Triplexes: The Overlooked Sweet Spot for Cash Flow, Financing Flexibility, and Scalable Wealth

Learn about Triplexes for real estate investing.

Why Triplexes Win More Often Than They Should

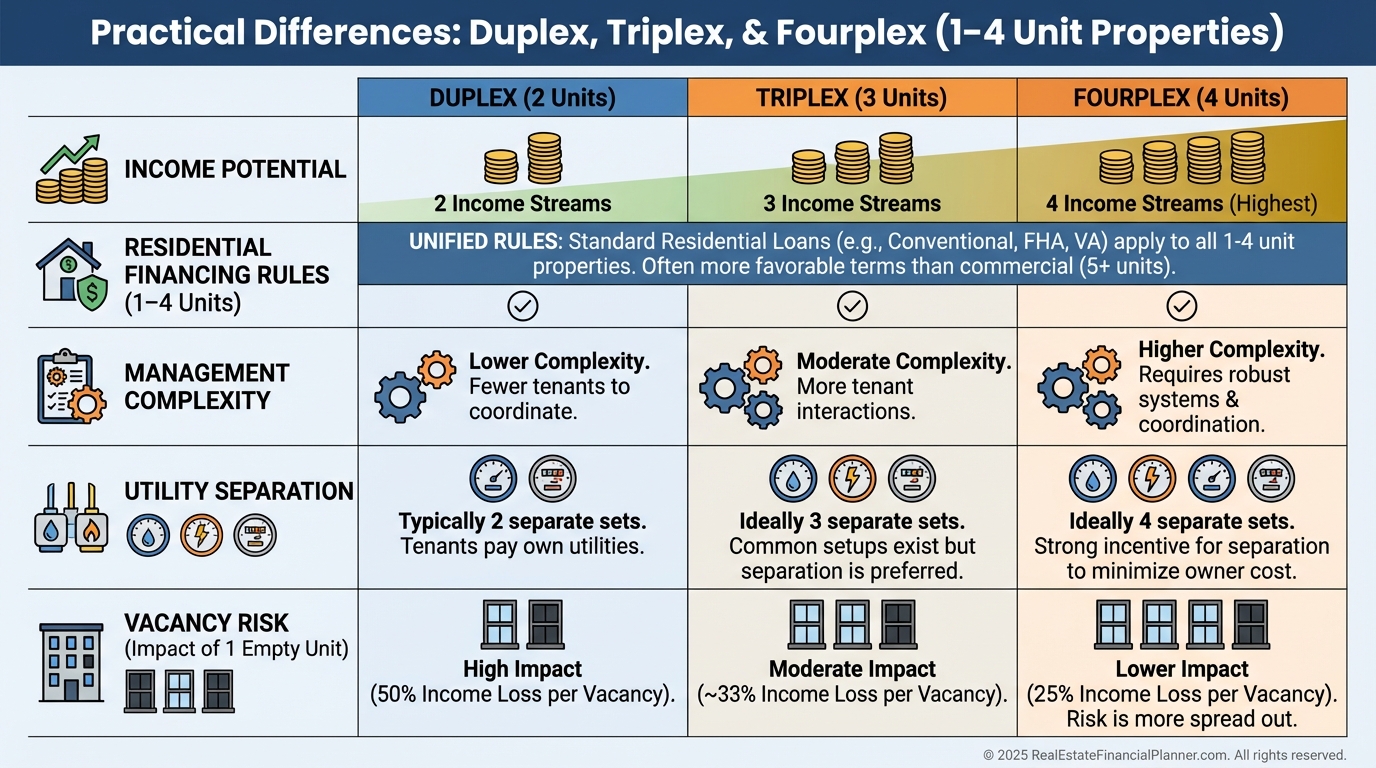

When I help clients choose between duplexes, triplexes, and fourplexes, triplexes quietly top the pro forma more than half the time.

You get the third stream of income and still stay under residential lending rules, which lowers rates and down payments versus commercial loans.

One vacancy in a triplex is a 33% hit, not 50% like a duplex or 100% like a single-family. That stability matters when a job market hiccups.

What Is a Triplex and Why It’s Different

A triplex is one building with exactly three legal dwelling units, each with its own entrance, kitchen, and bath.

It lives in the 1–4 unit category, so you can use residential financing and even owner-occupy for better terms.

