Debt Service Coverage Ratio (DSCR): The Metric That Quietly Kills Bad Deals

Learn about Debt Service Coverage Ratio (DSCR) for real estate investing.

Why DSCR Quietly Determines Whether a Deal Survives

When I help clients analyze rental properties, DSCR is one of the first numbers I look at.

Not because it’s exciting.

Not because it maximizes returns.

But because DSCR quietly determines whether a deal survives stress.

After rebuilding my portfolio following bankruptcy, I became far more conservative about debt risk. I learned—painfully—that deals don’t fail because appreciation stops. They fail because income can’t support debt.

Debt Service Coverage Ratio is how you measure that risk before it hurts you.

What Debt Service Coverage Ratio Actually Measures

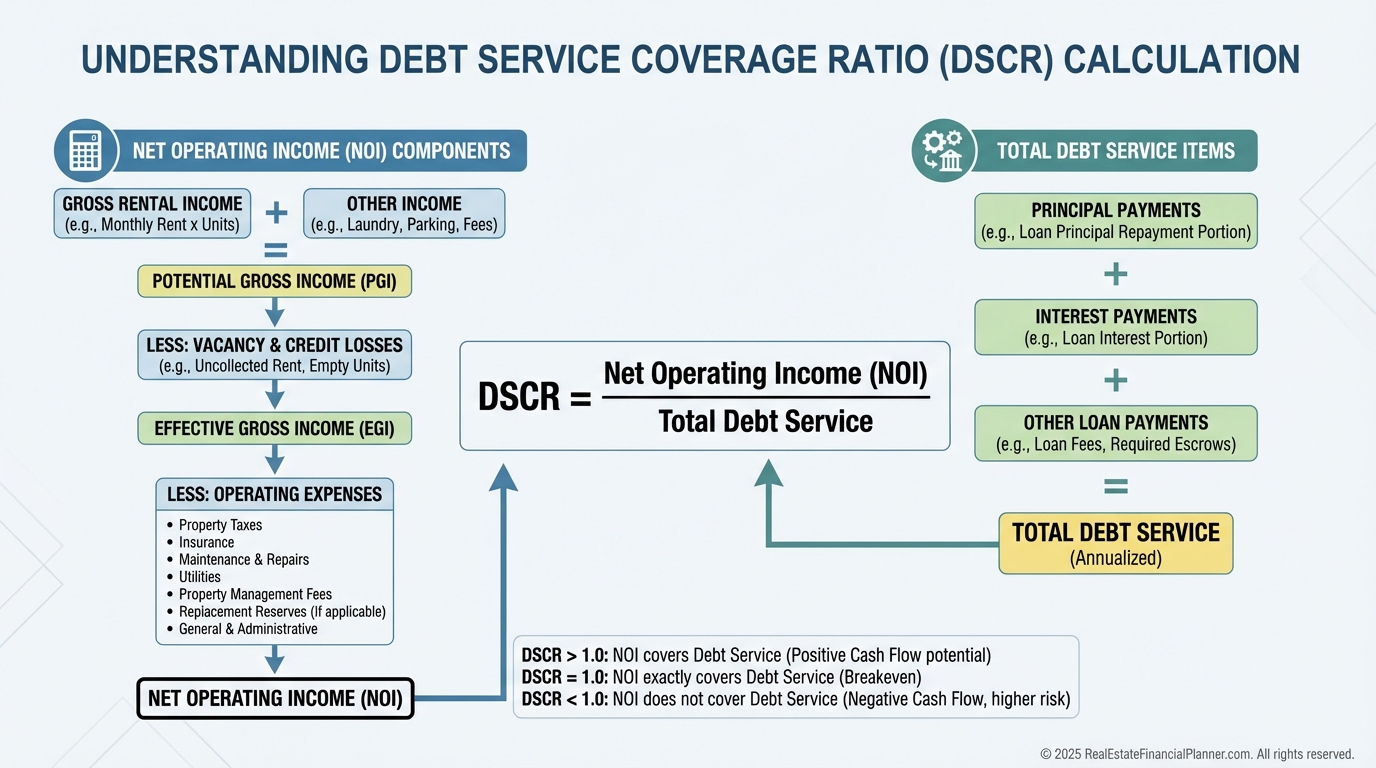

DSCR tells you whether a property’s income can comfortably cover its debt obligations.

