Nothing Down Real Estate, Done Right: 8 Ethical Strategies I Use to Acquire Properties Without Your Cash

Learn about Nothing Down for real estate investing.

When I help clients get their first property, the myth I dismantle first is “you need $50,000+ to begin.”

You need strategy, structure, and stamina—then capital follows.

“Nothing down” doesn’t always mean no dollars change hands.

It means your down payment doesn’t come from your personal savings.

Sometimes it truly is zero down.

More often, you re-route the down payment from partners, programs, or the end buyer.

My job is to show you how to do that cleanly, legally, and with a plan to hold or exit.

The Rules of Nothing Down Today

Markets change, fundamentals don’t.

Nothing down works best when your offer solves a seller’s problem faster than a conventional buyer can.

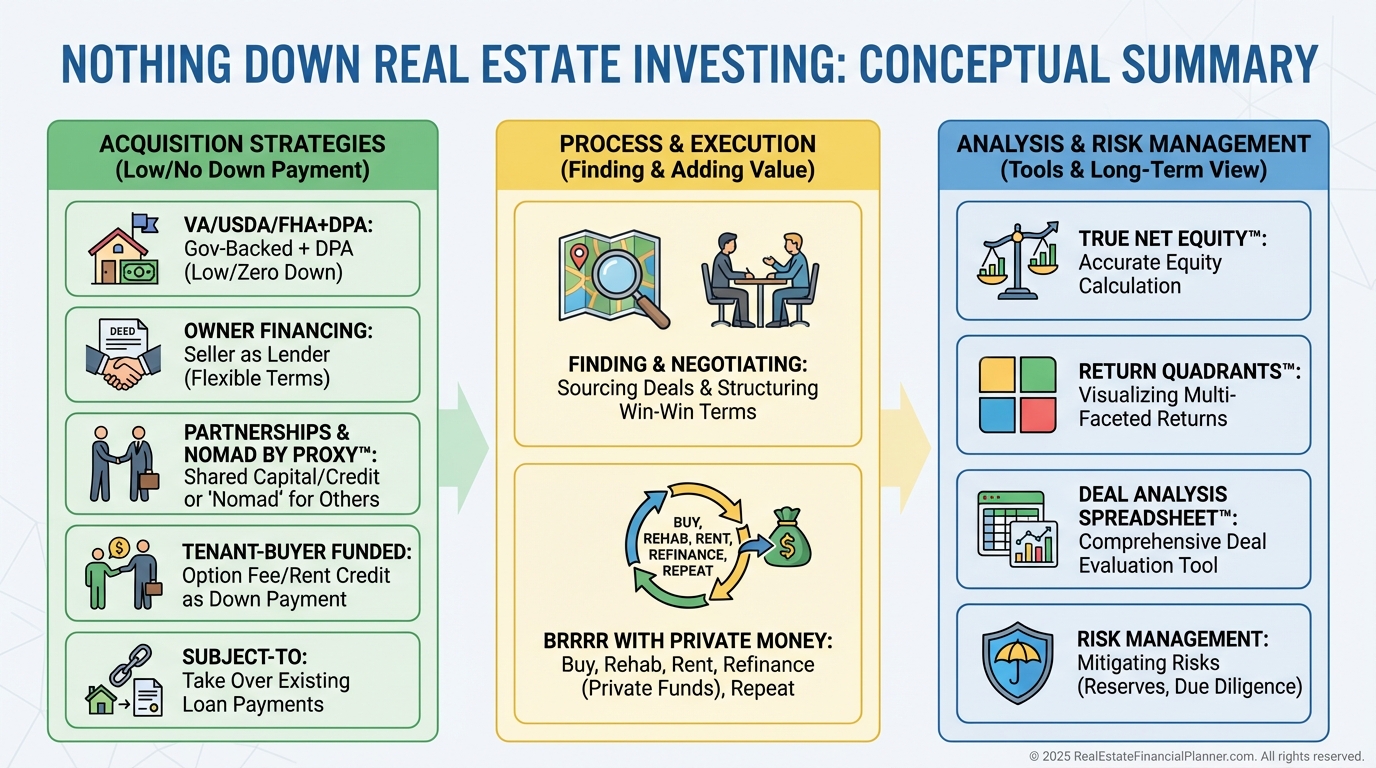

When I model deals, I start with Return Quadrants™ to see where my profit actually comes from.

