General Partners in Real Estate Syndications: How to Vet, Align, and Win With the Right GP

Learn about General Partners for real estate investing.

Why General Partners Decide Your Outcomes

When I help clients choose between two similar deals, the deciding factor is almost always the General Partner.

A skilled GP compounds tiny daily advantages into exits that beat pro forma, while a sloppy GP compounds risk.

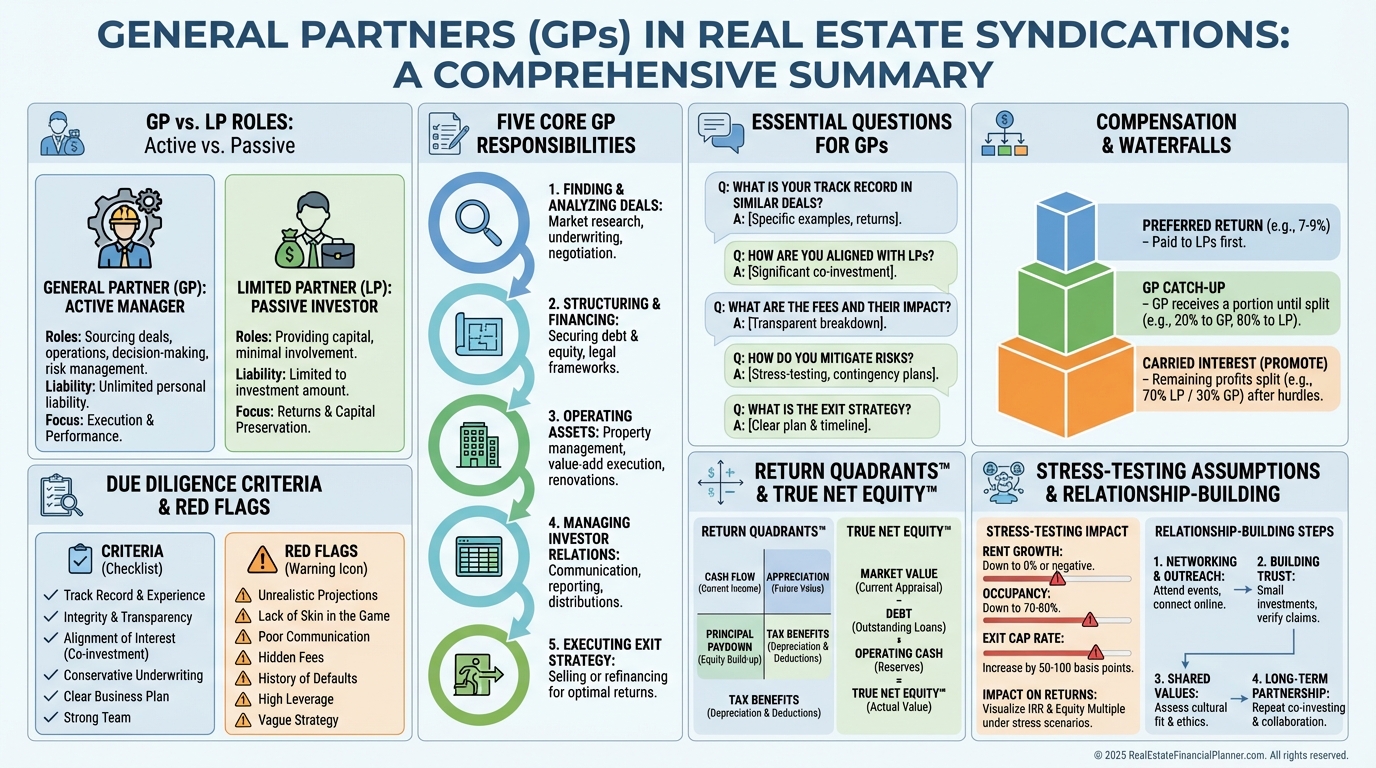

What Is a General Partner?