It compares Net Operating Income to total annual debt service.

If the property cannot pay its own mortgage, you are the backup plan.

Lenders know this. That’s why DSCR is one of the first filters they apply.

The DSCR Formula (And What Lenders Actually Mean by It)

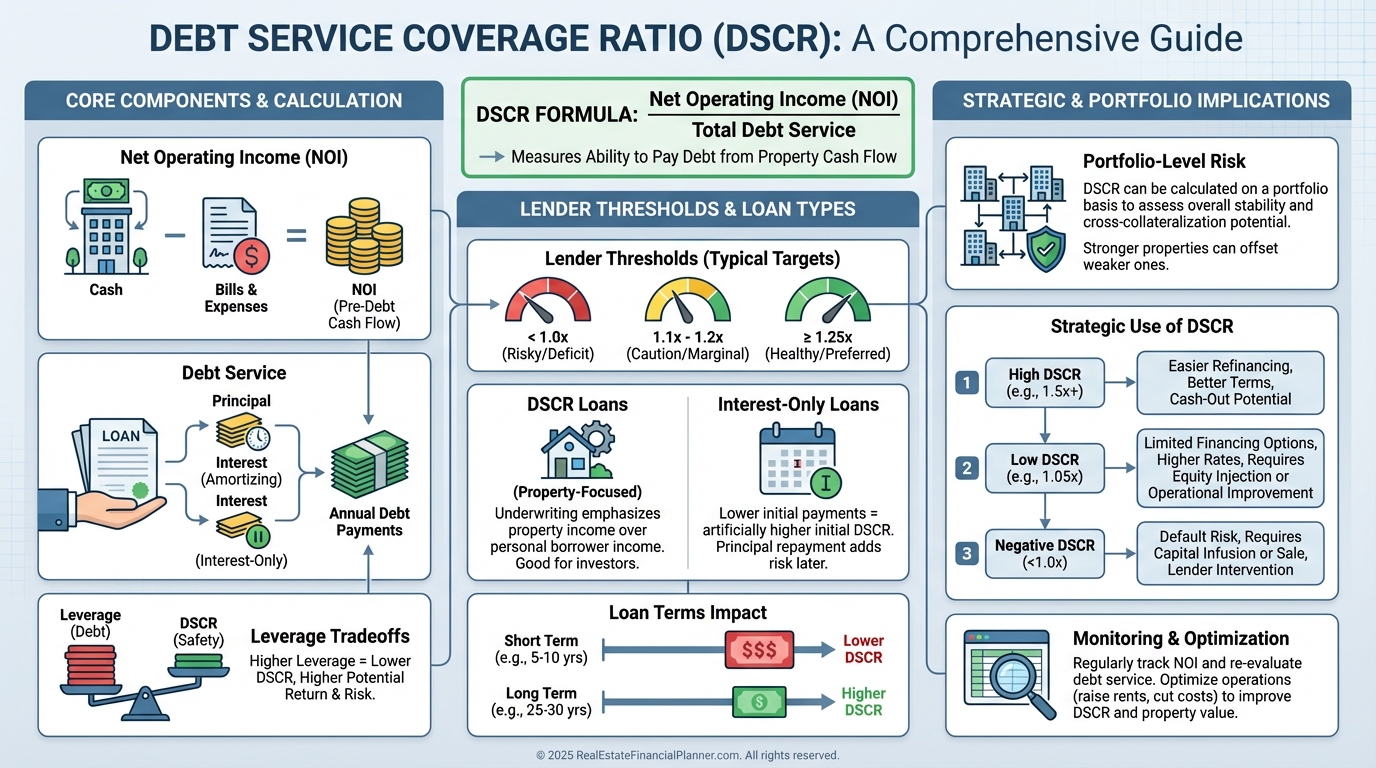

DSCR is calculated as:

Net Operating Income ÷ Annual Debt Service

Net Operating Income is income after operating expenses but before loan payments.

If a property produces $10,000 in NOI and requires $8,000 per year in debt payments, the DSCR is 1.25.

That means the property produces twenty-five percent more income than required to service the debt.

That margin matters more than most investors realize.

What Different DSCR Levels Really Signal

A DSCR above 1.25 usually signals stability.

A DSCR of 1.0 means the property barely survives.