Then I calculate True Net Equity™ so I know what I really own after costs, penalties, and payoff.

If those two pass, I keep negotiating.

If they don’t, I walk, no matter how “creative” the structure looks.

Government-Backed Paths to Zero

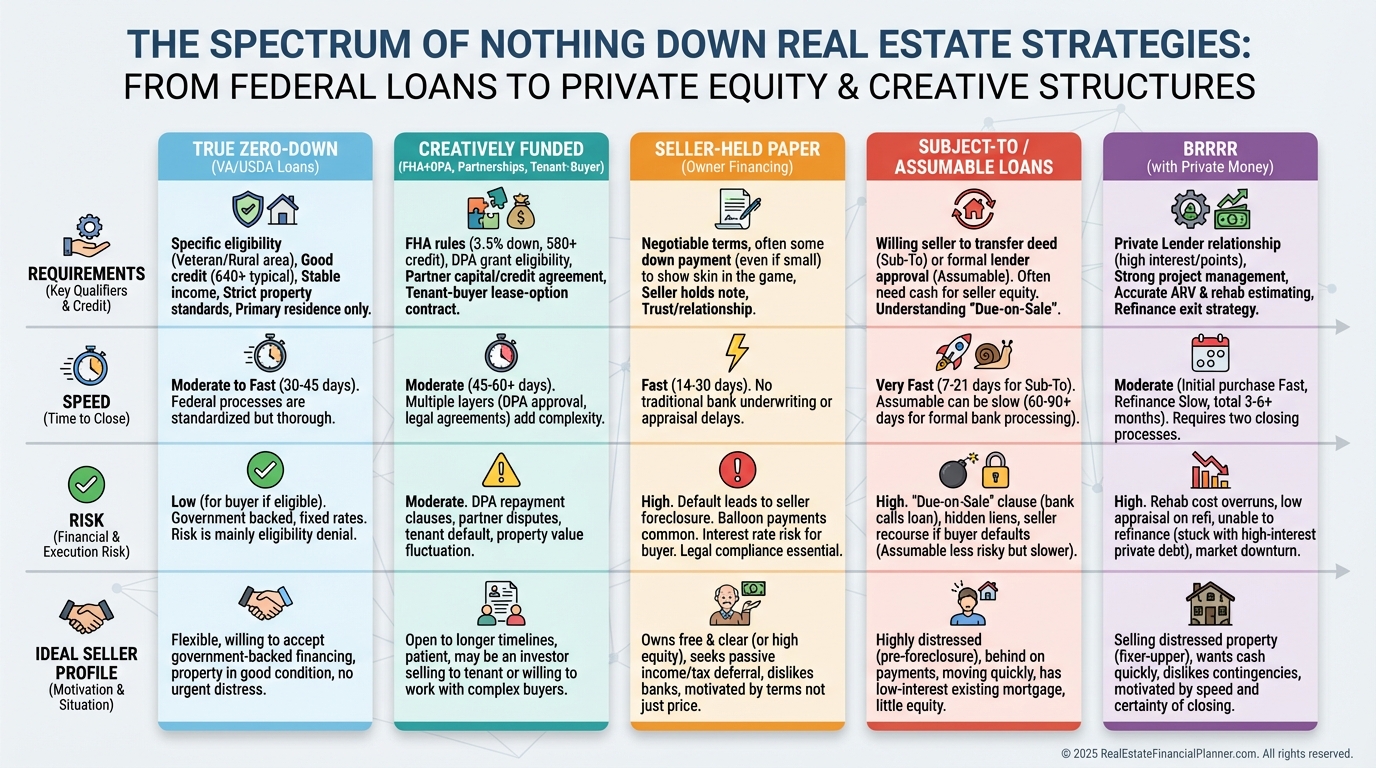

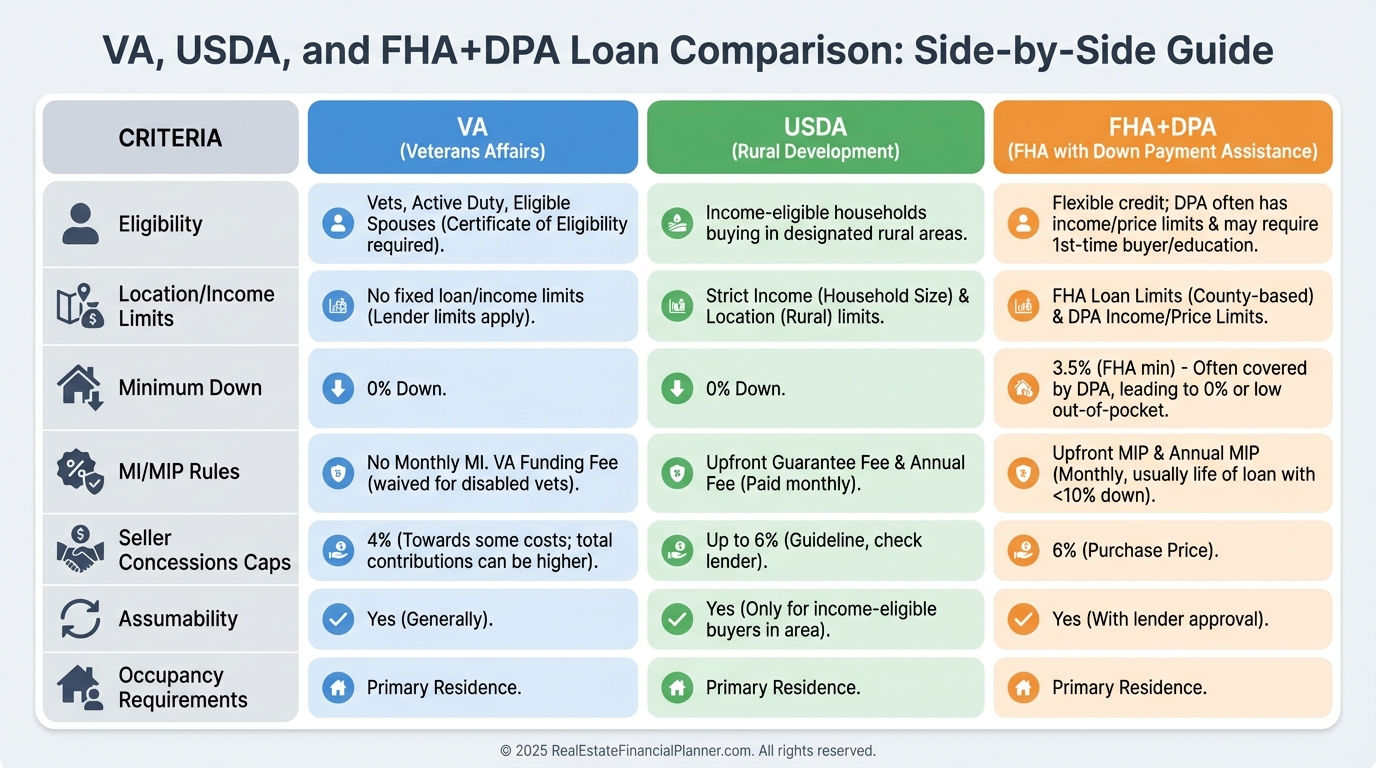

The fastest ethical path to nothing down remains VA and USDA.

For suburban and rural areas, USDA quietly unlocks 100% in places most buyers don’t realize qualify.

FHA isn’t zero down, but 3.5% can be bridged with down payment assistance, gifts, or negotiated credits.

I model total payment with MIP and buy-down costs so clients see the true monthly, not the teaser rate.