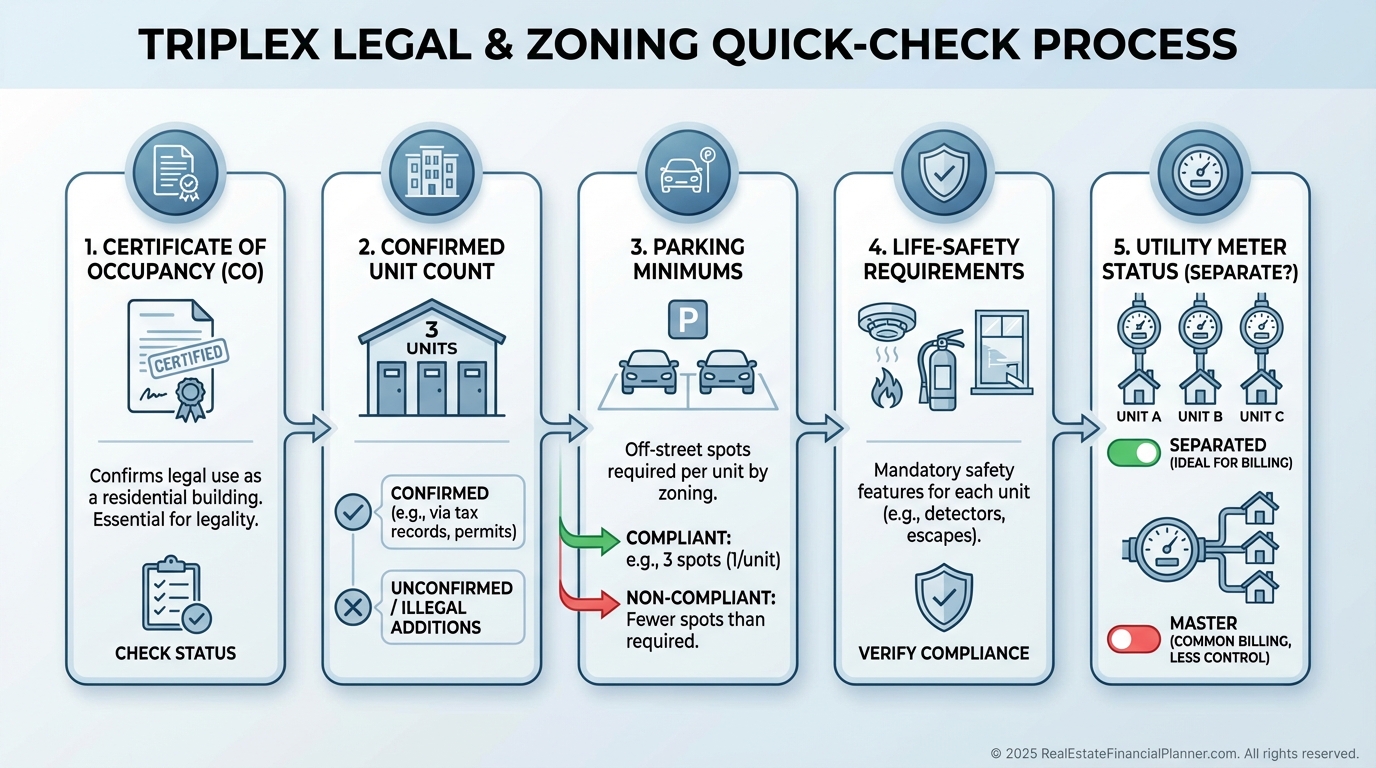

Legality and zoning are non-negotiable. I verify a current certificate of occupancy, unit count on record, and parking compliance before we ever write an offer.

If you plan to house hack, confirming the owner-occupancy allowance in the HOA or zoning code is step one, not step last.