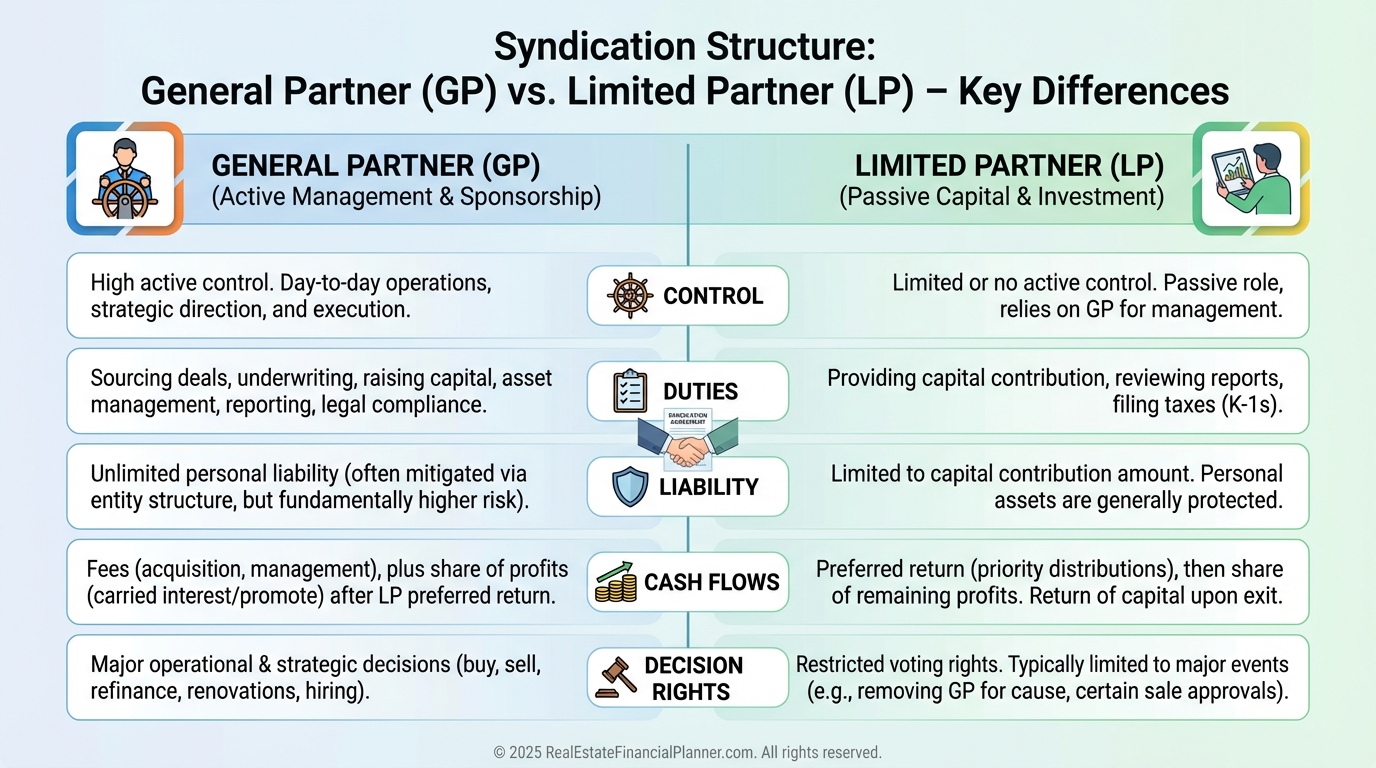

A General Partner (GP) leads the syndication, makes decisions, signs on debt, and carries the operational burden.

Limited Partners (LPs) supply capital and stay passive, trading control for diversification and time freedom.

The Five Core Responsibilities of a GP

Great GPs source and underwrite superior deals others never see.

They raise capital compliantly, manage assets with precision, report financials clearly, and time exits well.