Owner Financing That Actually Closes

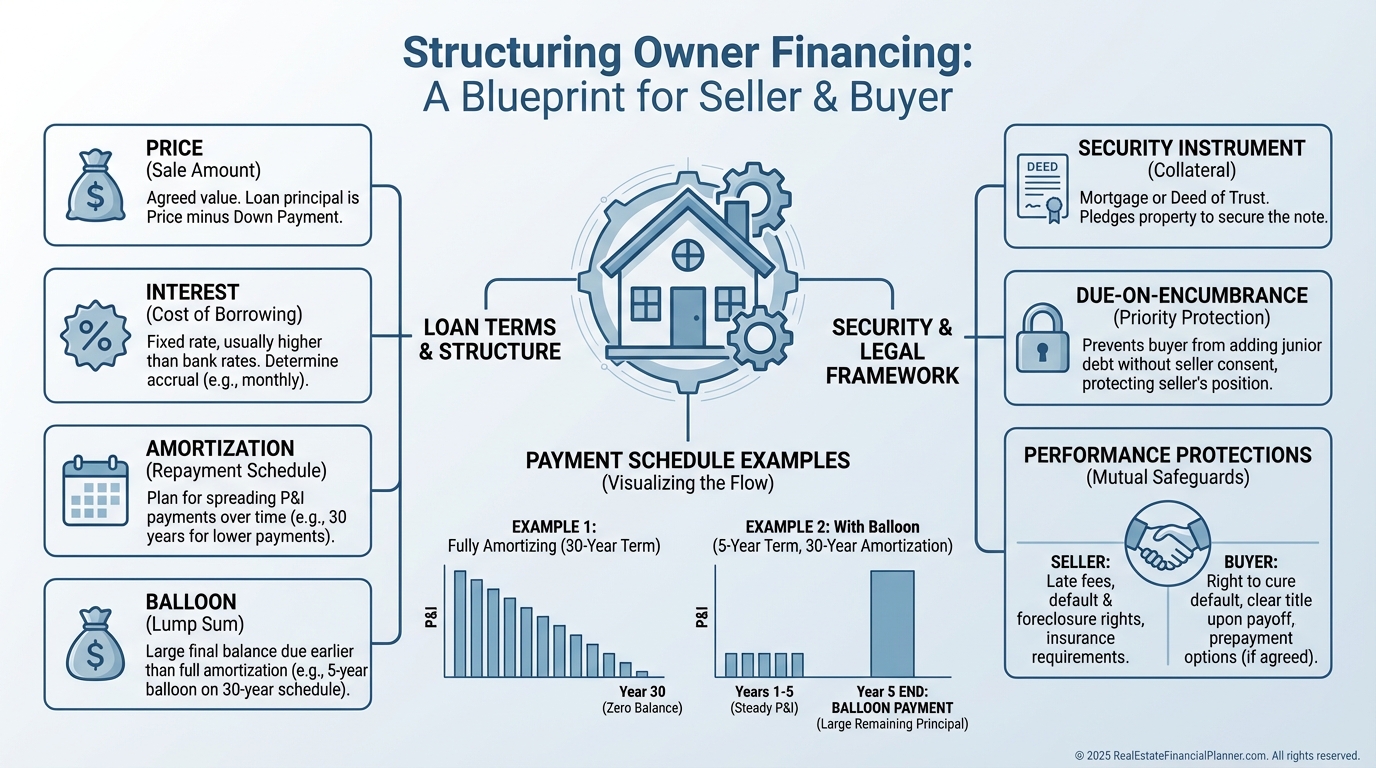

Owner financing is where many investors imagine “nothing down,” but the seller still must want the terms more than cash.

I target free-and-clear owners and long-time landlords because their True Net Equity™ is high and they value monthly income.

I structure clear notes: interest rate, amortization, balloon, and prepayment rights.

If the seller wants a down payment, I source it from a partner, a private lender, or a tenant-buyer’s option fee—never by overpaying.

I always confirm no underlying lien unless we’re intentionally wrapping, and I disclose in writing.

Partnerships That Pay the Down Payment

Nothing down doesn’t mean doing it alone.

It means you contribute something other than cash that’s equally valuable.