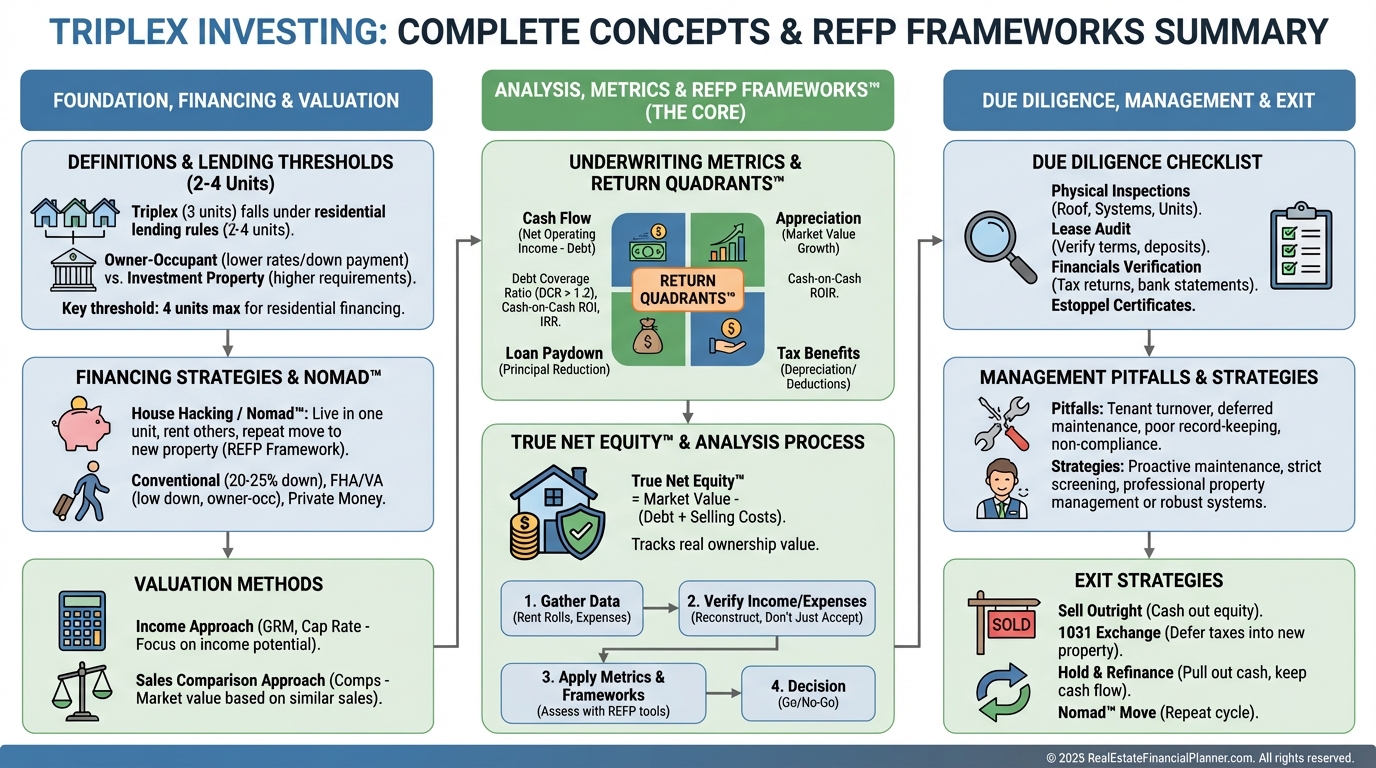

The Metrics That Matter (Using REFP Frameworks)

