Why Every Real Estate Investor Needs the Right Attorney

Learn about Attorney for real estate investing.

An attorney is one of the least exciting members of your real estate investing dream team.

They are also one of the most important.

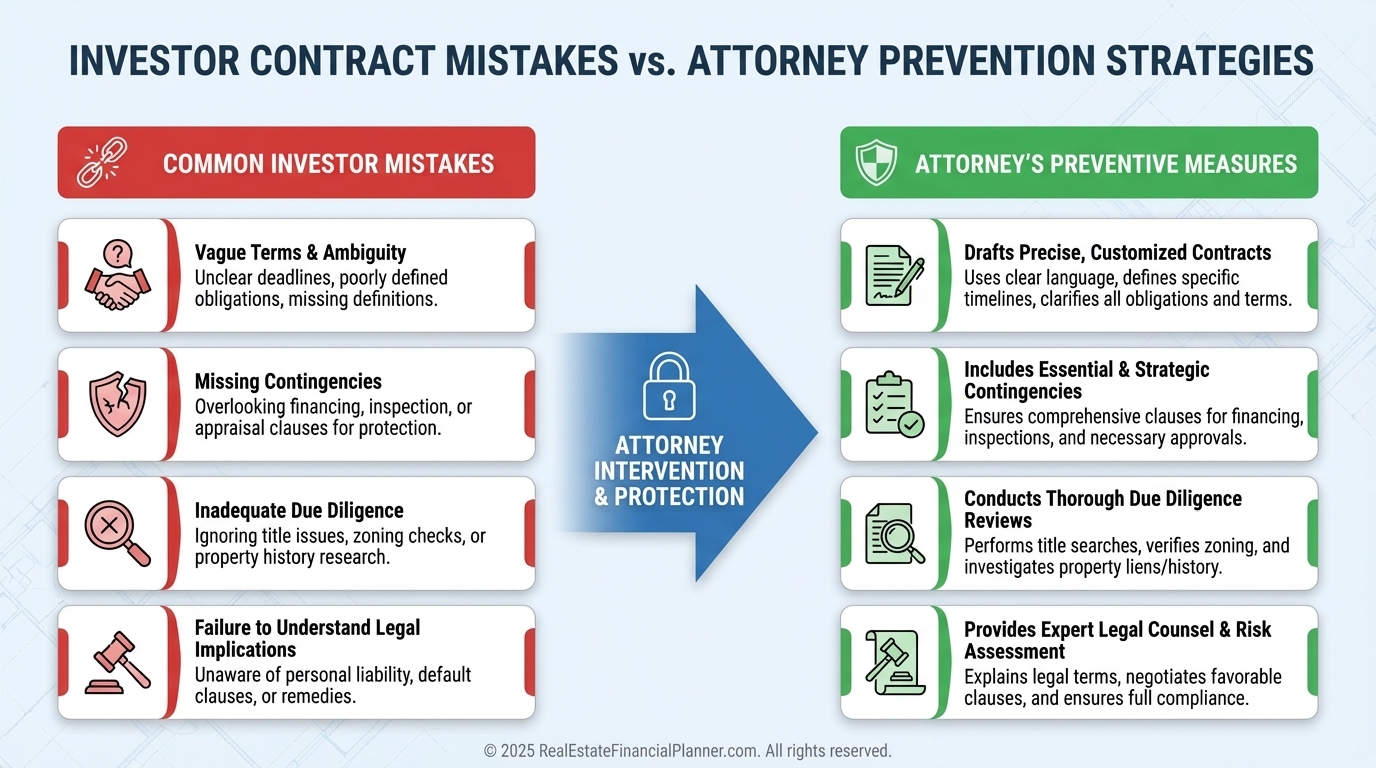

When I help clients buy rental properties, the deals that go wrong are rarely caused by bad numbers. They are usually caused by bad paperwork, misunderstood contracts, or legal issues no one thought about until it was too late.

I learned this the hard way rebuilding after bankruptcy. Legal mistakes compound just like financial ones, but they usually show up faster and hurt more.