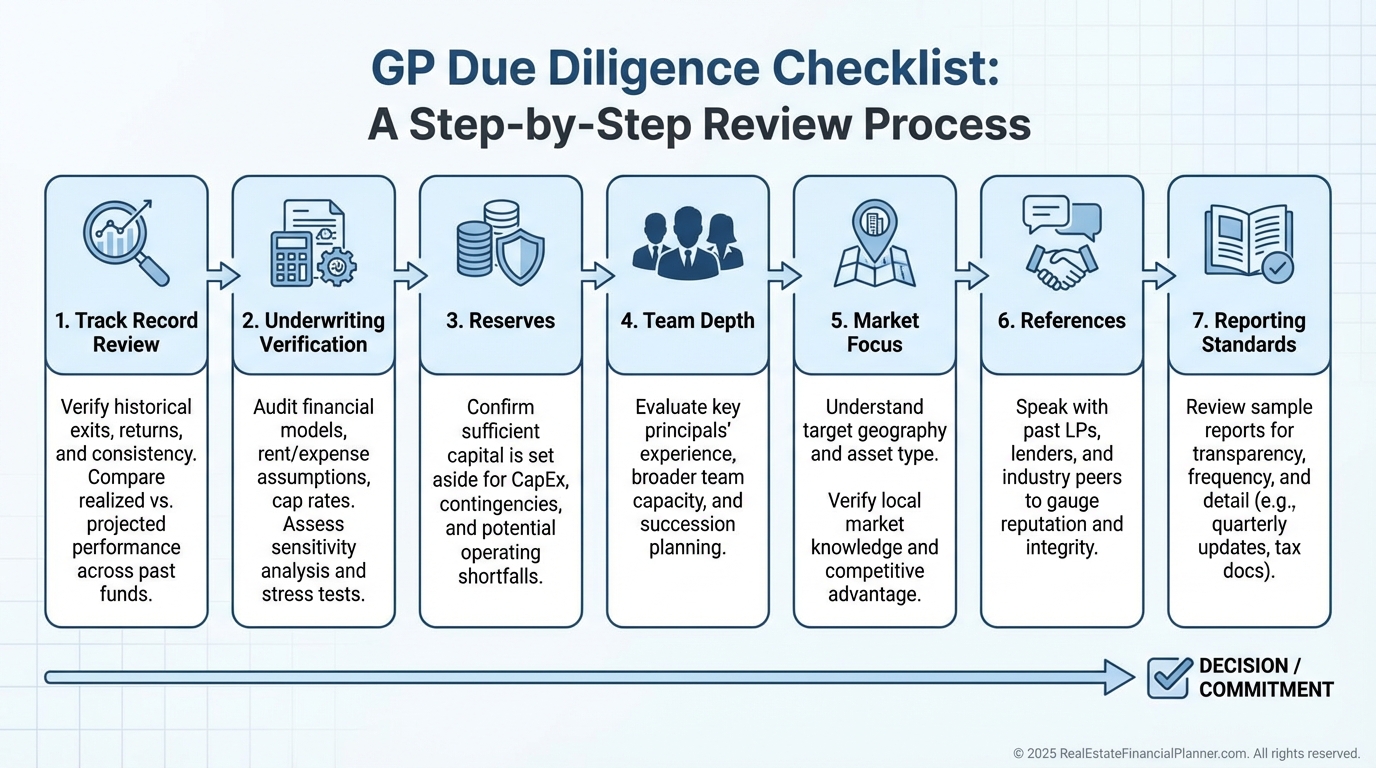

How I Evaluate a GP

I start with full‑cycle track record across multiple market conditions, not just recent acquisitions.

Then I compare their underwriting to market reality using The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

If the deal only works with best‑case inputs, I pass and advise clients to pass.

What I Verify Before Wiring

I confirm DSCR stays ≥ 1.25 under conservative rent and expense assumptions.

I verify interest rate caps, extension options, and refinance feasibility under higher rates.

I want evidence of vendor bench strength, especially management and construction.

Alignment, Control, and Communication

I prefer GPs who co‑invest 5–10% of the equity and take most upside through promote, not front‑loaded fees.

I test their communication cadence by asking tough questions and timing responses.

If a GP gets defensive before you invest, expect silence when things get bumpy.

Red Flags I Warn Clients About

Unrealistic IRRs built on rosy exit caps or aggressive rent growth are deal killers.

Thin reserves, fee‑heavy structures, and unwillingness to share financials point to avoidable pain.

Essential Questions to Ask a GP

Ask how many full‑cycle deals they have, and what their worst deal taught them.

Request references from investors who experienced both smooth and rough periods.

Have them walk you through their underwriting line by line, including stress tests.