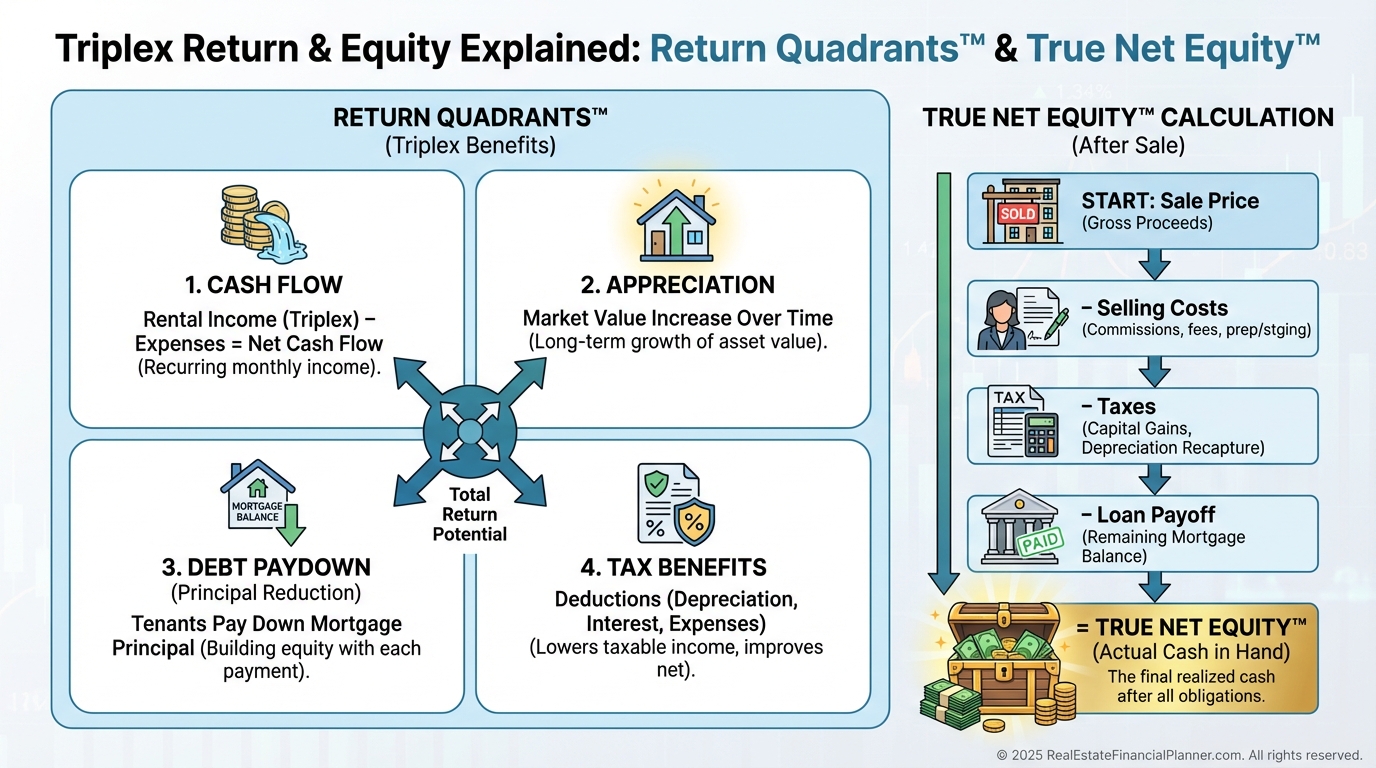

I teach every client to view returns through the Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

Triplexes shine because shared expenses across three units lift Net Operating Income, which pushes both cash-on-cash and DSCR higher.

When I model True Net Equity™, I subtract selling costs, capital gains, depreciation recapture, and payoff to reveal what you’d actually walk away with.

Triplexes often compound True Net Equity faster than duplexes because value rises with NOI improvements and smarter utility allocations.