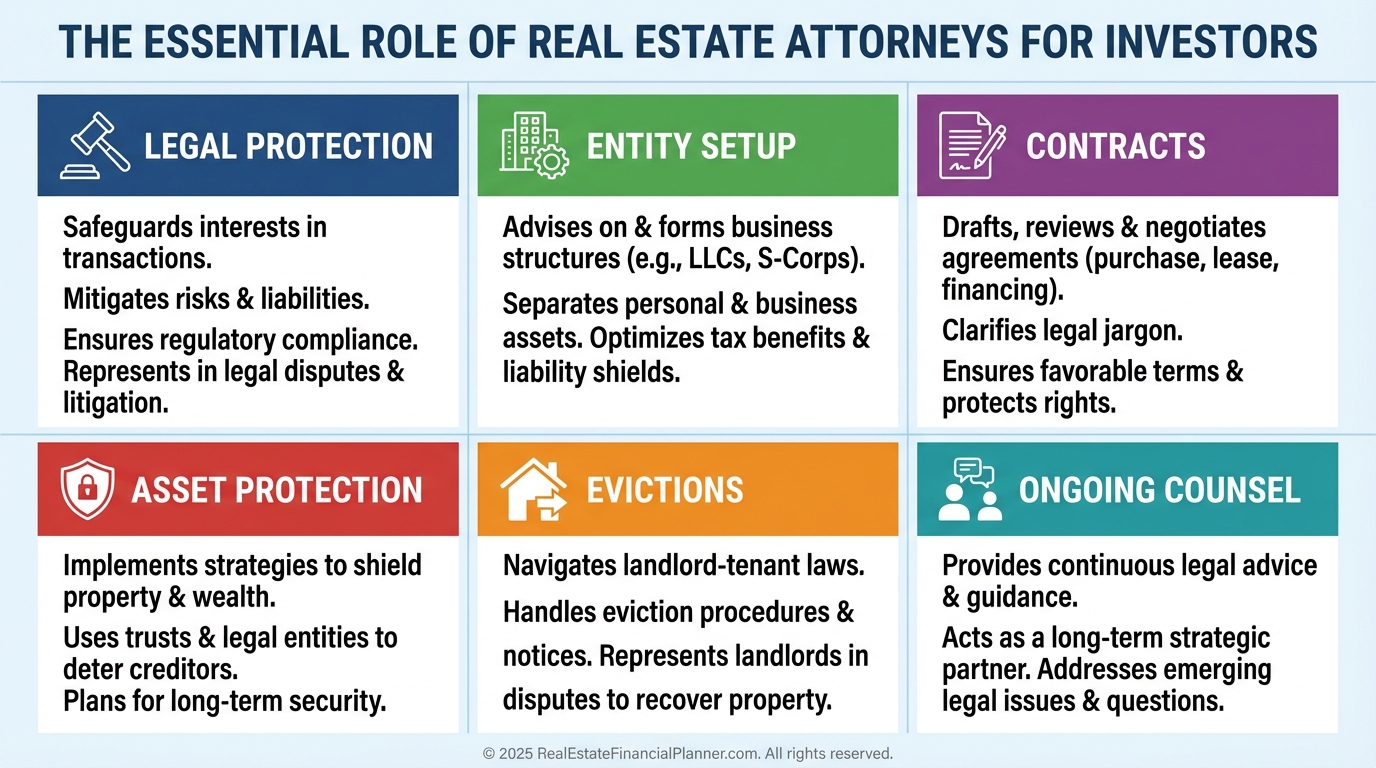

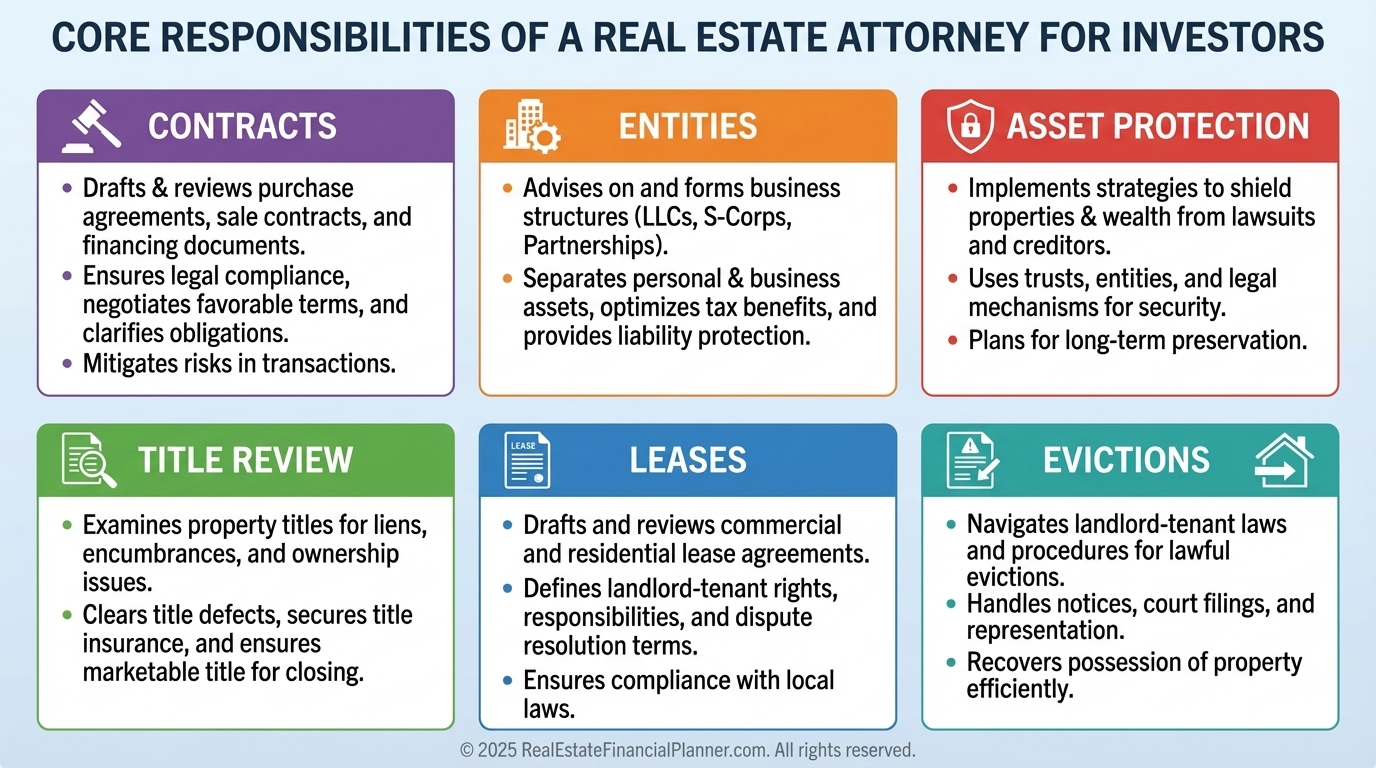

What a Real Estate Attorney Actually Does

An attorney’s job is not to slow your deal down.

Their job is to protect you when things do not go as planned, which happens more often than most investors admit.

Entity Setup and Maintenance

If you are using an LLC or other entity, your attorney helps structure it correctly from day one.

I regularly see investors create entities online that look fine on the surface but fail when tested in court.

Asset Protection Strategy

Attorneys help design the legal layers that keep a lawsuit from wiping out your portfolio.

This is not about being paranoid. It is about being realistic once you own multiple properties.

Contract Review and Explanation

Your real estate agent cannot give you legal advice.

Your attorney can explain what the contract actually says, what it does not say, and what needs to change to protect you.

This is especially critical when buying off-market or using creative financing.

Leases and Loan Documents

Leases pulled from the internet are one of the most expensive shortcuts investors take.

An attorney ensures your leases comply with local law and actually hold up in court.

The same applies to private money and hard money loan documents.

Title Review and Legal Issues

The title company handles mechanics.

