Cash on Cash Return on Investment: The Metric That Quietly Decides Whether a Deal Funds Your Life or Drains It

Learn about Cash on Cash Return on Investment for real estate investing.

Cash on Cash Return on Investment Overview

When I help clients analyze rental properties, cash on cash return on investment is usually the number they think they understand best.

It is also the number most investors get wrong.

When I rebuilt my own portfolio after bankruptcy, I learned the hard way that paper returns do not pay real bills. Only cash does. Cash on cash return forces you to confront that reality head-on.

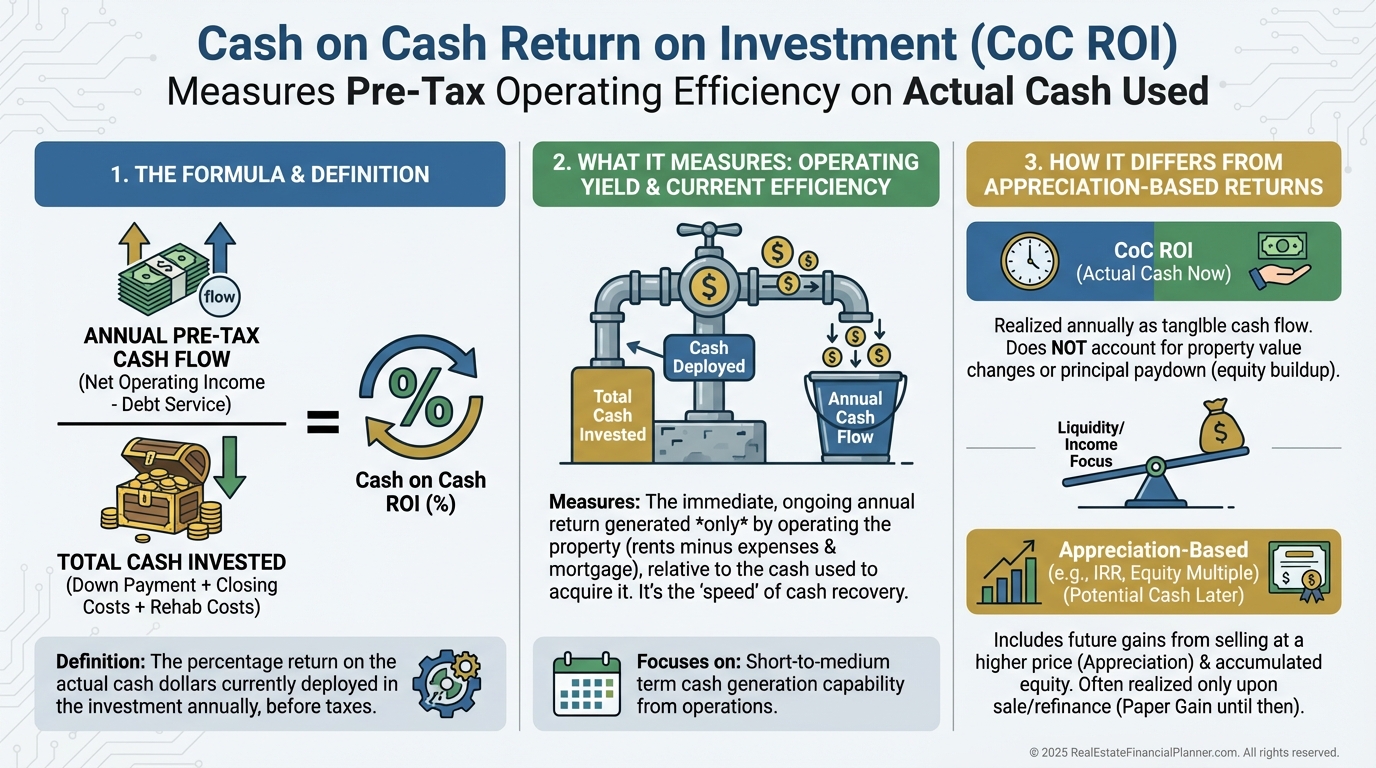

What Cash on Cash Return on Investment Actually Measures

Cash on cash return on investment answers one brutally simple question.

