Acquisition Costs: The Silent Deal Killer Most Investors Don’t Model

Learn about Acquisition Costs for real estate investing.

Acquisition Costs Are Where Most Deals Lie to You

When I help clients analyze properties, the numbers almost always look good at first.

Then we add acquisition costs.

That’s usually where the deal changes character.

After rebuilding from bankruptcy, I stopped trusting surface-level math. I learned to model everything that pulls cash out of your account before the property ever stabilizes.

Acquisition costs are not optional details.

They are the difference between projected returns and lived reality.

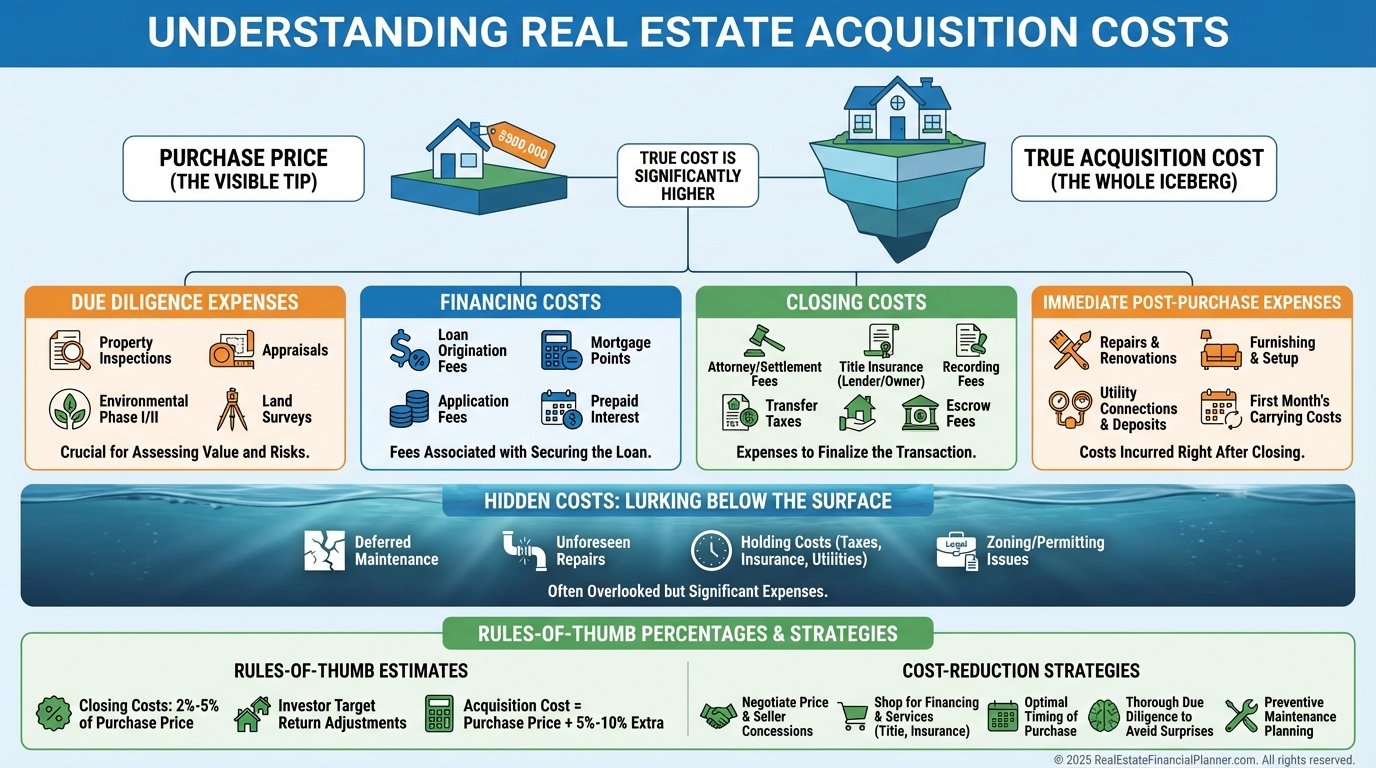

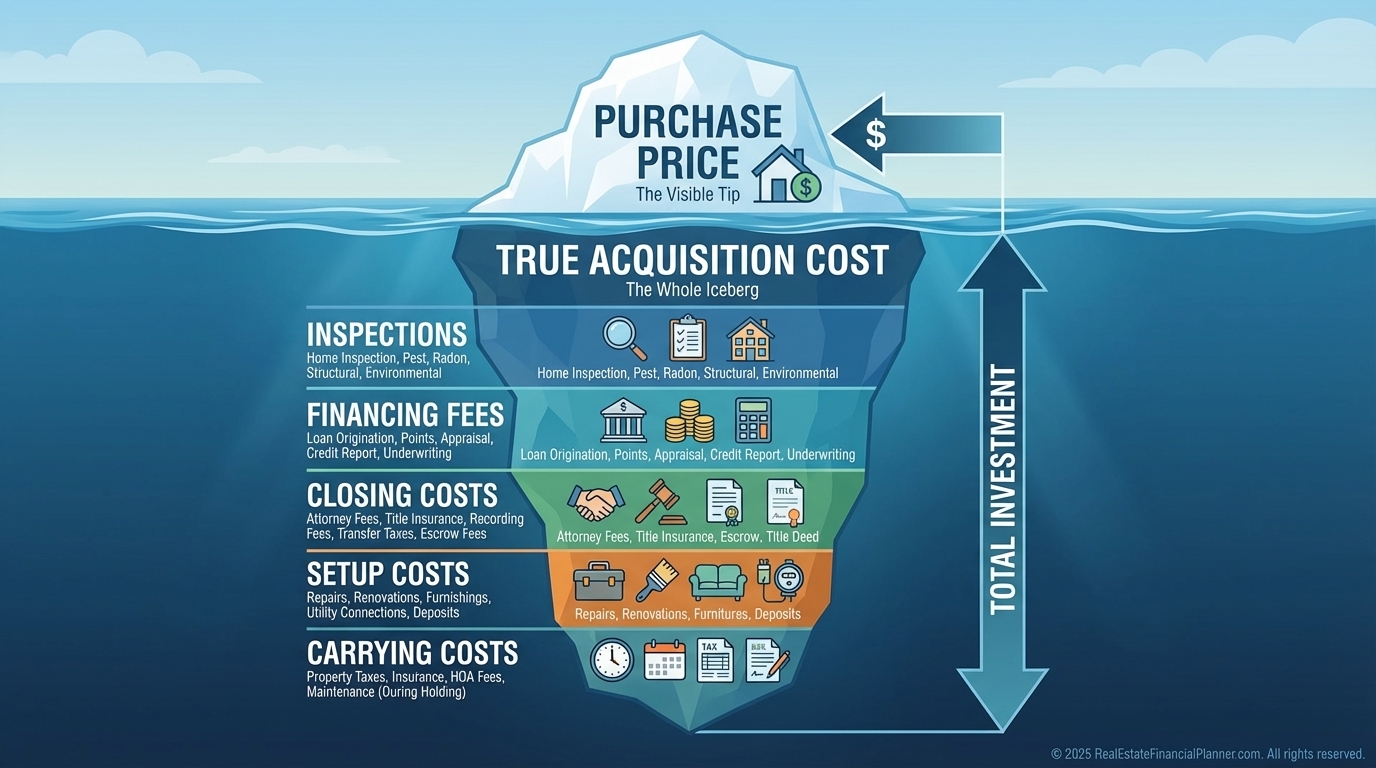

Purchase Price Is Not the Cost of the Deal

Most investors anchor on price.

That’s a mistake.

When I model deals in Real Estate Financial Planner™, I separate what you pay for the property from what it costs to acquire it.