Your attorney explains risk.

They help you understand exceptions, boundary issues, and title defects before they become your problem.

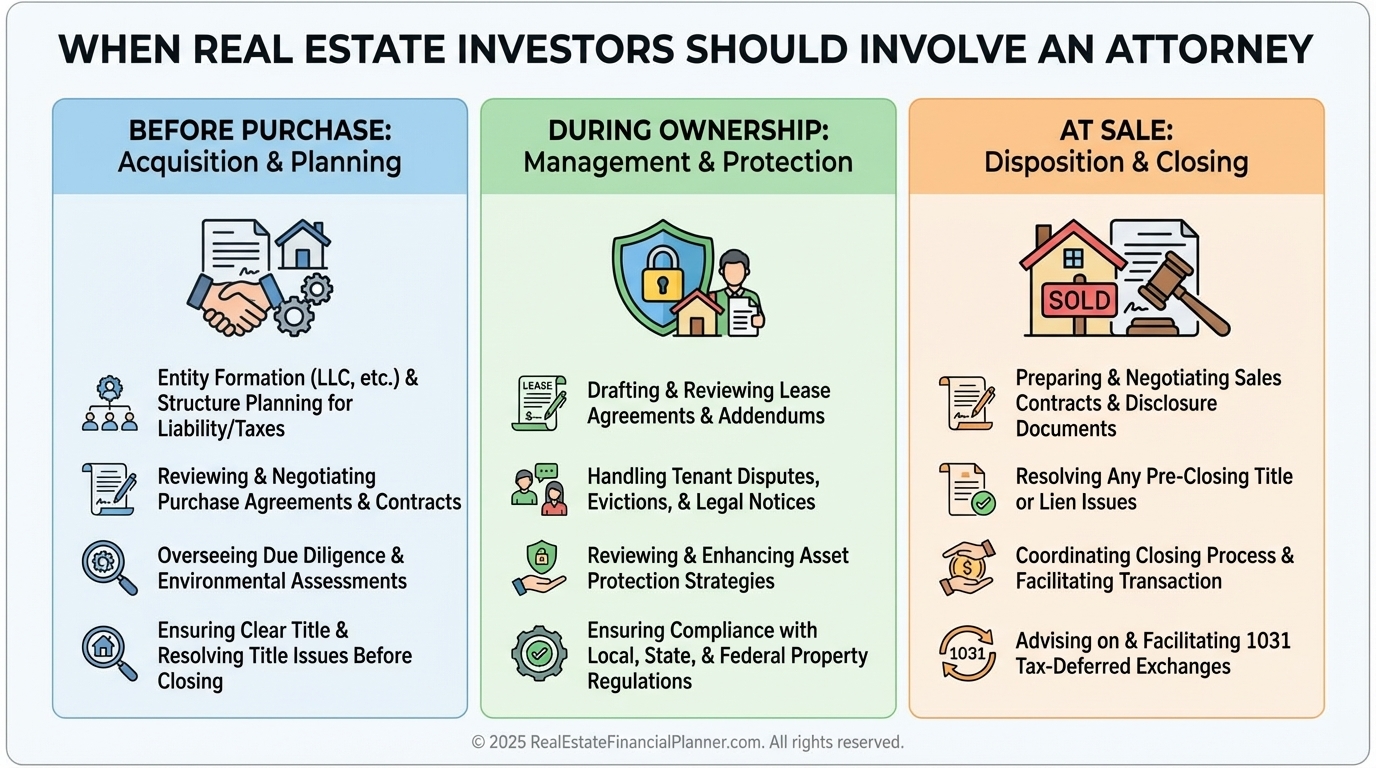

When You Should Involve an Attorney

Most investors wait too long.

They call an attorney after something breaks instead of before.

Before You Buy

This is when entity setup, contract review, and title advice matter most.

Fixing problems here is cheap.

Fixing them later is not.

During Ownership

Tenant disputes, lease enforcement, and partnership issues show up over time.

An attorney helps you respond correctly instead of emotionally.

