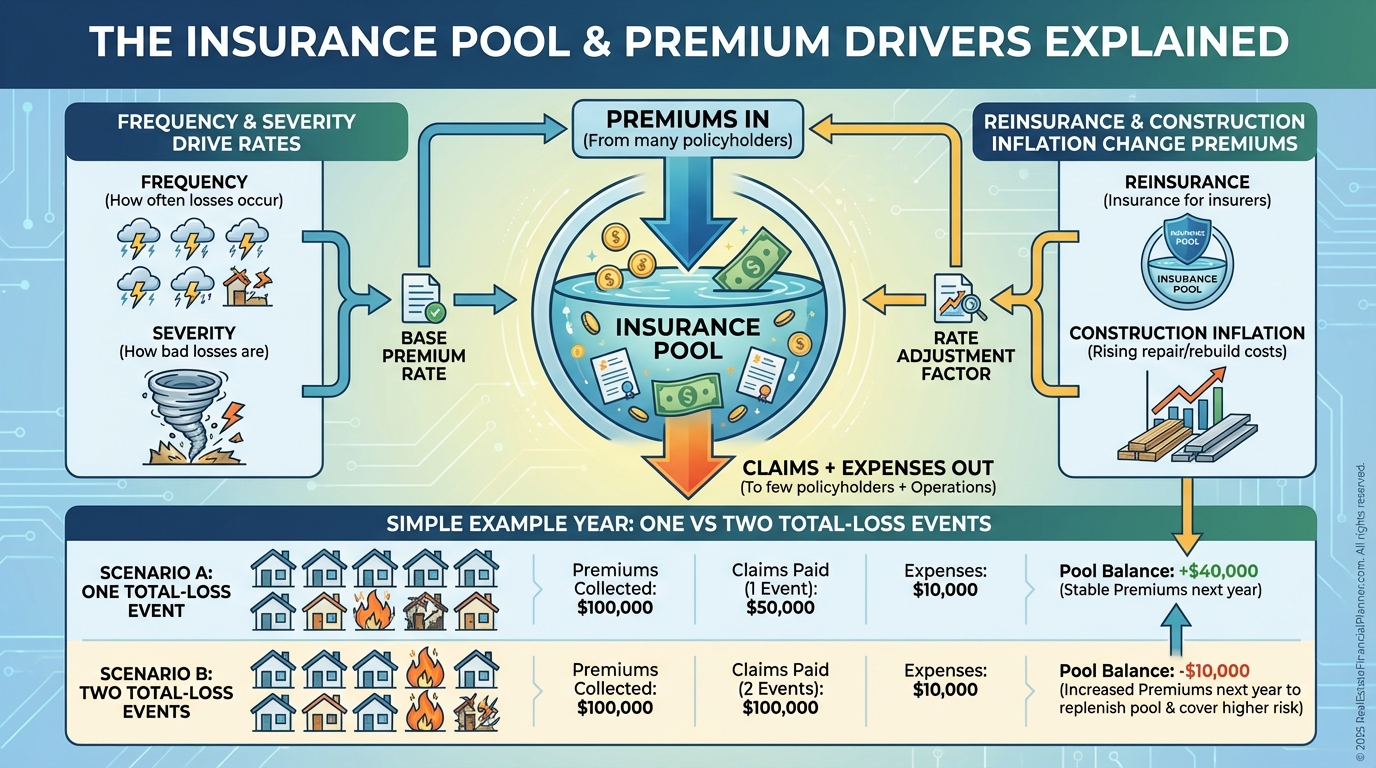

How the Insurance Business Works (Why Rates Change)

When I rebuilt after a rough year of hailstorms and a water line loss, I stopped taking rates personally.

Insurance is a pool.

Premiums in, claims and expenses out.

If construction, medical, or reinsurance costs rise, premiums must rise to keep the pool solvent.

You win by buying the right limits, with the right company, at the right time—then keeping your loss history clean.