That hidden gap is often five to ten percent.

On tight deals, that gap wipes out the upside.

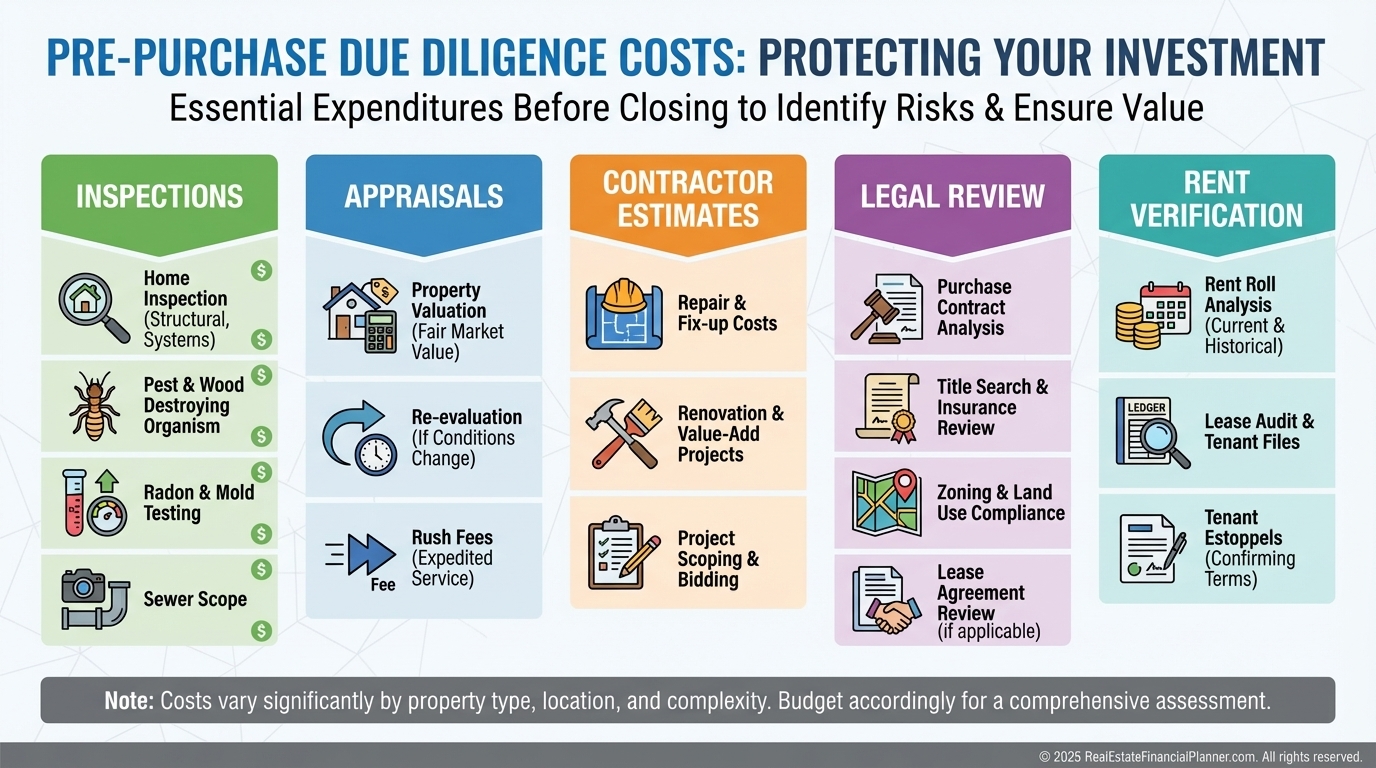

Due Diligence Is the Cost of Certainty

Before closing, you pay to reduce uncertainty.

Inspections.

Appraisals.

Contractor walk-throughs.

That money is gone whether you close or not.

I warn clients not to fall in love before this stage.

Due diligence doesn’t make deals safer.