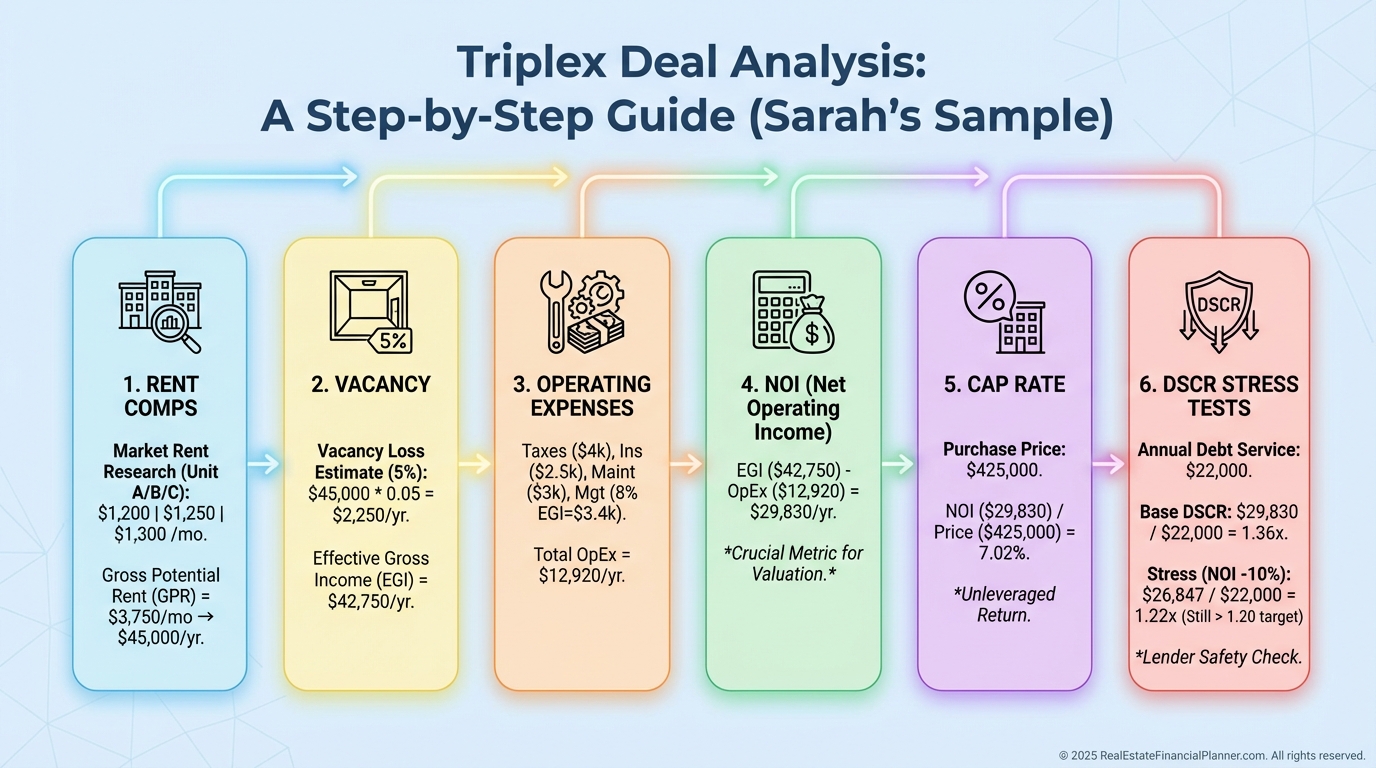

How I Analyze a Triplex Step by Step

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and a repeatable checklist so emotions never override math.

Here is how I walk clients through a live example.

Assume a $375,000 triplex in a stable B- area.

•

Unit A (2/1): $1,200

•

Unit B (2/1): $1,100

•

Unit C (1/1): $950

•

Total: $3,250 per month, $39,000 per year

Vacancy:

•

I model 5% unless submarket data demands 7–10%.

•

Taxes: $4,500

•

Insurance: $2,400

•

Maintenance reserve: $3,900 (10% of rents)

•

Management: $3,120 (8% of rents)

•

Owner-paid utilities: $1,800

•

Grounds/snow: $1,200

•

Admin/misc: $600

•

Total: $17,520

•

Expense ratio: ~41–45% after vacancy

NOI and value check:

•

Effective Gross Income: $37,050

•

NOI: $19,530

•

At $375,000, cap rate ≈ 5.2%

•

If market caps run 5–6%, the price is fair, not fantastic

I also stress test. I check DSCR at market rate +1%, vacancy at 10%, and maintenance at 12% to see if cash flow survives normal turbulence.

Where the Data Comes From

I triangulate rents from Rentometer, Apartments.com, MLS rental history, and two local property managers.

For expenses, I prefer actual T-12s, but I will benchmark with local REIA data and confirm insurance quotes in writing.

For cap rates, I lean on small multifamily brokers, recent 1–4 unit sales, and my own database of closed triplexes within a 6–12 month window.

If three sources rhyme, we proceed. If they fight, we pause or walk.