A DSCR below 1.0 means the deal is feeding on your personal cash flow.

I’ve seen investors obsess over Cash on Cash Return while ignoring DSCR. That usually ends with stress, forced refinances, or selling at the wrong time.

Why Lenders Care More About DSCR Than You Do

Lenders do not care about appreciation.

They care about math.

DSCR answers one question for them:

“Can this property pay us back even if things go sideways?”

That’s why most lenders require minimum DSCR thresholds, often between 1.20 and 1.30 depending on property type.

You may accept lower DSCR for higher upside.

Lenders will not.

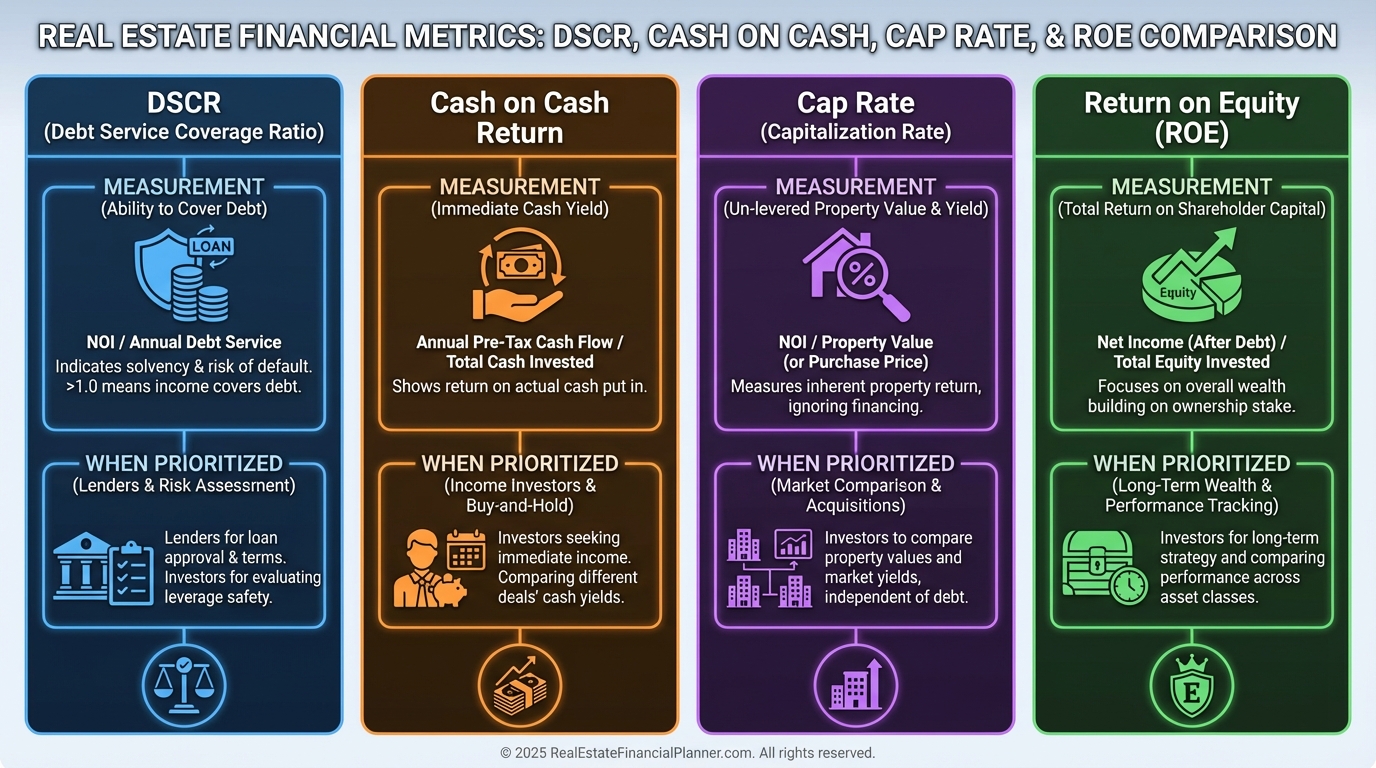

DSCR vs Cash on Cash, Cap Rate, and Return Quadrants™

DSCR measures survivability.

Cash on Cash measures efficiency of invested cash.

