Deferred Maintenance: The Hidden Cost That Makes or Breaks Real Estate Deals

Learn about Deferred Maintenance for real estate investing.

Most investors think deferred maintenance is something you notice during inspection and “deal with later.”

That belief quietly destroys returns.

When I help clients analyze deals, deferred maintenance is one of the first places I slow them down. Not because it’s complicated, but because it’s easy to miss and brutally expensive when you do.

I’ve watched investors overpay by tens of thousands of dollars for properties that looked “updated,” only to discover the updates were cosmetic and the systems were on borrowed time.

Deferred maintenance doesn’t announce itself. It hides behind fresh paint.

Understanding it is the difference between buying problems and buying opportunities.

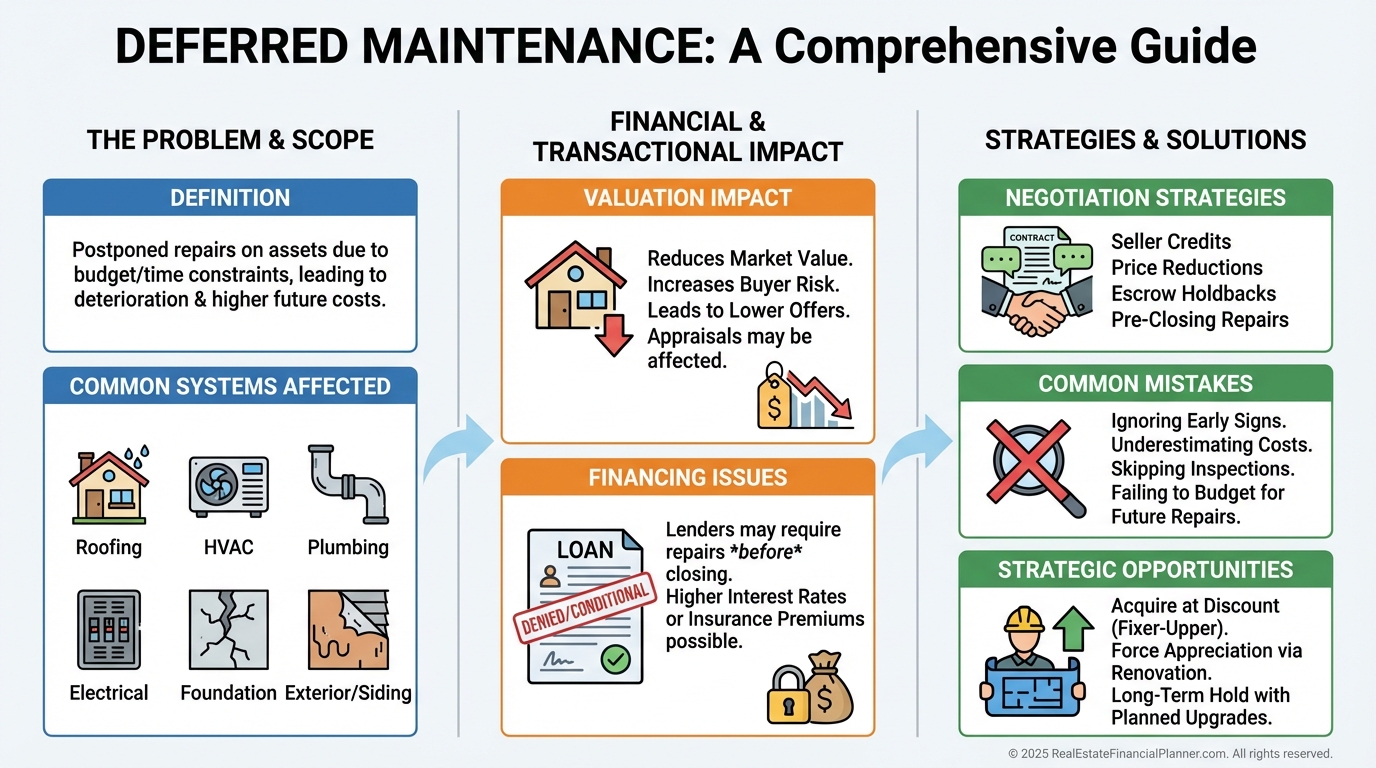

What Deferred Maintenance Really Means

Deferred maintenance is not about things being old.

It’s about components that have exceeded their useful life or should have been repaired or replaced earlier but weren’t.