For every dollar of your own cash you put into a property, how much cash comes back to you each year?

That means spendable cash. Not appreciation. Not loan paydown. Not tax theory.

Just money you can use.

Cash on Cash Return Defined

When I review deals for investors, this is the metric that tells me whether a property supports their lifestyle or quietly sabotages it.

Cash on cash return lives on the Cash Now side of the Return Quadrants™. It reflects income you can actually touch.

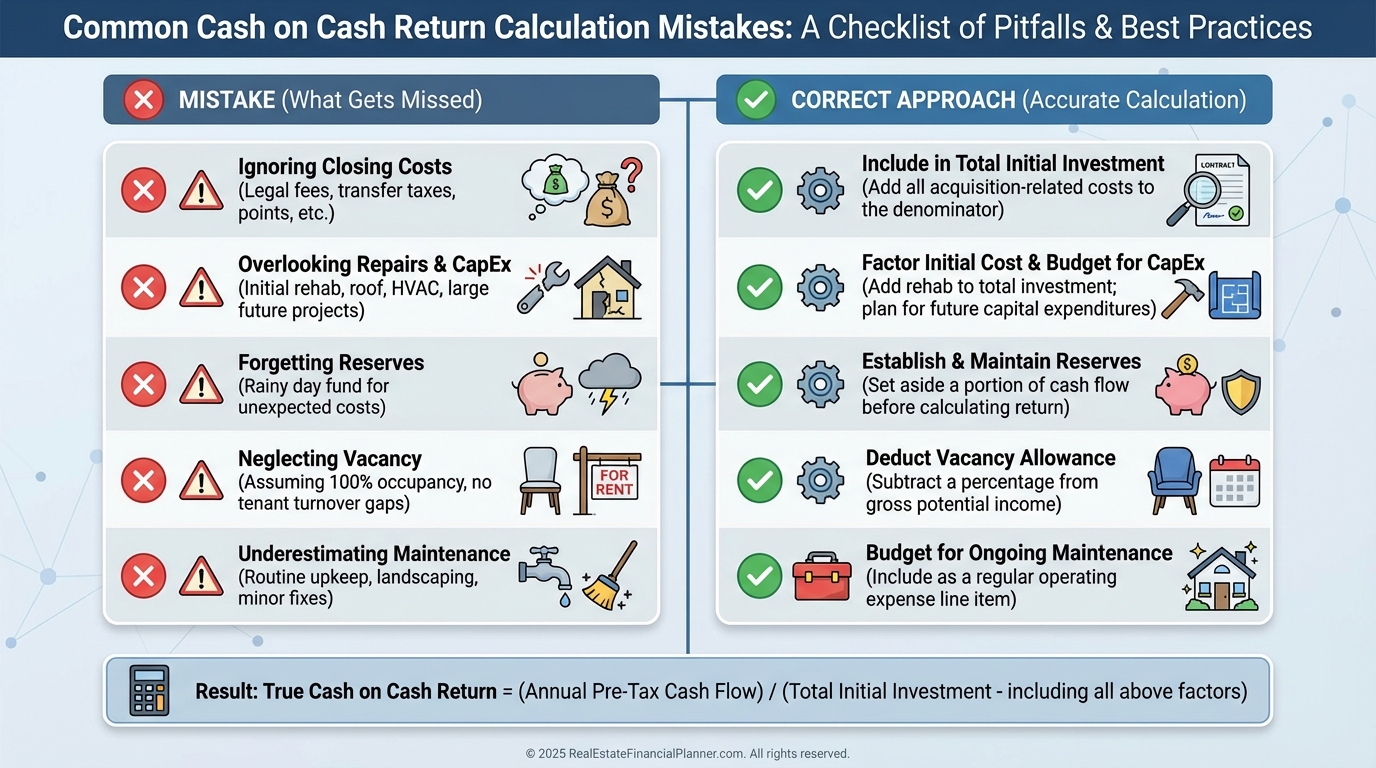

Why Investors Miscalculate It So Often

Nearly every bad calculation starts the same way.