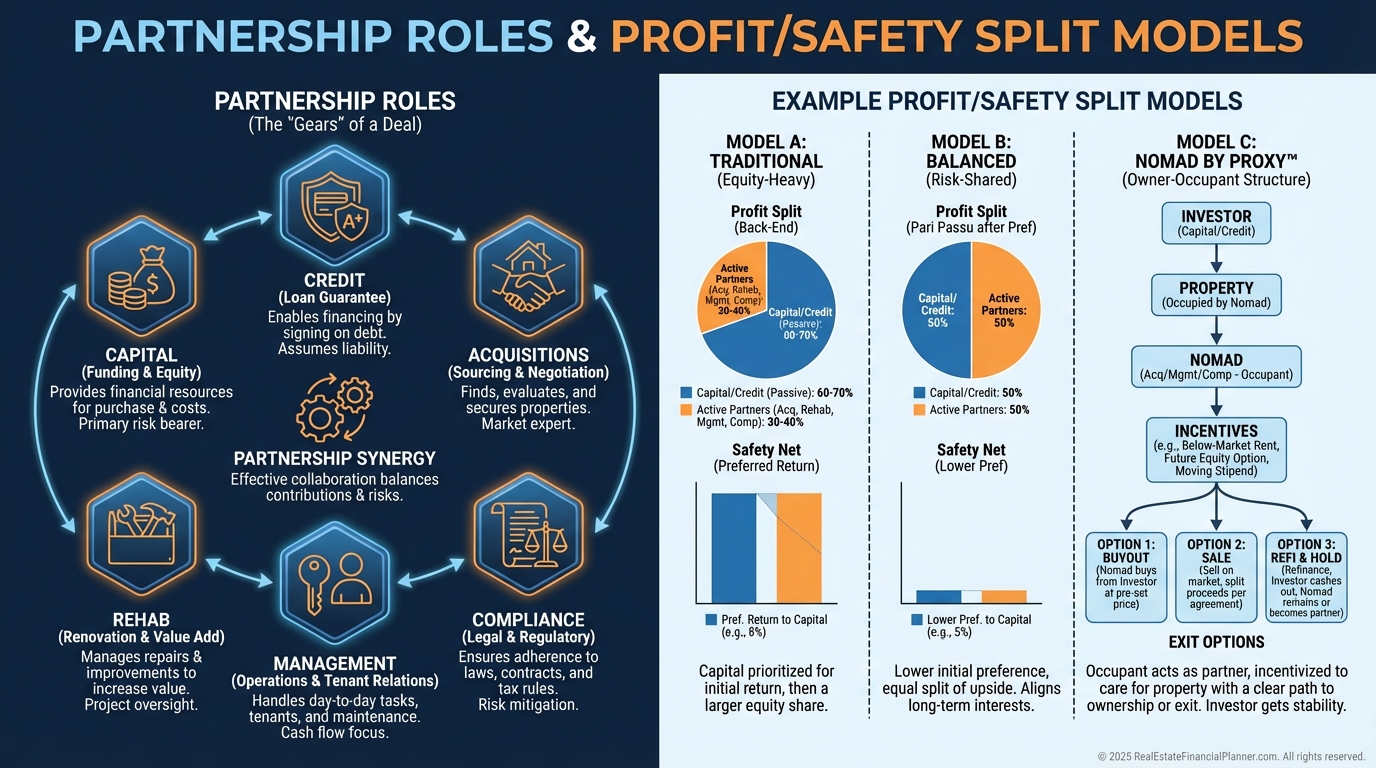

When I structure partnerships, I separate money roles (capital and credit) from work roles (acquisitions, rehab, management).

Nomad by Proxy™ is my favorite entry point: your partner owner-occupies for the low-down loan; you provide deal analysis, management, and systems.

We model multiple splits in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and pick the one where everyone is motivated, protected, and paid.