Return on Investment and Return on Equity capture appreciation, cash flow, debt paydown, and tax benefits.

These metrics often conflict.

Maximizing leverage improves Return on Equity but compresses DSCR.

After bankruptcy, I stopped optimizing for one number. I started balancing the entire Return Quadrants™ framework against risk.

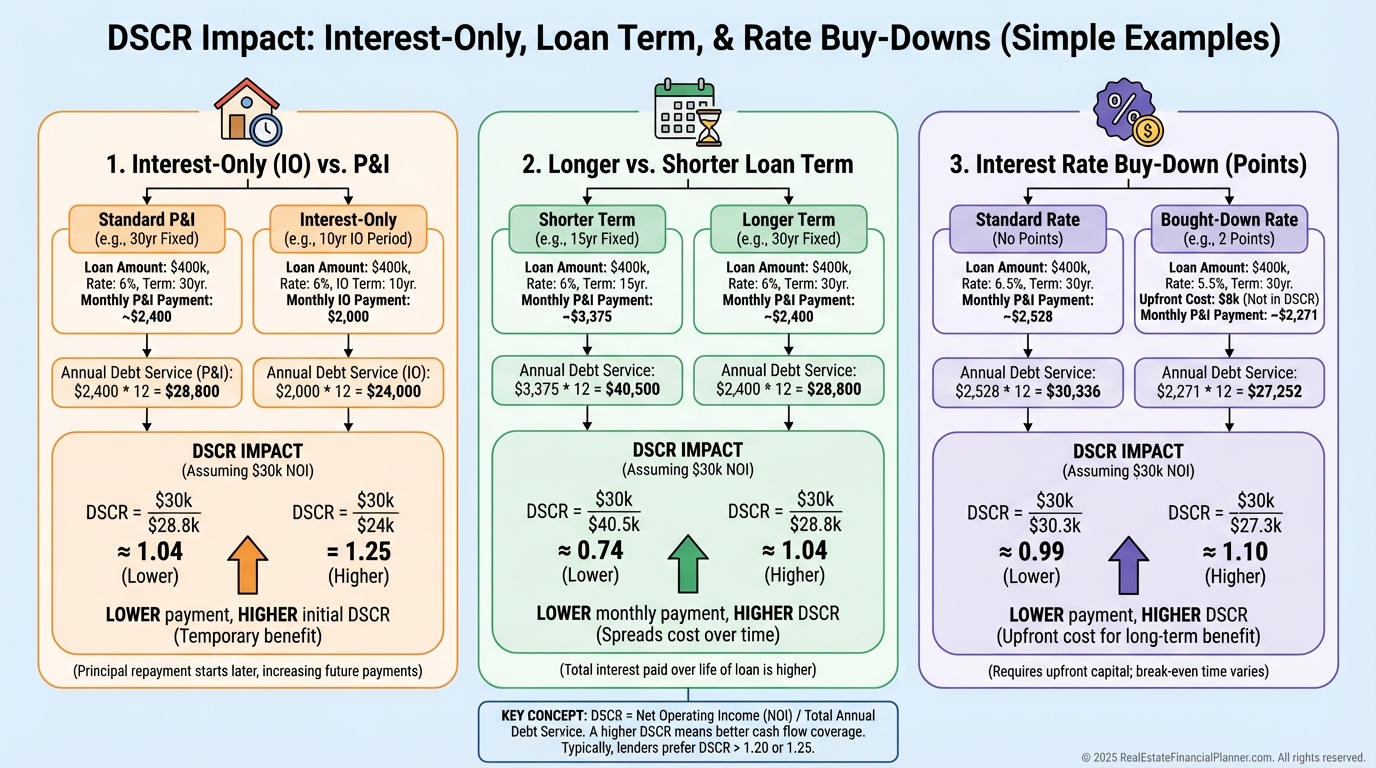

How Loan Structure Quietly Changes DSCR

Most investors underestimate how much financing structure impacts DSCR.

Interest-only loans temporarily boost DSCR by lowering payments.

Thirty-year loans raise DSCR compared to fifteen-year loans.

Buying down interest rates improves DSCR by reducing debt service.

None of these change the property itself.

They change survivability.

Interest-Only Loans: DSCR Now vs Risk Later

Interest-only loans inflate DSCR in the short term.

But interest-only loans do not eliminate risk.