A ten-year-old roof is not deferred maintenance.

A twenty-five-year-old roof designed to last twenty years is.

When I review properties with clients, I’m not asking, “Does it work today?”

I’m asking, “How close is this to becoming my problem?”

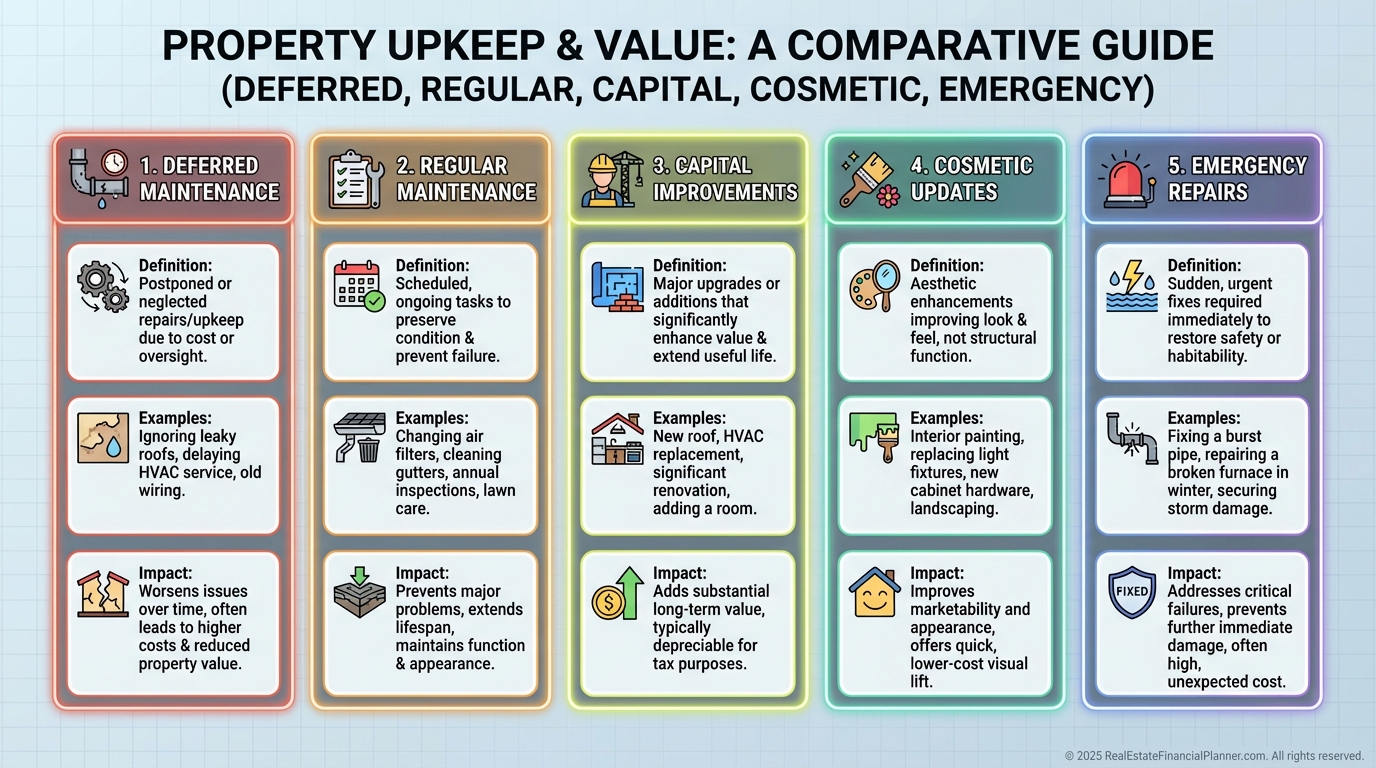

Deferred maintenance often gets confused with other concepts.

Capital improvements add value. Deferred maintenance restores function.

Regular maintenance prevents problems. Deferred maintenance is what happens when prevention stops.

Cosmetic updates hide issues. Deferred maintenance creates them.

