Seasoning in Real Estate: The Quiet Rule That Can Stall Your BRRRR—or Accelerate Your Growth

Learn about Seasoning for real estate investing.

The difference between a 3-month and a 12-month requirement can turn a great deal into a capital chokehold.

I learned this the hard way early in my career. A cash-out refi that “should” have closed in 90 days got pushed to month 12, and my growth stalled for a year.

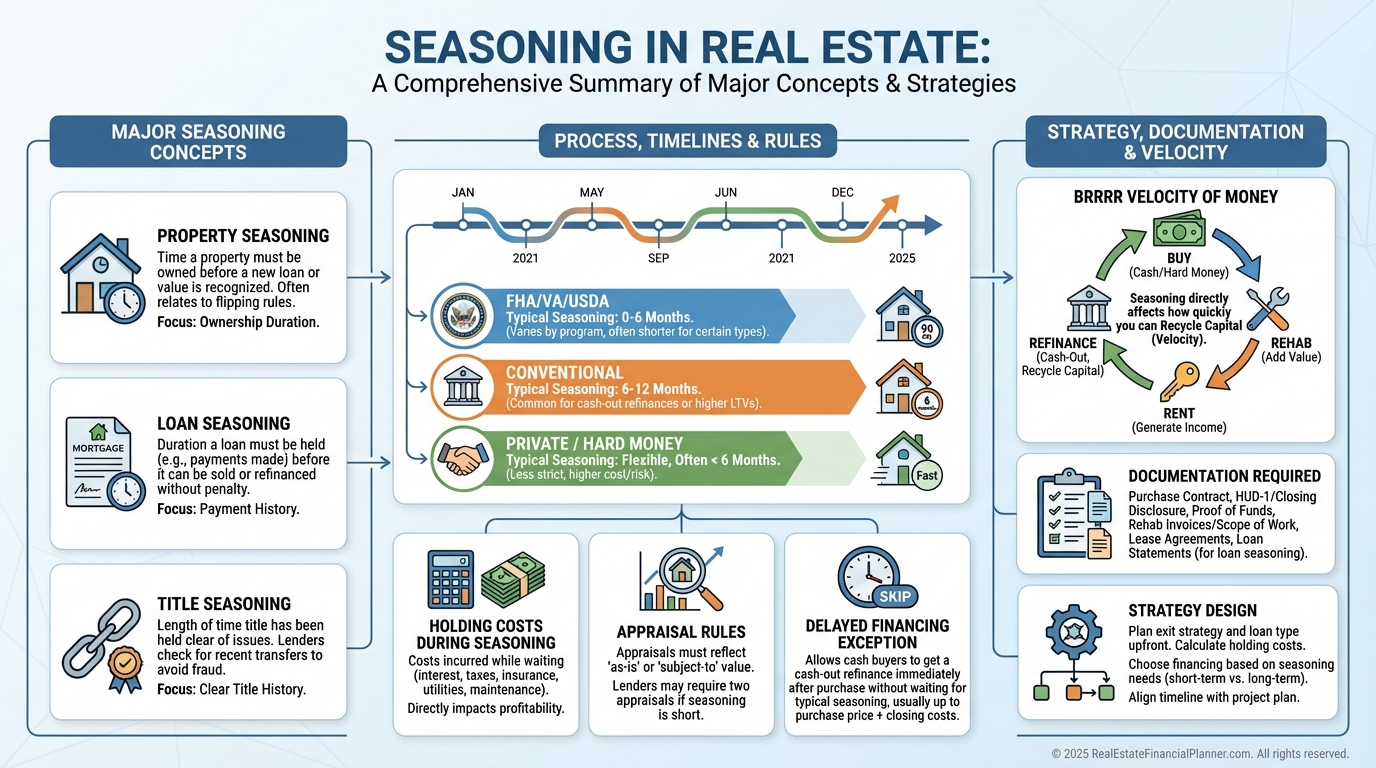

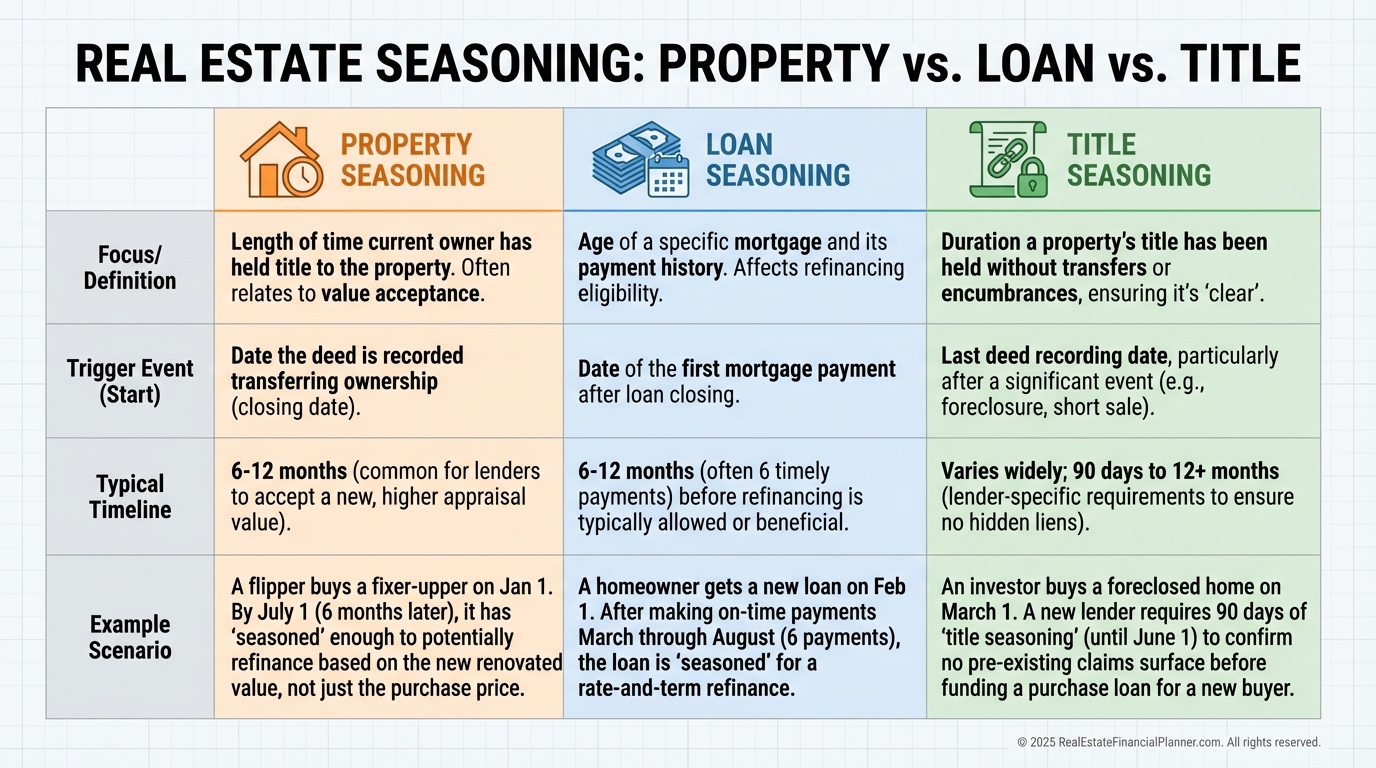

What Seasoning Really Means

Seasoning is the minimum time a lender or program requires before you can execute a specific action.

It is not about your intentions. It is about their risk controls.

There are three flavors every investor must know.

•

Property seasoning: How long you must own the property before a refinance or equity pull.

•

Loan seasoning: How long an existing loan must be in place before payoff, modification, or cash-out.

•

Title seasoning: How long you must hold clear title for the lender to consider you the legitimate owner for underwriting.