They delay it.

Balloon risk, refinance risk, and market timing risk all pile up later.

I only recommend interest-only structures when the exit is clear and conservative.

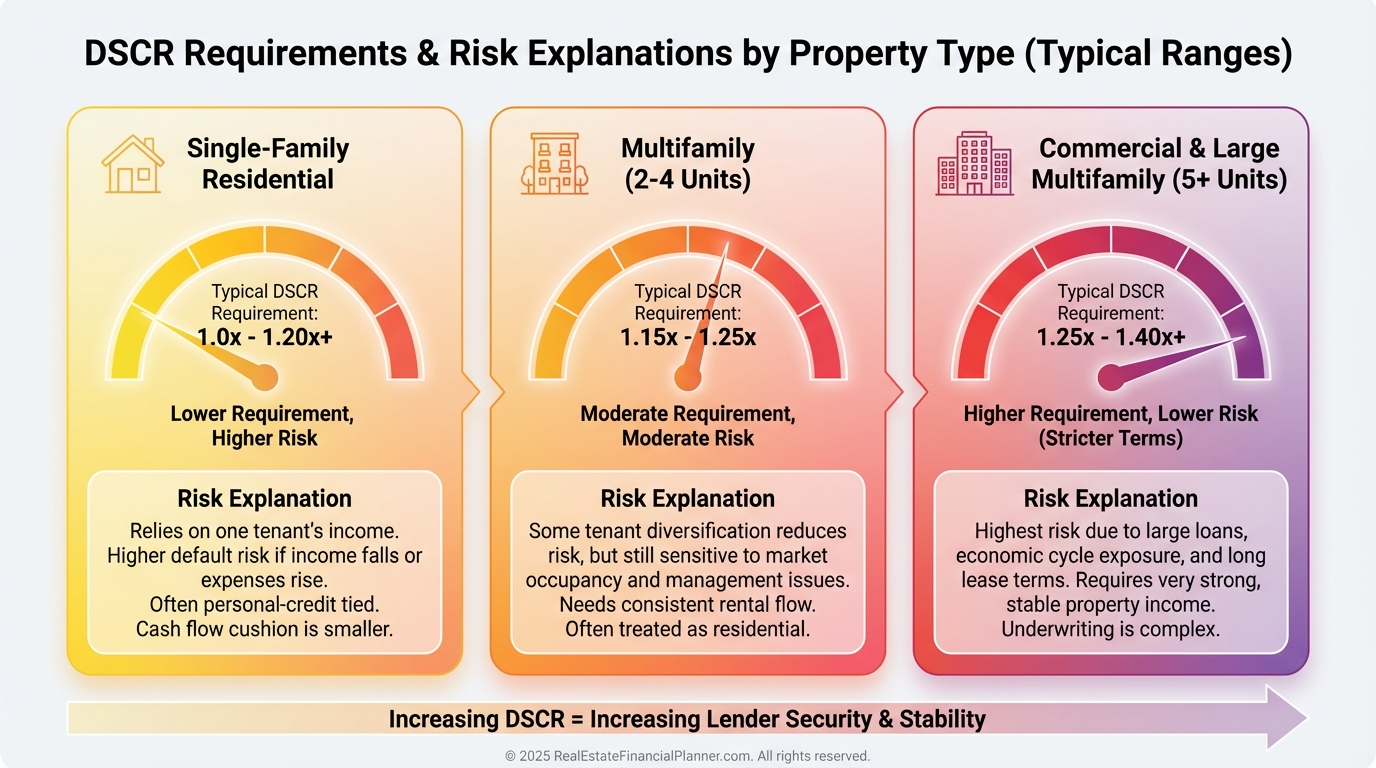

Typical DSCR Requirements by Property Type

Single-family rentals usually require 1.20 to 1.25.

Five-plus unit multifamily often requires 1.25 to 1.35.

Commercial properties commonly require 1.30 to 1.50 or more.

Higher volatility demands more margin.

DSCR Loans: Why Investors Use Them to Scale

DSCR loans focus on property income, not your personal income.

That matters once your portfolio grows.

These loans allow investors to keep buying even when traditional debt-to-income ratios stop working.

They come with tradeoffs: higher rates, larger down payments, and stricter DSCR thresholds.

Used carefully, they unlock scale.