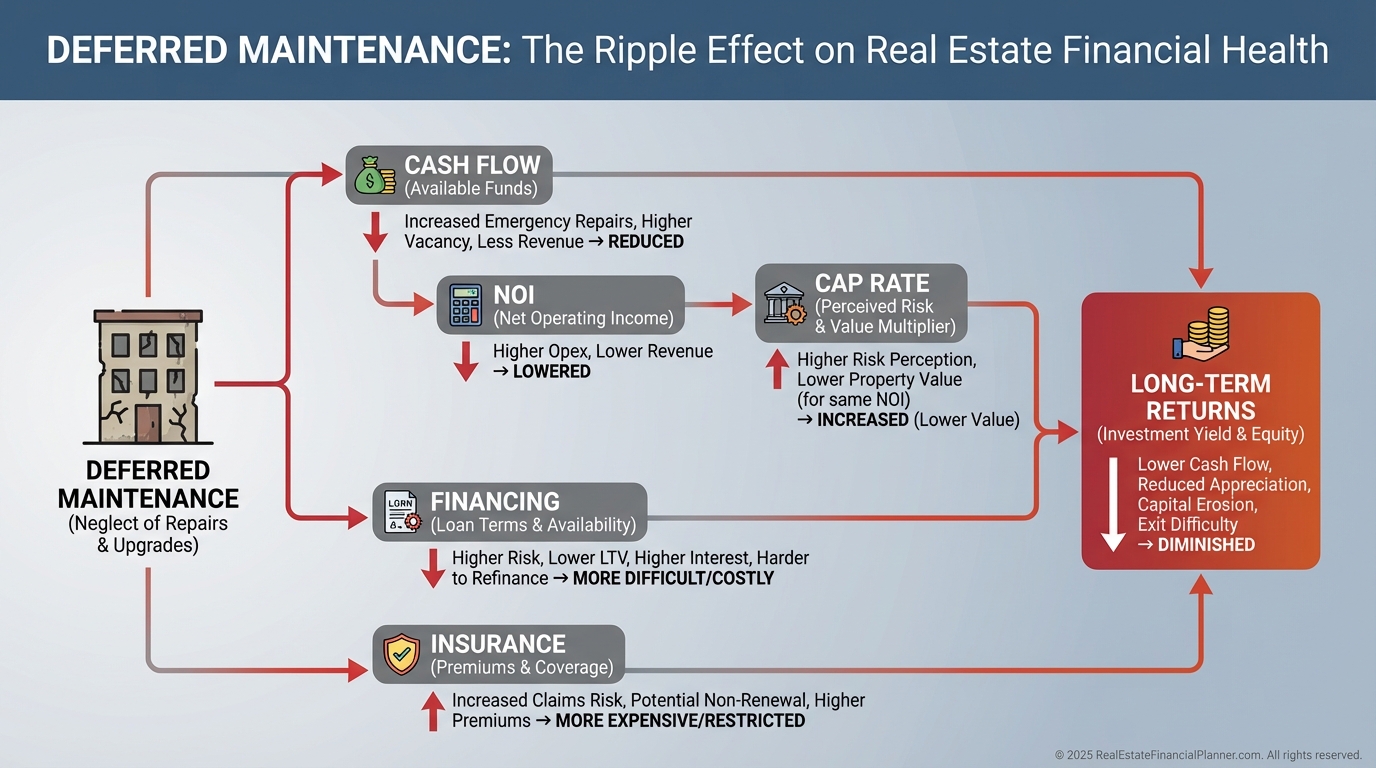

Why Deferred Maintenance Hits Returns Harder Than You Expect

Deferred maintenance doesn’t just cost what the repair costs.

It impacts returns in multiple layers.

When you spend thirty thousand dollars fixing old systems, that money produces no appreciation, no cash flow, no debt paydown, and no tax benefits until the property stabilizes.

In the Return Quadrants™, deferred maintenance capital is temporarily “dead money.”

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, deferred maintenance goes straight into initial CapEx. That increases all-in cost and lowers cash-on-cash return and IRR immediately.

Ignoring it makes numbers look better than reality.