Someone divides cash flow by the down payment and calls it a day.

That shortcut creates confidence without accuracy.

When clients bring me deals, I usually find three missing pieces.

They forget closing costs.

They ignore initial repairs.

They pretend reserves are optional.

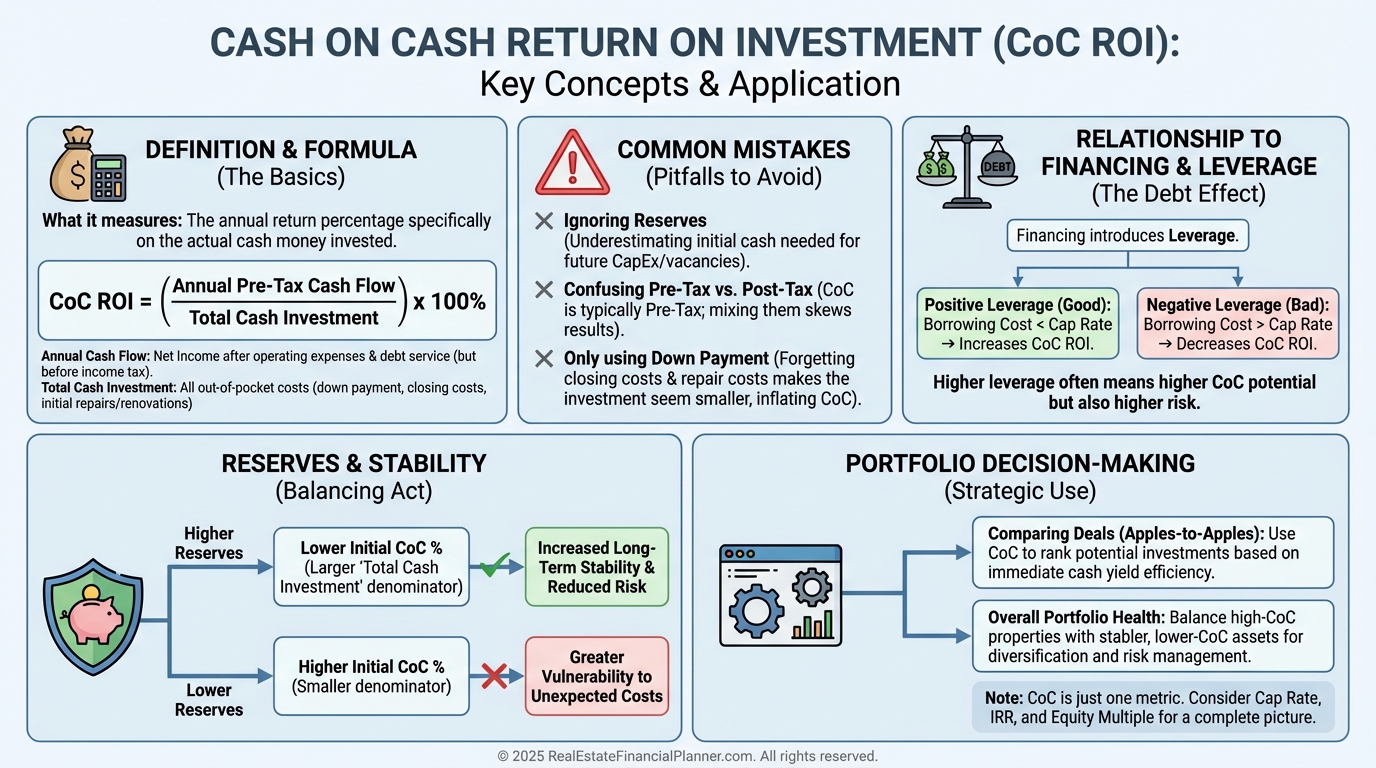

Common Cash on Cash Calculation Errors

Those errors inflate returns on paper while quietly shrinking real-world results.