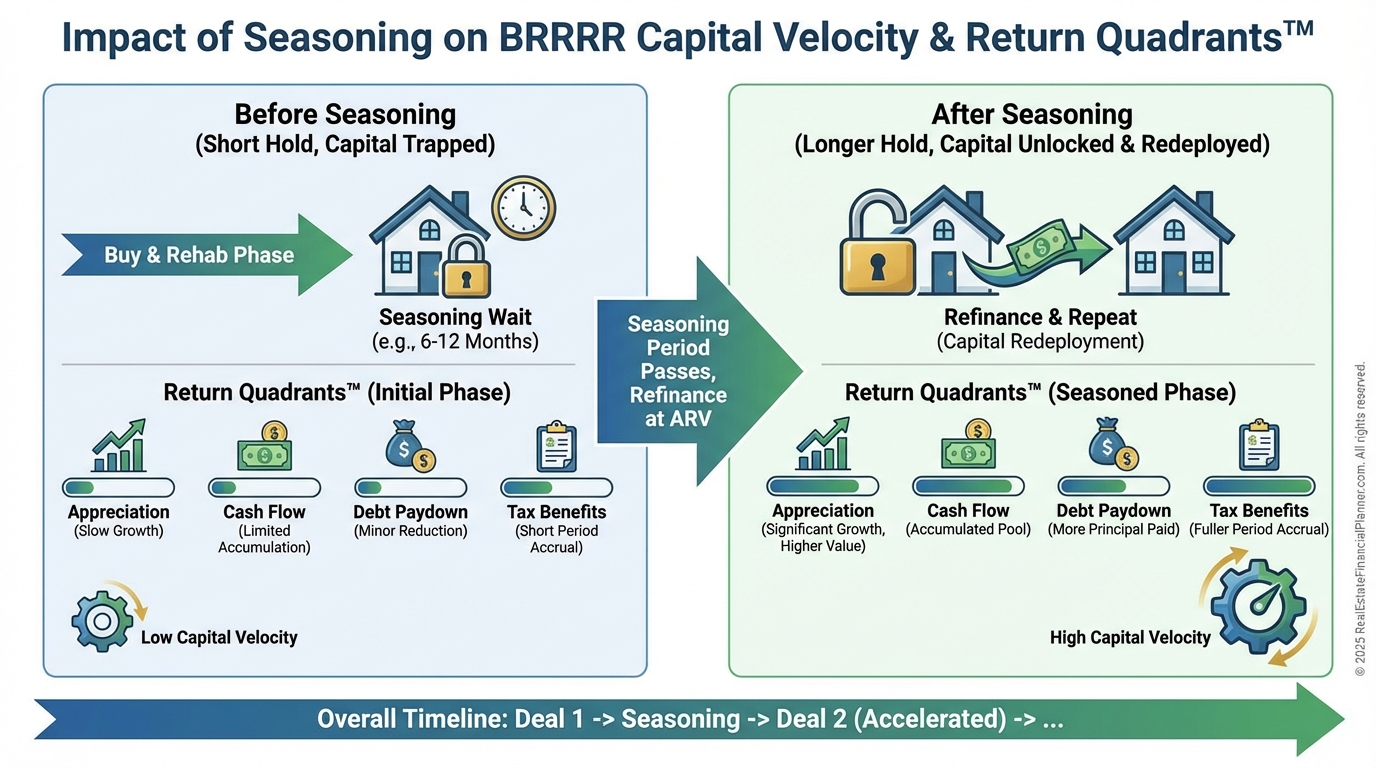

Why Seasoning Matters for Returns

Seasoning changes the velocity of money in BRRRR. If your capital sits in a property for 12 months instead of 90 days, your yearly deal count and compounding slow dramatically.

It also affects Return Quadrants™. Your appreciation and debt paydown still accrue, but cash-out timing delays capital redeployment and can reshape your total return mix.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add seasoning months to the timeline so cash-out occurs when the lender allows it, not when the rehab ends.