Tenant-Buyer Funds: Lease-Option Done Right

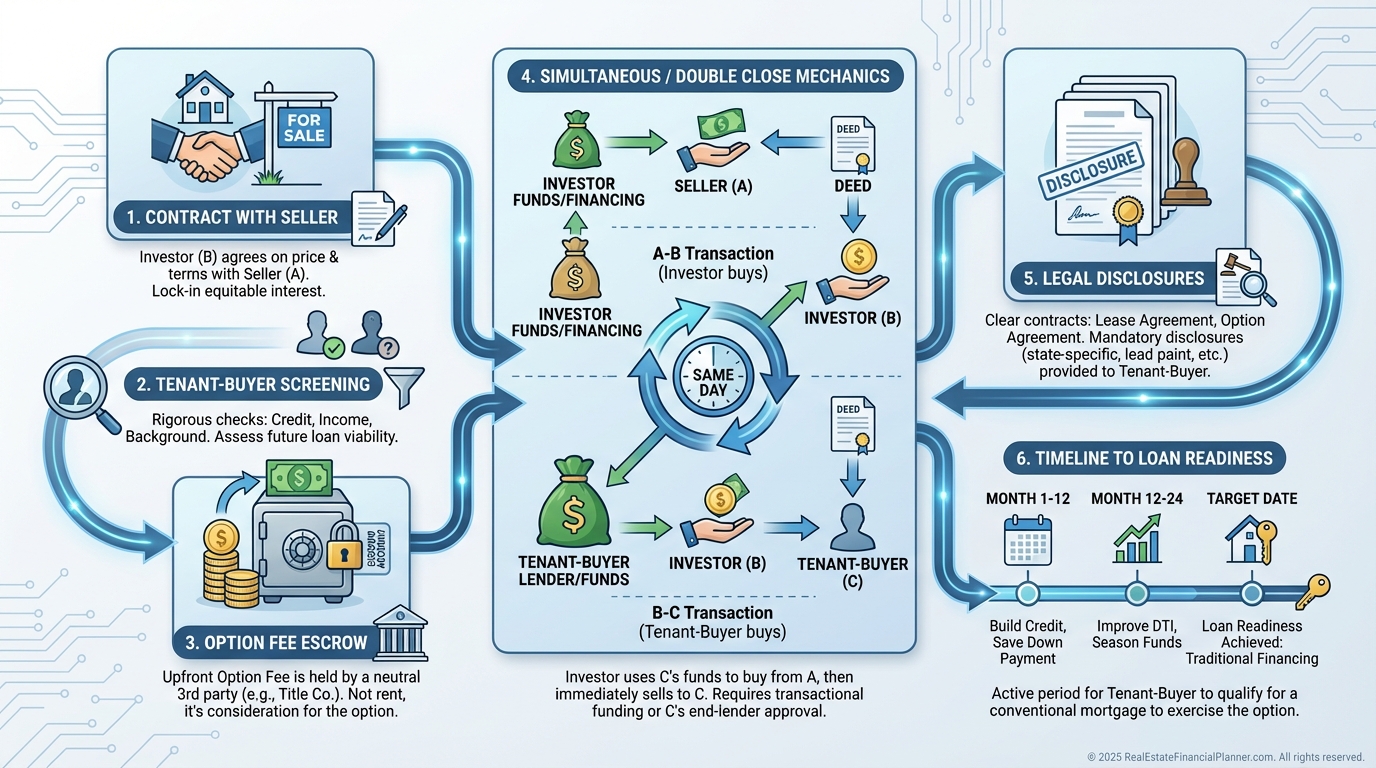

The sequencing and disclosures matter more than the idea.

I never market a property I don’t control; I secure a contract with clear assignment or a double-close path first.

Then I qualify tenant-buyers like underwriters do, collect a meaningful nonrefundable option fee, and set realistic timelines for mortgage readiness.

I disclose everything to the seller and use escrow so money flows properly.

Finally, I model the spread and tax consequences before I ever sign.

Subject-To and Assumptions

Subject-to can be powerful when the existing loan is better than today’s market.

I take title, keep the loan in the seller’s name, and make payments through a third-party servicer.

I confirm insurance is correct, escrows are funded, and everyone knows about the due-on-sale clause.

If the lender calls the note, my plan B is refinance, plan C is rapid disposition, and reserves cover the gap.

Assumable loans are the clean cousin—VA and some FHA—so I always check assumption feasibility first.