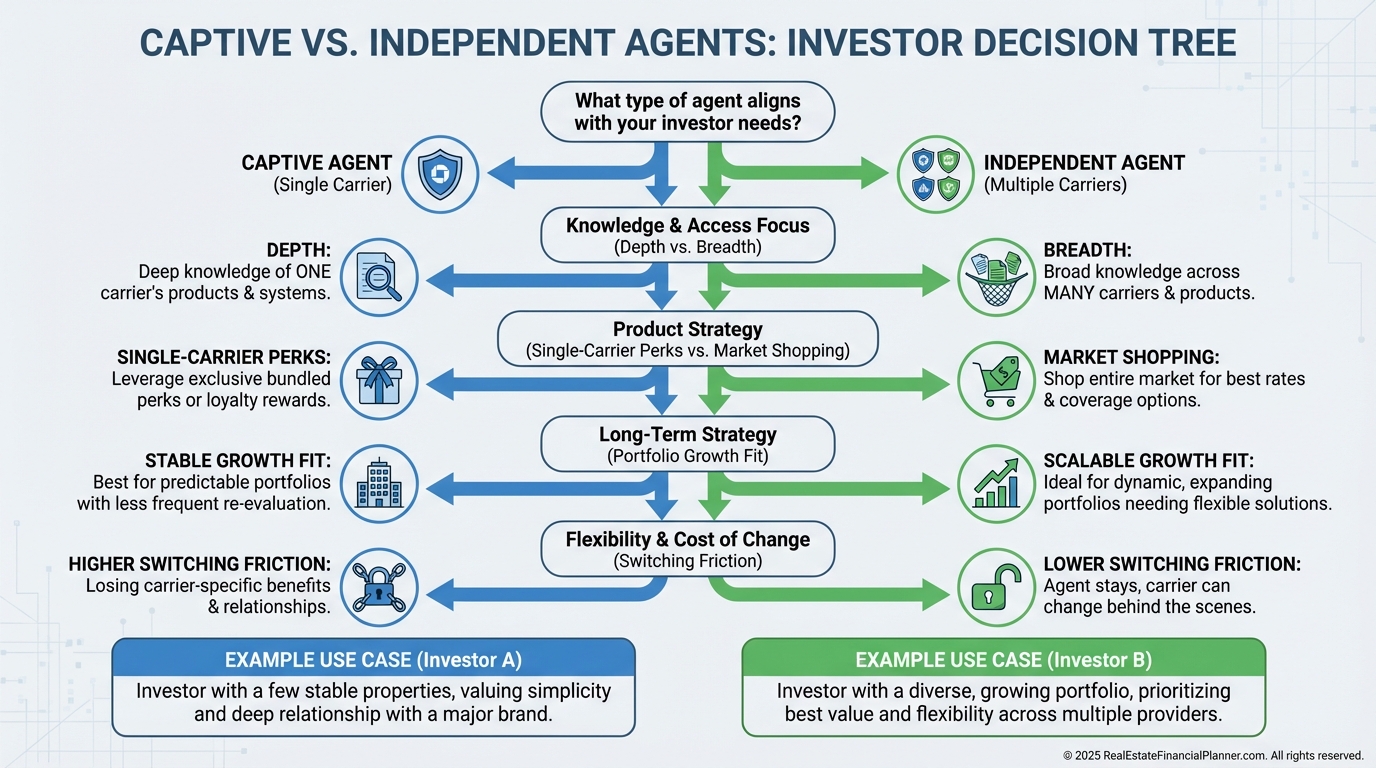

Captive vs Independent: Which Agent For Which Job?

Captive agents know their product in depth and can sometimes pull strings internally.

Independent agents can shop multiple carriers and pivot when a market pulls out of your state.

For portfolios, I prefer an independent to tender the market, plus a savvy captive for specialty programs a carrier does unusually well.

The best setup is options, not loyalty for loyalty’s sake.

Policies Are Snowflakes: Read, Compare, Confirm

No two policies are the same.

Endorsements, sublimits, and definitions decide outcomes more than the headline premium.

Ask your agent to highlight exclusions, wind/hail deductibles, matching coverage for siding/roof, and water-related sublimits.

Beware of jargon like Silver/Gold/Platinum.

Those aren’t standards; they’re marketing.

Ask for plain-English coverage summaries, then request the specimen policy to verify.