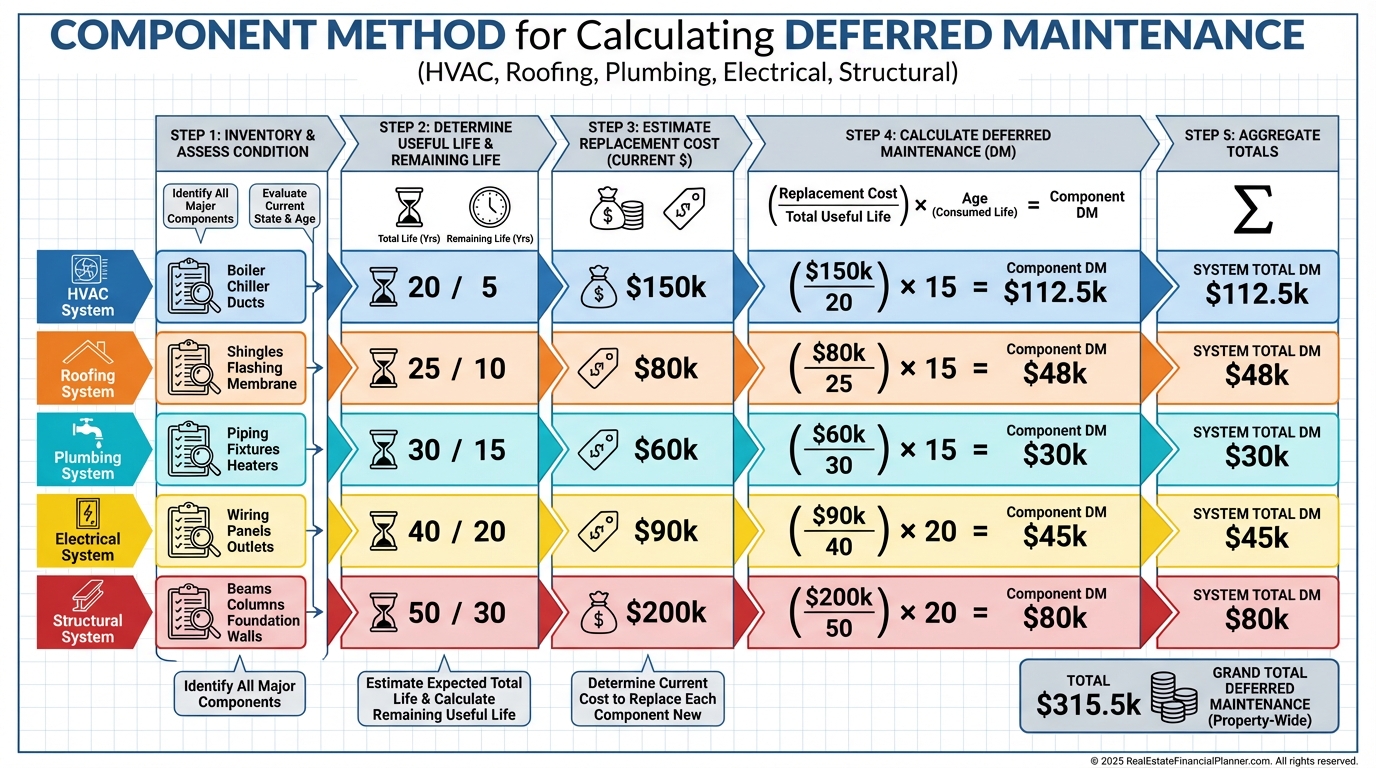

How I Calculate Deferred Maintenance With Clients

I don’t rely on gut feel.

I use a component-based approach that forces discipline.

Each major system gets evaluated independently based on age, expected lifespan, and replacement cost.

HVAC systems get prorated by age.

Roofs get evaluated by remaining life, not appearance.

Plumbing and electrical get assessed by material type and era, not seller descriptions.

A system that “still works” but is near end-of-life still counts.

That mindset saved clients from buying properties where everything failed within the first eighteen months.

Where Accurate Numbers Actually Come From

Inspections are the starting point, not the answer.

When I rebuilt after bankruptcy, one thing I learned quickly was never to trust a single source of truth.

Deferred maintenance estimates come from overlapping data.

Professional inspections.

Multiple contractor bids.

Permit histories.

Insurance claims.

Utility service records.

When several sources point to the same issue, the number is real.

When sellers downplay issues, paper trails usually don’t.