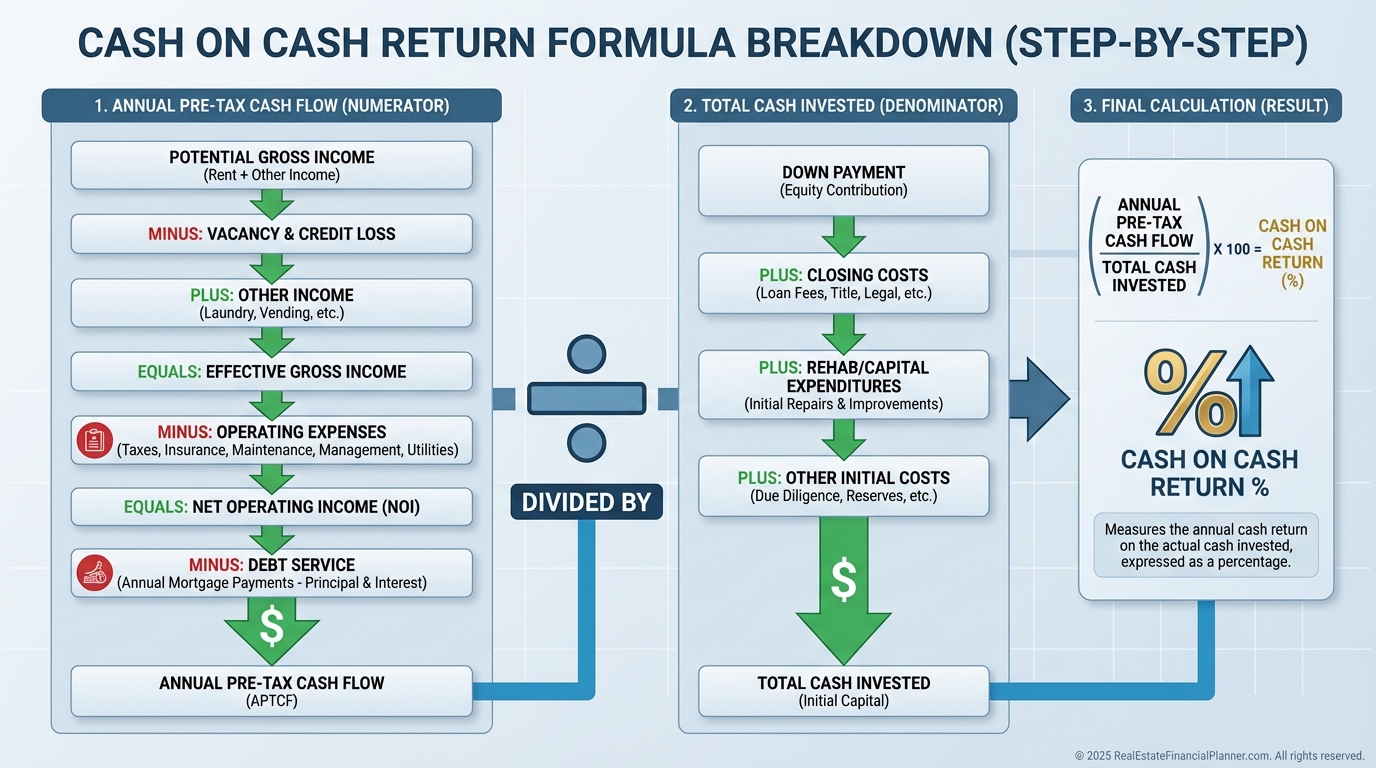

The Correct Formula, Without Shortcuts

The formula itself is simple.

Cash on Cash Return on Investment =

Annual Pre-Tax Cash Flow ÷ Total Cash Invested

The discipline is in defining each input correctly.

Total cash invested includes every dollar you cannot easily get back tomorrow.

That means down payment, closing costs, repairs, and initial reserves.

Annual cash flow means after vacancy, after expenses, and after debt service.

If the money does not make it into your checking account, it does not count.

Cash on Cash Return Formula Breakdown

This is why tools like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ exist. Precision matters.