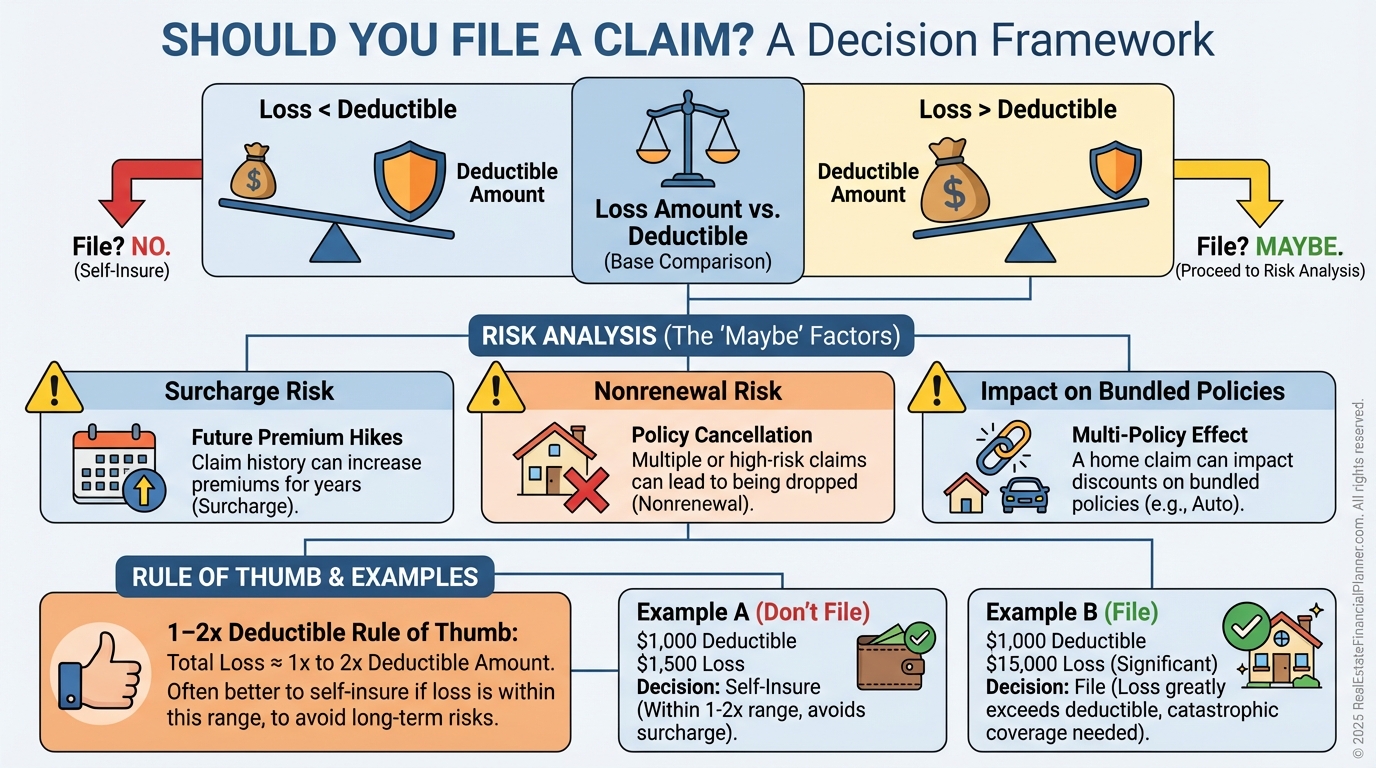

Claim Strategy: When Filing Costs More Than It Pays

Insurance is for big, rare events.

I model expected value before filing.

If the loss is within 1–2x the deductible, I usually pay cash to protect my insurability and keep future premiums down.

I also avoid “death by many small claims” that can trigger nonrenewals.

Set a personal claim threshold now, not during chaos.