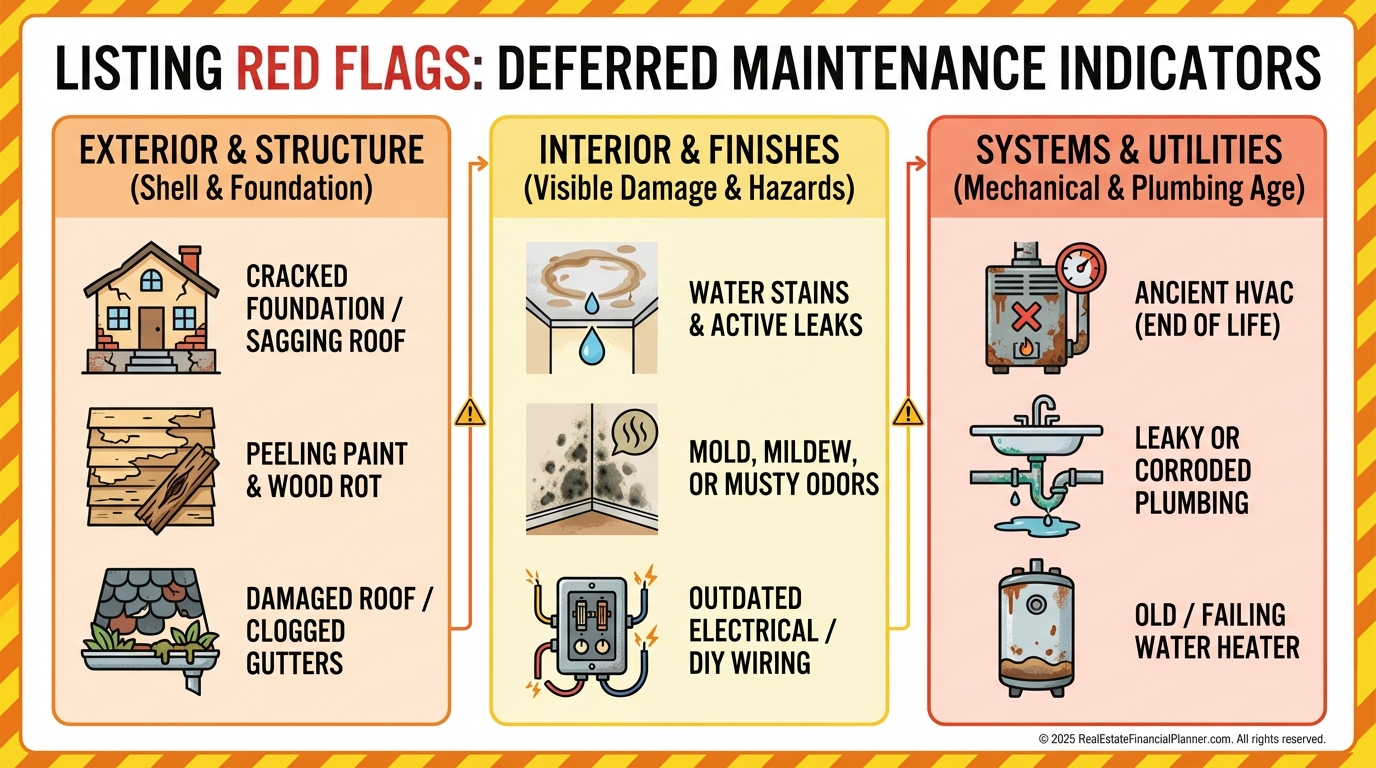

Deferred Maintenance Red Flags I Teach Clients to Watch For

Listings often telegraph deferred maintenance without realizing it.

“Vintage charm” usually means original systems.

“Bring your contractor” means the seller already gave up.

Sparse photos mean something is being hidden.

“As-is” usually means the seller knows exactly what’s wrong.

When I see multiple red flags stacked together, I assume deferred maintenance exists even before inspection.

Financing Problems Deferred Maintenance Creates

Deferred maintenance doesn’t just scare buyers.

It scares lenders.

Conventional loans often require repairs before closing.

FHA and VA loans fail habitability tests quickly.

Insurance companies may refuse coverage altogether.

Portfolio lenders and hard money lenders will still fund deals, but they price the risk with higher rates, lower leverage, or repair escrows.

When clients plan to use Nomad™ or house hacking strategies, deferred maintenance can kill the deal entirely.