Clarify reserves, insurance coverage, interest rate protection, and contingency triggers.

Ask for a precise fee table and when each fee is earned versus paid.

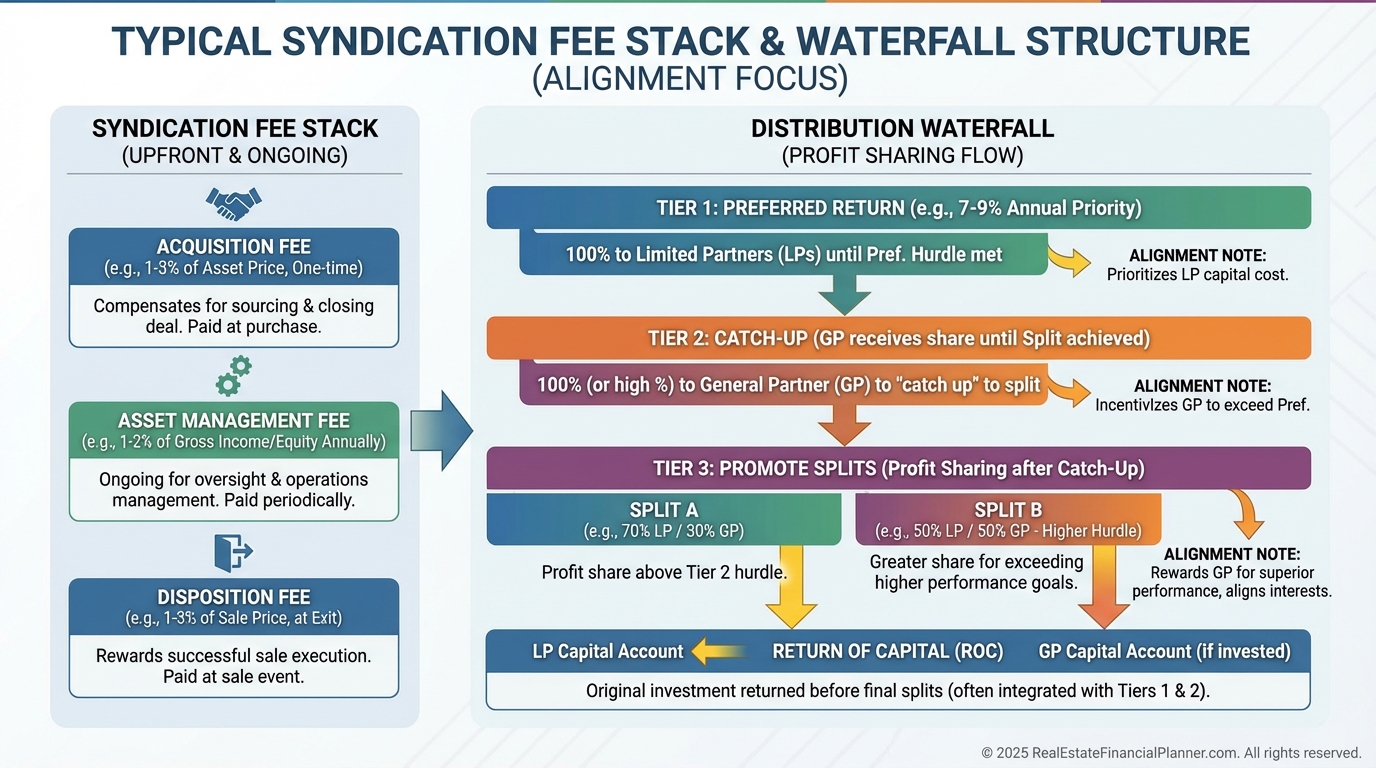

GP Compensation and Real Alignment

Acquisition fees of 1–3% are normal if they are not the main paycheck.

Asset management fees of 1–2% should fund oversight, reporting, and execution.

Promote should dominate total GP compensation and only activate after preferred returns.

Disposition fees are fine if tied to outcomes and disclosed clearly.