It makes bad deals visible.

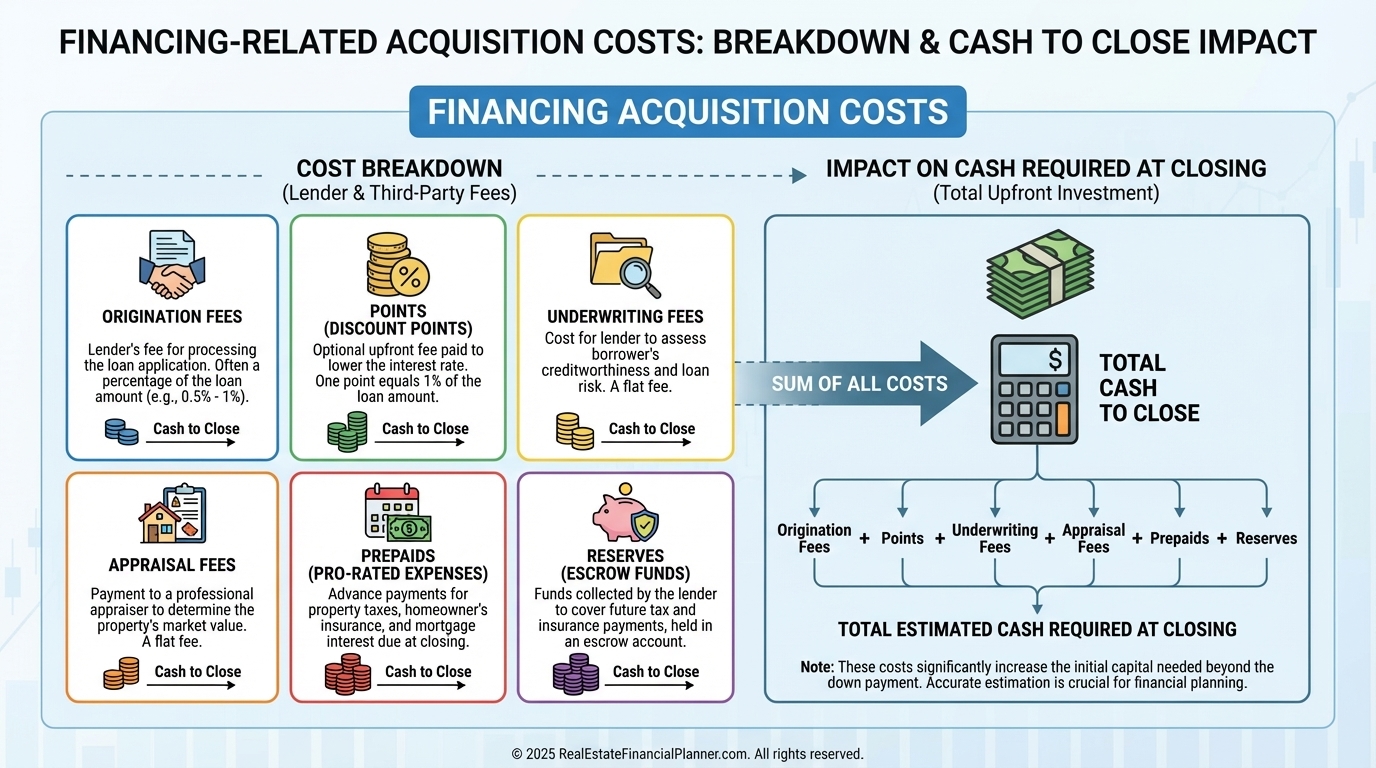

Financing Makes Leverage Expensive Upfront

Leverage amplifies returns later.

It drains cash immediately.

Origination fees.

Points.

Prepaids.

Reserves.

When I compare loan options, I don’t just ask, “What’s the rate?”

I ask, “How much cash leaves the account on day one?”