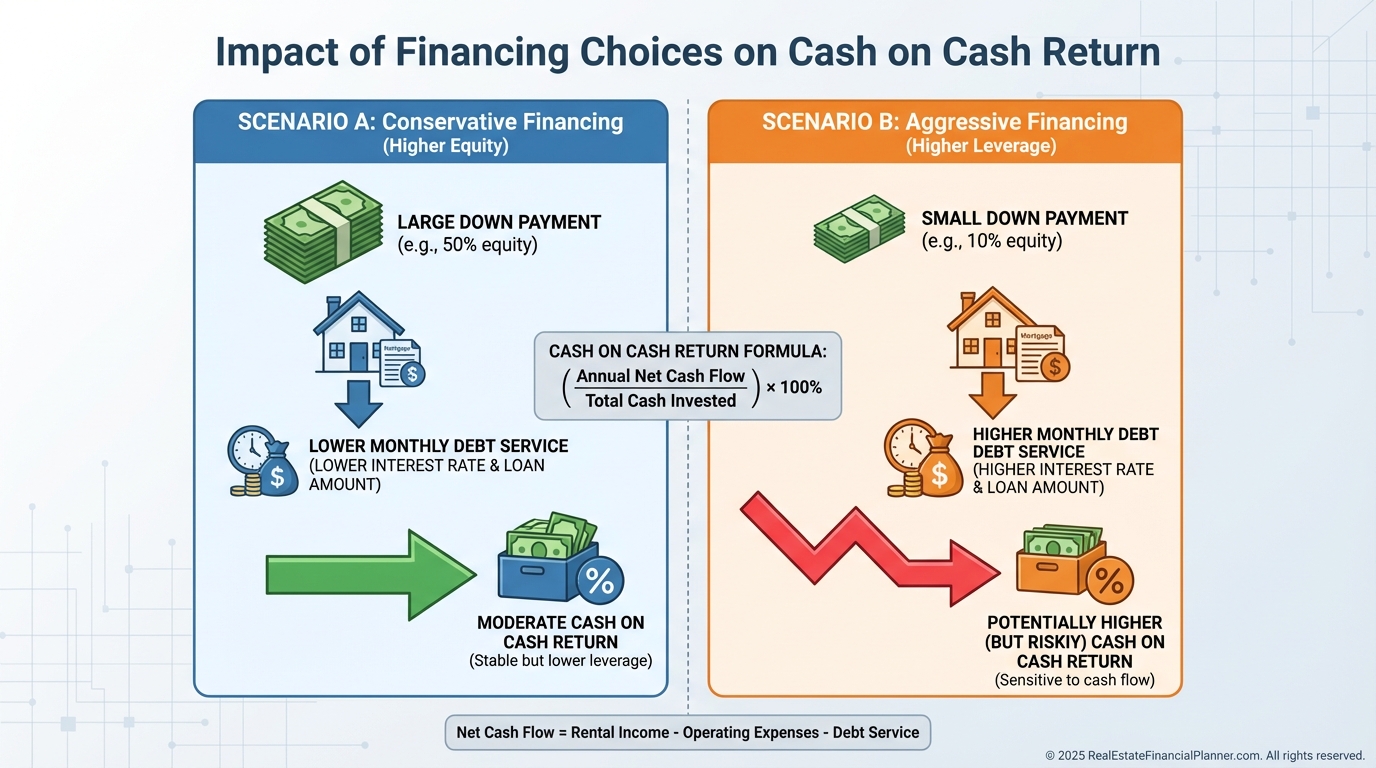

Financing Changes Everything

Two investors can buy the same property and experience wildly different returns.

The difference is financing.

Interest rate, down payment, and loan type directly shape cash flow.

A lower rate with more cash down often produces higher cash on cash returns than maximum leverage with bad terms.

Financing Impact on Cash on Cash Returns

When I model deals, I always test multiple financing scenarios. The best return is rarely the most obvious one.