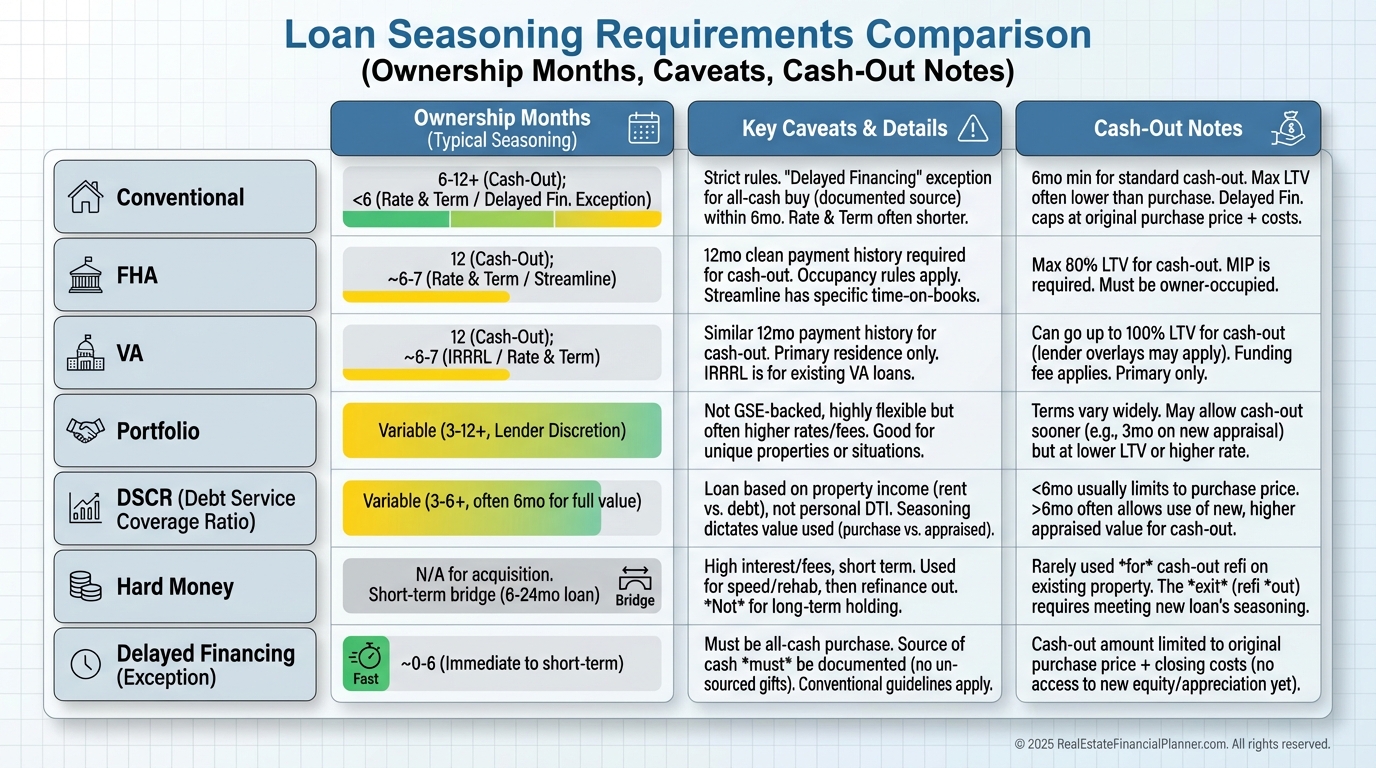

Typical Seasoning by Loan Type

Not all lenders or programs agree on timelines. Some are rigid. Some are flexible—usually for proven operators with great documentation.

Here are common patterns I see in the field. Always verify in writing before closing on the purchase.

•

Conventional cash-out: Often 6–12 months of ownership. Some will review documented rehab to consider ARV earlier, but expect scrutiny.

•

FHA cash-out: Generally 12 months ownership and primary residence requirements apply. Expect zero wiggle room.

•

VA cash-out: Usually 210 days from first payment due date and at least 6 monthly payments made.

•

Portfolio lenders: Frequently 3–6 months, case-by-case. Relationships matter.

•

DSCR/Investor loans: Varies widely. Many require 6 months for cash-out based on new value.

•

Hard money: Often no seasoning for their own payoff, but they don’t control your takeout lender.

•

Delayed financing exception (conventional): Within 180 days, allows cash buyers to recover purchase funds up to original purchase price with documentation.