Applying REFP Frameworks to GPs

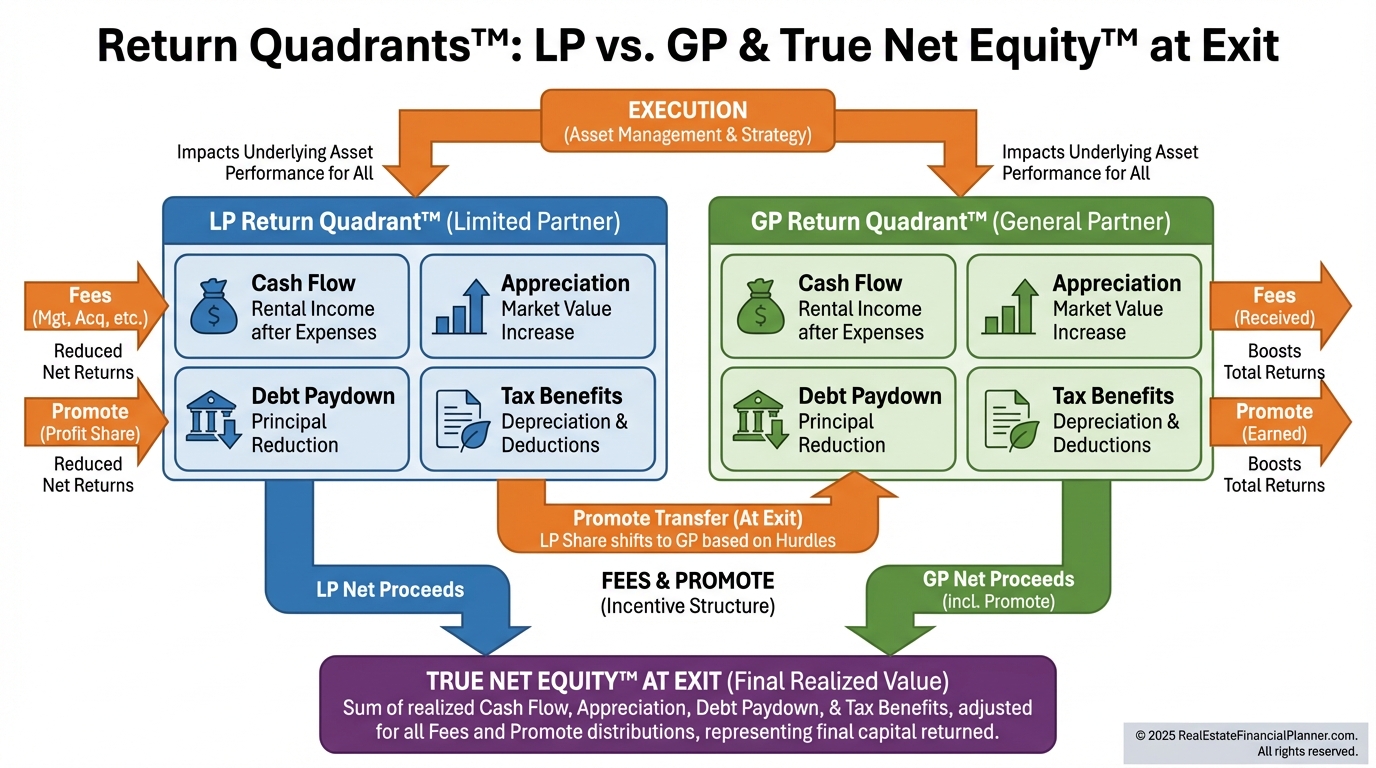

I decompose returns with Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

For LPs, each quadrant is reduced by fees and execution slippage, which is why GP quality matters most.

For exits and refis, I calculate True Net Equity™ after debt, closing costs, promote, and taxes.

That number, not paper value, is what funds your next deal.

My Process When Two GPs Look Similar

I re‑underwrite with conservative inputs and compare downside cases.

I score communication clarity, team depth, reserves policy, and market focus.

I favor the GP who can show boring, repeatable systems over flashy decks.

Building Relationships With GPs

The best allocations go to investors who show up early, ask smart questions, and close decisively.

I meet GPs at conferences, watch their webinars, tour assets, and request investor memos from past deals.

I track monthly reporting quality before I ever wire.

For Aspiring GPs

If you lack cycle‑tested deals, build operating reps now.