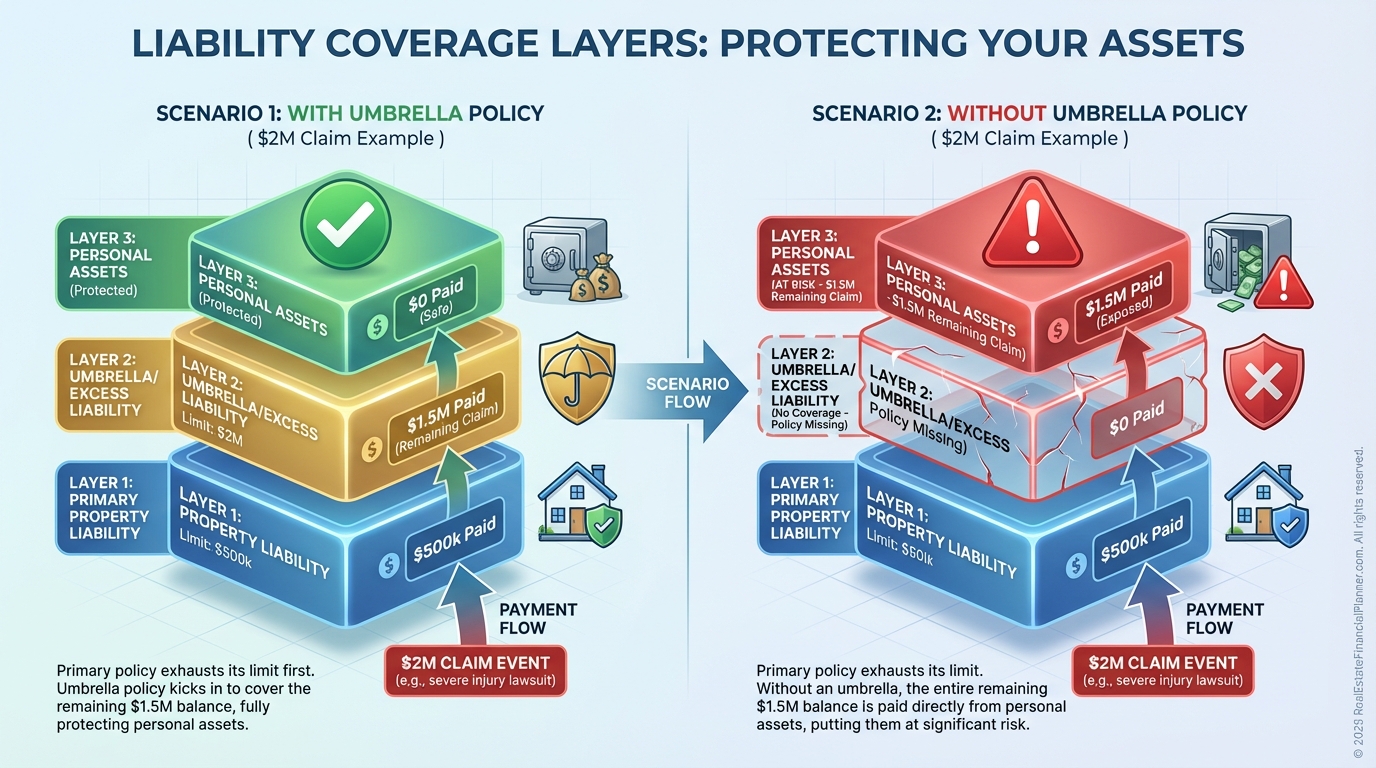

Maximize Liability Where It Matters

Large liability claims are what wipe out portfolios.

When I underwrite risk, I focus on bodily injury exposure and defense costs.

Imagine the balcony collapse.

With no insurance, the judgment attaches to wages and assets.

Underinsured, you lose properties to cover the gap.

Adequately insured, your carrier and umbrella take the hit, not your balance sheet.

This is where your portfolio’s True Net Equity™ lives or dies.

Umbrella Policy: Cheap, Scalable Defense

Umbrella coverage is excess liability that sits above your home, rentals, and auto.

It’s designed for the rare, devastating claim.

Don’t size umbrellas to your equity.

Size them to plausible claim severity in your market and risk profile.

Typical umbrellas exclude business losses and intentional acts, but they can pick up things like libel/slander and personal injury.

Ask for required underlying limits and make sure every policy meets them so the umbrella applies.

Pricing is often lower than you expect per million of coverage.

I routinely see $1M–$5M stacks costing less than a single vacancy.

Premium vs Deductible: Dialing In Deal Analysis

I treat deductibles like a retainer I’m willing to pay when something big happens.

Higher deductible, lower premium, fewer small-claim temptations.

In the Return Quadrants™, premium shows up as an operating expense that suppresses Cash Flow, while right-sized deductibles help preserve Appreciation and Debt Paydown by preventing forced sales after losses.

When we analyze a purchase, I price two to three deductible options and put them in my deal model.

If the premium savings compounds better than the occasional paid-out-of-pocket loss, I push the deductible higher.

And I never “waive” a deductible with a contractor.

That’s insurance fraud.