At Sale or Refinance

Legal mistakes at exit can destroy your Return on Equity and True Net Equity™.

This is where small oversights turn into six-figure problems.

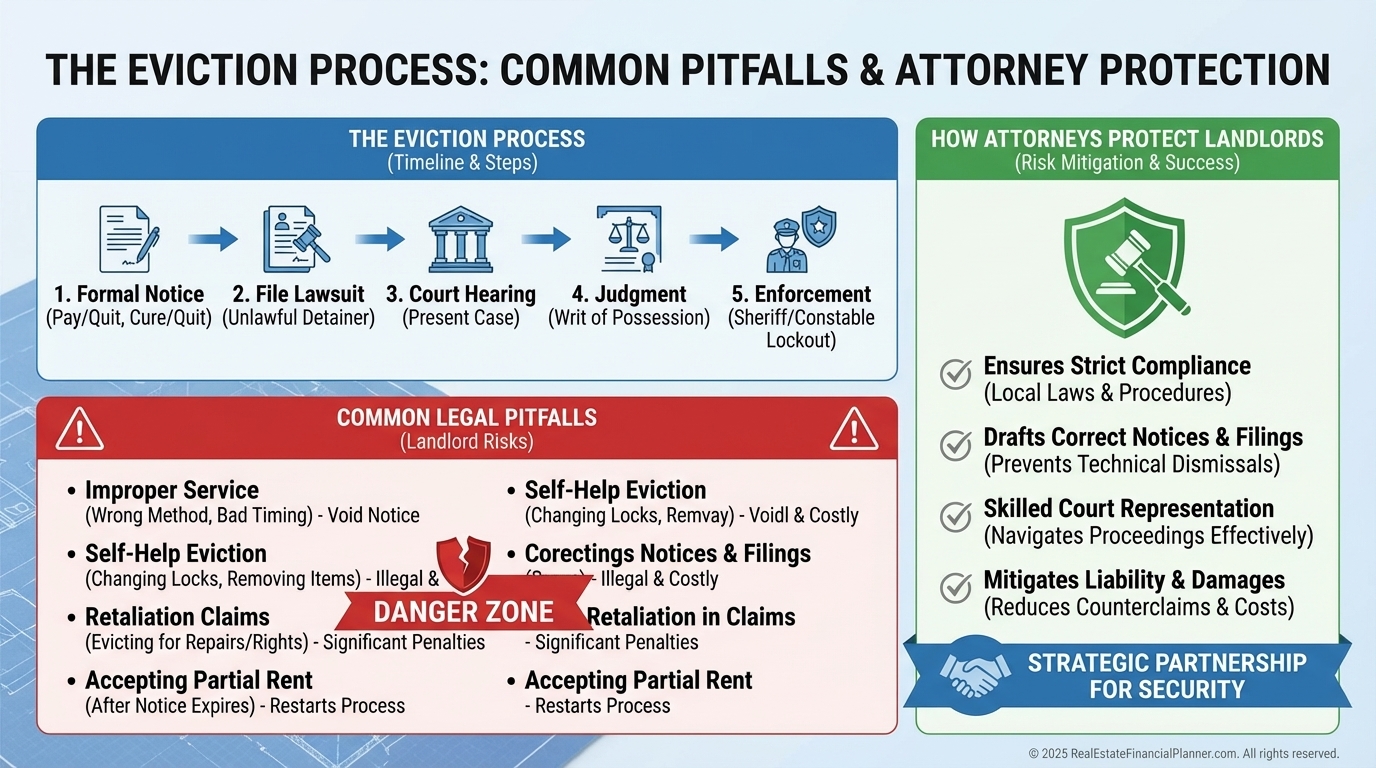

Evictions and Disputes

Evictions are procedural, emotional, and unforgiving.

One missed step can reset the entire process.

When I coach investors, I remind them that eviction law is local and specific.

What worked for your friend in another state may cost you months of lost rent.

Why Attorneys Matter More as You Scale

As your portfolio grows, your risk surface grows with it.

More properties mean more tenants, more contracts, and more exposure.

