Promote Structure Mastery: The Waterfall Blueprint LPs and GPs Use to Align Interests and Maximize Returns

Learn about Promote Structure for real estate investing.

Why Promote Structures Decide Who Wins

When I help clients evaluate syndications, the fastest way to see who wins is to read the promote.

Two deals with identical IRRs can put wildly different dollars in LP or GP pockets.

I’ve watched a promote move more than $500,000 between parties on the same property.

That’s why we model the waterfall before we model the rent roll.

What a Promote Actually Is

A promote is performance pay for the GP that only kicks in after investor hurdles are met.

It’s also called carried interest, carry, or incentive fee.

In plain English, it’s the GP’s bonus for beating the target.

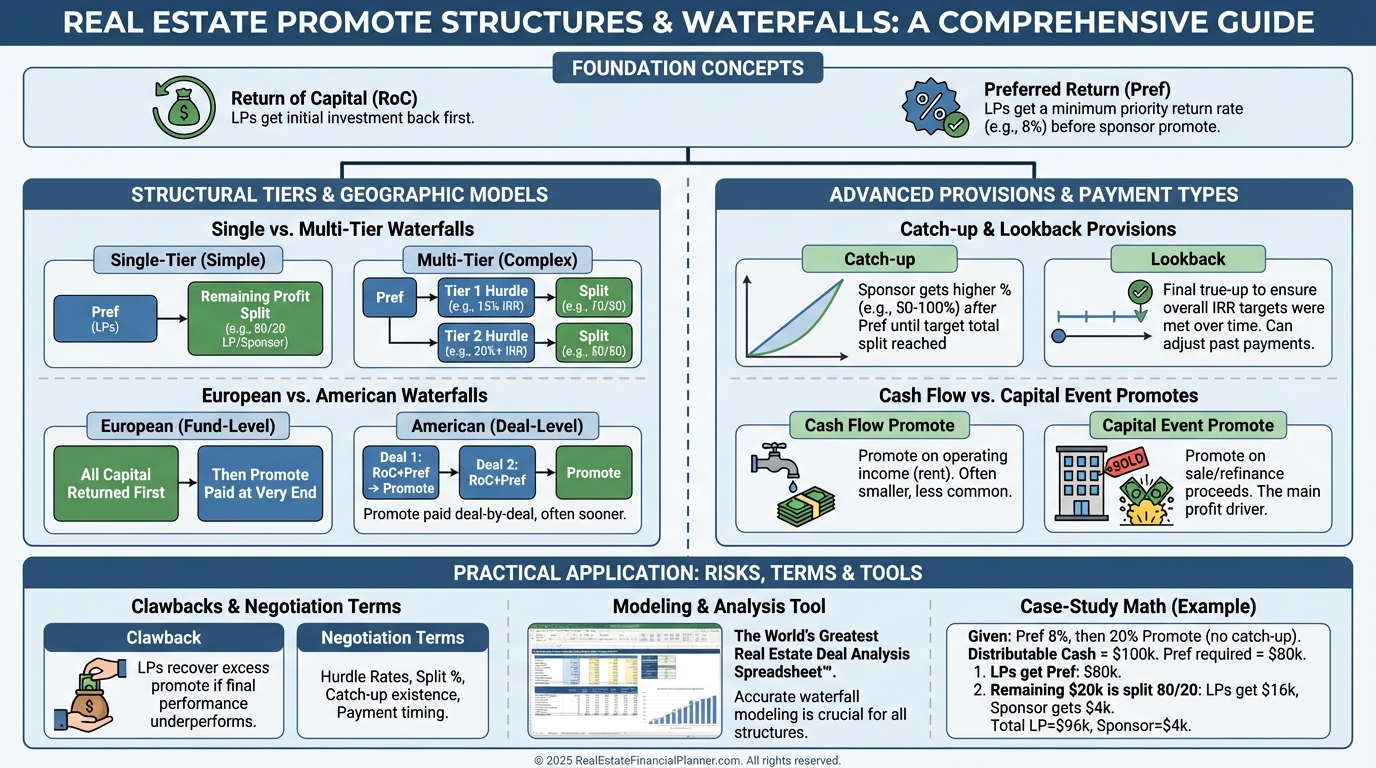

The Core Rules Most Investors Miss

Return of capital comes first.