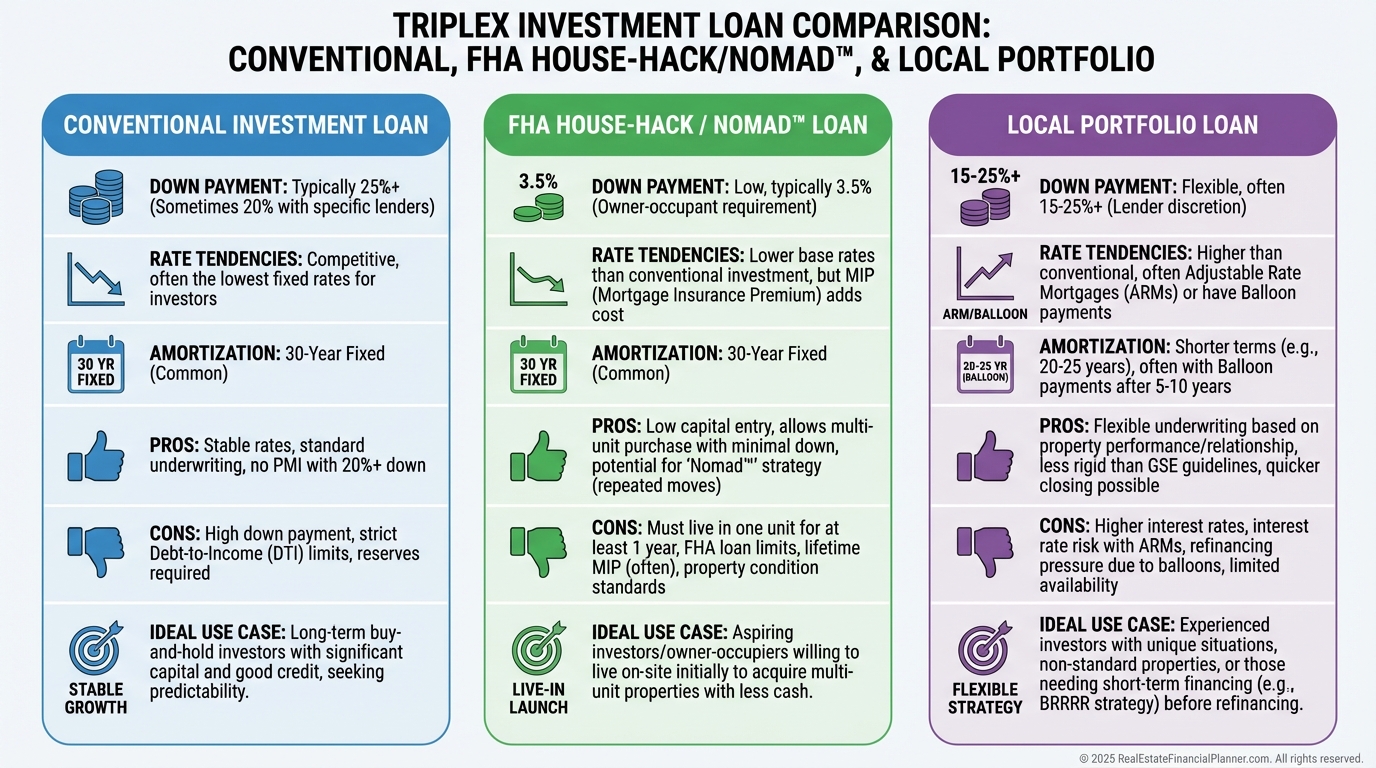

Financing Triplexes Without Overpaying for Money

Triplexes qualify for residential loans. That usually means lower rates, longer amortizations, and less cash down.

Here is how I compare options for clients on a $425,000 purchase at $3,500 in monthly rents.

Conventional investment:

•

25% down, loan ≈ $318,750, 30-year fixed

•

Rate often 0.5–1% better than portfolio

•

Best for long-term stability and DSCR

FHA owner-occupied:

•

3.5% down, includes MIP

•

Live-in requirement for 12 months

•

Often the fastest path into a quality asset with minimal cash

Local portfolio:

•

15–25% down, flexible underwriting

•

Can include interest-only periods or 20-year amortization

•

Good for speed or unique properties, but watch payment shock

When I rebuilt after bankruptcy, I used a triplex house hack with FHA to reduce housing costs to near-zero and accelerate savings.