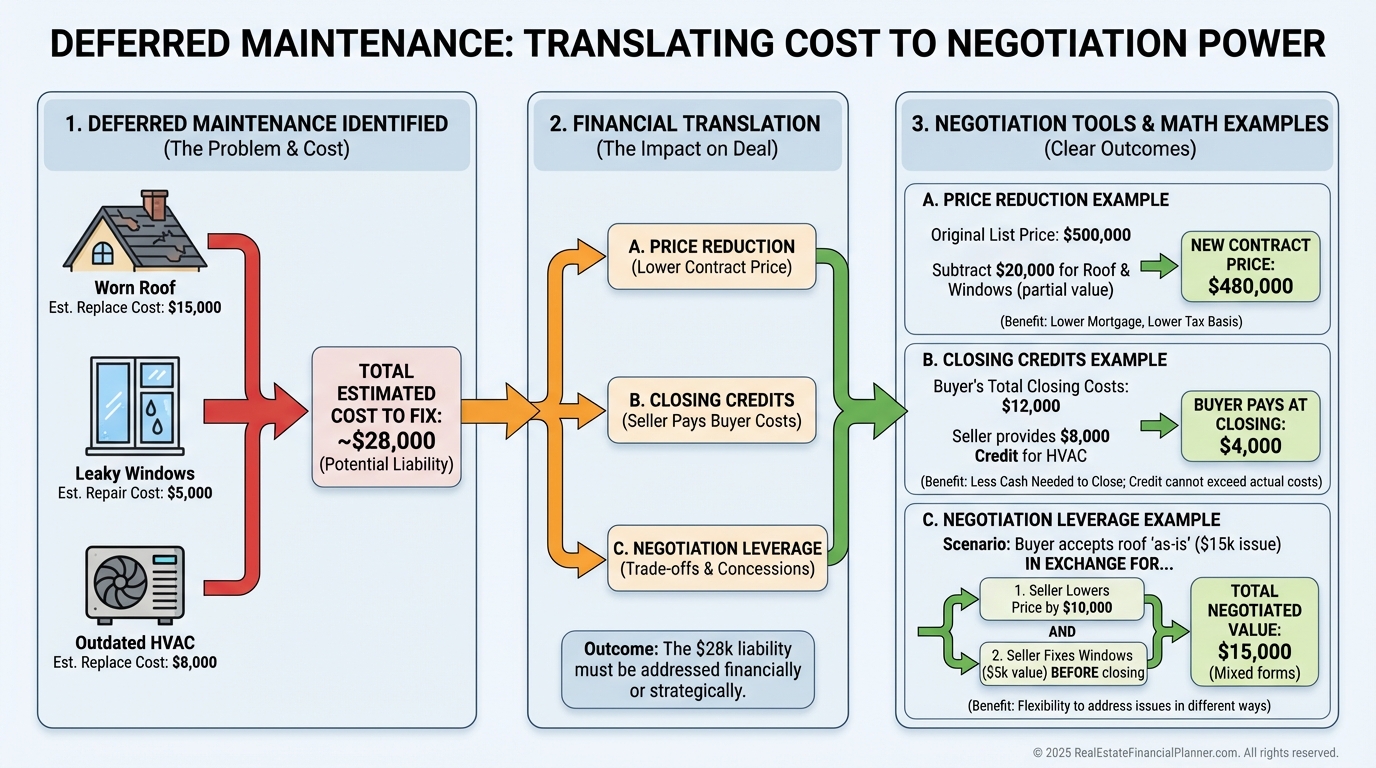

How Deferred Maintenance Changes Property Value

Deferred maintenance reduces value dollar for dollar, and then some.

A property worth two hundred thousand dollars fully updated is not worth two hundred thousand dollars with forty thousand in deferred maintenance.

It’s worth less than one hundred sixty thousand because buyers discount for risk, time, and hassle.

When I help clients negotiate, deferred maintenance becomes leverage backed by math, not opinion.

The Most Common Deferred Maintenance Mistakes

The biggest mistake is underestimating scope.

Small stains often mean big problems.

Old systems always fail at the worst time.

DIY estimates ignore permits, downtime, and mistakes.

Another mistake is trusting seller disclosures.

Sellers describe problems in the smallest language possible. Systems tell the truth.

The cosmetic fix trap is especially dangerous.

Fresh flooring and paint hide failing infrastructure. I’ve watched investors replace brand-new finishes after opening walls for plumbing repairs.

Sequence matters.