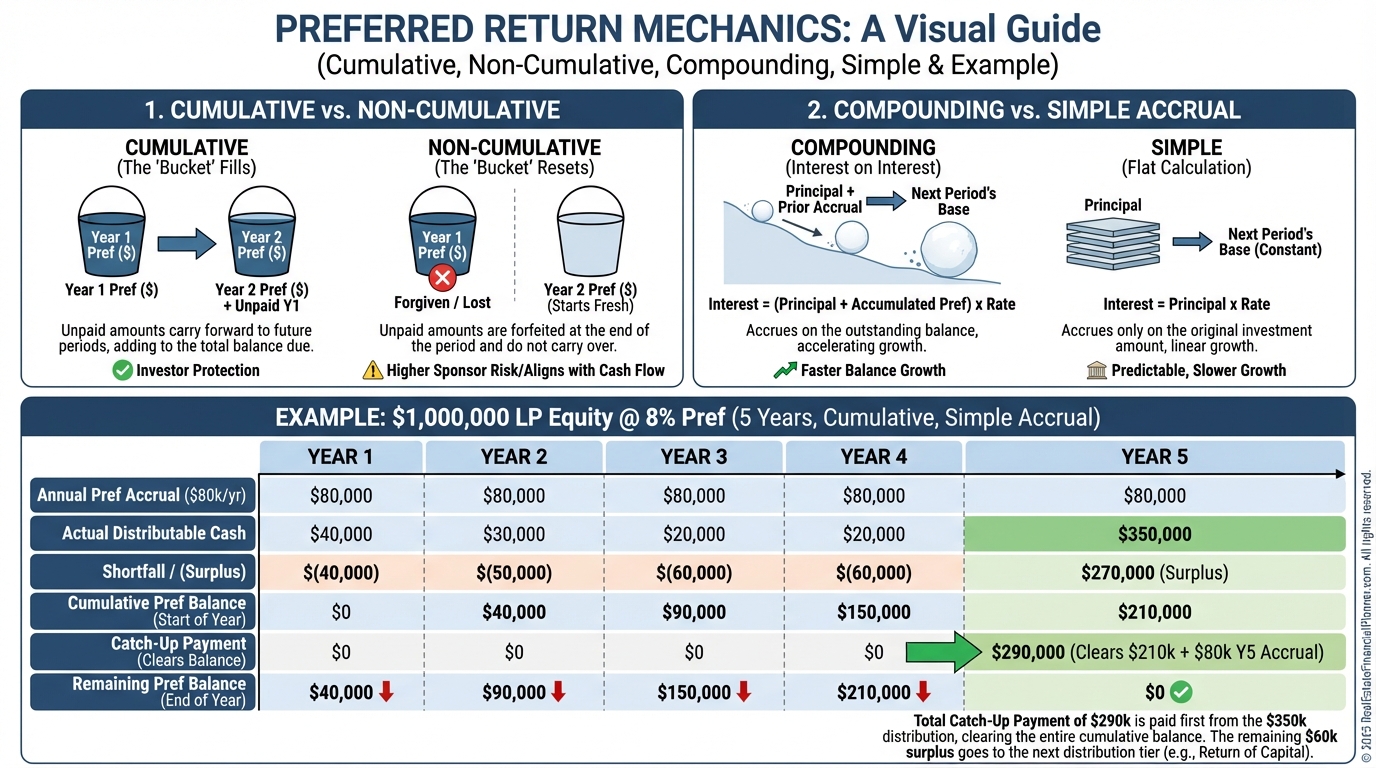

Preferred return typically follows, often 6%–10% and usually cumulative.

Only then do profits split at the promote ratios.

When I review offering docs, I confirm those three in that order before reading anything else.