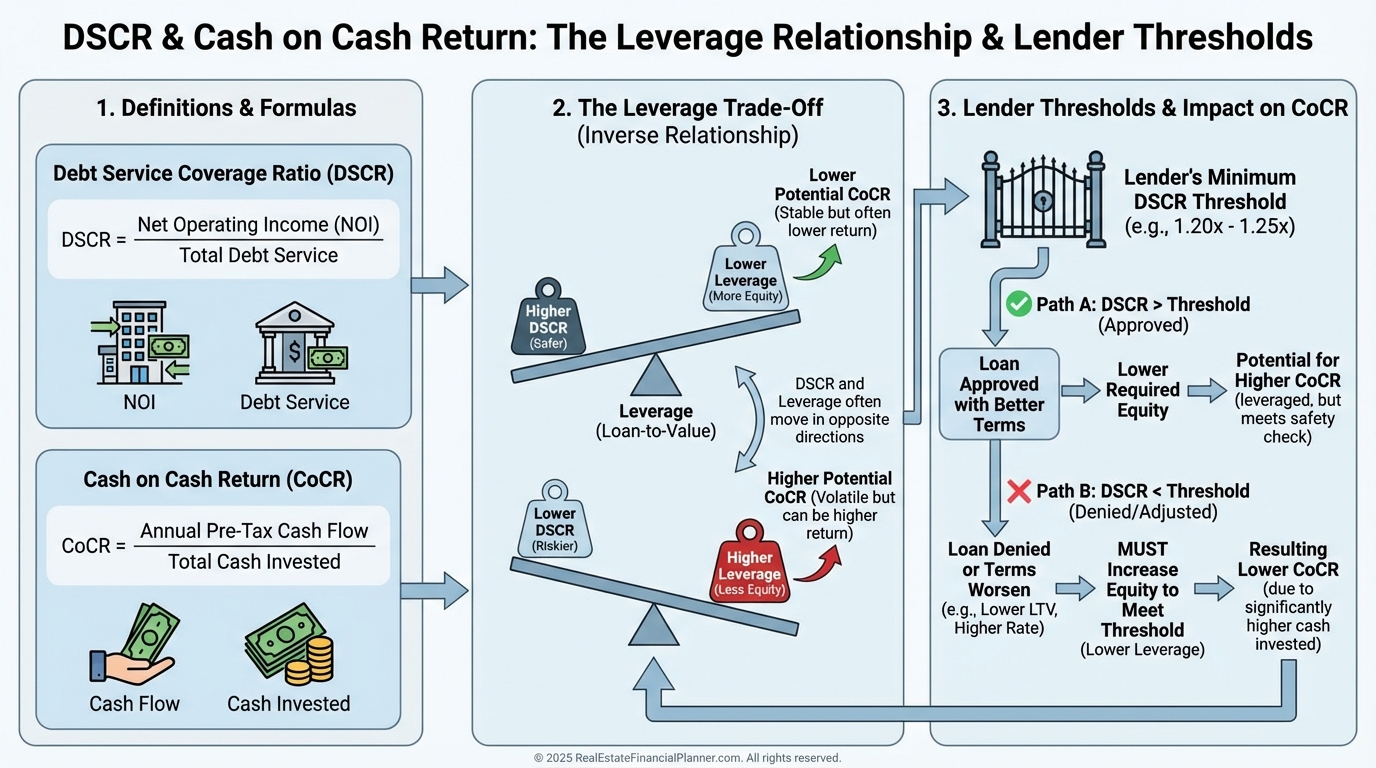

How Lenders Quietly Cap Your Returns

Lenders care about one thing more than your projected return.

They care about debt service coverage ratio.

If your property cannot safely cover the loan, the deal stops there.

This creates an invisible ceiling on achievable cash on cash returns.

DSCR and Cash on Cash Relationship

Strong cash on cash returns often unlock better financing later through refinances or portfolio loans.