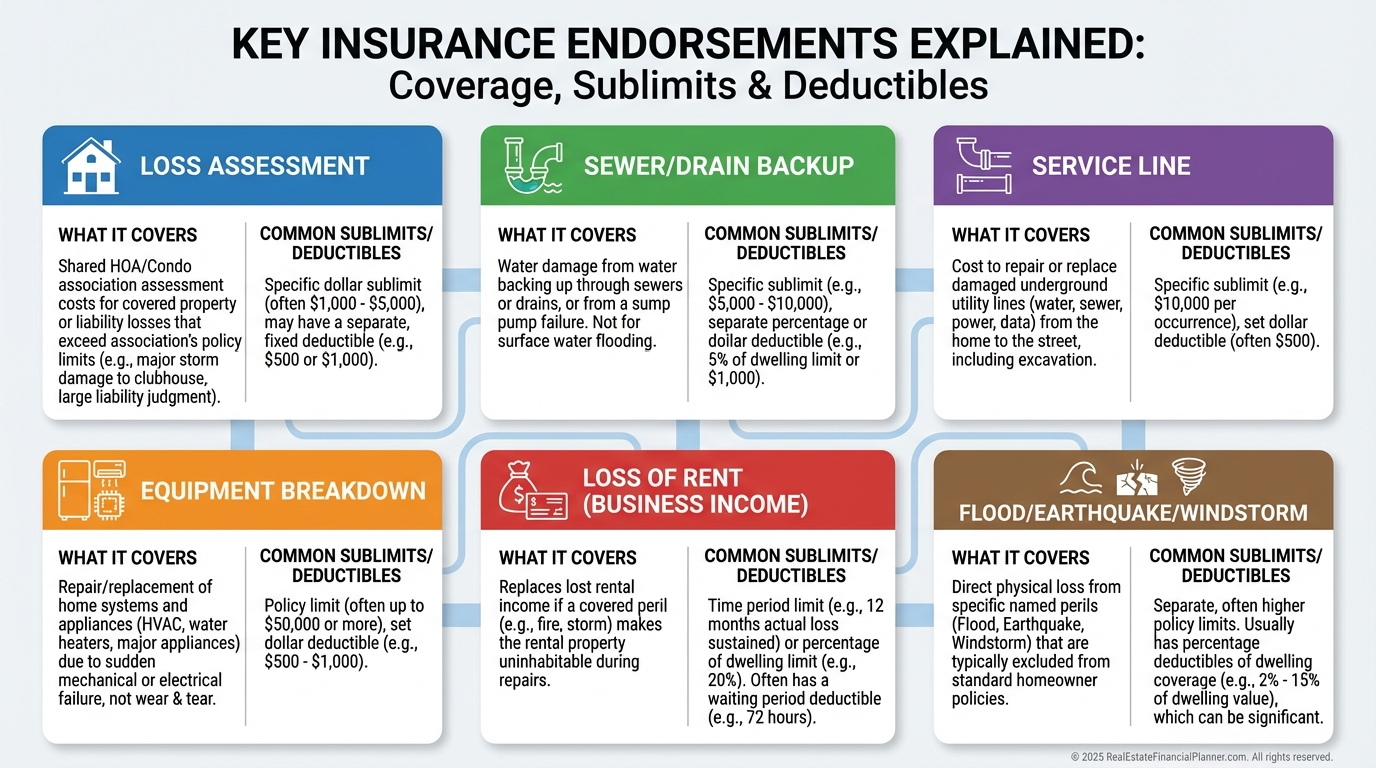

Extra Coverages That Save Portfolios

There are small riders that quietly save five figures.

Loss Assessment if you own in an HOA.

Sewer/Drain Backup to cover the messy, excluded stuff.

Service Line to handle underground water/gas/electric to the house.

Equipment Breakdown for boilers, HVAC, and key systems.

Loss of Rent to keep debt service paid while repairs happen.

In coastal, river, or seismic zones, add Windstorm, Flood, or Earthquake as needed.