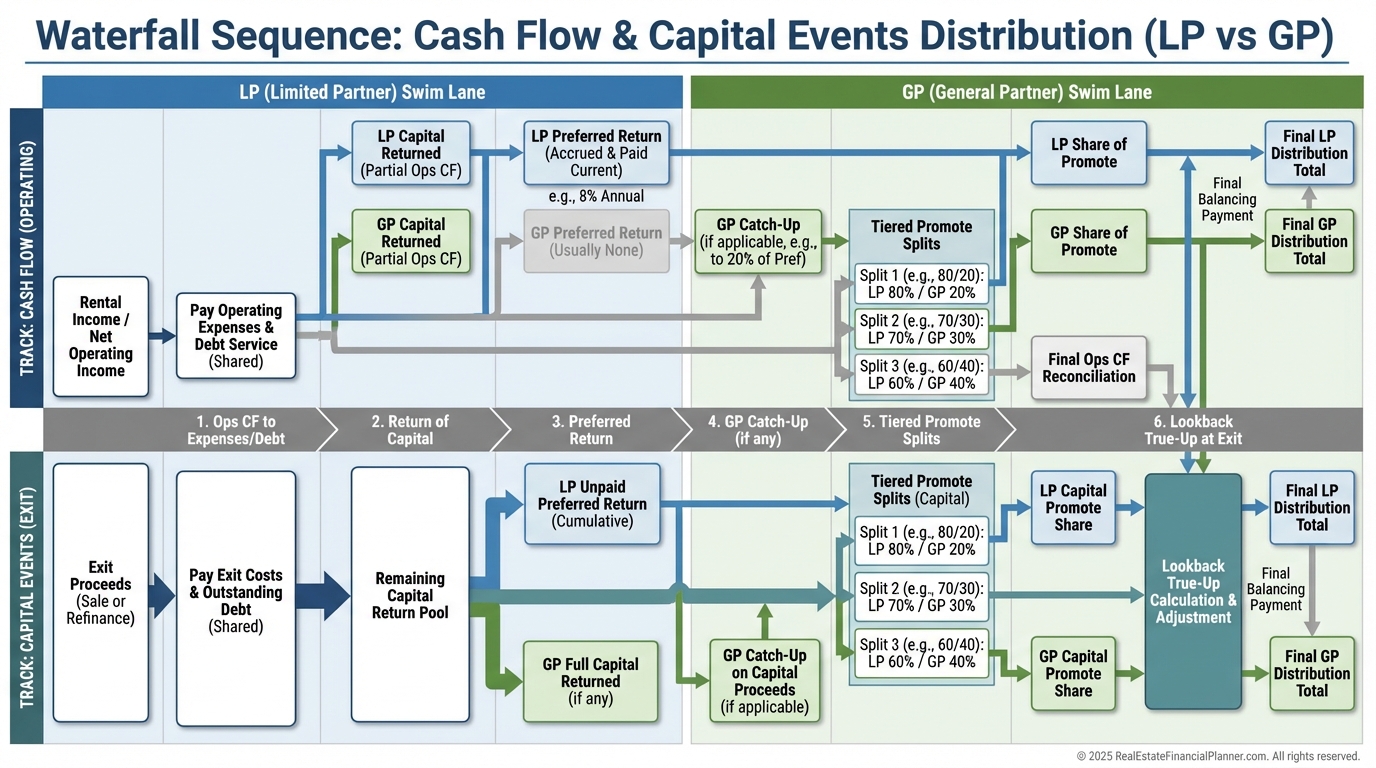

How the Waterfall Flows

Think of distributions as a series of pools that must fill in order.

Capital back fills first, then the pref, then the tiers split profits—often 80/20, then 70/30, then 60/40.

Catch-ups let GPs grab a slice to reach their intended percentage after the pref.

Lookbacks true-up at the end so nobody keeps the wrong amount due to timing.