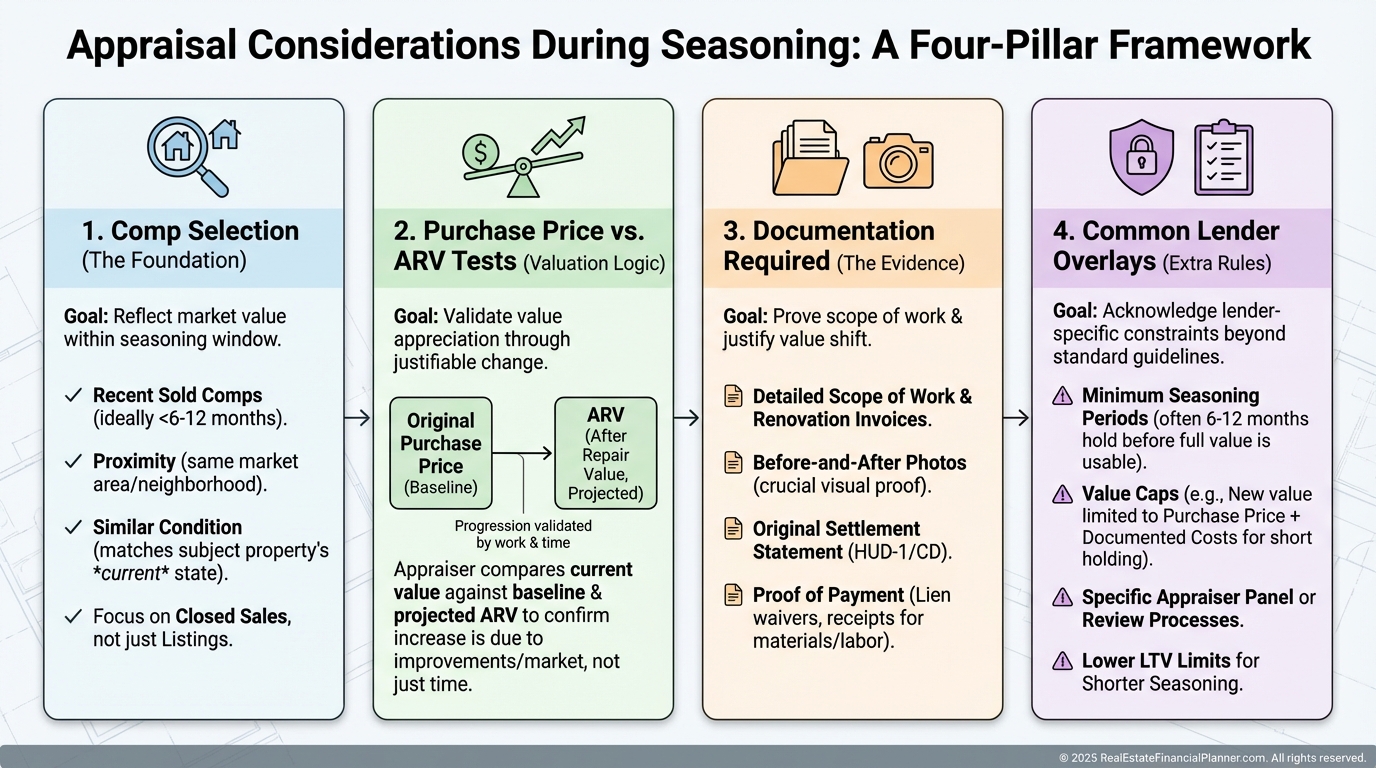

Appraisals During Seasoning

During the seasoning window, appraisers and underwriters want evidence that value is real, not paper gains.

Expect requests for before/after photos, itemized rehab budgets, paid invoices, permits, and rent roll support. Some lenders cap value at purchase price plus documented improvements during early months.

When I coach clients, I tell them to build a “valuation file” from day one. It wins appraisals.