Used carelessly, they amplify risk.

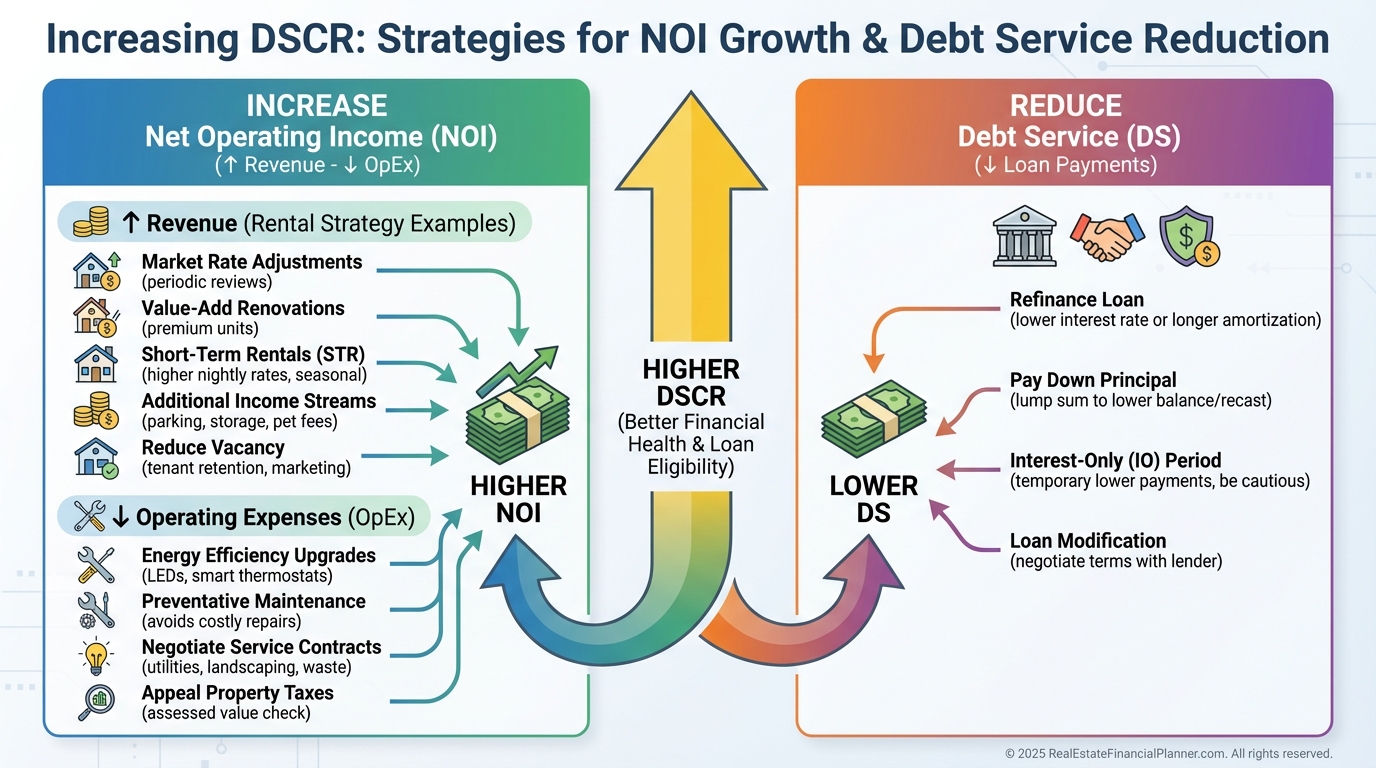

Increasing DSCR the Right Way

You improve DSCR by increasing NOI or reducing debt service.

Raising rents responsibly matters.

Controlling expenses matters more.

Aggressive strategies like student rentals or short-term rentals can dramatically improve DSCR, but they increase operational risk.

Higher DSCR does not always mean lower stress.

DSCR as a Long-Term Portfolio Risk Tool

I track DSCR per property and across entire portfolios.

A single weak property can destabilize everything.

Portfolio-level DSCR shows whether you can survive vacancies, recessions, or financing changes.

This ties directly into Rent Resilience™ and long-term financial independence planning.

High returns mean nothing if the portfolio collapses under stress.

DSCR is not about maximizing upside.

It’s about staying in the game long enough to win.