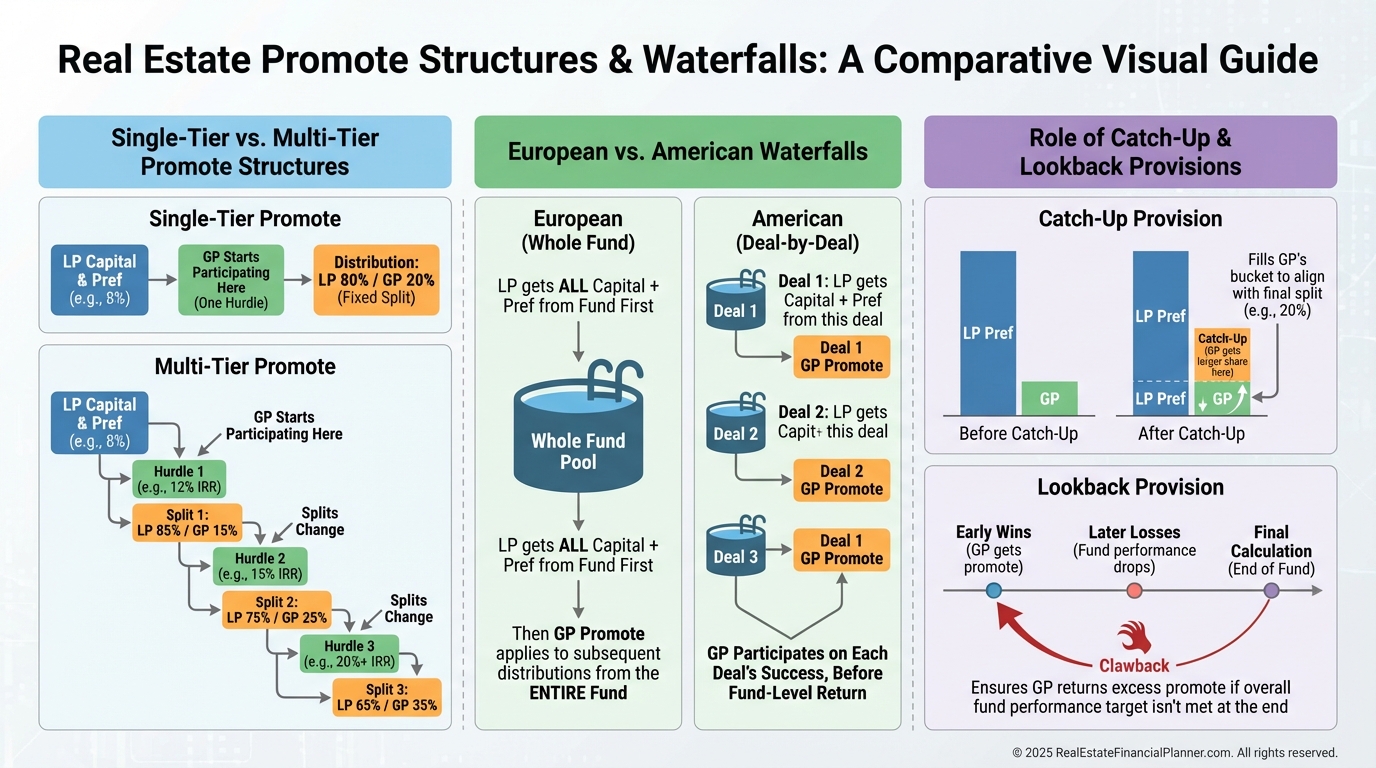

Common Promote Structures You’ll See

Single-tier: one hurdle, one split.

Multi-tier: multiple hurdles with richer GP splits at higher performance.

European waterfall: whole-fund or whole-deal test before any promote.

American waterfall: deal-by-deal promote even if others underperform.

Catch-up and lookback provisions keep the math fair.

Where Promotes Show Up in Syndications and JVs

In most syndications, GPs invest 5%–10% of equity but earn 20%–40% of profits above the pref.

That delta is the promote, compensating sourcing, guarantees, execution, and risk.

When I underwrite GP deals, I price the promote to the complexity of the plan, not my ego.

Investors are happy to share upside when the GP actually creates it.