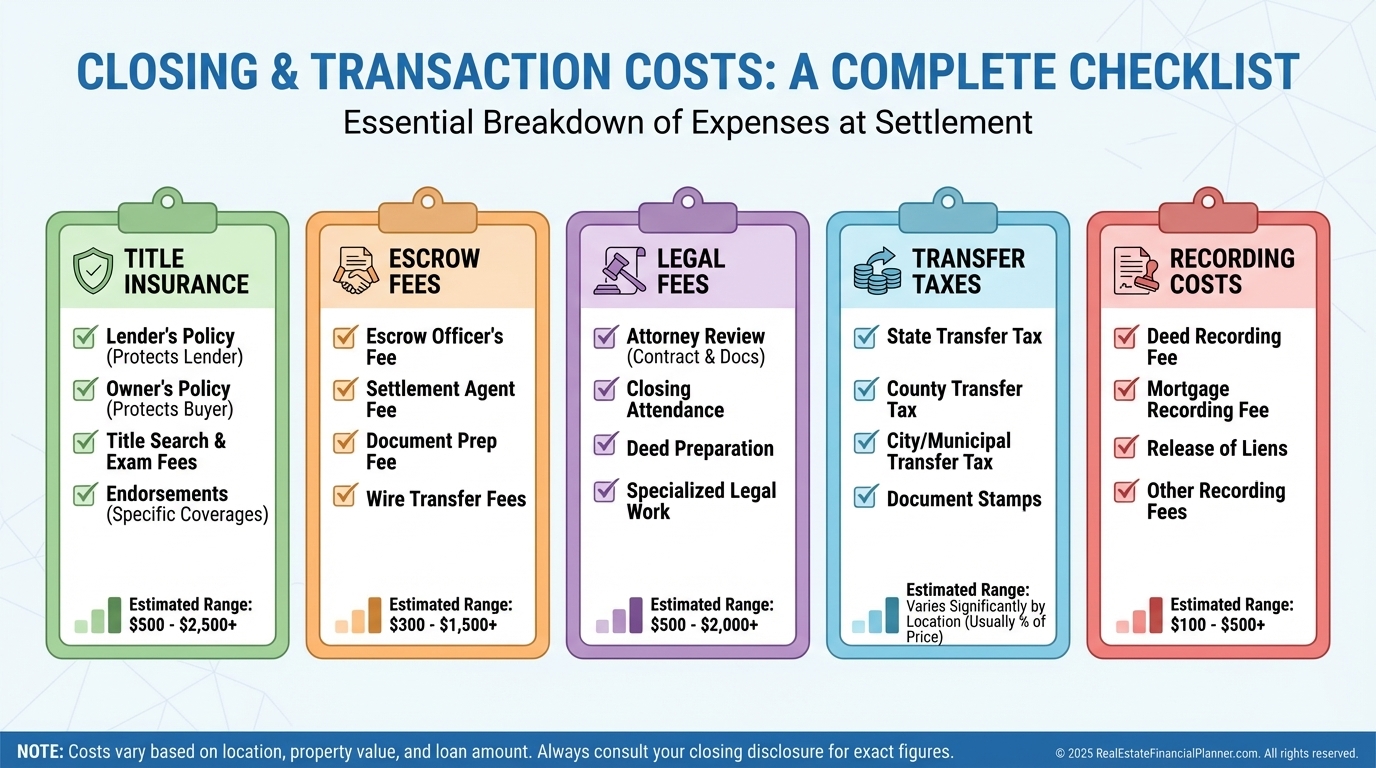

Closing Costs Are Predictable—If You Count Them

Closing costs feel routine.

That’s why they’re dangerous.

In high-tax states, transfer taxes alone can erase an entire year of cash flow.

Ignoring them doesn’t make them smaller.