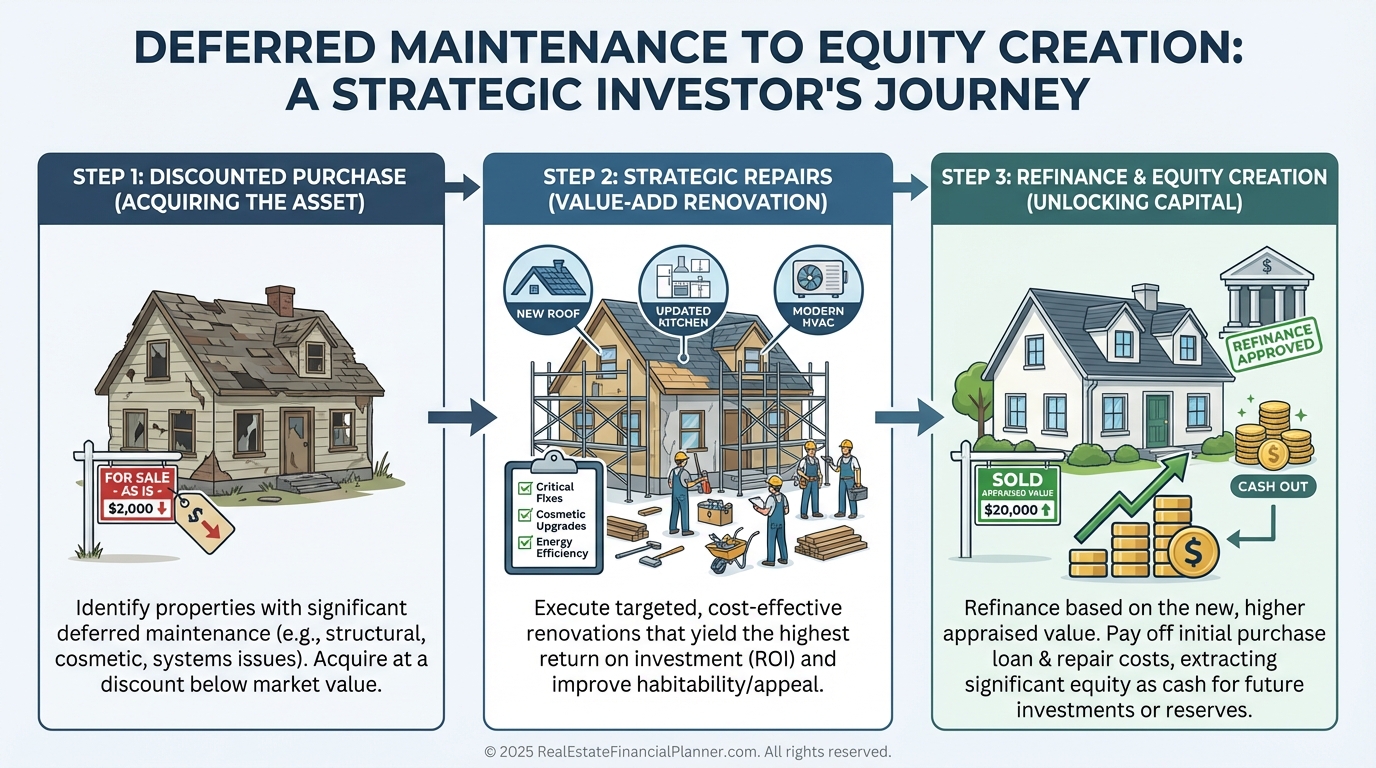

Turning Deferred Maintenance Into Opportunity

Sophisticated investors don’t avoid deferred maintenance.

They price it.

Properties with deferred maintenance scare retail buyers and create discounts. When systems are bad but bones are good, returns can be excellent.

Estate sales, tired landlords, and portfolio cleanups often come with deferred maintenance and motivated sellers.

When planned correctly, deferred maintenance becomes forced appreciation.

Deferred Maintenance and Long-Term Portfolio Planning

Deferred maintenance isn’t just a buying problem.

It’s a portfolio problem.

I teach investors to maintain rolling five-year CapEx schedules, track system lifespans, and fund reserves aggressively, especially for older properties.

Preventive maintenance is cheaper than deferred maintenance every time.

Tracking systems inside your analysis tools allows you to plan repairs around tenant turnover, tax planning, and market cycles.

That’s how deferred maintenance stops being a surprise and becomes a strategy.

Final Thoughts

Deferred maintenance is one of the clearest dividing lines between amateur and professional investors.

The amateurs avoid it blindly or underestimate it.

Professionals identify it, quantify it, and use it.

The property with visible problems and accurate numbers is often safer than the “turnkey” property hiding future failures.

When you understand deferred maintenance, you stop fearing ugly properties and start fearing misleading ones.

That shift alone can save you years of returns and unlock deals others walk past.