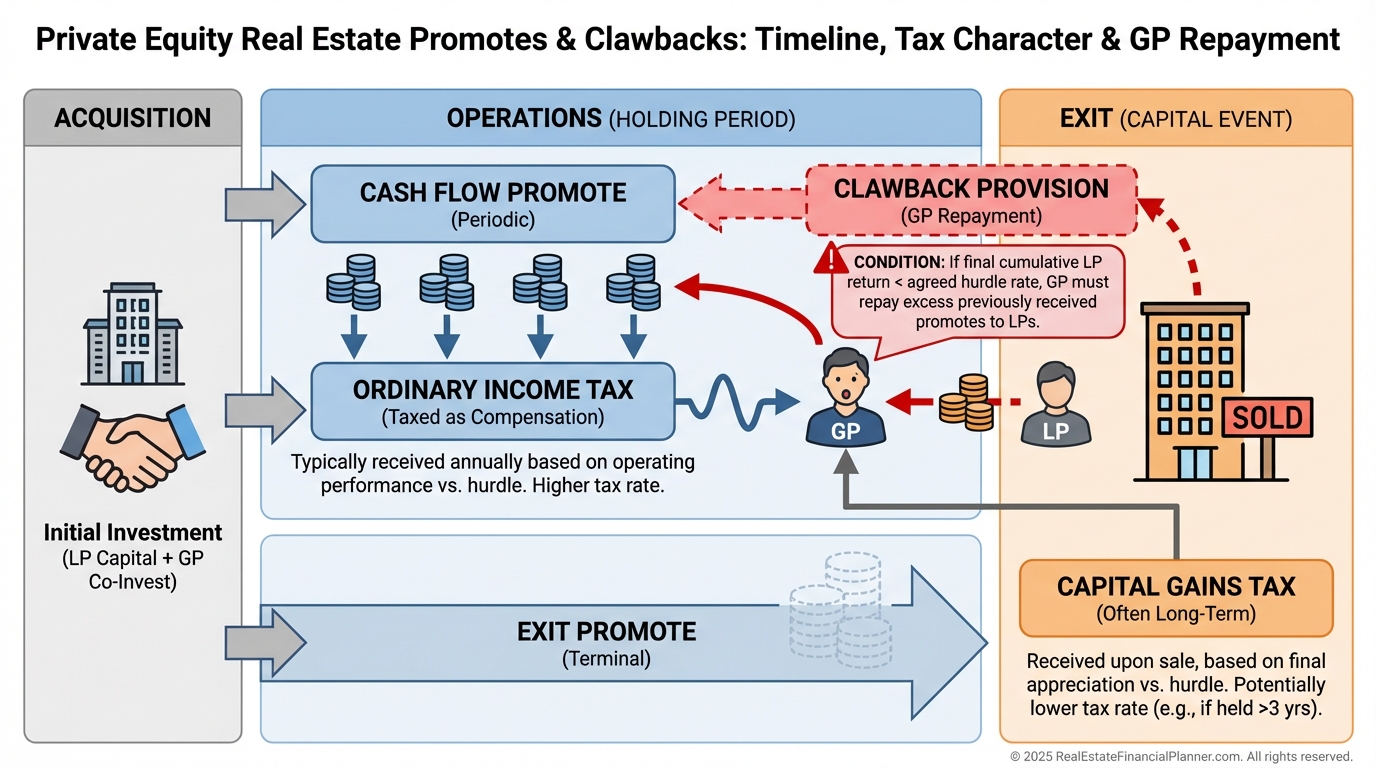

When Promotes Get Paid (Cash Flow vs Exit)

Promotes can be paid from ongoing cash flow and from capital events like refis or sales.

Cash flow promotes help sponsors run a business; exit-heavy promotes keep focus on the finish line.

Taxes differ, too—ongoing distributions may be ordinary income while carried interest at sale may be capital gains.

I flag timing for clients so their cash needs and tax plans line up with the waterfall.

How I Evaluate a Promote in 5 Minutes

Step 1: Confirm return of capital, then pref, then splits.

Step 2: Identify hurdles (IRR or Equity Multiple) and whether they’re deal-by-deal or whole-deal.

Step 3: Find catch-up, lookback, and clawback language.

Step 4: Map when cash flow promotes begin.

Step 5: Model it in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

If any one of these is unclear, I pause the deal until it’s clarified.

Negotiating a Fair Promote

Simple deals deserve simple promotes.

Complex, multi-phase, high-risk plans can justify higher, multi-tier promotes.

I negotiate to the plan’s complexity, the sponsor’s track record, and market competition for capital.

Red flags I warn clients about:

•

Promote before capital is returned

•

Non-cumulative pref

•

GP catch-up that eats all near-term cash flow

•

Promote on unrealized gains without liquidity

•

No clawback when there are early promotes

Tie the Promote Back to Return Quadrants™

Promotes usually come from appreciation and capital events.

Cash flow promotes touch the cash flow quadrant more directly.

Debt paydown and tax benefits flow primarily to owners by percentage, then the promote modifies the split after hurdles.

When I coach LPs, I show which quadrant is funding the GP’s promote and whether it’s earned.

Use True Net Equity™ to See Your Real Take-Home

LPs care about dollars, not just IRR.

I calculate True Net Equity™ at exit: proceeds after debt, costs, pref, promote, and taxes.

I do the same for GPs to ensure the promote supports a durable business, not just spreadsheet glory.

Clarity beats surprises when the wire hits.