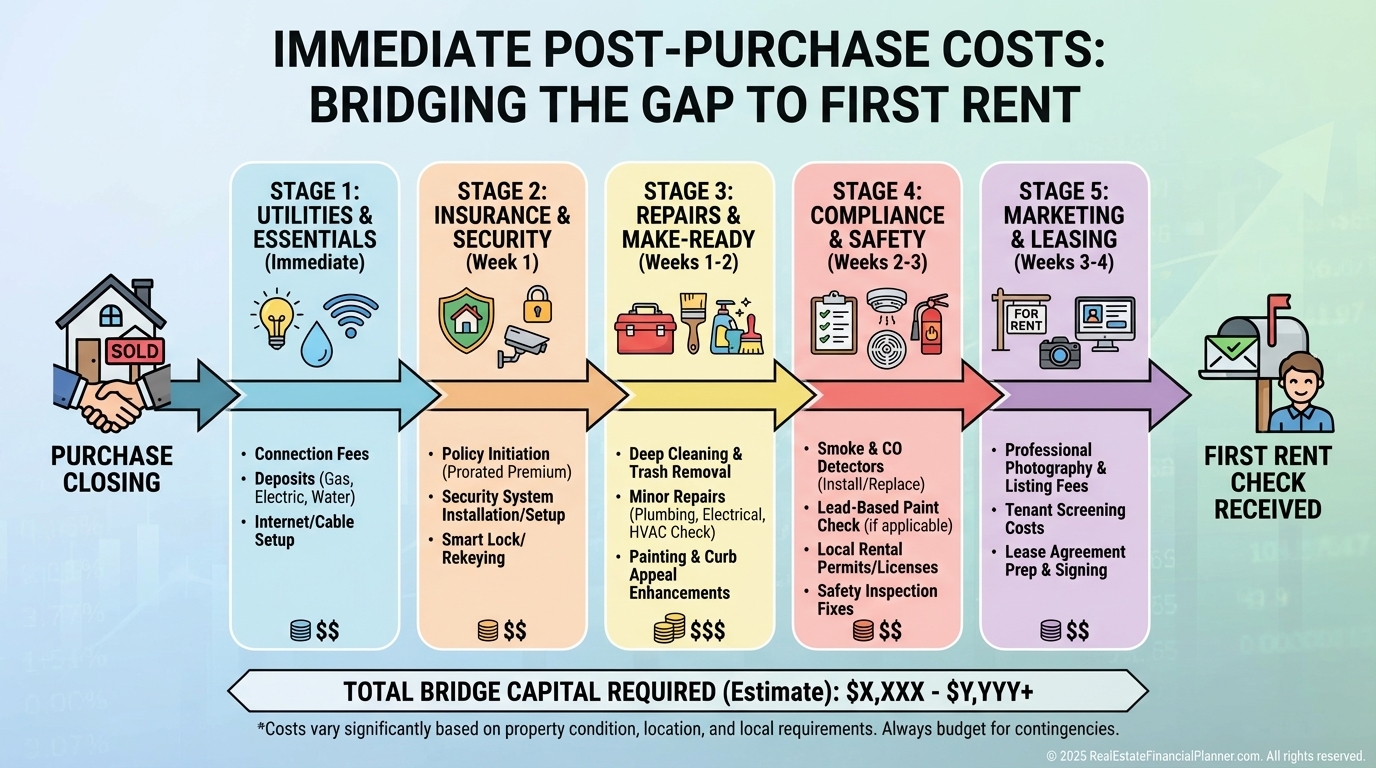

The Property Is Still Losing Money After Closing

After closing, the clock keeps running.

Rent hasn’t arrived yet.

This is why acquisition costs are separate from operating expenses.

They hit faster.

They hit harder.

The Costs Investors Forget to Model

Even experienced investors miss these:

When I calculate True Net Equity™, acquisition costs directly reduce what you actually have at risk.

Inflated assumptions lead to inflated returns.