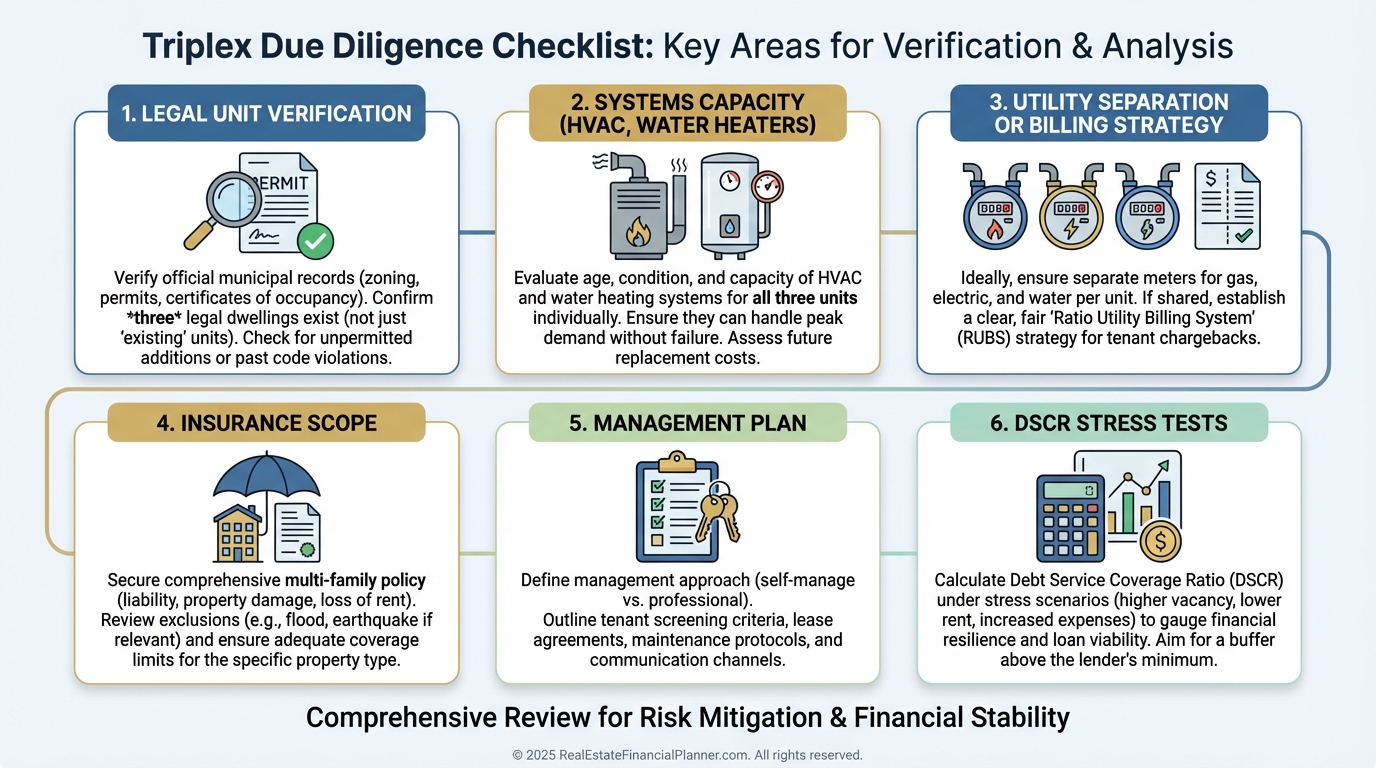

Legal, Zoning, and Utility Checks I Refuse to Skip

Older triplexes sometimes have “mystery” units that never got permitted. I verify the legal unit count at the city before inspection deadlines.

I confirm separate meters or get bids to sub-meter water and electric. Utility ambiguity kills cash flow and creates tenant disputes.

Parking and life-safety matter. I check local code for required spaces, egress, smoke/CO detectors, and any retrofit mandates.

Pitfalls That Sink Triplex Deals

Underestimating management is common. Three tenants mean three kitchens, three baths, and three schedules.

If utilities are not separated, align leases with clear billing rules or budget owner-paid usage with historicals and buffers.

I once consulted on a 1920s triplex with one electric meter. A tenant’s high-usage hobby spiked bills, sparked disputes, and cut NOI for months.

Investors also misprice insurance. They buy single-family policies on small multifamily and leave liability gaps wide open.

I run DSCR shock tests and model a 10% rent haircut to see how close we are to the red. If we are one repair away from negative cash flow, we renegotiate or pass.

Strategic Uses in a Portfolio

I treat triplexes as scalable stepping stones. They cash flow better than most duplexes and teach systems you will use on 10–20 unit buildings.

Geographically, they can support professional management, which frees you to buy in better submarkets rather than just close to home.