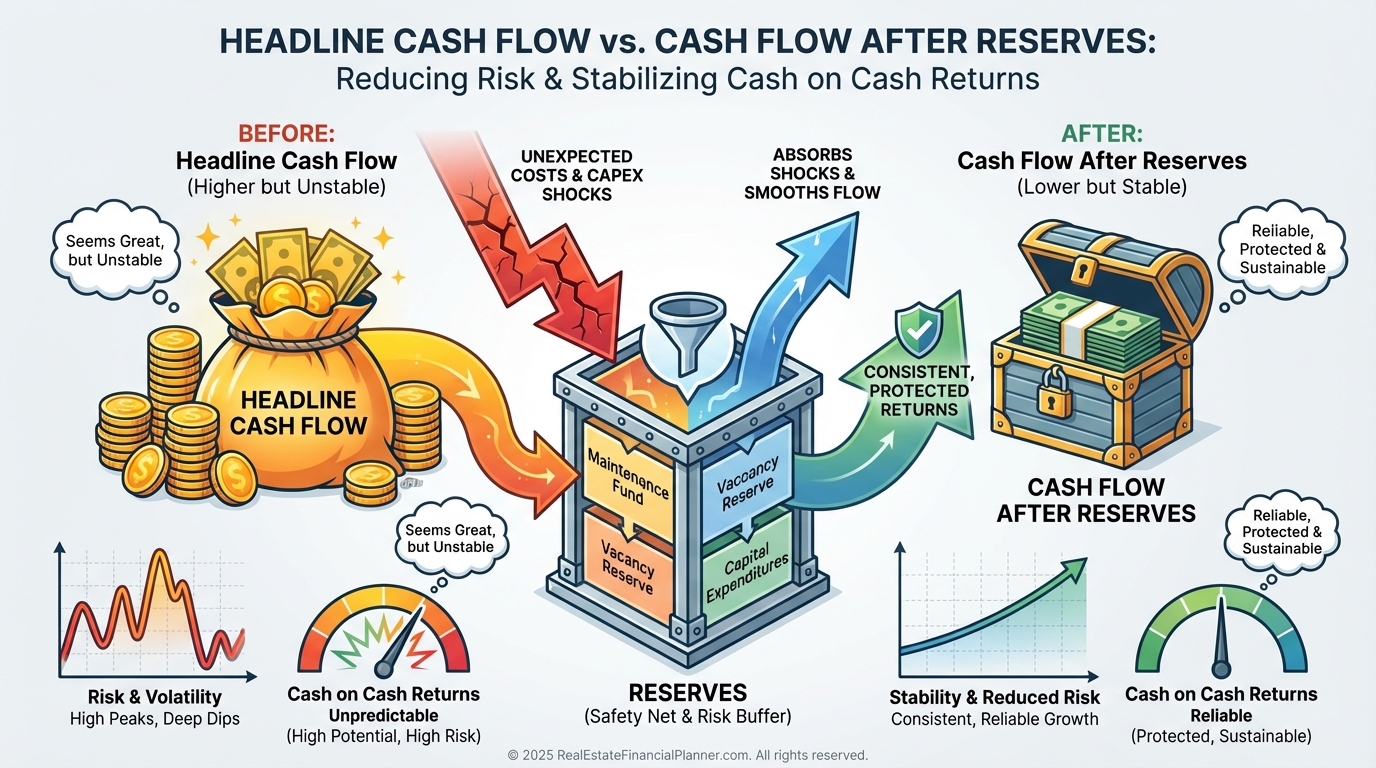

Why Reserves Are Non-Negotiable

When investors argue with me about reserves, I already know how the story ends.

Every property eventually needs capital.

Roofs fail. HVAC systems quit. Tenants leave at the worst time.

Cash on cash return without reserves is fantasy math.

Cash Flow vs Cash Flow After Reserves

This is why I track returns with and without reserves inside the Return Quadrants™. Reality lives in the conservative numbers.