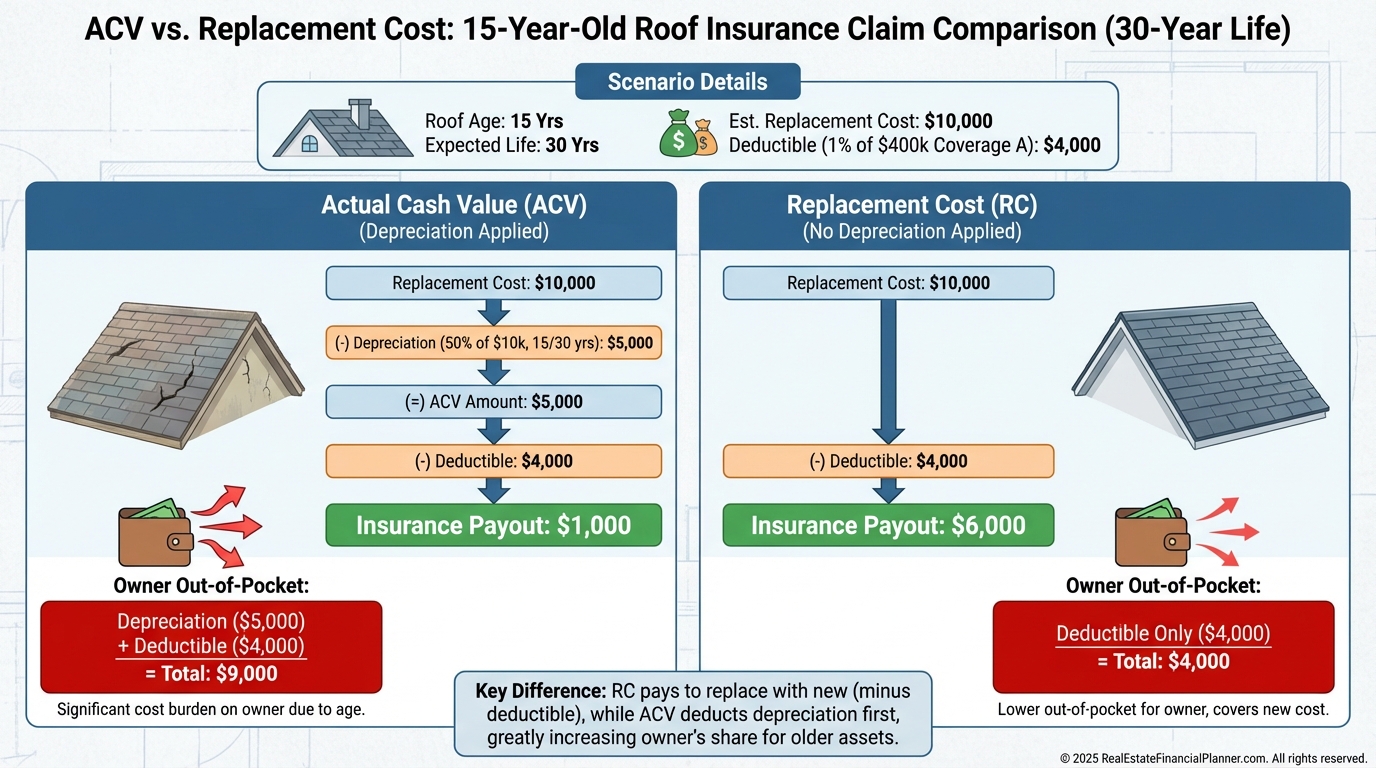

Replacement Cost Wins: Dwelling, Roof, Contents

Replacement Cost pays to rebuild at today’s prices.

Actual Cash Value (ACV) pays depreciated value, which can be far short of replacement.

For the dwelling, ask about Extended or Guaranteed Replacement Cost.

For roofs, watch for wind/hail deductibles that are a percentage of Coverage A.

Matching coverage for siding/roof prevents “patchwork” outcomes.

For furnished rentals, mid-term rentals, and house hackers, add Replacement Cost on contents.

That way, the appliances, furniture, and electronics you provide are replaced at current cost, not yard-sale value.