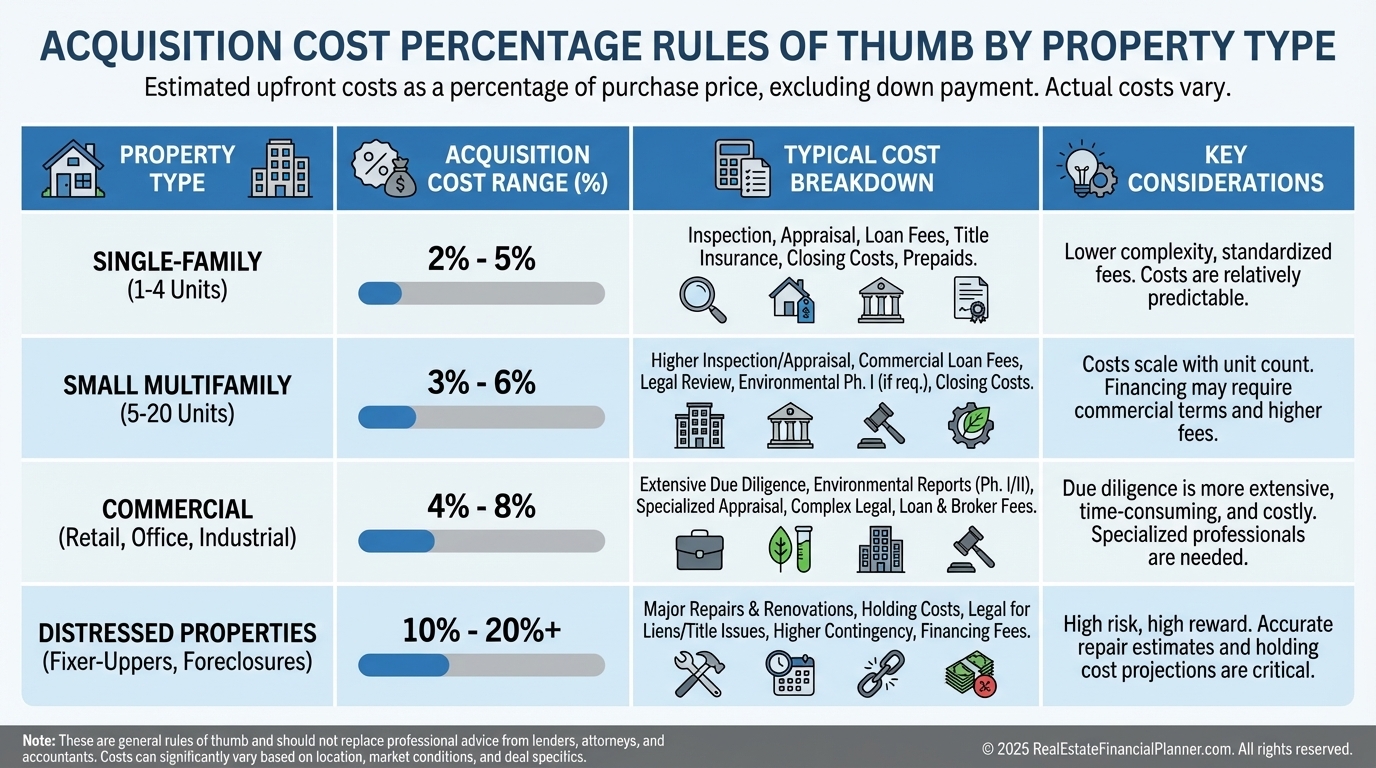

How I Estimate Acquisition Costs Quickly

Before deep analysis, I sanity-check the numbers.

If a deal only works when acquisition costs are unrealistically low, it doesn’t work.

Why Acquisition Costs Shape Long-Term Returns

Acquisition costs don’t just reduce cash flow.

They distort Return on Investment.

They distort Return on Equity.

They distort Return on True Net Equity™.

They determine whether scaling accelerates or stalls.

Good investors don’t ignore acquisition costs.

They model them early, honestly, and without optimism.