BRRRR, Modified for Zero Cash

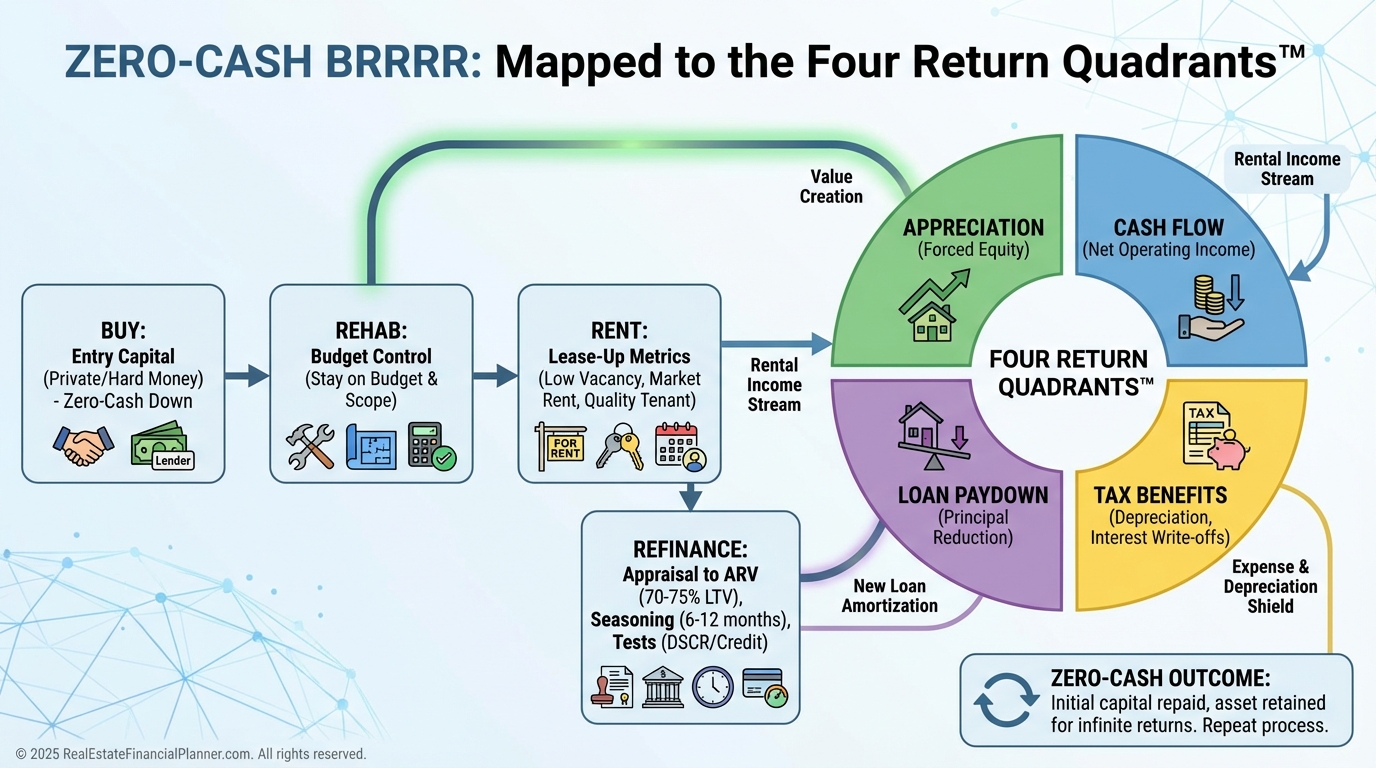

When I guide clients through BRRRR with no personal cash, we pair a purchase/rehab lender with a refinance that returns all invested capital.

The keys are conservative ARV, tight scope, and timeline discipline.

I underwrite with Return Quadrants™ so we don’t confuse forced appreciation with true cash flow.

Then I stress-test with interest-rate buffers and vacancy assumptions before swinging a hammer.

If the refinance won’t clear all initial funds under multiple scenarios, we renegotiate or pass.

Finding Real Nothing Down Opportunities

On the MLS, I look for long DOM, price reductions, vacant homes, and notes like “seller flexible” or “assumable.”

Off-market, I target free-and-clear owners, tired landlords, estates, and relocations with tight deadlines.

My opening questions are simple: “If I could get you your price, would you consider flexible terms?” and “Would monthly income be more helpful than a lump sum?”

I keep a ready list of pre-screened tenant-buyers and private lenders so I can say yes when the right seller appears.

Speed with integrity closes these deals.

Negotiating and Papering the Deal

I write offers that solve the seller’s problem and document what we actually agreed to.

I avoid “creative fog” by naming the instrument: deed of trust, all-inclusive trust deed, land contract, or lease-option.

I record memorandums when appropriate, use servicing when money changes hands monthly, and calendar renewal/balloon dates before closing.

Then I mirror the economics inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so my projections match the paper.

Risk Management and Compliance

I assume everything will cost more and take longer.

I size reserves to survive that, not to look good on paper.

I use attorneys for seller-financed notes, subject-to packages, and any wrap.

I make Dodd-Frank, SAFE Act, and state licensing part of the plan, not an afterthought.

And I never hide facts from lenders or counterparties.

Reputation is leverage you can’t replace.

What I Model, Check, and Avoid

I verify liens, taxes, utility balances, insurance claims history, rent comps, and permit history before I commit.

I avoid deals where the monthly is negative and the path to fix it is “hope.”

I walk from notes with impossible balloons or junk-fee landmines.

I refuse tenant-buyer deals that set people up to fail.

And I steer clients toward Nomad™ or Nomad by Proxy™ when it gives them the safest first win.

Your Next Steps

Pick a primary path that fits who you are today, not a fantasy version of you.

If you’re eligible, get VA or USDA pre-approval this week.

If you’re a systems builder, assemble a partnership bench and model three split options.

If you’re a marketer, build a tenant-buyer list and a compliant screening flow.

If you’re analytical, practice with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ until you can underwrite blindfolded.

Then make five offers that solve real seller problems.

The first accepted “nothing down” deal changes how you see every deal thereafter.