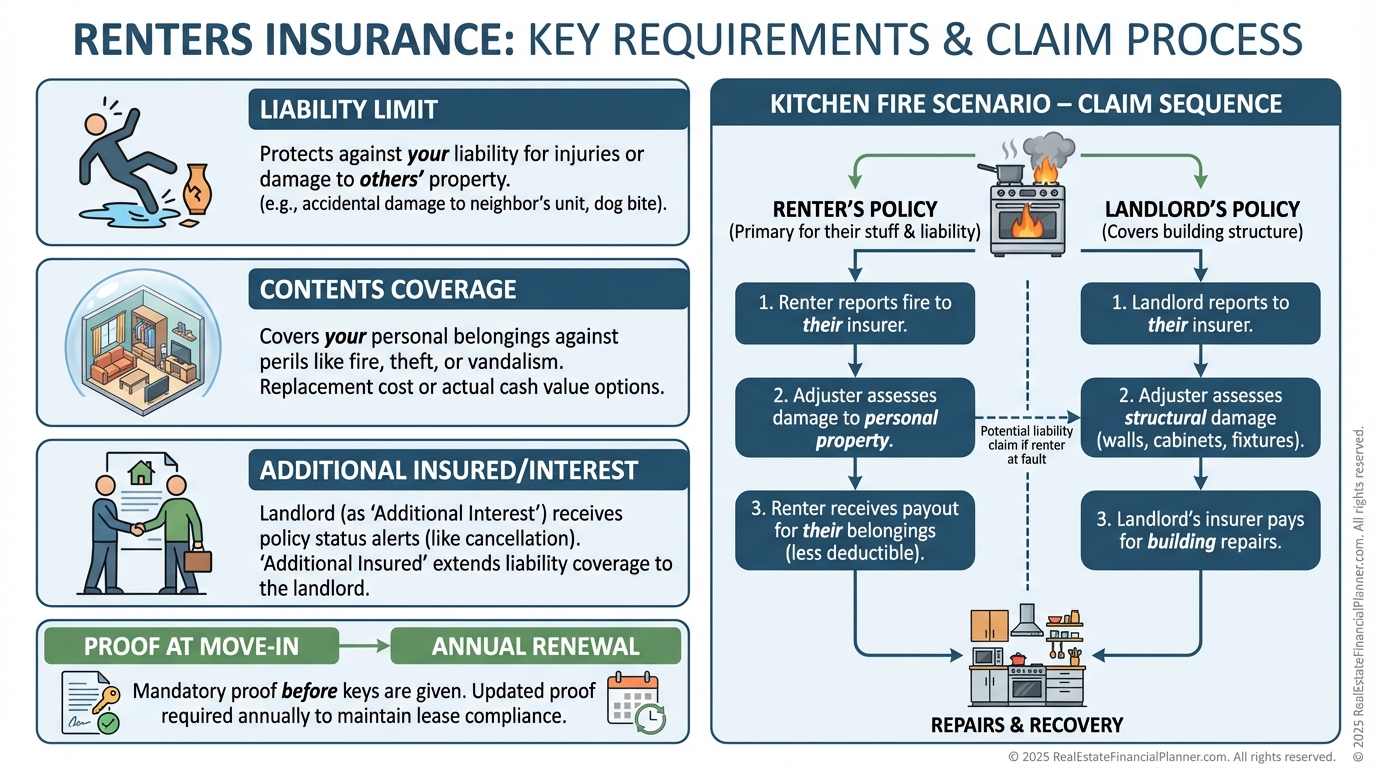

Require Renters Insurance and Get Added

I require tenants to carry renters insurance with at least $300k–$500k liability.

I’m added as Additional Insured or Additional Interest so I get notified if they cancel.

In a kitchen fire, their policy can respond to their liability and personal contents so mine doesn’t carry the whole loss.

This keeps rent flowing and reduces disputes.

Spell it out in your lease and verify at renewal.

Other Insurance Real Estate Investors Should Consider

Title Insurance and Owner’s Extended Coverage protect against title defects and boundary surprises.

Hold-open policies save on title costs when you plan a quick resale.

Specialty policies like Meth cleanup are rare but mission-critical when you need them.

Earthquake, Flood, and Hurricane/Wind policies are environment-specific.

Right policy, right geography.

Getting Insurance During Acquisition

During deal analysis, I ask my agent for indicative quotes so my numbers are real.

Once under contract, I bind coverage effective at closing and confirm the lender’s mortgagee clause.

If I can’t get insurance or the price torpedoes my deal, I lean on the contract’s insurance contingency if available.

Nomad™ or house hacking?

Disclose mixed use and occupancy so you get the correct form (DP vs HO) and no claim denials.

Final Field-Tested Tips

Update your insurer when the loan is sold so escrow pays the right company.

Disclose pools, hot tubs, trampolines, and dogs by breed.

Undisclosed risks become unpaid claims.

If tenants run a business or see clients at home, tell your agent.

Some activities aren’t covered without a business endorsement.

Bundle policies for discounts, but don’t let bundling trap you in a bad carrier.

Re-shop at renewal and let carriers compete.

Document property condition with photos and receipts.

Claims get easier when you can prove pre-loss condition and value.

Protect your True Net Equity™ first, then fine-tune premiums to improve Return Quadrants™ without gambling on ruin.