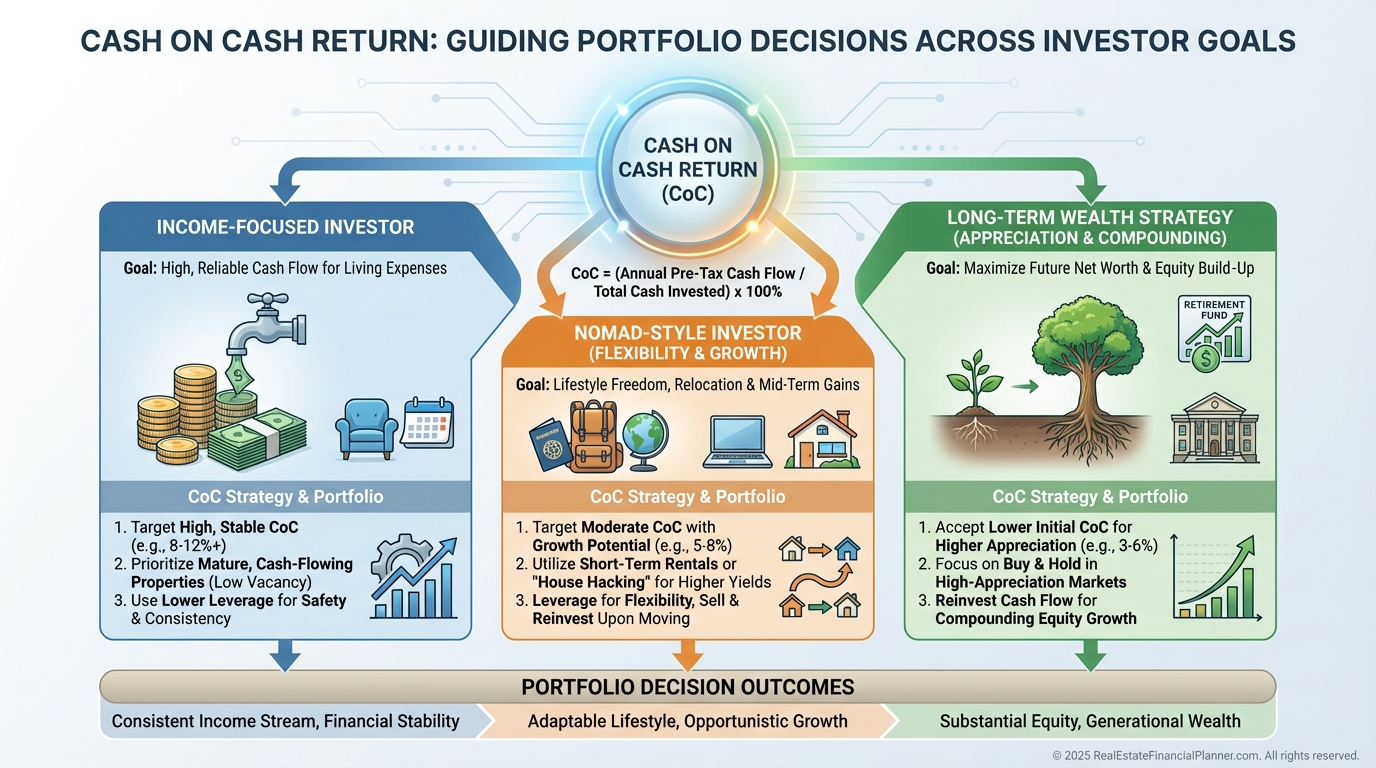

How Cash on Cash Guides Better Decisions

Cash on cash return is not about chasing the highest percentage.

It is about alignment.

When I work with Nomad™ investors, we often accept lower early returns in exchange for long-term flexibility and stability.

When I work with income-focused investors, we demand higher returns from day one.

Using Cash on Cash Return for Portfolio Strategy

The metric does not make the decision for you. It keeps you honest while you make it.

The Bottom Line

Cash on cash return on investment is not exciting.

It is not flashy.

It is honest.

It tells you whether a property feeds your life or quietly drains it.

The investors who build durable wealth are not the ones chasing appreciation headlines. They are the ones who understand their numbers deeply and refuse to lie to themselves.

Run your deals correctly. Include everything. Stress-test your assumptions.

That discipline compounds faster than any hot market ever will.