Attorneys help preserve the upside you model in the Return Quadrants™ by preventing downside you cannot spreadsheet away.

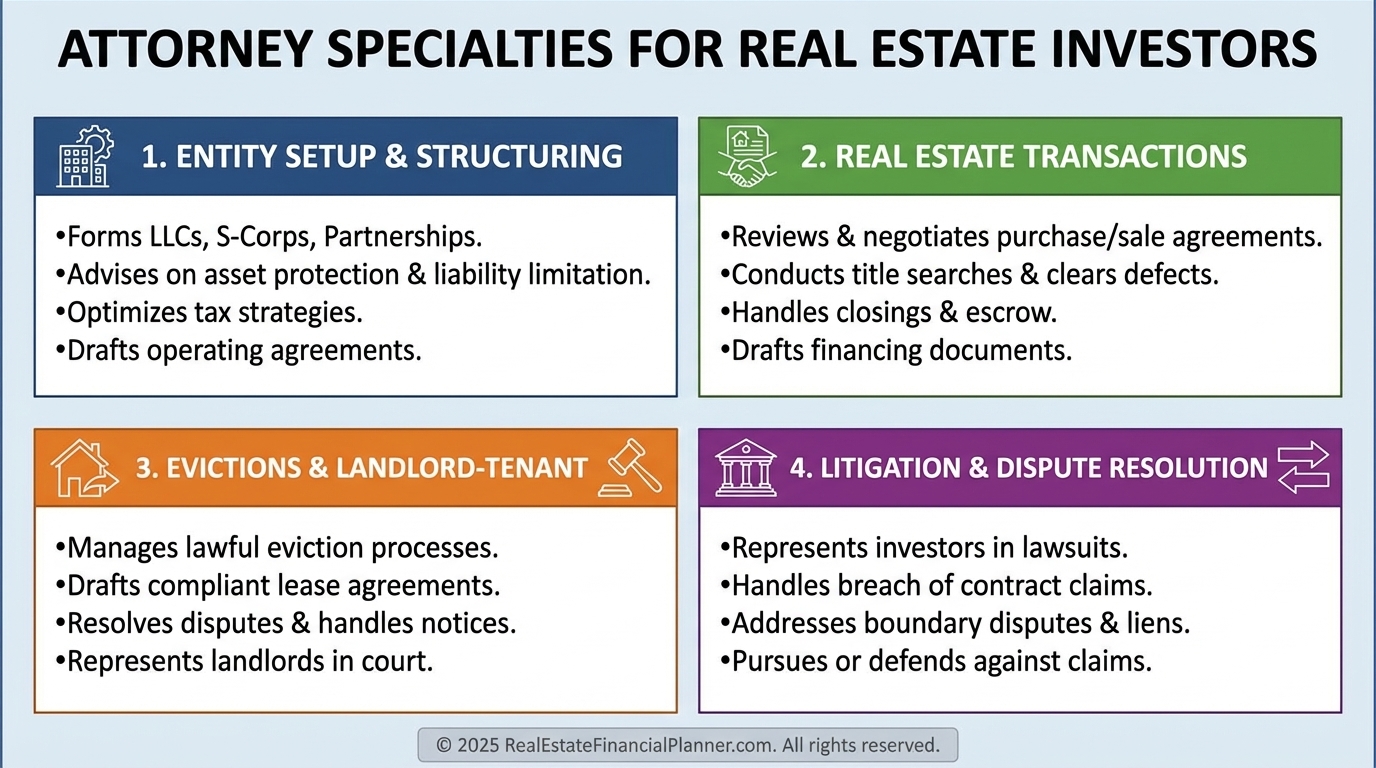

One Attorney or Many

Most serious investors work with more than one attorney over time.

Different specialties matter.

You might use one for entity structuring, another for evictions, and another for complex transactions.

That is normal.

The Real Cost of Not Having an Attorney

Investors often ask how much an attorney costs.

The better question is how much a mistake costs without one.

When I analyze deals with clients, legal protection is treated like insurance.

You hope you do not need it, but you never want to be without it.