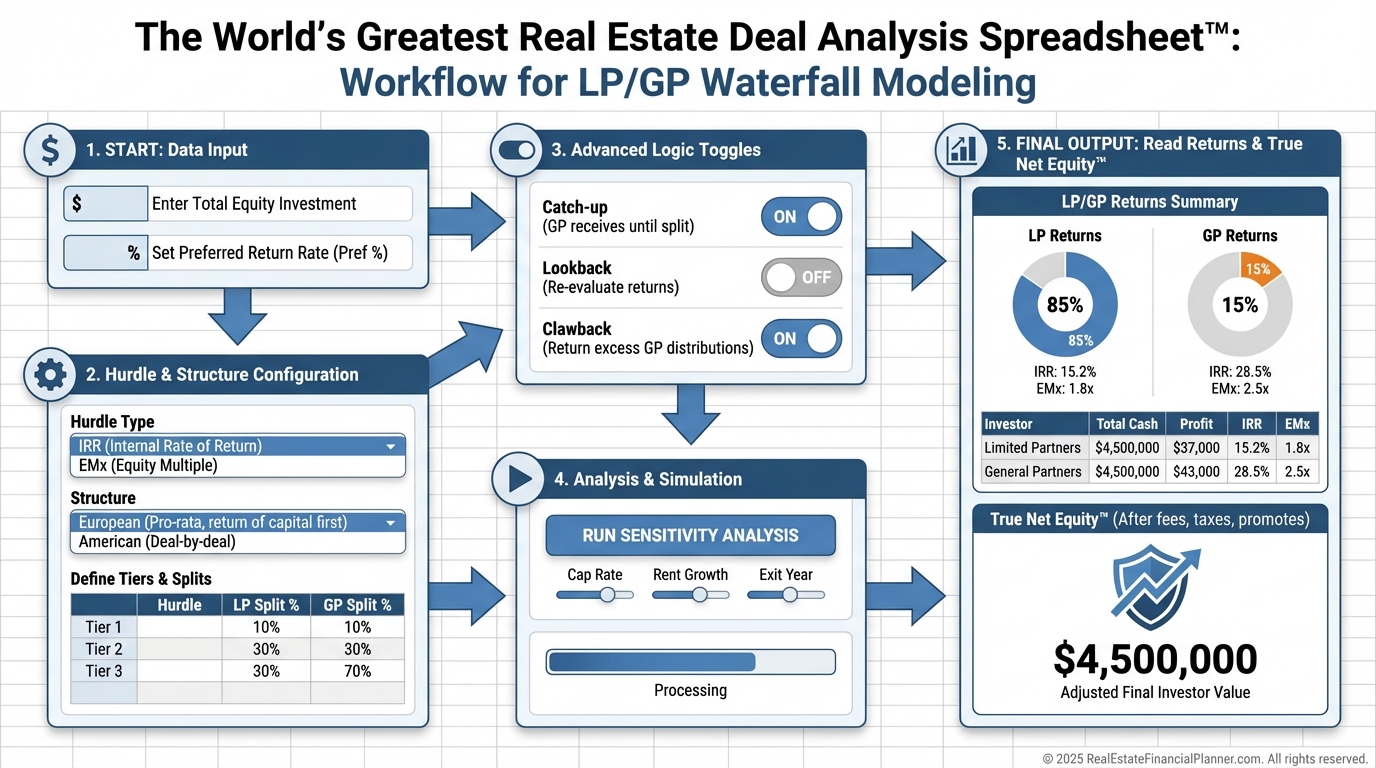

Modeling in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I start by selecting IRR or Equity Multiple hurdles that match the deal’s story.

Then I enter the pref, tiers, and splits exactly as written—no assumptions.

I set European vs American and catch-up/lookback options.

Finally, I run sensitivity on exit timing and value to see who benefits under each scenario.

When data and docs disagree, I side with the docs and fix the model.