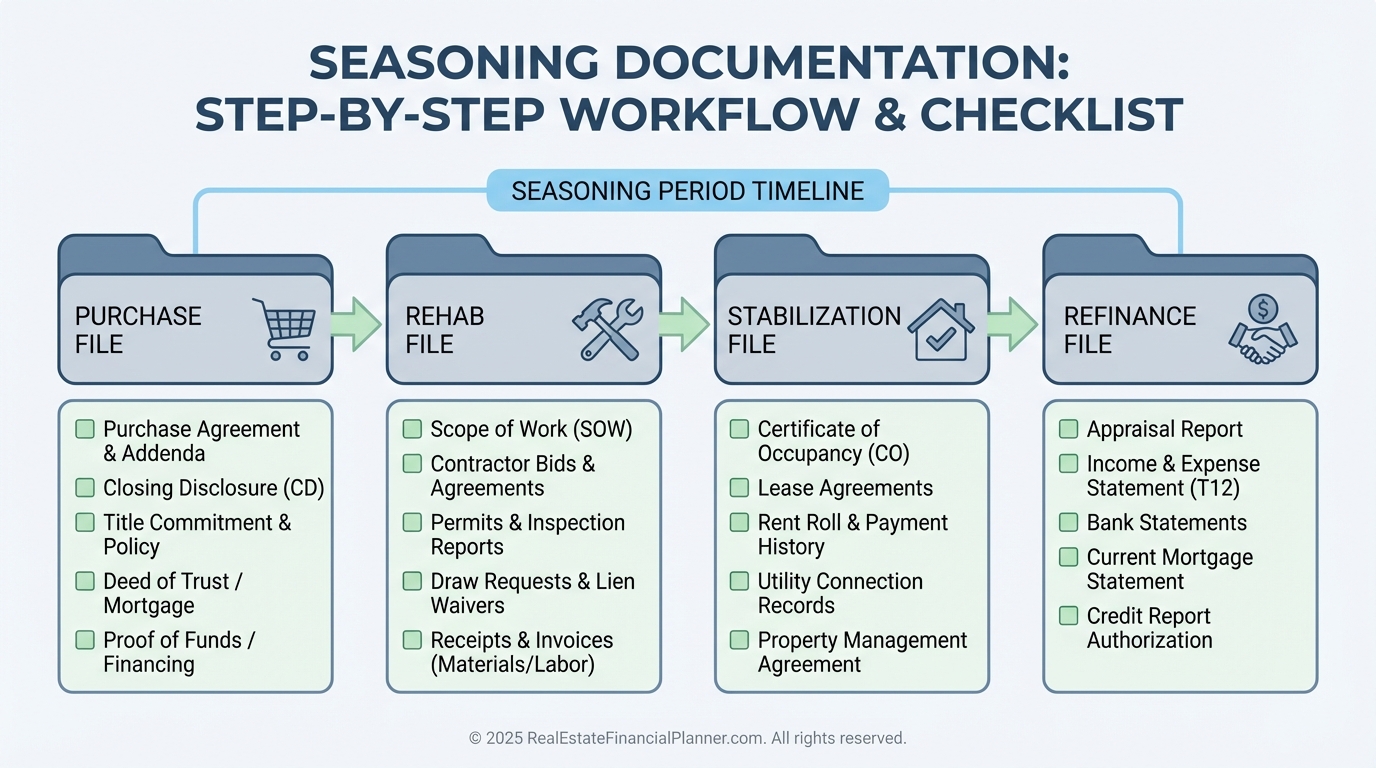

Documentation You’ll Need

Underwriters approve what they can verify. If it’s not documented, it didn’t happen.

Keep these ready:

•

Closing Disclosure or HUD-1 from your purchase.

•

Recorded deed with ownership date.

•

Mortgage payment history.

•

Rehab invoices, proof of payment, and contracts.

•

Before/after photos and permits.

•

Property tax bills and insurance declarations.

•

Lease agreements and deposits for stabilized units.