Co‑GP with an experienced operator only when your contribution is real and defined.

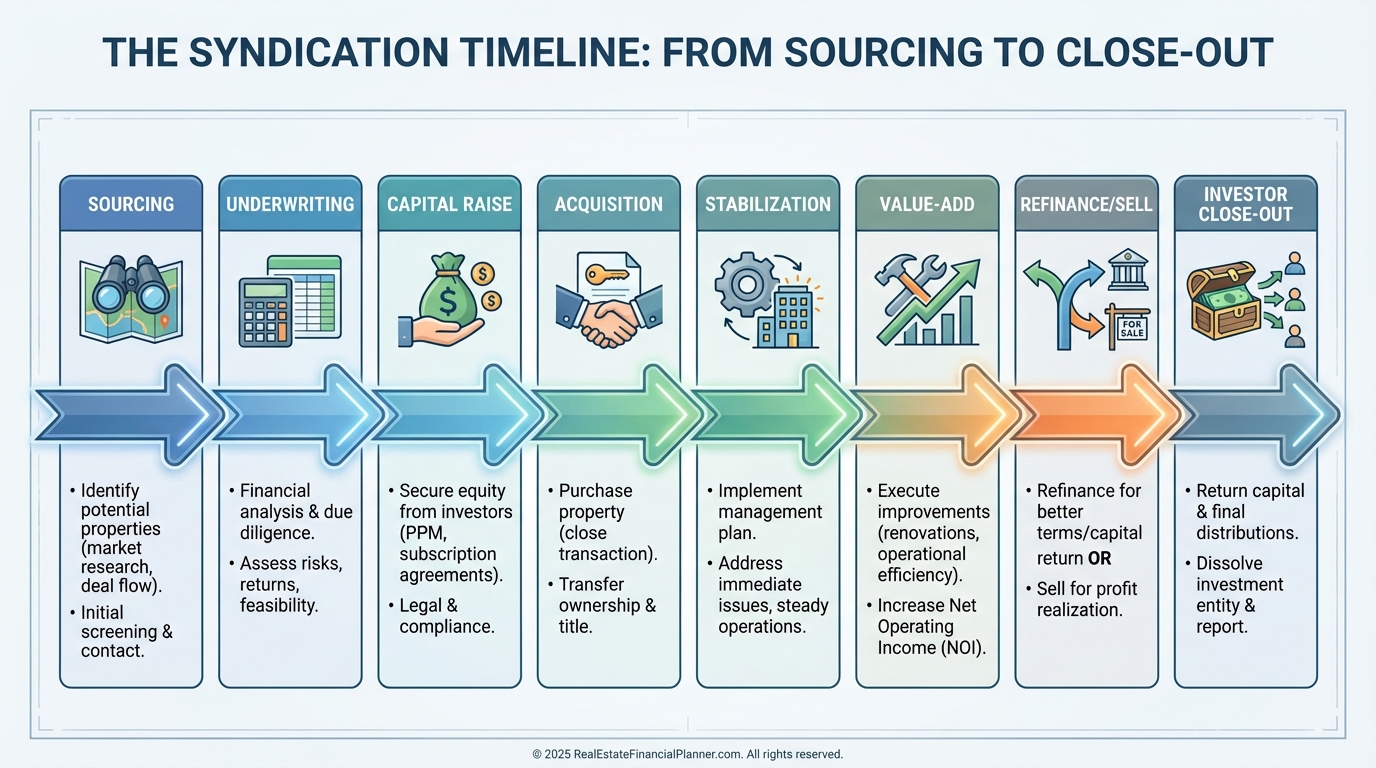

From Sourcing to Exit: A Simple Timeline

Great GPs build proprietary deal flow via broker trust and direct owner relationships.

They sequence diligence, financing, CapEx, leasing, and exit planning before day one.

Action Steps You Can Take Today

Download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and re‑underwrite your top two GP deals.

Build a GP scorecard with categories for track record, communication, alignment, reserves, team, and market expertise.

Require written stress tests and confirm rate protection and contingency budgets.

Start with a smaller allocation, audit reporting for six months, then scale with the winners.

Document everything so your process improves with each deal.