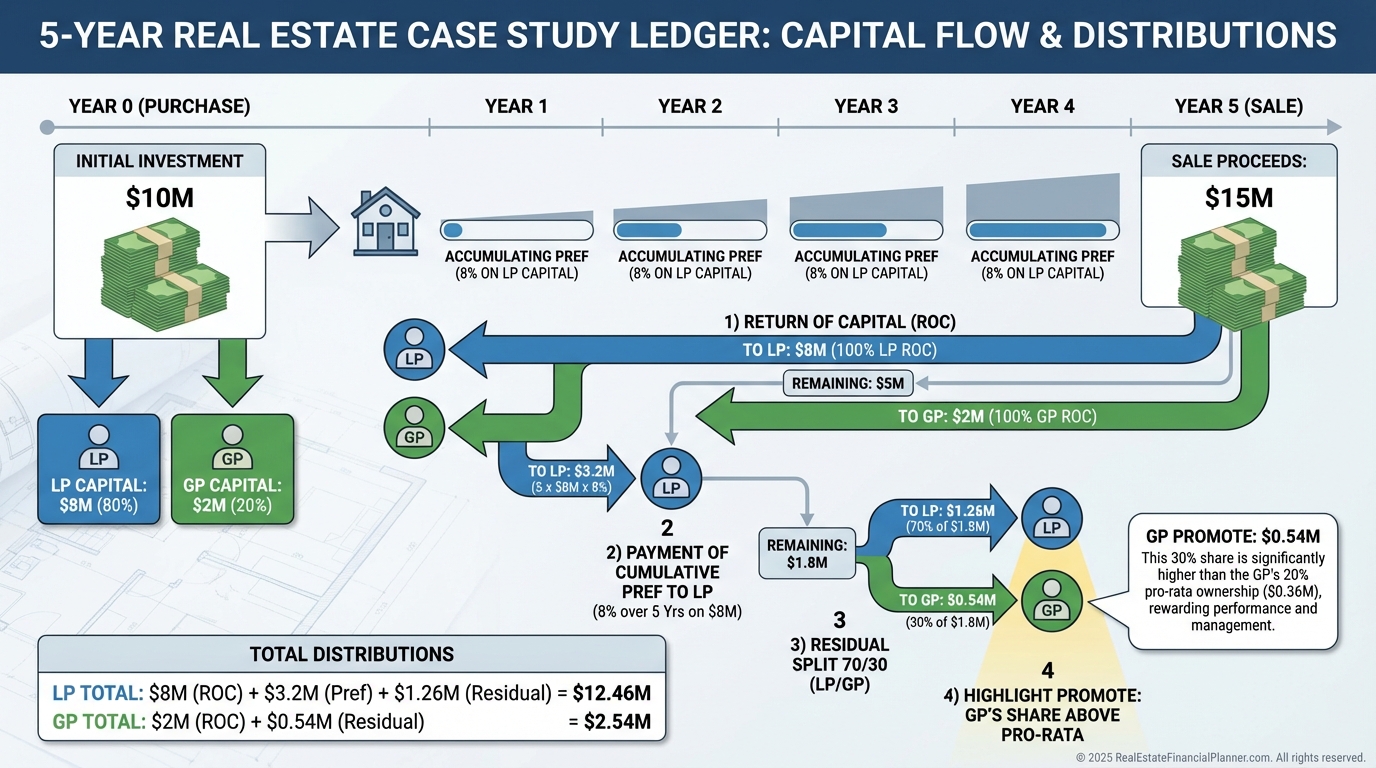

Real-World Example You Can Copy

Assume a $10M purchase, all-equity to keep the math clean.

LP invests $8M; GP invests $2M; 8% cumulative pref; 70/30 split above the pref.

At sale five years later for $15M, total profit is $5M after returning the $10M.

LP first collects any unpaid 8% pref accrual.

Remaining profits then split 70/30, so the GP earns more than their 20% capital share—that’s the promote.

How Market Conditions Change the Promote

Core/stabilized assets often justify 10%–20% GP promotes above a 6%–7% pref.

Deep value-add or development can demand 30%–40% above an 8%–10% pref.

When debt is volatile, I recommend back-ending promotes to protect LPs and keep GPs aligned.

If a sponsor’s track record is thin, I negotiate lower GP splits or stronger lookbacks.

LP and GP Checklists Before Signing

LP checklist:

•

Is the pref cumulative and paid before any promote?

•

Are hurdles IRR or Equity Multiple, and how are they calculated?

•

Is the waterfall European or American?

•

Are there catch-up, lookback, and clawback protections?

•

What is my True Net Equity™ under base, downside, and upside?

GP checklist:

•

Does the promote compensate the plan’s real risk and workload?

•

Is cash flow timing sufficient to run the business?

•

Can I defend the promote to sophisticated LPs and lenders?

•

Have I modeled clawback risk and reserved for it?

When both lists read “yes,” the terms are probably fair.

A Note for Nomad™ and Small JV Investors

Even small JVs benefit from clean waterfalls.

Complexity is not a substitute for trust or skill.

Simple terms plus clear roles win over time.

Final Thought

Promotes are not about clever math.

They are about trust, alignment, and paying the people who actually create value—after investors are protected.

Model it, negotiate it, and then manage to it.

That’s how you turn a good deal into a great one.