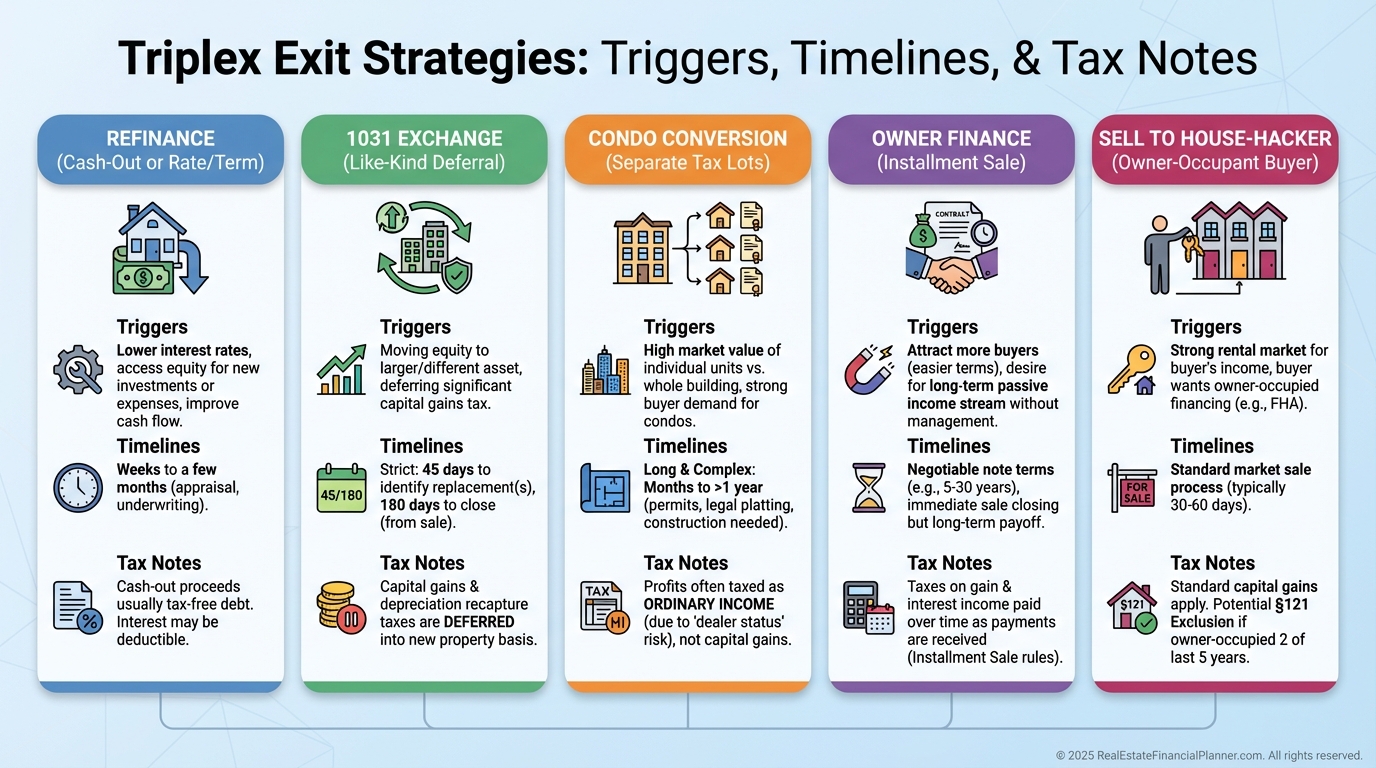

I plan exits on day one. If we can raise NOI through value-add and utility fixes, we create a refinance or 1031 option in 18–36 months.

Exit paths I model:

•

Refi to harvest capital while keeping cash flow stable

•

1031 into two fourplexes or an eight-unit

•

Condo conversion where legal and economic

•

Owner-finance sale to create notes and defer taxes

Advanced Triplex Plays

The Value-Add Trifecta is my favorite. Raise under-market rents, cure deferred maintenance, and separate utilities to force 30–40% appreciation in 18–24 months.

Conversion specialists can legally split large homes into triplexes where zoning allows, but only after running full cap-ex and lease-up schedules.

If you plan to syndicate later, document your triplex track record. Lenders and investors love to see consistent NOI growth and clean management files.

Your Next Steps

Pull three live triplex listings and run them through the spreadsheet. Stress test rate, rent, and expense shocks.

Call two local lenders and a portfolio bank to quote terms. Line up insurance and property management ahead of your offer.

If the numbers hold and your True Net Equity grows faster than your alternatives, write the offer with confidence.