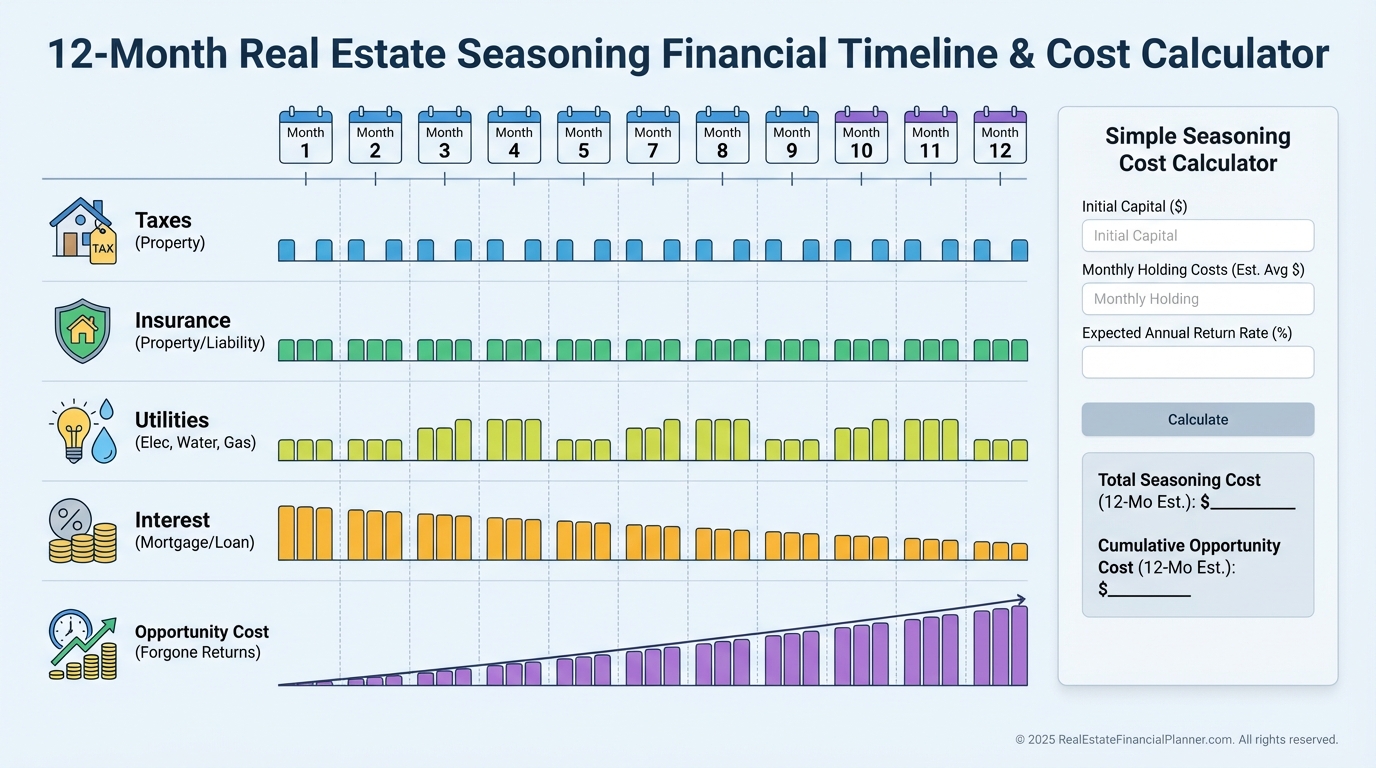

Model the Real Costs of Seasoning

Seasoning is not just time. It is money.

When I rebuilt after bankruptcy, I learned to price time. I model monthly holding costs until my realistic refi date, not my optimistic rehab date.

Example:

•

Purchase: $150,000. Rehab: $40,000. Monthly holding costs: $1,200.

•

Rehab: 3 months = $3,600.

•

Additional seasoning to month 12: 9 months = $10,800.

•

Total holding during ownership to refi: $14,400.

That $10,800 is a line item in your Return Quadrants™ and reduces True Net Equity™ at the refi date.

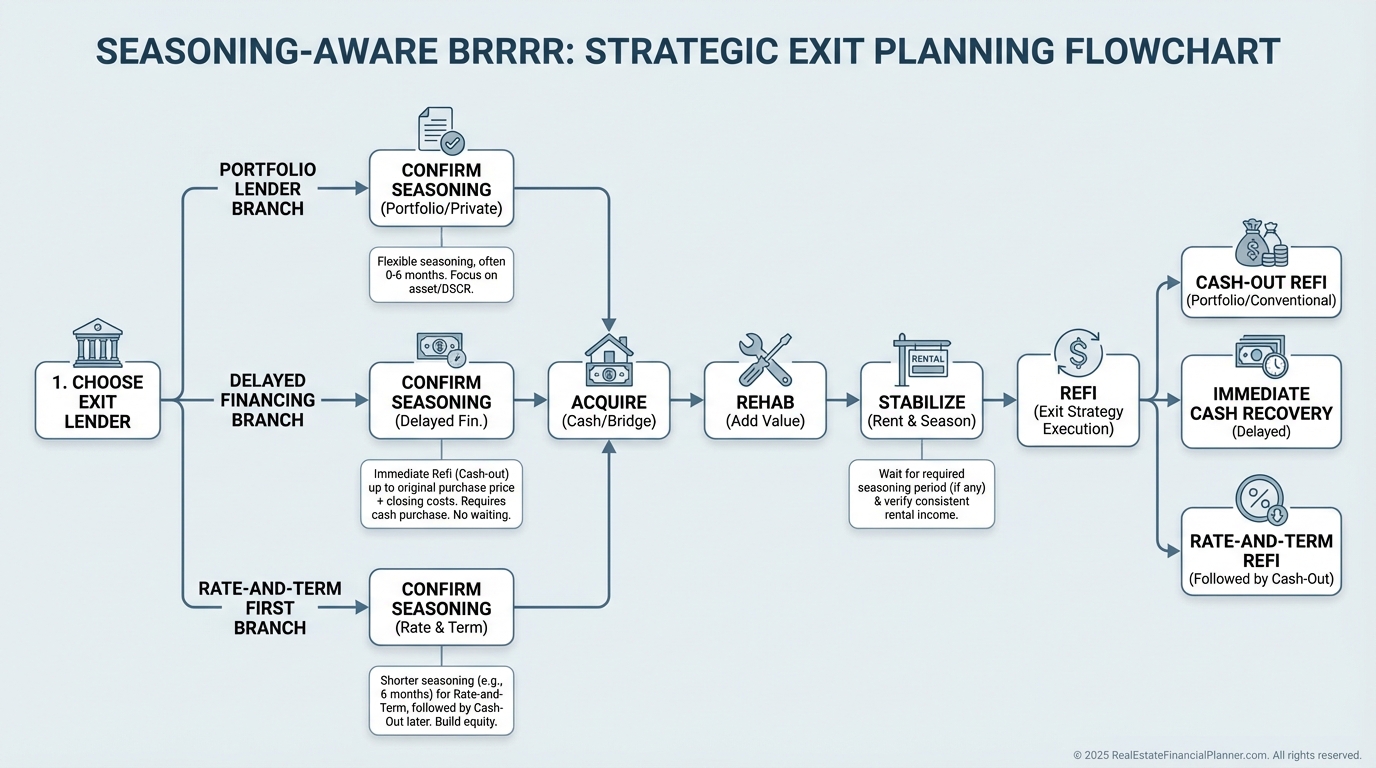

Financing Moves Affected by Seasoning

Cash-out refinance is the headliner. Most lenders want 6–12 months and may consider the lower of purchase-plus-improvements or appraised value early on.

Rate-and-term refis usually have fewer constraints, so I sometimes coach clients to refi terms first, then wait for cash-out eligibility.

HELOCs can require 12+ months, with extra hurdles if you bought below market.

Delayed financing is a powerful exception for cash buyers, but it only reimburses the purchase price and documented closing costs—not your rehab.

The True Return Impact

Let’s quantify opportunity cost.

Say you invested $250,000 cash into a fourplex and could otherwise earn 20% annually in alternative deals.

If a 12-month seasoning rule holds that capital in place, your opportunity cost is roughly $50,000 for that year. You may still want the deal—but decide with eyes open.

I track this in the spreadsheet as “capital at risk duration” and tie it into True Net Equity™ at each milestone.

Common Mistakes That Cost Investors

•

Assuming all lenders follow the same rulebook.

•

Ignoring seasoning in BRRRR pro formas and running out of cash.

•

Confusing property seasoning with loan seasoning.

•

Failing to cultivate portfolio lenders who can flex.

•

Poor documentation that weakens appraisals and underwriting.

•

Underestimating opportunity cost while capital sits.

When I review client files that went sideways, it’s rarely the rehab. It’s the timetable the lender needed and the investor didn’t plan for.

Cautionary Tale: The 12% Lesson

Marcus bought a distressed duplex for $120,000 and used hard money at 12% interest, planning to exit in 90 days.

His target takeout lender required 12 months of ownership for cash-out on an investment property.

Nine extra months at 12% erased $13,500. Half his projected profit evaporated because of one unchecked guideline.

Had Marcus verified seasoning and lined up a portfolio lender, he could have cut the delay and saved thousands.

Seasoning-Aware Strategy Design

I teach investors to “design the exit first.” Choose the lender and their seasoning rule, then work backward to your acquisition and rehab plan.

Tactics I use with clients:

•

Staggered acquisitions so refi windows arrive monthly or quarterly.

•

Maintain 3–5 portfolio lender relationships for options.

•

Bridge the seasoning period with private money or seller seconds, then refi into best long-term debt.

•

Use delayed financing after cash purchases when it fits.

•

Price in opportunity cost so you don’t chase paper returns that don’t beat your alternatives.

Nomad™ and Seasoning

Owner-occupant strategies like Nomad™ introduce their own clocks.

Plan for occupancy requirements, loan seasoning, and timeline to convert to rental. Nomad™ can unlock better rates and lower down payments, but the calendar still governs refi timing and cash-out access.

I build Nomad™ timelines with clear move-in dates, conversion dates, and the first eligible refi and HELOC windows.

How I Underwrite Seasoning Into Every Deal

Here is my simple checklist:

•

Confirm exit lender and seasoning rule in writing.

•

Build rehab plus stabilization timeline.

•

Add seasoning months past stabilization.

•

Price carrying costs and opportunity cost monthly.

•

Assemble the valuation file during rehab.

•

Calculate True Net Equity™ and Return Quadrants™ at each milestone.

•

Stress-test for 3 extra months of delay.

If the deal still works, buy it. If not, adjust leverage, price, or plan.

Your Next Step

Open The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Add a realistic seasoning window. Price the cost of time. Model velocity.

Then decide if this deal is actually your best use of capital for the next 6–12 months.

That is how you stop seasoning from stalling your growth—and start using it to plan compounding with precision.